The other day I was asked whether I was happy that the US President was…

Spain in limbo but has not rejected austerity

On the Sunday before last (December 20, 2015), Spain conducted a general election, which has left the nation in limbo. Alex Tsipris, the Greek Prime Minister, still trying to hang on to the image that he is a progressive leader in some way, tweeted once the results were known that “Austerity has now been politically defeated in #Spain, as well. Parties seeking to serve society made a strong showing #20D”. I wonder who he is trying to kid … “as well” – as well as where? Certainly not in Greece, which was the implication of his tweet. And, to be clear, certainly not in Spain. While the conservative Popular Party (PP), which has overseen the most recent imposition of austerity and is firmly pro-EU and pro-euro, did not gain an absolute majority, they did win the most seats (123 in the Spanish parliament) and were well ahead of the other major austerity party, yes, the Spanish Socialist Party (PSOE), which won 90 seats). Even the left-wing We Can party (Podemos), who won 69 seats is not planning to exit the common currency. There is no hope of an anti-austerity coalition forming.

The Eurozone is biased, by design, towards austerity. I say that because the fiscal rules embedded in the Stability and Growth Pact (SGP) and its extensions (the six-pack, two-pack, and the fiscal compact) are so restrictive that in a crisis, the Member States’ fiscal balances will too easily breach the allowable ceilings and trigger the Excessive Deficit Mechanism.

In other words, in many cases, the cyclical responses alone (the so-called automatic stabilisers) will likely push the fiscal balances beyond the permitted threshold and force the governments to introduce pro-cyclical fiscal contraction – that is, discretionary cuts to the net government spending at a time when the non-government spending cycle is also contracting – which is the anathema of responsible fiscal management.

That bias is integral to the design of the common currency and means that in bad times, the governments cannot respond in a reasonable manner and protect their domestic economies from meltdown.

The austerity bias that a Member State faces is thus intrinsic to membership of the monetary union and cannot be easily avoided.

Once the European Commission deems that a nation is in violation of its commitments within the union then not only does that particular government have to start a policy cycle that worsens the state of their economies but it also begins to face increased scrutiny by the from the private bond markets, which inevitably forces its yields up (certainly relatively to the safer, but not risk-free German bund).

At that point, not only is the domestic economy facing a real crisis with rising unemployment and collapsing incomes, but the fiscal affairs of the government become fragile (given it uses a foreign currency – the euro).

The situation can then spiral into a full-blown crisis. Whether it does or not depends but what is not in doubt is that elevated levels of mass unemployment, falling incomes and rising poverty rates are assured.

That is what the crisis in the Eurozone has demonstrated without any doubt at all.

So when a political party claims to be anti-austerity but then supports the nation remaining within the monetary union with all the pernicious and unworkable rules that go with that, then we know the political leaders are lying and trying to pretend to be progressive rather than neo-liberal (lite or otherwise).

This is the case in Spain after the elections. No likely coalition will adopt a policy platform that works towards exit.

It is true that the election has demonstrated that either of the two major political parties, each one dominant at one period or another for the last 30 years, will be prevented from holding office in their own right. It is also true that the sentiment of the electorate expressed was disdain for these ruling elites that have overseen such damage to the nation.

How much of the slide in the PP vote (down to 29 per cent of the total from 44 in 20

But the Spanish people did not reject membership of the Eurozone and hence there is no new start for the nation still belaugured with the damage that comes with that membership.

With unemployment, which peaked around 27 per cent in early 2013 is still around 21 per cent and remains the second-highest unemployment rate in the Eurozone behind the hapless Greece.

The dip in the rate in the September-quarter 2015 (a drop of 1.2 per cent from 22.4 per cent) was the result of 182,200 net new jobs being created as part of the seasonal boost related with Summer – they are most temporary jobs on low pay.

The Spanish labour market has bifurcated with older workers, who managed to keep their jobs in the crisis still enjoying relatively secure employment, and younger workers in casualised, precarious, low-paid jobs.

The labour market policy shifts associated with the imposition of austerity exacerbated this segmentation.

There is no sign that the much-touted ‘recovery’ is reducing that segmentation. It is no wonder that political sentiment among the younger voters is at odds with the choices made by their parents.

