In the annals of ruses used to provoke fear in the voting public about government…

The so-called euro stability spawned banking system that caused havoc

In yesterday’s short blog post – Some Brexit dynamics while across the Channel Europe is in denial (January 2, 2019), I noted that various European Commission officials were boasting about how great the monetary union had been over the last 20 years. European Commission President Jean-Claude Juncker had the audacity (and delusion) to claim it had “delivered prosperity and protection to our citizens. it has become a symbol of unity, sovereignty and stability”. I think he was either drunk or in a parallel universe or both. I provided two graph (GDP growth and employment) to show how poorly performed the monetary union has been since its inception. Today, I want to bring to your attention a Bank of International Settlements (BIS) research report which categorically finds that the European banks during the pre-crisis period not only fuelled the massive boom in sub-prime loans and doomed-to-fail assets that were floating around at the time, but also “enabled the housing booms in Ireland and Spain”. Rather than the US banking system being primarily responsible for the pre-crash buildup of private debt, the European banks were also helping the “leveraging-up of US households”. The “European banks produced, not just invested in, US mortgage-backed securities”. This role is not well understood or recognised. And it was because the Single Market mentality of the neoliberal European Union which abandoned proper prudential oversight and regulation allowed it to happen. So much for “prosperity”, “protection” and “stability”.

The BIS paper – The 2008 crisis: transpacific or transatlantic? – (published December 16, 2018), appeared in the December edition of the BIS Quarterly Review and was written by Robert N. McCauley.

The BIS paper considers two rival “hypotheses that ascribe the 2008 US financial crisis to capital inflows”.

The first is the so-called “Asian savings glut hypothesis” that:

… posits that net inflows into high-grade US public bonds from countries running current account surpluses led to the housing boom and bust. An excess of savings over investment abroad led to an excess of US investment over savings.

The second is the so-called “European banking glut hypothesis” that:

… holds that gross inflows into private bonds led to the boom. Leveraging-up by European banks enabled the leveraging-up of US households. Gross flows from Europe better matched US mortgage market trends towards private credit risk, floating interest rates and narrow spreads. What is more, European banks produced, not just invested in, US mortgage-backed securities.

The GFC created “three different groups” of nations:

1. “Some countries experienced housing booms in the years before the crisis, and found themselves at its epicentre: the United States, the United Kingdom, Spain and Ireland.”

2. “Banks in some other countries had exposed themselves to these booms and suffered banking crises: Germany, Belgium, the Netherlands and Switzerland.”

3. “the rest of the world played the role of spectators hit by the seizing-up of the US dollar-based international banking system and the subsequent downward spiral of world trade.”

The American story was that the Asian financial crisis in 1997-98 had caused profitable investment opportunities in Asia to dry up and the resulting glut of savings via current account surpluses sought returns elsewhere.

The obvious target was the “safe US bonds” and the “one-way investment put downward pressure on US bond yields and stimulated US investment, especially in homes”.

The mirror of the Asian external surpluses was the “widening … US current account deficit” as US spending outstripped domestic output and these “‘transpacific’ imbalances ultimately caused the GFC”.

The alternative story looks at the “two-way transatlantic flows” which reached huge scales in the 2000s.

After the monetary union began:

European banks leveraged up their equity with dollars borrowed from US and other investors and ploughed them into US private debt. More than anything else, they bought private label mortgage-backed securities (MBS), or complex bonds based on them.

But, further, these huge purchases “enabled their issuance to surpass that of government agency MBS in 2005. Leveraging-up by European banks begat unsustainable leveraging by US households”.

When comparing the capital flows from external surplus nations, the evidence is clear:

1. “gross capital flows from Europe to the United States dominated”.

2. “banks from both surplus and deficit countries, mostly in Europe, set up conduits that held risky US MBS funded by short-term commercial paper”.

3. ” European banks’ US subsidiaries manned the production line of the private label MBS, issuing them as well as investing in them.”

4. “the more exaggerated property booms in Ireland and Spain drew on even larger portfolio and money inflows from European banks”.

5. “In contrast to US developments, securitisation played little role in the Irish or Spanish booms, but in common with US developments a strong flow of credit from European banks played a big role.”

So which story best explains the characteristics of the GFC?

The BIS research finds it was the European banking glut rather than the Asian savings glut that gives a better account.

The paper finds that that the behaviour of capital inflow from Asian external surplus nations was very different to that coming from the European banks.

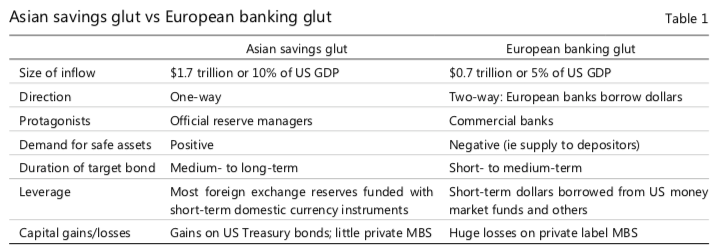

The following table (Table 1 in the paper) makes the comparison.

