I started my undergraduate studies in economics in the late 1970s after starting out as…

More back to fiat monetary system basics!

Yesterday I reported on a document I received from one of the largest international investment banks in the world. That document is part of that organisation’s advice it gives to bond investors. I used some of the document to illustrate that the understandings of how a modern monetary system operates that I write about here are also now out there in the real world – in the financial markets where bonds are bought and sold. I didn’t identify the document because it is a subscribers-only publication sent to me by the author and I respect his privacy. Today’s blog provides some more insights that will help you better understand the public debate and allow you to cut through the nonsense being peddled by all and sundry.

The purpose of my blog is always to take us back to the basics – the essential way the system functions. Once that is understood you can then impose whatever politics you like on top and advocate whatever you please. But it is reprehensible to try to blur your politics by using macroeconomic theory which has no validity and is designed to appear to be authorative and generates the ideological conclusions you desire.

The document provides some further information to reinforce this point:

Over the last five years the 10yr JGB yield has averaged 1.56% whilst the debt/GDP ratio has been at 162%. Throughout the ten year period after 1990, when the real estate and equity market bubble burst, the 10yr yield continued to fall as the debt/GDP% increased … There is no historical evidence of positive correlation between budget deficits and bonds yields in Japan, if anything the relationship is negative … the debt ratio has no relevance to the path of bond yields. Bond yields started a downward

trajectory in the post bubble years.

What we learn from Japan is that the huge deficits added reserves to the banking system and financed rising savings in the private sector. From the early 1990s onwards, private confidence in the future was low and so banks found it hard to find credit-worthy customers. In fact, borrowers in net terms were paying down their debts as a safety-first measure in uncertain times. So we had a combination of a dearth of credit-worthy borrowers and rising private saving. Ordinarily this flight into private saving and deleveraging would cause a dramatic decline in GDP growth and very sharp increases in unemployment as employment growth fell apart. What rescued the Japanese economy was the rising fiscal deficits.

In this sense, the fiscal deficits stopped the inevitable income adjustments (decline) from occuring because they “funded” the rising saving desires by maintaining sufficient spending to support output and income generation at non-recession levels. The economy certainly suffered but it kept growing (at very low rates) because Japanese Government’s resolve to ignore the neo-liberal advice to the contrary (not to run deficits) and the downgrading of their sovereign debt ratings by the discredited ratings agencies.

The other salient point is that the Japanese Government held firm to this strategy and avoided falling prey to the growing claims that the rising deficits (as a proportion of GDP) would drive up interest rates and cause inflation. This is a fundamental lesson for all Governments who are currently being bombarded by the deficit-debt hysterics and being urged to get the budget back into the black as quickly as possible.

In this regard, the document concludes that:

The biggest risk to the global economy right now would be for governments to attempt to reduce fiscal deficits too quickly.

But I go a bit further than this and argue that deficits are the typical or normal situation rather than being a cyclical phenomena. So while the automatic stablisers will reduce the deficit as the economy returns to stronger growth but the discretionary component of the budget will normally have to keep adding reserves on a daily basis because private sector entities will normally desire to net save a positive proportion of GDP. That is, the net government spending will have to provide the spending left by this net withdrawal for output to remain at high levels.

Anyone who says that the government should balance the budget on average over the course of the business cycle – or worse still to achieve a budget surplus on average over the business cycle – are clearly denying that the non-government sector on average desires to net save a positive fraction of GDP over the same cycle. The recent period of negative private saving and massive leveraging of the private sector is atypical (in the extreme).

It is clearly difficult for people to understand the national accounting relationships between government and non-government – so that a government deficit is $-for-$ equal to the non-government surplus. But understanding this accounting relationship is crucial to getting a complete grasp on the fiat monetary system.

The document says that:

The link between the budget deficit and savings is a powerful one but not immediately intuitive from a householder’s perspective. Deficits can actually be good for bond markets (yes you have read this correctly). This is difficult to accept from the perspective of personal accounting, as how completely illogical it would be for personal savings to increase whilst borrowings go up!

In short … governments are different. Governments have to spend before savings can take place. Deficit spending will add to nominal saving of financial assets, something that can be shown through the national accounting identity … Deficits raise the private sector savings and holdings of financial assets because the private sector keeps the bond or reserve. In accounting terms it shows up as an asset on the private sector’s balance sheet and as a liability for the government.

