I started my undergraduate studies in economics in the late 1970s after starting out as…

The BIS remain part of the problem

The Bank of International Settlements published its – 84th BIS Annual Report, 2013/2014 – yesterday (June 29, 2014). Their message is that governments (particularly central banks) have been too focused on reducing short-term output and employment losses at the expense of a long-term focus on the financial cycle, the latter, which is in their view, essential to restore “sustainable and balanced growth”. I beg to disagree.

The BIS gained a lot of headlines in the last 24 hours from reporters who don’t seem to be able to cut through the sophistry. The basic claims by the BIS in this Annual Report have been put out by them over the last few years. Nothing very new and while there is some interesting and correct propositions in the Report, there is also a lot of incorrect surmise, which steers the policy debate in exactly the wrong direction.

The BIS Annual Report is quite technical but can be summarised relatively simply for a lay audience.

A basic claim by the BIS is that the Global Financial Crisis was a long time in the making (p.7):

… the crisis was no bolt from the blue, but stemmed almost inevitably from deep forces that had been at work for years, if not decades.

We can agree with that. Despite the denial by the mainstream economists who rely on so-called New Keynesian models to analyse policy developments, economists in the Modern Monetary Theory (MMT) school have argued since, at least, the early- to mid-1990s that the world was heading for a major financial crisis.

Other economists who understood the work of Hyman Minsky were of a similar view. But the mainstream New Keynesians didn’t utter a word of caution.

Moreover, the policy changes that were being promoted by the mainstream economists, including those at the BIS which can be summarised as labour and financial market deregulation and passive fiscal policy (bias towards surpluses) over the last 3 decades, were principle causes of the crisis.

But the BIS, like many of the mainstream, are now trying to reposition themselves to regain the credibility they lost in the crisis. Now they seem to be lecturing the world about economic wisdom, when their track record demonstrates anything but.

It is amazing that the mainstream is now claiming virtue by fact that there is now a ‘rapidly growing literature’ seeking to remedy the almost total disregard my profession has had in the past for financial markets. The belief was that these markets are so efficient that they could never create any major problems because poor commodities, behaviour etc would be eliminated quickly by competitive processes.

According to the perceived (pre-crisis) wisdom, everyone would soon work out that a product had too much risk associated with it relative to return and it would die on the vine. The mainstream economists were too busy recommending more deregulation and fiscal cutbacks to see the elephant staring them in the face. It was denial on a grand scale.

The problem is that all the new developmets in the academy still use deeply flawed frameworks of the monetary economy. The models will become more elaborate and include various stylised observations about financial markets (for example, non-linear feedbacks between asset prices and funding in different states of liquidity where financial institutions mark-to-market and impose margin calls etc). But they will forever remain deficient and should be disregarded.

A whole generation of new PhD students will emerge extolling the virtues of their new models of financial cycles etc and like the previous generation that ignored them they will exit their programs basically illiterate with respect to the way the real world operates.

That won’t stop them though from arrogantly strut around within the large institutions like the BIS and the IMF etc solving complex (linear) models, and eventually, as their seniority progresses, they will telling governments what to do.

The advice given will be exactly what governments should not do.

The other point is that the mainstream are great at inventing things that have been known for years. As they respond to empirical anomaly (basic failures of their ‘models’ to correpsond with reality), they make ad hoc additions to the existing flawed base of theory.

The problem is that most of the new insights, particularly about financial cycles were known by those who studied authors such as Hyman Minsky and his financial fragility hypothesis. The mainstream basically disregarded Minsky’s work before the crisis because he was seen as operating in the Post Keynesian tradition, the anathema to the neo-liberalism of New Keynesian economics, the dominant paradigm of modern economics.

Once the GFC hit, a lot more people were claiming to know about Minsky and quoting him. Sort of a reversal of the phenomenon of ‘No Nazis to be found in Germany in late 1945’. Suddenly, everyone wanted to talk about financial fragility and over the last five years, the link to Minsky has faded as these new ‘experts’ try to take credit for warning the world about financial cycles. It is ridiculous really how brazen these characters are.

It is interesting that in their 256 page Annual Report, BIS mention Minsky once (p.49) and then it is not his work they cite but rather someone other paper at the ’21st Hyman P Minsky Conference on the State of the US and World Economies, 11-12 April 2012′. I found that lack of credit for the ideas to be intellectually bereft – even though it is typical of the mainstream approach.

