I have been a consistent critic of the way in which the British Labour Party,…

Britain caught in the mire of its own policy failure

It is a public holiday in Australia – celebrating our national day. For the indigenous Australians, it is symbolically “invasion day” – the day the colonialists came and usurped their rights and engaged in a systematic destruction of their culture and ensured they remain (collectively) among the most disadvantaged citizens on our Earth. So it is a day of shame really. It is also weird that we are gung-ho with nationalism today yet our head of state is the British queen. Taken together it is a confused society – hiding a deeply conservative form of prejudice, fear and paranoia with the anti-intellectual “larrikinism” that many associate with my nation. Not a very compelling mix to say the least. But then I know we need to be careful about generalisations like this. Today, among some pressing deadlines I took a little (depressing) journey into the latest national accounts release from the British Office of National Statistics – Gross Domestic Product Preliminary Estimate, Q4 2012. The narrative gleaned is terrible. It comes on the back of the ONS release of the – Public Sector Finances, December 2012 – which showed that budget deficit and public borrowing rose over the 12 months to December 2012. So at the half-way mark of this government’s tenure, the conclusion is clear – the British government has failed and is inflicting untold damage on its citizens – which has been temporarily interrupted but not curtailed by the Olympic Games.

Before I start on that topic, as an aside, I receive many E-mails asking me to outline the Modern Monetary Theory (MMT) position on the latest monetarist monetary policy fad – so-called nominal GDP targetting (aka NGDP targetting). The only position I think my colleagues take is that it is a fad that has been tried before under another guise – monetary targetting – and failed then and would fail again. Practical matters like the lag in national accounts data makes it impractical – the horse bolts before you even know the gate was open. But ultimately, the goal of policy should be to sustain full employment and monetary policy cannot do that reliably. That is the capacity that fiscal policy offers although there is still an obsession with monetary policy. The incoming governor of the Bank of England is one who is trying to push the NGDP line as a last ditch attempt to maintain the dominant policy position that the central bank holds.

I have also been receiving a lot of E-mails about whether the UK should leave the European Union or not. I wonder why the citizens of the UK don’t try to leave the UK as the Irish, Spaniards, Portuguese and Greeks are leaving their own respective nations. Perhaps another blog will emerge on the topic of “austerity migration” given we are now getting more data as the years of madness pass by and the trends are quite startling.

For now, I say (to stop all the E-mails coming) – that large international liaisons are only desirable if they help a nation maintain full employment and reduce oppressive rules that limit social freedoms. At present, the problems in the UK are all of its own making. Until they realise that they are a sovereign nation with the capacity to provide for their own citizens the question about the EU membership is moot.

Other than obedience to international conventions about human rights and responsibilities to give aid to poor people in poor nations wherever they are, a sovereign, currency-issuing nation should never constrain their own policy frameworks to meet the demands of some monolithic centralised institution, whether it be the sclerotic European Commission or the corrupt and incompetent IMF.

Having said that, it is also the case that British government should not stand outside the Eurozone and egg it on as the Eurozone governments systematically dismantle the prosperity of their own citizens.

Larry Elliot from the UK Guardian considers the UK government has failed. In his recent article (January 24, 2013) – Osborne’s economic strategy has failed – he writes:

When the rating agencies strip Britain of its AAA credit rating – as they almost certainly will – George Osborne’s strategy will be in complete tatters.

I wouldn’t judge government policy on what the ratings agencies do or don’t do. They are essentially irrelevant and it would be better outlawing them. But as a judgement on what the government should be doing they have performed with the utmost incompetence over a long period of time.

Please read my blog – Ratings agencies and higher interest rates and Time to outlaw the credit rating agencies – for more discussion on this point.

Larry Elliot continued with more apposite statements:

The strategy has failed. The public knows it. The International Monetary Fund knows it. The credit rating agencies know it. Nick Clegg knows it. Even George Osborne knows it, although he can’t bring himself to admit as much.

The failure is clear. The ONS document – Gross Domestic Product Preliminary Estimate, Q4 2012

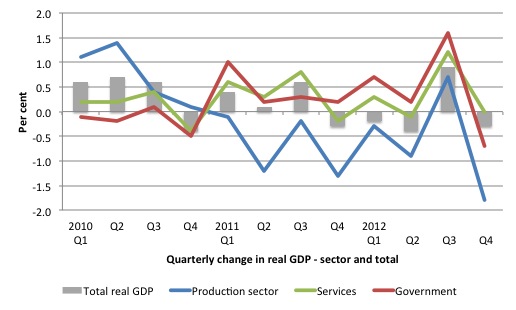

The following graph shows the quarterly changes in real GDP by selected sectors and overall economy. The British economy has contracted in four of the last five quarters with the Olympic effect producing an interruption to this patter in the third-quarter 2012.

