These notes will serve as part of a briefing document that I will send off…

The fictional world of economics we blithely live in

This morning on the national radio, the Australian Treasurer was explaining to the nation the issues presented in the December – Mid-Year Economic and Fiscal Outlook (MYEFO) – which is a half-yearly review of the fiscal statement presented in the May each year (mostly) and was released to the public yesterday (December 16, 2019). I will get into some of the detail presently. But every statement that the Treasurer made, every sentence, was a classic example of fake knowledge being touted as verity. The interview lasted a few minutes and nothing the Treasurer said was correct. It is clear that we live in a fictional world where some of the most important influences on our lives are so misunderstood in reality yet ‘understood’ in this fictional world that the economists, the elites, the serving politicians, and us perpetuate. I have always been perplexed by the dichotomy between our human ingenuity in some areas and our dumbness and ignorance in other areas. And I clearly understand we cannot know everything. But on matters economics, if I survey people, I am astounded at how much they claim to ‘know’ – words such as Zimbabwe, hyperinflation, and the rest of the myths – come of their lips with ease as if they are knowledge. It is a quite extraordinary situation.

You can find the – Archive of Budgets – back to 1901-02 (the creation of the Commonwealth of Australia), if you want to trawl back in time and see how the narratives have changed until we are now so obsessed with attaining fiscal surpluses that we just deny the damage they do.

My commentary on this year’s fiscal statement – Australian government’s fiscal statement – pitiful and irresponsible election ploy (April 3, 2019).

The current context for my comments here is:

1. In the September-quarter, real GDP growth was only 0.4 per cent – signalling further weakness. The annual growth rate was 1.7 per cent, well below historical trend. Household consumption expenditure growth is moderating despite the July tax cuts and the saving ratio has risen sharply, signifying an unwillingness by households to continue to accumulate debt.

See – Australian growth outlook remains poor (December 4, 2019).

2. Australia’s labour market is weak with employment growth negative in November, a bias towards casualisation, and an unemployment rate stuck around 5.3 per cent and underemployment around 8.5 per cent.

The total labour underutilisation rate (unemployment plus underemployment) is 13.8 per cent and has been around 13.5 per cent for some years now. There were a total of 1,889.3 thousand workers either unemployed or underemployed and this number has been rising.

Australia’s participation rate is below the pre-GFC levels as is the Employment-to-Population ratio.

See – Australia labour market deteriorating – symbolises massive Federal government policy failure (November 14, 2019).

3. Wages growth continues at record low levels. Both private and public sector wages growth was just 0.5 per cent in the September-quarter – keeping growth at record lows.

Over the year to September 2019, overall wages growth was 2.2 per cent and in decline. With the annual inflation rate running at 1.7 per cent, workers were able to enjoy some real wages growth.

However, over the longer period, real wages growth is still running well behind the growth in GDP per hour (productivity), which has allowed profits to secure a substantially increased share of national income.

In the March-quarter 2016, the wage share was 55.2 per cent. By the June-quarter 2019, it had fallen to a low of 51.7 per cent.

See – Australia – wages growth continue at record low levels – further evidence of policy failure (November 18, 2019).

4. Australian households are carrying record levels of debt.

See – Reliance on household debt and a lazy corporate sector – a recipe for disaster (September 6, 2018).

5. The unemployment benefit payment has not adjusted in line with poverty line estimates for some years and recipients are being forced by both sides of politics to live well below the accepted poverty line.

See – Progressive’ groups in Australia captured by neoliberal ideology (September 18, 2018).

6. Inflation is persistently below the Reserve Bank’s lower targetting bound and shows no signs of increasing.

In that context, one should be surprised that the Government is still close to achieving a fiscal surplus, and I will explain how that is happening.

The Treasurer had a simple story to tell as yesterday’s revised data revealed that the Government was still aiming for a surplus, albeit a smaller one.

