I started my undergraduate studies in economics in the late 1970s after starting out as…

A journey back in time

A bit of a different blog today. I was rummaging through some boxes of papers today in search of some “non-digitised” notes which I wanted to consult as part of the development of our macroeconomic textbook, which Randy Wray and I hope to get out sometime next year. I came across some old drafts of papers I wrote in the early 1990s which had handwritten annotations etc. The old way of doing things. I thought it was interesting to compare the final published version of one such paper with the unpublished draft. That is what this blog is about – looking back to an article I wrote in 1993 (“Demystifying the Deficit”). A little journey back in time – but with alarming overlaps with what is going on today.

Black Labour

Before I go to my archival material a lot of readers have asked me to situate Black Labour in the debate (similarly the Blue Dog Democrats).

I don’t want to write “When you’ve got friends like this – Part X” blogs all the time so I suspended my research into Black Labour for today because the blog might have headed down that road again. Apparently, if I keep writing these sorts of blogs I will have no friends left.

But didn’t Groucho Marx say:

Please accept my resignation. I don’t care to belong to any club that will have me as a member”.

The “so-called progressive club” that is. (-:

But I came across some extraordinarily co-opted material anyway.

Take this article – Cut to the chase: 15 political truths for the centre-left – which was published by the self-styled centre-left Policy Network. The various writers that are assembled under this portal are getting a lot of attention in the UK Guardian at present.

For example, see this article Labour urged to stop dithering over deficit reduction (December 1, 2011) and Labour must make fiscal honesty the key to responsible capitalism (December 1, 2011).

I think the flooding of the Policy Network rhetoric in the Guardian sadly compromises the independence of that newspaper. But that is another story.

The article in question was part of the Policy Network’s “Priorities for a new political economy: Memos to the Left” and was presented to the Progressive Governance Conference in Oslo on May, 12-13 2011. It was published on the Policy Network portal on May 10, 2011.

The paper attempts to outline a manifesto for the “centre-left” (whatever that is) to allow them to “extract the right lessons from the crisis” and to define a “progressive political action plan”.

While each of the “15 Ideas” were interesting, I choose only to consider Idea 7 in this blog which was entitled “Fix your fiscal accounts – the progressive way”.

Accordingly, we read:

There is nothing progressive about large fiscal deficits and high public debts: when public finances blow up and need to be fixed in an emergency, it is the poor and the vulnerable who end up footing the bill.

It is much better to strengthen fiscal accounts before a crisis – and to do it the progressive way. The first thing is to get the timing right. A weak recovery is not the time to tighten fiscal policy sharply. But if markets see no indication of tightening, they may abort the recovery themselves. The way out of this conundrum is to commit to adjustment, backload it, and make credible any promises of additional future tightening. This may require setting up fiscal rules and independent fiscal councils …

That sounds like a neo-liberal prescription to me. My view of progressive policy ignores the fiscal position and focuses on the substantive issues. If you have high unemployment then the deficit – whatever it is – is too small.

The only rule that the government should be guided by is that aggregate demand has to be such that all productive inputs are working according to their desires.

Fiscal rules and fiscal councils erode democracy and usually impart conservative biases to policy (such as, using the neo-liberal NAIRU as a benchmark).

The concept of public finances “blowing up” is not a progressive one. What constitutes a blown up situation?

If it is rising bond market yields, that further extends the neo-liberal construction. Currency-issuing governments can ignore bond markets which are really just arenas where some of the corporate welfare is delivered in the form of risk-free government annuities (bonds).

A progressive position is to break free of the grip that debt markets place on the capacity of governments to pursue public purpose. Under those circumstances, what could constitute an “emergency”?

A rapid rise in unemployment is an emergency and requires a rapid budget expansion.

What does “strengthen fiscal accounts” mean in progressive language? I would say that we would be moving to a stronger position when the government was expanding its net discretionary position to engender growth and reduce unemployment. According to these (so-called) progressives that would be a weaker position.

Financial markets are dependent on government not the other way around when that government issues its own currency. I consider it a neo-liberal position to assert that “if markets see no indication of tightening” then bad things will happen.

What exactly can the markets do to a progressive government that uses its fiscal capacity appropriately to fill the real spending gap between non-government spending and available real productive capacity?

Not buy government debt? A progressive wouldn’t issue debt!

Sell the currency down? Perhaps, but a progressive would declare illegal or tightly control most of the financial transactions that are not associated with real production and so that would reduce that capacity.

Persuade firms not to invest in productive capacity? Perhaps, but the capitalists chase profits and no firm is going to resist going for market share by maintaining enough capacity if aggregate demand is growing.

What else? Not a lot. The financial markets cannot “abort the recovery themselves” unless the relevant national government allows them too. The ascendancy of the “markets” is a government construct. Our representatives became co-opted and bought off. The progressive challenge is to reclaim our states and make them work for us and not to adopt a timid resignation that the markets have the power.

Most importantly, fiscal policy should never be guided by context-free rules (backloaded adjustments, promises of future tightening etc). It is a moving feast and should be defined by what is happening in the non-government sector combined with the socio-economic mandate that the government wishes to pursue.

