I started my undergraduate studies in economics in the late 1970s after starting out as…

Leadership lacking in the US

I am sitting in one of my “offices” – the little nook I have found at Melbourne airport that lets me work while waiting for planes – watching the video fo the US President’s recent Press Conference (June 29, 2011). I have “offices” like this at various airports. In the speech he berates the Republicans for refusing to show leadership in the current budget debate. My assessment is that after reading the full speech (the video goes for 67 minutes and 5 minutes is too long) – is that the US President outlined in the most categorical terms why he shouldn’t be in charge of the largest economy in the World. In the short time I have to write my blog today I will tell you why that is the case. But overall – as I noted the other day – it is looking more every day like a case of RIP USA.

Before we start though, the following quote is worth reflecting on. In the 2010 State of the Union Address (January 27, 2010), the US President said:

Rather than fight the same tired battles that have dominated Washington for decades, its time to try something new. Let’s invest in our people without leaving them a mountain of debt. Let’s meet our responsibility to the citizens who sent us here. Let’s try common sense.

This quote is also emblazoned on the home page of the Office of Management and Budget where I was visiting to get some historical data. The quote immediately captured my attention.

I wanted to see the whole context so I searched for where the US President actually made that statement and tracked it down to the above Address. But searches always come up with interesting results even if they are completely depressing. Among the resources that the search engine found were discussion forums which provided considerable insights – like:

“His is clearly magical Marxist thinking”

“Let’s try chutzpah and brazen lies, and call it common sense, and try to ram through as much socialism as possible before we get our asses handed to us in November”

“He is Mussolini in diapers. The same dictatorial aspirations, but too PC’d even to admit he wants a totalitarian, fascist state with himself at the head”.

I know that Marxism and National Socialism share some commonality – influence of Hegel – but this is getting ridiculous.

At least one “expert” tried to conduct some economic analysis – “Whose money is he going to be investing, and in what people? And how can a government – a non-productive entity – ‘invest’ without debt?”

As I said, insights … insights into how bad the problem in the US is and why they are lumbered with the politicians they have. As the joke goes (in Australia at least) – these people vote!

But on the substantive matter – since when has a government that provides risk free assets with a return above zero to supplement private sector wealth been a bad thing (from the wealth accumulation perspective)?

Anyway, back to yesterday’s speech.

Before he took questions from the Press Gallery, the US President said “a few words about the economy”. He noted that:

Many people are still looking for work or looking for a job that pays more.

Many equals millions.

He then went into the usual pap about how he is trying to get the “government regulation” monkey off the back of private US businesses so they can employ more workers. No matter how easy it becomes to employ people firms will only increase output and employment if there is a rise in sales.

The following macroeconomic verity is indisputable: Spending equals income which leads to sales which underpin employment growth. It doesn’t matter how “cheap” employees become to a firm if there are no customers coming through the door then firms will not hire the “cheaper” labour to build inventory.

Further, when the neo-liberals like Obama talk about freeing up firms by further deregulation etc the flip side of that is typically degraded conditions of work, reduced job security or other reductions in the capacity of the workers to gain a reasonable share of real GDP.

The US President then blamed the US Congress for tying up essential job creating legislation that his Administration has proposed. My assessment is that the measures he noted (you can find them in the full transcript) will not be employment-rich.

Then he moved onto the main theme with this introduction:

Of course, one of the most important and urgent things we can do for the economy is something that both parties are working on right now — and that’s reducing our nation’s deficit. Over the last few weeks, the Vice President has been leading negotiations with Democrats and Republicans on this issue, and they’ve made some real progress in narrowing down the differences. As of last week, both parties had identified more than $1 trillion worth of spending cuts already.

But everyone also knows that we’ll need to do more to close the deficit. We can’t get to the $4 trillion in savings that we need by just cutting the 12 percent of the budget that pays for things like medical research and education funding and food inspectors and the weather service. And we can’t just do it by making seniors pay more for Medicare. So we’re going to need to look at the whole budget, as I said several months ago. And we’ve got to eliminate waste wherever we find it and make some tough decisions about worthy priorities.