The production sector has contracted 7 quarters out of the 11 that the current government has been in office. Even the services sector declined in the fourth-quarter 2012.

The ONS produced a document – Understanding and Interpreting the Quarter Four 2012 Gross Domestic Product Preliminary Estimate – Article – where they tell us that:

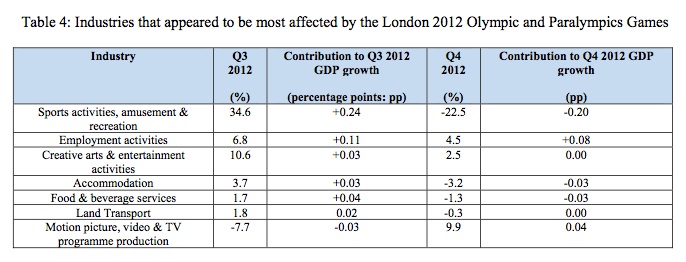

The service sector was estimated to be flat in 2012 Q4, although it did make a small downwards contribution to GDP … This followed growth of 1.2% in 2012 Q3. The level of the service sector in 2012 Q3 was boosted by the Olympics and Paralympics (the Games) … The largest impact was in Sports activities, amusement and recreation which fell by 22.5% and contributed 0.2 percentage points to the fall in GDP quarterly growth. The fall was mainly but not exclusively, a result of the increased output in 2012 Q3 from the ticket sales for the Games.

The British ONS produced this Table (Table 4) to show the estimated effect of the Olympic Games and its aftermath.

The point is that while the December-quarter 2012 “the “growth rate was based on the level of GDP in the third quarter of 2012, which was boosted by the London 2012 Olympic and Paralympics Games (for example, ticket sales were estimated to have added 0.2 percentage points to growth)”, the so-called “fall back” is not an extraordinary event (inflated by the artificial growth level in the third-quarter) but rather a return to the underlying trend of recession.

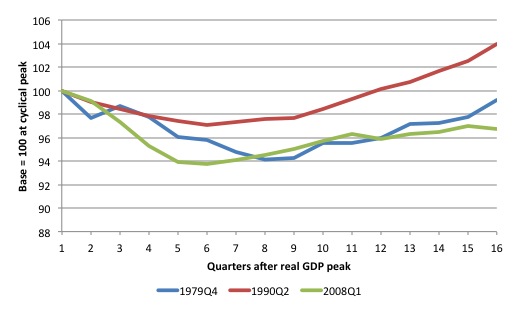

To put this in some perspective I examined the last three recessions. The following graph shows the movement in seasonally adjusted British GDP for the last three recessions (peaks in 1979Q4, 1990Q2 and 2008Q2).

The respective troughs were 94.1, 971 and 93.7. The 1980 recession took longer to reach the trough but once growth resumed in the 10th quarter of the downturn, there were no contractions again.

The current downturn is marked by the severity of the collapse – 6.3 per cent of real GDP was knocked off within 6 quarters – and the stalled, now failed recovery, notwithstanding the fact that a major sporting event (the Olympic Games) occurred in Britain during this period.

The graph shows that on the back of the deficit stimulus the British economy resumed growth in the third-quarter 2009 and growth continued until the third-quarter 2010 (that is, the 11 quarter after the peak).

The current British government was elected half-way through the second-quarter 2010 (May) – the 10th quarter after the peak – and in June announced a package of austerity measures, which to be scaled in over the next few years.

The problem was that the announcement itself damaged private sector confidence and the deficit was not sufficiently large enough to support growth in the face of the private spending contraction.

Larry Elliot says:

But the government also sucked demand out of the economy by raising taxes, cutting welfare and … by taking the axe to capital spending programmes. The blood-curdling rhetoric from Osborne in 2010 about Britain being a Greece in waiting shredded consumer and business confidence.

The Ricardian narrative that the Government borrowed from the conservative members of my profession without checking first whether it was nonsense of not claimed that the fiscal austerity would boost private spending

Since the election the stimulus to growth has faded and the economy has basically failed to show signs of growth. The services sector is holding up against the relative collapse of the production sector (in particular, manufacturing) and construction.

Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

The modern version of Ricardian Equivalence was developed by Robert Barro at Harvard. For non-economists – this piece of neo-liberal dogma says that the non-government sector (consumers explicitly) having internalised the government budget constraint will negate any government spending increase whether the government “finances” its spending via taxes or borrowing. So if the government spends and borrows, consumers will anticipate higher future taxes and spend less now offsetting the stimulus).

The model is based on a number of assumptions that can never be realised in the real world. But the motto of my mainstream colleagues is to never let some facts get in the way of a good story – where good is defined as reinforcing one’s ideological hatred of government intervention except when the handouts are aimed at the top-end-of-town.

If we wrote out the equations underpinning Ricardian Equivalence models and started to alter the assumptions to reflect more real world facts then we would not get the stark results that Barro and his Co derived. In that sense, we would not consider the framework to be reliable or very useful.

But we can also consider the model on the basis of how it stacks up in an empirical sense. When Barro released his paper (late 1970s) there was a torrent of empirical work examining its “predictive capacity”.

It was opportune that about that time the US Congress gave out large tax cuts (in August 1981) and this provided the first real world experiment possible of the Barro conjecture. The US was mired in recession and it was decided to introduce a stimulus. The tax cuts were legislated to be operational over 1982-84 to provide such a stimulus to aggregate demand.

Barro’s adherents, consistent with the Ricardian Equivalence models, all predicted there would be no change in consumption and saving should have risen to “pay for the future tax burden” which was implied by the rise in public debt at the time.

What happened? If you examine the US data you will see categorically that the personal saving rate fell between 1982-84 (from 7.5 per cent in 1981 to an average of 5.7 per cent in 1982-84).

In other words, Ricardian Equivalence models got it exactly wrong. There was no predictive capacity irrespective of the problem with the assumptions. So on Friedman’s own reckoning, the theory was a crock.

Once again this was an example of a mathematical model built on un-real assumptions generating conclusions that were appealing to the dominant anti-deficit ideology but which fundamentally failed to deliver predictions that corresponded even remotely with what actually happened.

Barro’s RE theorem has been shown to be a dismal failure regularly and should not be used as an authority to guide any policy design.

Please read my blog – Deficits should be cut in a recession. Not! – for more discussion on this point.

And Britain is another laboratory – pity the test rats! One gets the impression that the masters of these policy impositions harbour socio-pathological tendencies.

I predicted this would happen late in early 2011 (two years ago) – please see the blog – Ricardians in UK have a wonderful Xmas

Over time I noticed a change in the senior managers in the Australian public sector, particularly those in the big policy departments (employment, education, social security, immigration). I formed the view (based on personal experience) that not only were these characters vehemently enforcing the most pernicious rules and regulations which caused untold damage to the most disadvantaged citizens among us, but – more disturbing again – they seemed to enjoy doing it. The smile of the torturer.

MMT is not an imaginary approach that deals with imaginary problems. It is about the real world and starts with some basic macroeconomic principles like – spending equals income.

The basic macroeconomic rule – spending equals income – is being ignored by governments who have been captured by the neo-liberal dogma that self-regulating private markets will deliver prosperity to all if only governments reduce regulation and run budget surpluses with low taxation.

There have been scores of mainstream economic lies that this crisis has exposed including deficits cause inflation; deficits cause interest rates to rise; there is a money multiplier; etc.

But the most basic neo-liberal lie is that if governments cut their spending the private sector will fill the gap. Mainstream economic theory claims that that private spending is weak because we are scared of the future tax implications of the rising budget deficits. But, the overwhelming evidence shows that firms will not invest while consumption is weak and households will not spend because they scared of becoming unemployed and are trying to reduce their bloated debt levels.

Pity the rats!

Larry Elliot concludes that:

In reality, changes to fiscal policy are likely to be small and cosmetic. Osborne will rely on the Bank of England to do the heavy lifting. Further monetary easing looks inevitable, even though a combination of 0.5% bank rate and £375bn of quantitative easing has proved ineffective. The chancellor will cross his fingers and hope that the UK benefits from the slightly better news coming out of the US and China.

Yet politically as well as economically, the figures are a disaster for the government. With the clock ticking towards a 2015 election, it ensures the next few months will be spent debating a possible triple-dip recession and how soon the credit rating agencies will strip Britain of its AAA credit rating. This looks inevitable and when it happens, Osborne’s strategy will be in complete tatters.

