I am stuck in London courtesy of the terrorist policies of Donald Trump and his…

There is no European citizen – cultures and narratives diverge in the Eurozone

I have noted before that when someone asks me where I come from I immediately (and innately) respond Australia. If questioned further I might tell them I grew up in Melbourne, Victoria. Sure enough, I am a Victorian (with some of the cultural attachments that that denotes) but that affiliation is weak compared to my nationality. That doesn’t make me a xenophobe or a nationalist. It just says I am culturally from that geographic area. If I ask my friends from Italy, Spain, France, the UK, Germany, Belgium, Netherlands, Finland, Norway, etc the same question, they will answer they are from those nations. They never immediately respond by saying they are European. I can get them to say they are European but that is not their innate cultural association. The point is that there is really no such thing as a European citizen. They are all citizens of their individual Member States with little shared culture and quite diverse histories (not to mention languages etc). An interesting study came out from European economics think tank Bruegel last week (February 15, 2018) – Tales from a crisis: diverging narratives of the euro area – highlights the consequences of these differences and concludes that it makes “for an extremely challenging context within which to conduct a uniform monetary policy across different countries”. I would add economic policy in general to that assessment.

The study investigates “Who gets the blame for the crisis” in the Eurozone. They also were interested in the question: “How did narratives of the crisis develop since 2007?”

Their approach fell within the area of research known as ‘narrative-building’ in economics which Robert Schiller described in his January 2017 paper – Narrative Economics – as involving:

… the study of the spread and dynamics of popular narratives, the stories, particularly those of human interest and emotion, and how these change through time, to understand economic fluctuations.

Recessions are obviously about people deciding to “spend less, to make do for now with that old furniture instead of buying news, or to postpone starting a new business, to postpone hiring new help in an existing business, or to express support for fiscally conservative government”.

These decisions are subject to feedback – so as a recession deepens and confidence falters, people will decide to spend less.

But as Schiller notes: why did the recession even start in the first place?

There is a body of literature in the fields of marketing, journalism, education, health interventions and philanthropy that show the “people respond strongly to narratives”, which in the economics context, might be considered to be “largely exogenous shocks to the aggregate economy”.

That is, they influence behaviour in their own right and inject shifts in spending and other economic decisions into the economy.

A narrative is thus (according to Schiller):

… a simple story or easily expressed explanation of events that many people want to bring up in conversation or on news or social media because it can be used to stimulate the concerns or emotions of others, and/or because it appears to advance self-interest …

… a narrative is a gem for conversation, and may take the form of an extraordinary or heroic tale or even a joke. It is not generally a researched story, and may have glaring holes, as in “urban legends.” The form of the narrative varies through time and across tellings, but maintains a core contagious element, in the forms that are successful in spreading …

Narratives can be based on varying degrees of truth.

He argued that with the rise of social media (with fake Twitter accounts, etc), the “impact of non-factual narratives might be somewhat greater in today’s world than in decades past”.

This is a “post-truth” world, where narratives can easily become “based on false ideas”.

I have long argued that most economic commentary is based on fake knowledge, which has been parading as verity long before the advent of social media.

The lies and myths just become amplified by social media.

But the idea that narratives can spread is interesting and was the basis of the methodology used by the Bruegel study.

The Bruegel authors say that:

Over time dominant narratives tend to emerge, influencing the way a society views itself and forms its policy priorites.

They write that these narratives “cannot be observed directly” but are disclosed in “reporting patterns in mass media”.

Their proposition is that:

Since major newspapers cater to the broader public they can be expected to reflected the prevailing economic narratives.

Thus, they engage in a textual analysis of the “key crisis-related topics in articles from four opinion-forming newspapers in the largest euro-area countries (Germany’s Süddeutsche Zeitung, France’s Le Monde, Italy’s La Stampa and Spain’s El País)” which resulted in:

… a dataset of 51,714 news articles: 16,486 articles from Süddeutsche Zeitung, 9,566 from Le Monde, 6,416 from La Stampa and 19,246 from El País.