There is another sense that this election cannot be seen as a victory against austerity.

The fact is that the PP-government relaxed the austerity over the last year that it had been applying since 2012 to help improve its electoral standing and offset the rise of Podemos.

It allowed the discretionary fiscal deficit to rise and it is now getting closer to the 3 per cent threshold.

The Financial Times article (October 5, 2015) – Spain faces Brussels rebuke over 2016 budget – was already beating the drum that the European Commission was about to deliver a “stinging rebuke” to Spain for violating the fiscal discipline that the Commission expects.

The Commission believed:

… that the Spanish budget would lead to a deficit of 3.5 per cent of economic output next year, significantly above the EU’s 3 per cent ceiling and the 2.8 per cent target Madrid had agreed last year.

It also said that Spain’s pursuit of so-called “structural reform efforts” were “well below what was recommended”. The plan was to “have implemented reforms equalling 1.2 per cent of gross domestic product; instead, Tuesday’s decision will credit Madrid with 0 per cent.”

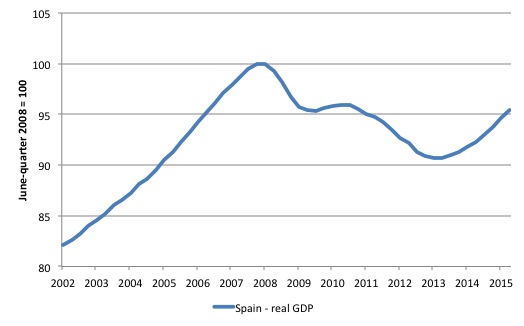

Even with this slight relaxation in the austerity mania in Spain, real GDP is still 4.6 per cent below the June-quarter 2008 peak. On the current growth path, Spain would not exceed the June-quarter 2008 level before the March-quarter 2017.

There are other points to make about the National Accounts performance.

1. Household consumption expenditure is still 8.5 per cent below the June-quarter 2008 peak.

2. Government consumption expenditure is 1.3 per cent above the 2008 real GDP peak.

3. Total investment (capital formation), which increases productive capacity and therefore potential real GDP, is 28.5 per cent below the June-quarter 2008 real GDP peak.

4. Exports have grown significantly on the back of shifting European production in search of lower costs (mostly car production shifting from France) but the real story is that imports remain 9.3 per cent below the June 2008 real GDP peak.

Net exports have growth because imports have been significantly suppressed by the reduction in domestic incomes.

None of that is sustainable nor a demonstration of a viable adjustment to a path to prosperity.

The sectoral GDP results are also interesting:

1. Agriculture, forestry and fishing is 4.4 per cent larger than the peak in the June-quarter 2008. A modest improvement.

2. Industry (Manufacturing and Construction) is still 12.8 per cent smaller than in the June-quarter 2008 and has only just started to expand.

3. Construction (a sub-sector) is 45.7 per cent smaller – seemingly a necessary adjustment, given the ridiculous, speculation-induced expansion in real estate prior to the crisis.

4. Services is 5.1 per cent larger – mostly in Information and Communication, Real estate activities, and Artistic, recreational and other services.

5. The accelerating overall growth in the recent quarters has been spread across the sectors – Industry contributed 0.5 percentage points in the September-quarter 2015 to the 0.8 per cent overall growth in real GDP, while services contributed 0.9 percentage points. Only financial services shrank and detracted from growth.

However, the European Commission wants to spin the story – 8 years of suffering cannot be considered a policy success.

The psephologists are in heaven at the moment stitching up all sorts of coalition permutations:

1. PP (centre-right, pro-austerity ruling party – 29 per cent of total vote and 123 seats out of a parliament of 350 seats) and Ciudadanos (the pro-business, anti-Catalan independence Citizens Party party – 13.9 per cent of total vote and 40 seats).

2. PSOE (Socialist party, but austerity stooges to the European Commission – 22 per cent of the vote and 90 seats) with Podemos (20.7 per cent of total vote and 69 seats) and Ciudadanos.

This option is not likely given the disputes between Podemos and Ciudadanos over Catalonia. The former supports the right of the Catalans to vote on the question of independence while the latter clearly does not want a vote nor does it support independence.

