My friend Alan Kohler, who is the finance presenter at the ABC, wrote an interesting…

Employers lying about the flat wages growth in Australia

Last Friday (February 8, 2018), the Reserve Bank of Australia issued its latest – Statement on Monetary Policy – February 2018 – which in its own words “sets out the Bank’s assessment of current economic conditions, both domestic and international, along with the outlook for Australian inflation and output growth.” Of interest to me (apart from all of it) was the discussion of domestic economic conditions, in particular the discussion concerning wages growth. Workers around the world are struggling to gain any semblance of decent (if any) wages growth, are facing real wage cuts, and seeing national income redistributed to profits (even as investment ratios fall). They are observing increasing gaps between real wages growth and productivity growth, which means the workers’ share of output gains is falling. With sluggish investment ratios, it isn’t rocket science to realise that the redistributed national income is being pumped into the financial markets casino, which delivers little or no productive benefit to society and provide for continued economic instability. It is clear that major shifts have to occur in wage setting mechanisms to redress these imbalances. That should be a major focus of progressive activists. It is a global problem.

I have written regular updates when the Australian Bureau of Statistics (ABS) releases its Wage Price Index on a quarterly basis.

The most recent blog post on this topic was – Australian real wages growth flat – the ripoff of workers continues.

In that blog post, I noted that in the September-quarter 2017, private sector wages growth was recorded at 1.86 per cent (annualised). But with the annual inflation rate running at 1.83 per cent, real wages barely moved.

The Wage Price Index (WPI) has recorded six consecutive quarters of record low wages growth in Australia, which is a trend that is being observed in other nations.

I noted that with real wages growth lagging badly behind productivity growth, the wage share in national income is now around record low levels.

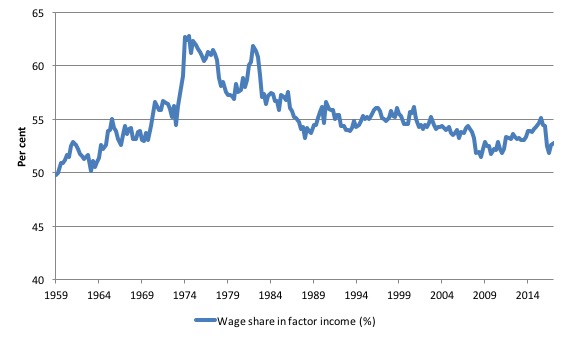

Here is the relevant graph from the September-quarter 1959 (when this data was first available) up to the September-quarter 2017. The wage share is at 52.8 per cent having peaked in the early 1970s at 62.8 per cent.

That represents a massive redistribution of national income.

While the flat wages growth (with on-going productivity gains) represents a major rip-off for workers, it is also intensifying the pre-crisis dynamics, which saw private sector credit rather than real wages drive growth in consumption spending.

The same pattern is, for example, being seen in Britain, where the government’s growth strategy relies heavily on households funding consumption growth through debt as the labour market fails to deliver adequate income growth (despite the employment gains).

The other angle that is lost on the conservatives is that that keep demanding incommensurate outcomes. On the one hand, they have been pressuring the wage setting tribunal in Australia to suppress wages growth (and cut the miniumum wage and penalty weekend rates).

In almost the same breath they demand the federal government cut its own net spending and generate a fiscal surplus post haste.

The problem is that the forward estimates for fiscal outcomes provided by the Australian government rely on growth in tax receipts that cannot be achieved given the flat wages growth.

The projections assumed much stronger wages and employment growth than will occur under current austerity-type fiscal settings.

It is the same error in logic (and causality) that accompanies the call for fiscal austerity. The austerity typically undermines economic growth, which, more often than not, increases the deficit as mass unemployment rises.

Back to wages.

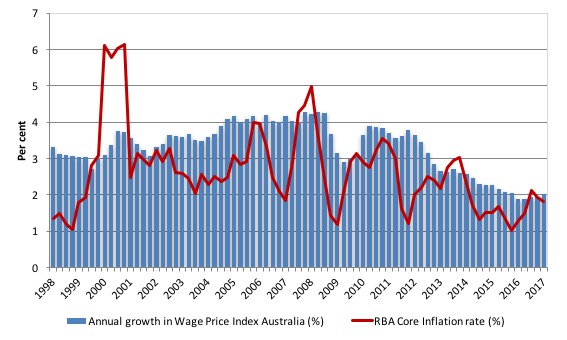

In my latest commentary on the movements in the WPI, which is the ABSs preferred measure of labour costs I produced the following graph, which shows the overall annual growth in the Wage Price Index since the September-quarter 1998 (series was first published in the September-quarter 1997) along with the annual inflation rate (red line). The bars above the red line indicate real wages growth and below the opposite.

