The other day I was asked whether I was happy that the US President was…

News from Europe continues to deteriorate

I am travelling for most of today and so have very little time to write. But I do comment on the latest French unemployment data released the day before Xmas which signals that things are getting worse in France as the European Commission bolts down the austerity clamps even tighter. While I thought that Italy might be the jewel in the crown and be the ones to exit the unworkable Eurozone first, I am now thinking that France might be the straw that breaks the back. Things are certainly going to get worse there and their political system is veering towards an anti Euro sentiment. Not before time, although the parties promoting the anti-euro feeling are not very nice at all. Where are the Socialists? Oh, I forgot, they are in power – spearheading the austerity. What a mess. In addition, as a sort of stocking filler, I also thought I would post the Q&A section of the presentation I made in Rome on November 24, 2014 – Framing Modern Monetary Theory.

France still melting down

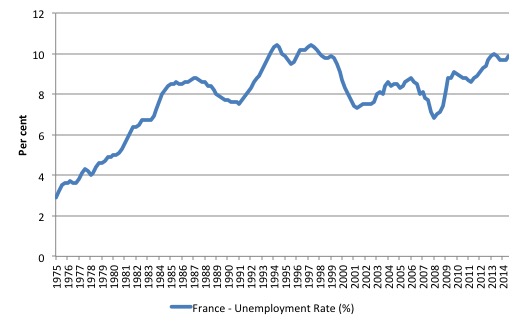

The following graph shows the French unemployment rate (%) from 1975. The data is available from – INSEE – (the National Institute of Statistics and Economic Studies).

INSEE also reported that unemployment is now at a record high of 3.488 million people in November or 9.9 per cent of the workforce. Over the last 12 months French unemployment has risen by 5.8 per cent.

You can see (from the graph) that the wheels started falling off during the time of – Raymond Barre – who was the Prime Minister in the government of Valéry Giscard d’Estaing from 1976 until 1981.

He was simultaneously appointed by Giscard d’Estaing as the Minister of Economy and Finance, which prompted the President to call him the “meilleur économiste de France” (best economist in France).

He led the first Monetarist government, several years before Margaret Thatcher in the UK and started the austerity with his Barre Plans, which involved attacks on the trade unions, cuts to public spending and welfare cuts.

This was a crucial period in European history because it was the beginnning of the neo-liberal onslaught in Europe which is now entrenched in the austerity Groupthink.

Prior to Barre coming to power in France, there was no way a Eurozone could have been created. What eventually allowed the Eurozone to emerge as a reality in the late 1980s was not a diminution in Franco-German national and cultural rivalry but, rather, a growing homogenisation of the economic debate.

The surge in Monetarist thought within macroeconomics in the 1970s, first within the academy, then in policy making and central banking domains, quickly morphed into an insular Groupthink, which trapped policy makers in the thrall of the self-regulating, free market myth.

The accompanying ‘confirmation bias’ overwhelmed the debate about monetary integration.

The introduction of the Monetarist-inspired Barre Plan in 1976 by Raymond Barre showed how far the French had shifted from their Gaullist ‘Keynesian’ days.

Across Europe, unemployment became a policy tool aimed at maintaining price stability rather than a policy target, as it had been during the Keynesian era up until the mid-1970s. Unemployment rose sharply as national governments, infested with Monetarist thought, began their long-lived love affair with austerity.

You can see that in the way the unemployment rate rose sharply during this period and has never fallen back to the low levels found before the neo-liberals took over. There have been cycles since but the level has been creeping up over time – each cycle seems to create a new higher mean tendency.

The reality now is that the unemployment rate is once again on the rise in France, a legacy of the cuts that the Hollande government is undertaking to satisfy the mandarins in Brussels and Washington.

The European Commission’s response to the disaster unfolding in France is that they have to cut the fiscal deficit even harder to come within the Stability and Growth Pact fiscal rules.

The growth projections for next year are so low that unemployment will continue to rise for at least the next 12-15 months. But I consider the official projections to be overly optimistic and if the European Commission succeeds in forcing the French government to make further cuts, there is every chance France will return to recession in 2015.

The official growth projection of 1.5 per cent in 2016 is unlikely to be achieved.

The only saving grace is that the President’s popularity is now down to 12 per cent (as at November) – a record low. Remember when he came to power in 2012 his mantra was jobs, jobs, jobs.

The French Association L’UNI (Union Nationale Inter-universitaire), which was founded as a response to the May 1968 student uprising in France and seeks to – the right in education carried the following graphic to represent the disaster that is unfolding as a result of austerity:

Etudiant aujourd’hui, chômeur demain…. retraité jamais. Merci Hollande

Which means – Students today, unemployed tomorrow …. never retired. Thanks Hollande! – which sums up the rosy state that France currently finds itself in.

