I started my undergraduate studies in economics in the late 1970s after starting out as…

Corporate Australia – the mendicants who want more!

Over the last few months, we have had the Australian Treasurer clogging up the media with his relentless claims that Australia has no choice but to cut corporate tax rates to keep up with the rest of the world (this is after Donald Trump started the ball rolling). The Federal government is trying to eliminate the resistance in the Senate (Upper House) to their proposal to cut corporate rates from 30 to 25 per cent. The Treasurer is a really pathetic figure – a non-economist, mouthing platitudes over and over about matters that he has little understanding and which the research evidence doesn’t support anyway. Then, last week, the ultimate public purse dependents, big business sent the members of the Senate a letter (a sort of blackmail letter) claiming if the Senators stopped blocking the legislation, then their corporations would go on an investment, wage increasing, employment creating binge. It was sickening to read and listen to. These mendicants are trying to convince us that the only thing stopping an investment boom or wage increases is a 5 cents in the dollar tax impost that tax data reveals many of them don’t pay anyway. It was hypocrisy parading as blatant self-interest. These characters have no shame.

Special pleading for more corporate welfare reaches new heights

As part of its special pleading for more corporate welfare, the Business Council of Australia (which represents large companies) sent a letter last week (March 21, 2018) to all members of the Australian Senate, which has been holding up the proposed tax cuts.

At the outset (in the mid-1980s), the BCA membership was the largest companies in Australia. Now it has “130 firms, plenty of them consultants, lawyers, accountants and investment bankers feeding off the original BCA types, investment bankers such as Goldman Sachs and JP Morgan – neither of which paid corporate tax here in the past three years” (Source)

It was signed by the CEOs of 10 largest companies trading in Australia.

The letter claimed that if they agree with the legislation then these companies will increase investment, raise wages and create more jobs.

The letter said:

We believe that a reduction in the corporate tax rate, as proposed through the Government’s enterprise tax plan, is urgent and vital to keep Australia competitive.

If the Senate passes this important legislation we, as some of the nation’s largest employers, commit to invest more in Australia which will lead to employing more Australians and therefore stronger wage growth as the tax cut takes effect.

In its campaign, the BCA claims that corporate tax rates in Australia a very high and onerous.

The facts speak otherwise.

In March 2017, the CBO published = International Comparisons of Corporate Income Tax Rates – as part of its briefing for Donald Trump’s tax agenda.

The CBO uses data from the OECD, IRS and other well-known and transparent data sources.

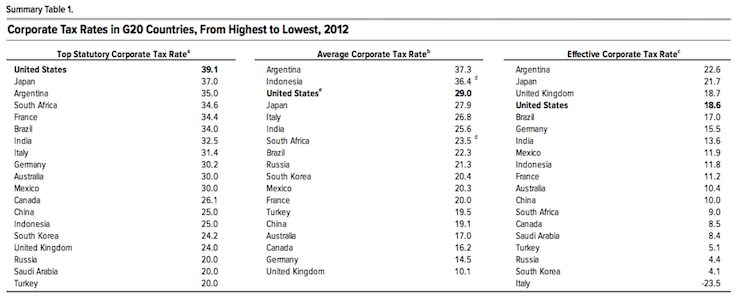

Summary Table 1 (reproduced below) shows ‘Corporate Tax Rates in G20 Countries’ for 2012.

Australia sits at equal 10th in terms of ‘statutory corporate tax rates’, which “are specified in law”.

But using the statutory rates is misleading because it only applies to the top rate applicable “to each additional dollar of taxable income in the highest tax bracket” and ignores concessions and deductions.

In terms of the ‘average corporate tax rate’, which is “the total amount of corporate income taxes that companies pay relative to their income”, Australia drops to 15th place in the G20 list.

So while the statutory rate is 30 per cent, once all the (corporate welfare) concessions are taken into account, the Australian effective corporate tax rate is just 10.4 per cent.

Who pays tax anyway?

On December 7, 2017, the Australian Tax Office (ATO) released corporate taxation data for the financial year 2015-16 under its – Corporate Tax Transparency – program.

