I started my undergraduate studies in economics in the late 1970s after starting out as…

US Federal Reserve chairman loses his independence

Having heard the “historic” Press Conference held by Ben Bernanke, the Chairman of the US Federal Reserve Bank (April 27, 2011), I confirm the advice I gave on December 20, 2009 that – Bernanke should quit or be sacked. During that conference he chose to wade into the fiscal policy debate claiming that the priority of the US government was to reduce its budget deficit by cutting spending. He gave no justification for those statements and there is no supporting research paper available which might give us a clue as to the rationale for this extraordinary intervention into the policy debate. The fact is that Bernanke is another mainstream macroeconomics stooge who in my view has chosen to abuse his position of power to misinform and distort the policy debate. It is clear that the US Federal Reserve chairman has lost his independence and even mainstream economists who put the concept of independence on a pedestal of virtue should be calling for his resignation.

The UK Guardian provided a blow-by-blow account of the Bernanke Press Conference today.

The Press Release (April 27, 2011) from the Federal Open Market Committee explaining their monetary policy action said:

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

In other words, they are not predicting that unemployment is going to fall very fast.

Much is being made of the historic nature of this event – being the first regularly scheduled press conference in the Federal Reserve’s 98-year history. I think history is very important and transparency like this is compelling.

But it also brings out in the open how the Chairman of the US central bank thinks and sadly that isn’t very compelling. He is basically a mainstream economist who adopts all the neo-liberal myths that go with that status.

Inflation expectations

There was a lot of talk at the Press Conference about the inflation threat and Bernanke claimed the US was running out of trade-off room – between inflation and real output growth. Those remarks seem like dogma when you get behind the projections they provided (see Table below).

The projections forecast a benign core inflation environment over the next three years and an unemployment rate well above their “longer-run” rate.

So the discussion moved to inflationary expectations? But with relatively modest growth and large pools of idle capacity, why would anyone think inflationary expectations would be diverging from the low core inflation outcomes at present. Even mainstream economic theory separates transitory factors such as energy price spikes from core trends.

The Cleveland Federal Reserve Bank publishes estimates of inflationary expectations. Their latest data shows that inflationary expectations are benign and trending downwards. So even if you believed the mainstream view that inflationary expectations will drive spiralling prices when there is deep tranches of idle capacity, you could not mount that case at present.

So I see no basis for the statement that the “trade-off” is becoming harder. There is plenty of non-inflationary (core) real growth potential in the US economy at present and fiscal policy should be used to generate that and to more quickly reduce the unemployment rate.

Unemployment

The Federal Reserve Chairman admitted that:

We don’t have any tools for targeting long term unemployment specifically.

Which is true and that is why monetary policy should be subjugated by fiscal policy to fulfill the obligations of government to create an environment of full employment and price stability which the FOMC claims is their central charter.

I noted with disgust that he was claiming long-term unemployment was a “structural” problem that required specific labour market (supply-side) policies to address.

The evidence from a number of studies (including my own research) is that when the economy grows fast enough jobs are gained not only by those in the short-term unemployment pool but also those who are long-term unemployed.

The supply-side approach pushed by the OECD Jobs Study has failed badly to reduce unemployment since it became the status quo in the early 1990s.

Long-term unemployment is a problem of insufficient jobs and that is a policy choice of government.

Fiscal policy

While mainstream economists claim that the central bank should be independent (from the legislature) it seems that it is fine for the central bank chairman to make statements about fiscal policy which are controversial and reinforce one side of politics. Bernanke’s statements today about the US budget deficit were nothing short of disgraceful.

The real crunch came when he was asked about the S&P shenanigans of last week. He said that:

Well, in one sense S&P’s action didn’t really tell us anything. Anybody who read a newspaper knows that the United States has a very serious long-term fiscal problem.

That being said I’m hopeful that this event will provide at least one more incentive for Congress and the administration to address this problem. I think it’s the most important economic problem at least in the longer term that the United States faces.

We currently have a fiscal deficit which is simply not sustainable over the longer term. And if it is not addressed it will have significant consequences for financial stability, for economic growth, and for our standard of living.

It is encouraging that we are seeing efforts on both sides of the aisle to think about this issue from a long run perspective. It is not a problem that can be solved by making the case only for the next six months. It’s really a long-run issue.