Sometimes budgets have to be tightened, other times loosened. There should never be a “tightening bias”.

Black Labour is not a progressive movement.

Empirical context of the 1993 article

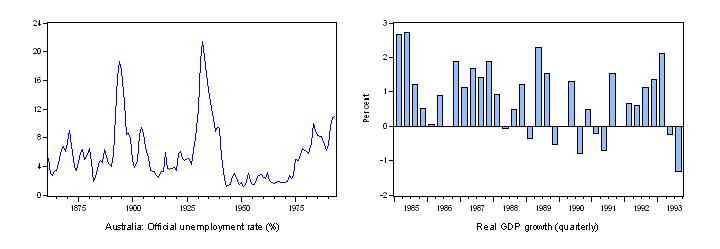

To appreciate the context that the article was written within I created the following graphs. The left panel shows the annual unemployment rate in Australia from 1861 to 1993 while the right panel shows the quarterly growth rate in real GDP from the first-quarter 1985 to the third-quarter 1993 (the article was written in October 1993). In the left-panel, the Great Depression of the 1930s stands out.

By the time I was writing this article, Australia had gone back into recession. The Federal Government’s refused initially to intervene as the 1991 recession (our worst since the Great Depression) deepened.

It was a Labor Government at the time and they had become obsessed with budget surpluses. Eventually they reluctantly intervened with a relative modest (but very late) fiscal stimulus but it was too late – the economy was already back in recession. It took the rest of the decade and then some for the unemployment rate to go back to the November 1989 level (the low-point in the previous cycle).

Demystifying the Deficit

The article appeared in the Arena Magazine in the October-November 1993 edition. The following text is the final published version and I have annotated it with the extra information I discovered today.

The final version presented below had to fit into a word constraint which largely explains the edits. While I would have written a few things differently now I thought you might be interested in reading what I might have written in 1993 if blogs were the go.

[1993 TEXT BEGINS]

The budget deficit is often paraded by economists, politicians and so-called financial market experts to set out a case against an active fiscal policy. It appeal lies in its seeming simplicity.

We are given the easy-to-understand homily of the family budget and told that if the family or government lives beyond its means then trouble looms.

[Comment: In my original draft – which was edited by me to meet the word limit I had added after this sentence]:

Indeed, the idea that the government is just a big household has not relevance to an economy where the government issues its own currency.

The fact is that the budget outcome is far from unambiguous. In this regard, it is one of the most misunderstood and misused concepts that creep out of economics into the public domain. The current debate about the state of the Federal Budget is a good example of how misleading “rationalist” rhetoric can distort the policy process and impair the operation of the economy.

[Note: at the time the term “economic rationalist” was popular in Australia. We use the term neo-liberal now – one who believes in the myth that private markets self regulate and deliver optimal outcomes for all]

It is true that the annual budget documents represent the major statement of policy direction for the Federal Government. Intuitive reasoning might conclude that the actual budget figures measure in dollar amounts the policy choices being made by government and hence its impact on the economy.

But this is not really possible without first analysing the nature of the deficit.

[Comment: original draft had this extra sentence]:

We have to distinguish between good deficits where the government spending and taxation decisions support real GDP growth with strong employment outcomes and low unemployment from bad deficits which result from the collapse of taxation revenue with insufficient public spending. The latter is associated with stagnant growth or recession and high unemployment.

So while a deficit reflects expenditure larger than budgeted income, this is by no means an indicator of government policy or intention. Nor does the family analogy help in grasping the complexity of government budget necessities.

According to that analogy, the deficit indicates a more-or-less immediate need to raise income contain expenditure. But this overly simplistic thinking, which is viewed by its adherents as common sense, takes no account of cyclical processes, or of the knowledge of economic relationships critical for proper economic management.

[Comment: original draft had this extra sentence]:

Household spending faces intrinsic funding constraints which do not apply to the Federal government. Further, government deficits are required to support growth when private spending is insufficient.

Economists who are not bent on misusing the budget outcomes for ideological purposes by appealing to some of these popular perceptions, make a clear distinction between structural (or full-employment) deficits and cyclical deficits.

[Comment: original draft had this extra sentence]:

This relates to the earlier distinction between good and bad deficits.

The actual figure which is published and is most often quoted in debate is the sum of these two components. Put simply, the budget outcome is influenced by the state of the business cycle as well as chosen fiscal policy parameters.

When the economy enters a period of slow economic activity, and output and employment fall, taxation receipts (both income and indirect) fall and transfer payments rise (principally unemployment benefits). This causes an increase in the budget deficit even though the fiscal policy parameters (tax rates, benefit rates, government spending programmes) have remained unchanged.

The deficit will fall again, without any necessary change in fiscal policy, if the economy increases its activity (more tax and less transfers).

[Comment: original draft did not have the last phrase in parenthesis but had this extra text]:

With higher levels of output, income and employment, the government receives increased tax revenue and pays out less in unemployment benefits (without changing any policy settings). Economists refer to these cyclical shifts in government revenue and spending – the automatic stabilisers. They are so-named because in a downturn they serve to put a floor in total spending in the economy and in an upturn work to contain aggregate spending.

