I started my undergraduate studies in economics in the late 1970s after starting out as…

Our national broadcaster has become part of the problem

There was a time, in better days, that the evening news had news, sport and weather. Then, at some point, around the 1980s the national news started to host a Finance segment. Sometimes these segments are meagre reporting of what happened in the share markets. Even that benign news is symptomatic of the way neo-liberalism has infested our daily thinking and made the common folk feel part of the game that they are really can never be part of – wealth creation. At other times, the finance segments introduce economic theory and analysis as if it is news. Then the insidious nature of the neo-liberal propaganda machine becomes stark. But the starkness is lost on most because they think it is news and we have been led to believe that what gets pumped out at 19:00 on the national broadcaster (and other times by other broadcasters) are facts. Facts don’t lie do they? Well, when it comes to finance segments they are mostly lies.

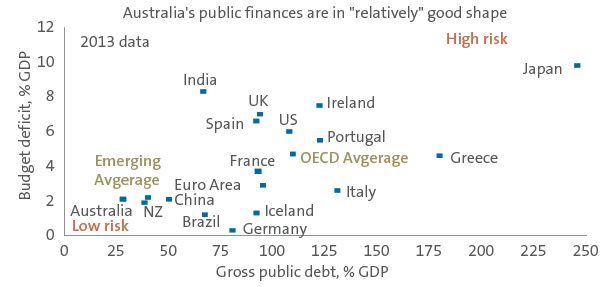

On Thursday, two days after the federal budget was released, the finance segment on the ABC evening news provided a graph that purported to show what was at risk if the Australian government didn’t return to surplus as promised.

I cannot show you the graph that was derived from the following graph by the presenter of the ABC finance segment each night. They haven’t, as yet put the segment up on their homepage. But it embellished the above graph by placing a diagonal separation line to form high risk and low risk regions.

While the graph for the TV segment was tarted up by the presenter, it was taken from a report (May 15, 2013) – The 2013-14 Australian Budget – struggling back to surplus – by Shane Oliver who is the AMP Capital’s Chief Economist.

I downloaded the graph, which depicts, spelling errors and all a scatter plot of selected nations with the Gross Public Debt as a percentage of GDP on the horizontal axis and the Budget Deficit as a percentage of GDP on the vertical axis. What such a scatter plot is telling us is anyone’s guess given the bi-directional causality and the cyclical nature of both aggregates. That is just a start though.

The report was part of his regular briefings in his professional role with that financial organisation. Presumably investors read them. Clearly, the presenter of the finance segment on ABC News reads them.

AMP started life as a small-time life insurance company with its agents knocking on household doors during 1950s Australia hoping to flog policies that were rarely of any value to the holders (in NPV terms). But as the financial industry started its massive growth surge, spin-offs like AMP Capital became big in funds management, in particular real estate and infrastructure.

So not only do they fuel asset price booms and participate in major shopping centre developments, where one gets lost for a weekend they are so big, but AMP Capital also is a major player in Public-Private Partnerships, which milk public money for massive private gain. In some specific cases distort public transport systems away from rail (by building toll ways that overcharge given the need for profit).

Anyway, I digress.

The graph was taken directly from Oliver’s 2013-14 Budget analysis, which I filed on my computer under a folder I call “spurious”. This folder contains lots of information that is pumped out into the world as fact but, in fact, is spurious at best.

This blog is, by the way, not a personal attack on Shane Oliver. He is part of the scene – it is the scene I attack.

This is the sort of graph that Rogoff and Reinhardt might have come up with.

The AMP Report provided the following commentary under a heading “The budget deficit – the good and bad”:

Given the coverage around a continuing budget deficit, it is worth putting it into context. First, some background. Just as with a household, a government’s budget deficit is the difference between the amount it spends (on social welfare, defence, infrastructure, health, etc.) and the amount it gets in revenue (from taxes, investment earnings, etc.). It has to be financed by borrowing and to do this, a government issues bonds (to investors such as super funds, insurance companies and foreign investors). The cumulative sum of all such borrowing is its public debt.