The problem of graduate unemployment is now becoming serious in Europe and I will be analysing that issue is more detail in the New Year as I accumulate more data.

Q&A session from my Rome presentation – Framing Modern Monetary Theory, November 24, 2014

I edited out the Italian language sections and paraphrased the questions in English. Some of the questions had long statements preceding them and I have not attempted to capture that material.

It followed the main presentation – Framing Modern Monetary Theory.

The edited Q&A runs for 41:44 minutes. Credits are included in the footage.

Conclusion

I will surface again tomorrow although for the rest of the week I will not be writing all that much.

That is enough for today!

(c) Copyright 2014 William Mitchell. All Rights Reserved.

It’s comforting to know that the neoliberal agenda is being undertaken by a bunch of ineffectual, not to say incompetent operators! They make it obvious for all to see them with no clothes, so to speak.

Now there is the news that Stephanie Kelton will chair the Senate budget office. I wonder though if it will be an attempt to listen to MMT and start the overdue process of resetting the agenda behind economics? Or a cynical attempt to muffle her voice?

Great Q & A session Bill.

I thought you clearly spelt out the role of MMT which I now get fully (always takes a while)

Thanks.

The problem with socialism is that its core belief is the seizure of private wealth so as to aid redistribution.

Of course this is not classic distributionism , it is yet another bank pyramid scheme in disguise.

We can see this false dichotomy in the Ireland after nama blog

Where the author asks does making a radical left alternative break mean leaving Europe.

“A depressing confession: I find it increasingly difficult to imagine a radical left alternative (RLA) taking shape anywhere, as perhaps my recent posts here and here indicate. It’s not that I am a TINA-tout, as Matthew Sparke, whose text on globalization I’m using with Cian O’Callaghan, puts it. There is an alternative. There are alternatives. But geography. Geography.

Ok, so let’s say Irish voters elect a government with a RLA mandate. Let’s hope so. What then? I don’t doubt for a second – and if I’m off, please correct me – that Ireland’s credit rating would sink immediately once the financial world believes an RLA government will emerge here. These guys would have a quick scan of what’s on the cards.

They might, for example, have a look at the taxation agenda (or other proposed policies, all of them with a radical progressive slant). The backdrop here, of course, is that rich people are quite astute when it comes to moving their money around. Not all can, or will. Lots of capital is fixed in place, not quite as mobile as we might think. Still, will the necessary sorts of progressive taxation policies, such as increases in higher rates of income or wealth taxes (but I’d hope also some reductions in sales taxes), scare off some, lots; or, maybe just enough? And what will the credit ratings agencies make of that? Surely they’d hit us. An RLA government here would be such an outlier amidst a wider geography of neoliberal and conservative – fascist? – governments across Europe. Maybe it’d all pass. Maybe we could get by for a while – or at least for the duration of the government’s term i.e. long enough for the sorts of progressive changes people might vote for to be made – without needing to borrow. Maybe.”

Keep in mind I think this guy is based in Maynooth ( with catholic foundations)

I find it amazing he is not even aware of social credit doctrine.

Most of the “wealthy” in Ireland are simply trying to escape the extraction of purchasing power games the estate managers are engaged in on behalf of the new /old banking priesthood.

If people became fully aware of the costs of usury rather then engaging in these false left / right games then we may indeed make some progress.

I can’t think of any period of time where the socialists were not part of the banking establishment.

France is friggin mason central and is a hopeless case.

Having got into trouble in Foix last year ( and many other times) I can say my experiences of lower level masonry was always positive but you can forget about it when the system works at higher levels.

As JFK stated weeks before his death ,secrecy is repugnant.

Control Libya and you control much of Italian energy flows.

With greenstream cut periodically and Libyan oil terminals on fire ( the IEA are reporting massive declines in production once again) then any independent minded Italians are given some more moments of pause.

With Islamic dawn guys raiding oil terminals on the coast and the Tuareg apparently occupying the largest oil field in the interior one must ask who is paying them………….

The Tuareg being slave trading nomads until recently require money in hand to do anything and do not value resources much.

Thanks Bill. Enjoyed that Q&A even though the sound was hard to hear at times but out of your control I assume.

I especially like the assurances at the end about MMT not being a religion. I strongly believe that some of the loudest criticisms may be around this area. I speak specifically about the Right-wing echo chamber of the foxy chracy that will start shouting over any sane discussion on MMT! At least until Rupert has left the earth where I hold higher hope for his legacy through his sons. I hope I am right if not we need to prepare for viscous and ruthless beyond our understanding attacks on its integrity.

