I started my undergraduate studies in economics in the late 1970s after starting out as…

There is no unemployment in a non-monetary economy

I wrote recently about Eugene Fama, a Chicago economist who basically denied that a breakdown in the financial markets had caused the current crisis. Please see – Yesterday austerity, today growth – but leopards don’t change their spots – for further discussion. Last week (February 17, 2012), one of Fama’s colleagues wrote a Bloomberg Op Ed – How 3 Myths Drive Europe’s Response to Debt Crisis. The article by one Harald Uhlig, from the Department of Economics at the University of Chicago demonstrates the way that the Chicago School likes to obfuscate issues. He develops a model, which purports to show that the imposition of fiscal austerity and zero impact on the standard of living of the population. The only problem is that the model not only makes some false conclusion, within its own logic, but is also inapplicable as a vehicle for explicating problems that might arise in a modern monetary economy. This is typical Chicago economics – a stylised but irrelevant analytical framework.

Harald Uhlig asks us to:

Imagine a beautiful island whose inhabitants don’t need to exert themselves to live happily. Each citizen has an apple tree that each day at noon drops an apple sufficiently large to feed its owner. A citizen’s only task is to pick up the fruit and eat it; otherwise he or she can spend the day at the beach. The per-capita GDP of such an economy would be one apple a day.

So this is a world where it seems that everyone owns their own means of production (capital) which came from nature and never depreciates. There is no labour market or trade, in fact there is no market activity.

There is also no investment in this economy amd no productivity growth. The real wage is static at 1 apple per day presumably for time immemorial so the standard of living is constant.

There is clearly no spending in this economy.

All these single-firm, single-person production-consumption units are assumed to sustain themselves without the need to enter a labour market and in the absence of any state money there can be no unemployment.

As the author says – a beautiful and happy existence.

But the most important point is that it is not a monetary economy.

The absence of state money (fiat currency) eliminates a range of interesting and crucial phenomena that drive real world monetary economies. I will come back to that once we deal with some other matters pertaining to a “national accounts” treatment of this economy.

We are also asked to assume that this island has invented a new strain of the apple genus which fruits all year round. Apples “grow on small, deciduous trees” and their “fruit matures in autumn” (Source).

The substantive issue, however, is how we might construct the beachcombing, apple-eaters into the System of National Accounts (SNA)? Let’s consider the concept of the production boundary in the SNA. Do our apple-eaters actually produce anything?

The System of National Accounts home page tells us that:

The System of National Accounts (SNA) is the internationally agreed standard set of recommendations on how to compile measures of economic activity. The SNA describes a coherent, consistent and integrated set of macroeconomic accounts in the context of a set of internationally agreed concepts, definitions, classifications and accounting rules.

The most recent version is System of National Accounts 2008. The Australian Bureau of Statistics also provides an excellent on-line resource – Australian National Accounts: Concepts, Sources and Methods, 2000.

In the SNA we learn that:

GDP is the sum, for a particular period, of the gross value added of all resident producers, where gross value added is equal to output less intermediate consumption … Output consists of the value of goods and services produced within a producing unit and available for use outside the unit … Market output is output that is intended for disposal at economically significant prices. These are prices which have a significant influence on the amounts producers are willing to supply and purchasers wish to buy. Accordingly, market output is valued using market prices, which are generally transaction prices. Non-market output includes output produced for the producer’s own final consumption, own-account capital formation and output that is intended for disposal at prices that are not economically significant … Non-market output is valued according to costs incurred or by reference to market prices for analogous goods or services …

Intermediate consumption consists of the value of goods and services consumed in the production process, other than depreciation of fixed assets.

Which is clear enough – the stress on production and valuation should be noted.

On the idyllic island, valuation will clearly be difficult as there is no monetary unit.

The SNA employs a series of “boundaries” to act as accounting demarcations. The production boundary is used to separate out activities not considered to be production.

The SNA define “Economic production” to be an:

… activity carried out under the control and responsibility of an institutional unit that uses inputs of labor, capital, and goods and services to produce outputs of goods or services. There must be an institutional unit that assumes responsibility for the process and owns any goods produced as outputs or is entitled to be paid, or otherwise compensated, for the services provided.

So it seems that our apple-eaters have to display some intent and be operating within a defined system of property rights (which defines ownership).

They must consider their apple picking to be “labour” rather than a casual activity on their way to the beach. However, as noted above, there is no market test to justify that status.

The SNA excludes “certain household activities” if “these activities tend to be self-contained and have limited impact on the rest of the economy” which might lead you to ask whether the apple-eaters are indeed self-contained. They pick up an apple each day and head to the beach and laze in the sun. Their so-called “production” activities would seem to be fairly unconnected. In which case they would not be considered to produce anything under the SNA.

Then we come to valuation issues. The SNA requires that a “market value” test be satisfied:

Goods and services … are measured at market prices; the value of output is equal to the market price of the good or service times the quantity of the good or service produced during the year.

Unlike our Chicago economics professor, the keen observer will immediately notice that the apple-eaters do not participate in any market process. Indeed, as there is no “money” in this economy there is no valuation in the way the SNA recognises.

Of-course, in the real world there are many activities which are difficult to value (“where market prices do not fully reflect the value of a good or service or where services are provided without an actual exchange”) – and in this case the statistician “imputes” a value.

However, imputation requires either the capacity to relate these activities to some market value or if that cannot be done then the “market price is estimated based on the costs of production”.

Clearly, the apple-eaters would have trouble estimating the “costs of production”.

Under the heading 1.D The boundaries of the SNA, there is a discussion of non-monetary transactions.

Clearly, “(w)hen goods and services produced within the economy are sold in monetary transactions, their values are automatically included in the accounts of the SNA”.

However, “(w)hen goods or services are retained for own use, no transactions with other units take place. In such cases, in order to be able to record the goods or services in the accounts, internal transactions have to be recorded whereby producers allocate the goods or services for their own consumption or capital formation and values also have to be estimated for them”,

The Statistician in these cases makes “estimates and imputations”

Household production is included for “activities that produce goods or services that could have been supplied to others on the market but are actually retained by their producers for their own use”.

So that might include the collection of apples but given the information it appears that the orchards are strictly subsistence and so short of starving the beachcombers could not reasonably be considered enaging in activities that could have provided goods to “others on the market”.

Theirs is a hand-to-mouth existence.

