The other day I was asked whether I was happy that the US President was…

IMF wrong on QE

Yesterday the IMF released new analysis of Quantitative Easing, specifically in relation to the Euro Area – Euro Area – Q&A on QE. This is in the context of the ECB beginning to discuss the possibility of introducing a large sovereign debt buy-up as the euro-zone inflation rate looks to be close to deflating (negative inflation). Once again, all the financial commentators are rehearsing their usual claims about driving up inflation etc. The reality is the QE will not provide much help for the euro-zone economies which are mired in recession or stagnant, low growth. What is needed are fairly substantial increases in the fiscal deficits in all Member States and none of the neo-liberal ideologues want to face up to that. So, instead, we get these ridiculous debates and analyses of QE – good and bad and all the rest. The IMF is wrong on QE. But then why should we be surprised about that. An apology or admission of error will be issued down the track, notwithstanding that in between all sorts of spurious forecasts about inflation, inflationary expectations and growth will be issued by them.

European QE mooted

On March 31, 2014, Eurostat released the latest inflation data for the euro area, which showed that annual inflation fell in March 2014 to 0.5 per cent. A year ago (March 2013), the euro area annual inflation rate was 1.7 per cent and has fallen progressively over the last year, signalling that Europe is approaching a dangerous deflationary situation.

The next day, Eurostat released new data showing that the euro-zone unemployment rate was 11.8 per cent and hadn’t moved since October 2013.

Both data releases indicated a failed policy structure is in place. They have also promoted a rethink of monetary policy in Europe as the policy makers realise that the EMU is not only failing to grow at any acceptable level, with some nations locked into depression rather than recession, but also that inflation is decelerating.

There is even talk of deflation (price levels falling rather than the rate of increase slowing), which is extremely damaging for asset holders and firms. Both facts indicate a dramatic shortfall in total spending relative to productive capacity.

While the economic policy debate has been mired in calls for increased ‘structural reform’ (aka cutting wages and working conditions and reducing the generosity of pension and income support schemes), there can be no reasonable structural explanation for this coincidence of outcomes.

On March 25, 2014, the Bundesbank President Weidmann was interviewed by the press agency Market News International (MNI) – Asset purchases must be examined critically.

In what was seen as a ‘radical’ departure from Bundesbank rhetoric, he claimed that the ECB could purchase “top-rated” private assets and even government bonds as long as this was in “conformity with the Maastricht Treaty”. In other words, he was given the nod to the ECB engaging in so-called Quantitative Easing (QE)

It is questionable whether the ECB would have been prepared to openly consider such a policy direction without the Bundesbank imprimatur. When the ECB President Mario Draghi addressed the press on April 3, 2014 to announce the monthly interest rate decision – Press conference Mario Draghi – he made it clear that QE had “explicitly” entered the discussions at the Governing Council meeting for the first time at the April meeting.

Draghi said that in light of “the broad-based weakness of the economy”, the ECB “is unanimous in its commitment to using … unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged period of low inflation”.

The IMF also ratcheted up pressure on the ECB when its Director told a gathering in Washington that the ‘low-flation’ economies “particularly in the Euro Area”, are in danger of suppressing spending and output growth and that “More monetary easing, including through unconventional measures, is needed”. Please see – The Road to Sustainable Global Growth-the Policy Agenda (April 2, 2014).

So when all else fails, try something else that will fail but do not mention the ‘war’ – in this case the war is expansionary fiscal policy.

QE has been of limited success where it has been tried and is not the appropriate answer to the on-going malaise in the euro-zone. QE involves the central bank exchanging a non- or low-interest bearing asset (that is, adding funds to the reserve accounts that banks have to hold with the central bank to facilitate the clearance of cheques) for some higher yielding and longer-term assets (for example, 10-year government bonds or commercial bonds).

It is nothing more than a simple asset swap between the central bank and the private sector with the additional negative aspect that it reduces income flowing to the non-government sector. Proponents of QE claim it adds liquidity to a system where lending by commercial banks is seemingly frozen because of a lack of bank reserves. They say that giving the banks more reserves will stimulate more lending to the private sector with commensurate higher rates of investment and economic growth.