I guess from a senior employee of a funds management company that has an interest in fixed-income assets this sort of misleading statement is to be expected.

But the facts are:

1. There is no “just as with a household” when it comes to discussing government spending and revenue. The Australian government issues the currency that the household uses.

These two roles are so fundamentally different that attempts to conflate them in some “accounting” sense is meaningless and misleading.

2. While a budget deficit is the difference between what the federal government spends and what it receives as revenue it does not have “to be financed by borrowing”.

Has is the third person singular present tense of have. In the context used it would mean (Source):

… be obliged or find it necessary to do the specified thing

Here the difference between the essential characteristics of the monetary system in operation and the ideological/political layers that are put over those characteristics become important.

When I say the government does not have to finance its spending it is a recognition of the economic fact that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

Note: I confine the term “sovereign” to a currency-issuing government so I am using the term in a monetary sense, rather than as a description of the legal maintainers of some geographic borders. In my usage, Greece or Germany are not sovereign but Australia is.

Under the convertible currency monetary system (gold standard and its variants) the government was obliged as part of the intrinsic characteristics of that system to borrow to fund its net spending. That system largely died in 1971 when President Nixon abandoned US dollar convertibility.

The Euro monetary system shares some characteristics of the convertible system (member states face fixed exchange rates and are unable to issue the currency in use at will).

It is clear that after 1971, governments voluntarily maintained the practice of matching its deficits with some “funding source”. As neo-liberalism gained prominence as an ideology constraining government policy choices, those funding sources were narrowed to private market funds, except, of-course, when it was convenient for governments to suspend that charade and draw on its central bank capacity to create bank credits from thin air (computer data entries into ledgers).

So voluntary is not an obligation. The laws that say that the government has to match deficits with debt-issuance to the private markets are not set in stone. They could be changed in a flash. Even within the current legal framework the government can draw on central bank “funding” if it wanted to.

The “has to borrow” is thus not a binding economic constraint. It is a political issue and people should understand that. When an economist writes that the “government has to borrow” it misleads people into thinking it is an economic statement that is being made.

Further, the accounting charades that might surround such practices – for example, the government might legislate that it has to have the receipts from debt-issuance in a particular account and that account has to be in positive balance before a cheque it spends on can be issued – have no intrinsic relationship to the capacities of the government issuing a fiat currency.

We could easily have an account called “debt sales” standing separate in the books to signal how much non-government sector non-bond financial assets have been converted into non-government sector bond financial assets. Whether that it of interest is a matter of opinion. But that account would have no relevance for the accounts the central bank might keep to record credits its makes into private bank accounts on behalf of the treasury.

Tying the two accounts together and imposing some privileged sequence (money has to be in the debt sales before the credits can be made) is purely voluntary and has nothing to do with the intrinsic characteristics of the monetary system nor economic responsibility or prudence.

When we understand that deficit spending is the only way that net financial assets in the currency of issue can enter the economy then we also understand that the funds the government gets back when it issues a bond came from the government anyway in the form or past deficits – $-for-$.

If people really understood that governments just borrow back their own spending then the financial markets would be seen for what they are in relation to bond market activity – mendicants in receipt of privileged corporate welfare.

Bond issuance is totally unnecessary for the smooth operations of government fiscal policy. There is no essential reason that bond issuance is required for smooth monetary policy.

The central bank can maintain any interest rate target it chooses without open market operations. They are a throwback to the convertible currency system.

The AMP Budget Commentary continued:

While the A$19 billion deficit for this financial year is a lot of money, it needs to be compared to the size of the economy (A$1.5 trillion) to put it into context. This puts it at 1.3% of GDP and as can be seen in the first chart is a big fall from 2.9% of GDP last financial year when the deficit was A$43 billion. This is in fact the biggest reduction in a deficit in modern history. So despite the failure to hit the surplus target (which was always a stretch to achieve anyway) the budget deficit is still going in the right direction.

So context is important. But unfortunately the context provided – size of the overall economy – is also missing the point.