Further, Section 6.32 of the SNA:

The SNA includes the production of all goods within the production boundary. The following types of production by households are included whether intended for own final consumption or not:

a. The production of agricultural products and their subsequent storage; the gathering of berries or other uncultivated crops; forestry; wood-cutting and the collection of firewood; hunting and fishing;

There is a further complication. The SNA would count the “production of agricultural goods by household enterprises for own final consumption” as production if other complicating factors could be resolved.

But the “inclusion in the SNA is not simply a matter of estimating monetary values for the outputs of these activities”. Why not?:

If values are assigned to the outputs, values have also to be assigned to the incomes generated by their production and to the consumption of the output. It is clear that the economic significance of these flows is very different from that of monetary flows. For example, the incomes generated are automatically tied to the consumption of the goods and services produced; they have little relevance for the analysis of inflation or deflation or other disequilibria within the economy. The inclusion of large non-monetary flows of this kind in the accounts together with monetary flows can obscure what is happening on markets and reduce the analytic usefulness of the data.

All of this should be borne in mind when deciding whether the beach-bums have produced anything and whether there is any reasonable basis for valuation.

The type of model being considered by our Chicago professor takes us back to the Robinsom Crusoe Economy that the mainstream use to befuddle students in introductory microeconomics. But even in these models there is a monetary unit introduced.

The other type of model taught to students followed from what has been considered to be David Ricardo’s Corn Model explanation of value. Italian economist Piero Sraffa considered this model at length in his devastating critique of classical value theory.

So we get a single product economy (corn) where the producer-consumer has to choose how much corn to eat each period and how much to save (as seed) to replant for next year’s crop. Workers are paid in corn units so the real wage is how much corn they get per hour (or some period). Profits are also measured in real terms – how much corn is left over after the wages are paid and seed is planted for the crop.

This model was used to show how the rate of profit was determined by production (not exchange) and also was used to deny the possibility of generalised over-production.

This follows from the following logic. Total output (in units of corn) can be consumed (C) or saved (S). Any corn saved is automatically re-planted (which is considered to be investment (I)) so by definition C + I = C + S and so S = I. What is not consumed each year automatically becomes investment and the only question of interest is the composition between C and I. This was a simplistic version of Say’s Law.

Even if consumers stopped spending, there would be no dislocation in the economy because firms would immediately divert the increased flow of saving into the capital goods sector (increasing investment). Employment would presumably shift from making muffins to sophisticated capital equipment. Never mind the detail!

In the apple-eating economy things are very simple though. There is no trade – so the beachcombers are all Robinson Crusoes with no Man Fridays in sight!

Further, there appears to be no saving nor investment – so all output is consumed. There are no profits and the real wage is 1 apple per day.

Valuation issues beside, we can agree that the total output in the economy is how ever many apples are picked and eaten each day aggregated to some period of interest (a quarter, year or whatever). Lets quantify it. Say the island has 100 people which means that overall production (in real terms) is 100 apples a day (which we might call real GDP). There is no concept of nominal GDP in this example because there is no money.

Now, our Chicago professor decides to see what would happen if the government entered this economy. He imposes a government on this island, which apparently doesn’t use any currency but declares tax obligations in real terms (apples). You will immediately get suspicious at this stage because in failing to analyse what would happen if a fiat currency was introduced our erstwhile Chicago professor avoids all the issues that he wishes to pontificate about.

He says::

Enter a government that decides it needs to tax away the entire harvest every day, and then pays each citizen an apple a day for lying on the beach. They would have done so anyhow, but they now get paid by their government for performing a “service.” GDP has been doubled. The services provided by the government are accounted for by how much they cost — an apple in this example. It would be easy to keep going and even triple or quadruple the original one-apple-per-day GDP.

We are thus led to believe that the government (presumably backed by some coercive force) levies a real tax (apples) and the rate is 100 per cent of total non-government production.

Given that the government chooses not to use its own currency the tax obligations can be extinguished by the private sector through their own-home production. If the government had have introduced a currency into this economy, then the taxes would not have been able to have been paid before the government had spent or made the transfers at least equivalent to the tax revenue being collected.

In a monetary economy, the imposition of taxes creates a demand for the newly-introduced currency. The non-government sector has no other way of getting access to the currency other than by offering real resources (labour etc) to the government in return for government spending (or transfers).

The scheme proposed by our Chicago professor is in fact a redistribution scheme involving “Current Transfers” between the government and the non-government sector (the beach-bums).

The SNA defines a Current Transfer in the following way:

A current transfer is a transaction in which one institutional unit provides a good or service to another unit without receiving from the latter any good or service directly in return as counterpart and does not oblige one or both parties to acquire, or dispose of, an asset.

The “pay” the citizens get is not a wage but rather a transfer akin to social security. It is a redistribution of the tax “income”.

The apple-eaters do not have to “dispose” of their assets (the apple trees). The current transfers in this case would appear to be of the form of “Social contributions and benefits”, which come under the SNA category of the “secondary distribution of income account”.

To be more specific, the “pay” the beach-bums receive would be more accurately classified under “social insurance benefits in kind” (given the economy has no nominal constructs (money)).

The statistician computes Disposable incomes as “balancing item in the secondary distribution of income account” and is the sum of all primary (market) incomes plus “current transfers, except social transfers in kind, receivable” minus “current transfers, except social transfers in kind, payable”.

It gets tricky because under Section 8.22, it is recognised that “Disposable income is not all available in cash” as a result of the SNA recording imputed values for “non-monetary transactions associated with production for own consumption or barter, or with remuneration in kind”.

But, “social transfers in kind from government … to households are recorded separately in the redistribution of income in kind account” so would not even show up as disposable income but rather is an adjustment made to balance the books (called “Adjusted disposable income” within the SNA).

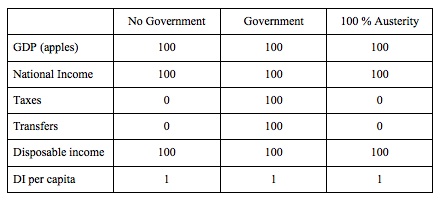

Ignoring some of these complexities, we can deduce the following. In the SNA, Disposable income equals National Income plus transfers minus taxes.

If we ignore capital consumption allowances and indirect business taxes, which are zero in this example, then GDP equals National Income (apple for apple).

So Disposable income = GDP + Transfers – Taxes.

In the example, total daily production (GDP) equals 100 apples. The government then taxes each beach-bum 1 apple per day (Total Taxes = 100) but then transfers 100 apples a day back to the private sector as part of social policy (Total transfers = 100).

The upshot is that GDP remains at 100 and is equal to disposable income.