The key differences are:

1. One-way (external surpluses invested in US government bonds by Asian foreign currency reserve managers as an alternative to holding US currency reserves) versus two-way (instigated by European banks borrowing from the US and then flowing back into the US via investment in risky MBS – so-called “round tripping” of dollar flows).

2. official reserve managers versus commercial banks.

3. positive demand for safe assets (investments avoided “risky private MBS”) versus negative demand for safe assets.

4. medium- to long-term (“safe, longer-term US government” debt versus short term speculative investments in risky private bonds (“spread product” – “earn a margin over cost of short-term funding”).

5. quality of the debt – the European banks “borrowed from US money markets”

6. Gains from Asian surplus investments (“as US Treasury bond yields fell and the dollar rose”) versus “huge losses” to European banks (from collapse of risky, private MBS).

The paper also finds that the way the US financial markets responded to these two types of capital flows favours the proposition that it was the European banks that drove the proliferation of high risk debt rather than the investments by Asian foreign currency reserve managers.

What happened was this:

1. Treasury yields were depressed by the massive foreign inflow into US Treasury bonds.

2. But there was a trend away from fixed rate mortgages (as yields fell).

3. Adjustable rate mortgages (ARMs) dominated and they came without agency guarantees (Fannie Mae etc).

These developments were contrary to what one would expect to happen if the financial markets were responding to a dominant investment strategy from Asian foreign currency reserve managers, who are risk averse and long-term focused.

The BIS paper concludes in this regard that:

In sum, key bond market developments in the 2000s did not match what might have been expected from a big official flow into Treasury notes …

What actually happened supports the European “banking glut story better”.

Why?

1. The European banks “drove US mortgage finance away from government guarantees to private credit risk.”

2. “ARMs predominated” because this allowed the European banks to better match their short-term funding sources with return.

3. The narrowing of spreads on risky private sub-prime ARMs and “‘conforming’, agency ARMs” were driven by the rising demand for risky short-term debt by the European banks.

Further, the European banks became “producers of MBS”.

The European banks were far from being “hapless investors in US MBS”, which is the “usual image” portrayed, particularly by the revisionists in the European Commission..

The BIS paper shows that “Six European banks” were pumping out “private label MBS” from their “US … affiliates”.

For example, Greenwich (RBS) ranked first of all the underwriters of subprime MBS. This was an operation that was formed when NatWest purchased the US-based Greenwich Capital in 2000. At that time, Natwest became part of the RBS Group.

Other leading European underwriters were Credit Suisse (Ranked 5th), Deutsche Bank (7th), UBS (13th), Barclays (14th) and HSBC (16th).

Overall these 6 banks “claimed a 35-40% share” of the subprime MBS market.

Effectively, the “production line” of European banks saw them busily borrowing in US dollars, then buying up US mortgages, which they then assembled into MBS.

Next step was to have the MBS “sliced and diced … into collaterised debt obligations (CDOs)” which they then sold as trading assets.

By 2007, the European banks held massive volumes of US MBS “on the balance sheets of their US securities affiliates”.

By 2008, these assets collapsed and the banks were recording “large losses … from writedowns”.

The data shows that the European banks spread their exposure across their own balance sheets and those of their US-based affiliates.

While in 2002, the risk profile of their holdings was similar to US residents, by mid-2007:

… the profile of European investors’ US bonds had veered away from that of US investors towards riskier bonds

Their massive participation in the US financial market saw the “US mortgage market reshaped” in terms of “prices around the needs of the foreign banks”.

US mortgages were increasingly priced using the “offshore Libor” reference rate rather than the one-year Treasury bill rate.

The paper notes that:

The benchmark was not “Changed by Wall Street, for Wall Street” … but rather for Lombard Street (London) and for Taunusanlage (Frankfurt).

A vicious cycle developed:

1. As the European “underwriters ramped up production, they sent a signal to mortgage bankers to extend more credit.”

2. And the “European banks, bulked large as ultimate holders of such paper as well”.

This explosion in risky behaviour was aided by flawed (and corrupt) behaviour from ratings agencies that emphasised “size” rather than risk.

The BIS author speculates that the ratings agencies guessed that “size” would increase “the odds of government support in extremis”.

Too large to fail.

Private returns, socialise the losses.

The BIS paper goes on to analyse the way in which the risky behaviour of the European banks also fuelled the Spanish and Irish real estate and credit booms.

The conclusions of the BIS paper are clear:

1. When the crisis hit, the “highly leveraged European banks scrambled to secure dollar funding as they experienced credit losses – and the dollar appreciated sharply”.

2. “European banks’ vulnerability arose from their role as producers of the ultimately toxic assets as well as from their role as investors. As a result, their affiliates’ US balance sheets required massive writedowns in 2008.”

