I started my undergraduate studies in economics in the late 1970s after starting out as…

Wealth inequality rising slowly in Australia

The Australian Bureau of Statistics released the – Household Wealth and Wealth Distribution, Australia, 2011-12 – today, which is drawn from the bi-annual Survey of Income and Housing (SIH),first published in for 2003-04. My interest is in how the distributions changed during the period of the crisis and the fiscal stimulus. We are currently working on an update to our – Employment Vulnerability Index – which we hope to release sometime next week. The preliminary results suggest that the fiscal stimulus significantly reduced the risk of job loss in the period after the crisis. But more on that when we have analysed our results more carefully. Today’s data shows that wealth inequality is rising slowly in Australia but will accelerate if the proposals to further demolish the income support system and increase tax breaks for the wealthy are introduced after the next election.

The publication – 6554.0 – Household Wealth and Wealth Distribution, Australia – provides the detailed analysis of the – Data.

The data is in fact a good case study of when to use median rather than the mean of a sample. Students studying statistics learn about when the mean should be used as a measure of central tendency and when the median is more suitable.

Both statistics provide some guide to where the “middle” of the sample (or population) is. However, their use is not straightforward.

The mean weights all observations equally and comes up with an “average” of the observations. But if there are outliers (extreme values) then it will likely give a flawed viewed of what is average despite the better mathematical and statistical properties that the mean possesses.

When a distribution is skewed to the right (which means it has an extended right-hand tail with extremely high values) the median will be less than the mean and is generally the better measure.

This applies to the case of income and wealth distribution data, where the very high income or wealth holders push the average up well above the median and make it look as though the socio-economic well-being of the sample is higher than the reality.

The ABS report that:

In real terms the value of mean household net worth in 2011-12 was $728,000 which is not statistically different from the value of mean household net worth in 2009-10 ($759,000). However the value of mean household net worth in 2011-12 ($728,000) is 9% higher than in 2005-06 ($667,000) and 24% higher than in 2003-04 ($585,000) …

Conclusion, we are on average, wealthier by a considerable margin relative to 2003-04 and not poorer relative to 2009-10.

However, in terms of the median net worth ($A434,234 in 2011-12 and $A368,813 in 2003-04) the growth was only 18 per cent.

Before we draw conclusions therefore, we should consider the distribution of the net worth data.

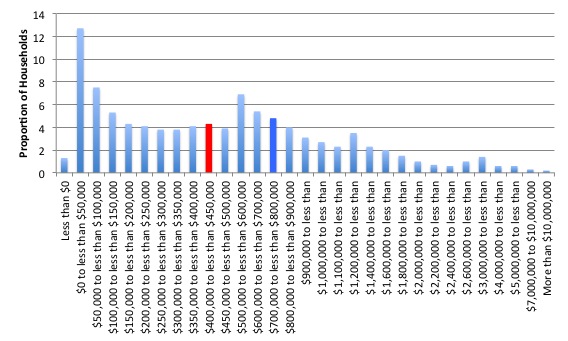

The following graph is compiled from data in Table 2 of the release. It should the distribution of household net worth in 2011-12. The brighter blue column is the range the mean sits in and the red column is the median range (noted above).

The ABS report that:

While the mean household net worth of all households in Australia in 2011-12 was $728,000, the median (i.e. the mid-point when all households are ranked in ascending order of net worth) was substantially lower at $434,000 … This difference reflects the asymmetric distribution of wealth between households, where a relatively small number of households had high net worth and a relatively large number of households had low net worth …

The data (from ABS Table 2) shows that “over 1.2 million households (14%) had net worth less than $50,000” while “114,000 of these households having negative net worth (1% of all households)”.

Around 75 per cent of the households had below average net worth.

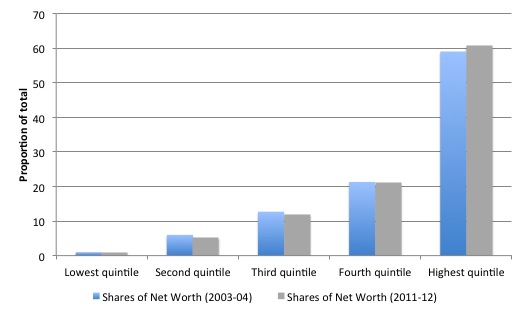

The next graph shows how the net worth distribution has changed since 2003-04 by quintile. In 2003-04, the highest quintile had 59 per cent of the total net worth, rising to a peak of 62.2 per cent in 2009-10 and falling back to 60.8 per cent in 2011-12. The increased share has been at the expense of the middle three quintiles.

In absolute terms, the average household net worth has risen from $A585,264 in 2003-04 to $A728,139 in 2011-12, a rise of 24.4 per cent. However, overall, the average fell by 4.1 per cent in years between 2009-10 and 2011-12.

