It is true that all big cities have areas of poverty that is visible from…

The British Tax Credits system is a sign of New Labour failure

In 2012, the British government, which had for the first two years of its last term, realised that it was going to drive the economy back into deep recession if it maintained its fiscal austerity plans. It had spent the previous two years telling everyone how it had to cut into the fiscal deficit to save Britain but by 2012 the data was telling the government that their view of the world did not accord with reality. As a consequence they curtailed the austerity onslaught and allowed the deficit to grow and support growth. The result was that Britain avoided a triple-dip recession and the nation demonstrated to its EU partners across the Channel how stupid and reckless the Eurozone’s fiscal austerity was. But ideology often comes back to the fore when the emergency is over. Now with continued, albeit weak growth and a renewed electoral mandate, courtesy of the pitiful British Labour Party, the Tories are once again talking tough and in the Spring 2015 ‘Budget’, the austerity returned with vengeance. The focal point at present of that austerity is the impending parliamentary vote on cutting the benefits to low income families in Britain via the Tax Credits system. The attempt to force harsh austerity onto the poor in Britain is vile in its conception. But the Tax Credits system in the first place is the result of weak-kneed decisions by New Labour to avoid forcing British employers to pay a decent minimum wage which would have eliminated ‘working poverty’. Now the chickens are coming hometo roost. And as usual, when austerity is introduced it is the poor that suffer. A disgrace all around really.

There is often an over-reach among the right-wing governments that feel entrenched in power. In Australia, for example, the previous Liberal government under John Howard has been in power for 8 years and finally seized control of the Senate (Upper House), which meant he could introduce any legislation he liked in the lower house and know that it would get through both houses.

He took this as a sign that he was invincible and immediately wheeled out the pernicious Workplace Relations Act which hacked into worker entitlements and protections and dramatically shifted the balance in favour of employers.

It was one shift to the right too many for the population and was the principal reason the conservatives lost office in 2007 after 11 years in office.

The British government seems likely to be engaging in the same sort of hubris with the Spring ‘Budget’ announcement that it would reduce the tax credits offered to workers on low pay.

The proposal is now broadly reviled in Britain and many commentators are claiming it may be Osborne’s ‘plank’ (as in ‘walk the plank’ into shark-infested waters).

The House of Lords is poised to defeat the legislation when it goes to vote in London today.

What is the tax credits system?

The previous Labour governemnt introduced the system to assist low-paid workers and their families because they did not have the foresight (they were New Labour after all) to reform the mininum wage system to ensure that no one was in poverty who had employment.

They created a two tier system of benefits paid to British families who have low incomes:

1. Working Tax Credit (WTC) – so an income threshold was established at £6,420 below which maximum tax credits were provided by the Government. The upper ceiling after which no benefit was paid is £13,253. A minimum number of hours worked per week is also enforced (at least 16).

Under the current proposal, this threshold will be cut to £3,850 a year from April. So benefits will start to taper sooner and the taper rate has been increased, which means that from April 2016, for every £1 earned above the threshold a loss in 48 pence will occur instead of the current loss of 41 pence.

It is estimated that millions of poor working families in Britain will lose on average £1,000 per year as a result.

2. Child Tax Credit (CTC) for those with at least one child. The income threshold in this category is £16,105 and will be cut to £12,125 under George Osborne’s proposal.

The Government claims that these negative impacts will not occur because it has announced the introduction of a National Living Wage from April 2016 to offset the loss of benefits under the Tax Credits system.

On October 7, 2015, the British Resolution Foundation analysis – Summer Budget changes will push up to 200,000 working households into poverty – took into account the changes to the minimum wage system and rejected the Government’s claim that cutting the Tax Credits would not increase poverty.

They found that by 2020, a single parent in a low pay position (earning £9.35 per hour for 20 hours per week) will be £1000 worse off per annum while a couple working a combined total of 53.5 hours per week on the same hourly rate will be £850 worse off per annum.

They found that “the number of poor working households will rise by up to an additional 200,000 over the course of the parliament as a result of policies announced in the Summer Budget”.

100,000 of these increased poor will be directly the “result of cuts to tax credits and other benefits announced in the Summer Budget”.

