I grew up in a society where collective will was at the forefront and it…

US and Eurozone inflationary expectations diverge

Back in October 2009, the US unemployment rate had climbed to 10 per cent (its seasonally adjusted peak in the recent recession), the fiscal deficit was around $US1.4 trillion (9.8 per cent of GDP), which was the largest since the end of the Second World War (1945) 9.9 per cent of GDP and federal spending rose by 18 per cent with about 50 per cent going to bail out the banks. Meanwhile the US Federal Reserve ramped up its so-called quantitative easing (QE) program and its balance sheet expanded rapidly (as its purchase of government bonds accelerated). A lot of mainstream economists and conservative politicians at the time predicted an economic maelstrom – higher interest rates, an acceleration of inflation in the US and the inevitability of higher taxation. The trends in other nations were similar – higher deficits as the unemployment rates rose and the same shrill predictions of doom from the mainstream. None of the predictions came to be. But what is interesting is that the behaviour of long-term inflationary expectations in the US is now quite different to Europe. The most likely reason is that market participants now consider the drawn out recession and stagnation in the Eurozone to be the result of manifest policy failure and do not consider QE will do anything to alter that. In the US, the policy framework – fiscal stimulus to growth and benign QE appears to be more credible.

John B Taylor (Stanford) a loud critic of the US stimulus packages wrote and Op Ed in the New York Daily News (August 31, 2009) – The Coming Debt Debacle – that the:

These large deficits represent a systemic risk to the economy … Without spending discipline, damaging tax increases are required to close such deficits, and that is why rumors of new value-added tax are circulating. The deficits would also bring a long painful period of high inflation like the late 1960s and 1970s, a period of frequent recessions and persistently high unemployment when people began to lose confidence in the dollar.

His view was representative of the academic noise.

Earlier in 2009 (February 13, 2009), as the fiscal deficits started rising, Paul D. Ryan, the manic Republican Congress representative (and failed Vice Presidential candidate) and devotee of the idiocy of the extremist Ayn Rand, wrote in his New York Times article – Thirty Years Later, a Return to Stagflation – that:

CONGRESS has made a terrible mistake … the stimulus bill…. [is] … dangerous … And now the package threatens a return to the kind of stagflation last seen in the 1970s … It seems that no one in Washington is discussing what happens when the world begins this gargantuan borrowing spree. How high will interest rates rise? … Soon we may again find ourselves watching a rising “misery index” of inflation and unemployment together.

That was a representative conservative political view at the time. One might suggest that his position was less than some of the extreme predictions regarding inflation.

It was not only the deficits that the conservatives were worried about. The QE introduced by the central banks in the US, UK and Japan also sent the inflation doomsayers into fearful rages.

QE involves the central bank exchanging a non- or low-interest bearing asset (that is, adding funds to the reserve accounts that banks have to hold with the central bank to facilitate the clearance of cheques) for some higher yielding and longer-term assets (for example, 10-year government bonds or commercial bonds).

It is nothing more than a simple asset swap between the central bank and the private sector with the additional negative aspect that it reduces income flowing to the non-government sector. Proponents of QE claim it adds liquidity to a system where lending by commercial banks is seemingly frozen because of a lack of bank reserves. They say that giving the banks more reserves will stimulate more lending to the private sector with commensurate higher rates of investment and economic growth.

Financial journalists regularly claim that QE involves ‘printing money’ to ease a ‘cash-starved’ banking system. Invoking the evil-sounding ‘money printing’ terminology to describe QE is deliberately emotive (for example, it stokes our irrational fears of Weimar scenarios).

It is also highly misleading. All transactions between the government sector (treasury and central bank) and the non-government sector involve the creation and destruction of net financial assets (‘money’) denominated in the currency of issue. Typically, when the government buys something from the non-government sector they just credit a bank account somewhere – that is, numbers denoting the size of the transaction appear electronically in the banking system.

These numbers signify a new financial asset has been created to the favour of the recipient of the spending. The reverse is true when taxes are paid. There are no printing presses involved!