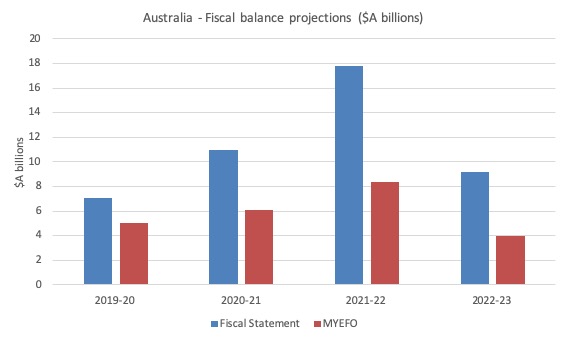

The following graph shows the estimated (projected) fiscal balance ($A billion) out to 2022-23 provided in the 2019-20 Fiscal Statement (aka ‘The Budget’) forecast, released in April 2019 (blue bars) and the updated estimated released in the MYEFO yesterday.

So the Treasury is now forecasting a smaller surplus across the forward estimates culminating in a surplus equivalent to 0.5 per cent of GDP in 2022-23.

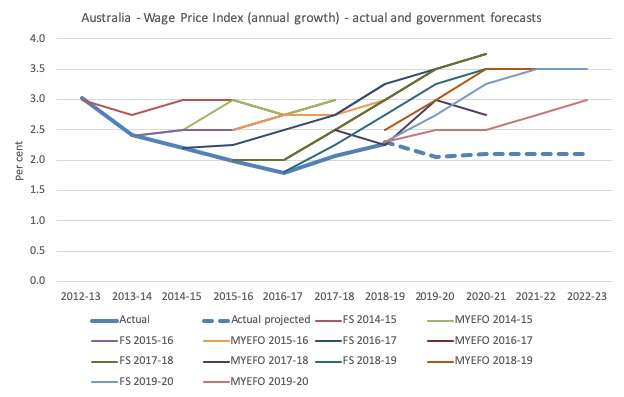

These two graphs tell the story.

The first shows the annual growth in the Wage Price Index since the 2012-13 financial year (thick blue line). The dotted projected is based on the average over the last five years.

The other lines show the various projections published in successive fiscal statements (FS) and revised in the respective MYEFO’s over the period shown.

The government consistently has been wrong on how strong the labour market will be over its forward estimates.

And, income tax receipts in 2018-10 were $A333,449 million, while total tax receipts were $A438,579 million, meaning income taxes were 76 per cent of the total receipts and taxes on individual workers’ incomes dominate total income taxes.

So, these forecasting errors would normally push the fiscal balance away from surplus into increasing deficit.

Indeed, in yesterday’s MYEFO, the government has once again downgrades its total estimated tax receipts in 2019-20 by $A3 billion.

So, with such weakness in the domestic economy and wages growth well below the estimates that the Government used to forecast its surpluses, how come the Government is able to maintain confidence that it will generate a surplus in the coming financial year?

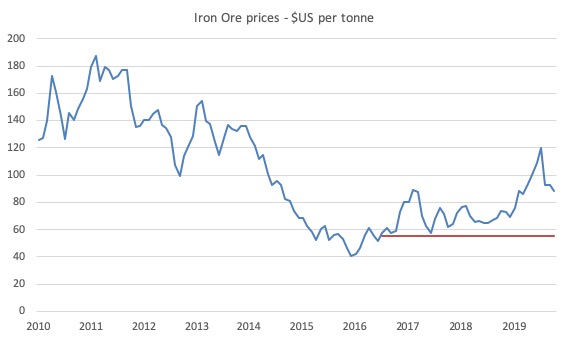

The answer is in the second graph, which shows the movement in iron ore prices ($US per tonne) (blue line) and the baseline forecast the government has used (red line) for the last several years ($US55 per tonne).

The Government could not anticipate the Vale iron ore mining company’s tailing dam disaster in Brazil, which forced its closure and caused a supply shortfall that led to spiralling iron ore prices.

This delivered record profits for iron ore miners in Australia.

As a result, Australia has recorded to two trade surpluses in a row – a rare event – and the Government’s company tax revenue has risen dramatically.

This is the reason that the fiscal position has still moved towards surplus even with the domestic economy in a parlous shape.