He also claimed that addressing the deficit is a “top priority” and that the Congress has to “make credible commitments to cutting programs”. He emphasised the long-run problem but said that if “changes are focused entirely on the short-run then it will have negative consequences for growth”. I will come back to that point.

But in making these statements he is on the one hand he is giving undeserved credibility to S&P when he knows that their input is irrelevant (ultimately) and that the ratings agencies have been found to be corrupt organisations carrying major culpability in terms of the current crisis.

He knows full well that S&P have no power over governments. The US central bank can effectively set interest rates. Yes, it would have to be prepared to purchase all the bonds on offer should bond markets decline to participate in the tender – but so what? Japan showed in the early 2000s how meaningless the sovereign debt ratings of the agencies are.

The raters can hold an EMU nation to ransom because everyone knows these governments face a default risk given they surrendered their currency-issuing monopolies. But the currency issuing monopoly that the US government posseses is exactly the reason why the raters are irrelevant.

Bernanke is also prepared to give unwarranted oxygen to the deficit terrorists who have built a destructive narrative based on the myths about budget deficits without fully explaining his position.

Apparently, the American “newspapers” provide factual explanations of fiscal policy which are beyond dispute. I found that inference to be disgraceful. I rarely read anything that is worthy of merit in the financial press. The electronic and written media, particularly in the US, provides a barrage of misinformation and wheels our mainstream economists on a daily basis to reinforce this deception.

Bernanke claimed there would be “significant consequences for growth, financial stability, standards of living etc” unless the deficits were cut. But that is as far as he went. That represents an abuse of his position.

He should have been compelled to spell out how he thinks that will happen. As it stands, he was just mouthing the erroneous textbook mantra’s that students are fed in the mainstream macroeconomics classes all around the world. It is the same mantra that helped create the crisis and is currently ensuring the negative consequences are dragging out for the next several years.

There is no credibility in that position.

He admitted (as above) that if deficits were cut now there would be adverse consequences for economic growth which would jettison the Fed’s projections.

But then you have to ask what is the long-run? This is a construct mainstream economists use to justify their belief that deregulation and balanced budgets will provide optimal outcomes after all the short-run fluctuations are exhausted. It is a construct that allows them to sit back in their secure jobs while they advocate policy positions that destroy growth and drive up unemployment.

“Don’t worry”, they say, “It will be fine in the long-run”.

I especially liked the view that the great Polish economist Michal Kalecki took on this charade. In his 1933 book – An essay on the theory of the business cycle, Kalecki outlined a very sophisticated theory of effective demand (prior to Keynes’s General Theory – which was published in 1936 and popularised the notion that business cycles moved in response to effective demand fluctuations. Kalecki had got the notion from the works of Marx.

His macroeconomic model – which still stands scrutiny today and puts the mainstream textbook models to shame – showed how capitalism was essentially unstable and prone to cycles.

One of the contributions of this work was a repudiation of the notion of a “long-run”. Kalecki constructed the concept of a “short period-equilibrium” (where change was suspended temporarily). He considered capitalism was pronte to generating periods of mass unemployment without any innate tendency to correct that malaise. This clearly was in contrast to the mainstream notion that markets were self-correcting.

But he also considered the “long-run” to be just a sequence of short-runs. You are where you have been!

The reality is that if deficits are reduced now – the long-term growth path is compromised. Bernanke is in denial about that and offered no clue as to how you have fiscal contraction expansion. That is the same myth that the British government is propagating and real GDP growth has been virtually zero since they took power.

The Federal Reserve Projections

Here is the Table describing the US Federal Reserve Bank’s latest projections – released today for the period 2011-2013.

To put those projections in context, the following Table provides five-year average growth rates for labour productivity, the labour force (data from the US Bureau of Labor Statistics and real GDP (data from US Bureau of Economic Analysis) for five-year periods back to 1975. It provides an historical reality check for those who think that the US can growth, for example, at 4.2 per cent indefinitely. It hasn’t achieved that growth trajectory for any extended period in the last 35 years.