When considering whether a particular budget balance is appropriate it is not the size of the economy that matters. Rather, it is the balance of spending and output capacity, the latter which includes the state of the labour market.

It is the size of the output gap that matters not the absolute size of the economy (measured via GDP).

Would a deficit that was 4 per cent of GDP be worse than one that is only 1.3 per cent of GDP (as is the 2013-14 forward estimate)?

According to the AMP Capital commentary you would conclude the 1.3 is better than the 4. Note the last part of the quote “going in the right direction”.

Why is a movement from a $A43 billion deficit (2.9 per cent of GDP) to a $A19 billion deficit better (1.3 per cent of GDP) a movement in the “right direction”?

Well, it might be an appropriation reduction in government economic impact if the output gap was forecast to close in the coming financial year and unemployment was likely to reach its (low) full employment level.

We know from all the evidence available and even the Treasury’s budget estimates that real GDP will be at least $A60 billion below trend output in 2013-14. We know that unemployment is rising and predicted to rise further in 2013-14.

So if fiscal policy has any purpose one of its primary purposes is to close output gaps, which means the budget is heading in the wrong direction.

What the “biggest reduction in a deficit in modern history” achieved was exactly the opposite to what the neo-liberals said it would achieve. First, it reduced output growth and caused unemployment to rise. Second, in doing so, it undermined its own revenue base and thwarted the Government’s surplus aspirations.

Ken Davidson’s article in the Melbourne Age today (May 20, 2013) – A clever budget? More likely it gives the Coalition room to wind back the welfare state – says that:

… macro-economic policy is concerned about the impact government spending and revenue raising has on the rest of the economy. In a period of uncertainty, when individuals and private business decide to rein in their spending, unless the government steps in to fill the gap, incomes fall and unemployment rises.

Exactly.

His earlier point “that when expenditure is growing faster than the capacity of the economy to produce, governments should run surpluses”, the deficit dove view is, however, flawed and runs contrary to the quote above.

The point is that when expenditure is growing fast than the capacity of the economy to produce the government, if it is happy with the private-public mix in final output, should start reducing its deficit, which is not the same thing as running a surplus.

Whether it should run a surplus or not depends on what the external sector and the private domestic sector is also doing. If there is a very large external surplus (as in the case of Norway), then the private domestic sector can save overall and the government can run a surplus while the economy maintains full employment.

However, that is a special case and cannot apply to all nations because for every $ of external surplus there has to be a $ of external deficit.

In normal times, a nation with a current account deficit (such as Australia) will not be able to achieve strong economic growth, support a desire by the private sector to net save (overall) and run a surplus.

With a current account deficit, a nation can only run a budget surplus if growth is driven by increased private sector indebtedness. That is the way the last government achieved 10 surpluses in 11 years. It was atypical behaviour and, ultimately, unsustainable because the private sector cannot rack up increasing debt levels forever. We are now seeing a return to more typical household saving behaviour and private investment is dropping.

Ken Davidson then said:

… Keynesian economics have always been resisted by neo-liberals because they correctly see Keynesian policies as being consistent with social democratic agendas. The counter-revolution came in the form of the G7 finance ministers meeting in 2010, which agreed to an austerity agenda. This was built around the assumption that the deflationary consequences of cutting government spending and taxes would be more than offset by increased confidence, leading to an upsurge in consumer spending and private investment.

It was a seductive theory for those wedded to a right-wing political agenda involving a winding back of the welfare state, and who resisted the re-regulation of the financial system that precipitated the GFC in the first place.

He says that the neo-liberals promoted the idea that “continuing profligacy involving more deficit budgets would lead ultimately to more Greece-type crises.”

Which is the segue into the next item in the AMP Capital Chief Economist’s assessment of the 2013-14 Federal budget. He wrote:

What’s more, Australia’s budget deficit is tiny compared to other advanced countries. At around 2% of GDP across all levels of government, it compares to around 3% of GDP in the Eurozone, 6% in the US and 10% in Japan.