The budget deficit figure is appealing, because, in a single number it summarises the complexity of policy decisions. But to use it as an unambiguous summary of discretionary fiscal policy choices, we need to separate the impact of the business cycle (the cyclical component) from the impact of the policy choices (the structural component).

How do we calculate the structural component? We define some notional full employment/unemployment rate, and using the current policy settings we work out what the budget outcome would be (with the implied higher tax revenue and lower transfer outlays).

[Comment: original draft had these extra sentences]:

Defining full employment is highly controversial and the economic rationalists use a concept referred to as the NAIRU (Non-Accelerating-Rate-of-Unemployment) which they claim is unchanging in the face of the business cycle but defines the unemployment rate consistent with stable inflation.

The concept has evaded empirical scrutiny and fails to consider the so-called structural changes in the labour market (skill obsolescence) that themselves cyclical in origin but reversible. The attempts to empirically define the NAIRU produce outcomes that appear to track the actual unemployment rate up and down which makes the concept fairly useless as a guide to policy.

Full employment should always be defined in terms of the number of jobs that are needed to satisfy the desires of the workers for jobs.

The difference between the structrual balance and the actual budget outcome published is due then to the economy not being at this full-employment level of activity, rather than to discretionary government policy. Any structural deficit is due to deliberate policy decisions.

So prior to judging how much impact the deliberate policy stance is having on the economy we have to decide how much of the actual deficit outcome or estimated outcome is structural.

Currently the actual budget deficit is estimated to be around $16 billion, which is a very high figure.

[Note: I would now have written “a very high figure in absolute terms relative to our past history”].

But before we get worried by it we should put it into the context of the persistently high unemployment and slack growth which plagues Australia (and the rest of the world).

How many commentators do this?

While it is a complex task to compute the structural component, some simple calculations can give us an idea. Using six per cent unemployment as an arbitrary benchmark and taking pre-1993-94 fiscal policy settings, we can estimate what the budget deficit would be at that higher level of activity.

[Comment: original draft had this sentence instead of the last sentence above]:

Given the unemployment rate at the end of 1989 (6 per cent) as the growth cycle peaked as our benchmark and taking pre-1993-94 fiscal policy settings, we can estimate what the budget deficit would be at that higher level of activity. We should not assume that full employment is reasonably defined as being consistent with a six per cent unemployment rate. However, this is currently about what the Treasury estimates the NAIRU to be and to neutralise objections to the analysis based on disputes about what constitutes full employment, we adopt the six per cent benchmark.

[Note: the actual unemployment rate in November 1993 was 10.9 per cent]

Based on ABS data and Treasury’s own data base, after estimating the gains in tax revenue and the savings in transfers as a result of the higher level of economic activity, the rough calculations reveal that the structural deficit at the end of June 1993 was approximately $6 billion, or around 1.5 per cent of GDP, a far cry from the $16 billion of the actual budget outcome.

Further, in the 1993-94 Budget, the government has factored in large indirect tax gains over the next four years which alone if realised would more than wipe out this structural component.

So the only reason we would still expect to see any deficit by 1996-97, the current fiscal setting unchanged, would be before the economy is still languishing at high unemployment levels.

[Comment: original draft had this extra sentence]:

This is not to say that eliminating the structural deficit is a responsible fiscal strategy. A deficit of around 1.5 per cent of GDP has historically been associated with full employment and provides the spending impetus to support the private sector saving intentions.

The next question is whether that is an appropriate degree of stimulus to be putting into the economy by choice. Another way of posing this question is to ask whether budget deficits are ever warranted. Some say the budget should always be balanced. Their reasoning is briefly as follows.

Total national savings is the sum of private household saving and government saving. Governments save when the budget is in surplus and dissave when in deficit. If the government budget is in deficit, this must be financed by drawing down private savings via bond issues or by increasing overseas indebtedness (via current account deficits).

The reduced availability of funds and the higher interest rates crowd out private sector investment. The moral epithet usually invoked says that public spending is largely wasteful and replaces more productive private spending.

This argument is seriously flawed.

Firstly, public spending is not inevitably unproductive, even when it is only for consumption purposes like education and health. Public infrastructure serves as a backbone for private-sector investment and national development. Further, spending on education, for example, reduces the costs of training to the private sector and increases the productivity of the labour force.

Secondly, the idea is based on the notion that private-sector investors are champing at the bit to increase productive capacity and are only constrained by available private-sector savings. This is patently untrue. Recently there have been substantial incerases in corporate profit levels, yet private investment remains flat.

[Comment: original draft had this extra sentence]:

The empirical evidence is that private investment is substantially driven by confidence and with high and rising unemployment, firms will not invest in new capacity if the existing capacity is sufficient and there is considerable uncertainty relating to realisation of sales.

In previous times, many potential investment resources were frittered away by the private sector chasing speculative gains.