At which point, one’s jaw drops, eyes glaze over and you wonder what planet the speaker is on. In saying that I am probably being unkind to the other planets. All the sci-fi movies I have seen (Outer Limits was a favourite TV series in my youth) the residents of the alien spaces would never have been so stupid to say that it is an urgent need for the US to cut its deficit right now.

That sort of stupidity is probably monopolised by Earthlings – totally stupified by the neo-liberal ideology that holds them (us) in their grip. We are too stupid to realise that the messages that are continually pumped into our homes and offices by the mainstream media is largely devoid of meaning or substance. Just now some character on the radio (ABC) is saying that the US is on the right track because both sides of politics recognise that the most important policy issue is the dangerous deficit and unsustainable public debt.

The radio was turned off at that stage.

The US President then quibbled about where the budget cuts might be made and indicated that the top-end-of-town should share in the burdens of the public net spending cuts. He also said that a “balance approach” to fiscal consolidation would require some spending cuts and some tax increases (especially targetted at the high income earners).

From the perspective of Modern Monetary Theory (MMT) the emphasis is on aggregate levels of demand although the composition of demand (who is doing the spending) is not unimportant.

In that context, it might be desirable from an equity perspective (or some other perspective) to reduce the capacity of the high income earners to spend. But it is madness to cut spending overall which is what the US President is claiming is an important and urgent policy goal when there is so much idle productive capacity.

I know most progressives want to reduce the capacity of the rich to spend. I have no problem with that view as long as they also advocate how the spending gap (whatever it is) that such a policy environment would create would be filled.

The Press Conference then moved into the press questions for the US President.

Among the questions he was asked (many were about Libya etc) was one that challenged the notion that “the August 2nd deadline is the final deadline by which a deal must be raised?” (which refers to the current debate about raising the public debt limit in the US).

The US President replied:

By August 2nd, we run out of tools to make sure that all our bills are paid. So that is a hard deadline. And I want everybody to understand that this is a jobs issue. This is not an abstraction. If the United States government, for the first time, cannot pay its bills, if it defaults, then the consequences for the U.S. economy will be significant and unpredictable. And that is not a good thing.

We don’t know how capital markets will react. But if capital markets suddenly decide, you know what, the U.S. government doesn’t pay its bills, so we’re going to start pulling our money out, and the U.S. Treasury has to start to raise interest rates in order to attract more money to pay off our bills, that means higher interest rates for businesses; that means higher interest rates for consumers. So all the headwinds that we’re already experiencing in terms of the recovery will get worse.

Which is not a truthful statement. They do not “run out of tools to make sure that all our bills are paid”. They could introduce legislation to force the central bank to provide sufficient spending capacity to meet all its obligations.

There would be no need to increase interest rates to attract demand for bonds.

He claimed that this view was not his “opinion” but rather “a consensus opinion”. It is not a consensus opinion. Even the bond markets know that if things became bleak the US government has all the capacity to isolate them (not issue debt) and go on spending regardless. They also know that the central bank can target whatever interest rate they like (at any maturity on the yield curve) by standing by to buy the debt that the private traders boycott.

The bond markets also know that the offer of risk-free public debt is a substantial corporate welfare initiative and while they might make threats they will never stop buying US government debt. The only reason they are holding the Greek government to ransom is because they know there is true default risk in that case. All EMU goverments face default risk because they surrendered their currency sovereignty.

It got worse. The US President challenged the view that the government might side-step the debt ceiling constraint by just paying “interest on the debt” and said:

This is the equivalent of me saying, you know what, I will choose to pay my mortgage, but I’m not going to pay my car note. Or I’m going to pay my car note but I’m not going to pay my student loan. Now, a lot of people in really tough situations are having to make those tough decisions. But for the U.S. government to start picking and choosing like that is not going to inspire a lot of confidence.

The US household is not a currency issuer and faces a continual and binding financial constraint.

The US government is a sovereign government and is never revenue constrained because it is the monopoly issuer of the currency.