3. PP and PSOE – which would unite the major parties – both neo-liberal although the latter would claim otherwise. This is being touted as a ‘grand coalition’. The two parties have compromised themselves together before – to ward of Basque nationalist party ambitions.

The ‘Left’ does not have a viable solution along the lines of the recent coalition in Portugal.

One suspects after all the talks there will have to be new elections to break the impasse.

Podemos has become ‘pragmatic’ since the brutalisation of Syriza in Greece and their own falling electoral support in the opinion polls leading up to the election.

They had previously said they would restore the welfare state that the austerity policies has progressively undermined. That won them five seats in the European Parliament in 2014 and in January 2015, the polls suggested it might command up to 28 per cent of the total vote.

It appeared the political expression of the so-called Indignados movement that rose up in May 2011 was set to dominate Spanish politics on the back of a firm anti-privatisation, increased public spending, debt relief and other anti-austerity policy initiatives.

However, by October 2014, the polls were predicting it would win around 14 per cent of the vote as it lost ground in various regional and municipal elections and proceeded to modify its more extreme anti-austerity policies back towards centrist-type positions (austerity in disguise).

It also began to abandon its close links to the grass roots supporters who had created its popularity in the first place. Some commentators characterised Podemos as pursuing a strategy of winning rather than changing the policy debate.

So its 20.7 per cent at the December elections could be seen as a failure or as a comeback. But it is hard to see it as a victory for the anti-austerity forces.

Above all, Podemos no longer advocates an exit of from the Eurozone nor the introduction of income guarantees.

When they released their modelling on their basic income proposal it was clear that the policy overall was not compatible with remaining in the Eurozone. It was the same inconsistency that Syriza presented the Greek people – we will abandon austerity and reverse the damage but stay in the Eurozone which prevents a nation from abandoning austerity.

In the article (September 24, 2014) – Pablo Iglesias: “Los españoles van a ganar lo que decida el Parlamento” – we learned that the expenditure necessary to sustain the basic income proposal would be equivalent of 14.5 per cent of GDP and would push the fiscal deficit well beyond the SGP criteria.

While I do not support a basic income, it is clear that the Spanish government should be pushing the fiscal deficit well beyond the SGP criteria to eliminate the mass unemployment that the country endures.

Conclusion

I am happy that the Spanish election seems to have broken the hold that the two corrupt major parties have had on Spanish politics since democracy was restored after the dictatorship ended.

It is also a positive sign that grass roots movements can gain traction via social media and project support into the mainstream political processes.

But it is disappointing that parties like Podemos replace their strong commitment to change with a desire to win votes immediately before they have had a chance to fully educate the voters on the need for and advantages of change.

The failure to educate (and thus lead) means it has compromised a number of key policy areas, which reduce its anti-austerity status.

Even though it claimed that as the Eurozone’s fourth largest economy, any reform government would have much more traction against Brussels and Germany, than Syriza had in the earlier part of this year, the fact remains that with a growing majority of Spaniards still convinced that Euro membership is in their best interests, the room to truly negotiate with the Commission is limited.

Syriza didn’t crumble because Greece is too small. It abandoned its anti-austerity because it refused to countenance and exit from the Eurozone and once the Commission knew that they had all the power.

It would be the same if Podemos had have won more votes and more seats. The public must be educated first as to how damaging the Euro membership is.

How it is equivalent to austerity.

A nation cannot have the euro and pursue and anti-austerity stance.

And, Alexis Tsipris was wrong – again. Austerity was not defeated in the Spanish national election on December 20, 2015.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

The Spanish election illustrates,again,the political poverty of the left.This appears to be the case throughout the West. The only beneficiaries of the left’s nonsensical thinking (if they can think) are the right,and in some cases the extreme right.

Hello again to fascist states. Pity about that.

My colleague Esteban Cruz and I wrote a piece last week about Podemos’s programme and made precisely the point that their anti-austerity stance was unsustainable within the rules and boundaries of the Eurozone. Intriguingly, Podemos’s leader, Pablo Iglesias, was suggesting that Spain should drop out of the Euro about a year ago. In his effort to look respectable and eat into the Socialist constituency Podemos has now abandoned their anti Euro position. They are dutifully following the path and example set by Alexis Tsipras. In the end, there will be nothing but a wasteland in the European left.