I also wanted to do some analysis of their unemployment rate projections. The great American economist Arthur Okun left some very useful concepts indelibly etched on those who appreciated his work. I should add he was a mainstream economist who supported Keynesian demand-stimulus policy when unemployment was high. He also brought a very applied bent to the profession and had a good feel for the underlying statistics and interrelationships between them. He taught me a lot when I was a young academic and student.

One such concept was his rule of thumb about the way unemployment reacts to growth. He developed what has become known as Okun’s Law arithmetic to estimate the deficiency in GDP growth which leads to rising unemployment rates. Okun’s Law (it was in fact a statistically estimated relationship with stochastic variation) is the relationship that links the percentage deviation in real GDP growth from potential to the percentage change in the unemployment rate.

The algebra involved in the conceptualisation of this “law” can be manipulated to come up with a “rule of thumb” which is a way of making guesses about the evolution of the unemployment rate based on real output forecasts.

What is a rule of thumb? It is not a rigid exact relationship. There are no such relationships in social sciences. It is rather a recognition that labour market and product market aggregates are intrinsically linked by construction and behaviour and over time allow us to make guesses about the future of one variable based on the evolution (hypothesised) of other variables.

Here is a simple explanation of this rule of thumb. We can relate the major output and labour-force aggregates to form expectations about changes in the aggregate unemployment rate based on output growth rates. A series of accounting identities underpins Okun’s Law and helps us, in part, to understand why unemployment rates have risen. Take the following output accounting statement (which is true by definition and not a matter of opinion or conjecture):

(1) Y = LP*(1-UR)LH

where Y is real Gross Domestic Product, LP is labour productivity in persons (that is, real output per unit of labour), H is the average number of hours worked per period, UR is the aggregate unemployment rate, and L is the labour-force. So (1-UR) is the employment rate, by definition.

Equation (1) just tells us the obvious – that total real output produced in a period is equal to total labour input [(1-UR)LH] times the amount of output each unit of labour input produces (LP) .

Using some simple calculus you can convert Equation (1) into an approximate dynamic equation expressing percentage growth rates, which in turn, provides a simple benchmark to estimate, for given labour-force and labour productivity growth rates, the increase in output required to achieve a desired unemployment rate.

Accordingly, with small letters indicating percentage growth rates and assuming that the hours worked is more or less constant, we get:

(2) y = lp + (1 – ur) + lf

Re-arranging Equation (2) to express it in a way that allows us to achieve our aim (re-arranging just means taking and adding things to both sides of the equation):

(3) ur = 1 + lp + lf – y

Equation (3) provides the approximate rule of thumb which in English says that – if the unemployment rate is to remain constant, the rate of real output growth must equal the rate of growth in the labour-force plus the growth rate in labour productivity.

Remember that labour productivity growth reduces the need for labour for a given real GDP growth rate while labour force growth adds workers that have to be accommodated for by the real GDP growth (for a given productivity growth rate).

It is an approximate relationship because cyclical movements in labour productivity (changes in hoarding) and the labour-force participation rates can modify the relationships in the short-run. But it should provide reasonable estimates of what will happen once all the cyclically-sensitive components of the economy return to more usual values.

For example, labour participation rates in the US prior to the downturn were around 66 per cent whereas over the 11 months in 2010 for which data is currently available the average was 64.6 per cent. The average over the entire period 2000-2010 was 66 per cent. So in the short-term as growth strengthens we will expect the labour force participation rate to rise again back towards 66 per cent or thereabouts.

In other words, the labour force growth in the short-run will be more brisk than it will be once growth is sustained which will tend to mean our rule of thumb will overestimate the decline in the unemployment rate in the short-term although over a longer period the rule of thumb will be more accurate.