The point is that while the Government might try to claim that its economic management is sound as evidenced by how close it will come to surplus this financial year, the reality is exactly the opposite.

The factors that is within its influences – employment, domestic demand, wages growth etc – are all stagnating towards recession and the Government’s policy stance is responsible.

The factors outside their control – are keeping Australia from recession despite the Government’s own fiscal policy position undermining the economy.

The truth of the matter then is that the only way the Government will be able to get close to surplus this year is because of an unprecedented environmental disaster in Brazil that has seen the mining company executives imprisoned and an ongoing criminal investigation (Source).

Yet, the Treasurer continues to represent the fiscal position as a sign that the nation is “living within its means” and the Government is acting responsibly.

Here is the – Transcript – of the radio interview this morning with the Treasurer that I mentioned in the Introduction.

The Treasurer said:

1. “Well, we’ve seen a very strong labour market” – when there is 13.8 per cent of available labour resources not being used (either via unemployment or underemployment) then “very strong” is not the applicable descriptor.

2. “real minimum wages have gone up every year under us, whereas they went down three out of the six years that the Labor Party were in government, and what we’ve seen is again, a strong labour market.”

The minimum wage is set by an independent tribunal and the Government’s submission regularly argues for lower increases than have been awarded.

3. “you don’t want to underestimate the importance of the country now living within its means”.

Refer to point (1) again. We are wasting a massive amount of our available labour and incurring massive daily income losses in the millions as a result.

The relevance is that our ‘means” are the available productive resources that can be used productively and sustainably to generate output and incomes.

We are certainly living within our means as a nation in the sense that there are at least 1.8 million people who could be working who are not (in hours).

4. “The fact that we are able to deliver a surplus is very important because our interest bill on our debt was $19 billion last year, and that will reduce to $14.5 billion over the forward estimates, which frees up more money to be spent on schools, hospitals, infrastructure and other essential services that Australians need and rely upon.”

The interest bill is actually income flows to the non-government sector – us.

Thus, the Treasurer is celebrating cutting our income. Not something I would celebrate.

But, the causality is just a lie.

Sure enough, if the government says it can only ever spend $X and interest payments use up some of that $X then clearly the amount remaining for other things will increase if the interest payments fall.

But for a currency-issuing government there is no $X.

The net spending should be whatever it takes to ensure aggregate spending in the economy is sufficient to fund the overall saving desires of the non-government sector, and thereby maintain full employment.

It might be at full employment, there is a trade-off between components of government spending, should the government desire to increase one or more components.

That is because nominal spending growth should not outstrip the capacity of the productive sector to respond by producing real goods and services.

But Australia is no where reaching that limit yet.

5. “delivering a surplus is hard – that’s why no one has done it for the past 12 years – and we’re committed to doing it because it means that the country is living within its means.”

See point (3) again.

Living within a nation’s means is a real concept – defined in terms of available productive resources – and cannot be reduced to saying a surplus is good and a deficit is bad.

6. “One of the reasons why we were able to get through the GFC (global financial crisis) was because Howard and Costello paid off Labor’s debt and had the fiscal flexibility to spend through that cycle. So we need to create the buffers, we need to create the flexibility so that Australia can respond to future economic shocks when and whenever they occur.”

An outright lie.

The public debt ratio is irrelevant in determining whether a currency-issuing government can increase its net spending to redress a shortfall in non-government spending.

The Australian government can always increase its deficit and does not have ‘buffers’.

There is no sense that running surpluses create a ‘buffer’ of spending capacity. Surpluses are flows which disappear as soon as they are recorded.

They mean that the government spending injection is less than the spending drain via taxation.

They mean that the non-government sector is squeezed for liquidity and has to run down its net financial assets to meet the shortfall imposed by the

fiscal drag.

They mean that to maintain non-government spending growth, private debt has to rise, creating a more precarious, crisis prone situation.

They mean that the government is undermining growth.

There is no sense that the government ‘saves’ when it runs a fiscal surplus.