Financial journalists regularly claim that QE involves ‘printing money’ to ease a ‘cash-starved’ banking system. Invoking the evil-sounding ‘money printing’ terminology to describe QE is deliberately emotive (for example, it stokes our irrational fears of Weimar scenarios).

It is also highly misleading. All transactions between the government sector (treasury and central bank) and the non-government sector involve the creation and destruction of net financial assets (‘money’) denominated in the currency of issue. Typically, when the government buys something from the non-government sector they just credit a bank account somewhere – that is, numbers denoting the size of the transaction appear electronically in the banking system.

These numbers signify a new financial asset has been created to the favour of the recipient of the spending. The reverse is true when taxes are paid. There are no printing presses involved!

Does QE work? The mainstream belief is that it will stimulate the economy sufficiently to put a brake on the downward spiral of lost production and the increasing unemployment.

It is based on the erroneous belief that a bank is an institution that accepts deposits in order to build up reserves, which, in turn, provides it with the funds to on-lend at a margin in order to profit. But this is not how banks operate.

Bank lending is not ‘reserve constrained’. Banks lend to any credit worthy customer they can find without, initially, worrying about how much funds they have in their reserve accounts.

They know that if they are short of reserves (their reserve accounts have to be at least in positive balance each day) then they borrow from each other in the so-called ‘interbank market’. If that is not possible, then they know they can borrow from the central bank, which always stands ready to provide funds to meet reserve shortfalls.

Ensuring there are adequate reserves (liquidity) in the system is part of the central bank’s charter to maintain financial stability. If the central bank refused to supply bank reserves on demand (at a price) then cheques might fail to clear and the financial system would be plunged into turmoil.

The ECB, itself, debunked the myth that banks need reserves before they will make loans, in their – Monthly Bulletin for May 2012.

In considering whether “a large increase in central bank liquidity … necessarily implies rapid broad money and credit growth”, the ECB said (pages 20-24):

The occurrence of significant excess central bank liquidity does not, in itself, necessarily imply an accelerated expansion of … credit to the private sector … The Eurosystem, however, as the monopoly supplier of central bank reserves in the euro area, always provides the banking system with the liquidity required to meet the aggregate reserve requirement … the Eurosystem always provides the central bank reserves needed on aggregate, which are then traded among banks and therefore redistributed within the banking system as necessary. The Eurosystem thus effectively accommodates the aggregate demand for central bank reserves at all times and seeks to influence financing conditions in the economy by steering short-term interest rates.

In sum, holdings of central bank reserves are thus not a factor that limits the supply of credit for the banking system as a whole. Ultimately, the growth of bank credit depends on a set of factors that determine credit demand and on other factors linked to the supply of credit.

The Bank of England also recently rejected the idea bank lending is constrained by prior reserve holdings. In their Quarterly Bulletin 2014 Q1 article – Money creation in the modern economy – they conclude that (p.14):

In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money. The reality of how money is created today differs from the description found in some economics textbooks.

The reality of how money is created today differs from the description found in some economics textbooks

- Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

- In normal times, the central bank does not fix the amount of money in circulation, nor is central bank money ‘multiplied up’ into more loans and deposits.

On QE, the Bank of England says (p.14):

As a by-product of QE, new central bank reserves are created. But these are not an important part of the transmission mechanism.

The point is that building bank reserves will not increase the bank’s capacity to lend, which has been a central premise of those advocating QE. The reality is that loans create deposits, which then generate reserves not the other way around.

The reason that bank lending is restrained at present is because there is a dearth of credit worthy customers. In the current climate the assessment of what is credit worthy has become very strict compared to the lax days prior to the crisis and there are less people/firms wanting to take out loans.

It is also important to understand that QE does not change the net financial position of the private sector. When the central bank exchanges one type of financial asset (an increase in a private bank’s reserve balance) for another type of financial asset (private holdings of bonds, etc), the net financial assets in the private sector are unchanged although the portfolio composition of those assets is altered.