It contains information on (Source):

… the total income, taxable income and tax payable of more then 2,043 entities

They include 1,693 Australian public entities and foreign-owned entities – including privately owned foreign companies – with a total income of $100 million or more

They also include 350 Australian-owned private entities with a total income of $200 million or more

Together their collective income was more than $A500 billion in that financial year.

You will see, for example, that QANTAS AIRWAYS LIMITED with a Total income $A15,754,181,367 with a Taxable income of $A52,432,000 paying ZERO tax.

Its boss signed the BCA letter and has been outspoken in the media in his demands for tax relief for his company – relief from ‘nothing’!

His entreaties have been simpering and self-serving.

Of the other signatories to the BCA letter: Origin Energy (Total Income $A11,917,688,617, Taxable Income $A94,061,718, Zero tax paid) and JBS Australia chief Brent Eastwood (Total Income $A640,358,338, Zero tax paid).

The ABC news analysis (February 13, 2018) – Why many big companies don’t pay corporate tax – pointed out that:

Qantas CEO Alan Joyce, one of the most prominent supporters of the Turnbull Government’s proposed big business tax cut, presides over a company that hasn’t paid corporate tax for close to 10 years.

It also noted that “one in five, of Australia’s largest companies have paid no tax for at least the past three years”.

It also said that:

At a time when Australian households have seen their electricity prices soar, the country’s leading energy retailer, EnergyAustralia … paid no corporate tax for the decade to 2016.

That’s despite EnergyAustralia’s 1.7 million electricity and gas customers across eastern Australia helping it record $24 billion worth of revenue for the three years to June 2016, and an operating profit of about $200m last year …

What about the big international banks that generate multi-million-dollar advisory fees and turnover billions in lending and trading in Australia? …

… some of the world’s most prominent investment banks are collecting tidy sums of revenue in Australia and not paying corporate tax.

So it makes the claim that they will invest more if they get tax relief look very thin, when the actual tax burden they bear is at times zero.

And more evidence

Two pieces of research have emerged in recent days that bear on this issue.

First, “a secret survey conducted by the Business Council of Australia” itself has been leaked and reveals that (Source):

Fewer than one in five of Australia’s leading chief executives say they will use the Turnbull government’s proposed company tax cut to directly increase wages or employ more staff …

The lame response from the BCA is that the survey was unrepresentative and that “What’s on the public record is what matters and those commitments are on it.”

What is on the public record is the Letter these goons sent the Senate members trying to coerce them into extending the corporate welfare net.

On February 21, 2018, regular business commentator Michael Pascoe, who is hardly anti-corporate in outlook, said of the BCA special pleading (Source):

The business lobby is at a low ebb when it can’t offer up policies capable of giving Australia the same growth dividend as a corporate tax rate from 30 to 25 per cent, and when the Republican Party is its hero … spare me specious claims of it being all about jobs and wage rises.

The ‘race-to-the-bottom’ corporate tax drive that the neoliberals are pushing at present has overtones of the competitive devaluations in the 1960s as the Bretton Woods fixed exchange rate system was falling apart.

If one nation devalued then it might gain a competitive trade edge, depending on the responses of exports and imports to the relative price change.

But if everybody follows suit – end of story.

This point was made by the Reserve Bank Governor in his most recent appearance before the House of Representatives Economics Committee on February 16, 2018.

The Hansard records the following interchange:

Committee Member: I would invite you to make a comment-obviously it’s a competitive business-on what corporate tax cuts, not just in the US but indeed in a lot of major economies, such as the UK as well, have been doing for global growth rates-how you see that.

RBA Governor: I don’t know whether it’s a thing that’s really lifting global growth, because, if everyone’s cutting their tax rates to get a competitive advantage, it doesn’t improve global growth. It’s a bit like exchange rate depreciation.

He noted that any growth that did come from the tax cuts would be “because you get a fiscal stimulus: the government’s taking less money out of the economy, and that can give you a short-term hit.”