Saving is the act of foregoing consumption to increase future consumption possibilities and is applicable only to an entity that is financially-constrained.

The government can spend whenever it likes irrespective of whether it ran a surplus or a deficit last period. It does not store up spending capacity.

7. The Treasurer was asked by the ABC interviewer:

Q: Why should voters, though, care about how much the surplus is if they are worried about their wages growth or if they’re not getting enough hours at work, for example?

Treasurer: Well, just like your listeners pay down their mortgage over time, so too governments pay down their debt over time, and it has been, as I said, 12 years since we’ve last had a surplus, and that interest bill is dead money. It means it goes to bond holders, whether they are overseas or here in Australia, and it is money foregone – money that could otherwise be spent on important domestic initiatives and important essential services.

So the reason why we pay down the debt is to have the discipline to live within our means, but to ensure that future generations don’t have to pick up the tab for the last.

The household ‘budget’ fallacy.

The interest bill is not “dead money” – it is non-government income.

See point (4) on whether such income flows reduce the government’s capacity to spend on other things.

Future generations enjoy the benefits of infrastructure spending that provide services over many generations. They don’t endure any burden but enjoy the benefits.

Opposition response – pathetic is the word that comes to mind

Whoever is advising the Australian Labor Party on macroeconomics should be sacked immediately.

Here is a political party that lost the unloseable election in May 2019 against one of the worst conservative governments in our history after banging on about their goal to achieve an even bigger surplus despite the tanking economy and proposing to ‘pay for it’ by taxing retirees among others.

And they lost easily, with the government being returned with an increased majority to wreak havoc for another three years.

And they clearly learned nothing from that humiliation and betrayal of the working class.

They should have spent the first few years in opposition educating the public about why deficits are appropriate and why the goal of fiscal policy is not to achieve any particular ‘number’ but to ensure there is full employment after the non-government sector has made its spending and saving decisions.

Fast track to yesterday.

The economy is tanking, there are 13.8 per cent of available labour resources idle, household debt is at record levels and household consumption spending is stalling, etc etc.

What do they do?

Their finance spokesperson Katy Gallagher continued her ridiculous attack on the government for increasing public debt.

Her contribution to the public debate was:

The record and what you can see in the numbers, in the MYEFO today, is that net debt is up to $392 billion on their watch …

This is the seventh year, this is their budget, their MYEFOs, their updates they put out. Gross debt has more than doubled and is now at $556 billion. In this update, they have chucked away their promise on eliminating net debt in 29-30, that promise has gone.

No mention of unemployment.

No mention of anything that matters.

Just a reinforcement of the neoliberal myth about public debt.

The reality is that in a macroeconomic context, the exact statement is that the Government has more than doubled the wealth held by the non-government sector in the form of government bonds.

Is she saying that the Labor Party seeks to destroy that wealth and the income flows that arise from it?

Answer: she wouldn’t even understand the basis of the question.

In other words, she is, in my view, unelectable.

The same goes for the Shadow Treasurer Jim Chalmers, who blathered on about government failure for having to revise the surplus estimates downwards.

He called that “humiliating”.

Previously, he had claimed that Labor would only consider increasing the unemployment benefit, which successive governments have held, increasingly below the poverty line, if such an increase didn’t jeopardise their fiscal surplus ambitions.

He is unelectable.

So, for my British readers, you are not alone in having a hopeless situation where the progressive party is unable to cut through because it is receiving poor economic advice.

Conclusion

Such is life in Australia.

A moronic government only matched by a hopeless Opposition.

The point is that the fiscal surplus, if achieved, will only come about by accident – literally. It will have nothing to do with the good economic management of the Government.

That management is driving the domestic economy into the ground.

As soon as the supply response to the current shortage of iron ore is sorted out, the prices will decline dramatically and the lagging wages growth will then impact substantially on the Government’s forward estimates and a surplus will disappear.

Then the true causality relating government policy to economic destruction will be visible to all.

But not a word of that from the Opposition. They just raved on about higher public debt.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

‘So, for my British readers, you are not alone in having a hopeless situation where the progressive party is unable to cut through because it is receiving poor economic advice.’