The Chicago professor’s claim that “GDP has been doubled” is false. He will claim that the 100 apples is a payment for productive work (collecting the apples) so that G (government spending) = 100 and that should be added to the initial 100 apples that have been collected. But that is double-counting.

If the government is indeed employing the workers to collect the apples then they are not paying them “for lying on the beach”. Then the wage costs of collecting the apples would be 100 but GDP would remain at 100. The wage costs in this case would presumably be incorporating some capital input cost given the implied property rights.

But it is much better to think of the payments from Government as a transfer. It doesn’t make any difference how you construct it though.

Further, in real terms the government’s budget is balanced. There is no government spending and taxes and transfers net to zero.

It is also hard to imagine how we could “keep going and even triple or quadruple the original one-apple-per-day GDP”. How would that happen in a real economy without productivity growth? The tax rate is already 100 per cent and that means it completely taxes away the real national income generated when the apple-eaters collect the apples each day.

The beach-bums only eat because the government then transfers the apples back in strict proportion to the tax (1 per person).

At this stage, you will be wondering – WTF! What sort of weird economy is this? The only way the beach-bums would allow a government to do this if if the latter could coerce them, presumably via the backing of a military or policy authority.

Is the example, a good pedagogic model to advance our understanding of a monetary system? Answer: absolutely not. It contains none of the elements that drive the dynamics of a modern monetary economy.

But this sort of model is often used in mainstream teaching to indoctrinate students into accepting fallacious logic.

The Chicago professor then imposes austerity on this economy or rather what he thinks is a reasonable representation of fiscal austerity to demonstrate how the private sector (the apple-eaters) “are no worse off” when the government disappears.

He says:

Now imagine fiscal austerity is imposed, say, by eliminating the government. Yes, GDP would come crashing down; it would fall 50 percent in this example. The citizens, however, are no worse off: They still get to eat an apple a day, just as before. They may even be better off in cases where the government required them to perform an onerous task in exchange for their salaries, such as sitting in a government office all day. Moreover, if the tax imposed on citizens is a labor tax on collecting the apples, then high tax rates might have been preventing them from collecting the apples in the first place.

First, before investigating the logic let’s just do the national accounting. The following Table shows the changes (all in real terms). The upshot is that the elimination of the taxes and transfers makes no difference. Obviously, but that provides us with no insights into how the real world works.

This professor would consider rational expectations to be a reasonable approxiation. So it is obvious that if there was a 100 per cent tax rate on labour income (even if the workers were employed in the government sector) and that the tax-payer knew with certainty they would get the 100 per cent of the tax back – then then there should be no change in behaviour.

Second, the mainstream economists claim that imposing taxes on labour income reduce the supply of labour. That is a claim that doesn’t receive strong empirical support at the aggregate level. But that aside, such a proposition would not be valid for these forward-looking apple-eaters. They would quickly realise that tax-transfer scheme was a charade.

Further, given that the government is collecting taxes via openly coercive means (rather than using its currency sovereignty to induce private agents to supply resources into the public sector as in a fiat currency system), there would be rather stronger disincentives not to collect the apples in this economy than any “tax distortion” the other way might present.

But all this tells us nothing about what happens in a real world, monetary economy.

Now consider the way a monetary economy works.

The introduction of a currency unit (with government holding monopoly power over its issuance) immediately changes the situation in this real economy. Even with we retain most of the unusual (read: unbelievable) characteristics about this economy – no markets etc – the introduction of money changes things fundamentally.

First, the valuation problem changes because now goods and services (apples) could be valued in terms of the monetary unit – that is, a price would be defined.

Second, the own-producer model had no currency. There were no transactions. Each producer somehow was endowed with a very productive apple tree (given it dropped one apple per day through the year) and had very frugal nutritional requirements.

When the government levied the tax (1 apple per person per day), the private sector would have only been induced to pay that tax by some non-economic authority.

But if the government is using its own currency and is levying the tax in that currency (rather than in-kind – apples) then the situation changes dramatically – and – we approach something more akin to the real world.

Note here that I am not against simplifying models. They are clearly useful in demonstrating key aspects of the real world yet allowing us to avoid undue complexity, which might lead us to confusion.

But these simplifying models have to have some tractability with the real world. They must not violate basic principles of the actual monetary system.

Modern monetary economies use money as the unit of account to pay for goods and services. An important notion is that money is a fiat currency, that is, it is convertible only into itself and not legally convertible by government into gold, for instance, as it was under the gold standard.

The fact that the government has the exclusive legal right to issue the particular fiat currency it also demands as payment of taxes renders it a monopoly supplier of that currency.

Once we realise that government spending is not revenue-constrained then we have to analyse the functions of taxation in a different light. Taxation functions to promote.

Clearly by imposing a tax on households in terms of currency units the government immediately creates a demand for its currency, which otherwise would be seen by the beach-bums as worthless bits of paper (for example).

The government might rock down the beach and announce to the bums – we will pay you a dollar a day of our currency to come and work for us. The bums will just say – whatever! – and go back to sleep.

But then the government official says that in order to use the beach and to be part of the society (eating apples) the bums will have to pay $1 per day in taxes. The apple-eaters immediately will say – when do we start work!

They know that they need the government to spend first before they can the dollars necessary to pay the tax. They also immediately would understand what most people in advanced societies do not – that the taxation revenue the government raises has no causal bearing on their capacity to spend.

The apple-eaters will perceive that taxation cannot provide a fiat currency-issuing government with the wherewithall to pay because they know that cannot pay the government the taxes before the government has spent.

What other differences does the introduction of money invoke?

The absence of a liquid financial asset means that the apple-eaters can never hedge against uncertainty using money as a bridge across time. They occupy a real world subsistence economy where own-production is never exchanged nor held in storage.

In a monetary economy, the existence of state money (a liquid store of wealth) means that individuals can choose not to spend if they are uncertain about the future (perhaps because they fear unemployment or firms are worried about the state of aggregate spending).

This recognition is relevant for how we think about uncertainty, a standard Post Keynesian concern. Veteran Post Keynesian Paul Davidson has spent a fair part of his career trying to elevate an awareness that monetary economies are non-ergodic. I might write a blog about the way in which mainstream macroeconomics is built on notions of ergodicity, which are inapplicable to a modern monetary economy.