[Note: this was written at the start of the growth surge in the financial sector aided by the deregulation that the government introduced in the erroneous belief that this would “grow wealth” for all of us]

Thirdly, the idea is based on the old classical loanable funds doctrine which conceived of savings as a fixed pool which could only be increased by reducing consumption as interest rate changes (rises) made future consumption cheaper. Any reduction in savings was, obviously, simultaneously a reduction in investment (both being related in opposite ways to interest-rate changes).

Yet one of the significant steps which Keynes made was to point out that savings could be released without any decline in consumption in the short term via portfolio adjustments between cash holdings and other financial assets. But more importantly, both savings and consumption could increase as output grew.

So if a budget deficit contributed to growth the savings pool would also grow and investment expenditure could also be financed.

[Comment: original draft had this extra sentence]:

This observation led some economists to say that investment brings forth its own savings by which they meant that investment spending created multiplier effects which stimulated national income and some of the extra income would be saved.

Fourthly, the idea of budget deficit-motivated growth only makes sense when the other components of growth are absent. In particular, investment can only be starved for funds when there is too much expenditure demand. Governments have to use deficit stimulus when private-sector demand is low.

[Note: I would now express the investment constraint more clearly in real terms]

In that instance, it is nonsense to talk about damaging expenditure that is patently non-existent. Moreover, the costs of not attempting to stimulate the economy in terms of wasted human and physical resources are so large that modest negative effects on private expenditure in the short run are small by comparison.

[Comment: original draft wrote the last sentence in this way – which I think was better on reflection]:

Moreover, the costs of not attempting to stimulate the economy in terms of wasted human and physical resources are so large that even if there were modest negative effects on private expenditure in the short run they would be small by comparison.

So at a time of low private-sector activity and high unemployment the government must use its spending and taxaction policies to stimulate the economy. There is no dynamic in the system which would get the economy going again in the absence of this fiscal stimulus.

Properly targeted spending with some monetary growth must remain the priority of the government. The relatively small structural deficit currently existing could even be increased in the short run without any damaging consequences.

[Comment: original draft wrote the last sentence in this way]:

The relatively small structural deficit currently existing is too small once you consider the persistently high unemployment and could be increased in the short run without any damaging consequences like inflation. The persistent inflation that we carried over from the OPEC decade (mid-1970s) was eliminated in 1991.

It is the poor private investment performance which really lies at the heart of Australia’s problem and necessitates a higher structural deficit than would otherwise be justified.

[Comment: original draft wrote the last sentence in this way]:

… otherwise be justified in relation to the need to maintain price stability.

Australia has a moribund entrepreneurial class which has not shaken off the effects of our long historyof guaranteed profit under protection. It sees business as predominantly an activity based around asset speculation.

In the mid-1980s, this class was given unprecedented opportunities to use the higher profits from the Accord-motivated income redistribution, lower corporate taxation and a depreciated dollar to increase productivity and per capita income.

[Note: the Accord was the Federal government wages policy which engineered real wage cuts for several years in the 1980s on the pretext that the capitalists would use the redistributed profits to create more employment and, ultimately, real wages growth. The unions became totally compromised by their association to the Labor government and this period, arguably, started the demise of the union movement. They had become co-opted to the neo-liberal agenda]

The funds were largely squandered in share and property transactions. This necessitated higher interest rates to moderate the economy to bring the external debt into manageable proportions. The debt was largely a legacy of the private-sector binge. The slower economy has led to the budget deterioration.

[Comment: original draft wrote the third last sentence in this way]:

Given that the Federal government became increasingly resistent to using fiscal policy, the RBA considered it necessary to increase interest rates to moderate the economy to bring the external debt into manageable proportions. Monetary policy is a blunt instrument and the long time lags involved introduce a bias to increasing rates too far and holding them at those levels for too long.

[Note: to avoid stirring erroneous claims I now never refer to a rising budget deficit as a “deterioration”. In 1993, I was using the term in the common parlance which I now consider to be misleading and focuses the discussion on the wrong thing]

Once again, with low inflation and extremely modest wages growth, corporate profits are booming, but there are insignificant levels of private capital formation. There is always an excuse. Too much regulation here, too many restrictive costs there. Yet we forget that two of the most regulated and highest taxing economies (Germany and Japan) dominate the world.

[Note: by this time Japan was wallowing in the immediate aftermath of the asset price bubble]

The unfortunate truth for all of us, and especially the poor and disadvantaged, is that we ultimately rely on private investment for employment and prosperity. That is the old problem of capitalism, and no matter how sophisticated the disguise over the class structure, it will not disappear.

The budget deficit is just another smokescreen which capitalists and their agents use to obscure their own failings.

[END OF 1993 ARTICLE]

Conclusion

There were many smaller edits – a word or two here or there – but the final draft was not that much different to the penultimate draft that I had to cut to get within the word limit.

At the time I had not gained the position of professor (I was a lecturer).

I consider the arguments used in that article remain applicable and I wouldn’t have written it much differently.

What followed – during the rest of the 1990s – was an acceleration in the neo-liberal deregulation and the massive accumulation of private debts. The financial sector that I had identified as the problem in this article became a much larger problem and has delivered the death knell to that method of organising the monetary system.