The BIS argument can be summarised as follows:

1. Financial cycles (whatever they are) are ‘long-term’ (whatever that is) in nature and require a long-term focus.

2. The temporality of these cycles and the focus necessary to understand them “should extend well beyond the time span of the output fluctuations (“business cycles”) that dominate economic thinking” (p.7). Which means that politicians will typically ignore the financial cycle dynamics as they pursue politically popular policies, which aim to manipulate the business cycle in their favour.

The BIS say that the economic cycle(p.7):

… is the reference time frame for most macroeconomic policy, the one that feeds policymakers’ impatience at the slow pace of economic recovery and that helps to answer questions on how quickly output might be expected to return to normal or how long it might deviate from its trend. It is the time frame in which the latest blips in industrial production, consumer and business confidence surveys or inflation numbers are scrutinised in search of clues about the economy.

But they say “this time frame is too short” (p.7) because financial cycles – which “can end in banking crises … tend to play out over perhaps 15 to 20 years on average” (p.7).

3. The “bottom line is simple” (p.8) – Nations need “to complete the process of repairing balance sheets and implementing structural reforms” (p.3). Household and firms are still carry excessive debt after the previous financial boom. The associated problem is that “many banks face lingering balance sheet weaknesses from direct exposure to overindebted borrowers, the drag of debt overhang on economic recovery” (p.5).

4. Governments must focus more on long-term “structural reforms” (p.8) and reduce focus on “on monetary and fiscal stimulus” (p.8) because the “supply side is crucial” (p.8).

We read the extraordinary statement (p.8):

Good policy is less a question of seeking to pump up growth at all costs than of removing the obstacles that hold it back.

As if the supply-side is holding back growth. Millions are unemployed. Capacity utilisation rates in industry are still well below their potential.

What will bring these idle resources and capacity back into productive use? More spending! If the private sector is unable for whatever reason (confidence, restoring balance sheets etc) then the increased spending has to come from the government sector.

There is no sense to the statement that a currency-issuing government or a euro-zone government funded by the ECB cannot increase spending and bring these resources back into use.

To argue that fiscal policy has reached its limits in this sort of environment is a basic lie and reflects conservative ideology rather than fact.

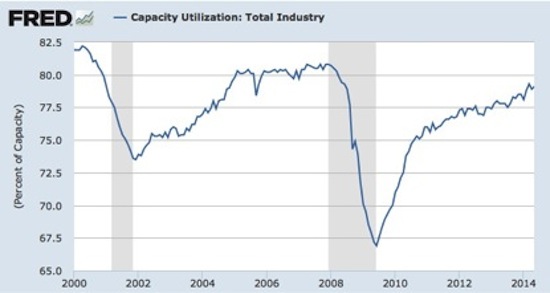

The US Federal Reserve, for example, publish monthly – Industrial Production and Capacity Utilization – G.17 – data.

The following graph shows Total Industry Capacity Utilisation (% of total) from January 2000 to May 2014. The gray shaded areas are the peak-to-trough NBER recession periods.

The current rate of utilisation is still well below the previous peak before the crisis. There is still room for expansionary fiscal policy to bring more idle resources back into production.

Other economies are in much worse shape than the US economy. There is no reason to believe that the major economies including the US are at full capacity and only supply-side policies will benefit growth.

The next graph shows a longer view (from January 1967), which lets you see the downward trend in total utilisation over the longer period. The trend to lower capacity utilisation rates began after the 1982 recession and broadly corresponds with the resurgence of neo-liberal ‘supply-side’ economic policies, exactly the type that the BIS consider are essential to resurrect growth now.

This was the period when demand-side management was eschewed in favour of deregulation, privatisation and other manic policies, which were all aimed at tilting the balance away from workers to capital.