The graph make it very clear that wages growth has been very subdued over the last several years, with real wage gains difficult to achieve.

But reading the latest statement from the RBA (central bank) linked to in the Introduction it turns out that things are much worse than we thought.

The RBA note in Chapter 3 of the Monetary Policy Statement on “Domestic Economic Conditions” that:

Wage growth remains low but stable across most aggregate measures … Despite strong employment growth over the past year, spare capacity in the labour market continued to weigh on wage growth …

The wage price index (WPI) grew by 0.5 per cent in the September quarter and by 2 per cent over the year. This was a little lower than expected given the boost to wage growth from the 3.3 per cent increase in award and minimum wages in the quarter …

Growth in average earnings from the national accounts (AENA) remains subdued and noticeably weaker than growth in the WPI.

What does the last point mean?

First, it is important to understand the difference between the WPI and the Average Earnings Per Hour measure. The former is taken from a quarterly business survey, while the latter is derived from the quarterly national accounts series.

The ABS Feature Article (October 2005) – Comparison of ABS measures of employee remuneration – is helpful.

We learn that the WPI measures:

The WPI series is more stable than the other series. Unlike the other series, the WPI is specifically designed to provide movement estimates of the changing price of labour.

The WPI is unaffected by changes in the quality and quantity of work performed, such as changes in the composition of the labour force, the number of hours worked, or the characteristics of employees. The WPI only reflects changes which are a response to market prices and so provides a pure measure of wage inflation. The WPI is therefore recommended when measuring changes in wages.

In contrast to the WPI, the estimates of movements in AWTE and AENA … show considerable volatility. Unlike the WPI, these two measures are affected by factors such as compositional change and hours worked.

So Average Hourly earnings indicates the wages bill but “may be affected by changes in weekly hours worked (or paid for) and by changes in the composition of jobs in the workforce.”

It is a broader measure and also includes “allowances and redundancy payments”.

For example, if hourly rates of pay are steady but workers are moving from lower to higher paid employment, then the Average Hourly earnings measures will rise, whereas the WPI would be unchanged.

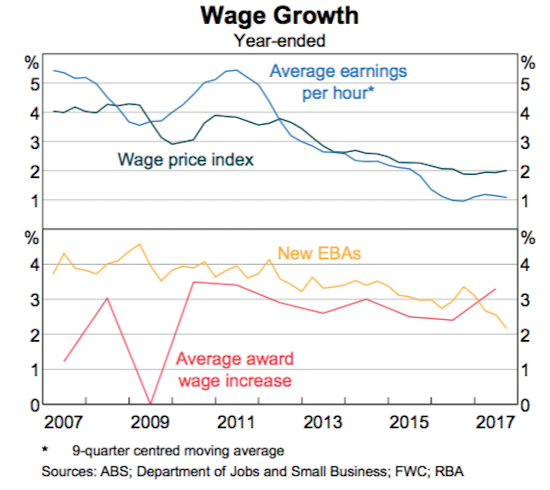

The RBA Graph 3.20 shows both measures (and some additional measures to be discussed below).

They have used a 9-quarter centred moving average for the Average Earnings Per Hour to smooth out the volatility and allow us to see the underlying trend movement.

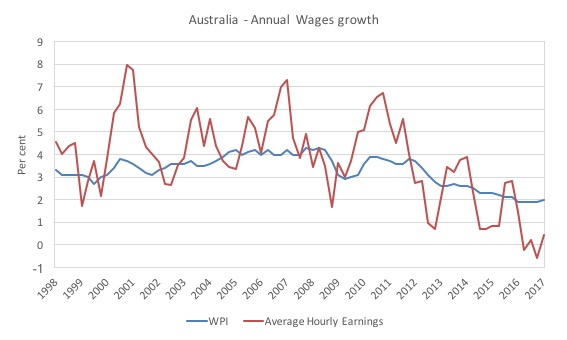

The next graph plots the raw data from the annual growth in WPI and the Average Earnings Per Hour from the September-quarter 1998 to the September-quarter 2017 to let you see what the movements per quarter have been.

The conclusion is clear. Using Average Earnings Per Hour, the growth in wages has been far worse than disclosed by the reliance on the WPI as the indicator.

The situation is worse when we consider real wage movements – that is, taking into account movements in the inflation rate.

The following graph plots the annual real wages change in terms of WPI and Average Earnings Per Hour from the December-quarter 2008 (start of the crisis) to the September-quarter 2017.