Fast track five years. Interest rates remain low. Growth has returned except where fiscal austerity is preventing it and no one believes that inflation, which is now low or negative in most countries, is about to accelerate in any significant way.

Last week’s employment data from the – US Bureau of Labor Statistics (BLS) – for February 2015 showed the total employment growth was ratcheting up fairly quickly (although the quality of the employment is another issue which I will consider in detail in another blog).

Yet the – Actual US inflation rate – as recorded by the BLS was -0.7 per cent in January 2015.

So perhaps that accelerating inflation is just around the corner or a year away or something.

The IMF certainly thought that QE would shape inflationary expectations upwards.

The IMF’s 2014 report (June 25) – Euro area policies Staff Report for the 2014 Article IV Consultation with Member Countries – said that (p.45):

… if inflation remains too low, consideration could be given to a large-scale asset purchase program, primarily of sovereign assets. Directors noted that the signaling of the ECB’s commitment to its price objective would eventually raise inflation expectations across the euro area.

The IMF further claimed that QE “can push up inflation by raising consumption and investment across the euro area” because “growth and inflation expectations would rise as the ECB signals resolve to achieve its inflation objective”.

The Federal Reserve Bank of Cleveland provides the most current series on inflationary expectations and the real interest rate that is available.

In October 2009, the Bank released a discussion paper outlining – A New Approach to Gauging Inflation Expectations. It is a non-technical version of this 2007 paper – Inflation Expectations, Real Rates, and Risk Premia: Evidence from Inflation Swaps.

Well the latest data from the US Federal Reserve Bank of Cleveland current to January 2015 – Cleveland Fed Estimates of Inflation Expectations – suggest that the:

… 10-year expected inflation is 1.66 percent. In other words, the public currently expects the inflation rate to be less than 2 percent on average over the next decade.

The data spans the period from January 1, 1982 to January 1, 2015.

The three major rounds of QE in the US were dated as follows:

- Quantitative Easing 1 (QE1, December 2008 to March 2010) – This was announced on November 25, 2008. The program was expanded on March 18, 2009 as described in this FOMC press release.

- Quantitative Easing 2 (QE2, November 2010 to June 2011) – The FOMC announced on – On November 3, 2010 – that it “intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.”

- Quantitative easing 3 (QE3, September 2012 and expanded on December 2012 and terminated in October 2014) – The FOMC announced on – September 13, 2012 – that it “agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month”. This would continue “If the outlook for the labor market does not improve substantially”. This phase was expanded on – December 12, 2012 – such that the FOMC “will purchase longer-term Treasury securities … initially at a pace of $45 billion per month”. QE was terminated in the US in October 2014.

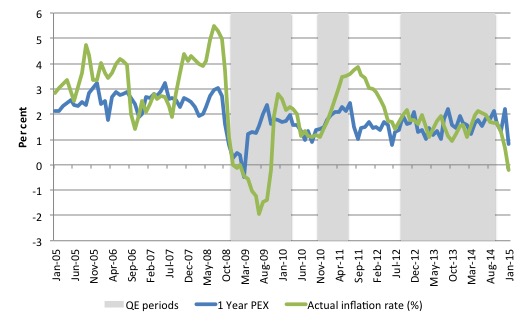

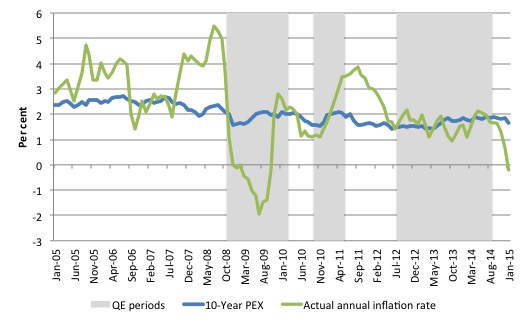

Those phases are depicted by the shaded areas in the following graphs.