A linguistic algorithm was used to “reveal reporting patterns” and extract the dominant narratives.

See Latent Dirichlet allocation for more technical information on the statistical approach.

Their overall conclusions were that there were “varying narratives” across the four newspapers:

- Süddeutsche Zeitung blames everyone else but Germany, the chief suspects being Greece and the ECB; it stresses the need to get back to a perceived status quo of stability and fairness.

- Le Monde blames everyone including the French political class, but largely refrains from criticism of European institutions such as the European Commission and the ECB.

- La Stampa sees Italy as the victim of unfortunate circumstances, including the EU austeri- ty measures promoted by Germany, and Italy’s own politicians.

- El País primarily blames Spain for misconduct during the boom years preceding the crisis.

They suggest that these differences were the result of the “quite different effects” that the crisis had in the respective Member States.

Of note, was that “systemic euro-area issues” were “largely unmentioned” as the “National problems and solutions took centre-stage in national discourses”.

They found that:

A transnational consensus view on the causes and consequences of the euro-area crisis – in other words, a common economic narrative on the risks faced by the euro area – is missing. This impedes the emergence of a common body of public opinion as the basis for a debate around the reform agenda for the euro area as a whole.

One might suggest that this is strong evidence that there is no European culture or awareness beyond the national focus.

Of interest was the role of the ECB.

It is clear that the only reason the Eurozone has survived is because its main Euro-wide institution has breached the rules of the Treaty.

If the ECB had not have funded the fiscal deficits of the Member States – even though it does not express their QE policies in that way – then the several states would have been forced out in 2010 and 2012 (at least).

Italy, for one, would have become insolvent in 2012 if the ECB via its early Securities Market Program (SMP) had not have bought large volumes of Italian government debt in the secondary bond markets in that year.

I find it rather odd that the Europhiles are all crowing about growth now while they ignore the fact that the ECB has been operating for years in breach of the Treaty.

Yes, the Eurozone is growing now but not because its legal framework as defined within the Treaty provides for a sustainable monetary system.

The growth is because the Treaty has been put to one side by the ECB for the last six or so years.

But the Bruegel study found that the narratives in the four newspapers about the ECB were “dealt with from a distinctly national point of view.”

The coverage of the ECB in the German Süddeutsche Zeitung was dominated by typical ‘German’ concerns about “panic”, “disposession of savers”, inflation, etc.

This was in contrast to Le Monde and La Stampa, which both, in different ways, urged the ECB to help out the “most-indebted euro countries” and introduce “large-scale monetary easing”.

La Stampa even questioned the ECBs assessment of “inflation risks” as being “exaggerated” in 2011.

Across the Member States, the ECB was seen “to be too accommodative and too restrictive” and the Bruegel authors conclude that”

These opposing narratives make for an extremely challenging context within which to conduct a uniform monetary policy across different countries.

The study was reported in Bloomberg’s article (February 19, 2018) – Europe Can’t Get Its Stories Straight.

The article concludes from the Bruegel study that:

It’s as if the euro area’s four biggest economies didn’t share a reality … The euro zone is the only currency union in which there is no single constituent public. Instead, there are a number of national filter bubbles.

While the debate about the differences across the Member States in the early 1990s surrounding the Maastricht process was focused on whether they formed an Optimal Currency Area, there was less willingness to accept that differences in language, history, and culture were significant across Europe.

These differences would make it very hard for a federation to work much less a common currency without a true federation, with its own fiscal capacity and democratic responsibility.

All the working federations have a strong cultural identification with the ‘national’ unit – Australia, the US, etc.

That cultural identification is missing in the European context.

The Bloomberg article quotes one of the authors of the Bruegel study (Italian Giuseppe Porcaro), who has a very ‘European’ track record.

Porcaro was mentioned by the article as claiming:

… that ‘europeanizing the public debate’ was still possible if only different countries’ media were more interested in crossing the national barriers and showing their readers alternative perspectives too.

Which is a sort of vain hopeful plea against reality.

The newspapers pitch the angles to their national audiences because that is where their ‘markets’ are. They are not European because that is not the geographic organisation level which would deliver them profits.