The problem now is that it is taking a long time for the population to work through all the narratives to reach that inevitable conclusion. Meanwhile, the lying politicians remain in charge and co-opted by the elite lobbies that are dominated by the financial sector interests.

It took 30 odd years to create this mess and it will take a fair time to get out of it.

My current role is – as I considered in then – to provide the analytical case to reject the mainstream approach. And to just keep pushing down that road!

You might conclude that I have been bashing my head against the brick wall for all of my career and you would be pretty right. Some time I will stop!

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – even harder than last week!

That is enough for today!

Yes,and the mid 80s to the mid 90s were the time of the Silver Bodgie and the Worlds Greatest Treasurer – a so called Labor government.Nothing has changed.With friends like these the working class doesn’t need enemies.

Hi Billy i love reading your blog every day. I have learned so much over the past few months since i discovered your site. I have no third level education and had little or no interest in economics growing up to be honest i found it a little boring that was until i found your blog. I really like the way you analyze the drivel coming from the media and politicians and your interpretation of whats really going on in the world around us. Your research has also inspired me to go back to education watch Bloom berg and read various newspapers from around the world, things i never had an interest in before. your work has also had a negative impact on my life to I cant listen to a polatican longer than 60 second without wanting to kick in the TV screen and feel as frustrated as you at the Neo-Liberal self defeating policies purseued by governments around the world, it is like a cult has taken over the world and only a few people can see it. Keep up the good work its not in vein i assure you.

Dear Bill – can you recommend anyone in the UK academic establishment who is even close to ‘getting’ MMT? With the increasingly destructive approach taken by the UK Coalition, I’m keen to approach politicians and journalists to push MMT but doing so without any academic credentials one risks being taken as a crank.

Best

Dear Bill

Not everybody who wants to work is employable at current wages. Some people have, for various reasons, such low productivity that no profit-conscious employer would hire them even at the minimum wage. The higher the minimum wage is relative to average productivity, the higher the number of unemployable people must be. That is only realistic.

Regards. James

Guardian journalists and readers describe themselves as “progressive”. I’d just like to announce that I’m, intelligent, good looking, sexy, wise, and possessed of numerous other virtues.

@Anders,

http://moslereconomics.com/support/, there’s a couple of UK academics on the list, I’m sure you can look them up and see for yourself what their opinion on MMT is once you have their names.

Being listed on Warren’s site probably means they are very keen with MMT but as a rule of thumb you shouldn’t trust the Internet blindly 🙂

The Guardian has always had a few right-wing political economic commentators amongst their self-described progressives. But the recent stream of blather from Blue Labour and now Black Labour is rather distressing . The Observer is even more so, but was always redeemed by some decent columns in the business pages. It makes you wonder if the lords-of-the-universe are worried about their status, given the failure of orthodox economics, and are using a few levers to frame the future debate. You can’t look in the media at the moment without finding yet another pundit stating that whatever government wins the next election, their main policy must include “necessary” cuts and deficit reduction – trying to close down the debate for the next nnn years.

“I’m keen to approach politicians and journalists to push MMT but doing so without any academic credentials one risks being taken as a crank.”

Anders, you have to remember these politicians and journalists are not interested in the truth. It’s hard to believe that but I’m becoming more and more convinced of it. They will never start saying the complete opposite of what they have been saying for the last however many years. It’s not good for their reputation or bank balance. What you need to do is ridicule them at every opportunity and point out the many absurdities they utter whenever they open their mouths. I devote a large amount of leisure my time to it. Not sure if it makes much difference but it makes me fool good. I recommend you give it a go on the Guardian CIF blogs. You will find some enlightened posters there. The BBC’s site is awful and Peston, Flanders et-al are no hopers though.

MMT macroeconomic textbook – great!!!!

Andy – I’m just not sure that ridiculing is a strategy that pays off over an acceptable timeframe.

I agree that commentators or those with a vested interest will refuse to countenance MMT, but it seems there must be some route through to someone with a public mouthpiece who doesn’t have any baggage and so is open to MMT, in order to force MMT on to the agenda.

For example, I can imagine the Independent ‘getting’ it, and starting to run front-page articles as they have done with some campaigns in the past (eg GWoT). Admittedly, this is a long shot, and you would need to overcome the barrier of the embarrassment of the incumbent economics team who had missed this ‘huge’ story. But showing up without academic/economic credentials would result in zero chances of getting traction – even if one or more individuals there were broadly sympathetic.

Much as the MMT online materials are pretty good, there is still no pithy statement of purpose that is cogent, professional and short enough to get the attention of a busy, unsympathetic audience.

Anders, I’ve had the same question.

A brief search brings up these;

http://www.ntu.ac.uk/nbs/document_uploads/108676.pdf

http://books.google.co.uk/books/about/Modern_theories_of_money.html?id=TAC5fHXg0_QC

Dunno how good that is, isn’t there someone at UCL who’s close? Ex-Bank of England…

I’m not so sure that a lot of financial reporters and economists don’t get at least part of it. It was interesting to listen to a BBC radio programme about the Euro crisis a week or so ago and most talking heads, which included a lot of top economists, knew exactly what the problem was (non-sovereign-currency nations and the need for fiscal transfers from north to south). The problem is a little more complex than that.