Typically there will be more short-term assets in the mix, a shift referred to as maturity substitution (short for long in this case).

QE thus increases central bank demand for so-called ‘long maturity’ assets held in the private sector (for example, 10-year bonds), which reduces their ‘yields’ in the market place and, in turn, makes interest rates on longer-term loans cheaper.

This might increase aggregate spending overall given the cost of investment funds is likely to drop. But on the other hand, the lower rates reduce the interest-income of savers who will reduce consumption (demand) accordingly. How these opposing effects balance out is unclear. The central banks certainly don’t know!

Overall, this uncertainty points to the problems involved in using monetary policy to stimulate (or contract) the economy. It is a blunt policy instrument with ambiguous impacts.

The current debate about monetary policy evokes a strong sense of déjà vu, given that these points were well understood during the 1930s.

On December 16, 1933, as the Great Depression was worsening and policy makers were relying on monetary policy solutions, similar to the emphasis in the current crisis, British economist, John Maynard Keynes, who is often credited with the ‘pushing on a string’ analogy, wrote an – Open Letter to President Roosevelt – and said:

Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt. In the United States today your belt is plenty big enough for your belly. It is a most misleading thing to stress the quantity of money, which is only a limiting factor, rather than the volume of expenditure, which is the operative factor.

In that context, he said that the government “must be called in aid to create additional current incomes through the expenditure of borrowed or printed money”.

QE is not a sensible anti-recession strategy. What will motivate consumers to borrow if they are scared of losing their jobs? Why would a company borrow if they expect their sales to remain depressed?

The major problem facing the euro-zone and elsewhere at present is that the private sector is not willing to spend as robustly as it did before the crisis. The only way to fill the resulting spending gap is for governments to increase their deficit spending. Relying on an export boom will not work for most nations. There is a crying need in all euro-zone nations at present for increased government deficits.

IMF on QE for Europe

Which brings us to IMF assessment of QE for the euro-zone noted at the outset. The IMF’s recent report (June 25, 2014) – Euro area policies Staff Report for the 2014 Article IV Consultation with Member Countries – said that (p.45):

… if inflation remains too low, consideration could be given to a large-scale asset purchase program, primarily of sovereign assets. Directors noted that the signaling of the ECB’s commitment to its price objective would eventually raise inflation expectations across the euro area.

The IMF further claimed that QE “can push up inflation by raising consumption and investment across the euro area” because “growth and inflation expectations would rise as the ECB signals resolve to achieve its inflation objective”.

The Federal Reserve Bank of Cleveland provides the most current series on inflationary expectations and the real interest rate that is available.

In October 2009, the Bank released a discussion paper outlining – A New Approach to Gauging Inflation Expectations. It is a non-technical version of this 2007 paper – Inflation Expectations, Real Rates, and Risk Premia: Evidence from Inflation Swaps.

You can get the latest data – HERE.

The data spans the period from January 1, 1982 to June 1, 2014.

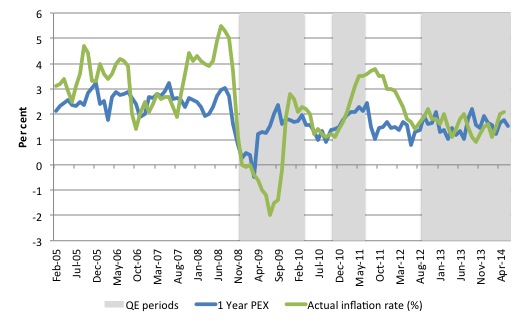

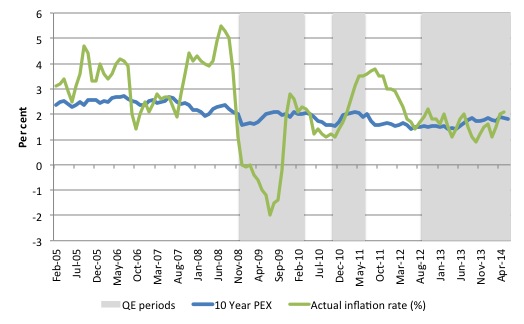

The three major rounds of QE in the US were dated as follows:

- Quantitative Easing 1 (QE1, December 2008 to March 2010) – This was announced on November 25, 2008. The program was expanded on March 18, 2009 as described in this FOMC press release.