Hofstede’s Cultural Dimensions – Eurozone Member States

To see how varied the cultures are across the Eurozone, I examined the data from – Hofstede’s cultural dimensions theory – which is an approach developed in the 1960s by a Dutch sociologist (Geert Hofstede) to categorise and distinguish national cultures.

It is widely used although some caution is required in blind application.

There are six dimensions:

1. Power Distance (PDI) – “This dimension expresses the degree to which the less powerful members of a society accept and expect that power is distributed unequally. The fundamental issue here is how a society handles inequalities among people.”

2. Individualism vs. Collectivism (IDV) – “The high side of this dimension, called individualism, can be defined as a preference for a loosely-knit social framework in which individuals are expected to take care of only themselves and their immediate families. Its opposite, collectivism, represents a preference for a tightly-knit framework in society in which individuals can expect their relatives or members of a particular in-group to look after them in exchange for unquestioning loyalty.”

3. Masculinity vs. Femininity (MAS) – “The Masculinity side of this dimension represents a preference in society for achievement, heroism, assertiveness and material rewards for success. Society at large is more competitive. Its opposite, femininity, stands for a preference for cooperation, modesty, caring for the weak and quality of life. Society at large is more consensus-oriented.”

4. Uncertainty Avoidance (UAI) – “The Uncertainty Avoidance dimension expresses the degree to which the members of a society feel uncomfortable with uncertainty and ambiguity. The fundamental issue here is how a society deals with the fact that the future can never be known: should we try to control the future or just let it happen? Countries exhibiting strong UAI maintain rigid codes of belief and behaviour and are intolerant of unorthodox behaviour and ideas. Weak UAI societies maintain a more relaxed attitude in which practice counts more than principles.”

5. Long Term Orientation vs. Short Term Normative Orientation (LTO) – “Every society has to maintain some links with its own past while dealing with the challenges of the present and the future. Societies prioritize these two existential goals differently. Societies who score low on this dimension, for example, prefer to maintain time-honoured traditions and norms while viewing societal change with suspicion. Those with a culture which scores high, on the other hand, take a more pragmatic approach: they encourage thrift and efforts in modern education as a way to prepare for the future.”

6. Indulgence vs. Restaint (IND) – “Indulgence stands for a society that allows relatively free gratification of basic and natural human drives related to enjoying life and having fun. Restraint stands for a society that suppresses gratification of needs and regulates it by means of strict social norms.”

I don’t intend to write a lot here about this at this point.

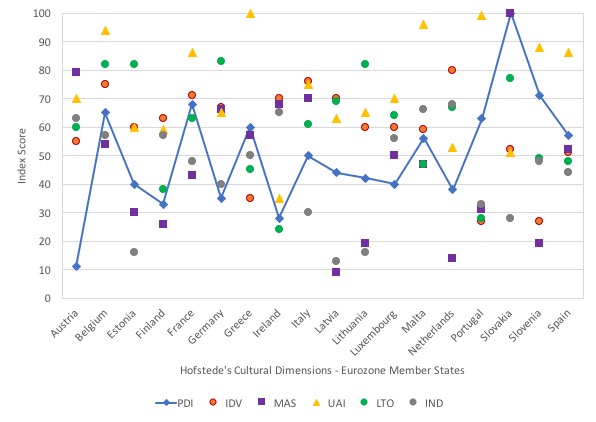

But consider the following graph that I assembled to plot the current scores for the 6-dimensions for the 19 Eurozone Member States.

The range is 0 to 100 (they are not percentages). The Median score is 50 and if a Member State has a score above the Median the the specific cultural dimension is strongly characteristic of that nation. An opposite interpretation follows for nations with scores below the Median.

I have connected the dots for one of the indicators (PDI) just to show you the degree of variation across the nations on that dimension alone.

The point is that there is huge diversity across the Member States for most of these cultural indicators.