Both real wage measures showed positive growth in the period after the onset of the GFC, which was the period that the Federal government in Australia introduced its rather large fiscal stimulus and prevented the economy from going into recession.

In that period, real wages growth was fairly close to productivity growth.

However, the situation deteriorated after 2012, when the federal government abandoned its stimulus and claimed it had to pursue austerity to generate a fiscal surplus.

All they succeeded in doing was reducing economic growth and pushing up unemployment and underemployment, which not only prevented the fiscal deficit from falling (as a consequence of ongoing growth) but also created the conditions for suppressed wages growth.

While real wages in WPI terms have been barely growing for the last 12 months, and have been negative in the March and June quarters of 2017, real Average Earnings Per Hour have declined substantially for four successive quarters up to the September-quarter 2017 (latest data).

So what explains the difference in the WPI and the Average Hourly Earnings measures?

Go back to our brief explanation above.

The Average Hourly Earnings measure is affected by ‘compositional changes’ in the labour market (hours, gender, industry shifts etc).

The RBA conclude that:

… there have been broad-based declines in wage growth outcomes for the majority of workers who have remained with the same employer in recent years. The gap between the lower wages of those entering into employment and those already working

has widened. The share of workers changing employers has been at a low level in recent years and the boost to earnings from changing jobs has declined since the mining boom.

These are the compositional shifts that the WPI will not pick up (by construction).

In other words, at a time when mass unemployment remains at elevated levels and underemployment is a chronic problem, workers who are not shifting workplaces are being forced to take low or zero wage increases.

And, while firms that are growing and taking on new staff might are taking advantage of the relatively weak labour market conditions to offer “lower wages” some movement between firms might be at more favourable wage outcomes.

So the only way a worker can achieve some growth in real wages in Australia is to change their employer. But as the RBA notes, there have been a “low level” of such movements due to the weak labour market.

I mentioned that I would explain the lower panel in the RBA graph.

The red line is the growth in minimum wages set by Fair Work Australia across the various industries (the “award wages”). The rise in the last year reflects more positive minimum wage decisions as part of a catch up for previous shocking decisions (in 2007-2009).

The Yellow Line is for the “Enterprise bargaining agreements”, which the RBA note that:

Average annualised wage increases for new EBAs have declined notably over the past year. As EBAs have an average duration of a little over three years, it is expected that average wage growth for those on EBAs will slow as current agreements are replaced by new agreements that have lower average wage growth outcomes.

Hook, line and sinker

The Assistant Governor of the RBA (Luci Ellis) gave a public presentation about the economic outlook from the central bank’s perspective in Sydney today (February 13, 2018) – Three Questions About the Outlook.

On the wages growth question, she said:

In Australia, we estimate that there is still some spare capacity in the labour market … wage growth has been quite weak even allowing for … the extent of spare capacity … business surveys … are telling us that suitable labour is becoming increasingly difficult to find.

So far, though, the response to that difficulty has not been to pay people more to ensure they stay, or poach them from elsewhere. Instead, we hear that firms are increasingly using other creative ways to attract and keep staff without paying across-the-board wage rises. These include everything from hiring bonuses, to offering extra hours, to increasing perks and workplace conditions.

Their reasons for doing so stem from the competitive landscape … This is a theme from our liaison with the business community. They appear to believe that competition is so intense that they would lose too much business if they did so. So they are especially reluctant to grant wage rises, because this would increase one of their most important costs.

Aah, the competitive pressures argument.

The RBA conducts liaison with business lobbyists in the same way that many central banks do. They claim it is to garner information that will better help them frame monetary policy.

The way in which the financial market players lobby the central banks via this process is scandalous.

I wrote about the way in which the ECB, for example, is captured by the financial market lobbyists in this blog post – The sham of ECB independence.

It is clear the corporate sector uses these consultative processes to implant their own narrative into the minds of the policy makers who seem to buy it more often than not, and thus make policy that suits the interests of the corporations rather than society in general.

The RBA speech today certainly emphasised this “competititive pressures” narrative.

She claimed that profit “margins cannot be squeezed forever”, implying that this is the reason wages growth is so flat. Those poor darling corporations.

She claimed that firms will have to pass on wages growth “when it comes” because of the squeezed margins, which will “boost price inflation over time”.

The problem with her story and the line that she has been fed by the corporate sector is that it does not stack up with the facts.

Who would have thought?

There was an interesting response to that Speech in the Fairfax papers today (February 13, 2018) – RBA swallowing business bunkum on wages – about this topic.

The journalist, Michael Pascoe who often gets to the bottom of things more than other commentators notes that there is a significant degree of corporate lying going on in their claims about the low wages growth.