There are, of course, ideologues who have no interest in the truth. This includes both economic ideologues and their political acolytes. The latter are quite happy with mainstream theory as it fits in with their world view – welfare for the rich and the dustbin for the poor. You might also include a large proportion of the German banking community in the former.

Then you might have quite a large community that have some idea, but there are large-scale impediments to progress here. The first is the historical weight of orthodox nonsense. The second is the “understandability” of the orthodox view – for every politician willing to listen to reason, there will be many more in whose ears the spin doctors will be saying that anything radical is a sure route to political death, and they quake in their boots.

The most important battle in the next couple of years is “framing the argument”. You can see it happening right now – “the cuts are inevitable whatever government, or you’re a madman”. There is a case to be made – employment and investment – but it has to be made effectively.

Agree Gastro – so what’s the right approach for an MMT enthusiast with no academic/economic credentials??

@Anders

I don’t think anyone in the mainstream media, economics or politics has the guts to stand up and say anything against the accepted authority.

The best chance we have of getting the MMT message out there is probably through taking out full page ads in newspapers or maybe even tv, but this would cost a small fortune and I just can’t see us being able to find the funding. It might be a good idea to try and get in touch with a group like 38degrees and see if they’re receptive to MMT, They seemed to have been able to put together some impressive campaigns in other areas.

There’s a lot of excellent work and scholars behind MMT, but it’s not something the public will find easy to get behind and that’s where real change will come from.

Opponents of MMT often say;

1. There is nothing new in it. It is Keynesianism plus Functional Finance.

2. Keynesianism/Functional Finance failed in the 1970s with stagflation.

3. The stagflation era displayed high inflation, high unemployment and high budget deficits.

4. Point 3 refutes MMT.

How would you reply to that Bill? (Please remember I am MMT sympathetic. I want ammunition against the neoliberal economists, commentators etc. i.e. almost everyone.)

In the early ’80’s I was, i’m ashamed to say, an unimportant member of the ALP Labor Unity( Right) faction. The perception of most of us at the time was that, given that Keynesianism had “failed” and monetarism,despite our disdain, was gathering followers, the best a progressive could do was to work within the new “reality”. While it is undoubtedly true that the accord and various other “reforms” have downgraded the position of workers, I think the Labor party may have been doing the best it could with limited intellectual ammunition. Its been said before that : “politics is the art of the possible” and politicians being simple creatures are understandably not keen to have to sell difficult ideas( eg : view how easily the liberals can divert the climate change debate) . Now that we have the intellectual ammunition of MMT, its time to for progressives to take back the political ascendency, to get involved and influence the public debate, its time for civilization to reconquer territory lost to the barbarians.

As a worker in an area of government that gives value to our monopoly issued non convertible fiat currency with floating exchange rate, I expect Mr Swann’s surplus fetish will lead to decreased economic activity and hence lower revenues collected.Sad news for our unemployed fellow Australians.

@James Schipper:

Didn’t Keynes show how that argument runs afoul of the fallacy of composition about 80 years ago?

Didn’t numerous studies from the OECD among others show that there is no link between minimum wage and unemployment?

@Ikonoclast – yes an inflation account is a key weapon in the MMT armoury.

Bill has written about cost-push inflation before. But in short – it’s important to pick apart the inflation dynamics. MMT is often read as saying that inflation cannot happen if ADAS, unionisation (bargaining power) or wage indexation provisions. Right now, all inflation in the West is the self-limiting kind.

Thanks Will – I think Philip Arestis looks promising!

Bill,

I’m looking forward to the book – I hope you and Randall promote the bejesus out of it. I hope your publishers keep the price down as well!

As for MMT dissemination, I have seen Neil Wilson trash all-comers in a very courteous fashion on the CiF forums. However, inevitably, these are swamped by right-wing grassroot trolls who – deliberately or otherwise – misunderstand basic macroeconomics, and invoke bogeymen like Weimar Germany, Zimbabwe, stagflation and so forth. I think Bill, Warren Mosler, Randall Wray, Marshall Auerback et al, will need to push harder to get op-ed articles in major newspapers, and make sure that their edited copy doesn’t get distorted. Actually, Marshall Auerback was on a news programme on Irish TV (not RTÉ, of course), and got fairly free rein to tell the nation how the ECB could bring the current fiasco to an end, and in the process, bamboozle his fellow guests, being our clueless ‘Minister for Europe’, as well as the main economics correspondent from the Irish Times – in the end, he was left smiling as the ‘Minister’ was reduced to continuing to bark that ‘the ATMs would be empty’ if Ireland ditched the euro, while the Times journalist, normally a model of calm, was apoplectic at the notion that the ECB could stop the crisis ‘at the stroke of a keyboard’. Marshall did well to keep his cool in the face of this kind of hostility – it kind of reminded me of the Bill Hicks line about an audience staring back at him ‘like a dog that’s just been shown a card trick’.