But for now, the point is that (in Davidson’s own terminology) – the introduction of money allows private firms and households to reduce their:

… cash outflow payments for goods and services today in order to increase their cash liquidity position so as to be better able to handle any uncertain adverse future events since our fear of the future has increased”. The most obvious way of reducing cash outflow is to spend less income on produced goods and services – that is to save more out of current income. If, however, many people suddenly think the future is more uncertain, then the cumulative effects of them all reducing their spending on the products of industry will result in a significant market decline for the output of business firms. Faced with this decline in market demand, businesses are likely to reduce hiring of workers.

This problem would never be encountered in the primitive apple-eating society that the Chicago professor envisages.

Moreover, Paul Davidson says that:

In a money using, capitalist system, the fact that people recognize that the future is uncertain means that households and business firms will want to maintain a liquid position … This unspent portion of money income we call savings. To carry these savings, i.e., contractual settlement power, into the future savers will use a variety of liquid “time machines”.

That option is not provided to the apple-eaters. For them there is only the uncertainty of the harvest but they can do little about that.

For a worker in a capitalist monetary economy, they can use money as the “time machine” and choose not to spend.

In Modern Monetary Theory (MMT) terms, it is thus the introduction of state money into an economy that raises the possibility of unemployment. There can be no unemployment in the apple-subsistence economy. If the government failed to transfer 100 per cent of the tax take back then at least one beach-bum would starve.

If the apple world was monetised then immediately there would be offers from the beach-bums to government of goods and services in return for the necessary funds to extinguish the tax liabilities.

While mainstream macroeconomics conceives taxation as providing revenue to the government which it requires in order to spend, MMT demonstrates why the reverse is the truth. Government spending provides revenue to the non-government sector which then allows them to extinguish their taxation liabilities.

So the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending. It follows that the imposition of the taxation liability creates a demand for the government currency in the non-government sector which allows the government to pursue its economic and social policy program.

This insight allows us to see another dimension of taxation which is lost in orthodox analysis. Given that the non-government sector requires fiat currency to pay its taxation liabilities, in the first instance, the imposition of taxes (without a concomitant injection of spending) by design creates unemployment (people seeking paid work) in the non-government sector.

The unemployed or idle non-government resources can then be utilised through demand injections via government spending which amounts to a transfer of real goods and services from the non-government to the government sector. In turn, this transfer facilitates the government’s socio-economic program.

While real resources are transferred from the non-government sector in the form of goods and services that are purchased by government, the motivation to supply these resources is sourced back to the need to acquire fiat currency to extinguish the tax liabilities.

Further, while real resources are transferred, the taxation provides no additional financial capacity to the government of issue.

Conceptualising the relationship between the government and non-government sectors in this way makes it clear that it is government spending that provides the paid work which eliminates the unemployment created by the taxes.

So it is now possible to see why mass unemployment arises. It is the introduction of State Money (which we define as government taxing and spending) into a non-monetary economics that raises the spectre of involuntary unemployment.

As a matter of accounting, for aggregate output to be sold, total spending must equal total income (whether actual income generated in production is fully spent or not each period). Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages).

Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account through the offer of labour but doesn’t desire to spend all it earns, other things equal. As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment. In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

So we should at this point appreciate that the purpose of State Money is to facilitate the movement of real goods and services from the non-government (largely private) sector to the government (public) domain.

Government achieves this transfer by first levying a tax, which creates a notional demand for its currency of issue. To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency.

This includes, of-course, the offer of labour by the unemployed. The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets).

It is also clear that if the Government doesn’t spend enough to cover taxes and the non-government sector’s desire to save the manifestation of this deficiency will be unemployment. Keynesians have used the term demand-deficient unemployment. In our conception, the basis of this deficiency is at all times inadequate net government spending, given the private spending (saving) decisions in force at any particular time.

For a given tax structure, if people want to work but do not want to continue consuming (and going further into debt) at the previous rate, then the Government can increase spending and purchase goods and services and full employment is maintained. The alternative is unemployment and a recessed economy.

Conclusion

I am now back on the terra firma with my body suspended in time somewhere over the Pacific Ocean.

Our Chicago professor seeks to demonstrate how “How 3 Myths Drive Europe’s Response to Debt Crisis” and then proceeds to demonstrate that claim through the use of a mythical model that not only is pretty lame in itself but, more importantly, has no applicability to a monetary economy.

In a monetary economy, fiscal austerity means that there is less spending overall in the economy unless the non-government sector increases in spending growth to match the decline in net public spending.

The current bout of fiscal austerity is being imposed on economies with high unemployment and low economic growth (moving into recession). In this context, private spending is highly subdued as households fear rising unemployment and firms see no need to invest in greater productive capacity when consumption spending is so flat.

In these conditions, fiscal austerity will further undermine aggregate demand and generate reductions in real living standards. The empirical evidence is mounting to support that contention.

Our Chicago professor has developed a model where there can be no unemployment. That clearly cannot provide insights into the world we live in.

That is enough for today!

This is typical Chicago economics – a stylised but relevant analytical framework.

Error : a stylised but IRrelevant analytical framework.

I think you lisped

“For a worker in a capitalist monetary economy, they can use money as the “time machine” and choose not to spend.”

That can be simplified to a couple of words:

“banks buffer”

Abstract that away in your models and you’re no longer describing a modern credit economy. Your model may not have unemployment, but it won’t have iPods either.

Dear Jean-Baptiste B (at 2012/02/21 at 19:15)

Yes, quite a slip – fixed now. Thanks very much for the help.

best wishes

bill

“When the government levied the tax (1 apple per person per day), the private sector would have only been induced to pay that tax by some non-economic authority.

But if the government is using its own currency and is levying the tax in that currency (rather than in-kind – apples) then the situation changes dramatically – and – we approach something more akin to the real world.”

Except that it is not the use of the currency that changes the situation, as you point out later on:

“The government might rock down the beach and announce to the bums – we will pay you a dollar a day of our currency to come and work for us. The bums will just say – whatever! – and go back to sleep.

But then the government official says that in order to use the beach and to be part of the society (eating apples) the bums will have to pay $1 per day in taxes. The apple-eaters immediately will say – when do we start work!”

It is the government’s claiming of the land and denying people access to it that drives the desire to pay taxes. Whether those taxes are in apples or dollars is irrelevant to the point.

“In Modern Monetary Theory (MMT) terms, it is thus the introduction of state money into an economy that raises the possibility of unemployment. There can be no unemployment in the apple-subsistence economy. If the government failed to transfer 100 per cent of the tax take back then at least one beach-bum would starve.”

Starvation is not the same as unemployment. If the government failed to transfer 100% of the tax take back then people’s wages would be below subsistence rates (I’m assuming that payments would be in portions of apples here). People would still work, they just wouldn’t be able to for very long. You could have 100% employment with a fast reducing population.