There is no applicable analogy between a household and a sovereign government. The false analogy is a vehicle used by conservatives to entice unknowing voters into relating the experiences and options of the government to their own budget constraints. This flawed intuition then makes it easier for the neo-liberals to maintain their false policy agenda. But there is no valid analogy and we should continually expose the falsehoods that are embedded within it.

After suggesting that his young children do their homework on time (even early) as so demonstrate if something has to be done you should “just do it” he claimed that leadership required that the US Congress should just show leadership in bringing down the budget deficit.

He then further demonstrated how poor his understanding of the economics is:

I do think that the steps that I talked about to deal with job growth and economic growth right now are vitally important to deficit reduction. Just as deficit reduction is important to grow the economy and to create jobs — well, creating jobs and growing the economy also helps reduce the deficit. If we just increased the growth rate by one percentage point, that would drastically bring down the long-term projections of the deficit, because people are paying more into the coffers and fewer people are drawing unemployment insurance. It makes a huge difference.

So which is it? Deficit reduction creates growth and jobs or vice versa?

There is no credible evidence to support the proposition that a nation that starts hacking into public spending in situations as exist now in the global economy and particularly in the US will grow and create jobs.

There is an overwhelming body of evidence to support the opposite – cutting budget deficits when there is slack private spending growth and external deficits will erode growth and destroy net jobs.

There is also overwhelming evidence that growth reduces the budget deficit for the reasons the President acknowledges.

As an aside, I often get asked whether I would support spending cuts if they truly targetted public spending waste. The answer is always the same. Waste is typically a bad thing but in this context is usually a loaded term. Spending on corporate initiatives is usually considered productive but when spending is focused on the poor it is considered to be wasteful and eroding incentives.

But moreover, “wasteful” spending is still contributing to aggregate demand and therefore creating jobs and reducing unemployment. It would obviously be better if public spending was not deploying real resources wastefully. So I don’t support spending cuts that create unemployment but definitely support spending that promotes welfare gains and uses real resources in a non-wasteful manner.

Former IMF senior economist, Simon Johnson considered the fiscal contraction expansion argument in this article (June 23, 2011) – Fiscal Contraction Hurts Economic Expansion. While I do not agree with the underlying logic of his analysis (which would be a separate blog to explain) I do agree that Johnson understand the problems facing the US more coherently than the US leadership.

He says that:

There are four conditions under which fiscal contractions can be expansionary. But none of these conditions are likely to apply in the United States today.

These conditions are:

1. Low “perceived sovereign default risk”. He might has said zero default risk. He thinks that has something to do with the fact that the US dollar is widely used “as a reserve asset” which misses the point that any nation that issues its own currency and trades it freely in foreign exchange markets has no sovereign default risk in relation to any liabilities issued in its own currency.

2. It is “highly unlikely that short-term spending cuts would directly boost confidence among households or firms in the current US situation”. I provide some evidence below to support that statement. Johnson notes the high unemploymenr rate and the high real GDP gap.

3. Monetary policy cannot become “more expansionary” that it already is in the US. Again, this is true but largely irrelevant and reflects the bias that Johnson and most “mainstream” economists have towards the use of monetary policy as the principle counter-stabilisation tool. As I have explained many times, monetary policy is a poor macroeconomic tool if you desire to stimulate (or contract) aggregate demand.

4. The US has limited capacity to depreciate its currency and enjoy the increased international competitiveness. We might consider a strong currency to be a good thing because it means consumers can buy foreign goods more easily. But irrespective of that debate, I agree with Johnson that the US is not likely to experience a large boost in aggregate demand from net exports any year soon. It runs consistent external deficits (which benefit their citizens in material terms) and they are not about the change.

Johnson argues that the “best way to bring debt-GDP” down (he uses the emotional and meaningless term “under control”) is to is “to limit future spending increases and boost revenue while the economy continues to recover”.

My statement would be that the debt-GDP ratio will fall once growth is strong enough. The policy emphasis has to be on growth not the debt. The rise in debt is just a reflection of the parlous growth rate in the US. Further, it might be at some point public spending will have to fall and taxation rise. But that has nothing to do with the debt levels. Rather it would reflect the need for the US government to ensure that aggregate demand is growing in line with real productive capacity while maintaining the desired public-private balance (whatever the political process determines that to be).