It found that “Many of those looking forward to a pay rise this April will soon learn that those gains will be dwarfed by reductions to tax credits.”

The modelling by the Resolution Foundation found that the minimum wage would have to rise to around £12 per hour (£22,700 a year) to offset the loss of tax credits.

In Britain, the so-called ‘living wage’ is currently £7.85 an hour or £9.15 in London. The legal minimum wage is only £6.50 per hour.

The ‘living wage’ is how much a family has to receive to enjoy an acceptable standard of living.

The Government’s justification is clothed in the sophistry of moving Britain from a “low wage, high tax, high welfare society to a high wage, low tax, low welfare” but, in reality, this is just an ideological move to attack the defenceless as a way of attempting to reduce the fiscal deficit.

On October 5, 2015, the British Resolution Foundation published its – Low Pay Britain 2015 Report – which is the fifth in an annual series and shows the “the prevalence of low pay in Britain”.

The five annual publications have established a pattern where:

Even before the financial crisis hit, too many employees in Britain were low paid by the standards of the day and relative to other countries. The downturn has done little to alter that, and pay has fallen behind the cost of living

The 2015 Low Pay Report found that:

1. “21 per cent … were low paid in Great Britain”. This proportion has shown “little change … over the last 20 years”.

2. “2 per cent of employees” were affected by “‘Extreme’ low pay”.

3. “22 per cent … were paid less than the voluntary Living Wage” and that proportion has risen since 2013.

4. “5 per cent … were on the minimum wage. This proportion has been increasing steadily since the early 2000s”.

The question then is what is the relation to low pay and the poverty line? The proposition is that if low pay is insufficient to ward of poverty so that employment is not a sufficient path to a poverty free inclusive life then the problem is the wage floor established by the minimum wage is too low.

In its – Monitoring poverty and social exclusion report 2014 – released on November 20, 2014 in liason with the New Policy Institute, a person is considered to be in ‘relative poverty’ if their “income is below 60 per cent of the median”

To overcome the problem that a declining median income level over the last decade presents this sort of classification, the Report uses a “fixed level of income as the threshold”.

The difference between the two measures amounts to “a difference of two percentage points when estimating the number of people in poverty”.

We learn that:

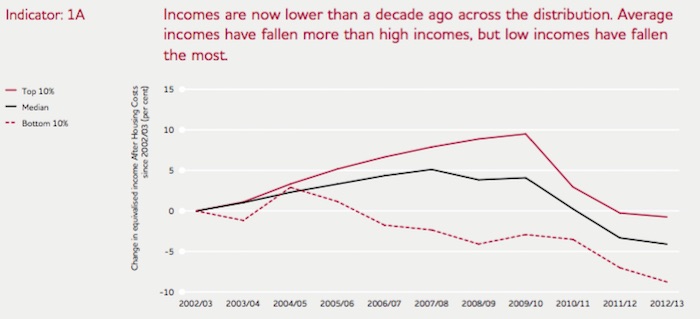

Household incomes fell in real terms for the third year in a row. Median income in 2012/13 was 9 per cent below where it was in 2007/08 and 4 per cent lower than a decade ago. Incomes of the bottom tenth have fallen further and for longer and are now 8 per cent below their level in 2002/03.

The following graph (reproduced from Indicator: 1A in the Report) shows that the low income trend turned well before the GFC although the GFC has exacerbated the disadvantage.

Over the same period, (2003-2013), “the consumer prices index rose by 30 per cent” and for “all family types, the cost of attaining a minimum standard of living has risen more quickly than average consumer prices”.

The Report found that the “poorest households spent over a quarter of their income on housing” compared to the richest 20 per cent who spent less than 10 per cent of their income on housing.

The poor are also heavily indebted with “One in five adults in poverty are behind with at least one bill, compared with one in twenty of adults not in poverty”. More households in the UK now have negative equity.

In the period since 2011/12, the proportion of people in material deprivation has risen in Britain.

How does this all impact on poverty measures?

The 60 per cent of median income’ rule shows that 21 per cent of people in Britain (13.3 million) were in living below the poverty line. Using the 2010/11 fixed threshold measure, reveals that 23 per cent (14.6 million) were below the poverty line.

