It is true that all big cities have areas of poverty that is visible from…

Bank of England Groupthink exposed

I am travelling a lot today so do not have much time. Apart from my usual projects that are on-going, I started reading the – Court of Directors’ Minutes 2007 – 2009 – that were released yesterday (January 7, 2015) by the Bank of England, after the UK Treasury Select Committee (House of Commons) demanded the Bank act in a more transparent manner in its November 8, 2011 Report – Accountability of the Bank of England. The minutes and accompanying data demonstrate that the Bank and the supporting financial oversight bodies were caught up in the myth of the Great Moderation and the governance of the Bank was captive to a destructive neo-liberal Groupthink. The Bank helped cement the pre-conditions to the crisis, didn’t see it coming, and delayed on essential action, thus ensuring the crisis was deeper and more prolonged than was necessary.

The Minutes archive

Since writing this post, the Bank no longer publishes the document mentioned in the introduction.

But you can still get them in non-consolidated form if you dig around a bit:

1. Court of Directors Minutes – 2008 (book 1) (pdf 1.9MB)

2. Court of Directors Minutes – 2008 (book 1) (pdf 1.9MB)

3. Court of Directors Minutes – 2008 (book 2) (pdf 1.7MB).

4. Court of Directors Minutes – 2007 (PDF 1.2MB).

Groupthink

I have been studying the literature on group dynamics a lot over the last 18 months. My upcoming book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – developed some of my research and focused, as the title suggests, on the practice of Groupthink within organisations, professions, and other groups.

In 1972, social psychologist Irving Janis identified group behaviour he termed ‘Groupthink’, which is a:

… mode of thinking people engage in when they are deeply involved in a cohesive in-group, when the members striving for unanimity override their motivation to realistically appraise alternative courses of action (Janis, 1982: 9).

[Reference: Janis, I.L. (1982) Groupthink: Psychological Studies of Policy Decisions and Fiascoes, Second Edition, New York, Houghton Mifflin].

It “requires each member to avoid raising controversial issues” (Janis, 1982: 12).

Groupthink drives a sort of ‘mob-rule’ that maintains discipline within the group or community of decision-makers.

These communities develop a dominant culture, which provides its members, with a sense of belonging and joint purpose but also renders them oblivious and hostile to new and superior ways of thinking.

Groupthink becomes apparent to the outside world when there is a crisis, or in Janis’s words a ‘fiasco’, such as the Global Financial Crisis (GFC).

In fact, the Groupthink within the Bank of England is now only surfacing given how secret the institution has been over the last decades.

It is clear the governance of the Bank fell prey to the neo-liberal belief in the efficiency of private markets and the need for deregulation and freedom from oversight that emerged in the 1970s.

The surge in Monetarist thought within macroeconomics in the 1970s, first within the academy, then in policy making and central banking domains, quickly morphed into an insular Groupthink, which trapped policy makers in the thrall of the self-regulating, free market myth.

The accompanying ‘confirmation bias’, which is “the tendency of people to only notice information consistent with their own expectations and to ignore information that is inconsistent with them” (IEO, 2011: 17)

[Reference: Independent Evaluation Office (IEO) (2011) IMF Performance in the Run-Up to the Financial and Economic Crisis: IMF Surveillance in 2004-07, Washington, International Monetary Fund, February 9, 2011].

Just before the GFC revealed its worst, Olivier Blanchard, the chief economist at the IMF, reviewed the understanding that macroeconomists had of the real world and claimed that the “state of macro is good” (Blanchard, 2008: 2).

He asserted that a “largely common vision has emerged” (p.5) in macroeconomics, with a “convergence in methodology” (p.3) such that research articles in macroeconomics “look very similar to each other in structure, and very different from the way they did thirty years ago” (p.21).