The graphs show the evolution of inflationary expectations (PEX) and the actual annual inflation rate from January 2005 to January 2015. The first graph shows the one-year ahead inflationary expectation while the second shows the expectation over the 10-year horizon (in other words, what people in the US think inflation will be over the next decade).

It is hard to mount an argument that the QE episodes have increased inflationary expectations. The last phase (QE3) didn’t alter short- or long-run inflationary expectations one iota – they remain low and anchored despite the massive increase in the asset-side of the Federal Reserve balance sheet and the commensurate swelling of bank reserves.

1-year ahead inflationary expectations

10-year ahead inflationary expectations

An interesting observation concerns the concept of ‘inflation anchoring’.

Mainstream economists think that when a central bank announces an inflation target then private households and firms will eventually come to expect that inflation rate will persist as long as the central bank is independent and carries on its duties diligently.

They use the term anchoring to describe that alleged relationship between the central bank’s announced target and long-term inflation expectation.

The US Federal Reserve – state that it judges

… judges that inflation at the rate of 2 percent (as measured by the annual change in the price index for personal consumption expenditures, or PCE) is most consistent over the longer run with the Federal Reserve’s mandate for price stability and maximum employment … The FOMC implements monetary policy to help maintain an inflation rate of 2 percent over the medium term.

So 2 per cent is what mainstream economists would term the inflation anchor in the US.

The graphs are interesting because they show that long-term inflationary expectations have remain fairly stable around that anchor.

Even during the early years of the crisis, when the actual inflation rate fell sharply to negative territory, the long term inflationary expectations were stable around the US Federal Reserve’s implicit inflation target.

The shorter term expectations which pick up a lot of the month to month fluctuations in energy and housing prices etc were much more volatile and followed the actual inflation path.

As energy prices have fallen and the US has entered a deflationary period again, the short-term inflationary expectations are once again down but the 10-year ahead expectation has only marginally fallen and is still close to the 2 per cent mark.

There has been no clear break in behaviour of the long term series since downturn in both the recession and recovery phases.

This suggests that market participants despite all the noise coming from the conservatives judged that growth would return given the fiscal stimulus and realised that QE would do very little in that regard.

They thus judged that the long-term trajectory of the price level would not be distorted by these policy interventions and the different growth experience over the last 7 years.

And now to Europe …

The same cannot be said for Europe. The scaremongering about future high inflation is the same – given the announcement by the ECB on January 22, 2015 that they would introduce a QE program in an effort to stimulate growth.

But what is happening with inflationary expectations is quite different in Europe as a result, I surmise, of the failed policy environment and the lack of faith that market participants have in the overall policy direction.

What has been happening in Europe then, which has experienced a very different real GDP trajectory relative to the US?

The annual inflation rate is now negative – which is similar to the US. What impact has this had on inflationary expectations?

Europe is not a happy place for these ‘market’ mainstream economists. Not only is the central bank (the ECB) failing spectacularly to meet its inflation target but inflationary expectations in Europe are now thoroughly ‘unanchored’ in terms of the ECB target.

The ECB defines its target range in terms of its – Quantitative definition of price stability:

The ECB’s Governing Council has defined price stability as a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%.

Price stability is to be maintained over the medium term.

The Governing Council has clarified that, in the pursuit of price stability, it aims to maintain inflation rates below, but close to, 2% over the medium term.