Nothing will be gained by further monetary “easing”. Britain needs a major fiscal boost immediately.

The point is clear. A sovereign government has the fiscal capacity to ensure that recessions are short-lived at worst. In general, a pro-active government can ensure that recession doesn’t occur.

There are no “external” factors that can override that capacity. Sure enough a collapse in world demand will hit an export-led nation. But then, as we saw in 2008-09 in China it is time to substitute the lost production with domestic output. There is never a shortage of domestically-oriented projects that can be funded by deficit spending.

This appalling GDP performance is the reason that the budget deficit is rising. It is hard for a government to row against the automatic stabilisers as history has shown over and over again.

Deficit reductions are easy to accomplish when there is strong private growth. They are almost impossible to pull off when there is weak or negative growth. And the damages that are created by trying are enormous and the losses never regained.

Conclusion

The major problem is that the Opposition is so pathetic that the alternative is virtually non-existent. The Labour Party try to differentiate themselves by claiming their contraction will be less severe and fairer.

The problem is that when the private sector is contracting, pro-cyclical fiscal policy of any kind will always cause disproportionate damage to the most disadvantaged citizens. The poor and the weak are hurt by recession the first and the most.

My other writing deadlines are pressing.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Excellent post, Bill. Couldn’t agree more.

Cheers.

“Until they realise that they are a sovereign nation with the capacity to provide for their own citizens the question about the EU membership is moot.”

It’s not Bill.

The EU freedom of movement rules and bans upon state aid make it near impossible to introduce a full blown Job Guarantee without upsetting the European Court, or causing a flood of European migration that would overwhelm the public infrastructure of the UK.

I can’t see how the neo-liberal hell of the Lisbon treaty allows any individual member state to use the full policy proposals of MMT. If you can see a way through I’d appreciate your thoughts on it.

Dear Neil (at 2013/01/28 at 18:06)

In the following paragraph from the sentence you quoted I gave the caveat, which means that Britain should leave the EU.

best wishes

bill

Another UK ‘mystery’ that could do with a bit of Bill analysis is the continuing fall in unemployment in the UK despite the terrible GDP figures.

It seems to be confusing the hell out of the normal commentators because it doesn’t fit with their neo-liberal beliefs in the way the employment market works. So much so that some are suggesting the GDP figures are wrong.

A classic example of ‘if the data doesn’t fit my theory then the data must be wrong’.

Could the ‘abnormal’ level of employment in the UK and the wages people are receiving actually be stopping things getting worse (since wages are a source of profits)?

Ain’t that the truth! Thank goodness for Australian rules football. It is our one worthwhile accomplishment. 🙂

Hi Bill,

Thanks for making that 100% clear. It didn’t get that from the original text.

The EU is being used in the UK as a convenient excuse as to why we can’t use the full power of the government to sort out the appalling mess we’re in.

Neil,

Another way round the problem of introducing a Job Guarantee only for British citizens is simply to do it and pay any fine imposed. I would call it money well spent. It amounts to a bribe, but if that is the cost of doing business with the EU whilst retaining the common market, then that’s fine with me.

In the case of the UK, wouldn’t the required fiscal stimulus lead to a deterioration in an already bad balance of trade, a further depreciation in sterling resulting in inflation, especially in energy?

“In the case of the UK, wouldn’t the required fiscal stimulus lead to a deterioration in an already bad balance of trade, a further depreciation in sterling resulting in inflation, especially in energy?”

No it wouldn’t because the causality doesn’t work like that.

is the BoE coming around, without admitting anything?

Morning papers: ‘Growth over inflation’ says Carney

http://www.ftadviser.com/2013/01/28/investments/uk/morning-papers-growth-over-inflation-says-carney-YxPL8SZ8vRknM52AvCsnPN/article.html

Dear Bill

Elizabeth II is also constitutionally the head of state of Canada. However, this is just a constitutional fiction, comparable to the Dutch constitutional fiction that Amsterdam is the capital of the Netherlands, even though the entire government is in Den Haag. The real head of state of Canada is the Governor General. He or she makes all the decisions that the Queen makes in the UK. The Queen plays absolutely no role in Canadian politics. In Australia there must be a similar person. Let’s not get excited about constitutional fictions.