Agree that the Chicago example was simplistic rather than simple. (Indeed, I agree that the Chicago school often lives in a fantasy world – though no less fanciful than most of the economic schools.) It’s a shame really because one of his key points was as follows:

“I’m not suggesting that Greece, Italy or other countries with large government sectors pay government employees to lie on the beach or sit idly in offices. But it may be worth asking why the government share of their economy has to be so large, and how much truly would be lost if these governments spend less.”

Can you sensibly argue, using MMT, that the public sector is anywhere near as “productive” as the private sector? I ask this because if 30% of the labour force is in the public sector, then the “productive” output of remaining 70% is being spread rather more thinly than would otherwise be the case.

In the public sector, people are performing a range of tasks for which there would ordinarily be no demand. Would you pay for someone to issue you parking ticket? Increasing the size of the public sector or raising wages to public servants (even if the MPC equals 1) it seems would do little more than cause a temporary blip to economic growth. How could it be permanent? I suppose if the spending policies that interventionists advocate were a panacea, the US would have emerged from the Great Depression by 1937-38 – not 1947.

Moreover, I would like to see the assumptions of MMT codified into a dynamic CGE model. Such models are incredibly flexible and could easily accomodate the behavioural assumptions embodied in MMT. (It turns out that Australia has the very best CGE modelers in the world.) I would love to see the results of MMT-based CGE simulations. Short of this, it is easy to make very plausible sounding arguments about the expected outcomes of MMT prescriptions but there maybe other overriding factors you can’t take account if you don’t rigouressly test them. In a CGE model this is made practically possible.

A lack of codification is the key weakness of the Austrian school. It still isn’t taken seriously in the policy arena. I think for MMT to be taken more seriously, both in acadaemia and in practice, adopting a CGE framework is one crucial step that must be taken. There is no more transparent way. ‘Hand-waving’ essays just don’t cut it at the policy coal-face.

Love your blog. Cheers!

“Can you sensibly argue, using MMT, that the public sector is anywhere near as “productive” as the private sector? ”

How large is the financial sector, and what has been the result of their ‘output’ over the last decade?

From where I’m sat that output has converted perfectly serviceable factories into really crap flats due to an asset price bubble.

It’s not a matter of which sector an entity is in. That’s a simplistic viewpoint as ridiculous as ‘money printing causes inflation’.

Productivity is a function of the level of entropy in an organisation and an emergent function of that entropy across the entire system. Hugely complex.

Esp Ghia

“I suppose if the spending policies that interventionists advocate were a panacea, the US would have emerged from the Great Depression by 1937-38 – not 1947.”

Actually it was the war that proved Keynes and others right. The government spent lots more money on tanks, planes etc provided by the private sector, and employed lots of service personnel to prosecute the war, thus lifting the economy out of recession. War is all about state intervention!

The previous policies (New Deal etc) were less effective than they should have been because they were continually blocked by the Republicans in the same way we are seeing today.

The following quote has been attributed to Albert Einstein. Whether the attribution is correct or not, the statement’s value is undisputable: “Everything should be made as simple as possible, but not simpler than that”.

There is an entry in wikipedia titled “Spherical cows”.

Cheers,

Vassilis Serafimakis

Bill said: “It is also clear that if the Government doesn’t spend enough to cover taxes and the non-government sector’s desire to save the manifestation of this deficiency will be unemployment. Keynesians have used the term demand-deficient unemployment. In our conception, the basis of this deficiency is at all times inadequate net government spending, given the private spending (saving) decisions in force at any particular time.”

This seems to me to perhaps be incomplete. Wouldn’t the productivity level of the private sector influence exactly how much government spending would be required to achieve full employment? Just to make that clear, in a hypothetical extreme where productivity is very high so that very few additional employees are required to meet very high levels of additional demand, then achieving full employment might require extremely high levels of additional government spending. In such an extreme situation the real production might then have to be much higher than is actually desired by the whole society which raises questions about wasting resources. I’m not suggesting that we have exactly that situation today of course, but as productivity increases, aren’t we moving more in that direction and thus requiring relatively more government spending to achieve full employment?

I suppose what I’m thinking is that increasing government spending will certainly increase overall societal wealth, but doesn’t directly deal with how that wealth is distributed equitably, which is obviously a big issue for us right now and arguably becoming critical.

I suspect this is at least partly why the Job Guarantee idea exists. I get wound around the axle trying to decide whether JG jobs are better if they are more productive or less so. If they are as productive as private sector jobs, then wouldn’t that suggest that the government could just spend in the private sector to get the same number of jobs (which again doesn’t deal real well with the wealth distribution and resource utilization problems)? If they are much less productive than private sector jobs, then don’t they start to look more like wealth transfers than real jobs? But maybe that’s not such a bad thing …

OK, I should have phrased my last comment better. I do understand that government spending for JG does not necessarily imply a transfer of wealth from rich to poor. I meant to use the word “transfer” in the national accounting sense that was defined in Bill’s posting, which was payment without requiring goods or services in return.

“If they are much less productive than private sector jobs, then don’t they start to look more like wealth transfers than real jobs? ”

Remember that highly efficient public sector services reduces the scope for profit making. Be careful what you wish for 🙂

If they are much less productive that private sector jobs doesn’t that give an opportunity to some smart entrepreneur to have a quiet word with his bank, hire the individuals off the JG and bank the profit?

JG is about being an effective price anchor. The private sector can then sort out any efficiency issues with a little investment and the JG will automatically back off.

In the thread above the question was posed by Esp Ghia, “Would you pay for someone to issue you a parking ticket?”

This question propounds a false proposition. Let us rephrase it correctly.

“Would you pay somebody (a regulatory agency of some kind) a small surcharge (maybe on you car registration) to issue parking tickets to chronic over-users (free-riders) of existing parking facilities so that you could avail yourself of your fair share of said parking facilities?”

The answer then to this question is “yes”.

I feel compelled to post again. This idea that democratic governments provide nothing useful to the citizens is a most absurd notion. What sort of system would propounders of this notion prefer to live in? A corporate dictatorship perhaps or a failed state?

To cite just one example, people often complain of “regulation” and the cost of said regulation. One soon notices that they only complain of regulations that impede what they wish to do but are the first to make of use of regulations which assist what they wish to do. Democratic government regulation of civil life is a very valuable service. Try living in an anarchic, highly dangerous, failed-state system for a while and you will soon understand the profound truth of this statement.