Similarly, Australia’s gross level of public debt at around 28% of GDP is very small compared to around 95% in the Eurozone, 108% in the US and 245% in Japan.

Which is meant to assuage us. All it does it perpetuate irrelevant assessments – note the comparison between Australia and the Eurozone, for example. At that point the graph above appeared.

Note the summary of the two corner positions – High Risk and Low Risk. We are not exactly told what the risk is but the implicit message is that those nations in the south-west corner are unlikely to become insolvent while those out in the high risk area are vulnerable.

To which a person who really understood this stuff and was being straight would say – nonsense. The graph combines oranges and apples. Certainly, the Eurozone nations are vulnerable to default (Greece has already done so courtesy of the Troika bullying bond holders to take a dive).

And what is Japan doing out there – high risk of what? Note the graph is in terms of Gross Debt. The conservatives always use that instead of net debt because they cannot then put Japan as an outlier. Not, of-course, that either aggregate matters in the ways they claim.

The logic the neo-liberals visit on us is this:

Logic Claim 1. Governments have to issue debt to fund their deficits – which is an untrue statement. They could stop issuing debt today, spend tomorrow and the sky wouldn’t fall in. But then the conservatives wouldn’t have the spurious debt stick to beat them with in order to stop them spending in areas that do not directly benefit the commercial interests of them directly or their mates, who then provide kickbacks to them in a variety of ways.

Logic Claim 2. But governments should have low debt because the bond markets will punish them otherwise so therefore should not spend – unless it benefits the commercial interests of them directly or their mates, who then provide kickbacks to them in a variety of ways.

Of-course, the level of debt a sovereign government has is largely irrelevant to its capacity to increase public welfare via high employment and first-class public services and public infrastructure.

Bond markets cannot “punish” a government via their demand for higher yields because the central bank can maintain whatever yield it wants by offering to by any quantity of public debt at that target.

Bond markets are also hypocritical – when bond markets get to thin they scream blue murder because the public “teat” that nourishes them starts to dry up. Think back to 2001-02.

What happened? The Australian government caused the official bond markets to dry up when it used the surpluses it was running to run down outstanding debt. The Sydney Futures Exchange led the charge and demanded that the Government continue issuing debt, which gave the game way – if debt-issuance was to fund net government spending (deficits) then why would they be issuing debt when they were running surpluses?

Answer: it was patently obvious that the outstanding debt was private wealth and its risk-free nature allowed the private investment institutions to price other risky assets and maintain a safe haven when uncertainty rose (by holding bonds).

It was patently obvious that the government, which decided to continue issuing debt was not funding anything.

Please read my blog – Market participants need public debt – for more discussion on this point.

Logic Claim 3. Governments should thus run surpluses to avoid these problems – but make sure they issue debt anyway so the corporate parasites can get their share (as above) and also avoid cutting any spending that … you can fill in the missing line (think vested interests).

The AMP Capital report then tried to sound reasonable:

However, comparing ourselves to a bad bunch is not necessarily wise. First, our level of net public debt (i.e. gross public debt less what the Government is owed) is about where Ireland’s was in 2006 before a severe property crash necessitated the Irish Government to bail out its banks which saw public debt skyrocket. This is unlikely in Australia, but the Irish experience highlights just how quickly good times can turn sour. Second, after the biggest resources boom in our history, public finances should be in far better shape. Norway is a good example in this regard. Realising that its North Sea oil reserves would not last forever, it has been running big budget surpluses (around 10 to 18% of GDP) and putting the money into a sovereign wealth fund for use when their boom is over. As a result, Norway’s net public debt is negative, i.e. it is owed way more than it owes.

1. Comparison with Ireland is irrelevant and dishonest – they use a foreign currency we issue ours.

2. Comparing us with Norway is spurious – they have massive external surpluses that contribute several percentage points to quarterly GDP growth and their private sector hasn’t been forced in to record levels of debt by the surpluses that the government has been able to achieve on the back of the growth. They also have close to full employment. Their surpluses reflect a virtuous cycle.