They now follow “strict, haiku-like, rules” (p.26). He also noted that the dominant ‘New Keynesian’ approach in macroeconomics had “become a workhorse for policy and welfare analysis” (p.8) because it is “simple, analytically convenient … [and] … reduces a complex reality to a few simple equations” (p.9).

It didn’t seem to matter to these economists that in the “basic NK model … there is no unemployment” (p.12), such that all fluctuations in measured joblessness are characterised largely by workers choosing whether or not to work as part of a so-called optimal choice between work and leisure.

[Reference: Blanchard, O. (2008) ‘The State of Macro’, NBER Working Paper No. 14259, National Bureau of Economic Research, August].

The mainstream macroeconomists, who developed an abiding faith in the ability of the self-regulated market to deliver optimal outcomes, had declared some years before the crisis, with an arrogance common to the discipline, that the ‘business cycle is dead’.

That is, the large swings in macroeconomic performance (recessions and mass unemployment and boom and inflation) that had dominated the attention of economic policy makers in the post World War II period and led to fiscal policy (the manipulation of taxation and government spending) being the primary tool governments used to maintain full employment and price stability, were now being denied.

University of Chicago professor Robert Lucas Jnr gave an extraordinary address to the American Economic Association in 2003 where he claimed:

… that macroeconomics in this original sense has succeeded: Its central problem of depression-prevention has been solved, for all practical purposes, and has in fact been solved for many decades” (Lucas, 2003: 1).

[Reference: Lucas, R.E. Jr (2003) ‘Macroeconomic Priorities’, American Economic Review, 93(1), 1-14].

A year later, the former US Federal Reserve Bank Governor, Ben Bernanke claimed that as a result of the policy shift away from governments attempting to manage total spending in the economy by varying fiscal policy settings in favour of using monetary policy (interest rate setting by central banks) to concentrate purely on price stability and the pursuit of fiscal surpluses, the world was enjoying the Great Moderation (Bernanke, 2004).

[Reference: Bernanke, B. (2004) ‘The Great Moderation’, speech presented to the Eastern Economic Association, Washington, DC, February 20, 2004].

Please read my blog – The Great Moderation myth – for more discussion on this point.

In 2011, the IMF’s Independent Evaluation Office (IEO) released a scathing assessment of the institution’s performance in the lead up to the GFC (IEO, 2011).

The IEO said:

Warning member countries about risks to the global economy and the build up of vulnerabilities in their own economies is arguably the most important purpose of IMF surveillance (IEO, 2011, vii).

However, the IEO identified neo-liberal ideological biases at the IMF and determined that the IMF failed to give adequate warning of the impending GFC because it was “hindered by a high degree of groupthink” (p.17), which, among other things suppressed “contrarian views” where an “insular culture also played a big role’ (p.17).

The report said (p.17):

Analytical weaknesses were at the core of some of the IMF’s most evident shortcomings in surveillance .. [as a result of] … the tendency among homogeneous, cohesive groups to consider issues only within a certain paradigm and not challenge its basic premises.

The prevailing view among IMF staff – a cohesive group of macroeconomists – was that market discipline and self-regulation would be sufficient to stave off serious problems in financial institutions.

They also believed that crises were unlikely to happen in advanced economies, where ‘sophisticated’ financial markets could thrive safely with minimal regulation of a large and growing portion of the financial system.

The External Evaluation Report says that “IMF economists tended to hold in highest regard” (p.18) economic models of the world proven to be inadequate (so-called Dynamic Stochastic General Equilibrium models).

Willem Buiter in the Financial Times article (March 3, 2009) – The unfortunate uselessness of most ‘state of the art’ academic monetary economics – described these economic models as useless:

… self-referential, inward-looking distractions at best. Research tended to be motivated by the internal logic, intellectual sunk capital and esthetic puzzles of established research programmes rather than by a powerful desire to understand how the economy works – let alone how the economy works during times of stress and financial instability. So the economics profession was caught unprepared when the crisis struck … [and the work] … excludes everything relevant to the pursuit of financial stability.