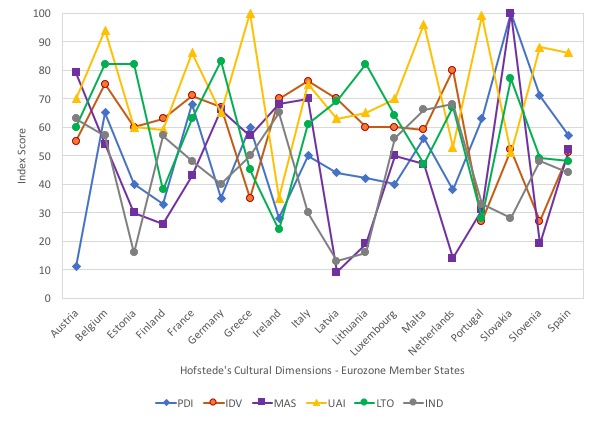

If you were to print the graph and play dot-to-dot with different coloured pencils then this is what would transpire:

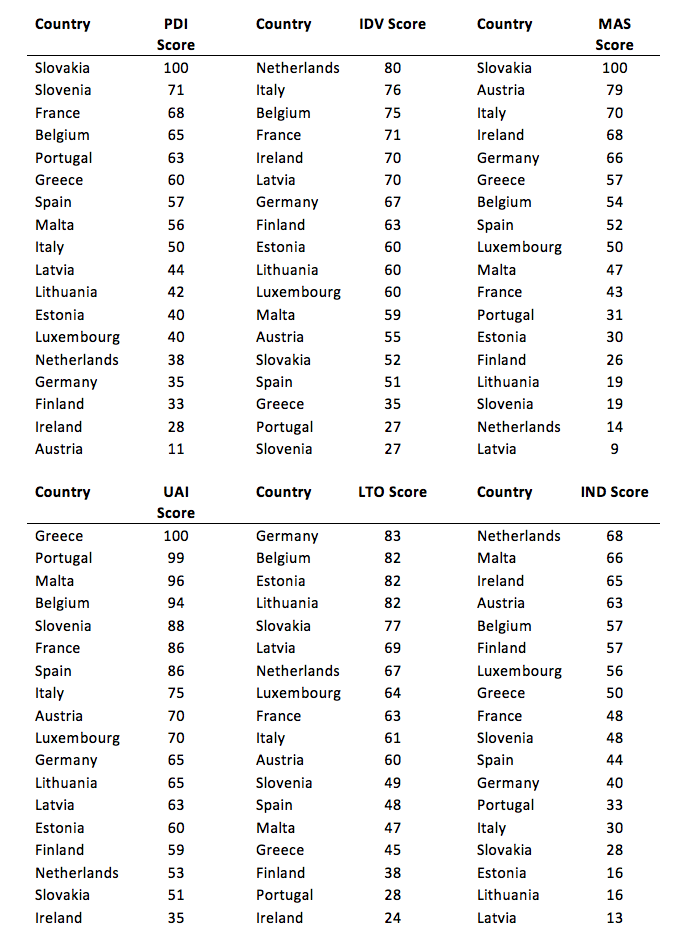

To provide help interpret the graphs more easily, I created this Table of the scores (ranked largest to smallest) across the 6 dimensions for all the Eurozone Member States.

The summary of the data suggests:

1. There is large variations for the PDI dimension although only a few nations are well below the Median.

2. On the IDV dimension, large variations with a biase towards ‘individualism’

3. For the MAS dimension, the spread is the largest (but close to PDI).

4. For the UAI dimension, only Ireland is below the Median. People in the Member States seem to dislike uncertainty.

5. For the LTO dimension, large variations but a bias towards a long-term orientation, which maybe helps to explain the tolerance to the crippling austerity based on the lie that it would do them good in the long run.

6. On the IND dimension, the variation is lower, although the old Soviet Baltic satellites clearly prefer restraint (not having fun) in comparison to the Netherlands, for example.

The overall cultural variation across the 19 Member States is large.

There have been attempts to form regional clusters aggregating Member States that are alike across the 6 dimensions.

These aggregations are fraught and become rather stylistic – the Germanic-Benelux formation; the Latin formation etc.