The analysis by the ABC journalist Ian Verrender (October 16, 2017) – Who really wins in the murky world of corporate tax cuts? – is apposite.

He writes:

If you believe the hype, without the proposed cut, Australia will become an economic backwater, capital will flood to rival economies with lower tax rates and any multinational looking to invest will simply look elsewhere …

Will a lower statutory tax rate boost the economy?

The theory says yes and goes something like this: Less tax equals greater profits. And bigger profits means more money to invest, which should boost employment and help lift wages.

The trouble with theories is that they tend to not work as envisaged in the real world. And what we’ve seen in the past decade – with global interest rates cut to zero – doesn’t quite fit the model.

The idea behind those rate cuts, to zero and even into negative territory, was that corporations would borrow and invest, boost wages, fuel inflation and pick the global economy up off the mat.

Instead, most of the benefits of the tax cuts were passed directly onto shareholders who demanded bigger dividends in a world where there was no return on cash.

Even the Treasury concedes that our Gross National Income will rise by just 0.6 per cent in the long term.

In other words, not a major boost to well-being of the rest of us as the foreign owners of companies reap a shareholding harvest.

In a forthcoming article in the Economic Analysis and Policy journal (Vol 59, September 2018) – Do firms that pay less company tax create more jobs? – Australian economist Andrew Leigh, who is also a Labor Party federal MP, explored the claim that “lower company taxes will lead to higher rates of job creation”

This article is already available on-line via ScienceDirect, if you have library access. You can find it HERE.

His conclusions were:

1. “no evidence that firms which pay lower rates of company tax create more jobs.”

2. “In aggregate, the one-third of Australian companies whose effective corporate tax rate is below 25% shed jobs, while the two-thirds of firms with an effective corporate tax rate of 25% or above were net job creators.”

3. “These results are robust to the inclusion of controls for firm size and industry fixed effects, as well as to expanding the sample to include unprofitable firms.”

Put away the glasses!

Hollow threats

Of all the analysis presented in recent months on this question, the most entertaining input, in my view, came from one Scott Phillips, who manages an investment advisory firm in Australia.

In his Op Ed (March 22, 2018) – Companies flee Australia if they don’t get a tax cut? Don’t buy it – he reaffirms his pro-corporate values.

So not a ‘progressive leftie’ at all.

But coming from that ideological persuasion he wrote:

So it chafes, slightly, to be sitting on the other side of a debate involving the ‘peak lobby group’ for large businesses, the Business Council of Australia (BCA) …

Now, you and I can agree or disagree on the appropriate level of corporate tax. Frankly, I see little reason for it to be lowered – the list of significant companies that have fled Australia for the US since Donald Trump became president can likely be counted on the fingers of one finger. At night …

The scare campaign of ‘companies will flee’ is almost certainly that: a scare campaign …

And who’s going to up sticks? The miners, whose ore isn’t going to follow? The supermarkets or telcos whose customers won’t take kindly to being told to shop in Kentucky, California or Ohio? The banks, with their cosy margins and oligopoly? The lawyers and accountants whose advice is needed by local firms looking for offshore tax havens? …

We often hear of ‘capital flight’. But once the bricks and mortar are in place, the capital is not going anywhere.

And if the ‘capital’ is in the ground, it is not going anywhere and can be exploited by someone else.

Further, many companies, as Phillips notes, have to sell goods and services locally. They are not going anywhere.

Scott Phillips challenges the BCA argument about the likelihood of an investment boom should corporate tax rates fall.

He writes:

Apparently, Woolies can’t get a decent return on its investment without a tax cut. Ditto Woodside and Fortescue. Man, there must be some marginal investments out there. Can you imagine doing something at a 25 per cent corporate tax rate that you wouldn’t do at 30 per cent? Because, remember, you don’t pay 30 per cent tax on your revenue. Or even your gross margin. You pay it on before-tax profits. So if that investment isn’t profitable, you don’t pay any tax, regardless of the rate.

He finishes by quoting from Warren Buffett’s New York Times Op Ed (November 25, 2012) – A Minimum Tax for the Wealthy.