In the New York Times article (November 2, 2008) – Challenging the Crowd in Whispers, Not Shouts – economist Robert Schiller (2008) relates that Groupthink tells us why:

… panels of experts could make colossal mistakes.

He also implicates central bankers in this self-censoring behaviour where “mavericks” are put under intense pressure if they question the “group consensus”.

A related article by Ryan Grim (October 23, 2009) – Priceless: How the Federal Reserve Bought the Economics Profession tell us that the US Federal Reserve Bank:

… through its extensive network of consultants, visiting scholars, alumni and staff economists, so thoroughly dominates the field of economics that real criticism of the central bank has become a career liability for members of the profession.

Not only does the Federal Reserve fund a huge amount of non-staff economic consultancies but also “keeps many of the influential editors of prominent academic journals on its payroll” (Grim, 2009).

By controlling what gets published in the key journals, the bank also influences the career trajectory of economists, and thus suppresses independent research that might be critical of the way the central bank operates. The Federal Reserve has an “intolerance for dissent”, something that well-known economist Alan Blinder found out quickly, when he joined the bank as a vice chairman. He lasted around 18 months after “a lot of senior staff … were pissed off … [because he was] … not playing by the customs that they were accustomed to” (Grim, 2009).

His sin? He asked too many questions and challenged too many assumptions.

As we will see, the group dynamics among the governance body of the Bank of England behaved in a similar way.

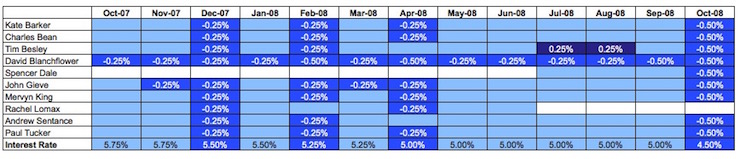

Here is an example of Bank of England Groupthink in action. The Bank also has released a spreadsheet – Historical MPC voting spreadsheet – (4 MB), which documents “the votes of MPC members on Bank Rate since May 1997, and on asset purchases from March 2009”.

It provides a pithy summary of the group dynamics within the Monetary Policy Committee.

Looking at the ‘Bank Rate Decisions’ worksheet, the blue coloured cells indicate who was on the MPC at any particular time. A number in the cell indicates the particular intention of that member.

So if there is a -0.25% entered for a particular month, then that member was proposing a cut in the short-term policy rate in the UK of that amount.

A coloured blue cell with no number entered indicates the member voted for no change in the rate. The final decision each month is noted in Row 43 of the original Worksheet (Row 12 on the graphic).

I produced the following graphic from a section of the spreadsheet for the period October 2007 to October 2008, a year’s span, when the crisis was clearly at hand.

I suppressed some of the rows to highlight only the voting membership of that period.

What you see is Groupthink in action. David Blanchflower clearly wanted rates lowered in October 2007 (the two previous months (not shown) saw all members in agreement that rates should stay at 5.75 per cent), but that proposal was rejected by the MPC.

They agreed unanimously to lower by 0.25 per cent in December 2007. Blanchflower again proposed to lower further in January 2008, but the rest of the MPC rejected that and voted together. February 2008, the MPC agreed to lower by 0.25 per cent even though Blanchflower wanted a 1/2 of one percent reduction.

The dynamic continued.

As the crisis was intensifying, Blanchflower proposed to lower rates in May 2008 (indicating he wanted a steady easing of monetary policy over an extended period starting in October 2007). The Governor’s wish for no change was met with accord from the other eight members.

That pattern persisted for the next 4 months (with one other member actually wanting rates hiked in July and August of 2008). But it is clear the Governor’s wish ruled the MPC.

In September 2008, with the crisis now obvious, Blanchflower wanted a 0.50 per cent easing. That was rejected.

Then in October 2008, as UK tumbled into recession, the Governor decided that a 0.50 per cent easing was appropriate and everybody else suddenly voted accordingly.