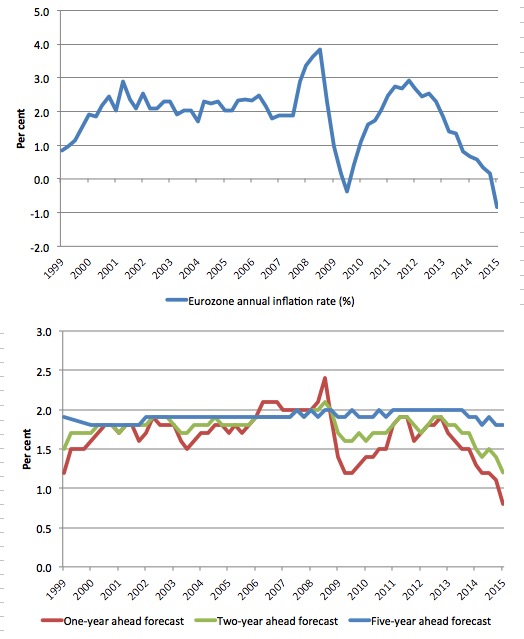

The following graphs shows the inflation history in the Eurozone (from the March-quarter 1999 to the March-quarter 2015) – top panel – along with the ‘mean point estimates’ of inflation from the – ECB Survey of Professional Forecasters (SPF) – (mostly private sector bankers) for one-year ahead (red), two-year ahead (green) and five-year ahead (blue) – bottom panel.

The SBF is relatively straightforward. The ECB say it “is a quarterly survey of expectations for the rates of inflation, real GDP growth and unemployment in the euro area for several horizons, together with a quantitative assessment of the uncertainty surrounding them.” The link to the page provides detail of the survey instrument etc.

This 2007 discussion paper – The ECB survey of professional forecasters (SPF) – A review after eight years’ experience – is also informative if you are interested in these things.

The latest ECB data for its SPF is to January 2015 just before the January 22, 2015 announcement by Mario Draghi that the ECB would introduce a large-scale QE program.

But that announcement was hardly unexpected and all observers who follow these things would have factored in such a program as early as October last year.

The graphs are interesting because they show that long-term inflationary expectations have now broken away from the anchor provided by the ECB’s target range of “close to” 2 per cent in the medium-term.

Even during the early years of the crisis, when the actual inflation rate fell to negative territory, the long term inflationary expectations were stable around the ECB’s definition of price stability. The shorter term expectations which pick up a lot of the month to month fluctuations in energy and housing prices etc were much more volatile.

But the longer-term expectations were very stable around 2 per cent. As the Eurozone has entered deflation, the ECB has maintained that it wants to achieve a 2 per cent inflation rate but now long-term inflationary expectations are following the shorter-term horizons downwards.

There has been a clear break in behaviour of the long term series since the December-quarter 2013 as the Eurozone struggles to grow within the Stability and Growth Pact straitjacket.

The evidence would support the notion that in the early days of the recession, the hype from the IMF and the European Commission that the downturn would be short-lived and that appropriate implementation of fiscal austerity to ensure nations abided by the fiscal rules in the SGP would see a quick return to prior levels of activity.

This was the fiscal contraction expansion lie that was peddled by the ECB, by the IMF and the EC as it formed its nasty TROIKA (sorry Greece) to enforce its anti-growth policies.

The constant hype that this would be ‘growth-friendly’ (another of the terms they used to justify the austerity) seemed to be accepted by financial market participants who were surveyed by the ECB in the SPF. They clearly didn’t alter their sentiment about the trajectory of longer-term inflation.

But as it has become obvious that the austerity has been killing growth and destroying some economies (like Greece) in a wholesale manner, it is now apparent that the ECB’s price target is no longer believed.

The respondents to the SPF now consider that deflation with low growth is likely to persist for at least 5 more years. The short-term factors driving inflationary expectations are now converging with the longer-term outlook.

In other words, the ECB has not only lost control of its alleged anchor but that anchor is no longer seen as relevant by market participants.

If the survey respondents had been considering the January 22, 2015 announcement by Mario Draghi as they answered the last survey or two then they sure didn’t believe that QE would accelerate the inflation rate (nor for that matter stimulate growth in any meaningful way).

We will thus be curious about the actual impact which will be revealed when the ECB releases the next SPF results in May 2015. The big question is whether the ECB has convinced the market participants that inflation will be higher in the coming years as a result of its bond-buying extravaganza.

If the experience of the US and Japan is anything to go by then there is unlikely to be a convergence between the long-term inflationary expectations and the ECB’s target rate while growth remains stuck in the slow (to negative) lane.