They have also not savaged their public sector and their services sector has grown within the public sector and provides well paid flexible employment to highly skilled and well-educated citizens. Our public sector has been decimated through privatisation and outsourcing and the service sector is dominated by burger flipping shops which offer poor pay to low-skilled workers.

Further, our surpluses were at the cost of a massive rise in household indebtedness, which will not be repeated and persistently high levels of labour underutilisation. Even at the peak of the last cycle around 10 per cent of available labour resources were idle in Australia. Norway is light years from that situation.

Please read my blog – Norway … colder than us but … – for more discussion on this point.

If Dr Oliver can tell us how we can run have “big budget surpluses”, have private saving high and full employment with our on-going external deficit then I will be interested in his phone call. He won’t ring because it is an impossible combination. Norway and Australia are not comparable therefore in this regard.

The ABC operates under the auspices of the – Australian Broadcasting Corporation Act 1983 – which is the latest version of the Broadcasting and Television Act 1942. The Act outlines the Charter of the ABC, which is so general that almost anything would be possible.

Essentially, the ABC has to provide “innovative and comprehensive” broadcasting services to the nation.

The ABC Board of Directors has a legal duty, among other obligations specified in the Act, to ensure:

… to maintain the independence and integrity of the Corporation

…. to ensure that the gathering and presentation by the Corporation of news and information is accurate and impartial according to the recognized standards of objective journalism

In general, the ABC news and current affairs has become a major perpetrator of the neo-liberal economic myths. Its pretension to balance has disappeared in this regard. I used to write letters to the management pointing out their biases but never received a reply.

Under Section 4 of the ABC’s own – Editorial Policy – which deals with “Impartiality and diversity of perspectives” we read:

The ABC has a statutory duty to ensure that the gathering and presentation of news and information is impartial according to the recognised standards of objective journalism.

They recognise that what constitutes impartiality will “vary among individuals according to their personal and subjective view of any given matter of contention”. I agree.

They say though that they are “guided by these hallmarks of impartiality”:

- a balance that follows the weight of evidence;

- fair treatment;

- open-mindedness; and

- opportunities over time for principal relevant perspectives on matters of contention to be expressed.

They have developed standards which include:

4.2 Present a diversity of perspectives so that, over time, no significant strand of thought or belief within the community is knowingly excluded or disproportionately represented …

4.5 Do not unduly favour one perspective over another.

Now there is clear evidence that they have breached those standards by presenting a right-wing bias.

The right-wing think tanks, politicians, industry groups etc are always claiming the ABC has a left-wing bias. They intone that the Government should discipline the Board, sack staff, cut its budget and privatise it – usually in the same quick news grab.

For example, late last year, the Opposition Leader (soon to be the new Prime Minister) told the Australian Financial Review that “there is still this left-of-centre ethos in the ABC” (Source).

But the evidence is clear. A 2012 academic research article published in the Economic Record – How Partisan is the Press? Multiple Measures of Media Slant – revealed

In a press report when the working paper came out (September 3, 2009) – Study finds ABC bias leans towards Coalition – the conclusion drawn from the paper was that:

The ABC television news was significantly slanted towards the Coalition.

The Coalition are the conservative neo-liberals in Australia although it is hard to tell the difference between them and the so-called progressive Labor party, which holds government at present.

Anyone who watches the news and then the 730 current affairs program on the national broadcaster will not be surprised about the ABC’s pro neo-liberal bias when it comes to economics reporting.

This May 20, 2013 news item – Graphic denial: no plan to dump Kohler – confirmed the worst:

A report in the Australian Financial Review on May 10 claiming ABC management was considering dumping Alan Kohler’s graph-friendly finance segment from the 7pm news is “completely without foundation”, an ABC spokesperson says. “Alan Kohler’s nightly contribution … is highly valued by ABC News, which has no plans whatsoever to discontinue it.”

If they value his propaganda what does it say about them?