I believe this fight is about the fact it’s a complex issue in a world that wants simple answers. It’s really a childish trait that seeks out the simple answers in a complex world. Childishness is not used a cheap insult to their beliefs but about the real limited scope of wanting all things to be simple in a complex world. The world isn’t simple but beautifully and amazingly complex. We can break things dow simply but some complex understanding is required like learning degrees and schooling. That is where I think the focus needs to be on in many areas.

That’s all for now! 🙂

Thank you for all you do and safe travels. Happy new year if I miss you.

MMT is not a religion? Oh my! Do we even have to say that? Perhaps it’s just me, but I see it as completely mechanical, and that’s the beauty of it. You put something in at one end, and MMT will tell you what it will look like when it comes out the other. If that’s a religion, where do I sign up?

A great session. The discussion around balance of payments is very pertinent and now that the hyperinflationistas have lost credibility they have transmuted into prophets of currency crisis.

The propaganda around Russia at the moment on all sides is quite astounding – clearly targeted at non-Russians to make sure they are scarced of ‘doing a Russia’.

I expect we’ll be hearing a lot of ‘look at Russia’ in Greece now they have called elections.

@

Neil , near hyperinflation has already happened in the eurozone , at the very least catastrophic inflation.

But you need to measure it as a loss of real purchasing power.

In the eurozone the stock of money / debt was / is frozen causing hyperinflation like conditions for people without a large stock of Euros or income..

Italy has the second highest cost ( not including taxes) for electricity in Europe ( Ireland is the winner of course)

While both Denmark and Germany share first and second place when taxes are included.

Given the Libyan population was 99% electric before the fall of the regime ( the highest in Africa) a possible reason for western military intervention was to lower the standard of living and transfer new surplus gas to Italy.

If indeed this was the reason it has come a cropper given the present political flux in the country.

The dash for gas economies of the eurozone have come apart partly from a lack of nation state redundancy investments.

Given the state of current entropy people must retreat from the nation state apparatus and try to rebuild something in the village given its lack of fossil fuel needs when trade is local.

This is a very viable alternative in med villages given the climate ( local biomass can be used for cooking and heating during the winter season) as still happens in fiercely independent Corsican villages of the interior.

Urban living much like during the fall of Rome days has become impossible given the sheer scale of the rentier / usury structure.

Ireland is a classic example where the centralizing powers wish to bituamous coal burning even in rural areas so as to have a fully captured market for the gas utilities and corrib field debt merchants.

As can be seen hydro Norway and nuclear France have the lowest real electricity costs in Europe.

Both are still living off investments from their capitalistic national monopoly period.

Meanwhile the UK ( via its London battleship)is currently using its credit power to record imports of electricity from depression hit France.

In the third quarter imports of current provided a record 7 % of total electrical consumption.

It is not possible to understand what is happening unless you understand that it is the systemically inherent result of late stage capitalism. This article by Richard Wolff sums it up. It’s better that I quote rather than paraphrase.

“Government austerity for the masses (raising taxes and cutting public services) is becoming the issue shaping politics in western Europe, north America, and Japan. In the US, austerity turned millions away from the polls where before they supported an Obama who promised changes from such policies. So Republicans will control Congress and conflicts over austerity will accelerate. In Europe, from Ireland’s Sinn Fein to Spain’sPodemos to Greece’s Syriza, we see challenges to a shaken, wounded political status quo (endless oscillations between center-left and center-right regimes imposing austerity). Those challenges build impressive strength on anti-austerity themes above all else. In Japan, Prime Minister Abe resorts to ever more desperate political maneuvers to maintain austerity there.

In responding to austerity, ever more people find their way to a critical understanding of capitalism. Beyond blaming individuals or groups, such people condemn the system, capitalism, whose structure of incentives (rewards and punishments) drives their behaviors. That system brought the 2007/2008 crisis. It then delivered trillions in government bailouts to fund its survival. And now austerity serves to shift the costs of crisis and bailouts onto the general public. Austerity is today’s hot issue not only because it affects practically everyone, but also because it touches the foundations of economy and society.

The austerity policies imposed on western Europe, north America, and Japan are consequences of capitalism’s massive relocation underway since the 1970s. Where modern capitalism began (western Europe, then north America and Japan), its production and distribution facilities grew and concentrated mostly in certain industrialized towns and cities from the 1770s to the 1970s. Those regions’ rural and agricultural areas became capitalism’s “hinterlands” providing industry with food, raw materials, workers, and markets for capitalists’ outputs. When local hinterlands proved insufficient, colonialism turned the rest of the world into such hinterlands. Along the way, increasingly well-organized working classes in western Europe, north America, and Japan won rising wages in tough struggles with capitalists there. In contrast, incomes of most people in the colonized hinterlands shrank.