However, MMT proponents (qualified ones, not armchair experts like me) would really want to get their skates on in terms of getting the message out there, particularly those living in the eurozone, which is looking more and more like a currency system designed purely for the benefit of the sovereign bond market, which, in other parts of the world, and as Bill and others have demonstrated, has no intrinsic right to exist. There must be a simple way of constructing the important points – for instance, I believe some MMTers took part in the OWS demos recently, with some good signs such as ‘INCOME = SPENDING’ and ‘IT’S AGGREGATE DEMAND, STUPID!’ on display. It may need to be boiled down to simple slogans like this. I have some other suggestions for such slogans, like: ‘Public Spending Is Private Income’, ‘The Government CAN Create Jobs’ and ‘Banks Don’t Lend Reserves!’.

For what it’s worth, I think it’s inevitable that MMT will become standard economic thinking – the danger is, that this won’t happen until we undergo a catastrophe even worse than what’s going on at the moment, and the idiot politicians and media hacks realise that the game is up. You wonder what exactly has to happen before they cop on – the move towards Eurobonds, witchery about a year ago, is now supported by everyone except Dr Merkel and the Bundesbank, who want to keep de facto subventions going for the German export sector – this is very slow progress indeed, but progress is happening. Unfortunately, until the day of reckoning, we’re going to continue to get pronouncements from Government-funded neo-liberal ‘think-tanks’ like the OECD or the ESRI (they’re the main economic think-tank in Ireland, made up of neo-classical economists, self-styled ‘libertarians’ and climate-deniers), assuring us that if Governments keep up austerity, everything will be fine as long as these austerity measures are accompanied by economic growth! You will also continue to have mainstream media outlets such as RTÉ in Ireland, who continue to give these fools carte blanche to say these stupid things without challenge, and to present it as a manichean struggle between ‘wealth creators’ on one hand, and evil trade unionists who want to tax success, rather than drinking water, on the other.

For non-economists such as myself, but who have at least a tenuous grasp of MMT/Functional Finance, we can at least relate the simple elements to our acquaintances – for instance, a couple of friends of mine applied for a mortgage, and were somewhat surprised that the bank was quite receptive to their application, considering said bank was having to be subsidised by the exchequer. I was able to tell them that since they were both employed and had a reasonable credit history, they were deemed credit-worthy, and whatever the Government was sticking in their reserves had no bearing on whether or not they were going to get a loan. I wish I had a friend who was a member of phoney small business organisations who keep demanding the rescission of the minimum wage and the strong-arming of banks to increase lending – I could tell said friend that if his business was able to get more customers, who weren’t being screwed by austerity measures, and therefore able to give them more custom, then they would be able to get a constant stream of credit from the bank. In other words, tell your friends about MMT! Read these blogs, read Center of the Universe and (some of) New Deal 2.0. Irish people, read smarttaxes.org.

I think the battle to get MMT/Functional Finance accepted is somewhere between uphill and impossible. Even left-moderate economists (whatever that means as Bill says) sneer with scorn and derision (but no substantive arguments) whenever MMT is mentioned. Their minds are closed. The general public just buy the line that government finances are like household finances.

When I asked some “left-moderate economists” if they thought deficit spending to the level to soak up unemployment was desirable/feasible they point blank refused to give me a straight answer. Instead they resorted to high-falutin’ technical quibbles which ultimately amounted to the crowding out theory or raising the spectre of hyper-inflation. They did point blank state that government deficits can never be unfunded but must always be funded by bond issuance.

@Ciaran on dissemination – all valid points. But I am struck that in the US, Mosler knows that a few guys in the Fed have read his book and are broadly sympathetic, albeit that for prefessional reasons they have to keep quiet for the moment; Mosler has also had dinner with Krugman; finally, you have a US Senator (Bernie Sanders) staffing himself with MMT heavy weights (Wray, Kelton, Galbraith et al. Heartening as Auerback’s performance was, there seems to be no institutional familiarity, let alone buy-in, amongst the corridors of power this side of the pond – Eurozone or UK. Philip Pilkington is an honourable exception – the UK could well do with one of him.

I continue to think that MMT suffers from a lack of materials. Sure, there’s plenty of papers and blogs, but they are generally so long and/or informal that they entail open-mindedness, goodwill and patience for someone to go through them. So yes, I’ve sent friends to this blog and Warren’s, but these are the odd ‘intellectual’ type; I can’t, say, get my local MP or a journalist friend-of-a-friend, and say “spend 30 mins reading Mosler’s ‘Soft Currency Economics and you’ll ‘get’ MMT”. It’s just not realistic.

@Ikonoclast – what sort of left-leaning economists? If you’re a regular here (and I suspect you are), you would know what responses to give to nonsense on crowding out or under-funding.

Near the beginning of this blog, Bill wrote:

“… Sell the currency down? Perhaps, but a progressive would declare illegal or tightly control most of the financial transactions that are not associated with real production and so that would reduce that capacity.”