In that sense, I agree with Johnson when he says that:

The major reason debt surged relative to GDP in the past three years is the deep recession – the result of a financial crisis brought on by the irresponsible build up of debt.

He might have been more specific and used the term PRIVATE debt. And then he might have indicated that with the need for the US private domestic sector to reduce its debt exposure and his own recognition that the US is not going to turn around its external deficit any time soon, the only way growth can occur is if the public deficits persist and probably grow even larger.

Empirical reality check

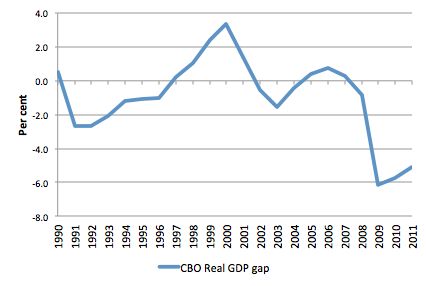

When I read statements by politicians espousing cuts in net public spending I think the technicians in the auditorium or wherever should immediately beam up the following two graphs on the screen behind the speaker.

The first is the US Congressional Budget Office measure of the real GDP gap in America from 1990 to 2011. The measure is likely to understate the size of the gap given the methodology used.

There is a massive shortfall in capacity utilisation given that the real GDP gap measures the percentage difference between actual real output and potential output. The improvement in the early part of this year has been very modest indeed.

There is no secret here. Firms will not increase production and push the real GDP closer to potential unless there is increased spending.

Will there be a fiscal contraction expansion in the US? Answer: highly unlikely. Which means that the spending necessary to reduce this real GDP gap will be further undermined by the government in the US.

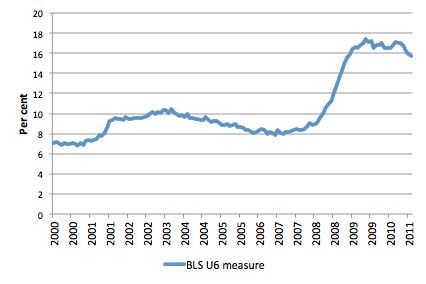

The human element of the real GDP gap is captured by the BLS U6 measure of broad labour underutilisation. This measure recognises that the official unemployment rate (percent of unemployed workers in labour force) is a very narrow indicator of labour wastage. It ignores underemployment (part-time workers unable to find enough hours of work); hidden unemployment (workers excluded from the labour force because they give up actively looking for work); and other marginal worker categories.

The BLS defines the U6 measure as comprising:

Total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force

A number of related pathologies are associated with this level of labour wastage including increased family breakdown, increased demands on the judicial systems (rising crime rates etc), increased demand on health systems (mental and physical); and other problems beyond the obvious income losses which lead to poverty after personal saving is exhausted.

Conclusion

It is very sad when such potential (the US workforce) is left to hang out to dry by the political leaders in a nation. But it is clear – there is no viable and effective political leadership in the US at present capable of putting the people first (especially the most disadvantaged workers).

Time to finish.

That is enough for today!

If Obama means to cut public service spending perhaps he should have a trial run and make cuts that effect congressmen like

1. stop paying congressmen salaries

2. stop paying salaries of congressmen staff

3. stop paying for entertainment in Washington

3, stand down weatherforecasters and air traffic controllers

etc

Not happy these congressmen have no understanding of macroeconomics

Obama cooking up expansionary contraction for the worlds biggest economy. PIIGS under austerity attack from the ECB and IMF. Tories willfully throttling the public sector in the UK. China puffing up the mother of all real estate bubbles.

There are too many storm clouds brewing over the miners proposal for Australian boom MkII. Time to duck and cover methinks.

Watchin the nickel and diming going on in the US Congress is like watching the movie “Dave”.