You can only squeeze so much out of data like this. Even the conceptual basis for generating the scores is contestable.

But the point is that there is no cultural homogeneity within the Eurozone and, instead, there remain large cultural differences, which reinforces the Bruegel findings.

Conclusion

Perhaps play the quiz that I started with when you are next around a table with your Eurozone mates. Ask them where they are from.

The point is that for a common currency in a federation of separate states to work effectively there has to be a strong federal fiscal capacity, which is capable of transferring net spending around the geographic space.

Without a common cultural identification such transfers typically would stir negativity.

Even without that fiscal capacity, we observed considered public disquiet in say Germany when it was mooted that funds would be provided to Greece to save it from insolvency.

The sort of ‘stealth transfers’ that the ECB is engaging in at present are relatively low profile to most people. But when a national government transfers billions to a particular state within its federation to help it cope with an economic emergency then that federation needs a high degree of cohesiveness, defined, in part, by the dominant culture.

Europe doesn’t have that.

The Eurozone will never have that. It can only work over time if the ECB flouts the rules.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

“It’s as if the euro area’s four biggest economies didn’t share a reality … The euro zone is the only currency union in which there is no single constituent public. Instead, there are a number of national filter bubbles. ”

Pretty damning there.

US still hasn’t helped Puerto Rico in any big way after Maria. I have suspect there is this same identity mechanism there at work.

Or it could just be that wealthy people want to privatize PR to reap more unearned income.

The people I have spoken to like the idea of belonging to a European community. There is geography which allows common borders and easy travel. There is a long lived shared European history which has drawn countries together for one reason or other. And there is a common set of basic values which is shared across Europe. Even the Christian religion is a binding factor. But all this, it would appear, is not enough for there to be sufficient motivation for pan European financial and economic institutions to be trusted and to develop.

Its definitely true that most US citizens identify primarily as ‘Americans’, not as residents of their individual states. To the point that there really isn’t even a word for what I am as a resident of the state of Connecticut, if that was how I wanted to describe myself.

So that is way different than Europe. And for all the agitation over “Brexit” – none of it remotely adds up to anything like the response of the United States to our historical exit attempt by the confederate states of the south. That exit was prevented only by the worst war in US history as far as US casualties are concerned. (The prosecution of that war and the monetary policies that assisted that, such as US Greenbacks currency, support the overall MMT understanding of economics).

Henry Rech, a lot of that long lived shared European history is that they were busy killing each other an awful lot of the time. And sometimes they did that killing even because of differences in their ‘Christianity’. Or at least they blamed it on that.

Jerry,

I guess you are a Connecticutian, I have never heard that word used either. Plenty of Texans, but no Arkansasians. Plenty of Californians though.

If it does not role off the tongue it does get used.

Or each State has a different level of self identity.

Yea Alan, I never heard of Connecticutian either 🙂 I was born in New York though – maybe I could call myself a New Yorker if it became necessary for some reason…

Jerry,

You said:

“Henry Rech, a lot of that long lived shared European history is that they were busy killing each other an awful lot of the time.”

So what?

What do they say – keep your enemies close.

Henry, the idea is to keep your friends close but your enemies closer.

Jerry, in English the phrase ‘I am an X’ is ambiguous, which it isn’t in German. Were you to say that you were a New Yorker, no one would think that you were claiming that you were a magazine of that name, but they wouldn’t necessarily know whether you were claiming that you were a resident of New York City or had a psychological/cultural affinity with NYC residents. Any listeners who, say, know you have never lived in NY might naturally assume that you were claiming some kind of affinity with the city.

Similarly, no German thought that Kennedy was claiming that he was a jelly doughnut when he said, ‘Ich bin ein Berliner’. Had he said, ‘Ich bin Berliner’, it would have meant that he was a resident of Berlin, which would have been ridculous. It would be more natural for you to say that you were from Connecticutt and thereby avoid what is an awful neologism.

The closest I think English gets is to use the term, “like”. As in the distinction between ‘He is a banker’, meaning he works for a bank, and ‘He is like a banker’, meaning something along the lines of thinking or acting like a banker without actually being one.