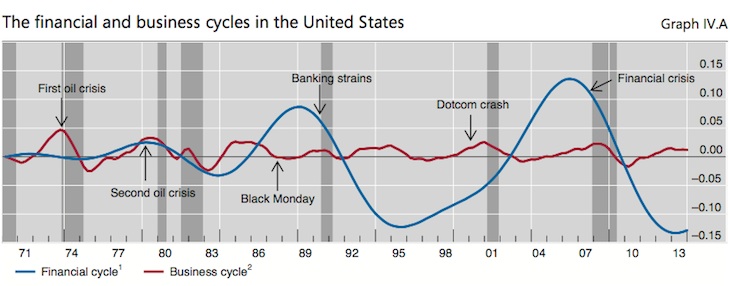

It is now well-established that financial cycles are longer than the usual ‘business’ or economic cycle. When we talk of the business cycle we are talking about the fluctuations in real GDP growth (and the accompanying real aggregates – employment, income etc).

The BIS analysis clearly shows that this cycle is shorter than the typical financial cycle.

They produce an interesting graph (Graph IV A) which I reproduce below which shows the two types of cycles for the US from the early 1970s to 2013. The BIS describe the graph in this way:

The traditional business cycle frequency is around one to eight years. By contrast, the financial cycles that matter most for banking crises and major macroeconomic dislocations last 10-20 years … Focusing on medium-term frequencies is appropriate for two reasons. First, credit and property prices move much more closely together at these frequencies than at higher ones. Second, these medium-term cycles are an important driver of overall fluctuations in these two series, much more so than medium cyclical fluctuations are for real GDP. Financial cycles identified in this way are closely associated with systemic banking crises and serious economic damage. This holds irrespective of whether they are identified with a turning point approach or a statistical filter.

Note that the amplitude (size of swing) of the financial cycles has increased dramatically in the post 1980 period. As noted above in relation to capacity utilisation, this is the neo-liberal period of deregulation when the religious belief in the efficiency of financial markets peaked.

Recall that after the 1990s, the mainstream macroeconomists were claiming that the “business cycle was dead”. Please read my blog – The Great Moderation myth – for more discussion on this point.

After the rise of Monetarism in the late 1970s, the mainstream economists waxed lyrical about the success of inflation targetting and claimed that the only thing governments should be doing was – in the words of the Chicago economist Robert E. Lucas at his 2003 presidential address to the American Economic Association:

… providing people with better incentives to work and to save, not from better fine tuning of spending flows. Taking U.S. performance over the past 50 years as a benchmark, the potential for welfare gains from better long-run, supply side policies exceeds by far the potential from further improvements in short-run demand management.

That is, more deregulation and hollowing out of the state. For Lucas and the majority of my profession “macroeconomics in this original sense has succeeded: Its central problem of depression-prevention has been solved, for all practical purposes”.

Meanwhile, the financial cycle heading towards the credit-fuelled boom as they were congratulating themselves and reinforcing the financial cycle by pressuring governments to deregulate even further, particularly in financial markets.

Articles by MMT economists at the time were predicting a major collapse of the financial markets based on our analysis of the sectoral balances and the growing precariousness of household and corporate balance sheets. For those who cared to include the financial markets in their analytical vision, it was obvious that the fluctuations in the financial cycle were becoming larger which meant that the crash would be that much bigger.

Stock-flow macroeconomics provided a framework for understanding those dynamics. But sadly, the mainstream models were not stock-flow consistent. Please read my blog – Stock-flow consistent macro models – for more discussion on this point.

The BIS acknowledge that there is a link between the behaviour of the financial cycle and the policy context (p.66):

… financial cycles change with the macroeconomic environment and policy frameworks. For example, they have grown both in length and amplitude since the early 1980s, probably reflecting more liberalised financial systems, seemingly more stable macroeconomic conditions and monetary policy frameworks that have disregarded developments in credit. The significant changes in regulatory and macroeconomic policy frameworks after the financial crisis may also change the dynamics going forward.

Note that the BIS only cursorily mention that the financial liberalisation meant that policy makers (central banks, prudential regulators) lost oversight of financial markets and allowed a plethora of questionable practices, which extended to outright frauds to proliferate.

They use the phrase “disregarded developments in credit” but fail to acknowledge that they were among many institutions cheering on the deregulation. You won’t find any research paper published by the BIS in the pre-crisis period which analysed how this lack of oversight was occuring.

Anyone who questioned what was going on at the time were brutally put down within the academy, the public policy processes and/or the wider public debate. The BIS were part of the neo-liberal Groupthink.