And I agree the stupidity of the debate is reaching nauseating proportions. The media is particularly bad, but I don’t know how that can really improve when the “leaders” and their advisors, not to mention prominent economists, are leading the debate. Watching CBBC do a story on how evil the deficit is, THEN following it directly with questions about what to do about unemployment is bad enough (and I’m sure they don’t see the irony). But just tonight I watched someone from bloomberg pull up a chart of the Treasury note yield, and wax on about the blip at the end (showing the last 3 days sell-off). This was supposed to show the markets were now afraid of buying Treasuries. Once again, the irony of the monster rally preceeding it, right behind her on the screen, was lost on her….. as was was bringing up the stale comments of Bill Gross on why to eschew Treasuries. Meanwhile, the chart is on the screen showing what he’s missed…..astounding.

Unfortunately I can’t agree on the idea (even though I agree the logic) that “They could introduce legislation to force the central bank to provide sufficient spending capacity to meet all its obligations.”. Republicans would rather start WW3 than let this through Congress, which is in fact why they are going through this debt ceiling charade now.

Bill;

Im confused by graph number one – how can real GDP *exceed* potential GDP?

Thanks!

Bill, others,

Finally the idea of leaving the euro, defaulting and a jobs guarantee is being discussed in Ireland. A debate this morning on one of the most popular radio programs from the proponent, Terrence McDonagh and an opponent Constantine Gurdgiev, the neo-liberals’ neo-liberal!

http://www.rte.ie/radio1/player_av.html?0,null,200,http://dynamic.rte.ie/quickaxs/209-r1-todaywithpatkenny.smil

(debate starts after 1 hour 14 mins on the clip)

Any comments or interest?

Kaiser

thank you bill. the same bit stopped me cold. at least now, thanks to you, i had a bit of clue how dangerously wrong my president’s statement was.

fwiw, here’s something from a couple of our “leading” senators:

http://coburn.senate.gov/public/index.cfm/pressreleases?ContentRecord_id=ae711529-741a-4f52-89eb-4e6ef1c861a7

MMT will fail not from poor logic but rather poor marketing if we don’t get a clear coherent message for the average joe to grasp. The trick to simplifying these discussions is two part. First pose everything in binary terms. People naturally think in binary terms: Currency Issuer vs. User, Spending vs. Savings, Savings vs. Debt, Asset vs. Liability

The second part is then to reframe: All issuer liabilities, or debt, is user savings.Debt for a user is a burden. Debt for an issuer is not a burden…it’s a convenience.

Once we get some good talking points, like i’m trying to create on DollarMonopoly.com, then we push a social marketing campaign all over the web.

McDonagh’s basic idea:

He said the country should default on its debt, leave the euro, build a single public bank, provide a jobs guarantee for all workers and nationalise the Corrib gas field.

see http://www.irishtimes.com/newspaper/ireland/2011/0627/1224299636846.html

Interesting. Would be the consequences. For the rest of the EMU.

Kaiser, great to hear. Maybe it has something to do with lecture Randy Wray recently gave in Ireland.

The Outer Limits was terrific but so was The Twilight Zone. Here is its intro – http://www.youtube.com/watch?v=NzlG28B-R8Y.

Apoligies for leaving this out. Fans of one program were often fans of the other.

Here is the original intro to The Outer Limits – http://www.youtube.com/watch?v=8CtjhWhw2I8. This intro I think has a little more punch in the paranoia stakes than the one for The Twilight Zone, but both were subversive programs.

It’s Herman Brüning all over again and we know how well that experiment unfolded after Brüning had devastated the German economy.

‘Germany Was Biggest Debt Transgressor of 20th Century’

economic historian Albrecht Ritschl

“SPIEGEL ONLINE: The situation after World War II was similar [high debt].

Ritschl: But right afterwards, America immediately took steps to ensure there wouldn’t be a repeat of high reparations demands made on Germany. With only a few exceptions, all such demands were put on the backburner …”

The Austrian chancellor Bruno Kreisky was once asked why Austria had so successful economic development. Kreisky answered, we have had a very successful export we exported our economists.