Your note of solidarity with the UK lifted my spirits this morning! Much appreciated. In your case, after decades of fighting this stuff, I’m amazed you can keep sane-I expect the music making helps!

In the election campaign here we heard the ‘where’s the money coming from’ refrain continuously and campaigners were not equipped to respond to it properly, or at all. I think we need some MMT educational programmes a.s.a.p for any future Labour campaign as Bill suggested yesterday. I’m not too hopeful that people will listen. I watched a gutted James Meadway talking when the results had come in- whether he will be more receptive to reframing the debate I doubt.

Hopefully, when Bill comes over in February (?) some Labour ears will be more attentive.

Bill: Confronted with this daily lies, examples of stupidity, scientific laziness and utter evil I wonder how you can keep your sanity. Please let us know your secret.

Dear Non Economist (at 2019/12/17 at 7:17 pm)

You asked:

That assumes that I have kept it.

But the formula is one foot in front of the other and repeat.

best wishes

bill

I’ve been reading up on Mmt for a while now,and I think I get the basic concepts..It seems to me that it’s really macro economics thought of via first principal thinking. Politicians are masters at avoiding first principal thinking

“I watched a gutted James Meadway talking when the results had come in…”

If he was gutted (which I don’t question) that merely shows how self-deluded he has been. What other results could anyone conceivably have expected? Bill (among others) had explicitly spelled-out to anyone who was listening what were going to be the consequences of their actions, but they chose not to listen.

“…whether he will be more receptive to reframing the debate I doubt”.

Is he, or any of the rest of them, going to see the error of their ways? We shall have to wait and see.

In striving for an MMT breakthrough in public understanding and acceptance, I echo Bill in believing it essential to link mainstream monetary scarcity theory with the austerity and other obvious evils of neoliberal capitalism. It seems to me that an increasing number of average citizens in a variety of countries–especially younger citizens–have reached the conclusion that neoliberal capitalism does not work for them, forecloses hope for their futures. Accordingly, following Bill’s lead, MMTers must explain to this growing army of post-capitalist citizens how liberation from neoliberalism entails freeing oneself and the larger society not only from neoliberal policies but also, even more so, from the neoliberal thinking used to support and justify those policies. That’s the stick we can use to get the horse to move the cart of public opinion. But, as the old saying goes, we also need to provide the horse with a carrot: the extraordinary scope of federal agency that MMT reveals is available to meet our most pressing socioeconomic and environmental needs, to restore quality of life for the average citizen and regenerate hope for his or her future. Not even to mention hope for the long-term survival of the human species, among countless others, increasingly threatened by neoliberal economic ecocide.

Have you read the article by mankiw

https://scholar.harvard.edu/files/mankiw/files/skeptics_guide_to_modern_monetary_theory.pdf

I would love if you did a reply to it. Because I can’t believe what he says regarding banking and general concepts.

One of the strategies the C I A actually came up with to tank China is to promote the “education” of neoliberal economists.

I find it pretty funny that economists are so cancerous and moronic, they wreck your domestic economy, perhaps without even knowing it!

Thinking in that context, economies of many countries in EU and Australia are kind of like collateral damage from uncontrolled economic-virus dispersion!

Simon Cohen:check out:

A Politician’s guide to the question, “How are you going to pay for it?”

If there’s one question a politician fears being asked, it is this one. After announcing a decision to undertake a bold new and expensive development project, the question always arises, “How are you going to pay for it?”

It shouldn’t be a horror moment for politicians, but it is, and the reason is simple. They are afraid to be caught out. Such is the millstone they have tied themselves to, over the years, trying to discredit their opposition, or portray themselves as fiscally responsible. In the process, they have shot themselves in the foot because they don’t understand how sovereign money works.

Therefore, in the interests of common sense and as a means of bringing an end to the foolishness that is endemic within this charade we call our parliamentary system, here is a prepared script for politicians to study which should help them to manage the, “How are you going to pay for it,” all fearing, all threatening, career ending, monster question, when being interviewed by a journalist.