Conclusion

The major difference between the US and the Eurozone in terms of this data is not to be found in the inflation trajectory. Both areas are now caught in a deflation (driven by lower energy prices and stagnant growth in Europe and slowing growth in the US).

But that aside, the behaviour of long-term inflationary expectations is quite different. The central bank policy target is deemed to be reasonable by market participants in the US but not in Europe.

The ECB’s target of 2 per cent is now considered to be not a good guidance of the longer-term inflationary trajectory.

The Eurozone is caught in a malaise of fiscal austerity and stagnant growth with high unemployment, while the US os growing much faster, adding employment and bringing down its unemployment rate substantially.

Market participants have formed the view that the current deflation is likely to be temporary in the US (given the fundamentals) but entrenched in the Eurozone given the on-going policy failure.

We will await the next release of the SPF to see whether this surmise has substance.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

“Proponents of QE claim it adds liquidity to a system where lending by commercial banks is seemingly frozen because of a lack of bank reserves. They say that giving the banks more reserves will stimulate more lending to the private sector with commensurate higher rates of investment and economic growth.”

This ‘Thatcherite Monetarist’ does not believe that QE relies upon ‘bank lending’?

“The intention of the Bank of England’s programme of quantitative easing is to increase the quantity of money by direct transactions between it and non-banks. Strange though it may sound, monetary expansion could occur even if bank lending to the private sector were contracting. . . .

In short, although the cash injected into the economy by the Bank of England’s quantitative easing may in the first instance be held by pension funds, insurance companies and other financial institutions, it soon passes to profitable companies with strong balance sheets and then to marginal businesses with weak balance sheets, and so on. The cash strains throughout the economy are eliminated, asset prices recover, and demand, output and employment all revive. So the monetary (or monetarist) view of banking policy is in sharp contrast to the credit (or creditist) view. Contrary to much newspaper coverage, the monetary view contains a clear account of how money affects spending and jobs. The revival in spending, as agents try to rid themselves of excess money, would occur even if bank lending were static or falling.

The important variable for policy-makers is not the level of bank lending to the private sector, but the level of bank deposits. (Remember Irving Fisher’s reference to “deposit currency”.) Indeed, because companies are the principal employers and the representative type of productive unit in a modern economy, bank deposits in company hands need to be monitored very closely. If these deposits start to rise strongly as a by-product of the Bank of England’s adoption of quantitative easing, the recession will be over. ”

http://www.standpointmag.co.uk/node/1577/full

“The Eurozone is caught in a malaise of fiscal austerity and stagnant growth with high unemployment, while the US os growing much faster, adding employment and bringing down its unemployment rate substantially.”

It was monetary policy that ‘made the difference’?

” . . . back in 2010, the US and euro zone had the same unemployment rate around 9-10%. And we had something like a controlled experiment, since the US and the Eurozone did roughly the same amount of austerity. (By some measures the US did a bit more.) The big difference between the two areas was monetary policy. The US did some monetary stimulus through QE and forward guidance, while the ECB did nothing. Now the unemployment rate in the Eurozone has gone up from 9% to 11.6%, while it’s gone down in the US to 6.3%. This huge divergence in employment outcomes over the last 3 years with monetary policy being the difference, not fiscal policy, seems very striking. . . .”

http://www.adamsmith.org/wp-content/uploads/2015/02/therealproblemwasnominal2.pdf

I’ve always been a bit uncomfortable with the characterization of QE as a simple asset swap. It is an asset swap in the same sense that any purchase is an asset swap, but an increase in demand for anything that is supply-limited will tend to increase its price. So QE might tend to increase the price of bonds. But since bonds are predominantly a savings vehicle, the people who sold those bonds will likely use the proceeds of the sale to purchase some other financial asset. That is, they simply exchange one form of saving for another. And the sellers of those financial assets will continue the same process. So it seems to me that QE has a demand impact on financial assets in general that would tend to support higher prices. But just as MMT predicts, that will have little or no impact on the price of commodities used to compute a general rate of inflation. We don’t refer to higher prices in financial markets as inflation, we refer to it as a bull market, which of course is exactly what we’ve experienced during the Fed’s QE in the U.S. Now the ECB is set to add more demand for financial assets so it’s no wonder that the financial markets react well to it.