The article is in Spanish, sorry, http://www.infolibre.es/noticias/luces_rojas/2015/12/17/el_programa_economico_podemos_radical_adiestrado_42341_1121.html

“A nation cannot have the euro and pursue and anti-austerity stance. ” Professor Bill Mitchell

Well, the Euro could be reduced to a purely private money, I suppose, and still serve the need for an international money form. Why not?

Of course, since the ECB and Eurozone banks have taken advantage of their unjust government privileges* to drive both the private and government sectors of the Eurozone into debt, then much of that debt is morally (as well as economically) bogus.

But how to eliminate much of that debt? The traditional solution is a debt-jubilee but that would destroy the banks and be resented by non-debtors (Debtors would gain assets such as a debt-free home while non-debtors would not). Inflating away the debt in real terms is a more modern solution but would be BITTERLY resented by savers, whose savings would be destroyed or reduced in value.

Then what’s to do? Professor Steve Keen suggests in his “A Modern Jubilee” that new fiat be distributed equally to the population along with new credit creation restrictions to prevent inflation. Note that though a new fiat distribution increases the money supply (by increasing bank deposits as well as creating new reserves for the banks, one for one) a restriction on new credit creation would decrease the money supply as existing credit is repaid (bank credit repayment destroys deposits (reserves are unaffected)) with no or less new credit to replace it. Therefore, a (properly metered) new fiat distribution combined with new credit restrictions could be contrived so that much debt could be paid off without increasing or decreasing the money supply.

What’s not to like? Banks are much more likely to have existing loans repaid, non-debtors are not disadvantaged or looted, and much debt is eliminated. So what’s not to like? The new credit restrictions? Because businesses, individuals and governments need loans? But note that loans that are 100% backed by reserves are not a form of credit creation but the lending (indirectly, given that only banks are currently allowed to have fiat accounts at central banks) of actual fiat and does not increase the money supply. Therefore, lending can continue unabated except now the loans will be, as some imagine they are now (“the loanable funds model”), loans from savers to borrowers of existing (mostly new) fiat with the banks as intermediaries.

*eq the acceptance of the Euro for taxes and fees in the Eurozone.

So sad that such an wonderful idea, to bring the peoples of Europe together, has become an unaccountable, ideological institution that willingly impoverishes its own people; and yet those very same people cling to it, making it nigh impossible for them to take control of their nations.

Bill if I might ask, do you have any posts talking about what countries like Spain and Greece would have to do/go through to exit the Euro and what they might have to look out for? It would be interesting to see their choices from your perspective.

As usual, thanks for sharing your thoughts.

Franco

Dear Bill

Even if the Eurozone had no rules at all about deficits, it still would be a fiscal straitjacket, with very little policy space. Political entities without monetary sovereignty cannot really practice macroeconomic policy successfully, just as a Canadian province or an Australian state can’t do it. The problem is not that the EMU was badly designed but that it exists at all. Unlike Canada or Australia, where the central government spends something like 20% of GDP, the EU central government spends less than 2% of the total GDP of the EU. We can forget about automatic fiscal transfers from countries with low unemployment to countries with high unemployment.

The most important rule for a successful monetary union is that all members have the same inflation rate. That way there is no real devaluation or upvaluation within any member of the union relative to other members. The Spanish euro has in fact undergone considerable upvaluation relative to the German euro. Small differences in the inflation rate can have a big cumulative impact. If productivity in both France and Germany rises by 1% per year and nominal wages rise by 3% in France and 1.5% in Germany, then prices will be about 20% higher in France than in Germany after only 12 years. That’s what in fact happened.

Regards. James

In fact there is no such thing as a Spanish or German euro. There is only one curtency. Differences in inflation rates are not that uncommon in other countries. These have been aggravated by Germany’s deflationary and mercantilist policies. But, the condition for a successful currency union is the existence of a transfer union to deal with asymmetric shocks.