Regards. James

Keith,

In my view, austerity is far more likely to lead to greater volumes of imports, as households and business seek to cut costs by making ever greater use of cheaper imports. Also out-flows of money maybe more likely as austerity creates fewer investment opportunities.

I could be wrong.

Keith,

In addition to the above, it would also be strange to assume that increased government spending and investment generates higher imports, whilst increased private sector spending and investment somehow doesn’t.

@ Neil Wilson.

“Another UK ‘mystery’ that could do with a bit of Bill analysis is the continuing fall in unemployment in the UK despite the terrible GDP figures.”

You might find the data reported on the real world economics blog useful.

http://rwer.wordpress.com/2013/01/26/broad-unemployment-in-europe-third-quarter-2012-a-disaster-in-southern-europe-rising-unemployment-in-the-uk/

The U-6 measure from eurostat data show that the unemployment level in the UK is around 17% and more in line with nations like Bulgaria and Hungary than Germany and France.

The Merijn Knibbe points out

“It seems that the UK shows an unusual large shift from ‘normal’ U-3 unemployment into categories not included in U-3 unemployment but included in U-6 unemployment,”

The opposition, labour, aren’t advocating any real policy change, just to implement the cuts more slowly. This may leave a little growth, but not enough to do more than ensure they aren’t presiding over any periods of negative growth! So we are stuck with the same old policies. We do need the media to become far better informed on economic affairs and start questioning economists and politicians vigorously. A better educated public is essential.

Bill

If you get a moment, please please please deconstruct Larry Elliot’s latest offering:

The ultimate Davos debate: Marx takes on Keynes, Friedman and Schumacher

Neil and Bill

I would be very interested in your opinion of the real world economics assessment. Does the interpretation make sense of the data. I think a number of us have the same gut feeling as Nell.

I try and keep an eye on the ‘broad’ measure in the UK and even on the broad measure the number of people wanting work is coming down: from 4.960 million a year ago to 4.819 million on the latest stats.

Similarly ‘part-time wanting full time’ is about the same as it was a year ago having peaked at the end of the second quarter.

And the participation rate and the ‘extended’ participation rates are both pretty near their peaks (not that the UK has much variation in participation. The range of movement of about 1%).

So there’s a definite improvement of sorts in the numbers. Now whether that is the Olympics and the lag hasn’t caught up yet I don’t know.

If you look deeply into UK trade figures you can see her hooking into the Rhine /Rhur Industrial complex and cutting the other western European countries adrift in a euro austerity sea.

The amount of expensive German cars imported into the UK suggests it is continuing down its old Manchester economics economic road.

Although I hate the current euro monetary system with a passion the lack of final settlement is the great weakness of MMT in my opinion.

Free floating currencies can just be gamed at a even more extreme level then the old gold system.

For example I imagine a free floating punt would be pushed into a major devaluation against the core so as to supply it with a surplus regardless.

The balance of trade data suggests the UK has chosen real goods (however useless) over income from the rest of the world.

It is either incapable or unwilling to increase its internal capital base…………….why should it ?

Such a policy would reduce the personal consumption of its elite as it would involve a subtraction of real resources to build a national wealth base.

http://www.smmt.co.uk/2013/01/2012-new-car-market-tops-two-million-units-hitting-four-year-high/

The Dork of Cork,

“It is either incapable or unwilling to increase its internal capital base…………….why should it ?”

Something to consider is that, just like companies serving domestic demand, exporters have historically relied on bank credit to fund their day-to-day operations. As a result of the downturn, exporters, like everyone else, are strengthening their balance sheets and paying down debt.

As a result, they are using the devaluation to increase prices, rather than expand production – car industry may be an exception.

Kind Regards

@Charles J

I am not quite sure what you mean.

But looking at UK trade data :

Uk Imports from China is very soft this year , while the Uk is now in trade surplus with South Korea.

Meanwhile its negative trade balance with the likes of Germany & Poland is increasing.

So we are seeing a slow shift in trade patterns.

Its very clear to me that the EU is both the UKs and French play thing.

It functions much like India did pre war. (trade surplus country)

Germany is a extreme colony when seen from a real trade perspective.

The only real non monetary difference between the UK and France is that the UK will seek to blow its trade advantage on any grot that comes its way.

France still has some ancient Physiocrat reflexes that it uses now and again but its systems have atrophied during the euro bank credit glut years.