In that article, Warren Buffett relates that in the 1950s when the top tax rates were high and he was managing funds for investors “Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered.”

He notes that:

Under those burdensome rates, moreover, both employment and the gross domestic product (a measure of the nation’s economic output) increased at a rapid clip. The middle class and the rich alike gained ground.

So let’s forget about the rich and ultrarich going on strike and stuffing their ample funds under their mattresses if – gasp – capital gains rates and ordinary income rates are increased. The ultrarich, including me, will forever pursue investment opportunities.

And his final advice:

… maybe you’ll run into someone with a terrific investment idea, who won’t go forward with it because of the tax he would owe when it succeeds. Send him my way. Let me unburden him.

And finally, while on the ‘snouts in the trough’ theme, there was a report yesterday (March 26, 2018) – Tax concessions to wealthy costing six times the dole – which discussed the results of Australian research into who benefits from welfare payments and tax concessions.

We learned that a study of various data sources (Treasury, ABS, HILDA longitudinal) that:

… major tax concessions totalling $135 billion per year were costing the budget more than the four main welfare payments – the aged pension, family assistance payments, disability benefits and Newstart – combined …

In fact, these tax concessions are costing the budget about six times as much as Newstart …. [the unemployment benefit] …

… more than half of the benefit from tax concessions goes to the wealthiest fifth of households …

The cost to Australian taxpayers of the richest 20 per cent of Australians is actually a staggering $68 billion per annum …

The report also highlights how skewed the savings are from tax concessions – the top 20 per cent get $68.5 billion and the bottom 20 per cent get about $6 billion.

That is what ‘welfare’ for the rich is all about.

Conclusion

The overwhelming argument used by opponents to the Federal government’s tax cut proposal is that it will “put the budget at structural risk to prosecute an ideological outcome”.

It is pointed out that the Treasurer has been one of the most aggressive proponents of ‘getting the budget back into surplus’ but then turns around and proposes a substantial increase in the deficit by proposing these tax cuts.

For me, clearly, these arguments are erroneous.

Yes, the Treasurer is a hypocrite. But we have known that all along. He professes deep Christian values yet is part of a machine that locks refugees up in hostile prisons on Pacific Islands, without the slightest blink.

The real questions that should be discussed in relation to the proposed tax cuts are:

1. Is a fiscal stimulus required right now?

Answer: Definitely, with more than 15 per cent of available labour resources either unemployed or underemployment or hidden outside the official workforce.

Okay:

2. Is a stimulus coming from giving the top-end-of-town more of the national income the most appropriate way to achieve 1.?

Answer: Definitely not.

There is a crying need for major investment in public infrastructure – school, health, transport, water, etc – at present in Australia.

There is a crying need for public sector job creation programs, preferably a Job Guarantee.

None of these needs will be satisfied by a corporate tax cut. If anything, the Government should seriously retract the billions of dollars in concessions and other corporate welfare it hand outs to business on a continuous basis.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

The really amazing thing is that if you look at how our dividend imputation system works, a reduction corporate taxes reduces the imputation credits passed onto their Australian shareholders 1:1. What you give to Peter (the company) you have to take from Paul (their Australian Shareholders).

The only winners will be foreign shareholders!

The corporate welfare bill will probably pass the senate as I expect the two senators currently holding out will vote in favour. If I was them I would ask for the Job Guarantee to be fully funded and implemented before I would agree to it, plus Bill’s other suggested measures.

Once again, the writing in this is very witty. The “mendicant” business types who actually pay no tax anyway remind me of Bill’s “bond vigilantes on Shetland ponies” a few weeks back.

Obviously, I get the “corporate welfare” message in this article. However, aren’t key MMT people like Randy Wray and Warren Mosler opposed to corporation tax?

For the record Sco Mo did Eco. Its just that he does not get anything that makes sense. You could say he is as brain dead as his predecessor: Jo Ho.

D

In a quote here mention was made of Welfare costing the budget [much less than corporate welfare].