Hi all and thank you for you replies – they are very informative.

CharlesJ, your comments are just perpetuating a fallacy. Think about the famous ‘broken window’ example. It boils down to the most fundamental economic concept there is – opportunity cost. Diverting resources away from productive uses and putting them towards destructive uses invariably results in both bad and distored economic outcomes. WWII was no different. If this was not true then you might as well walk down the main street of a low socio-economic area and smash everyone’s windows.

Neil Wilson, say what you will about the complexities of production but at the end of the day it is reasonable to believe that people respond to incentives and disincentives. Across the economy as a whole producers and physical capital investors will behave so as to profit maximise. Their incentives are clearly different from public enterprises and the results are typically different. However, I do agree with your point about the implosion of the financial sector. When interest rates are held artiificially low, what’s a banker gonna do? Lend like crazy. Also, it certainly is simplistic to say ‘money printing causes inflation’ (but there are examples where it has happened). In fact, that statement might be outright wrong if you are referring to ‘price inflation’. However, it is a truism that ‘money printing’ results in ‘monetary inflation’. It is just as silly to believe that money is ‘neutral’ when it results in enormous wealth effects – redistributions in purchasing power to those who get their hands on the new money first. The corporatist or crony-capitalist system in which we live is what drives increasing inequality and concentrated wealth in the hands of fewer and fewer. It is a disgusting and insidious process that is remedied by having less government, not more (in my view).

Ikonoclast, it is not a false proposition. You have merely redefined it in a way that creates intractable problems such as by using the word “fair”. What is fair? Fair is always somebody’s else’s definition! Different strokes for different folks. And even then the answer to your question is not necessarily yes, and most certainly it is not a resounding yes. Your second post where you write… “people often complain of “regulation” and the cost of said regulation. One soon notices that they only complain of regulations that impede what they wish to do but are the first to make of use of regulations which assist what they wish to do.”…shows that you understand that regulation distorts decision making. I am pleased about this. However, the illusion of ‘democracy’ is something you are yet to come to grips with.

Thanks again for your replies. I enjoy this blog. I am learning a lot that was glossed over at uni or was outright wrong in some cases. Still, I would love to see how MMT performs in a CGE modeling paradigm.

Cheers!

“Diverting resources away from productive uses and putting them towards destructive uses invariably results in both bad and distored economic outcomes. WWII was no different. If this was not true then you might as well walk down the main street of a low socio-economic area and smash everyone’s windows.”

You are confusing wealth with income and stocks with flows. If we smashed every window then had government pay to replace them we’d get a sudden surge in contractors hiring people to install windows. Those previously unemployed now have income which they will spend buying goods and services, which translates to greater demand, greater incomes and an additional drop in unemployment as businesses respond to the new spending.

Building tanks, ships and planes during WWII eliminated unemployment; wages were sufficient to induce almost the entire working-age population to get to work and the vast demand generated by government spending meant manufacturers needed every worker they could obtain. No unemployment and surging incomes in defense related industries boosted economic growth throughout the economy.

Ben Wolf, nice try but no cigar. How does the government pay exactly? Ultimately, it is through higher taxes. What you describe is utopia. I like that place but it does not exist on this planet, at least not until nano technology makes huge advances and fundamentally changes the way we think about scarcity.

p.s. what happened in Wiemar Germany when the government with its monopoly over fiat currency, paid workers to continue with the reparations from WW1 – remind me how that ended?

“How does the government pay exactly? Ultimately, it is through higher taxes.”

I can only assume you are new to MMT. In short: taxes don’t fund anything.

Esp Ghia, you are not thinking clearly. I suspect your thinking is distorted by the individualist dogmas of libertarianism. I more properly defined the parking problem by putting it into a fuller context. You caricatured the problem with a glib proposition which took many of the real dimensions out of it. You seem to view government (even democratic government) as entirely an imposition on citizens which performs no functions that citizens might want or need.

I wonder if you would complain if a parking officer wrote a ticket for a person who illegally parked across your driveway thus blocking ingress and egress for your own motor vehicle? The benefit of the regulation against parking across driveways and the general knowledge of its enforcement, function as a deterrent to reduce the frequency of such events. I figure I have to explain these facts of regulation and social (and anti-social) behaviour to you in minutiae as you seem so keen to gloss over the real complexities of modern civic life with a simplisitic and dogmatic view of individual rights taken out of the social context in which rights (and responsibities) actaully exist.

Ideally, we would all prefer parking which was free, ample and unregulated IF this never produced negative unintended consequences. The first aspect of empirical reality that intrudes is that space is not unlimited in a busy city. There is competition for space and its uses. Where there is competition for a resource (parking spaces in this case) there are several ways in which the competition can be resolved. One way is with violence. We could remove all regulation and allow people to resolve all parking disputes with tyre levers. Would this accord to your notions of a sensibly individualistic and unregulated society?

Another way of resolving competition in a mixed economy is by market pricing and this happens with private car parks for example. Note however that regulations, laws, policing and compliance checks still must govern the operation of a private market. That is, the workable operation of a market is ultimately governed and guaranteed by state laws and regulations ultimately backed by state force. Otherwise, tyre lever “diplomacy” could be used with impunity on the parking attendent of the private car park just as it could be used in the street.

You are quick to deride the notion of “fairness”, to claim that it is entirely subjective and claim that its introduction into the debate creates “intractable problems”. I would argue that abandoning the notion of “fair” (fair dealing, fair price, fair compensation etc. etc.) is what would actually introduce intractable problems into our attempts to run civil and commercial society. Fairness in this sense is very much a synonym for justice. If you are arguing for the abandonment of fairness you are actually arguing for the abandonment of justice.

The fact that fairness or justice is sometimes (but not always) difficult to define is insufficient reason to abandon the pursuit of it. The attempt must still be made and the best (and fairest) method yet devised is the form of group decision making called democracy. Just as you deride the notion of fairness (justice) you also deride the notion of democracy. You imply that I am naive and under an illusion because I argue for or invoke democracy when pure democracy is unattainable. Using that reasoning, it would be naive to argue for clean drinking water because absolutely pure water is technically impossible to produce.

You seem to imply that I am not aware that there are some very imperfect democracies around. The USA is a good example of a poor democracy. Indeed one could probably call it an oligarchy with quasi-democratic pretensions. I am genuinely puzzled. What form of government do you propose? I can only assume that if you are consistent you most propose no government or else very little i.e. anarchy or perhaps minarchist libertarianism.