For example, remember Brooksley Born, who was the head of the US Federal Commodity Futures Trading Commission and crossed the path of the so-called “Committee that Saved the World” (Alan Greenspan, Robert Rubin and Larry Summers). It was documented on the US PBS Frontline program The Warning which went to air in the US on October 20, 2009.

There was a segment which described Born’s first lunch with Greenspan after she was appointed as Head of the Commodity Futures Trading Commission. Apparently, Greenspan expressed a “disdain for regulation” and when she raised the issue of the problem of financial fraud Greenspan said that “the market would take care of the fraudsters by self-regulating itself”.

Born had wanted to regulate the growing and secretive Over the Counter (OTC) derivatives market and met with great resistance from Rubin, Greenspan and Summers. She told the program that “Alan Greenspan at one point in the late ’90s said that the most important development in the financial markets in the ’90s was the development of over-the-counter derivatives”.

When asked if Greenspan knew what he was talking about, Born replied “Well, he has said recently that there was a flaw in his understanding”. The last comment is in relation to testimony that Greenspan gave to the US Congress in October 2008 which I discussed in detail in this blog – Being shamed and disgraced is not enough.

Born got involved in the law suit filed by filed by Procter & Gamble against Bankers Trust. It is clear that BT were screwing Procter by selling them derivatives that were too complicated for them to understand the risk. The program reveals audio-tapes of Bankers Trust brokers talking about their deliberate “intention to fleece the company” (Procter). One said “This is a wet dream” while there was a lot of laughing about how smart BT was in “setting up” Procter as a pigeon (victim).

At that stage Born saw the need for government regulation of the financial sector (particularly the banks) but she met incredible resistance from the Adminstration and Greenspan. She sought to develop a “concept release” – a plan for regulation within the legal jurisdiction of the CFTC.

The Committee to Save the World came out publicly on May 7, 1998 with this Press Release from Rubin, Greenspan and Levitt (SEC Chair) issued by the US Treasury:

JOINT STATEMENT BY TREASURY SECRETARY ROBERT E. RUBIN, FEDERAL RESERVE BOARD CHAIRMAN ALAN GREENSPAN AND SECURITIES AND EXCHANGE COMMISSION CHAIRMAN ARTHUR LEVITT

On May 7, the Commodity Futures Trading Commission (“CFTC”) issued a concept release on over-the-counter derivatives. We have grave concerns about this action and its possible consequences. The OTC derivatives market is a large and important global market. We seriously question the scope of the CFTC’s jurisdiction in this area, and we are very concerned about reports that the CFTC’s action may increase the legal uncertainty concerning certain types of OTC derivatives.

The concept release raises important public policy issues that should be dealt with by the entire regulatory community working with Congress, and we are prepared to pursue, as appropriate, legislation that would provide greater certainty concerning the legal status of OTC derivatives.

This New York Times article from 2008 – Taking Hard New Look at a Greenspan Legacy provided a good summary of the events. It documented the fierce opposition that Greenspan, Rubin and Summers put up against any notion of regulation of the financial markets.

The PBS program showed us that Rubin set his attack dog … Deputy (Summers) onto Born. Summers made the incredible statement (that should have disqualified him from any further office given the developments that were to follow). In a phone conversation where he claimed there were 13 angry bankers in his office berating him, Summers shouted at Born:

You’re going to cause the worst financial crisis since the end of World War II.

He now cannot recall that conversation or ever making the statement.

Soon after, in the US summer of 1998 and unbeknown to the government, Long-term Capital Management collapses. Born captured her feelings when she found out:

… None of us, none of the regulators had known until Long-Term Capital Management phoned the Federal Reserve Bank of New York to say they were on the verge of collapse.

Why? Because we didn’t have any information about the market. They had enormous leverage. Four billion dollars supporting $1.25 trillion in derivatives? Excessive leverage was clearly a big problem in the market. Speculation? I mean, this was speculation, gambling on prices, on interest rates and foreign exchange rates of a colossal nature. Prudential controls? I mean, all these big banks had in essence … extended unlimited loans to LTCM, and they hadn’t done their homework. They didn’t even know the extent of LTCM’s exposures in the market or the fact that the other OTC derivatives dealers had been lending to them as well.

This was massaged away by the neo-liberals as nothing to worry about and they continued to resist regulation. By 2000, the Commodity Futures Modernization Act [CFMA] took away all regulative jurisdiction for over-the-counter derivatives from the CFTC. If you don’t like the rules then eliminate the umpire!