But the falling median income over the last decade blurs the extent to which poverty has risen in Britain. Using a pre-GFC income fixed income threshold measure (2007-08) and indexing it to inflation shows that there were 16.6 million people living below the poverty line.

More people below the age of 30 are in poverty whereas pensioners (above 65 years) have enjoyed lower poverty rates. There was an interesting UK Guardian article over the weekend (October 24, 2015) – Pensioners prosper, the young suffer. Britain’s social contract is breaking – discussing the age profile of poverty.

What about the working poor?

1. “half of all poverty is found in working families”.

2. “Around two-fifths of working-age adults in poverty are themselves in work”.

3. Poverty in working families is rising in the UK as is the number of families on low pay.

While the British government claims that the expanding employment in the UK is a sign of its policy success, the reality is quite different when we consider the quality of the work being created.

1. Underemployment remains at high levels.

2. “two thirds of those in work now but unemployed a year ago are in low-paid work” which means they are classified as being working for less than the ‘living wage’.

3. Only 20 per cent of low-paid workers have been able to gain better pay over the last decade. In other words, low pay is a trap.

4. “Changes to the way the welfare system operates have worsened the experience of poverty for many of those affected”.

So it is not hard to understand why the detailed analysis of the 2015 Summer ‘Budget’ by the Joseph Rowntree Foundation – Will the 2015 Summer Budget improve living standards in 2020? – found that:

Fiscal austerity is likely to worsen the ability of many low-income households to make ends meet in the next few years,

While the so-called progressive side of politics is attacking the Tax Credit cuts vehemently and are now pressuring the House of Lords to reject the three-times voted proposals (in the lower house) the real issue is the fact that the legally enforceable minimum wage is too low and should be increased substantially.

And that should be done before the workers’ benefits are cut.

The progressive argument should have nothing to do with ‘fiscal savings’ – they are irrelevant even though the Tax Credits system has moved from a system that paid out £1 billion in benefits per year when first introduced to around £30 billion a year now.

The increased fiscal outlays are just a testament to the increased proportions of working poor on low pay. The problem is low pay not the size of the fiscal outlays.

But then you only would be able to conclude that if you were a ‘deficit denier’ (like me), a position which the current British Labour leadership have firmly denounced to their discredit.

I also note that the Tax Credit issue is driving a wedge between reality and tradition in British politics with the House of Lords now being forced to play a non traditional role and make determinations on fiscal matters as a result of the Government’s “plans to front-load its welfare savings and pile the burden on the working poor” (Source).

I will leave that one for the political scientists to work out.

I have made this point before – but you know about repetition … if you say it enough!

The minimum wage (with appropriate social wage support via policies that provide adequate child care, cheap public transport options, housing help and similar) is, in my view, a statement of how sophisticated a nation wants to be or aspire to be. Minimum wages define the lowest real material standard of wage income that a citizenry wants to tolerate.

It should be a wage that allows a person (and family) to participate in society in a meaningful way and not suffer social exclusion or alienation through lack of income.

It is a statement of national aspiration.

There should be no such thing as the ‘working poor’.

In any country it should be the lowest wage that society considers acceptable for business to operate at. Capacity to pay considerations then have to be conditioned by these social objectives.

If small businesses or any businesses for that matter consider they do not have the ‘capacity to pay’ that wage, then a sophisticated society will say that these businesses are not suitable to operate in their economy.

Such firms would have to restructure by investment to raise their productivity levels sufficient to have the capacity to pay or disappear.

This approach establishes a dynamic efficiency whereby the economy is continually pushing productivity growth forward and allowing material standards of living to rise.

I consider that no worker should be paid below what is considered the lowest tolerable material standard of living just because some low wage-low productivity operator wants to produce in a country and make ‘cheap’ profits.

I don’t consider that the private ‘market’ is an arbiter of the values that a society should aspire to or maintain. That is where I differ significantly from my profession.

The employers always want the wages system to be totally deregulated so that the ‘market can work’ without fetters. This will apparently tell us what workers are ‘worth’.

The problem is that the so-called ‘market” in its pure conceptual form is an amoral, ahistorical construct and cannot project the societal values that bind communities and peoples to higher order considerations.