Beginning of interview:

Journalist: And how are you going to pay for it?

Politician: We will pay for it the same way we have always paid for it. By crediting the bank account of the recipient.

Journalist: But how can you do that if there is no money in your account?

Politician: We create the money. There is always money in our account.

Journalist: Until you run out of it, or have to borrow, you mean.

Politician: No, we don’t need to borrow money, we create it. We can’t ever run out of it.

Journalist: But how is that possible?

Politician: We use computers, just like you do. Do you use internet banking?

Journalist: Yes, but I can only do that if I have money in my account.

Politician: That’s right, because you are the currency user. The government is the currency issuer.

Journalist: But you still must have the money.

Politician: No, we don’t. What part of, “we are the currency issuer,” don’t you understand?

Journalist: I’m confused. Are you saying a government doesn’t need to raise revenue to spend?

Politician: I understand your confusion. It sounds a bit fishy, but a sovereign government who issues its own currency doesn’t need to raise revenue to spend.

Journalist: But you need taxation revenue to spend?

Politician: Not for spending we don’t.

Journalist: I don’t get it. You seem to be advocating printing limitless amounts of money. Isn’t that what Mugabe did?

Politician: No, it’s not what I am advocating, and it’s not what Mugabe did. Firstly, we don’t print money anymore. It’s all done via electronic interbank transfers. Secondly, Mugabe wrecked his country’s economy by systematically destroying its resources, not by spending.

Journalist: What about Argentina?

Politician: Argentina foolishly borrowed foreign currency and then wasted it.

Journalist: Venezuela then?

Politician: Sheer incompetence, again, by using another country’s currency.

Journalist: But if we just create money what’s stopping us from doing the same as they did?

Politician: We don’t ‘just create money.’ It’s not about the money, it’s about how we use it. If we use it to engage our workforce and produce meaningful goods and services, the kind of things people here and overseas want to buy, we strengthen our economy, unlike those countries you mention, who failed to use their natural resources, and failed to use their own currency.

Journalist: But surely there is a limit to what we can spend?

Politician: There are always limits, but they are resource related limits, not money limits. We can’t spend if there’s nothing to buy. We must produce before we can buy. So, logically, we must issue the money to get our workforce into jobs and manufacture things we need to live and to prosper.

Journalist: All this seems to contradict any need for the government to produce an annual budget that shows how much they will spend, how much they expect to receive in taxation, how much they need to borrow, to make up the difference, that sort of thing.

Politician: Yes, it does seem that way, but that’s a political choice. We do that to keep the accountants happy and to have you believe that running a government is the same as running a household or a company. It isn’t. Households and companies are different. They can’t create money. They can only use money. Only sovereign governments can create money. But keeping books that show spending versus revenue, makes it easier for us to say we can’t afford it and stuff like that. God help us! We can’t have you think we can work miracles.

Journalist: Then why bother with taxation?

Politician: That’s a great question. We do need to tax, but you are confused enough already. We’ll leave that for another day. There is a limit to what you can absorb in one sitting. Best we schedule another interview where we can cover that issue separately.

End of interview.

Don’t be surprised if, after the interview, the journalist returns to the office and pens tomorrow morning’s headline, “Politician says government is money machine, Taxation unnecessary. Hyperinflation imminent.”

I would observe that the insanity of the Australian government as you describe it is compounded by the fact that the “surplus” about which it idiotically brags is a function of iron ore exports — so the nation is actually poorer for having sent away a real resource. Not to mention all of the environmental degradation associated with the mining and shipping involved. Stupidity piled upon insanity.

Unfortunately, the same disease grips the talking heads in Toronto who scold our Federal government for continuing to run deficits — they ought to be applauding!

What a world …

Imagine yourself being the guy who maintains computers at central bank, looking at some dusty old pentium-133 and thinking “Is this that all there really is? All nations money in this computer? What is this all fuzz about running out of money? Has everyone gone mad?”

By the way, there was time before computers. When you did accounting on paper, there was no way people could get confused, it was all too obvious.