The behaviour of the financial cycles shown in the graph above were thus not “developments”. They were the result of a blind ideology that deployed erroneous macroeconomic models to justify policy changes which led, unambiguously to the malaise the world is now in.

The blind arrogance of my profession has caused millions of people to become unemployed and impoverished. It has led to huge write-offs in wealth for many people and cruelled the hopes of a reasonable retirement for many.

I am sure the Committee to Save the World have not been equally as damaged.

The BIS tell us that the GFC was a ‘balance sheet recession’. This is true and highlights that it is imperative to understand the nature of any real downturn because when they are linked to financial downturns the consequences for the economy and the correct policy response is different to situations when the real cycle is self-promoting.

Please read my blog – Balance sheet recessions and democracy – for more discussion on this point.

Most recessions begin and end in the real economy and are caused by a growing pessimism among firms (who invest) in the future state of aggregate demand. They respond to the downgrading of their revenue forecasts by slowing the growth of investment spending (capacity building) and laying off workers. The multiplier effects spread throughout the economy – one person’s spending is another person’s income – and a recession become inevitable if there is no other intervention (for example, government stimulus).

While these events can be very severe – they are generally relatively short and recovery is generally driven by renewed optimism as new investment seeks to expand market share at the expense of firms that went broke in the downturn or who have older vintages of technology (and hence higher costs).

This is the traditional V-shape business cycle. As you can see, from the graph above (for the US, which is not a special case) these real fluctuations can be occurring even during an upswing in the financial cycle.

However, when the real economy gets caught up in financial cycle downturn then the situation is different.

The sequence of events that define a balance sheet recession are:

- The private sector builds up massive debt levels to buy property and speculative assets.

- The asset prices rise as demand rises but then eventually the bubble bursts and the private sector is left with declining wealth but huge debt.

- The private sector then start restructuring their balance sheets – and stop borrowing – no matter how low interest rates go.

- All effort is devoted to paying back debt (de-leveraging) and households increase their saving and reduced spending because they become pessimistic about the future.

- A credit crunch emerges – not because there is enough funds but because banks cannot find credit-worthy borrowers to lend to.

- Attempts at pumping liquidity into the banks will fail because they are not reserve-constrained. They are not lending because no-one worthy wants to borrow.

- The faltering spending causes the macroeconomy to melt and output collapses and unemployment rises.

- Balance sheet restructuring for the private sector is a long process of saving and debt retrenchment.

- With this private contraction (reducing debt, saving) the only way out of the balance sheet recession is via public sector deficit spending.

Increased public deficits above the norm are required for an extended period to support income growth that allows the private sector to save and restore the viability of their balance sheets.

The BIS clearly understand that the private debt dynamics are still precarious. But they go into denial when they claim that “More emphasis on repair and reform implies relatively less on expansionary demand management” (p.15).

And the ideological position of the BIS doesn’t take long to surface, in this context. The BIS claim as an overarching constraint on growth that (p.9):

Particularly worrying is the limited room for manoeuvre in macroeconomic policy.

What does that mean? Not much of substance is the answer.

The BIS claim that:

After the initial fiscal push, the need to ensure longer-term sustainability has been partly rediscovered. This is welcome: putting the fiscal house in order is paramount; the temptation to stray from this path should be resisted. Whatever limited room for manoeuvre exists should be used, first and foremost, to help repair balance sheets, using public funds as backstops of last resort. A further use, where the need is great, could be to catalyse private sector financing for carefully chosen infrastructure projects … Savings on other budgetary items may be needed to make room for these priorities.

This is the austerity mantra that, in part, led to the crisis in the first place.

First, the BIS doesn’t distinguish between currency-issuing governments, which have no financial constraints on their spending and those governments such as the euro-zone nations that deliberately chose to use a foreign currency.

There is no meaning to the statement that there is “limited room for manoeuvre in macroeconomic policy” for the former nations because their debt ratios are high. The only constraints these governments face are the availability of real resources (goods and services) to purchase.

With millions of workers still unemployment or underemployed there are ample resources to purchase.