President Obama/Council of Economic Advisers:

Since WW II the Koch brothers/1% have spent tens of millions of dollars, buying politicians and state legislatures so they could systematically destroy “employee rights” in America, cementing “at will” employment in every state-with their most recent attack on March 9, 2015, in Wisconsin….

Running in parallel to this time-frame, we have undergone copious socio-economic change-and in the mid-1970’s the colliding forces of automation, technology, globalization, etc. reached a critical mass-resulting in “High and persistent unemployment [that] has pervaded almost every OECD country since the mid-1970’s” [Dr. William Mitchell]….

A truism is that we have one of two choices in the throes of socio-economic change: Adapt and change in a world that is changing whether we like it or not, or create a Police State to hold our anachronistic policies in place-and sadly America opted for the latter….

Evident by the militarization of our local police, and currently, we have 5% of the world’s population, and 25%–one in four prison inmates, on Earth, in our prisons [2.3 million]! We have the same incarcerated as China, but they have a billion more people!

For several years following the death of Dr. Martin Luther King, Jesse Jackson and other civil rights leaders marched on Dr. King’s birthday for his major cause– “Jobs”–And finally in 1978, Congress passed, and President Carter signed into law Humphrey-Hawkins [15 U.S. Code § 3101-hereafter H-H]–which provides America with the “legal authorization” to limit our UE rate to “3%”–tomorrow–at no time should our unemployment rate in America ever exceed 3%…..

So what is standing in our way?

95% of our social ills would be corrected by fixing unemployment, and given “automation”, alone, H-H is INDISPENSIBLE to the EFFECTIVE functioning of our 21st Century market economy….

In short, it is not the lack of political will, or legal authority preventing this next step in our social evolution-

Leaving the only conclusion: The war against “employee rights”, which still has one foot on the plantation, and is a menace to our market economy….is out of step in the current Zeitgeist….i.e., we need to abolish neo-liberalism…

Ref: HR 1000 and “A POOL OF SLAVES: To Be Used and Discarded “at will”, Amazon/Kindle

Jim Green, Democrat opponent to Lamar Smith, Congress, 2000

It seems the euro is unusually weak as the ‘markets’ think QE is inflationary. This may be leading to artificial increase in net exports.

I have a question for you Bill: how low do you go until you do not see the benefits of your own currency. Could everyone issue their own currency via non coercive means? Could you have towns and cities launching regional currencies, based on land value tax. Kind of an anarchist socialist kind of thing, but with protection of property if compensation paid. And they could collaborate but keep their own currency.

Also, what is MMT’s views on cryptocurrencies. Could you write a post on that?

Bill Black vs Troitka

http://neweconomicperspectives.org/2015/03/eu-decides-not-to-target-investments-to-help-nations-it-forced-into-great-depressions.html

Are the one year ahead and the ten years ahead graphs titles or labeling swapped?

Eg. The one year ahead shows 10 year pex and the ten year ahead shows 1 year pex.

Not to be nit picky. I know you work at the speed of light.

Dear micky9finger (at 2015/03/17 at 6:08)

Picky is good. Thanks. Fixed now.

best wishes

bill

Paul Krueger, “So QE might tend to increase the price of bonds”

Yes that’s the theory. As the price of bonds rises, their yield falls and so effectively QE reduces longer term interest rates.

Even if that works in practice, it is difficult to see why the ECB thinks longer term interest rates need to be lowered. The EZ countries that need longer term interest rates won’t get them because of the perceived risk of their default. Even if they did they’d still be up against the SGP rules on their borrowings. The countries that don’t need them won’t get them because they are ultra low as it is.

So I think we have to be quite cynical about the ECB’s QE. QE isn’t going to do the EZ any good. The ECB knows that QE isn’t going to do any good but, politically, it has to be seen to be doing something.