That is how Groupthink works.

You can read more about David Blanchflower’s experience during this period in this interview from 2008 – ‘They called me bonkers’.

You can see that Blanchflower consistently proposed lower interest rates as the severity of the crisis was becoming apparent, but the other members went along with group dynamic.

The UK Guardian article notes that in November 2008 (not shown on the graphic above):

… the MPC acted unanimously again to slash interest rates by an astonishing 1.5%, the biggest cut in 27 years, bringing the rate to its lowest level since 1955.

Suddenly, the blind saw the light, presumably, by keeping an eye on the voting intentions of the Governor.

The UK Guardian article reminds us of the excellent 1882 play by Henrik Ibsen – An Enemy of the People. It is an excellent narrative about group dynamics – you can download the play from – HERE.

At one stage the Doctor, who warns the town that the water supply to its public baths is poisoned, confronts his brother, the Mayor of the town, who has a political interest in covering up the fact that the municipal infrastructure is harming people.

The Doctor says:

The source is poisoned, man! Are you mad? We are making our living by retailing filth and cor- ruption! The whole of our flourishing municipal life derives its sustenance from a lie!

[Mayor replies:] All imagination-or something even worse. The man who can throw out such offensive insinu- ations about his native town must be an enemy to our community.

The Mayor has the power and the town turns on the Doctor and his family and the Doctor becomes “An Enemy of the People” because he refuses to go along with the Groupthink, which is driven by commercial gain, which would be threatened if the baths were closed.

The UK Treasury Select Committee noted that:

The Bank of England is being given new powers which affect everyone in the country. It will be responsible for preventing another financial crisis … [but] … The evidence that we have received suggests that the governance of the Bank needs strengthening and that it needs to be more open about its work. The Bank must be held more clearly to account than it has been in the past.

The Select Committee demanded that the ‘Court’ of the Bank be “transformed” and that it become “more expert” (actually having people who might know something about the topic at hand as members).

It also demanded the ‘Court’ publish more information including its minutes.

The minutes are too detailed for me to finalise a complete view but already (along with some supplementary data released by the Bank) one can see that the organisation was trapped in neo-liberal Groupthink, with the members of the ‘Court’ considering themselves Masters of the Universe.

The ‘Court’ is a novel title for the – governing body – of the Bank. It is:

… for managing the affairs of the Bank, other than the formulation of monetary policy. Court’s responsibilities under the Bank of England Act 1998 (‘the 1998 Act’) include determining the Bank’s objectives and strategy, and ensuring the effective discharge of the Bank’s functions and the most efficient use of its resources. Since the 2009 Banking Act (‘the 2009 Act’), the Bank has had a statutory objective to protect and enhance the stability of the financial systems of the United Kingdom’ and the Court, consulting HM Treasury and on advice from the Financial Policy Committee (FPC) … determines the Bank’s strategy in relation to that objective.

The Court was comprised of a number of people who the Bank itself now acknowledges “had standing conflicts of interest, and there was no provision for a non-executive chairman (to compensate for that”.

It also admits that the:

Governor established the practice of having all Court business discussed first in the non-executive directors’ committee)

This is a classic way in which Groupthink discipline is enforced. Create an inner cabal that echoes the voice of the boss and pressures, directly or indirectly, the ‘outer’ members of the group to conform.

Since 1997, the Court has been part of the so-called “tripartite system” which was designed to manage monetary policy decisions and prudential supervision. The structure of the system saw the Bank of England, the Financial Services Authority (FSA) and the Treasury jointly involved in decision-making.

The minutes released yesterday tell us that this system broke down with blurred responsibilities and Groupthink paralysing necessary action to meet the crisis.

The Bank admits that:

The roles, in a crisis, of the Bank, the Treasury and the FSA were ill-defined. These deficiencies were rapidly identified during the period covered by the minutes.