Isn’t the strong vs weak currency meme itself a neoliberal construct? So some folks want to exit the currency in hopes of finding higher returns elsewhere … seems to me that trade flows adjust, a new equilibrium is established, and life goes on. Right? Or do you think a no-bonds/interest policy would require currency controls?

“They did point blank state that government deficits can never be unfunded but must always be funded by bond issuance.”

What you are up against there is straightforward religious belief. It is almost a core value that must not be questioned. For some it is a core value that must be defended to the death.

But you change those in the same way that they were built up – by repeating mantras at those people and those that believe them. You’ll notice I’ve been refining some: “For every £100 a government spends it will always get £100 back in tax for any positive tax rate – each time, every time”, “The only deficit we should be concerned with is the one measured in jobs”, “If you owned a bank you wouldn’t borrow from anywhere else, so why should the government?”

Neil – “For every £100 a government spends it will always get £100 back in tax for any positive tax rate – each time, every time” – pls can you elaborate? Is this a statement of multiplier theory or something else?

Prof. Mitchell, first, thank you so much for this blog. I’ve been studying it and other MMT sites for many months now (along with all the reference material I need to make sense of them) and am finally beginning to really understand the essential ideas, from a layperson’s POV. It has opened my eyes quite startlingly. Reading the first part of your post today was great because it confirmed everything I’d hoped I’d got right in a conversation with a person in the OWS online Forum. It was so gratifying to realize I was able to make sense of it well enough to argue my point.

I’d like to know what you, or others here, think of Congressman Kucinich”s Bill in the House of Representatives which, if passed, would take away the ability of commercial banks to create new money as debt. It’s revolutionary, I think — and it doesn’t stand a snowball’s chance for the same reason, of course. Still, the fact that it has actually been presented in Congress is something, don’t you agree?

I can’t work out on my own what the all effects would be, however. It would certainly provide much more leeway for government action, but what else besides? Here’s the bill, for anyone who’s interested:

http://www.monetary.org/wp-content/uploads/2011/10/HR-2990.pdf

“”For every £100 a government spends it will always get £100 back in tax for any positive tax rate – each time, every time”.

It’s a statement of a basic mathematical progression (geometric decay I believe). The government spends £100. Spending = income. Income is taxed. The next person spends the remaining £70. Spending = income. Income is taxed. The next person spends the remaining £49. Spending = income. Income is taxed … and so it goes on until the spending sequence exhausts itself. At that point the original £100 will have turned into £100 of tax.

So money hops around an economy like a stone skipping across a pond. The lower the tax rate, the more hops.

That is the starting point – undeniable mathematics. From then you can get onto the delay caused by saving, and how the money circuit affects the real production circuit in a manner similar to electrical induction.

Neil – I think geometric decay is corect, but I don’t think it proves this particularly point (sadly, as it’s a compelling slogan).

I think the maths says that step 1 is you take the additional income from govt spending and apply a multiplier – say 2x, which would correspond to a marginal propensity to consume of 50%. So 100 of govt spending will ‘tend’ to create 200 of additional income (before the stone sinks into the water, so as to speak). Step 2 is how that income will be applied. I think it’s based on the marginal propensity to consumer, save and pay tax. If MPC is 50%, the MPT will presumably be less than 50%. If it’s 35%, the additional tax will be 35% of 200 ie 70.

In short, the total tax will be = the initial spending x (1 / (1 – MPC) ) x MPT. [unless my Econ A-level is even more rusty than I think it is…]

“In short, the total tax will be = the initial spending x (1 / (1 – MPC) ) x MPT. [unless my Econ A-level is even more rusty than I think it is…]”

It’s not rusty, you just forgot time. I didn’t mention an accounting period – you’ve assumed that and given me the calculation for a period. In infinite time everything always gets full spent.

As I said you start with the undeniable geometric progression. Then you ask why the tax take isn’t 100% and the answer is saving. So in any time period government spending creates tax and savings.

And who can be against that?

Neil, I was already doing a geometric progression to take account of time. In my example, with an MPC of 35%, the 100 of initial income boost (from higher spending) will eventually become 154 (ie 100 + 35 + 12 + 4 + …). That 154 of ‘eventual total income’ must be allocated across consumption, tax and saving based on the MPC, MPT and MPS (which must sum to 1). Assuming MPT of 40% and MPS of 25%, the 154 is allocated into approximately 54 of consumption, 62 of tax and 39 of saving.

But in simple terms, unless MPS is zero, the ‘eventual total’ tax take will always be less than the initial spending boost, because some of the boost will be saved.

Of course, this doesn’t contradict the balanced budget multiplier theorem. But it does undermine that mantra somewhat, unless you say “the govt gets back 100% every time of any spending boost as tax OR willing funding by the private sector” or some such.

Anders,

The government spending £100 can only end up in the government’s account, the banks reserve accounts or as a note in somebody’s pocket. There is nowhere else for it to go. When it ends up back in the government account it is figuratively destroyed and recreated as different government spending (you can see this as it getting a new serial number).

The spending multiplier comes from some other £100, not this one, and all saving from that particular £100 is eventually spent given enough time.

Savings are not forever.