The minimum wage is a values-based concept and should not be determined by a market.

All of that is in addition to the usual disclaimers that the pure ‘competitive market, cannot exist for labour given the imbalances between workers and employers and the fact that the use value of the labour power is derived within the transaction (that is, the worker has to be forced to work).

This is unlike other exchanges where the parties make the deal and go their separate ways to enjoy the fruits of their trade.

Which is why the decision by New Labour to introduce the Tax Credits system in the first place was a sign that they were not prepared to take the ‘market’ on and get rid of low wage-low productivity employers who are content to offer jobs that guarantee their workers remain below the poverty line.

New Labour were content to race-to-the-bottom and the low productivity that cripples the growth of material living standards in Britain today are a direct result of their lack of foresight in pushing up the wage floor and driving out low-wage (poverty wage) employers.

Conclusion

I don’t support the current British government’s plans to impose harsh austerity on the poor in Britain. But the fact they are admininstering a Tax Credits system in the first place is a sign of the failure of New Labour when they were in power.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Bill,

The situation is even worse if the gerrymandered CPI is replaced by RPI even the latter still ignores housing cost inflation!

Dear Bill

The real minimum wage in many countries has fallen so much that a quick return to the level of, say, 1970 would be disruptive to many businesses. A gradual increase would be more realistic.

In Canada, the argument is often made that minimum-wage jobs, although insufficient to support a family at a decent level, are still tolerable for people without dependent children or as a second income for a family.

We have 2 tax credits in Canada that were designed to offset the effects of other taxes. There is an HST tax credit administered by the federal government and a property tax credit in some provinces. The HST is a value-added tax. Since sales taxes and property taxes are regressive, a tax credit designed to offset them makes the tax system as a whole more progressive.

Employers do not distinguish between employees who have dependent children and those who don’t. As long as this is the case, child tax credits are a god-send to families with young children. In a way, they can be compared to free primary and secondary education. Childless couples or couples with grown-up children do not benefit directly from free education.

As you see said, ideally every able-bodied and able-minded person should have a job that pays him/her so much that further social assistance is unnecessary to keep him/her out of poverty. Until we are there, tax credits are welcomed by the working poor.

Regards. James

I disagree with minimum wages, wishing instead to see a equal capital allocation to each person.

But with that caveat we can see other Tory tax policies that will be absorbed by Labour simply because they are trendy.

Health fascist taxes are especially popular and effective at destroying purchasing power.

Ps

Listening to radio 4 Lw down in South Kerry gives you perspective and distance from the British fascistic state.

The today programme ( the official organ of this concentrated bank/ state) has become quite absurd since I listened to it last.

Meanwhile in the so-called Real World… no single member of a left wing party (whatever it means) has been elected to Polish parliament (due to the theshold eliminating minor parties).

Some of the ideas previously advocated by so called left wing parties have been absorbed by the winning nationalist-Catholic-conservative party PiS (“Law and Justice”).

I am slightly bemused why British Labour which is intellectually dead is still considered a topic worth debating. (British Labour died at least twice – as “Old Labour” when the radical socialist ideology died with Soviet-style communism in 1989 – and as neoliberal “New Labour” – with the GFC).

No matter how much “progressive framing” and “political correctness” is pushed down the throats of the dissatisfied “plebs” in the UK – they idea of old “socialism” – nationalisation, wealth redistribution and an omnipotent state controlling citizens – is dead. People don’t care. There is no critical mass. Maybe some people do care about the environment. And this is it. Radical Islam has replaced Marxism as the ideological vehicle of choice for deeply dissatisfied and often slightly mentally challenged young people who want to rebel and randomly destroy things because they see social injustice inherent to capitalism. Islamism is the pet enemy of choice for the Western civilisation – because is so medieval and stupid and creates no intellectual challenge (unlike some elements of socialist ideology).

There is one critical issue in Central Europe – people are sick of the political elites who do not represent their interests. Who cares about the EU if the majority of people in Eastern Europe simply do not want Muslim settlers or forced on them gay marriages? Who cares about “Common Europe” if the precondition of joining the EU was the destruction of heavy industry and disinflation, achieved through jacking up unemployment to over 20% in Poland – what led to mass migration and may lead to a demographic collapse. Forcing the neoliberal – pseudo-progressive (multikulti) ideological mix on people (who might be brainwashed already by Catholic Integrists) has nothing to do with democracy. If the Euro-elites try pushing harder then the only result is that true fascists (like Golden Dawn) might emerge. It takes a while – but what has happened in Poland was entirely predictable even 10 years ago.