This makes the point very clear.

Now what about interest rates and the deficits?

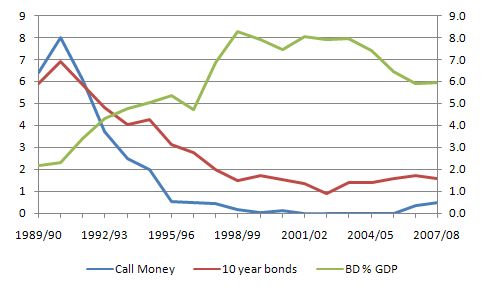

Whatever else is said about Japan, here is the chart that tells you what happened to budget deficits (as a percentage of GDP) and interest rates (both overnight – the call rate and 10-year bond yields). The chart also gives you information about the yield curve itself by allowing you to see the variations in the spread between the short-term rates that are set by government (in this case, the Bank of Japan) and the longer yields. The other maturities along the yield curve (different assets) are well represented by the 10-year government bond rates.

The point is simple yet powerful. Rising budget deficits do not push up interest rates.

The document says that governments (the consolidated central bank and treasury) “can set whatever rate they choose”. Accordingly, we need to understand that:

(m)ost importantly, bond sales are for interest rate support, they are not actually used to ‘finance’ deficit spending. The purpose of selling bonds, along with paying interest on excess reserves, is to control the Fed funds target rate. For the US government and Fed respectively, both selling bonds and the existence of excess reserves can be regarded as a way to drain the system of money, representing an effective tax on banks because of the opportunity foregone to earn a higher rate of interest.

While the example is in the context of the US system, the same appliesto all sovereign countries. But there are some deeper insights here that will also help us understand the way in which government spending impacts on the monetary system. The government deficits adds reserves to the banking system. The impact on the “cash system” provides net financial assets to the non-government sector which allow the latter to pay taxes in the currency of issue but also allow the non-government sector to swap the non-interest earning reserves for interest-earning bonds (government debt).

This is why I say often that the funds used to buy the debt (which is the government is constructed as “borrowing”) come from the government itself! This is an essential difference between the government and a household. Try telling the bank that your spending provides the funds to pay for the debt you have with the bank! You will not get very far.

The crucial point is that any analysis of government budgets based on so-called household budgets should be dismissed immediately as being non-applicable. There are no insights about public spending that can be gained from understanding the dynamics of household budgets.

What about deficits and debt?

The document concludes the following:

… the level of deficit has no bearing on the amount of bonds that end up being held by the private sector, this is a function of the interest rate targeting method. Recall that the BoJ’s ZIRP (zero interest rate policy) was accompanied by the BoJ paying 0% on reserves. Of course rational banks responded by not holding reserves at the BoJ, they bought a lot of government bonds instead. The US Fed pays 25bp on excess reserves but it could pay nothing at all, thereby encouraging banks to buy interest-bearing government bonds instead.

The same conclusions apply to Australia, as a sovereign government. You will have read constantly that the deficits are all on the “government’s credit card”. Again, the analogy with the household sector is invoked – it is deeply flawed as I noted above. The government doesn’t have a credit card because it doesn’t need one. My credit card allows me to purchase things in advance of having the income and then I have to pay it back. The sovereign government is not revenue-constrained so the analogy of spending on credit is totally inapplicable. So any time you see this sort of rhetoric – dump it in the rubbish bin. It is designed to mislead you and to steer your thinking towards neo-liberal conclusions.

Take the recent nonsense coming from the Australian shadow treasurer who bouyed up by the deficit nazis is constantly hammering our ears with nonsense about the debt buildup and crippling interest rates. At a recent press interview, he gave five answers in a row to five different questions. Here are his answers (edited) – the questions are largely irrelevant:

The increase in interest rates by the Commonwealth Bank today is directly linked to Kevin Rudd’s debt. If Kevin Rudd is going to borrow up to $3 billion a week, it is inevitably going to put upward pressure on interest rates and the decision by the Commonwealth Bank today is just the beginning … If the Government is borrowing so much money in competition with the banks, then the cost of funds to the banks will inevitably rise. You cannot continue with low interest rates whilst the Australian Government is borrowing billions of dollars every week to hand out cheques for $900.