The system had been lulled into believing the Great Moderation myth that the Bank itself had “no powers to take actions to manage macro-prudential risks”, it was “not responsible for banking supervision and there was no bank resolution authority”.

Here are some things that I have noted in my first reading of the minutes. We learn a lot from the – Court Minutes 2007 – which cover the period in which the regional bank – Northern Rock – collapsed, marking the beginning of the crisis in the UK.

In September 2007, Northern Rock approached the Bank of England for a “liquidity support facility” (that is, a cash injection to stop it becoming insolvent).

Northern Rock had grown in the cowboy days of deregulation by borrowing heavily in local and foreign capital markets, loaning the funds for home mortgages, and then on-selling the mortgages as securitised packages into international capital markets. The funds gained would allow the bank to repay the initial loans at profit.

Of course, when the asset-back securities markets dried up in August 2007 as the crisis revealed itself, Northern Rock were then unable to pay back its outstanding loans.

The Bank of England bailout sparked a run on Northern Rock (the first in 150 years – so a monumental event) and the crisis had begun in earnest.

By February 2008, Northern Rock was nationalised prior to split up (into a good and bad bank) and ultimate sale to Virgin Money.

The Minutes show that as all this was unfolding the Court of the Bank of England were in denial.

At its June 13, 2007 meeting it discussed a suggestion by HM Treasury that the Bank should have more power “to undertake oversight” of the payments system “whereby the Bank could set standards and oversee operational resilience”.

The conclusion “the Bank did not need or want statutory powers” (p.18).

It also concluded with respect to “Assessing risks to Financial Stability” that “It had not identified any looming gaps”.

The meeting Non-Executive Directors of the Bank on September 12, 2007 considered the state of the financial markets and the “Executive believed that the events of the last month had proven the sense and strength of the tripartite framework”.

At one point we read that in relation to the Bank’s handling of the “market turmoil”:

Members … were invited to raise any questions about the Bank’s paper. In doing so, several Directors congratulated the Governor for setting out a rigorous intellectual underpinning of his position. The view was that it would be helpful for the market and for commentators and would lead to rather more informed comment.

This was in relation to a paper Mervyn King had provided to the Treasury Committee which sought to reinforce the perception that the tripartite approach was effective and that the Bank had a range of tools to deal with any crisis.

The Minutes of that meeting tell us that:

The Bank Executive believed that the risks were appreciated by most of the commercial sector players. The Chairman of the FSA said that hedge funds were not a contributory factor in the current market turmoil.

In that discussion, it was clear that the Executive of the Bank reinforced the notion that the Bank could not fall into the “moral hazard” trap, where it supported excessive risk taking. They clearly recognised that there was “potential damage to the financial system” in general from non-intervention, but there was no dissent recorded as the ‘hands-off’ approach of the bank to risk.

The Governors report to the meeting noted that banks such as UBS and Citi had disclosed “credit portfolio losses” but that:

The problems of the leverage loans market where banks were holding a large amount of undistributed paper would probably persist for a further three months or so, possibly longer. It was noted that this problem would add to a constraint on the ability of banks to expand their balance sheets.

That is, the problem in that market would be over by the end of 2007. I wonder what Lehmans thought of that assessment.

The Sub-prime market collapsed in 2008 as the crisis deepened.

Clearly, the Bank of England’s management had no idea what was happening.

The Court of Directors met the same day (September 11, 2007) and signed off on the earlier meeting.

A few days later on September 13, 2007, the Court of Directors held an Emergency Meeting to discuss the Northern Rock collapse and application for liquidity support.

Despite several members declaring a “material interest” in the issue, the Court “agreed that none of these issues required members to withdraw” from the discussions and decision making.

Extraordinary!

A few weeks later, after the Northern Rock demise began, the Meeting of the Court were informed by the Governor of the Bank that:

… the situation in the markets was still fairly serious and was characterised by fragility in two sectors …

But they claimed the “the difficulties for institutions were ones of liquidity not solvency” and that Northern Rock “was the institution with the highest of all Tier I capital ratios amongst British banks emphasised that point.”