What would make much more sense in my humble view is translating analythical framework coming with Chartalism and Post-Keynesian Economics onto the language (“reference frame”) of modern liberals, right-wing libertarians, populistst and nationalists.

IF I have worked this out correctly?

In 2012-13 the bottom 10% of households had an average gross income of £9,743 and payed an average of £4,611 {47.33%} in direct and indirect taxes.

Hence the ‘net’ cost of benefits is much less than the ‘gross’ cost of benefits?

ons.gov.uk/ons/rel/household-income/the-effects-of-taxes-and-benefits-on-household-income/historical-data/sum–historical-tables.html

Table 14:

Dear Bill,

I really enjoy your blogs, and would like to raise some issues

that don’t seem to be adressed by anyone.

My point is, is Osborn self centred and just in the job to

feather his, his friends and families nests. Would you say

that he is first and formost looking after himself?

Why with all the comments on taxes and benefits, has no one written anything from the personal view of Osborn and Cameron?

Why does no one mention that with the basic tax allowance,and other taxes, Osborn and Cameron themselves benefit?

Why no mention of the tax changes that have benefitted Osborns father to over £50,000 a year?

The benefits to himself with the changes to inheritance tax?

The benefits to his family and friends.

The £10,000 a month he gets from renting out his home, etc

Why?

best regards

Perry.

@Adam

Catholic like viewpoints are not all alike.

I prefer basic Christianity as a definition anyhow.

If you think I trust a Jesuit who names himself Francis then you are mistaken.

The banks are always happy to introduce puritanism into every and all body politic.

This may have happened in the Muslim world in the Saudi Arabia of the 17th and 18th centuries

Scotish history is a fine example.

Indeed the historical examples are almost endless.

“Free markets” would only exist in a world of barter. The moment money, which is subject to fiscal policy ie political control, enters the picture, markets are no longer “free”. Economics that do not acknowledge the role of political choice in a fiat currency reality are simply more of the same language game the conservative plutarchy have played so well for centuries in order to retain power. Working within the framework of democratic governance has taken this to a whole new level which necessitates professional help.

The ability to spin labels and ideas used by the critical left has always been the key tool of conservatism. To quote John Kenneth Galbraith: ” The modern conservative is engaged in one of mans oldest exercises in moral philosophy; that is,the search for a superior justification for selfishness”.

It is evidence of a failure of capitalism that business schools now teach that limiting compensation to labor for it’s contributions counts as “productivity gains”.

“would be disruptive to many businesses. ”

That’s the point. It *is* disruptive. Business that can’t hack it go bust.

I have not contributed to this blog for some time mainly because I came to the conclusion from my researches that there isn’t a lot any of us can do about the wrongs of the world’s macroeconomics. There are forces out there far stronger than governments, let alone Lil old me. Added to which I had a heart attack – not through worry about MMT, more my mis-spent youth catching up with me.

But today’s missive, whilst laudable, may be premature as the cut in tax credit may be thrown out by the House of Lords tonight. Furthermore there are some indications that Osborne will introduce some measures that will soften the blow in the Autumn Statement. Raising of the NI threshold or re-introduction of the 10p rate for example.

There is no doubt that the tax credit system does need reforming as it is hugely complex, expensive to administer and difficult to police. Many accountants avoid getting involved with it because of its complexity. However, slashing it by half in one fell swoop is not the answer.

More importantly I was surprised you, Bill, didn’t comment on the Fiscal Charter which, if implemented will have far more serious consequences. It commits this government to a budget surplus in 2019 – 20 which, as we know, and as was illustrated in yesterday’s quiz answers will be followed by a recession in 21. It also commits the government to running a surplus in all future “normal times” – defined as when GDP growth is greater than 1 per cent. It beggars belief that they don’t get it. So much so that they really must do and are following a different agenda. Wonder what could be?