I read that treasurer Costello took pensions off the budget expenditure accounts, which means The budget deficit is less than before. Can someone clear this up? It does make the official deficit a lot smaller, not to mention a mockery of the whole process.

I am having difficulty fitting this post into my understanding of MMT in respect to the purposes of taxation for a country with a sovereign currency. It fits much better with my old ‘tax the corporations and the rich so we can provide the goods and services needed for a decent society’ typical FDR school Democrat position.

But MMT teaches that taxes do not fund such spending. Instead they have a different purpose and function. First some tax types serve to drive demand for the currency, giving otherwise worthless pieces of paper a baseline value. But corporate income taxes are not a type of tax that does that very well, if at all. Second, taxes remove spending ability from the private sector so they function to limit demand which at certain times may be excessive and cause inflationary pressures. Bill says that is not the current situation. Third, some taxes can be used to discourage unproductive or harmful behaviors like gambling or smoking perhaps. Again, a corporate income tax is not a good vehicle for achieving that goal. And fourth, some taxes might be used to address inequality in wealth and income in society, which is a nicer way for saying we’re gonna have the government take stuff away from wealthy people because we don’t want them to have that much stuff. Maybe a corporate income tax fits this purpose better than other taxes would?

The pretence for cutting corporation tax is that it increases jobs and investment. It doesn’t do that for the fairly obvious reason that investment is tax deductible. If you cut corporation tax there is less incentive to invest and more incentive to extract – particularly if you face no wage pressure because there are fewer jobs than people that want them.

So the corporation tax cuts flow straight to dividends and wage rises in the ‘talent’ economy. Or to corporate hoarding.

As ever the situation would be different with a Job Guarantee in place. Having more jobs than people changes the whole power dynamic. Then you actually want a payroll tax paid by corporations so that employing people can be made more costly if necessary to slow things down, but without affecting people’s wages.

Neil Wilson, why is there less incentive to invest when corporate income taxes are cut?

Ok, thinking about it- a tax deduction off a high corporate tax rate would sort of “subsidize” deductible expenses such as wage and materials costs. And charitable donations, if they were deductible. And it might be thought to make non-deductible expenses relatively more costly. I’m not sure that investment expenditure by corporations is deductible in the same way as wage and materials expenses are. I guess it depends on how the tax law is written, but in the US, I think investment expenses are only deductible as far as depreciation schedules allow. So cutting the corporate income tax rate might make investment relatively LESS expensive and therefore provide MORE incentive to invest. I am not a tax accountant though and could be mistaken.

If I train my staff, it may cost me £2000, but that is revenue deductible in the year of expenditure. If Corporation Tax is 30% then it only costs me £1400 ‘net trouser’.

Drop that to 10% corporation tax and the staff training costs me £1800 – a 28% rise in costs.

At that point I might decide to take the money as a dividend instead.

Mike Ellwood says:

Tuesday, March 27, 2018 at 20:05

Obviously, I get the “corporate welfare” message in this article. However, aren’t key MMT people like Randy Wray and Warren Mosler opposed to corporation tax?

Here’s Randy Wray’s views on Taxation from 2016: http://www.youtube.com/watch?v=PLjcjt4F5fA

Thanks Neil. Yes I agree that a high tax rate serves to ‘subsidize’ non-necessary, deductible business expenses. If corporate investment is fully deductible as in your example, then lowering the tax rate effectively removes part of the ‘subsidy’. I’m just not sure that training workers is the same as capital investments, or that capital investment is fully deductible as an expense.

Paying to train staff is a business expense for a company because workers are not property owned by the corporation. I don’t know that it really falls under the category of Investment, even though the effects might be similar to purchasing new machines or tools. If the workers remain your employees and you don’t have to pay them any extra (now that they know what they’re doing), you should be able to charge more for their time, or should expect that they produce more in the same amount of time and that would be the return on your business investment. In general, I would think it is primarily the expected return on the investment versus the cost incurred that is going to be considered when deciding to invest or not.

The BCA could find better arguments for their corporate tax cuts in Beardsley Ruml’s famous 1946 speech “Taxes for Revenue are Obsolete”, notwithstanding different times, different parameters etc.