He wrote:

In a nation rife with duopolies and oligopolies, businesses are telling the Reserve Bank they can’t increase wages because of intense competitive pressure.

Funny thing about genuine intense competitive pressure: it tends to squeeze profits. According to measures from the NAB business conditions survey to the national accounts, profits are growing nicely.

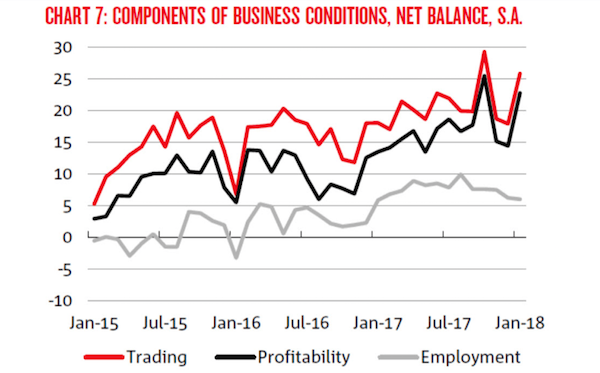

Indeed, the latest NAB business survey has profitability growing strongly.

Michael Pascoe argues that:

Rather than “intense competitive pressure”, it looks more like employers are resisting real wage rises to further lift profits, to pay bigger dividends and earn senior executives bigger bonuses. They’re squeezing down pay rises because they can.

He reproduced a graph (Chart 7) from the latest – National Australia Bank Business Survey: January 2018 – (published January 30, 2018) to make his point (next graph).

As he notes:

… the latest NAB business survey has profitability growing strongly. The bank reports business conditions are solid across all major industry groups with the exception of retail. And even in retail, NAB says there’s been some improvement with conditions “neutral” in January.

Rather than “intense competitive pressure”, it looks more like employers are resisting real wage rises to further lift profits, to pay bigger dividends and earn senior executives bigger bonuses. They’re squeezing down pay rises because they can.

They “can” because the government policy (austerity bias) is maintaining excessive slack in the labour market in both persons and hours.

The slack and related industrial relations legislation tilts the bargaining environment heavily towards business firms and employers in general.

A week or so ago, for example, transport workers in union were told they were not allowed to strike for better wages by the wages tribunal.

The argument was that it would undermine the economy if the train drivers took industrial action to defend their working conditions – they are being forced to do massively excessive overtime with low wages growth because the State government in Victoria refuses to employ more train drivers to meet the increased demand for public transport.

So, effectively, the main wage setting tribunal in the nation has outlawed the right to strike if they judge that such action in defense of the interests of the workers will undermine corporate profitability (at a time when the latter is booming).

Michael Pascoe also notes that there is now a “cult of cost-cutting” in Australia:

Since the GFC ended the boom times, cost minimisation has been a key to executive success, not investment. Competition in much domestic business is not enough to suppress profit growth, but it is enough to minimise price and wages growth.

What is happening in the real world is a degree of price signalling within industries. HR associations and recruitment firms conduct and circulate surveys of wages movements so that everyone knows what everyone is paying for labour.

There’s no prize for any HR director to be caught paying more than the industry average for talent, so they tend not to. Maybe businesses aren’t explaining that to the RBA.

Watch what happens to a company’s share price when it announces a round of cost-cutting redundancies – a lift that’s recorded as increasing “shareholder value” and thus the C-suite bonuses.

It’s part of the real world’s scepticism about the claims of big business and the federal government that reducing company tax rates will necessarily mean high wages.

So a total con job is going on with the support of the central bank and the federal government.

The Australian Treasury has also done work on this topic. On December 8, 2017, it released a technical report – Analysis of wage growth – which attempted to decompose various elements that have contributed to the flat wages growth in Australia over the last several years.

They conclude that:

1. “The unwinding of the mining investment boom and spare capacity in the labour market are important cyclical factors that are currently weighing on wage growth”.

The slack is because given the more subdued non-government sector spending growth, the government has refused to act responsibly to increase the fiscal deficit.

2. “weaker labour productivity growth seems unlikely to be a cause of the current period of slow wage growth in Australia. Over the past five years, labour productivity in Australia has grown at around its 30-year average annual growth rate”.

There has been a rising gap between real wages growth and labour productivity growth.

3. “Three key trends are the increasing rates of part-time employment, growth in employment in the services industries, and a gradual decline in the share of routine jobs, both manual and cognitive, and a corresponding rise in non-routine jobs”.