With which I’ll go back to sleep.

I have a feeling that the refugee crisis might change everything if Europe can’t get its act together. This is one can they can’t kick down the road.

I believe that tax credits on balance are a good thing, provided they are not use to compensate for low rates of pay.

They are good in cases where households simply cannot commit to the numbers of hours they would need to work (even at a good rate of pay) to live properly, due to child care as well as care of the disabled and infirm.

They can also be good for temporary situations like bereavement, divorce etc.

They shouldn’t disappear, but they shouldn’t be used to compensate for rates of pay that are too low.

Nigel, sorry to hear about your health problems. Hope the medics have dealt well with the problem. Re the Fiscal Charter, Bill has dealt with it and is obviously against it, seeing it as an inanity. William Keegan of the Observer considers that the Charter may be unconstitutional.

Bill, I would add a ceteris paribus clause here: “If small businesses or any businesses for that matter consider they do not have the ‘capacity to pay’ that wage, then a sophisticated society will say that these businesses are not suitable to operate in their economy.” In doing so, I am thinking of one person businesses or small businesses that depend on their customers having enough money to spend. They wouldn’t be in difficulty were the other factors you mention in operation. But currently they are not.

Let us take a specific example. We have a psychological counselor. Let us assume that said counselor is good at his/her job. The clientèle are individuals referring themselves or companies who have businesses sending them their employees for counseling who then send them on for counseling, as they can’t do it themselves. They pay the counselor a very low wage per client referred. These companies bid for contracts from the government and, with this government particularly, those companies who can bid the lowest get the contracts for accepting clients from businesses whose employees, for whatever reason, need some kind of counseling.

As wages are low, individuals referring themselves can’t afford very great counseling costs. And the companies who have bid for contracts have been forced by the bidding process to bid too low to be able to afford to pay the counselors on their books very much, or allow the people they refer on to receive much counseling.

There is a better way, of course, which would be for all counselors to work for the NHS and be paid a decent salary. All referees, either individual or via their places of work, will obtain the counseling they need. This government (and the previous Blairite governments), as you know, have been privatizing the NHS by stealth, so this isn’t gong to happen any time real soon.

There is much more that could be said, but possibly I have said enough to justify my contention that a big ceteris paribus clause be attached to statements like the one quoted above. You may have intended one to be there, but I think it needs to be made explicit. And nothing I have said seems to me to be in conflict with either the tenor or the rest of the content of your post. With this one caveat, I couldn’t agree more with what you have written.

Except perhaps to mention that it isn’t only the Lords who are bothered by the tax credits bill. It is Tory MPs who have already told Osborne “enough austerity already” and 71+ Tory MPs who will be feeling the wrath of their constituents after Xmas and are worried about their parliamentary longevity. The letter telling those affected by this bill, including many in the now somewhat ambiguous middle class, what they will lose could arrive by post between Xmas and shortly after the New Year. Unless Osborne changes his mind. He has only a few weeks to do so.

Isn’t the flip side of insisting that employers pay a livable wage £12 is running a greater deficit so that there is sufficient demand and sales and cash rich buying customers to make purchases to support businesses and full time employment at those wage levels.

We don’t really need national insurance or even any tax at all on low income earners.I’m not sure we really need anyone earning under £36000 to pay income tax.

I wonder why Britain is becoming an increasingly low wage economy.It is not as if the country hasn’t had a need for supermarket workers/labourers/retail staff/agricultural workers/fastfood workers/barstaff/waiters/warehouse workers before hand.

Immigration has obviously played a role in suppressing wages,since 2004 polish and Baltic workers have saturated the low to mid pay job market.Jobs that used to earn 10 went down to 6 an hour.Talk to anyone about this and they will insist that foreign workers come here to do jobs that locals don’t want too,so it all works out in the end.

Surely if a government does chose to expand the population which can freely emigrate to its economic space then the flip side of that is running a greater deficit so that there is sufficient demand In the economy to generate the sales needed to support full time employment at decent wage levels,to negate the wage suppression effect the of the increased labour supply.

Cameron might just pull a fast one like he did with NHS privatisation, call for a ‘review’ and then implement the measures anyway.

