At the moment, the UK Chancellor is getting headlines with her tough talk on government…

Options for Europe – Part 68

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Part III – Options for Europe

Chapter 17 Overt Monetary Financing?

[PRIOR SECTIONS HERE]

[NEW MATERIAL TODAY]

Why is Overt Monetary Financing taboo and should it be?

There is an urgent need for fiscal deficits at the Member State level to rise substantially. Employment rich spending and large-scale public infrastructure projects are necessary to break the cycle of recession (and depression in some nations). The scale of the challenge is estimated by the scale of the output gap (the deviation of actual output from the potential output the economy could produce) and we learned in Chapter 21, that the official estimates of this gap are always biased downwards. In December 2013, the OECD estimated that the Euro area output gap was of the order of 3.8 per cent for 2013 (OECD Economic Outlook, Volume 2013, Issue 2). They estimated Greece’s output gap to be around a staggering 13.6 per cent, with Ireland still at 8.8 per cent after five years of austerity. Spain and Portugal had estimated output gaps of 7.7 per cent, while Italy’s gap was estimated to be 5.3 per cent. As we saw in Chapter 21, a more reasonable way of estimating the output gaps would suggest the Eurozone output gap was of the order of 13 per cent in 2013. If you consider that Greece has lost around 25 per cent of its real output since 2007, the potential output has to have shrunk dramatically for the 13.6 per cent output gap to be realistic.

The latest data (third-quarter 2013) shows that the EU18 fiscal deficit was 3.5 per cent of GDP (Eurostat, 2014c). But underneath this aggregate figure the situation is much grimmer. For 2012, Ireland’s deficit was 8.2 per cent of GDP, Greece 9 per cent, Spain 10.6 per cent, Italy 3 per cent, Portugal, 6.4 per cent. The data is not yet finalised for 2013 and these deficits will be somewhat lower given the austerity that has been imposed. But Italy aside, they are all still well beyond the 3 per cent SGP threshold. Thus, even if we accept the OECD estimates as a reliable indicator of how much excess capacity there is in each nation, the deficit increases that would be required to close them would suggest they should at least double in most cases (Spain less, Italy more), thus blowing the SGP criteria out of the water. Even if OMF gets around Article 123, how would it get around the SGP rule?

The substantive criticism of OMF is the obvious one. All economists students are hard-wired to recite that inflation comes about if the money supply grows. This is one of the most basic and sacred of all the myths that mainstream economists use to dissuade the public of the benefits of fiscal activism, and particularly, if it is associated with running the money printing presses at ever-increasing speeds.

There are many misconceptions as to what inflation actually is. Many media commentators, for example, think that a pay rise for workers constitutes inflation. Others (of perhaps a different political persuasion) think that when companies increase the price of a good or service they are offering that this is inflation. Some people think inflation occurs, when following an exchange rate depreciation the local price of imported goods and services rise. A depreciating exchange rate means that the local currency becomes less valuable in relation to other currencies and foreign-sourced goods and services typically become more expensive to local buyers. But is this inflationary? Similarly, some commentators think inflation occurs when the government increases a particular tax (say, a value-added tax on goods and services) by x per cent and this is passed on by firms in the form of higher prices for goods and services. None of these examples constitute inflation. Given they all involve a rise in prices, each example would constitute what we would call a necessary condition for an inflationary episode. But none of these examples represent a sufficient condition. Observing a price rise alone will not be sufficient to justify the conclusion that one is observing as being an inflationary episode.

Inflation is the continuous rise in the price level. That is, the price level has to be rising each period that you observe it. If the price level rises by by 0.1 per cent every month, for example, then we would be observing an inflationary episode. In this case, the inflation rate would be considered stable – a constant or proportionate increase in the price level per period. If the price level was rising by 0.1 per cent in month one, then 0.15 per cent in month two, then 0.2 per cent in month three and so on, then we would be observing an accelerating inflation. Alternatively, if the price level was rising by 0.1 per cent in month one, 0.05 per cent in month two etc then you have falling or decelerating inflation. If the price level starts to continuously fall then we call that a deflationary episode. The term hyper-inflation is reserved for inflationary episodes, which rapidly exponentiate. There have been few instances of this problem in recorded history. Thus, a price rise can become inflation if it is repeating but a once-off price rise is not considered to be an inflationary episode.