Bill, Barcelona Council controlled by Podemos en Comun are working on using MMT to introduce a local currency. They know your stuff. I can see why you might want to copare them to syriza from the outside but the are a very different animal and the wonderful results of the election have opened up a new way of doing politics that will have an effect beyond Spain in the longer term. One problem I guess outsiders have is that they only get to read the English commentary, which hasn’t been very good to be frank. The best source is their mouths – the interviews of Igelsias and Errejon since the election have been great. They are engaged in a long term counter hegemonic project which is opening real possibilities. the fisrt step now is the Social Emergency Law they plan to introduce to Parliament next week. It is a process not an end – that is it will further expose the major parties and go to creating a new common sense that in time will allow for greater development such as those that you desire.

What these hypocritical comments on the election results by various politicians demonstrate is that parties right across the political spectrum have been hoodwinked by neoliberal spin, and have gullibly and unthinkingly accepted the outpourings of business and banking “economists”. The latter never waste an opportunity to inform us that there is no alternative to austerity (the TINA principle, as first espoused by Margaret Thatcher).

Hi, Dear Bill

“A nation cannot have the euro and pursue and anti-austerity stance.”

I have a way around this problem. Idea is called PILL as in Payment In Lieu of Loans.

This idea i have explained to Varoufakis before he became Finance Minister and this idea had a very good reception at naked capitalism blog.

PILL uses the fact that money has to be erased as the loans are payed off to banks.

The state can print and distribute vouchers that will have euro value and accepted only by banks in lieu of credit principal payments. Banks vould destroy vouchers instead of real euros.

This way a nation can avoid deficit restrictions and increase consumption while decreasing the need for bank bailouts. This is additional social spending that would not be under deficit spending.

Even those that do not have any outstanding loans can open a line of credit and pay off with vouchers while costing them only the interest on debt. With these loans paople could pay off utilities and other needs.

Another example that Croatia used just recently is printing vouchers to pay electricity bills. All pensioners under subsistence income are receiving a monthly voucher in currency value to pay electricity and TVbroadcasting bill.

Earlier the Finance Ministry made an agreement with state owned electric company to accept vouchers and use them as due tax payment. This way a voucher goes from new money, free to pensioners, to recorded as tax income to state.

I am sure that EU commision is unaware of this trick by Croatia to avoid SGP rules.

Slovenia also attepmted to use this trick and not reduce incomes of state administration, but it seems it was prevented.

PILL can be used on wide scale to reduce the burden of existing loans and to create new loans to non debtors by printing vouchers and distributing it to all citizens.

Until the people and political leaders collectively wake up to the fact we have an outdated financial system we will probably continue to descend into this wormhole of austerity, extreme inequality (income & wealth). The current financial systems foundation is from imperialistic empire’s whose goal was expansion and exploitation of land, peoples, nature, and resources. While some great things have been accomplished, we now face the situation where the world is overcrowded and there is no room to expand. As well due to environmental factors, we face some very serious impacts on natures habitat, even survival. We may not need to do away with the current financial system, but we need to modernize it (add mechanisms) so that the huge gaps in monetary flow can go to nature renewal as well as gainful employment for the worlds peoples, within the confines of a sustainable economy (smart growth).

“The Eurozone is biased, by design, towards austerity. I say that because the fiscal rules embedded in the Stability and Growth Pact (SGP) and its extensions (the six-pack, two-pack, and the fiscal compact) are so restrictive that in a crisis, the Member States’ fiscal balances will too easily breach the allowable ceilings and trigger the Excessive Deficit Mechanism.”

Yes and no. The “Macroeconomic Imbalance Procedure” also includes measures in the other direction, so that the current account balance should stay below +6%. Just that politicians and journalists don’t know about that or conveniently ignore it. So Germany never gets punished for its 9% account surplus.

“A nation cannot have the euro and pursue and anti-austerity stance.”

Well, the dominant austerity player in Europe is Germany, its finance minister has the strong influence on the Eurogroup. But the more of the southern governments get anti-austerity, the higher the likelihood of a real discussion in the Eurogroup gets. If Greece, Portugal and Spain would get Italy on board (and there were some very austerity-critical voices raised from there recently), France might finally see a chance to pursue its own agenda. Then suddenly Mr. Schäuble would lose his firm grip and a real discussion became a possibility. Of course the interesting question is: does this happen before Europe disintegrates, i.e. before Marine Le Pen gets elected?