By the 1970s, the wage gap between the capitalist centers and their hinterlands had become immense. That gap, together with the inventions of jet engine air travel and modern telecommunications, created an historic opportunity for capitalists. They could dramatically increase profits by relocating production. Jets and global telecommunications enabled western European, north American, and Japanese capitalists to monitor and control the production and distribution they relocated to new low-wage centers (in China, India, Brazil, and so on). Only the top direction, financing, and diplomatic/military control centers remained in the old capitalist centers.

Capitalist relocation seriously weakened working-class organizations (labor unions and left political parties) in the old centers. Simultaneously, rising profits from that relocation funded capitalists’ massive campaigns for neo-liberalist ideology and increased capitalists’ influence on politics. The growing inequality of wealth and income flowing from capitalism’s relocation enabled a growing inequality in political power and influence wielded by capital versus labor. This shaped both the changing relations among political parties and among tendencies within parties.

When yet another of its recurring cyclical downturns occurred in 2007/2008, working classes in the old capitalist centers had lost the cohesion and organization they had achieved in the 1930s and the 1940s. They could not force again programs like the New Deal in the US or Europe’s post-World War 2 social democracy. Capitalists in 2007/2008, like those in the 1930s Great Depression, wanted government help quickly to overcome the crisis (money from central banks and a quick jolt of stimulus paid for by government borrowing). They got that, and once the economy was functioning again (2009-2010), capitalists feared the risk of more taxes for them if government stimulus programs would be extended to the masses (to reduce unemployment and housing foreclosures or to support public services).

Many major capitalists in western Europe, north America, and Japan are losing interest in their home economies because they have become slow-growing or “mature.” Their business futures exist rather in the “fast growth areas” of capitalism’s relocation. So they changed the focus of economic discussion in 2009/2010: the problem in western Europe, north America, and Japan was no longer economic crisis for the masses, but instead it was government deficits.

Deficits were “the” problem. Moreover, the solution could not be raising taxes on capitalists since that would only accelerate their relocations causing further economic difficulties. The “necessary” solution was austerity: increased broad-based taxes and/or public spending cutbacks that would reduce government deficits. The masses would suffer, but they lacked the organizational strength and ideological support to prevent that. Capitalists would applaud governments imposing austerity because that socialized the costs of the crisis, shifting them from capitalists onto the mass of people.

Capitalists considering relocation have historically threatened their employees, host communities, and governments. They will leave, they say, unless they get tax cuts, subsidies, special privileges, favorable regulatory and legal changes, and so on. The threat is now continental. Austerity is what capitalists have demanded now, or else. A generation of political leaders that has watched capitalists’ power grow while labor’s power declines understands austerity to be what is “realistically possible.”

The solution is to rebuild the old or build new powerful working-class organizations. They must confront not just austerity but its foundations. Those include the “freedom” of capitalists to relocate when and where they wish regardless of the social costs and consequences. Where production is located — and how it is organized and to whom outputs and revenues are distributed — are basic economic decisions with profound social consequences. Democracy requires that they be made by and for the majority.

Capitalism blocks and negates that economic democracy. It privileges capitalists’ freedom to invest over the majority’s freedom to participate democratically in determining their jobs, job conditions, and what is done with the profits their labor helps to produce. Today, workers’ struggles against austerity are educating them to grasp and confront basic capitalist privileges and their incompatibility with democracy or the economic needs of the people. That is why today’s governments are so determined to maintain austerity and so fearful if austerity fails and falls even in one small country like Greece.” – Professor R.D. Wolff.

Bad news on the ferry this morning from Greece, but better news politically. There will be early elections with the high likelihood of a Syriza victory.

The possibility is there for Greece to free itself from being under the Troika thumb led by German right wing types like Finance minister Wolfgang Schaeuble too. Note he is NOT the finance minister of Greece. His, and others’, recent threats are clearly an infringement of Greek sovereignty.

Greece should reintroduce its own sovereign currency and tell Herr Schaeuble that he can whistle for his lost Euros. If Germany is temporarily short, I’m sure the ECB will be able to print off a few extra to tide them over any difficulty.

And what is Germany going to do about it? Invade? I don’t think so.The only invasion will be from an army of German tourists who will once again flock to the Greek islands once the Greek economy gets on its feet again with a new and more competitive currency.

R d Wolff’s observations on capitalism are absurd as he fails to differentiate between capitalists who require a yield ( ownership) and those who have control.