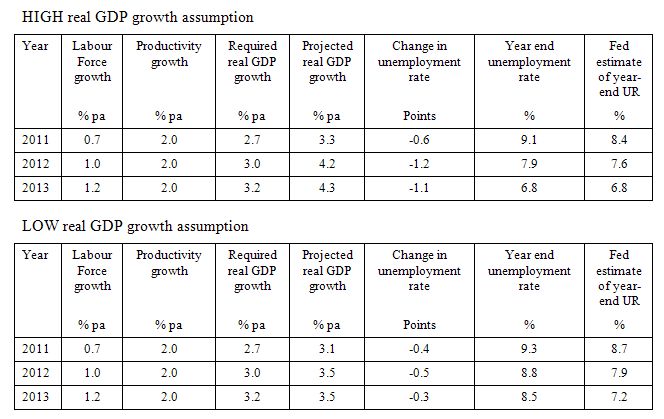

So I applied this arithmetic to the US Federal Reserve Bank’s latest projections outlined in the Table above. I created the following Tables based on the low and high (central tendency) projections from the US Federal Reserve and added plausible assumptions about labour force and productivity growth rates for 2011, 2012 and 2013. The Tables show what the annual change in and the year-end unemployment rate would be under these assumptions.

In January 2011 the US unemployment rate was 9.7 per cent. So if there is a drop of -0.6 points over the course of 2011 then it would end the year around 9.1 per cent.

The labour force and productivity growth assumptions are plausible and conservative. The bias is to understate the magnitudes under the assumption that there is real GDP growth of the stated magnitudes.

So the Required real GDP growth rate is at the bottom end of plausibility under these conditions.

The High real GDP growth results are not plausible given the history of the US economy over the last 3 decades or so. Notwithstanding the damage that cutting the deficit will cause, the US economy would struggle to maintain real GDP growth at 4.2 per cent in 2012 and 4.3 per cent in 2013. But if it did, then I largely agree with the US Fed’s projections that the unemployment rate would come down to around 6.8 per cent by the end of 2013.

Even the low real GDP growth assumptions are optimistic given the way the political process is heading at present. But they give a much more sobering view of things. By the end of 2013, under these assumptions, the US economy would still have an unemployment rate of 8.5 per cent – so a very long and drawn out recovery without much opportunities for workers to improve their job prospects.

I do not agree with the Fed’s projections here that the unemployment rate would be at 7.2 per cent by the end of 2013. Even if their projections were accurate it would still represent a disgraceful abdication of responsibility for the elected representatives to allow unemployment to remain so high for so long.

Remember the government chooses the unemployment rate every week of every year. It can lower the unemployment (to some irreducible minimum) whenever it wants to by directly creating public sector jobs.

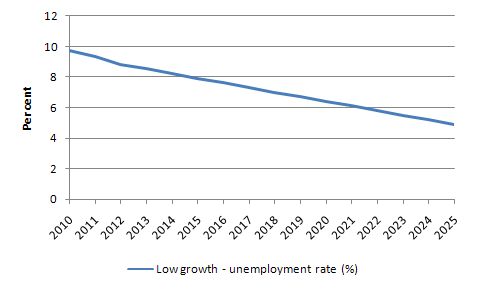

Just to see what the evolution of the unemployment rate would be under these assumptions I constructed the following chart. So assuming that the US Fed’s lowest central-tendency growth assumption for 2013 persists (that is, 3.5 per cent real GDP growth per annum) and the labour force and productivity growth assumptions in the previous table are maintained, the blue line shows what the unemployment rate trajectory would be. By 2024, the unemployment rate would reach what the Fed calls the longer-run rate of 5.2 per cent.

Using the logic adopted by the Federal Reserve (NAIRU-mentality) there would be no inflation threat emanating from the labour market over this period (to 2024) because the actual unemployment rate would remain above the “longer-run” rate – that is, the NAIRU.

This is an enormously long period of time for policy authorities to allow the unemployment rate to be so high.

The more likely assumption is that the political malaise that is crippling policy making in the US at present and will bias the outcome to fiscal withdrawal, aided and abetted by the moronic and patently false assessments provided by the Federal Reserve Chairman, which will diminish the US real growth prospects.

Depending on how savage the ultimate cut-backs are the simulated unemployment rate would likely represent the lower envelope that I would expect.

To all the unemployed Americans who cannot get a job because there is not enough spending to invigorate real output – and hence employment growth you can blame the government for your plight.

I guess that is the government extended to Wall Street. I did an telephone interview for a US network today and outlined some ideas in a book I am writing at present where I detail how democracy has been usurped by the top-end-of-town. More later perhaps on that theme.

Conclusion

The point is that if the US Congress follows Bernanke’s advice to make deficit cutting the priority, then these projections will not be achieved. As they stand – they lock the US labour market into an unacceptably high unemployment situation for the next several years.