Second, the real cycle helps the financial cycle to resolve itself. How? If the government deficits support real GDP growth, national incomes start to rise again and, given saving is a positive function of income, households are able to continue de-leveraging while enjoying some capacity to resume consumption spending without borrowing.

Firms are also given an incentive to renew capacity building (investment) as consumers signal they are able to spend more freely again (without recourse to the credit binges that created the problem in the first place).

Third, given that the balance sheet adjustments take a long time to work their way through (reducing debt is a slow process), policy makers have to understand that fiscal stimulus should not be withdrawn at the first sign of real GDP growth. For many years after the trough, private spending will remain subdued (relative to the pre-crisis behaviour) and aggregate demand will require on-going support from budget deficits.

This is why the current austerity push is so damaging. It is not only directly undermining real GDP growth at at time when the non-government sector is unable to pick up the gap (and is more intent on reducing their debt exposure), but also prolonging the financial cycle downturn – because it is thwarting attempts by households and firms to stabilise their balance sheets.

Fourth, note the bias in the BIS recommendation – that any fiscal spending should be targetted at banks etc rather than enhancing income support and providing job creation opportunities.

Conclusion

The fundamental point is that during a balance sheet recession the problem is too much non-government debt. But somehow the neo-liberals (who caused the crisis) have reconstructed the problem as too much sovereign debt.

This logic is just plainly false. The debt that a household, which uses the currency, carries is a burden on its future capacity to consume because it has to be funded in some manner. The debt that a government holds does not constrain its capacity to spend in the future. There is never a solvency issue with sovereign government debt if the government issues its own currency and only has liabilities in that currency.

The problem though is that by reconstructing the problem as a sovereign debt issue – the logic that follows merely prolongs the agony.

Governments will have to commit to large deficits for years to come to allow the financial cycle to resolve itself.

While committing to supporting aggregate demand growth, the governments should also be putting in place a robust regulatory framework that reduces the amplitude of the financial cycles and ensures they are relatively short, especially in the periods of euphoria (that is, prevent asset bubbles).

That is where the structural reforms have to be focused. A lot of the

References

Minsky, H.P. (1977a) ‘A Theory of Systemic Fragility’, in Altman, E. and Sametz, A. (eds.), Financial Crises: Institutions and Markets in a Fragile Environment, John Wiley & Sons, New York, 138-52.

Minsky, H.P. (1977b), “Banking and a Fragile Financial Environment”, The Journal of Portfolio Management 3(4): 16-22.

Minsky, H.P. (1982), Inflation, Recession and Economic Policy (Wheatsheaf, Sussex: Brighton). Printed in the United States as Can “It” Happen Again?: Essays on Instability and Finance, M.E. Sharpe, Armonk.

Minsky, H.P. (1986) Stabilizing an Unstable Economy, Yale University Press, New Haven.

Minsky, H.P. (1992) ‘The Financial Instability Hypothesis’, Working Paper No. 74, The Jerome Levy Economics Institute of Bard College, May.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Dear Bill,

How do you explain/justify this statement? If debt is the problem, then why can recognizing/writing off the debt not be a solution?

Bill et al.

I note the BBC have quoted the BIS report:

To me the phrase “transmission chain” is code for “trickle-down effect”. The clue is in the name – any positive effects of QE and other monetay policies amount to just a trickle. The “transmission chain” is not “badly impaired” – it was mostly an illusion in the first place.

The BIS then say:

So they fail to connect these two things and reach the appropriate conclusion that trickle-down does not actually work. To the extent that QE may have stimulated financial markets and generated a mere trickle for the real economy, it has been offset by dangerous speculation in commodity and other markets -hence the disconnect.

Kind Regards

It seems to me the highish deficits (despite the rhetoric) have influenced the UK economy for the better over the last few years. The politicians must know this but they can’t say so because it’s political suicide.

A crazy state of affairs with the financial media, of course, totally ignoring the inconsistencies.

Despite the high deficits though public services are still suffering and today it was announced that flexible working would be introduced for all workers (at least they would have the right to ask for flexible hours).

This won’t do much for those on zero hours contracts. Flexibility it seems works both ways.

“Nobody has been corrected; no one has known to forget, nor yet to learn anything”.