- Quantitative Easing 2 (QE2, November 2010 to June 2011) – The FOMC announced on – On November 3, 2010 – that it “intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.”

- Quantitative easing 3 (QE3, September 2012 and expanded on December 2012) – The FOMC announced on – September 13, 2012 – that it “agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month”. This would continue “If the outlook for the labor market does not improve substantially”. This phase was expanded on – December 12, 2012 – such that the FOMC “will purchase longer-term Treasury securities … initially at a pace of $45 billion per month”.

Those phases are depicted by the shaded areas in the following graphs. The graphs show the evolution of inflationary expectations (PEX) and the actual annual inflation rate from January 2005 to June 2014. The first graph shows the one-year ahead inflationary expectation while the second shows the expectation over the 10-year horizon (in other words, what people in the US think inflation will be over the next decade).

It is hard to mount an argument that the QE episodes have increased inflationary expectations. The last open-ended phase (QE3) hasn’t altered short- or long-run inflationary expectations on iota – they remain low and anchored despite the massive increase in the asset-side of the Federal Reserve balance sheet and the commensurate swelling of bank reserves.

The IMF introduces an additional way in which QE might stimulate growth – the so-called portfolio revaluation effect which prompts wealth-induced consumption and investment increases. This is really clutching at straws.

The alleged impact is as follows.

1. QE pushes up the price of long-term government bonds as the banks sell them to the central bank. This drives down the yields on those assets.

2. But banks desire to keep a certain proportion of long-term assets on their books so they replace them with other similar maturity assets (for example, shares, private bonds) and this drives those prices up.

3. All asset holders are now wealthier – households and corporations. These asset-holders were trying to pay back debt to reduce the risk of their balance sheets and now the QE will “reverse this dynamic” because they will perceive they have more wealth and thus more to spend and the cost of holding increased debt is lower (because yields have been driven down by the QE and subsequent portfolio rebalancing operations).

4. Banks would be more willing to lend because the value of the collateral offered would be higher.

5. “The increase in aggregate demand from higher asset values and growth expectations would increase credit demand. Unlike other ECB measures to date, QE also works to restore the demand for bank credit.”

If you believe all of that send me an E-mail and I will sell you the Sydney Harbour Bridge for cheap.

None of these effects have been observed in the US or in the past in Japan. Demand for credit remained weak in those countries during and after the QE phases.

Conclusion

QE will not work in the euro-zone to provide sufficient stimulus (if any) to resolve the crisis.

Once again, policy makers see monetary policy as the saviour because they refuse to entertain the obvious – fiscal policy is much more effective in providing stimulus to spending-starved economies. It works directly by pumping dollars (euros, whatever) into the spending stream and immediately generates multiplier effects, which enlarge its positive impacts.

Monetary policy has been proven to be largely ineffective in providing stimulus during the GFC and its aftermath.

The ideologues just refuse to admit the obvious.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“So when all else fails, try something else that will fail…” Touché. That phrase had me in stitches.

Someone seems to think that, to a certain extent, ‘Q.E.’ ‘worked’?

“To be sure, there is no proof that QE2 led to the stock-market rise, or that the stock-market rise caused the increase in consumer spending. But the timing of the stock-market rise, and the lack of any other reason for a sharp rise in consumer spending, makes that chain of events look very plausible. The magnitude of the relationship between the stock-market rise and the jump in consumer spending also fits the data. Since share ownership (including mutual funds) of American households totals approximately $17 trillion, a 15% rise in share prices increased household wealth by about $2.5 trillion. The past relationship between wealth and consumer spending implies that each $100 of additional wealth raises consumer spending by about four dollars, so $2.5 trillion of additional wealth would raise consumer spending by roughly $100 billion.