By January 2008, the denial was in full flight. At the January 16, 2008 meeting of the Non-Executive Directors the Northern Rock issue was updated as was the overall state of financial markets.

It was acknowledged that there was an “absence of a special resolution regime for banks” but the preference remained for a “private sector solution”

Their assessment of the financial markets (which were by now in deep crisis) was that:

… funding conditions had eased … And there remained some latent risk in relation toindividual banks getting into difficulty, as revealed by credit default swap spreads, which had not improved much over the past month.

Latent risk!

How long might this take to resolve? Note the earlier assessment in September 2007 that the crisis in the sub-prime market would be over by the end of 2007.

As this article (January 7, 2015) – Bank of England minutes: New documents reveal flaws in financial crisis response – notes:

The 113 pages of minutes of Bank Court meetings from July to December 2008 contain one mention of RBS, none of HBOS, and none of Lloyds.

David Blanchflower is quotes as saying that “This groupthink went on and nobody noticed this grand recession coming.”

The Chairperson of the House of Commons Treasury Select Committee was also quotes as saying:

The Bank appears to have been a very hierarchical organisation, with clear signs of ‘groupthink’ among its leadership … The executive rarely acknowledged possible weaknesses in its views or, other than grudgingly, admitted that it might have been unprepared for the crisis.

And you won’t find too many mainstream economists, policy makers that will acknowledge today that they helped cause and prolong the crisis with their nonsensical approach to economic policy.

The sort of denial I discussed yesterday – the historical revisionism – is the latest fad among these characters.

Conclusion

I will have more to write when I read the later minutes in detail. I have only really absorbed the 2007 Minutes.

There is a need for major changes to these policy making institutions to ensure there is indepenendent and qualified oversight and transparency in their decision making.

In general, the central bank could easily be absorbed within a consolidated treasury and bank department with full political accountability being gained.

At present, the likes of Mervyn King, who the UK Guardian article (January 7, 2015) – The Bank of England’s fear of criticism and openness has proved to be lethal

– described him as a “tyrant” who ran the Bank with an “iron fist” according to the rule “my way or the highway”, is likely enjoying his considerable pension, untainted by the damage his lack of oversight caused.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Court is an appropriate word, because handing over sovereign power to bankers turns the country from a democracy into ones run by the new Kings and Barons.

What is more amusing is that the UK Green Party proposes in its manifesto that it will expand the ‘court’ so that it has the power to set spending ceilings on the democratically elected parliament. So we really would be back to the days of Kings and Barons then.

The only thing experts at this level have proved to be expert in is self promotion of their own fallacious awesomeness.

Experts should therefore only ever advise in a democratic system. The final decision must be taken, and seen to be taken, by an elected individual. Because we can get rid of an elected individual at an election. We couldn’t get rid of Mervyn King – we had to wait until he decided to go of his own accord.

If you want an indication of the arrogance of the man, then him <a href="http://www.theguardian.com/business/2014/dec/29/mervyn-king-financial-crash-exciting-bank-england"describing the crisis as 'exciting' is probably the best. He still believes he helped save the world.

I’m not sure those currently queueing at the food banks would agree.

This was M.K. approach {Sept 2008}.

“In the UK we face a difficult but, temporary, period during which inflation will remain high for a while and output growth at best weak. But provided we do not impede the required adjustment we will come through this temporary period and resume a path of normal economic growth with inflation close to target.”

http://www.bankofengland.co.uk/publications/other/treasurycommittee/ir/tsc080911.pdf

Bill, related to all this is an article on the same basic topic by your namesake Rodger Malcolm Mitchell where he actually names and shames the economists etc who support this failed formula in use across the board;

http://mythfighter.com/2015/01/02/the-uk-wall-of-shame-how-the-poor-will-suffer-the-rich-will-thrive-the-gap-will-widen-and-the-economy-will-stagnate/

Homo Saps is a herd animal by nature. This may have advantages but it has a huge downside. Groupthink is just one.