We might also define a normal price level as being the prices firms are willing to supply at when they are operating at normal capacity. However, the economic (business) cycle fluctuates around these “normal” levels of capacity utilisation and firms not only adjust to the flux and uncertainty of aggregate demand by adjusting output, but in some cases, will vary prices. This is particularly the case during a recession. When there are very depressed levels of activity, firms might offer discounts or sales in order to increase capacity utilisation. They thus temporarily suppress their profit margins as a means of maintaining their market share. As demand conditions become more favourable the firms start withdrawing the discounts and the frequency of sales decrease and prices return to those levels that offer the desired rate of return to firms at normal levels of capacity utilisation. We would not consider these cyclical adjustments in prices, where they occur to constitute inflation.

With that cleared up, why do economists claim that OMF would cause inflation to run out of control? As the GFC has unfolded, mainstream economists and their pawns in the financial media have been humiliated by the fact that their predictions have failed to materialise. It isn’t the first time that the doomsayers have been proven to be categorically wrong. When QE was first introduced in Japan in the 1990s, there was a rush of predictions from macroeconomists that the massive expansion in bank reserves (hence the monetary base) would lead to a massive growth in the money supply and inflation. Some predicted Japan would break out into hyperinflation whereas reality was telling us that the main problem, in this regard, was deflation. But that experience was written off by the neo-liberals as being a ‘special case’ because Japan is ‘so strange’ and what happens there is not applicable to the rest of the advanced world. That was convenient because what was happening in Japan – sustained high deficits, the world’s largest public debt to GDP ratios, virtually and stable zero interest rates, and deflation – were all mind-boggling inconsistencies for the mainstream theory. Students in every mainstream macroeconomics class, and that means almost all students, would have predicted, based on the nonsense they were learning, that the high deficits and high public debt ratios, should have driven interest rates sky-high and bond markets should have stopped buying government bonds, the government should have run out of money, and all the time that this disaster was unfolding, inflation should have been be galloping towards hyperinflation. Nothing like that happened.

The GFC brought the same logic out when the US Federal Reserve Bank introduced a significant QE intervention as did the Bank of England. The hyperinflationists were once again quoting from their undergraduate macroeconomics textbooks and predicting that it was only a matter of time before these nations would ‘pay the piper’, which was code for heading down the path carved out by Zimbabwe. While the hyperinflationists were hyperventilating, such was their apparent angst, cooler heads in central banks and elsewhere, who might be considered to actually know a thing or two about the way monetary systems operate, produced several interesting reports. These publications illustrated just how far-fetched the monetary theory is, that is taught to students and espoused by mainstream economists and financial commentators. The real world doesn’t remotely operate in the way the textbooks claim.

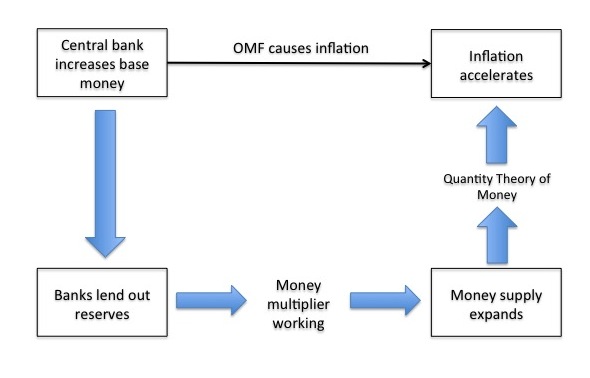

There are two arcane notions that are relied on to render OMF taboo. One is just plain wrong while the other has limited applicability in a recession. The first notion is the rather official sounding concept called the ‘money multiplier’, which links so-called central bank money or monetary base to the total stock of money in the economy (the money supply). The second notion then links the growth in that stock of money to the inflation rate. The combined causality linking these notions then allows the mainstream economists to assert that if the central bank expands the money supply it will cause inflation, which is their prima facie case against OMF (see Figure 17.1). Many critics of OMF do not even fully understand the theoretical route that is alleged to link central bank monetary expansion with inflation.

Students in macroeconomic courses around the world learn to recite the mantra – the money supply is determined by the money multiplier times the monetary base. The money multiplier is just some number that scales up the monetary base to give a larger number, which is the money supply. For our purposes, the monetary base would be enlarged by OMF because the quantity of bank reserves held in accounts with the central bank would increase. The causality embodied in this mantra is an article of religious faith among mainstream economists and underpinned the attempts in the 1980s by central banks, infested with the emerging Monetarist thinking, to attempt to introduce ‘monetary targets’, which were just projections of the growth in the measured money supply, as a primary policy vehicle for controlling inflation. They failed badly but the theory persisted. However, we will see why the Monetarists thought this would control inflation when we consider the second part of the story. But first we need to clear the decks on the ‘money multiplier’.