They’d have to redact the rest of it however as it would let the cat out of the bag.

Qantas’ Annual Report shows Tax Losses carried forward at 30 June 2017 at $951 million. Tax rules allow companies to ‘use up’, or carry forward that tax loss against any taxable income after 2014 before tax kicks in again.

“If I train my staff, it may cost me £2000, but that is revenue deductible in the year of expenditure. If Corporation Tax is 30% then it only costs me £1400 ‘net trouser’.

Drop that to 10% corporation tax and the staff training costs me £1800 – a 28% rise in costs.”

Neil

You’re assuming that investment in human and/or physical capital is at the very least revenue neutral. It shouldn’t be. Your staff are more productive, your revenues should increase if you can sell the extra product produced and with a lower tax rate, more of that extra revenue flows through into your net profit after tax.

You can’t just look at the costs associated with investment in isolation. Do that and the cheapest tax rate for a corporation becomes 100% because it maximizes the value of its deductions, but it also denies the corporation an opportunity to make a profit.

Lower taxes allow companies to retain more of their pre-tax profit and should (all other things being equal (which they never are of course)) create an incentive to invest.

“Obviously, I get the “corporate welfare” message in this article. However, aren’t key MMT people like Randy Wray and Warren Mosler opposed to corporation tax?”

Mike

The Australian government is neoliberal to its bootstraps. It’s committed to returning the budget to surplus. Under these circumstances, the only way they’re going to ‘fund’ this tax cut is to reduce expenditure and increase the tax burden imposed on individuals.

You and I know it really doesn’t have to do either of those things, but it will. This reduction in corporate tax rates is a blatant attempt to grab a higher share of the income distribution dressed up as a job creation scheme.

Interest rates and the cost of capital is at an all time low.

The profit share of the income distribution is at an all time high.

Real wages and labour costs have effectively stagnated.

There’s never been a better time to invest in capital, grow a firm and and employ more people. If firm’s aren’t investing, growing or employing more people it’s because they aren’t sure they will be able to sell the extra output surely.

Marx was right. History really does repeat itself. First as tragedy, then as farce. We’re making all the same mistakes governments made in the 1930s even though we have the benefit of hindsight.

What difference is a 5% reduction in corporate taxes going to make to an economy that’s crying out for an economic stimulus?

Great article Bill covered all the angles.

Jerry Brown. By cutting taxes on corporations, indirectly you are cutting taxes on the wealthy. This increases the portion of disposable national income going to the wealthy. This places a greater portion of the resources of the country at the disposal of the wealthy. The level of inequality is incredible. The wealthy and the powerful do not lack financial resources. They do not need extra financial resources. They have no productive use for the extra real resources of the country. They will simply accumulate more claims on the community. The economy will slow unless the government steps in to utilize those resources by spending. Business’s don’t invest to put people to work. They invest to gain some of the income of the population and acquire money. If you want to grow the economy you look for ways in which people are able to or allowed to work for themselves.

Yok- “By cutting taxes on corporations, indirectly you are cutting taxes on the wealthy. This increases the portion of disposable national income going to the wealthy.”

I agree with that.

” The wealthy and the powerful do not lack financial resources. They do not need extra financial resources. They have no productive use for the extra real resources of the country.” I agree with you but you will find many wealthy people who won’t agree.

“They will simply accumulate more claims on the community. The economy will slow unless the government steps in to utilize those resources by spending. Yes, MMT holds that the government should take into account the savings desires of the private sector when determining how much it will spend (and THEN tax!) so as to keep all resources employed. This would usually mean running a budget deficit unless the country is running an external surplus.

“If you want to grow the economy you look for ways in which people are able to or allowed to work for themselves.” This sounds good but it is unrealistic in that many industries cannot be scaled down to produce at an individual level. You wouldn’t want a car built by the self-employed Jerry Brown Corporation. And even when it could be scaled down, say on a small organic farm, the prices will have to reflect the inefficiencies in the production process.