I have listened to kissenger talk about the difficulty of western Jews integrating inside Chinese culture .

They like the auto man culture I am sure but again there is this difficulty – they are white.

This is possibly the last obstacle preventing them pulling the plug.

I mean jays us – imagine a Irish economic lecturer going through a entire semester while not talking of corrupt Irish Chicago boys.

It is simply not creditable.

It would be better for Europeans to return to their medieval roots both from a quality of life and spiritual sense.

But we are forced to occupy the purgatory of absorbing all of the costs of industrialisation while gaining little benefit.

I think I speak for most now although people remain afraid to express it – would they please fuck off to Hong Kong or where ever and leave us alone.

Dork of Cork,

In your medieval world are you the lord or the serf?

A serf that pays a rent of 15 % to the church and lord rather then the + 50% to the money changers…..

It was no picnic but certainly much better then the capitalist nirvana of 19 th century England with its rickets and other pleasures.

If you even take a casual look at current UK energy balances you will not only see a declining gas / coal / nuclear output but a static to rising level of transport energy demand.

They wish to impose a agrarian level of real energy use per serf but with industrial taxes and inflation and lack of local redundancy via green taxes and the like( the worst of all worlds)

Its a classic famine tactic that we Irish are somewhat familiar with during post Tudor times.

Bill. Interesting insight of French unemployment and policies since 1976. Wonder if the neo-liberal start-up in France had anything to do with France being a main challenger to the fixed exchange rate dollar hegemony which collapsed just a little earlier in the decade.

One quibble: what do you mean, Marine Le Pen not very nice? WIth respect, you have been brainwashed by corporate propaganda into a mindless reflex on the topic. I respectfully ask you to consider the facts:

– Marine Le Pen wants to limit the rate at which foreign nationals are allowed to settle in France to one that does not lower wages or increase crowding. Sort of like FDR and Samuel Gompers. She also wants new immigrants to assimilate, you know, like the American melting pot that worked so well. Sounds reasonable to me. In contrast, Hollande wants to use massive immigration to drive wages down and profits up.

– Marine Le Pen thinks it is outrageous that there are ‘no go’ areas in France, where Jews are assaulted and being driven out. She is not a fan of extremist ideology that teaches hatred of Jews and Christians and homosexuals and Women etc. (It’s like what Karl Popper said: a tolerant society must be intolerant of intolerance). Hollande apparently thinks that rising anti-semitism etc. is fine, because he is continuing to support the expansion of these networks of hate.

– Marine Le Pen wants to reign in parasitic finance, and have an economy that serves the nation as a whole. Hollande wants to crush the average worker into third-world poverty so that banking profits can be maximized.

– Marine Le Pen is against fighting wars unless absolutely necessary for the defense of France. Hollande and his ilk are happy to set the world on fire if only multinational corporations are allowed to suck the blood out of the shattered corpses of once sovereign nations.

It is Hollande, and the oligarchs that control him, that are not very once, I should think…

Ikonoclast:

Can you please provide the reference to the article by Richard Wolff. Thanks.

John Hermann,

http://mrzine.monthlyreview.org/2014/wolff151214.html

In case Ikonoclast does not revisit.

Neil: Wouldn’t Russia be better off, not defending the ruble? Just let it fall. It would drop lower than is justified, and then come back. Russia is not exactly a tiny country that lacks resources. Their foreign currency reserves are dropping, but they have them, not debts. There may be some important imports that they must have, and a falling currency would hurt for while, but I doubt that will bring them to their knees. Russians might panic and that could cause real problems. Otherwise, how they do should depend on what happens in Russia (like most large countries).

“Where are the Socialists? Oh, I forgot, they are in power – spearheading the austerity. What a mess.”

—

I believe it would be relatively easy to create a Fascist party in Britain atm, and many other places too, likely. Who isn’t disgruntled? And which traditional Institutions and power-centers aren’t failing? Who is there to trust? Where is there any hope?

If things don’t start getting fixed then there might be no other chance to do so.

Yes, I’m pessimistic. Very much so atm. We have enough food to feed the world, but we don’t. Why would we get anything else right?

TG’s comment above is exactly the sort of missive I would write were I to try and raise a Fascist movement in Europe, as I said in my previous comment. Though I would have gone easier on the brainwashing stuff eg

“TG: you have been brainwashed by corporate propaganda into a mindless reflex on the topic. ”

and likewise, the “bloodsucking Oligarch” stuff:

TG: “multinational corporations are allowed to suck the blood out of the shattered corpses of once sovereign nations.”

Bit too much of a tell.

BTW TG – French people would spell it “defence” in English, not your American “defense”.