Dollar Monopoly… Well done! There are alot of resources, but no real central hub yet. There’s no “user-friendly” coherent explanation, no explanation that a layman can understand from reading 2 pages. You have a few thousand pages to read and to extract the essence of, so as to create talking points and less detailed material :D. Good luck and looking forward to seeing the work. I send people here when i can, but it’s only the smart ones i know can handle reading alot. The less-inclined-to-read could use a portal!

Dollar Monopoly

Echo HarPe.

You have put into action what I wanted to do, but never got around to doing……Bravo to you…..Take the shame me.

I believe you are correct about Obama’s poor understanding of the economy and his options. But two of your statements jumped out at me as misleading in the current political context:

The US government is a sovereign government and is never revenue constrained because it is the monopoly issuer of the currency.

That may well be true. But the US Treasury is not a sovereign government, and the US Presidency is not a sovereign government. These are only two of the components of the sovereign US government. And the Treasury might very well be revenue constrained if the legislative branch of the government, which ultimately controls the purse strings, refuses to grant the executive branch the authority to issue additional debt. That is especially the case because the legal constraints on the monopoly production of currency in the US for the purposes of government expenditure appear to require the issuance of debt to the private sector first, which can only then be purchased by the central bank.

Which is not a truthful statement. They do not “run out of tools to make sure that all our bills are paid”. They could introduce legislation to force the central bank to provide sufficient spending capacity to meet all its obligations.

But when Obama said that on August 2nd we run out of tools to pay our debts, I suspect he was using the word “we” to refer to the executive branch – specifically the US Treasury Department. And they are indeed running out of tools to pay government bills. Surely you recognize that the “tool” of introducing legislation to force the central bank to provide spending capacity is completely unavailing in the face of a legislature that is determined not to pass that legislation, and is thus no tool at all in the real world the US president currently lives in.

It is not correct to say that there is no risk of default from a sovereign government that controls its own currency, and that lenders never have to take the possibility of default by such a government into account. Lenders always have to measure the risk that the government will voluntarily default by refusing to pay its bills. Ordinarily, that risk is quite small. But if the government has been taken over by radicals who are willing to default, then it becomes much more real.

In short, the “government” of the US, considered as some sort of abstract corporate entity without institutional articulation, has powers which the presidency in the actual government does not possess.

Don’t forget the legislative body is actually accountable to the voting population. Even though they do not act in the interests of the voters but act for the benefit of their financial sponsors. You can fool most of the people some of the time, but you can’t fool all the people all of the time.

As the selfish and influential early boomer generation start to retire, get senile and die. One way or another they will unclench their ass rings and stop fretting over their retirement outcomes. Then we will reach the end of this particular neo-liberal paradigm. Late boomers and Gen X are conditioned to work until death, they won’t be so anal over national debt and inflation. I say 10 years max to the end. It’s moving into the charades stage now. The national debt fallacy will wear thinner and thinner, it will surely be exposed in the aftermath of the Euro implosion. Legislative change will follow.

In Perry V. United States, 294 U. S. 330 (1935), the Supreme Court decided that, based on the 14th Amendment , section 4, as well as other relevant precedent, Congress does not have the authority to renege on obligations it has incurred in the name of the United States. (h/t Beowulf)

/L

That was a great quote from Kreisky. I have always admired him, for more reasons than one. Here is a snippet about him from Wikipedia

“Conservatives criticise Kreisky’s policy of deficit spending, expressed in his famous comment during the 1979 election campaign that he preferred that the state run up high debts rather than see people become unemployed, and hold Kreisky responsible for Austria’s subsequent economic difficulties. Despite this criticism, Kriesky did much to transform Austria during his time in office, with considerable improvements in working conditions, a dramatic rise in the average standard of living, and a significant expansion of the welfare state … and arguably remains the most successful socialist Chancellor of Austria to this day.”

Folks,

Just an update on the link to the debate on Irish Radio on the Jobs Guarantee. The link above is the latest show which was relevant when I posted it. Here’s the MP3.

http://www.rte.ie/podcasts/2011/pc/pod-v-05071113m35stodaywithpatkenny-pid0-815928.mp3