Figure 17.1 The central bank OMF inflation chain

Lets see what is wrong with their argument. First, students of macroeconomics are introduced to the money multiplier early in their studies. It is an article of faith in mainstream thinking. It is asserted, wrongly, that by manipulating the monetary base, the central bank can control the money supply. Milton Friedman, the father of Monetarism, once said in relation to the US monetary system that “the Federal Reserve System essentially determines the total quantity of money; that is to say, the number of dollars of currency and deposits available for the public to hold. Within very wide limits, it can make this total anything it wants it to be.” (Friedman, 1959a: 4; see also Friedman, 1959b). Later in 1968, as the Monetarists were gaining traction in the public debate, Friedman said that the central bank should publicly adopt “the policy of achieving a steady rate of growth in a specified monetary total …” (Friedman, 1968: 16). Unfortunately, like most aspects of the Monetarist doctrine, the theory doesn’t match the reality.

The monetary base is measured as the notes and coins in circulation or in bank vaults plus bank reserves held at the central bank. It is understood that central banks can add ‘money’ to the bank reserve accounts whenever they choose. QE, for example, involves the central bank exchanging bonds held by the banks for extra bank reserves as we discussed earlier in this chapter. The money supply is defined in a range of ways – from very narrow (a small number of components) to broad (more components). The so-called M1 measure includes only notes and coins in circulation and bank and cheque account deposits on demand (that is, able to be instantly withdrawn) and is considered a narrow measure of the money supply. Broader measures such as M3 include items such as longer-term deposits which require more than 24 hours notice to withdraw. The definitions also vary across nations. The money multiplier is then defined as the the money supply divided by the monetary base. The textbook argument goes that the central bank controls the ‘base money’ in existence and then the act of credit creation in the private banking system multiplies this base up to create the money supply. The determinants of the money multiplier need not concern us here but relate to various parameters in the banking system (for example, the quantity of notes and coins that depositors wish to hold and any required reserves that the banks must hold). A simple story is that someone deposits a sum in a bank to earn some interest. The bank then keeps a little of that deposit in reserve to meet the daily withdrawal behaviour and lends the rest out at a higher interest rate in order to profit. The recipient of the loan spends the money which ends up as a deposit in some bank or another. That bank, in turn, lends most of this deposit out, and the process continues. The resulting money supply expands as these deposits multiply.

The conception of the money multiplier is really as simple as that. But while simple it is also wrong to the core! There are two lines of attack. First, on the empirical front, if the money multiplier is not constant it can hardly be used to make predictions. Second, the stylised text-book model of the banking system isn’t even close to how things actually operate in the real world.

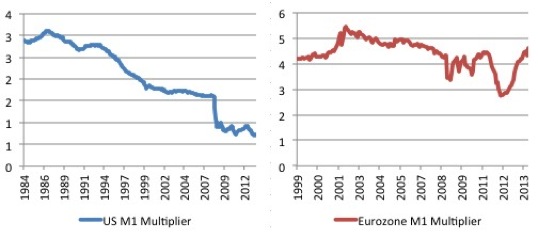

Figure 17.2 shows the estimates of the ‘money multiplier’ for the US and the Euro Area using the so-called M1 measure of the money supply. The situation would not be different if we had used a broader measure of the money supply. The point is if one is postulating a causal relationship between the monetary base and the money supply mediated by this so-called money multiplier then it would require the multiplier to be stable. It has not been stable in either the US or the Eurozone and serves no useful basis for predicting the money supply. Mainstream commentators attempted to argue that with QE driving up excess reserves in the banking system, the multiplier fell, which was an attempt to explain the sudden drops you can see in Figure 17.2. However, this defense is an example of the ad hoc reasoning that permeates economic theory. Whenever the mainstream paradigm is confronted with empirical evidence that appears to refute its basic predictions it creates an exception by way of response to the anomaly and continues on as if nothing had happened (see Gordon, 1972). Students are not told that the measured multiplier is a moving feast and can move around like a Mexican jumping bean? The textbooks just assert that the central bank controls the money supply via its manipulation of the monetary base, which assumes the money multiplier is stable. Moreover, the measured multiplier was clearly unstable in the pre-crisis period, which means the special crisis case explanation for the instability fails.