Conclusion

I love public broadcasting. But sadly, the national broadcaster in Australia has become part of the problem when it comes to economic news and analysis.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

There is a similar problem with Britain’s BBC. See:

http://www.positivemoney.org/2013/04/bbc-removed-misleading-video/

I was wondering when you’d get riled enough to write about this topic, Professor. A month or so ago, Emma Alberici wrote a piece at the ABC on budgetary matters, ostensibly trying to be reasonable/balanced about the Labor government’s abandonment of a surplus target. I despaired because she ended up, seemingly out of ignorance, rehashing the sovereign=household myth. And this from someone who wanted to be objective!

She should be contrasted with those at the Corporation who do not pretend to be anything other than servants of the neoliberal cult. Sales: shouts at those who (might be about to) dare question that the Australian Government faces a solvency constraint. She also has welcomed Niall Ferguson as an honoured guest multiple times. Uhlmann: doesn’t appear to regard himself as bright enough to wade into matters economic, other than of the headline variety. Nonetheless, he can be relied upon to give Tony Abbott a free run, yet be highly critical of any interviewee from the Labor party. Don’t even ask how he treats Green interviewees. Satyajit Das might be considered, by a reasonable person, to be on a retainer to pen opinion pieces that generally promote neoliberal ideology. The Business and Economics reporters mostly seem to not understand how the monetary system operates.

Only a month ago I complained about an item on The World Today (ABC Radio):

“Date of program: 5 April 2013

Subject: Bank of Japan fires latest shot in currency wars by David Taylor

Comments: The report contains this doozy: “.. policy-makers are running out of options to boost growth as … governments run out of money.”

The Japanese Government, like the Australian, issues its own fiat currency. It can no more run out of money than the Melbourne Cricket Ground can “run out” of points to display on its scoreboard. If Mr Taylor wishes to learn how fiat monetary systems work, I suggest reading Professor Bill Mitchell’s blog. It is essentially only the Eurozone countries who can run out of money, and only because they signed up to a foolish scheme whereby they use a foreign currency, the Euro.

This is an extremely important matter, as incorrect framing of economic issues in the media can result in corruption of the democratic process to the benefit of special interest groups. The electorate will automatically regard certain policy options as impossible – in other words, people will self-censor their thought processes in response to media conditioning. Language controls thought, to paraphrase Orwell.”

I received a reply several weeks later:

“Thanks for writing to The World Today.

We agree that the language used by the reporter was not sufficiently precise.

It would have been more clear if the reporter had referred to governments ‘running out of money’ as actually talking about a lack of cash to spend in a fiscal accounting sense.

Clearly there is another definition of ‘money’ as relates to economic/monetary policy, which takes in a currency’s value relating to the amount of it on issue, and affecting its relative international exchange terms.

We have amended the transcript and posted a note to reflect the changes.

Sincerely

Shane McLeod

National Editor, Radio

ABC News”

The response seems to indicate a lack of comprehension of what I originally complained about. It’s all rather depressing, but anger at propaganda and the injustices that it causes tends to spur one to action.

Ralph that link is priceless! So Robert Peston business correspondent for the BBC doesn’t understand how banks work and, perhaps more alarmingly, neither does the “Public Information & Enquiries Group” at the Bank Of England. On this blog comments a couple of days ago I defended the BBC (and Peston) against accusations of propaganda and to be fair to them in this case they withdrew the video in question (see link) and admitted their (and Pestons) mistake. But no one can defend them for the ignorance they have show in the video. As for the Bank of England…

Emma Alberici? I remember her reporting one morning when working at ch 9 that the US10yr bond had rallied 925 basis points. I recall thinking my day at work was going to be a belter. Alas … So it surprises me she’s allowed to write about anything related to financial matters.

Here’s another duffer who should know better – http://cuffelinks.com.au/the-consequences-of-sustained-budget-deficits/

What is really depressing, is that even from a neoliberal perspective, Oliver’s graph shows our federal govt have a vast amount of room in which to expand spending if needed (it is), and all the scaremongering about the deficit is completely unfounded.

Neil, note that their response was that they understood they just “simplified” matters

Journos at don’t care because they get paid anyway. Often times their reporting seems to be more fantasy than reality I have noticed.