His solution to the crisis is that:

Well the Government should reduce its borrowings. The Government should spend less money. If the Government is borrowing money in direct competition with the banks then it inevitably pushes up the cost of money to the banks and it inevitably has an impact on the price of a mortgage for everyday homeowners.

And the record gets stuck!

We have always been warning that when the Government borrows so much money in competition with the banks who themselves borrow money, then inevitably the cost of money is going to rise and the ultimate price of that is going to have to be paid by homeowners because of Kevin Rudd’s debt.

And continues to be stuck:

But the Government does have an influence on the cost of borrowings for the banks. When the Government is out there borrowing $3 billion dollars a week to fund their $900 cash splashes, to fund waste and mismanagement, building classrooms in schools that are about to be demolished – this is the price Australians are paying for Kevin Rudd’s debt. There’s no argument about it.

Please push that stylus forward:

… This is the price Australians are going to pay for the Federal Government borrowing tens of billions of dollars and the Federal Government being out there in competition with the banks in borrowing markets … There’s only so much money in the world and if the Federal Government for the first time is borrowing money on such a large scale in competition with the banks then the cost of funds to the banks is inevitably going to rise and they”re going to pass straight through to home borrowers.

None of this should be taken serious. I don’t make political statements in a party-preference sense but just on pure economic theory terms if this idiot was to ever be in charge of fiscal policy then the Australian population would decline by at least one as I migrate to somewhere else (I suspect the population would decline by at least 2!).

The debt issuance has nothing to do with financing the deficits but has everything to do with offering the non-government sector alternative financial assets to holding reserves. There are no interest rate implications as discussed above.

The document has this to say:

Not everyone can relate to this idea of unconstrained spending or that the causality runs from the Government spending money because from the perspective of personal finances, average income and expenditure must balance over-time. People save to purchase something or borrow the money and pay it back later. But it is not the same for governments who can spend freely, unconstrained by targets unless they choose them. The key difference between governments and households, is that the government always creates reserves and deposits when it spends, whilst it destroys reserves and deposits when it sells a bond or taxes the population. When selling a bond the government is actually exchanging it for a deposit, just a simple accounting entry.

But there is an interesting question about which end of the yield curve the government might like to work within – that is should it issue long maturing debt or debt of shorter-maturities?

The document has this to say on this question:

Governments do not need to issue longer-term securities if they don’t want to. If the yield on longterm bonds is too high relative to short maturities, then the simplest thing to do is to issue more short ones; which is exactly the position the US and UK governments find themselves in today. The current steepness of the US yield curve … is almost entirely explained by increased inflation expectations since the start of the year. Curve steepening has occurred for all major yield curves as these inflation expectations normalised; in the US example 10yr BEs have gone from zero to 200bp since the start of the year. So the move in the curve should not be confused with Sovereign solvency fears, just a return to more normal inflation expectations after a period of being excessively low.

So as the investors are becoming more optimistic they are expecting the price level to nudge back to the the normal capacity levels. The adjustments in the long yields are miniscule. Also note that this readustment in prices does not amount to inflation. All hotels in the US at the moment (at least the ones I stay in – that is, not the “Ritz”!) are offering excellent discounted deals. As occupancy rates increase they will restore their price levels to ensure their long-term target rates of returns are achieved. That is not inflation!

But the important point is that a sovereign government has all the cards. The Hockey nonsense above suggests that the government becomes captive of its own profligate ways and has to borrow its way out of this excess. Just like a household … no? No!

This is not even remotely correct. The government borrowing is doing us a favour. The government can choose to issue debt $-for-$ to match net spending; it can choose the yield that it issues the debt at – although many governments leave this to an auction process – but that decision is voluntary; it can choose whatever maturity it issues the debt at – short or long or in-between!; and clearly, it can choose not to borrow at all and just leave the impacts of the net spending as excess reserves. End of story. The government holds all the cards.

So that is the blog for today.

At present (for the next two days) I am the guest of the United Nations Development Program at the Levy Economics Institute workshop on Employment Guarantee Policies. I am giving a talk today and appearing on a panel tomorrow. The location is upstate New York (on the Hudson River) and while it is a long way from the surf it is still very lovely. I might write tomorrow’s blog reporting on my activities here. There is a growing swell of support for Job Guarantee policies as an intrinsic part of a development strategy and particularly as a means of dealing with the impact of the current economic crisis.

Then again I might write it about something else!