Figure 17.2 Money multiplier estimates, US and Euro Area, various periods

Source: ECB, M1/base money, US Federal Reserve, M1/monetary base.

In our earlier discussion of QE, we saw that banks do not wait for depositors to provide reserves that they then loan out. Rather, they aggressively seek to attract credit-worthy customers to which they can loan funds to and thereby make profit. These loans are made independent of a bank’s specific reserve position at the time the loan is approved. A separate department in each bank manages the bank’s reserve position and will seek funds to ensure they have the required reserves in the relevant accounting period. They can borrow from each other in the interbank market but if the system overall is short of reserves these transactions will not add the required reserves. In these cases, the bank will sell bonds back to the central bank or borrow from it outright at some penalty rate. At the individual bank level, certainly the ‘price’ it has to pay to get the necessary reserves will play some role in the credit department’s decision to loan funds. But the reserve position per se will not matter. For its part, the central bank will always supply the necessary reserves to ensure the financial system remains functional and cheques clear each day. The upshot is that banks do not lend out reserves and a particular bank’s ability to expand its balance sheet by lending is not constrained by the quantity of reserves it holds or any fractional reserve requirements that might be imposed by the central bank. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank.

The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place. Among the enlightening reports coming out from central banks in recent years is the Bank of England article Money creation in the modern economy (Bank of England, 2014). The two central conclusions are (p.14):

The reality of how money is created today differs from the description found in some economics textbooks:

- Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

- In normal times, the central bank does not fix the amount of money in circulation, nor is central bank money ‘multiplied up’ into more loans and deposits.

These conclusions are devastating for mainstream economics. The Bank of England flesh their argument out by noting that a “in reality … commercial banks are the creators of deposit money … the reverse of the sequence typically described in textbooks” (p. 15). Further, the Bank of England says that for the money multiplier theory to hold, “the amount of reserves must be a binding constraint on lending, and the central bank must directly determine the amount of reserves” (p. 15). However, the “money multiplier theory … is not an accurate description of how money is created in reality” (p. 15). Central banks do not control the quantity of reserves and implements monetary policy “by setting the price of reserves – that is, interest rates” (p. 15). These insights lead to the conclusion that “neither are reserves a binding constraint on lending, nor does the central bank fix the amount of reserves that are available” (p.15). In terms of the determinants of the broad money supply, the Bank of England ratifies the argument above that “lending creates deposits” (p.15), which then creates money.

Importantly, a “related misconception is that banks can lend out their reserves. Reserves can only be lent between banks” (p.16) and “consumers do not have access” (p.16) to central bank reserve accounts. This insight is also confirmed in an interesting article published in September 2008 by the Federal Reserve Bank of New York in their Economic Policy Review entitled – Divorcing Money from Monetary Policy (FRBNY, 2008). Commercial banks require bank reserves for two main reasons. First, from time-to-time, central banks will impose reserve requirements which means that the bank has to hold a certain non-zero volume of reserves at the central bank. Most nations only require the banks to keep there reserves in the black on a daily basis. Second, the FRNBY states that “reserve balances are used to make interbank payments; thus, they serve as the final form of settlement for a vast array of transactions” (p.42). There is daily uncertainty among banks surrounding the payments flows in and out as cheques are presented and other transactions between banks are accounted for. The banks can get funds from the other banks in the interbank market to cover any shortfalls but also will choose to hold some extra reserves just in case. If all else fails the central bank maintains a role as lender of last resort, which means they will lend reserves on demand from the commercial banks to facilitate the payments system.

When the central bank adds to these reserve accounts (for example, when conducting QE or OMF), “the new reserves are not mechanically multiplied up into new loans and new deposits as predicted by the money multiplier theory” (Bank of England, 2014: 24). The fact is that the existence of new reserves, even if they are well in excess of the banks’ requirements to operate an orderly clearing system, “do not, by themselves … change the incentives for the banks to create new broad money by lending” (p.24).