And Member State governments were lumbered with debts as they socialised the losses of this folly. They were then subjected to Excessive Deficit Mechanism austerity as a result of the rise in their deficits and debt.

The European system exemplified!

Conclusion

So what the European Commission elites claim to be the hallmark of stability and prosperity actually supported a financial system that caused havoc around the world, not just in Europe, but elsewhere.

The regulation of the European banks was so lax and the capacity of the corrupt ratings agencies to give cover to excessive risk was not disciplined by the European authorities.

The European Commission and the ECB were so bent on advancing neoliberalism and the Single Market that they overlooked what became disastrous behaviour by the major banks under their watch.

And for all the Europhile Left types out there who claim this can all be ‘reformed’ 10 years have passed and none of this behaviour has been legislated as being illegal.

The private banks were bailed out, their executives got away with blue murder, and all the talk of banking unions etc has done nothing to change the underlying culture of the financial system.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

There’s no good* reason why a Nation or currency union should have only ONE payment system (besides physical fiat, aka “cash”) – the one that must work through the banks – when we could have an additional, risk-free, always liquid payment system consisting of individual, business, State and local government, etc. checking/debit accounts at the Central Bank or Treasury itself.

Then, and after government-provided deposit insurance and all other privileges for the banks have been responsibly abolished as unneeded and destabilizing, the banks shall no longer hold the economy hostage and can be allowed to fail singularly or all together while the economy continues to function via individual, business, State and local government, etc. checking/debit accounts at the Central Bank or Treasury itself while the wreckage is resolved.

*A bad reason is that if depositors could escape the banking cartels, the ability of banks to safely create deposits/credit would be severely impaired. But with inexpensive fiat and equal fiat distributions to all citizens, who needs bank credit anyway when genuine loans of fiat (“loanable funds”), perhaps brokered by the banks, should suffice?

Bill writes in his concluding remarks: “The European Commission and the ECB were so bent on advancing neoliberalism and the Single Market that they overlooked what became disastrous behaviour by the major banks under their watch.” This may be true, but no evidence is supplied as to causation. How does the motivation to “[advance] neoliberalism and the Single Market” necessarily lead to “[overlooking] … disastrous behaviour by the major banks” What evidence is there to support this linkage from desire to result?

I have some maybe naive questions.

1. From page 42, “… overlooked European banks’ provision of safe assets to US money market funds. These banks invested the proceeds in pseudo-safe MBS, many rated AAA, in a so-called “credit arbitrage” strategy which proved far riskier than expected. Official reserve managers demanded dollar safe assets; European banks supplied them.”

I’m taking this as describing the differing investment stance of Asian reserve managers and European banks. I don’t understand how it could mean that European banks were providing safe assets to official reserve managers.

2. What do we think about Box A on page 44? “Inflows of foreign capital to banks free them from the constraint of the domestic funding base and thereby enable domestic credit booms.” The examples are from emerging economies, which have a hard time being independent, and Eurozone countries, which have agreed to be dependent. So it could support their point about a Banking Glut behind housing bubbles in Ireland and Spain, but would say nothing about the U.S. crisis. Or would it?

The underlying cause to all this is the land market which does not allocate to best use. This is because land was written out of the text books a century ago. It is the most important ‘asset’ as it in fixed supply, requires no expenditure to maintain its value and is the most important element of a basic human need: a home. The land market is all externalities unless its value is taxed away.

Carol

Where I live (in Australia) renovating homes for profit has transformed housing into a commodity. Television is replete with shows that extol the virtues of a quick fix for an even quicker buck, thereby removing what you so aptly described as a basic human need: a home. I think it will take a major crisis to knock sense back into our collective denial. Adam Smith was right to want to have a free market: free of Rentiers – those landlords that make money in their sleep. We have created a population nightmare, as migrants flock here to join the great property rush. History repeating itself – just as occurred in the mid 19th Century but with gold.

Everybody knew that the flow of dollars from Europe was instrumental to cause the conditions for the crash (see e.g. Michael Lewis book) However, as a “Europhile Left type”, I want to say that the lack of supervision on the financial system was not privative of the EU. Blaming the EU or the Euro or anything else than the neoliberal ideology -with its nonsense identification of political freedom with economic anarchy- is a europhobic prejudice.

Roman Ceano:Blaming the EU or the Euro or anything else than the neoliberal ideology -with its nonsense identification of political freedom with economic anarchy- is a europhobic prejudice.

Yes, but the Euro institutionalizes neoliberal ideology and enacts it into law. So much so that the law as written simply cannot be applied, as it would have caused the Greatest Depression ever after 2008. The only thing that keeps the EZ going is the ECB breaking treaties by (illegally) supporting each nation’s bonds – but only as long as they obey neoliberal ideology. So the choice is – obey neoliberal ideology and its innumerate economics. Or exit the Eurozone.