Bill,

My own thinking about the “crowding out” idea (and please let me know what you think I’ve missed!), is that it can occur but it is a short-term effect. Within your framework, I would explain this by saying that whilst Government deficits must be matched by public sector savings, it can take a while for these savings to percolate through to the bond market. So, for short periods of time there can be “indigestion” in bond markets when Government issuance of bonds increases significantly. However, this will settle down as savings flow around the system. As an example, I would point to recent Australian Treasury Note tenders. In the very short term, no one seems to expect the RBA’s target cash rate to change, so it is reasonable to compare the yield on these T-Notes to the target cash rate (3%) as banks can choose to either invest in T-Notes or keep their money in their exchange settlement account where it will earn this cash rate less 0.25% (i.e. 2.75%) or invest in T-Notes. Of course banks are not the only possible buyers of T-Notes, but other investors could also place their money on deposit overnight with a bank and earn close to the RBA cash rate.

Now, the AOFM has recently begun issuing T-Notes again (they had not “needed” to during the surplus years) and you can see the results of the tenders here: http://www.aofm.gov.au/content/borrowing/note_tenders.asp

Back at the end of April, the yields for these tenders were in the range you would expect: 2.75-2.77% for a July maturity back on 30 April. Since then, as issuance has continued, the yields have been creeping up. Last week, on 18 June, a July maturity T-Note was tendered in the range 3.06-3.08% which is above the cash rate!

Now, the impact is not huge, less than 0.5% and I would expect this to be a transient “indigestion”. Over the longer term, I would expect the processes you describe to take effect, but short term I think that crowding out can be a real effect.

I’d love to know your thoughts!

Dear Sean,

I don’t mean to “crowd in” here, but I would like to offer a few points, if I may . . .

1. As you note, the deficit necessarily and simultaneously creates net saving for the non-govt sector. So, in an accounting sense, there is not even temporary “crowding out” (you don’t appear to disagree with this).

2. I don’t know the particulars of the Australian payment settlement system, but in the US, a Tsy bond purchase can only be settled ultimately with the debiting of a bank’s reserve account, either by the bank purchasing the Tsy, or on behalf of its customer. But where do reserves come from? The primary source is a previous deficit, as that is how the govt spends initially, and Fed open market operations (the vast majority of the outright operations) are in Tsy’s, which is again a previous deficit. The other way to create reserves is via borrowing from the central bank, either via overdrafts or repos, and it’s commonly known that the Fed (prior to fall 2008, since when reserves have been increased dramatically, as everyone knows) engaged in substantial repo operations on the morning that auctions were settled. So, there can’t be crowding out, even in the short term, as the funds to purchase Treasuries are necessarily provided either via a previous govt deficit or via central bank lending.

3. Again, I’m not familiar with bond dealer mkts in Australia, but in the US dealers don’t use prior savings to purchase their bonds, but rather are borrowing in repo markets to obtain funds to finance their purchases. So, again, no temporary “crowding out,” as there is no need for prior saving to “percolate” to the bond markets.

Best wishes,

Scott

Scott,

I certainly agree that in in aggregate the Government spending creates the saving that can be used to purchase Government debt. My point is that actual demand for T Notes is segmented. Imagine that, as part of a fiscal stimulus package, the Government gave me some money (seeing me as particularly deserving for some reason). So, the Governments balance with the cental bank goes down, the reserve balance with my bank goes up. I then spend it on an environmentally friendly car and so the money moves from my bank to the car dealers bank. The dealer then pays its staff who go out and spend it on food and drink. The food company ends up getting the money and they pay it into a pension fund for its staff who allocate it into a low risk mutual fund which uses the money to buy T Notes and so the money ends up back in the Governments account. As Bill points out, there is no structural need to the Government to “fund” it’s spending by issuing the debt, but this happens to be the paradigm that most Governments are currently using. This looping of money through the system means that while the money is always there, the demand for purchasing particular Government debt securities may not appear at the same time as the Government spending, but may need to wait for the money to percolate through the system.