This also reflects on the claim that the central bank can control the money supply? The Bank of England conclude that “it does not directly the quantity of either base or broad money” (p.25). This insight is also confirmed by the FRBNY (2008: 41):

In recent decades, however, central banks have moved away from a direct focus on measures of the money supply. The primary focus of monetary policy has instead become the value of a short-term interest rate. In the United States, for example, the Federal Reserve’s Federal Open Market Committee (FOMC) announces a rate that it wishes to prevail in the federal funds market, where overnight loans are made among commercial banks. The tools of monetary policy are then used to guide the market interest rate toward the chosen target.

Thus, monetary policy is not practised through attempts by the central bank to control the ‘money supply’ but rather through its undoubted capacity to set short-term interest rates – the rate that gains all the headlines each month when the central bank board meets and announces what its ‘policy’ rate will be for the next month. The reality is that the demand for credit from private banks that determine the money supply. The essential idea is business firms seek credit to meet its working capital needs to produce goods and services to meet their expectations of sales. Consumers also seek loans for a variety of purposes. These loans appear as bank deposits and so the ‘money supply’ expands. When the credit is repaid the money supply shrinks. These flows are going on all the time and so the fluctuations in the money supply measures published by central banks are just arbitrary reflections of the credit circuit – the borrowing and repayment of loans. Central banks clearly do not determine the volume of deposits held each day. Rather they determine the price at which it will supply reserves on demand by imposing the penalty interest rate (see Lavoie, 1984). A far better depiction of reality is that instead of the money supply being a multiple of the monetary base (the money multiplier story), the money supply brings forth the demand for bank reserves and so the monetary base responds accordingly. The causality is thus reversed.

The second flawed aspect of the antagonism against OMF relates to the mainstream theory of inflation captured by the so-called Quantity Theory of Money (QTM). You can see that in Figure 17.1, the QTM links the expansion of the money supply with accelerating inflation. We won’t go into the place this theory has in the classical literature in this discussion for we would be led into the mirky and very opaque waters of theory. Suffice to say, while the QTM was formulated in the C16th, the idea still forms the core of what became known as Monetarism in the 1970s and is the principle reason for the taboo against OMF.

But first a small bit of theory. The QTM postulates the following relationship M times V = P times Y which can be easily described in words as follows. M is a symbol for how much money there is in circulation. V is called the velocity of circulation in the text books but simply means how many times per period (say a year) the stock of money ‘turns over’ in transactions. To understand velocity think about the following example. Assume the total stock of money is $100, which is held by the two people that make up this economy. In the current period, Person A buys goods and services from Person B for $100. In turn, Person B buys goods and services from Person A for $100. The total transactions equal $200 yet there is only $100 in the economy. Each dollar has thus be used “twice” over the course of the year. So the velocity in this economy is 2. When we make transactions we hand over money, which then keeps being circulated in subsequent purchases. The result of M times V is equal to the total monetary transactions in the economy per period, which is a flow of dollars (or whatever currency is in use). The P times Y is the average price in the economy times real output produced. So economists value the total sum of all the goods and services produced to get real GDP and then value this is some way using the price level. How they do that is beyond this discussion but there are well-defined procedures that all government statistical agencies such as Eurostat use to accomplish this. So P times Y is the total money value of the output produced in the period or GDP. Clearly, all the sales of goods and services (M times V) have to equal the total money value of output or GDP (P times Y).

At this level, the relationship M time V = P times Y is nothing more than an accounting statement that total value of spending in a period must equal the total value of output, that is, a truism. It is true by definition and at that level is totally unobjectionable. How does the QTM become a theory of inflation? The answer is by sleight of hand but we can say a little more than that. The Classical economists who pioneered the use of the QTM assumed that the labour market would always be at full employment, which means that real GDP (the Y in the formula) would always be at full capacity and thus could not rise any further in the immediate future. They also assumed that the velocity of circulation (V) was constant (unchanged) given that it was determined by customs and payment habits. For example, people are paid on a weekly or fortnightly basis and shop, say, once a week for their needs. These habits were considered to underpin a relative constancy of velocity. These assumptions then led to the conclusion that if the money supply changed the only other thing that could change to satisfy the relationship M times V = P times Y was the price level (P). The only way the economy could adjust to more spending when it was already at full capacity was to ration that spending off with higher prices. Financial commentators simplify this and say that inflation arises when there is ‘too much money chasing too few goods’.