Anarchy (going by what happens in failed states) quickly degenerates into warlordism. Minarchist libertarianism would simply hand rule over to the plutocrats and oligarchs and their willing henchmen and repressors in government. Take a look at contemporary Russia. That’s about what minarchist libertarianism will give when it comes out in the empirical wash. Notice in each case, my appeal to empiricism, my method of saying let’s look at what really happens when absurdly unrealistic theory (libertarianism) is applied in the real world.

Esp Ghia,

I strongly recommend you read Bill’s post here to help get you up to speed on MMT and Functional Finance:

https://billmitchell.org/blog/?p=5762

Ikonoclast, thankyou for your detailed reply. Yes I am new to MMT and am enjoying learning about it.

Where property rights are well defined (the “why are you parked in my drive way”? type situation) I would not require a ‘regulatory’ body to issue a fine. Usually people can work things out for themselves, though there are some real a-holes out there. Police should deal exclusively with these crimes – not victimless crimes, imho.

In terms of fairness, I do not deride it all. What could be ‘fairer’ than a voluntary agreement between individuals that was causing no harm to anybody else?

The problems with democracy are many-fold and deep rooted. In short, party politics results in behaviour that maximises the welfare of the party first, not the land mass the voters live in. Assuming the propositions of MMT are optimal to enhance welfare overall, you can virtually be guaranteed that they would somehow be badly implemented by whatever regime was in power.

Agree that USA is a bad democracy. What is an example of a good democracy currently in place?

What happened in Russia twenty years ago was an absolute disgrace. What you saw was the politically well-connected getting the usual leg-up from their cronies. That would not happen in any ‘libertarian’ world that I can think of. I doubt it would happen in an MMT world either.

I think you will find that we agree on a lot more than you think.

Ben Wolf, forgive my ignorance. Why do we pay taxes if not to, ultimately, fund public sector activity?

Esp Ghia,

In a modern, fully fiat currency a government spends by keystokes. Someone at a conputer pushes buttons and momey appears in the recipients’ accounts. Basically governments print every dollar or yuan or dinar (whatever the unit of currency) they spend. When they tax they unprint the currency and also create demand for it as everyone runs out to make money with which they can extinguish their tax liabilities. The U.S. for example has been doing this since it ended the Bretton-Woods system and fully abandoned the gold standard in 1971.

The taxes our IRS collects are sent to the government’s accounts at the Federal Reserve where they literally cease to exist. New money in the form of bank reserves is then created and spent into the economy. This is also why there is no reason to be concerned about the government’s capacity to pay back the public debt: the money “borrowed” is the same money the government created and put into the banking system in the first place.

Esp Ghia: I suppose if, the US would have emerged from the Great Depression by 1937-38 – not 1947. This preposterous “1947” idea propagated by professional liars & maniacs is quite recent. Nobody, nobody who lived through those years thought the Great Depression ended in 1947 rather than much earlier. Nobody said such a thing. Only the progress of time and deaths allow such ludicrous rewriting.

When I see such statements, I wonder whether the writer has parents or grandparents.

History very clearly shows, often enough recapitulated by Bill here, that “the spending policies that interventionists advocate” were “a panacea”. There just wasn’t enough panacea administered fast enough in the USA until a bit before the war. And MMT properly understood demonstrates the falsity of the concept “interventionist”. The point is to “intervene” enough to offset the departure of the unemployment rate from its natural rate of zero (Benedict@large) caused by the state’s “intervention” of creating a monetary economy by taxation. Viz today’s blog.

The real history is that things got a lot better soon after FDR got in. This continued until a short Roosevelt Recession in 37-38, quickly reversed with the first intentional, consciously designed deficit stimulus, and things got better until the war & its humongous deficit spending utterly eradicated the depression. Measured in real GDP, as this blog points out Another Wingnut New Deal Myth Busted, the economy had recovered to 1930 levels by 1937 As he says, “This gives us an insight as to why Roosevelt listened to his Treasury Secretary, and cut spending: he thought, or at least his gut was telling him, that the economy had grown beyond the level of 1930.”

See also Marshall Auerback’s Time For a New “New Deal”. “The reputation of fiscal activism has also been harmed by a historical revisionism aimed at the heart of FDR’s original New Deal, the essence of which is that he achieved little of lasting economic benefit and that it was only World War II that finally took America out of the Great Depression. This is factually incorrect. There is much evidence to support the contrary position, that the effects of the New Deal were in fact greater than even mainstream historians have been willing to allow. This paper presents some of the relevant evidence.”

CharlesJ perpetuated no fallacy. The problem is not in what you don’t know, but in what you know that ain’t so. “interest rates are held artiificially low” is another example. People back then devoted a titanic effort to purchase a titanic good, a fascist dictator-free world. Part of this came from not continuing to mindlessly squander colossal resources as “capitalism” with its “natural” tendency toward high unemployment does.

Still, I would love to see how MMT performs in a CGE modeling paradigm. That’s a lot like saying I would love to see how General Relativity performs in a Discworld modeling paradigm. Reminded me of a lecture though I went to on GR in a PPN modeling paradigm a loooong time ago (hint: guy, initials PAMD was there). Pretty similar. 🙂

Ben Wolf, thanks for that explanation. It kind of sounds like taxation as you have defined it is another form of open market operation performed by a central bank. Is that so? Does your explanation imply that if a govt prints money with no commensurate tax increase that price inflation will occur?

WWII spending is a good example of not ‘paying for something with taxes’ as debt to GDP more than doubled (turned out not to be a problem). A very elderly neighbor was asked by my son what she could tell him about WWII … her most vivid memory was that it was great because the factories were humming and EVERYONE had a job. Shows how rare that situation has been.

Praxeology at work. No real world example that Ikonoklast gives can ever convince Esp Ghia, because he’s convinced human behavior doesn’t need to be observed, rather it can be logically deduced from first principles. Libertarian principles, of course.

jms.grmwd, absolutely not true. I am the most open-minded person you will ever meet. It is ok to have a different view of social reality. What may appear to you as market failure could appear to someone else as government failure. That is not a weakness. Markets are far from perfect, but i am yet to see a system that is better. Maybe MMT holds the answers – that is what I am trying to figure out. I don’t claim to have a monopoly on wisdom.

What could be more real world than the behaviour of the Federal Reserve in the years leading to the GFC? How would you expect people to behave in response to Greenspan-ism?

This stuff needs to be codified so it can be properly examined. Waving your hands and insisting something is true is not good enough. This is where I diverge greatly from Austrian thought. I am prepared to test propositions – that is why I am trying to learn MMT.