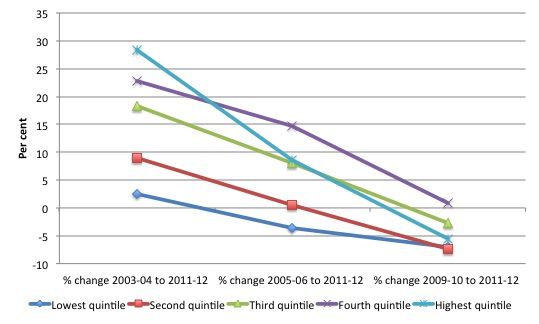

However, the overwhelming benefits of that growth has been in favour of the highest quintile which enjoyed a 28.3 per cent growth in their net worth, notwithstanding a 5.5 decline in the period 2009-10 to 2011-12.

The lowest quintile enjoyed an overall rise in net worth of 2.5 per cent between 2003-04 and 2011-12 but were much more impacted by the downturn with a loss of 7 per cent of net worth between 2009-10 and 2011-12.

The second quintile also lost 7.4 per cent of net worth over the last two years.

The following graph summarises the percentage changes in net worth for three periods – 2003-04 to 2011-12; 2005-06 to 2011-12 and 2009-10 to 2011-12 for each quintile.

In terms of income distribution, the ABS note that:

The distribution of wealth shows greater variability when compared to the distribution of incomes. This can be seen by analysing percentile ratios. The net worth of the households at the top of the 80th percentile was 11.6 times higher than the net worth of the households at the top of the 20th percentile (i.e. the ratio of the value of the top of P80 to the value at the top of P20). The corresponding P80/P20 ratio for gross household income was 4.5 …

There are many reasons why the inequality of wealth is greater than for income. The pattern is replicated in most nations.

The ABS note that life cycle effects contribute to this – younger households with high income are building wealth and older households with lower income are running down wealth.

Close analysis of the data also shows how important government pensions and other income transfers are to lower income recipients.

In terms of Equivalised Disposable Household Income, 73.3 per cent of total income earned by households in the lowest quintile comes from Government pensions and allowances. This proportion drops to 32.6 per cent for the second quintile and 3.9 per cent for the third quintile.

The constant attack on government income support payments to lower income groups undermines this redistributive capacity. But the data suggests that so far, those attacks have not undermined the capacity completely.

How do these changes and proportions compare to what we know about the US? I most recently (May 7, 2013) discussed movements in the US wealth distribution in this blog – Lower deficits now, undermine our grandchildren’s future.

The work of Ed Wolff shows that in 1976, the top 1 per cent of Americans held 19.9 per cent of total wealth in the US. In 2007, they held 34.6 per cent and by 2010 they held 35.4 per cent. In other words, the top 1 per cent have increased their share of total wealth. In 1983, the bottom 80 per cent had 18.7 per cent of total net worth. By 2010, that share had fallen to 11.1 per cent.

Further, while the Great Recession has wiped out wealth across the board it has impacted mostly on the bottom end.

[References: Wolff, E. N. (2012). The Asset Price Meltdown and the Wealth of the Middle Class. New York: New York University].

The ABS data, as presented, does not allow exact comparisons. But today’s ABS Australian data shows that the bottom 80 per cent had 41 per cent of total net worth in 2003-04. By 2011-12, that share had fallen to 39.2 per cent.

So while the top quintile have increased their share over that period a little, the relative shares are very different to the US. The bottom 80 per cent in Australia have a much greater share of net worth and have largely maintained that share over the last 10 years.

Conclusion

Relative short blog today as I have been immersed in number crunching. But this data release confirms that while income and wealth inequality has risen in Australia since the crisis began, the changes have not been as stark as in the US.

There is something to be said for a more comprehensive and progressive tax and transfer system (in Australia relative to the US).

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

I know this can be found elsewhere, but would be interesting to see this laid out for the US. Going back to ~ 1980, when the change really began to take off.

Bill, I wonder if we could have a short philosophical discussion about inequality? The historical records and thus the empirical data show that inequality has been the norm in most times and most places. Norms are not always good of course. Nor do I want to advance a fatalist argument by saying inequality is a natural and inevitable state for societies. What I do want to raise is the issue of how difficult the fight is for equality. The overall record shows that inequalities of wealth and power have been the norm throughout almost all of history and that a major reversal of this (with significant ups and downs and several huge wars) occurred from about the 1850s to the 1960s, at least in the Anglophone and EU spheres. But genuine progress was made and the inequality beast was tamed somewhat.

However, since about 1970 this has slowly but relentlessly gone into reverse. Equality gains have been steadily eroded. Workers have lost out, capital has re-asserted its power and inequality has steadily risen again. At the same time (of course these things a re linked) we have seen the political Overton window and real policy move to the far right. Examples include almost the two major parties in Australia vying to be the harhest and most inhumane to refugees. And also include the US’s move to the far right as it becomes the total surveillance society with an act (the Patriot Act) which essentially suspends all citizen and human rights at Executive whim.