To counter this natural tendency it would be necessary to alter the way in which children are educated (conditioned) from very early in life.That is not an easy task.

Fortunately there is always a wild card or two in the pack who are unashamedly original in their thinking. To them we owe the best, and sometimes the worst,in our culture.

Harvard Prof Sunstein’s 2014 book “Wiser” reports a subtle tendency for like-minded groups tend to become more extreme/intolerant in their otherwise loosely-shared ideology.. when they get together and rant to one another. Left or right, religious or atheist, etc.

This behaviour can be disrupted by strong-minded independent thinkers in the group. (Bill :0)

We have to be a little careful with the ‘groupthink’ argument. It’s one used by climate change deniers against climate scientists for example. If there is groupthink in the universites and in acedemia generally it is a groupthink that usually gets it right.

Is the Economics profession a special case? It must be. Any scientific discipline, or discipline wishing to be considered so, must adhere to the scientific method. To be termed scientific, a method of inquiry is commonly based on empirical or measurable evidence subject to specific principles of reasoning. In other words reality trumps everything. It is often said that just one experiment or observation can overturn any scientific theory , no matter how well established it might be.

So if there is a big recession/depression like there was in 2008 and the mainstream economic theories don’t explain it then it must be, at worst, completely wrong or , at best inadequate. So it can be argued that the economics profession, is a whole is a maverick profession, and doesn’t accept the principle of the basic scientific method.

As George Patton said “If everyone is thinking alike, then somebody isn’t thinking”.

Yes Peter, it is clear that the mainstream economics profession is unscientific. There is a long history of a priorism in mainstream economic thought, without any regard for scientific methodology or the need to base theories on empirical evidence. The ignorance and vanity of economic mainstreamers is on display in mainstream economics journals, where one will encounter mountains of “analysis” employing the application of modern mathematical methods and symbolism, without appearing to recognise that mathematics is only a tool (although a powerful tool) and that this tool should never be confused with the application of scientific method, and does not in itself represent a scientific account of any phenomenon. No matter how sophisticated the tools used for any study or area of research, it has always been true that “garbage in equals garbage out”.

Milton Friedmans Essay from 1953 where he suggested the assumptions of model were not important only the predicitions pretty much demonstrated how unscientific economics would become given his status.

[“The Methodology of Positive Economics”In Essays In Positive Economics

(Chicago: Univ. of Chicago Press, 1966), pp. 3-16, 30-43.]

I read the IEO report. It´s mind blowing to read about the oppressive and completely unscientific working culture the IMF is operating. If people just knew how completely rotten and biased organization is giving aka recommendations for their own “sound” economic policies. What a great laugh it is to read their own report, although at the very same time so tragic.

Note from Bill:

There were several comments about the Paris/France situation that took the discussion into conspiracy conjectures and statements about racism etc. I deleted them because I do not intend my site to be a forum for that debate. None of the comments I deleted related the discussion to the topic of the blog – the costs of unemployment and its relation to social alienation.

Some may say that I am exercising censorship and they would be correct. The debate should be had somewhere but my blog is focused on different issues.

best wishes

bill

Look’s like the girls and boyins Frankfort can have a few more sleepless nights chewing the cud of seventy different interpretations of inflation, see B.Coeure on France 24 for a smirk as wide as the Rhine needs to be to swallow Greece. Seriously though great blog, I just can get my head around QE defined by the above as buying assets…is this (mass liquid support facility’) it?

In a deflationary cycle or historically low as-voted interest rates, how a bad bank can shift assets at face value for future worth and be acquired on the cheap by central bankers? Strengthen your great, the good and a fiscal hand in uniting EU-HUH?