The policy environment has been incorrect in the context of these trends. The Australian government has allowed Fair Work Australia to bow to corporate demands to have the legal penalty rates (non-standard hours pay) cut, which have impacted significantly on the pay for part-time, casual workers, particularly in the service sectors that already have to endure low pay.

The correct policy response would have been to resist the demands for pay cuts.

4. “There are a range of reasons for the decline in bargaining including the reclassification of some professions, the technical nature of bargaining, natural maturation of the system and award modernisation which has made compliance with the award system easier than before.”

It is clear that the legislative environment that governs wage setting and wage bargaining has introduced laws that tilt the balance in favour of the employers.

There is no “natural maturation of the system” – rather it has been a contrived exercise by successive neoliberal governments (both Conservative and Labor) to do the bidding for capital.

Award modernisation has allowed working conditions and pay to be eroded.

At the centre of these shifts has been the legislative capacity of the Federal government. Nothing can be achieved in this area of our society without legislative backing.

The problem is that our Federal government (like most national governments) have become an agent for capital rather than a mediator in the class conflict between labour and capital.

Policy imperatives

In my latest book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017) – Thomas Fazi and I outline a progressive agenda to reverse these sorts of shifts which characterise the neoliberal period.

In summary, progressives have to push for:

1. Increase reliance on fiscal policy to ensure high pressure is maintained in the economy where firms are continually facing scarcity of labour instead of the current situation where they have a huge pool of underutilised workers (and new entrants) to pick and choose from and use to threaten those in current jobs bargaining for higher pay.

We should abandon the reliance on monetary policy. Central banks claim they have been trying to increase economic activity for years now with near zero nominal interest rates and massive balance sheet expansions (QE).

And still they fail. The point is clear.

Monetary policy is not an effective tool for counterstabilisation. Surely we have worked that out by now.

2. Introduce a Job Guarantee and ensure the wage paid to these workers puts pressure on the low productivity private firms who are lagging behind in giving wages growth to their workforces.

The Job Guarantee would be a force for dynamic efficiency. It would force firms to pay wages and offer conditions that the society judged were the minimum that it was prepared to tolerate.

It would create a shortage of labour – because the desperation element of unemployment and underemployment would be gone.

It would force firms to offer training with adequate wages and invest in new capital to lower their costs or else go out of business.

Win-win.

3. Governments have to stop attacking trade unions and allow them to exercise their democratic right to represent workers and use the withdrawal of labour as a legitimate weapon to extract wages growth from firms who just want to line the pockets of their executives and shareholders.

4. Use the government employment capacity to increase public sector pay, which then acts as a competitive guideline for the non-government employers.

If they fail to match the wage rule then they risk losing skilled labour to an expanding public sector.

5. Introduce a national productivity distribution process (like Australia used to have) where annually wages rise in line with estimates of national productivity growth.

This would force firms to share the productivity growth with workers in a more equitable manner and stop the ripoff that has been characteristic of the neoliberal era.

These policies would help and should be at the forefront of any progressive political movement. They have universal relevance (with different institutional manifestations).

They are sadly lacking in the platforms of most so-called progressive political parties around the world.

Conclusion

It is clear the low wages growth is nothing to do with capacity to pay arguments (the ‘competitive squeeze’) that corporations are continually mounting in defense of their squeeze on wages growth and their calls on government to further deregulate working conditions.

The low wages growth reflects policy failures in several ways.

Reversing these failures should be a major aim for progressive political movements around the world.

Upcoming event – Melbourne, Friday, February 16, 2018

I will be talking about our latest book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017) – in Melbourne on February 16, 2018.

More details:

Here is the flyer. The Bookshop tells me that they are happy for this to be circulated widely.

MMT University Logo competition

I am launching a competition among budding graphical designers out there to design a logo and branding for the MMT University, which we hope will start offering courses in October 2018.

The prize for the best logo will be personal status only and the knowledge that you are helping a worthwhile (not-for-profit) endeavour.

The conditions are simple.

Submit your design to me via E-mail.

A small group of unnamed panelists will select the preferred logo. We might not select any of those submitted.

It should be predominantly blue in colour scheme. It should include a stand-alone logo and a banner to head the WWW presence.

By submitting it you forgo any commercial rights to the logo and branding. In turn, we will only use the work for the MMT University initiative. It will be a truly open source contribution.

The contest closes at the end of March 2018.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

btw bill i am still waiting for your intermediate mmt textbook when will it be finally published?

Conservative governments have successfully both demonised and destroyed unions – and are now asking employers to increase wages? What a laugh! Why don’t we remove all the restrictions on child labour and minimum wages because we will expect employers to have some sense of morality.