Esp Ghia,

When you argue “where property rights are well-defined, I would not require a regulatory body” or “I can’t think of a ‘libertarian’ world where that would happen” you are arguing in the Austrian praxeological tradition, where logical intuitions on human behaviour trump empirical evidence. It’s not a matter of being open- or closed-minded, but of having incompatible frames of reference for debate. I agree that what looks like market failure to some, may look like government failure to others. But at this point I’m not even sure if you accept that market failure exists, or would agree to mutually satisfactory evidential criteria to prove the case one way or another.

jms.grmwd, market failure definitely exists. Indeed this is where government can make very positive contributions. There is no doubt about that whatsoever. It is sometimes tricky to tell why something came about as there are often multiple rounds of effects – but it always seems to be the second-last effect that gets noticed the most.

Esp Ghia, given that government is your official representative against the rest of society in all matters related to that society, then a government failure is by definition your private failure. So please stop blaming abstract others when the blame is on you. Until you reconcile your position with regards to the government (whatever your definition in fact is!), you will be forever lost in such mindless debates.

Sergei, surely you jest? What could be more abstract than the notion of a “society” or a “nation”? I know that I am against violence. If governments operate through violence then I cannot reconcile with that.

Anyway, I am here to learn – not to flame or be flamed. So to more important matters, I think I understand MMT. It goes like something like this: in periods of deficient aggregate demand (no matter how these periods arise), the government as the monopoly issuer of the fiat currency should engage in nation building programs – such as what might be deemed by government as important – infrastructure, e.g., ports, roads, hospitals, etc. This creates employment for those who have been marginalised and deserve better since there is no real reason for them to be unemployed. They spend their increased income; they benefit from job experience and training that couldn’t happen if they were stuck on the dole. The goverment implements as many projects as is necessary to offset deficient private aggregate demand (that is, to remove spare or unutilised capacity). Because the fiat issuing government faces no practical financial constraint (as it’s all done electronically), it may do this with gay abandon up until a time when private sector confidence is restored and there is full employment of labour…hence private spending rises. As this happens, in order to avoid an inflationary environment, the government increases taxes (some of this happens naturally anyway because of auto stabilisers) and effectively “unprints” money thay was previously electronically issued and thereby restores a sustainable ‘balance’ to the system. In other words, once the taxes are actually paid, some portion of the new money is removed from the system and this mutes pricing pressures that could otherwise emerge.

Am I on the right track? As far as I can tell that is the key message from MMT. Please let me know if I mis-stated or omitted any key concepts.

Kind regards.

Esp Ghia wrote:

“I think I understand MMT. It goes like something like this: in periods of deficient aggregate demand (no matter how these periods arise), the government as the monopoly issuer of the fiat currency should engage in nation building programs – such as what might be deemed by government as important – infrastructure, e.g., ports, roads, hospitals, etc.”

The problem with your statement is in the word “should”. For the umpteenth time, MMT is not a prescriptive, but, rather, a decriptive theory. MMT describes the world of macro-economy as it actually is and works. It offers the necessary insights into the workings of modern finance, so that people can form opinions abour what to do or understand the effectes of those actions.

In fact, the term “Theory” in MMT is, for me, problematic because it implies a conjecture, a postulate, something that carries an arbitrary preposition – while, in actual fact, MMT does no more than describe reality. When I look at a clear and non-edited photograph of Bill Mitchell, I do not say that this is how Mitchell theoretically looks.

Cheers,

Vassilis Serafimakis

Esp Ghia,

Taxes and spending are very much like CB operations intended to control the supply of money, only much more powerful. Raise taxes and you restrict monetary flows, lower them and the flows increase; ditto for raising and lowering spending. This is why here in the U.S., Secretary Geithner stated that a spending cut was the same as a tax hike, because both reduce the number of net financial assets available to the private sector to spend or save. A core tenet of MMT is that fiscal policies are in reality monetary operations.

as a relatively new comer to MMT this is a great discussion, I recognize “some guy” and “Neil Wilson”, my question to anyone willing to spend the time has to do with the possibility of currency devaluation due to government spending, I understand Bills points (at least I think I do) of inflation only being a concern as an economy reaches full employment and production utilization, but I have found little, through Randall Wray and Warren Mosler, and a little form James Galbraith on the depreciation due to government spending. Thanks for any help you can offer

Oh Lordy I’m being recognised now.

“possibility of currency devaluation due to government spending,”

The first thing to realise is that there is no acceptable theory of exchange rates in economics. There are a lot of religious beliefs but nothing backed by hard evidence.

As Prof. Wray put it in the primer last week:

“Truthfully, no one knows. No one has much of a clue, really. I like [John T] Harvey’s two JPKE papers and they might be as good as anything out there. Add in Keynes’s interest rate parity theorem and Sraffa’s commodity pricing and I don’t think economists have much else to say. Since daily trade in financial assets exceeds annual trade in goods and services, it is clear that whatever theory you have it must treat exchange rates in the context of a theory of asset pricing.”

So simplistic ideas that if interest rates go down the currency must go down, or if government spending goes up the currency must go down are nonsense.

About all we know is that it will fluctuate based on supply and demand, and if your economic policy is to stop subbing imports with interest payments and instead spend government money on increasing domestic sales (and therefore the profits of the country’s businesses) then it is very likely the value of the currency will go up as people pile into the shares of the businesses about to receive a very large amount of sales orders.

As John T Harvey says – “it’s complicated”.

@joey

I see little evidence the simple quantity of money has a significant impact on its value. On the surface it seems logical, but our deficits have been rather large over the last four years without any corresponding inflation. Think about it this way: if the National Mint were to print out $100 trillion and then put it in a vault at the bottom of the ocean would the dollar depreciate, or would that depreciation require that people get their hands on that money and use it?

Thanks, I appreciate both of your inputs, I am still trying to get a greater grasp of all of this, this blog and the comments helps, I think the most comprehensive writing I have read so far on this had been James Galbraith’s, which acknowledges basically what you two are saying, and others (countries) hold bonds at their discretion, and that depreciation would hurt our purchasing power and their economies, specifically China and Japan, and perhaps Germany

“and that depreciation would hurt … their economies, specifically China and Japan, and perhaps Germany”

The Germans are too pure to sully themselves with purchasing foreign currency. So they’ve outsourced the issue to the ECB who are pursuing a ‘strong currency’ agenda by whipping the Mediterranean countries into debt deflation.

Add one currency peg and you’re sorted.