That figure matches closely the fall in household saving and the resulting increase in consumer spending. Since US households’ after-tax income totals $11.4 trillion, a one-percentage-point fall in the saving rate means a decline of saving and a corresponding rise in consumer spending of $114 billion – very close to the rise in consumer spending implied by the increased wealth that resulted from the gain in share prices.”

http://www.project-syndicate.org/commentary/feldstein33/English

Off topic: it’s a good thing that David Leyonhjelm – a libertarian – supports gay marriage. Even though progressive libertarians and progressive Keynesians will struggle to agree on economic policy, if these groups got together, society will at least experience real progress. Few things sh!t me more than conservative social policies, regardless of economic persuasion. Cheers!

The IMF appears to be something of a schizoid organization. The research division says reduce austerity while Lagarde, the putative policy head, goes around saying just the opposite, almost simultaneously. Since research can be done better by others and their policy division is toxic, it might be best for the world to wind down this organization altogether.

I’m afraid this whole discussion will fail to win recruits until the various semantic terms are defined.

A fiscal “deficit” is not the sort of tangible, meaningful deficit that 99% of readers on planet Earth will interpret the word to mean.

Taking sloppy or undefined semantics to a policy fight is like like taking a rolled up paper with “bang” written on it to a gun fight.

Cease, forever, the practice of calling fiat or Public Initiative a “deficit.” That might help, right off the bat.

Sadly Roger, neocons and austrians would simply call foul on semantics and redouble their efforts to it call it a deficit. Which is the meme that would stick in peoples minds. Trickle (Sorry Gush up) up would seem to be their game. All QE in Euroland will do is goose asset prices and depress savings yield. The UK being a prime example.

The money must go to main street not the banks, boosting demand.

i.e. A tax holiday for those on low incomes. (0ne off) or push up the lowest personal tax allowances a lot.

Remembering that money is an artifact, a social construct, doing too much could push inflation as the extra demand may hit a physical resource limit.

A debt jubilee would be good again for the those on lowest incomes where it would have the greatest demand effect.

Regards Lee

Roger, even when the terms are defined, it doesn’t make any difference. We only need to look at Gigerenzer’s experiments on probability in medical and other settings. What he has shown rather conclusively is that both patients and medics don’t understand probabilities at all. However, if you present the problem to them in what he calls base frequencies, both get it (Reckoning with Risk). In the probability case, no one really understands what is happening except lack of familiarity – but that is unable to explain all the cases. In the economics case, on the other hand, what we seem to have is immense resistance + seeming inconsistency with what people are quite familiar with + a little of the Gigerenzer problem, lack of any similarity to the household case. While Gigerenzer could restate the probability problem in base frequency terms without distorting the structural character of the problems, this can’t be done with the macroeconomic issue at hand. So, we appear to face a cleft stick.

What is to be done? I don’t know nor do others who have tried different strategies of which none seem to have worked. Clear definitions are necessary, but don’t seem to be sufficient and moreover seem to possess little or no traction at all.

As for your clarion call for using a term other than “deficit”, this could work were it not for the fact that that is what it is and there is no other existing term to replace it that carries the same meaning. One could be invented. But that would face equal problems of lack of understanding, and the opposition certainly wouldn’t use it. The result would seem to just compound the problem.

“Proponents of QE claim it adds liquidity to a system where lending by commercial banks is seemingly frozen because of a lack of bank reserves. They say that giving the banks more reserves will stimulate more lending to the private sector with commensurate higher rates of investment and economic growth.”

That’s not what most of the proponents argue. They claim that just by participating in the market for the assets that central banks buys with QE, the result is a reduction in the yields on those assets. So QE is just a more aggressive extension of central bank interest rate management.

Hi Bill, I take it that the claims that QE in the U.S. has pushed more money into speculation, i.e. the stockmarket are just bunkum then?

QE does give an opportunity to describe the monetary power of the state

It is an example of central banks and by extension governments ability to spend

without taxing.

MMT ‘s strength is to describe monetary operations accurately

Yes QE has been used as a part of a failed monetary stimulus response to recession

but why not use it as proof of the possibility of fiscal stimulus

For example progressive governments could advocate a QE buy back

of half of all government bonds issued rendering interest on bonds as fiscally neutral .