1. Interesting data on consumer spending in the European Union during the last ten years:

http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS-SF-13-002/EN/KS-SF-13-002-EN.PDF

I love Bill’s posts about my country. I also enjoy Neil Wilson’s contributions too – as I do his all to infrequent posts on his own blog. That balance of trade constraint is one that is interesting me currently. Has Bill covered this anywhere on this blog? Bill made a brief caveat assuming that the goods and services could be purchased with the national currency of a sovereign country. That may be a different point from drawing in imports – but I wasn’t clear.

I live in a small town in Shropshire. From that perspective being governed from London is no less foreign than being governed from Brussels. I look at the likes of the political and financial elites of my country and these people may as well be a different species as from a different country. Everything about their lives and views are alien to me.

Let’s be clear about the exit from the EU – if carried out it would be to further move the weight of risk and uncertainty on to the backs of ordinary working people by increasing our freedom to work longer hours and to have less secure employment. It would also reduce the environmental protection that has largely flowed from the EU.

However, I draw the line at monetary union. If that ever became the price of continued EU membership then I would by in favour of an exit.

“if carried out it would be to further move the weight of risk and uncertainty on to the backs of ordinary working people by increasing our freedom to work longer hours and to have less secure employment. It would also reduce the environmental protection that has largely flowed from the EU.”

Only if we vote for that Sean. We have the ability to go much further and faster in the opposite direction if we wish. We just need to elect the politicians that will do that. A fully implemented Job Guarantee and a sovereign government can make our country a more secure and sustainable place to live – far in excess of the scraps the EU throws our way to keep the left quiet.

We just have to believe in it.

Sean,

A sovereign government can afford to buy anything for sale in its own currency. Britain for example can buy most anything it wants from the foreign sector because the British Pound is desired around the world, just as the USD or the Yen are desired. For small, unstable or unproductive nations it is often the case that foreign sellers do not want their currencies, limiting their ability to obtain foreign goods and services.

“or small, unstable or unproductive nations it is often the case that foreign sellers do not want their currencies, limiting their ability to obtain foreign goods and services.”

But that depends upon the action of the foreign central bank, which can undertake liquidity action to alleviate that blockage in support of its exporters. The foreign central bank can purchase the local scrip in exchange for its own scrip, or it can offer an exchange service so that foreign scrip can be accepted by exporters, safe in the knowledge that their own central bank will exchange it. Both these actions cause the local scrip to be ‘saved’ by the foreign sector, draining the local circulation and making more room for the imports from export-led nations.

It is this liquidity action by the central banks of export-led nations in support of their exporters helps drive the saving that happens in the foreign sector. It’s not the sole reason because the aggregate causality is extremely complex. But it is one factor.

Exporters are in the business of selling stuff after all. And the way you get customers to buy is to lower barriers.

Neil Wilson,

I don’t disagree with anything you write, but at the end of the day nations like Botswana are wholely dependent on the foreign sector to facilitate trade. The more economically powerful a nation is the more purchasing power it has internationally, the less powerful have more limited options. Virtually no one turns down USD because the Dollar is a claim against an enormous chunk of the planet’s productive capacity and is as safe a currency as one can find.

Also I’m not certain it’s all that easy for central banks to pave the way. If, for example, the Federal Reserve offered to purchase the local currency of an unstable country (without collateral) so as to facilitate trade, and in the future that currency becomes worthless, the Fed has effectively printed money and violated its charter. Foreign CB’s are generally going to tread carefully if there’s a real possibility their deposits at Botswana’s CB are going to go up in smoke.

“and in the future that currency becomes worthless, the Fed has effectively printed money and violated its charter.”

Charters are political constructs that can be altered. There is no operational reason it couldn’t. Losses for a central bank aren’t a meaningful concept.

You have to realise that the Federal Reserve is an odd construct in the wider world, hamstrung as it is by the US obsession with free market ideology. It is not a good example of the normal behaviour of a central bank in a sovereign country.

And that is why the central bank of China can aid liquidity. Because it isn’t hamstrung by that ideology. So it is the Chinese that are in Africa picking up the real resources, and not the US.

No nation can claim by right more than it exports in imports. But export led nations can effectively gift them more real goods if that is their policy.

Obviously the wider world will try and entrap a poorer country by trying to get them to borrow in a foreign currency. But sensible policy says that should be resisted as far as possible, and you can do that once you realise how the money system works and that it is the export led nations that are desperate to sell.

the irony of the oppositions economic strategy in the uk

cut the deficit slower

is that the government has even failed to do this