Tom- privatisation of Puerto Rican electricity happening as we ‘speak’: http://www.ft.com/content/ce012d2c-ffc0-11e7-9650-9c0ad2d7c5b5

Narratives that convey more than stories

Britain cannot easily be classified as European in the the sense of the EU; Brexit prohibits that analogy, despite many of the economic challenges affecting this discordant continent being similar across its many adjacent borders, including the UK.

Searching for a chronicle of these challenges is a feature of this century so far, just as it was throughout the last one when much of the narrative strove to find an explanation for the worst human conflicts in history.

At its most basic narrative is no more than a story, whether it is between neighbours over a garden wall, or in an illustrious journal capturing a message that is conveyed with impact and influence.

That so many disparate European communities managed to come together in the second half of the 20th century speaks volumes for the capacity of human beings to find compromise based on a narrative that represented a shared hope and desire.

But, as Bill has shown, economic integration can prove impossible if some fundamental elements of monetary and fiscal conventions are ignored, or worse still, misunderstood.

That society has been the victim of these shortcomings in the past was inevitable; democracy relies after all, on narrative composed by the transmitters of the message, whether genuine or contrived.

What Bill is trying to do is ensure not only that the correct interpretation of economic theory is expounded, but that is implemented in such a way that society is the beneficiary. We shall perhaps see to what extent that is practically possible in due course.

people say it will take a hundred years for european solidarity to emerge. it is there beneath the surface. for most of the past 2000 odd years there has been strong trends towards unity, consolidating in the very lengthy period of the middle ages. scratch the surface and you will find an ear for the latin language/civilization (and it did exist) and memories of stability. it can return.. moreover if stuff coming out of brussels was in latin it might be believable.

With such a mix of languages, can a European identity ever truly emerge?

I can think of a few successful multi-lingual states (Belgium and Switzerland for example) but there aren’t that many are there?

Found it very interesting how Italy ranked so low on the indulgence/restraint index – tending towards restraint.

We have such a stereotype in literature of romantic, fun-loving, uninhibited, emotionally demonstrative Italians. The reality is indeed very different – everything needs to be done in an orderly, careful manner from how you dress to never say using toilet paper to blow a nose (as I admit I am afraid to doing) – everything is “tutt’a posto”. Go camping with some Italians and you will not see anything resembling getting back to basics and going with the flow. Everything in life is highly organised and planned with strict rules – including relaxing. Was interesting to see my experience confirmed in the indices!

As an aside – I would love to see a debate between Mitchell and Varoufakis on the EU. I have come around to the view that Mitchell is right about the economics of the EU and realistic about the cultural divides.

But speaking as a person with an EU passport that is about to no longer be an EU passport and who loves Italy, France and spent many years trying to learn their languages etc.. I do mourn its loss. The freedom to live and work in the EU was a wonderful thing for me personally. But I get that it doesn’t help the unemployed in the North of England much.

The Halo Effect

Allow me to add another dimension to the importance of narrative in shaping opinion.

All readers of this series of blogs are aware of the force of argument that Bill derives from his belief in the superiority of Marxism. They will also be conscious of the role played by media presentation of Capitalism and its popular appeal to materialism.

If you wanted to be argumentative it is possible to describe much of Capitalism’s narrative as attractive; Communism, on the other hand is often depicted in uglier terms.

That Bill is fully aware of this intellectual and political polarisation was apparent from his reference in a recent blog to the benefit of a literary work projecting MMT principles as part say, of an inspirational proletarian blockbuster.

In other words, a creative and uplifting image would promulgate a Halo Effect.

And why not, we see media attempts to use narrative as a tool every day of the week – moulding public opinion even in its headlines.

MMT principles may indeed be the moral way to implement economic policy, but there will inevitably be opposition to some aspects of its enactment – Capitalism may one day come to be regarded as a rather ugly ideology, but whatever replaces it will also see its halo tarnished by events and attitudes.

A really good, high production value MMT doco that goes viral would be very helpful.

Any directors out there willing to do it? Funding?