Bill said: “The central bank can maintain any interest rate target it chooses without open market operations.”

While I agree with this statement, it immediately opens up the issue of how new state fiat money can be (or should be) introduced into the economy, other than by the current practice of open market operations.

I can think of only two alternative mechanisms: either it can be spent into the economy by the elected government, or it can be spent into the economy by the central bank (as a sort of national dividend, perhaps as regular payments to bank accounts).

The former method is workable in a sense, however I think it would be too easily politicized and corrupted.

“The former method is workable in a sense, however I think it would be too easily politicized and corrupted.”

As opposed to the central bank? Which is currently run by bankers and their mates for bankers and their mates?

Either you believe in democracy or you don’t. Any alternative control structure proposed cannot rely on the central bank as some sort of abstract notion that can magically make the right decision all the time.

The central bank is run by people. People who have been hired by other people and who have no more foresight than you or I and are subject to the same prejudices and failings as you and I. And tend to be selected from a particular class of society with even less understanding of the rest of society than the politicians in parliament.

Democracy has always been shown to be the least bad system. Any economic design has to make the best of a bad job – because it has to involve people making decisions. And that means them making the wrong decision as well.

Thanks for your comments Neil, and I do share your advocacy of democracy. However I am not advocating that the central bank (CB) would have any discretion in the matter of spending new fiat money into the economy.

It would be possible to set up an arrangement by a legislative Act, designed to effect payments to the private sector as a national dividend scheme — in which the CB credits the bank transaction accounts of citizens with payments on a monthly basis (in much the same way that interest is added to interest-bearing accounts today). As virtually the entire adult population possesses such accounts, this would be a non-discriminatory and efficient way of distributing a national dividend.

There would be no net impact on Treasury’s general CB account, since any interest received by the CB from Treasury would be returned to Treasury within a prescribed time-span. The overall mechanism would not involve direct Treasury spending of any sort.

I note that Emma Alberici has an article in The Drum on the ABC website. While she acknowledges that Germany has largely benefited until recently from a devalued currency she still assumes that the Growth and Stability Pact was a sensible policy. I would encourage people to head over and respond to her article – perhaps we can begin the process of informing the media.

“As virtually the entire adult population possesses such accounts, this would be a non-discriminatory and efficient way of distributing a national dividend.”

Who decides how much?

How is this different from a ‘citizens income’ which would similarly undermine the production system on which it is based.

Money is still resources. Others have to accept that you are worth the resources you can command otherwise they will alter their behaviour and start to withdraw from the production process.

For every problem there is a solution that is neat, plausible and wrong.

“As virtually the entire adult population possesses such accounts, this would be a non-discriminatory and efficient way of distributing a national dividend.”

Neil said: Who decides how much?

One of the virtues of running monetary policy via open market operations is that it provides a mechanism by which new money may be introduced into the economy endogenously — in which the supply of new money is driven by the demand of the private sector for credit and currency. The alternative is to attempt to control the money supply in a more direct manner – exogenously. The latter is certainly possible, and has been advocated by many monetary reformers, however there is a price to be paid for it – namely, the organs of the state (central bank and government) would lose all control over interest rates.

Here is an alternative way of carrying out open market operations:

1. The central government Treasury would create and maintain a special portfolio of securities to which the CB would have access — guaranteed by a legislative Act. Let’s call this the monetary policy securities portfolio (MPSP).

2. These securities would be unavailable to Treasury for the purpose of sale to the private sector.

3. The CB would have the power to acquire the MPSP securities for its own assets portfolio at its discretion, and would pay for them by creating credits in a special CB account, called the monetary policy spending account (MPSA).

4. The MPSA would be inaccessible to Treasury for the purpose of authorising Treasury spending.

5. There would be no direct budgetary implications, and these operations would not be represented in Treasury’s receipts or expenditures.

6. However, interest received by the CB from these assets would be credited to Treasury’s CB account.

7. The CB would pursue its monetary policy objectives by selling securities from its assets portfolio to the private sector as and when appropriate, and acquiring securities from the MPSP (rather than from the private sector), as and when appropriate.