I would see effects like this to be temporary only and, from the Government’s point of view, this “indigestion” does not really matter as it simply pushes the yields up temporarily for their debt issuance, but since they are not revenue constrained, increases in their interest costs do not matter to them in the same way as it would for a household or a business. The only reason for a Government to be concerned about these increases in rates is that Government interest rates are used as a benchmark for other forms of borrowing and this can effect the real economy too. Which is why the central bank may choose to use open market operations to push rates back down. Of course, this would involve the central bank buying bank debt which simply reverses the Government’s issuance in the first instance! But that is ok as central bank operations work on short timeframes (typically overnight) and so all they are doing is temporarily offsetting temporary indigestion. Of couse, the Government can also minimise the effect by spreading out their debt issuance across short term T Notes and longer term securities in order to tap into as broad a range of demand for low risk investments as possible.

My point here is not to follow the view that “crowding out” is a terrible thing that will distort incentives in the real economy, as some would have it. But likewise, I do not agree that significant volumes of Government issuance can be easily and immediately by the private sector. I believe that crowding out is a real effect, but it is only a short-term effect and, except for people who are very interested in movements in interest rates over the short-term, it is not particularly important and certainly not worrying from a macroeconomic perspective.

Dear Sean

Thanks for your reply, and I’ll reiterate that I hope I’m not bull-ing my way into a discussion between you and Bill.

Regarding my comments, please keep in my that I think we agree on the overall picture, certainly more than I would agree with neoclassical economists. We’re mostly tinkering at the edges here.

I do disagree, however, with your analysis for the following 2 reasons, which I explained in my earlier post but I will try to be more succinct here. Also, my analysis here is very US centric, so there may be some points here that don’t apply to Australia.

First, you can’t buy a Tsy without reserves, and they are therefore supplied before the bonds are purchased necessarily, either through an open market purchase (i.e., previous govt deficit . . .that is, the spending comes first) or a central bank loan to the banking system.

Second, the marginal investor in Treasury auctions is by and large not the saver you are describing, but a bond dealer primarily concerned about the path of short-term rates. There are some instances in the yield curve where I would relax this, but not by much. The change in Treasury rates in the past few months (as you describe, not an economically significant amount) in my opinion had to do with a return to some semblance of normalcy in financial markets (reduced liquidity preference and counterparty risk concerns that were driving Tsy rates down) and an expectation that the Fed may be tightening in the not too distant future (whether accurate or not).

In short, the trickling up of the deposit you received and then spent into the Tsy market is of virtually no significance in terms of setting Tsy rates, in my opinion.

Best,

Scott

Dear Scott

All discussions on this blog are multivariate! I just haven’t had time to enter it yet. But I lean to your view as you would suspect.

best wishes

bill

Scott: while I agree that broadly markets are heading towards normalcy, I do not think that can explain the recent behaviour of Australian T Notes. Having short-dated T Note yields above the cash rate when no-one expects a rate hike in the next month is not normal! You are certainly correct that dealers are also key buyers of T Notes as well as end investors, but even they would not have unlimited appetite for purchasing securities. I would summarise my view that from a macro-economic perpective, there is no long-term effect from Government debt issues as their spending does indeed create the savings, as we all agree. Locally (and by this I mean both in time and the particular market, i.e. a point on the Government yield curve), I believe that microeconomic analysis comes into play and there will be a downward-sloping demand curve and prices will fall (yields rise) to accommodate additional supply. The macro-economics comes in through my “percolation” approach which amounts to saying that over time the whole demand curve up and yields can adjust down. In the meantime, the Government can very easily deal with this by selectively issuing at different parts of the yield curve.

If you still disagree with this perspective, I would be interested in a more detailed explanation of why you think that these Australian T Note yields have risen in the last few weeks. Keep in mind that Australia’s short-term money market never froze to the same extent as was the case in the US. There were a number of reasons for this, is that the recent Government issuance of T Notes began on 5 March 2009 and that was the first issuance for over six years! There was no “flight to quality” here from money market funds into sovereign cash funds because there were no short-term sovereign cash instruments.

Anyway, as you say, we are tinkering at the edges as I believe these supply effects, while real, are short-lived and not particularly significant except to people trading these instruments.

Dear Sean

I can’t say I have much expertise on Australian bond markets, so I’ll have to bow out in that regard. I would just say that (obviously, given my previous posts) I don’t think such factors have had anything to do with the recent rise in US Tsy rates.

Best to you,

Scott

Scott,

I’d agree with you in regard to the US Tsy auctions: little sign of difficulty there. Of course, it’s always harder to interpret results on longer dated bonds (yields can be explained away as simply reflecting increased inflation expectations), which is why I find the short-dated Australian results interesting.

Sean.