There seems to me to have been a deep tendency thoughout human history to absolutism and a very tough fight of it for democracy, equality and human rights (for all). I thought we were overcoming this and making progress at least until 1971 (when I was just a 17 year and starting to think deeply about history and politivs). The reversal since 1971 is somewhat baffling and I wonder what is driving it. Marx provides some answers of course by identifying the true nature of capitalism and its tendencies. John Ralston Saul is interesting in pointing out the opposition (not complementarity) between democracy and capitalism and indeed between democracy and corporatism.

The left (even the moderate left) have been losing the fight since about 1971. To my mind there are no signs this is about to change. The fundamentalist neoliberal right has a stranglehold on the discourse and on the perceptions of what is possible. It would seem that Marx was right about capitalism. It would destroy every other value and reduce everything to the money nexus. Late stage capitalism and its progress (or perhaps regress) validates Marx’s predictions. No hope is available if and until capitalism is overthrown. Capitalism is now maladaptive as all thinkers know who understand AGW (Anthropogenic Global Warming), species extinctions and LTG (Limits to Growth) to name just three salient issues.

However, the collapse (or overthrow) of capitalism may bring no hope either. Damage to the biosphere and its sustaining capacity suggests a collapse into semi-barbarism at best. The historical record suggests humans or rather the powerful elites will respond with an intensification of absolutism and savagery. It is quite a puzzle to determine how we might turn matters around. I am tempted to be much like a mature Candide and close my mind to the greater world (where it seems no real hope is left) and cultivate my own garden.

Bill, somewhat related note, happened across this today and thought it might interest you. Pamphlet from the 1960s urging a full employment policy in the U.S.

http://www.insidehighered.com/views/2013/08/21/interview-paul-le-blanc-freedom-budget-all-americans

via: http://www.insidehighered.com/views/2013/08/21/interview-paul-le-blanc-freedom-budget-all-americans

Oops, sorry about that, here’s the original pamphlet:

http://archive.org/details/freedomBudgetForAllAmericansBudgetingOurResources1966-1975To

@Ikonoclast

I have similar misgivings about purely mental approaches to fundamentals of being: human beings come in layers. I mean, mind is the field in which inequality struts: can you trust the problem-maker to become the problem-resolver? Mind is also the field of knowledge. But knowledge as we know, is never enough.

For me, and simply put – inequality, cruelty, are just some of the many-headed hydras that arise from a body of energies that (among others) we label ‘Greed’.

At the centre of greed in a human being is the self – that little thing called ‘I’ that wants so much. It is the ‘I’ that directs these energies. Greed and the hydras belong to us; Generosity also belongs to us, and the ‘I’ belongs to us. These are the simple ingredients of the dilemma you are expressing I believe.

Greed in itself exists because of a vacuum – the kind of energy that rushes in when Generosity has withdrawn; even just a little. The ‘I’ is the slave of these energies. It is the slave of greed and may be the slave of Generosity if it is formularised by the mind: true generosity arises from the heart and is free. When there is light in a room, even if it is just one little candle, everything is seen as it is: darkness is not an entity – light is the entity, and darkness dissolves before it; darkness is just an absence. In human beings, ‘light is understanding’. When there is Generosity in the human heart, all human need is seen as it is; greed is not an entity – greed is simply the absence of the entity (energy) Generosity, and greed dissolves before it; kindness always answers to human need and dissipates greed. I think it is that simple!

The ‘I’ dancing to greed is just water running out into the desert. Death draws a line across this dance of mind-blown ego-phantasy: the heart which is real, remains empty and aches! Mind can do nothing about that. Mind is always constrained. Mind fears the unknown! It fears losing control. Death breaks the most arrogant ego like a pencil, the mind deflates like a balloon. Even if it is just for a few seconds, before Death carries them away – people cannot escape their own reality. Recently I heard: ‘society is the bread that we bake, but we are the individual grains of wheat’. The wheat is ground up to make the bread and loses its individuality in that sense, but the ‘I’ remains. Recently I heard a 104 year old lady express that the most important thing to her was a sense of her personal self!

I would redefine the beginning of ‘intelligence’ as the ‘I’ free of Greed. Intelligence to me is the ‘I’ itself – not the mind which is just a palette. I would define the beginning of consciousness as the day Generosity is allowed to arise from the human heart, and the ‘I’ embraces it and understands. Then the field of the mind will change as the players that play in the field change. It won’t happen overnight. Then we might begin to focus on the real question of human existence: what in reality is this ‘I’? What is this energy that breathes Life into me? What is consciousness? I would most assuredly cultivate your own garden and chat with other gardeners. For me, the greatest field of exploration is the human heart and the seed within. There is always hope for the greater world because there is always Hope within. Hope is our shield and we should never lower it to all of the stupidity.

After 200,000 years on the road, what is a human being?

That is our basis.

Hey Bill – met you some years ago at the ARCNSISS symposium. Please to find your blog while searching for income inquality in Australia. Just wondering if you have released your employment vulnerabilty index yet?

Dear Rebecca Wickes

Thanks for your comment. We plan to release the new EVI on Monday, September 30. We are just tinkering with our map server and the underlying databases at present.

best wishes

bill