8. Bond dealers would be able to buy securities from the CB, but would not be able to sell them to the CB.

9. Bond dealers would be able to sell government securities to anyone else willing to buy (i.e. other than the CB).

10. The MPSA credits would authorise the CB to create state fiat money for the purpose of financing such (non-Treasury) spending options as (a) direct payments to all citizens (a type of national dividend), (b) direct payments but only to taxpayers, (c) payments to the unemployed and/or welfare organizations, and (d) a discount (paid by the CB) on withdrawals of currency from depositories, up to a (variable) monthly limit.

11. Payments by the CB to the private sector do not need to be made at irregular intervals of time; it is possible to implement a mechanism in which regular payments are made with varying payment amounts (the variation in payment amounts reflecting the monetary policy decisions).

12. Within the context of a fractional reserve banking system, the payments would be modest. However the payments would be expected to be larger by more than an order of magnitude for a full reserve banking system (or its equivalent).

13. My preferred mechanism for payments to the private sector is a national dividend scheme in which the CB credits the bank transaction accounts of citizens with payments on a monthly basis (in much the same way that interest is added to interest-bearing accounts today). As virtually the entire adult population possesses such accounts, this would be a non-discriminatory and efficient way of distributing a national dividend.

14. There would be no net impact on Treasury’s general CB account, since any interest received by the CB from Treasury would be returned to Treasury within a prescribed time-span. The overall mechanism does not involve direct Treasury spending of any sort.

“If people really understood that governments just borrow back their own spending then the financial markets would be seen for what they are in relation to bond market activity – mendicants in receipt of privileged corporate welfare.”

However, it’s a bit more complicated than that. Distributed banks – starting with the Primary Dealers who are required to buy T-Bonds – are a legitimate, publicly licensed, supposedly regulated, private contractor, just like every other member of the citizenry. The terms of their contract – and it’s public regulation – matter absolutely. Most banking lobbies eventually return to the issue of who gets to set interest rate and control much if not all access to accounting fees for regulating inter-personal credit.

If the offered TERMS that banks get for their accounting and credit-rating services remain within SOCIALLY ADAPTABLE TOLERANCE LIMITS, then banks simplify public commerce by providing a self-adjusting monitor and regulator of inter-personal credit lines. What I call “ADAPTIVE” Warren Mosler calls “serving Public Purpose.” Whatever you choose to call it, in that guise T-bonds (still arbitrary) are at lease seen as one way of adequately funding the Primary Dealer banks for legitimate services. So long as their personal salary profits get spent into the rest of the country, circulating along with everyone else’s “money.”

If the TERMS get maladaptive and turn into obscene amounts of corporate welfare, then it’s because a public is failing to do it’s own, adequately organized regulation, and the credit examiners are then accumulating and hoarding the very credit they’re hired to simply analyze and report on!

Doesn’t this boil down to a OpenGovernance issue?

If bankers are grossly overpaid, whose fault is it? We can no longer re-regulate our own bankers, on a moments notice? Bullshit! Why CAN’T we? Arguing the details of the issue is itself admitting defeat. The public’s beef has to be on principle and tempo, not on micromanaging the details. “We want outcomes appropriate for consuming our full aggregate demand!” And we want that with our morning coffee. Or else.

Who the hell is in charge of this country? It’s citizens, or any arbitrary sub-class – acting like buffoon aristocrats? Isn’t that the only issue that matters?

Why not invite a national labor conference – with every union available – and make that the one and only theme? Recall any politician who fails to LEAD rather than sell-out. And for HEAVEN’S sake, quit electing buffoon politicians who DO sell-out.

Make the setting of banking terms the plainly stated “#1 PLANK IN THE NEXT ELECTION” (and immediate recalls). Cut the corporate welfare rates back down to a living wage, and voila – problem half way to being solved. We can go back to exploring actual emerging national options, instead of staring at fat-cat banker navels.