The feeble opposition will be satisfied being paid off with a pittance of attention, and the plan will then proceed.

None of them believe the goal of a broken peasantry can be achieved with no effort, just enough to get there.

I was wrong, the labour party came to Cameron’s rescue and abstained in the lords on the motion to kill the tax credit cuts, dismissing the opportunity to do something for once as ‘Gesture Politics.

Honestly, with enemies like this, the blue tories don’t even need friends.

Paul, that will be the Blairites. If they could get rid of Corbyn, which they thought of doing, even immediately after the election, they would do so. They are unable to get past their own view of the world, no matter how many times others tell them it is wrong.

Perry Kitsell I have been rising the question of corruption on this blog for a long

time no doubt to the point of everyone else’s boredom.Political economic corruption

is endemic .The MMT nature of fiat money its potential for egalitarian purpose is dependent

on overcoming this corruption which runs deep in ‘left’ political culture( take a look

at South America ) but is the defining characteristic of the centre right(Osbourne and all)

Paul, you should set yourself up as a prognosticator. Cameron has just called for a “rapid review” after the Lords forced a delay in the implementation of the tax credits scheme. He accused them of breaking constitutional convention, which they have done. While the Tories in the Lords are outnumbered, this is still an unusual step to take. On the other hand, Osborne bypassed the ordinary legislative process in putting this bill through the way he did. It is the equivalent in the US of an executive order, which is done or should be done only in emergencies where the ordinary legislative process is too slow. The tax credit change does not qualify.

Addendum:

As for the break in the constitutional convention between the lower House and the Lords, this may eventually bring about a constitutional crisis in the legitimacy of the Lords as it is now constituted. Certainly, Cameron is now going to try and neuter them completely. I can’t imagine this going smoothly.

While I have sympathy for Corbyn, (if he was caught failing to brush his teeth for the full three minutes he’d be reported as insulting the nation), why was he up here in jockistan, signing a

groundbreakingtotally pointless bit of paper when all this was going on in Westminster?Larry,

Might be a bit late in the day but if you read this thanks for your kind thoughts. Yes, even in the NHS the medics have done a very good job. Amazing what they can do these days. I was only in hospital 2 days. What happened to me killed my father 40 years ago.

I did try to keep up with Bill whist indisposed, but must have missed the bit about the Fiscal Charter.

Events last night have proved my words correct, but I doubt if it will make any difference in the long run.

Nigel, here I am reading your response. It is amazing what medics can do these days for some conditions. While I hope you are wrong on this political event, no reflection on you, you may prove to be right in the end. Osborne appeared to be shaken. Keegan, an Observer economics columnist, thinks he is tottering on the brink of hubris, which David Owen, a psychiatrist before he became a politician, considers to be a kind of psychopathology. Have a look at his short book, The Hubris Syndrome, which is primarily about Blair, who definitely still suffers from this pathology. Thatcher also exhibited the symptomatology of this condition, which in the end was the author of her downfall.

You might try ‘the man in the mirror’ by leo abse, which nailed the useful narcissist in blair quite early on.

It labour’s the point a bit,(a lot of people had him clocked as a slippery nutcase) but aside from that, I most remember it for his expression of the difficulties of effective legislation (the complication of aims and implementation) rather than the truly oddball nature of our most successful (but most actively forgotten) prime minister.

Lately legislation has become a substitute for action. Look at gideon osborne’s institutional efforts to create a society that is high wage,low welfare and low in taxes.

I said on richard murphy’s site that he will happily settle for the latter two goals.

Fiat society is the wishful thinking of despots.

I know they cannot bear to use the term ‘social security’, but promoting a low welfare society may be pushing the frame too far.

Quick caveats to the above:

succesful ==electorally succesful

wishful thinking is one thing, wishful action is quite another

extra caveat:

the book title is : the man behind the smile

It was a long time ago, so while the error is inesxcuseable, I hope it’s not unforgiveable.

He accused them of breaking constitutional convention, which they have done.

Is that a conventual constituition you are talking about?

Or just a constitutional convention?

What is the difference?

There was a valid process:

The changes were being made through an instrument, not an act of the lower chamber, which could be scrutinised and voted on by that chamber(with its members votes recorded).