Charles Louis Etienne in 1796

Bill,

Whilst not disagreeing with your analysis at the financial and business level, I wonder whether limits to growth are now also having an impact on the world economy? Surely resource limits are coming into play with;

(a) most of the cheap, easy to obtain oil being used and the 2nd half of the endowment (after peak oil) being expenseive to obtain in both financial and EROEI (Energy Return on Energy Invested).

(b) wild fisheries 90% destroyed.

(c) old growth forests at least half destroyed

(d) climate de-stabilisation damaging crops and much more infrastructure each year.

And so on and so forth.

DNM

“How do you explain/justify this statement? If debt is the problem, then why can recognizing/writing off the debt not be a solution?”

Once you understand that spending equals income it will become much clearer.

@Alan Dunn

I believe I do understand that, but I don’t think it answers my question. Bill says that “[b]alance sheet restructuring for the private sector is a long process of saving and debt retrenchment”, but one major reason for this is that insolvent banks are allowed to continue operating, hiding bad debt for many years until they are financially strong enough to recognise it. The problem is not just the lack of net financial assets but also unproductive circulation of “horizontal” money.

Seconded. If you think of dollars as IOU’s, there is always an I and always a U. Every credit is someone else’s debit (one way or another). In other words, all credits, assets, debits and liabitlies denominated in a given currency must add up to zero.

Ikonoclast

If one were to consider that the ‘fiat’ currency is the tool governments use as currency monpoly holders to actuate technological progress to solve said ‘issues’ by putting people into work. Then it follows that the ‘method’ (MMT/full employment/job guarantee) that puts more people to work is going to be better than a ‘method’ puts less people to work in general.

Bill’s article points out economic stagnation/underutilisation/inequity for really what is no good reason. As a concequence the government/private sector is going to deal with those issues less optimally.

Could be argued like this: capitalism’s drive to create new products is not going to be as effective at solving real world environmental problems. Consumers will have less certainty and wont be able to take on products which reduce environmental footprint. (throw in a large amount of inequality, rigged market capitalism and no wonder there are these issues).

(a) You’re talking about energy: solution? bio fuel, oil from bacteria or algae (all the other renewables eg: like base load solar which is cheaper than subsidized coal now in Australia)

(b) You’re talking about food: solution? Non-wild fisheries. Sustainable fishing. (other food)

(c) You’re talking about building material: solution? Plantations, silviculture. Pay to keep old growth forests/biodiversity.

(d) Climate change: Massive restructure of technology toward recycling, clean energy etc.

Nothing Bill has mentioned is averse to these limits. In fact i’d say the economic concepts discussed are more optimal to solve the very issues you’re illustrating. This is all ‘work’ intensive and currently the work to solve these is not being done because of sub optimal economics.

Note:

To prove said point: If you’re not Australian you may not know for instance there were massive ideological ‘budget cuts’ to the scientific research institution (CSIRO) in Australia.

That is an artificial constraint which will only make those hard constraints more likely to cause problems.

dnm

If the non-government sector reduces its spending to lower its debt then income falls.

To keep the economy on track the government would need to fill the gap [deficit spending].

The problem is about government surpluses forcing non-government deficits which are not sustainable for the non-government sector to hold.

The government does not face the same budget constraints as the non-government sector. And as such it is preferable for the government to be in deficit than the non-government sector if your goal is full emplyment.

Those that have abandoned full employment as a policy goal though are more than happy to disagree.

dnm

the only debt jubilee which will not bankrupt the lenders would be

one funded by the central bank .With or without issuing bonds this

would still be government sector deficit .

It is important to distinguish between stocks and flows if private sector

debt was granted an amnesty but government sector balances still pursued

household debts would just rise again.

@Alan Dunn

@Kevin Harding

Thanks for your comments. It is indeed important to distinguish stocks and flows. I don’t have any training in economics, and I may well screw up. However, the point I was originally trying to make is that the need to maintain a pretense about improperly accounted stocks (bank assets) drives behaviour in the real economy, namely spending/savings decisions.

I made no comment about government surpluses and indeed the scenario we are discussing (the balance sheet recession) does not require them.

So, recognizing bank losses may well cause bankruptcies that would certainly alter total private wealth holdings, but hopefully, the effect on the flows that are measured by GDP would be smaller, and of shorter duration. Under Bill’s proposal, the government is obliged to support bank malfeasance indefinitely, simply in order to stabilise the economy.