The problem with the theory is that neither assumption typically holds in the real world. First, there are many studies which have shown that velocity of circulation varies over time quite dramatically. Second, and more importantly, capitalist economies are rarely operating at full employment. The fact that economies typically operate with spare productive capacity and often, with persistently high rates of unemployment, means that it is hard to maintain the view that there is no scope for firms to expand real output when there is an increase in nominal aggregate demand growth. Thus, if there was an increase in availability of credit and borrowers used the deposits that were created by the loans to purchase goods and services, it is likely that firms with excess capacity will respond by increasing real output to maintain or increase market share rather than by pushing up prices. In other words, an evaluation of the inflationary consequences of OMF should be made with reference to the state of the economy. If there is idle capacity then it is most unlikely that OMF will be inflationary. At some point, when unemployment is low and firms are operating at close to or at full capacity, then any further spending, whether stimulated by OMF or some other scheme, will likely introduce an inflationary risk into the policy deliberations.

[TO BE CONTINUED – I WILL FINISH OFF THE INFLATION RISK ARGUMENT TOMORROW AND DOCUMENT WHY SOME OF THE ARGUMENTS FOR OMF ARE FLAWED AND HAMPER THE EFFORTS TO LEGITIMISE IT]

Additional references

This list will be progressively compiled.

Bank of England (2014) ‘Money creation in the modern economy’, Quarterly Bulletin, Quarter 1. www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q102.pdf

Bernanke, B. (2002) ‘Deflation: Making Sure “It” Doesn’t Happen Here’, Speech to the National Economists Club, Washington, D.C., November 21, 2002. http://www.federalreserve.gov/boardDocs/speeches/2002/20021121/default.htm

Bossone, B. (2013a) ‘Time for the Eurozone to shift gear: Issuing euros to finance new spending’, VoxEu, April 8, 2013, http://www.voxeu.org/article/time-eurozone-shift-gear-issuing-euros-finance-new-spending

Bossone, B. (2013b) ‘Italy, Europe: Please do something!’, EconoMonitor, April 19, 2013. (http://www.economonitor.com/blog/2013/04/italy-europe-please-do-something/

Bossone, B. and Wood, R. (2013) ‘Overt Money Financing of Fiscal Deficits: Navigating Article 123 of the Lisbon Treaty’, July 22, 2013. http://www.economonitor.com/blog/2013/07/overt-money-financing-of-fiscal-deficits-including-navigation-through-article-123-of-the-lisbon-treaty/

Committee on Economic and Monetary Affairs (2013a) ‘Draft Report on the European Central Bank Annual Report for 2012’, European Parliament, ECON/7/12316, June 11, 2013. http://www.europarl.europa.eu/meetdocs/2009_2014/documents/econ/pr/939/939362/939362en.pdf

Committee on Economic and Monetary Affairs (2013b) ‘Amendments 1-247 – Draft report – on the European Central Bank Annual report for 2012’, European Parliament, ECON/7/12316, July 12, 2013. http://www.europarl.europa.eu/sides/getDoc.do?pubRef=-%2f%2fEP%2f%2fNONSGML%2bCOMPARL%2bPE-516.605%2b01%2bDOC%2bPDF%2bV0%2f%2fEN

Committee on Economic and Monetary Affairs (2013c) ‘Report on the European Central Bank Annual report for 2012’, European Parliament, ECON/7/12316, November 13, 2013. http://www.europarl.europa.eu/document/activities/cont/201311/20131113ATT74398/20131113ATT74398EN.pdf

ECB (2012a) ‘Monthly Bulletin, 05/2012. www.ecb.int/pub/pdf/mobu/mb201205en.pdf

ECB (2012b) ‘Opinion of the European Central Bank of 24 January 2012 on a guarantee scheme for the liabilities of Italian banks and on the exchange of lira banknotes (CON/2012/4). https://www.ecb.europa.eu/ecb/legal/pdf/en_con_2012_4_f.pdf

ECB (2013) ‘Annual Report 2012’, European Central Bank. http://www.ecb.europa.eu/press/key/date/2013/html/sp130424.en.html

ECB (2014a) ‘Introductory statement to the press conference (with Q&A)’, Mario Draghi, President of the ECB, Frankfurt am Main, 3 April 2014. http://www.ecb.europa.eu/press/pressconf/2014/html/is140403.en.html

ECB (2014b) ‘ELA Procedures’, Accessed April 18, 2014. https://www.ecb.europa.eu/pub/pdf/other/201402_elaprocedures.en.pdf