The lords, as it was not a finance bill, could (according to our unwritten constitution) do what they like with it.

They chose to disguise their acceptance of it, and that’s the long and the short of it.

Paul, I don’t believe I could bear to read it now. But I recommend the 2010 interview with David Cornwell aka John le Carre by Democracy Now while they were in London. What he says about Blair is not anything I would want said about myself. Here is the link should you wish to view it: http://www.democracynow.org/2010/10/11/exclusive_british_novelist_john_le_carr. He virtually says about Blair that anyone who takes their country to war on the basis of lies is unacceptable. This was what was said about Cameron in the Lords in the vote on tax credits by a Labour peer, that the public were fed up with politicians who lie on the scale Cameron did, which in this case was “only” to win an election. One could view this as more trivial and therefore even more “unacceptable” (Cornwell’s term). Over the past few years, it has seemed as though Cameron has been using Blair as a role model. And the Blairites in Parliament are still loyal to Blair’s ideas if not the man himself and don’t seem to be able to let go of these ideas, not far from those of Cameron himself, deleterious to the common weal as they are. One could be forgiven for thinking that the light at the end of the tunnel appears to have been turned off or has burned out.

Paul, the convention governing the Lords includes the injunction that they do not comment on financial matters put forward by the Commons. They have just done this and it has infuriated Cameron, no doubt assisted by the Labour peer’s comments. Most of the British constitution is not written down and rests on long held traditions. One of these traditions has now been broken in a very public manner, and not with any help from many Labour peers.

The process Osborne went through is not entirely “valid” though “valid” is not quite the right word. But instead of putting his tax credit bill through the standard Commons parliamentary process, he sidestepped this and effectively produced what in the US would be viewed as an executive order, which is expected only in situations of extreme urgency. The tax credit system fails this test.

This is one of the factors that has troubled some of the peers, that Osborne is not going by the accepted rules. And they are making him pay for this. Another influential factor may be that Cameron said more than once during the last parliament that he would not entertain reform of the Lords. This may have given some of them a backbone they might otherwise have had difficulty finding.

Addendum:

The tax credits bill is a finance bill. That is how it is seen.

Jake the idea of raising the tax allowance to 36000 is completely regressive.

Most people do not earn £36000 they will not fully benefit from such a rise.

Only those earning above new thresholds fully benefit from them.

The lords have done a service for George this is four billion of the poorest

people’s income ,they spend it all .The UK’s fragile recovery would not have survived

the loss of such an efficient non inflationary stimulus.

Bill –

That’s inaccurate. They did reform the minimum wage system (by introducing one when there wasn’t one previously, and by gradually raising it). But whatever level the minimum wage is at, it alone won’t cure poverty.

What they failed to do was to address the housing shortage. Because of that, the wage rises just resulted in house price rises, so the working poor weren’t actually any better off.

Again I find myself agreeing with the goals ‘work and decent living conditions for all’

and doubting the methods to achieve them.

The government cannot achieve these goals in the short term because there is

insufficient quantity and significantly insufficient quality of goods and services required

to achieve them regardless of what minimum wage is set and what job programs are created.

Here in the UK this is best demonstrated by housing.Yes there is still insufficient housing space

to accommodate all but more importantly the standard of that housing is far from being able

to deliver decent living conditions .

What is true of housing is true across many goods and services Much of productive capacity

is dedicated to providing poor quality goods and services because that is all people can afford.

There is a chronic lack of money tokens.Wages and profits are in conflict ,employers will pass

on wage rises in increased prices, minimum wages will need to rise to compensate.

Progressive welfare and tax regimes and state expansion of employment and provision in areas

poorly served by the private sector are the least inflationary method of tightening the labour market

and moving along the long journey to achieve work and decent living conditions for all.

Larry,

Just to say thanks for your further good wishes. Time to move on.

Aidan Stanger

“What they failed to do was to address the housing shortage.”

What they did was leave ‘the market’ to supply accommodation?

It can be judged successful according to the ‘real’ IPHRP?

Experimental Index of Private Housing Rental Prices (IPHRP)

Office for National Statistics

Postkey, I googled IPHRP and found The IPHRP series for England starts in 2005 so it ignores most of Blair’s time in office.