Eurostat (2014a) ‘Euro area annual inflation down to 0.5%’, Flash Estimate March 2014, published March 31, 2014. http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-31032014-AP/EN/2-31032014-AP-EN.PDF

Eurostat (2014b) ‘Euro area unemployment rate at 11.9%’, February 2014, published April 1, 2014. http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-31032014-AP/EN/2-31032014-AP-EN.PDF

Eurostat (2014c) ‘Seasonally adjusted government deficit down to 3.1% of GDP in the euro area’, February 3, 2014. http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-03022014-AP/EN/2-03022014-AP-EN.PDF

Federal Reserve Bank of New York (2008) ‘Divorcing Money from Monetary Policy’, Economic Policy Review, September, 41-56. www.newyorkfed.org/research/EPR/08v14n2/0809keis.pdf

Frankfurter Allgemeine (2012) ‘Die Angst vor der Inflation’, September 23, 2012. http://www.faz.net/aktuell/wirtschaft/eurokrise/schuldenkrise-die-angst-vor-der-inflation-11899733.html

Friedman, M. (1959a) ‘Statement and Testimony’, Joint Economic Committee, 86th US Congress, 1st Session, May 25. http://0055d26.netsolhost.com/friedman/pdfs/congress/Gov.05.25.1959.pdf

Friedman, M. (1959b) A Program for Monetary Stability. New York, Fordham University Press.

Friedman, M. (1968) ‘The Role of Monetary Policy’, American Economic Review, 58(1), 1-17.

Friedman, M. (1969) The optimum quantity of money, and other essays, Chicago, Aldine Publishing Company.

Gordon, D.M. (1972) Theories of poverty and underemployment, Lexington, Mass: Heath, Lexington Books.

Lagarde, C. (2014) ‘The Road to Sustainable Global Growth-the Policy Agenda’, Speech to the School of Advanced International Studies, Johns Hopkins University, Washington, DC, April 2, 2014. http://www.imf.org/external/np/speeches/2014/040214.htm

Lavoie, M. (1984) ‘The endogenous flow of credit and the Post Keynesian theory of money’, Journal of Economic Issues, 18, 771-797.

McCulley, P. and Pozsar, Z. (2013) ‘Helicopter money: or how I stopped worrying and love fiscal-monetary cooperation’, Global Society of Fellows, 7 January 7, 2013. http://www.interdependence.org/wp-content/uploads/2013/01/Helicopter_Money_Final1.pdf

MNI (2014) ‘Interview with Jens Weidmann’, March 21, 2014. http://www.bundesbank.de/Redaktion/EN/Interviews/2014_02_28_weidmann_mn.html

Turner, A. (2013) ‘Debt, Money and Mephistopheles: How do we get out of this mess?’, Speech to Cass Business School, London, February 6, 2013. www.fsa.gov.uk/static/pubs/speeches/0206-at.pdf

von Goethe, J.W. (1888) ‘Faust: A Tragedy’, London, Ward Lock and Co.

Weidmann, J. (2012) ‘Money Creation and Responsibility’, Speech at the 18th colloquium of the Institute for Bank-Historical Research (IBF), Frankfurt, September 28, 2012. http://www.bundesbank.de/Redaktion/EN/Reden/2012/2012_09_20_weidmann_money_creaktion_and_responsibility.html

White, W. (2013) ‘Overt Monetary Financing (OMF) and Crisis Management’, Project-Syndicate, June 12, 2013. http://www.project-syndicate.org/blog/overt-monetary-financing–omf–and-crisis-management

Wood, R. (2012) ‘The economic crisis: How to stimulate economies without increasing public debt’, Policy Insight, No. 62, Centre for Economic Policy Research, August. http://www.cepr.org/sites/default/files/policy_insights/PolicyInsight62.pdf

Wood, R. (2013a) ‘Conventional and Unconventional Fiscal and Monetary Policy Options’, EconoMonitor, June 20, 2013. http://www.economonitor.com/blog/2013/06/conventional-and-unconventional-fiscal-and-monetary-policy-options/

Wood, R. (2013b) ‘Overt Money Financing and Public Debt’, September 3, 2013. http://www.economonitor.com/blog/2013/09/overt-money-financing-and-public-debt/

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Overt Monetary Financing is what many people wrongly misunderstood Quantitative Easing to be.

I’m just wondering why OMF might be necessary. As interest rates are very low, and could be even lower if governments chose, it wouldn’t cost much to increase fiscal deficits in the conventional way.