If growth falters – then the situation will be even more dire.

Bernanke offered no clue as to how deficit reduction will also be consistent with those projections. He failed in his main task.

That is enough for today!

Bernanke might find solace in the news this morning that the United States is not the only major advanced economy getting closer to insolvency. Despite the fact that Japan, like the US, is the exclusive issuer of its own fiat currency, it appears that the country, like the United States, has taken a small, yet very market-worrying, step towards potential insolvency: Standard & Poor’s yesterday downgraded Japan’s sovereign debt. The End Is Near.

Still time, though, for MMT infidels to repent.

unemployment is still high, but what if inflation comes before we reach full employment

oil, food, gold and silver aren’t signals of coming inflation?

Thanks, Bill – I watched old Ben in horror and disgust as well. The Q and A was even more disgraceful.

Regarding ‘democracy has been usurped by the top-end-of-town.’ I really hope you write that book. But, in a way, we all know it already. It’s not subtle anymore. Washington belongs to Wall Street, Big Oil and the top one percent. We see it every day. And after three big “change elections” in a row, nothing changes unless it’s for the worse. There is still no genuine reform movement in America, and, on the national level, there isn’t even any sign of one. Confusion reigns. The explicit servants and apologists for the top end of town masquerade effectively as champions of the little guy against “Big Government.” The traditional party of labor begs to do the party of capital’s heaviest lifting in order to prove that they still deserve the jackal’s share of the spoils. Around the world, the American Empire sputters along in violent confusion as well. It has killed more innocent bystanders in the last fifty years than Pol Pot and Chairman Mao combined. You are absolutely right to call it a “terrorist organization.”

But what can anyone do about it? Noam Chomsky has been writing brilliantly on the subject for decades – without measurable effect. As you yourself frequently point out, even the most well-intentioned American progressives are as economically illiterate as the reactionaries. Nominally “socialist” Bernie Sanders cries out as loudly as any Republican that we are “burdening our grandchildren with a mountain of debt”. Even Dennis Kucinich, than whom no liberal is stauncher, recently became sufficiently bemused to call for a return to – the gold standard. With friends like these…

I keep reminding myself that America is not the whole world. I go back and re-read the last section of Naomi Klein’s book “The Shock Doctrine”, where she writes about the leftward swing of Latin America. They kicked the IMF right out of their continent. They are kicking the U.S. military out of their bases. I loved the Ecuadorean president’s line – sure, you can have a base here… if Ecuador can have a base in Miami. And these leaders, including Hugo Chavez, have proved very difficult to force out with a coup, as would have happened in the bad old days. Latin American countries are building bi-lateral relations with each other, with China and with other countries and there doesn’t appear to be anything Washington can do to stop them. And that is an encouraging sign, surely.

But it is peripheral to the main drama of America, Asia and the Eurozone, where the bad old days seem to drag on endlessly. We need some sort of mass movement. I don’t know what kind, exactly. Wage workers have lost most of their economic leverage and all of their political influence. So, even though workers will be an important part of it, it won’t be a labor movement. Young people need to be part of it too, but it won’t be a student movement. What we saw in Madison, Wisconsin last month was a glimpse of it. I go back and read the protest signs, and what strikes me is that they are so original, so good-humored and, above all, so optimistic. These are people who do not, even in the short run, expect to lose. And that kind of optimism is a rare thing today.

And that is enough for today.

As much as it’s the complete opposite of what is required, I think we just have to accept now that the US authorities are bent on ‘fiscal consolidation’. It would help if the current administration appreciated what America’s problems really are and the tools they actually have to address them, but now S&P have scared any progressives enough such that they are petrified of the relentless right-wing spin machine, which is loud and relentless, and with relatively little regard for the facts. If the right keep getting free passes on lies, then you get to the current state of play where they even dispense with the subterfuge. The cruel irony is that the very people who stand to benefit from pro-growth/recovery policies are also the ones scared into submisison by the right wing chorus. The fact that Paul Ryan is still in Congress stuns me. It’s all very bizarre. But then again, Bernanke feels it necassary to praise (deifict) ‘efforts on both sides of the aisle’. Surely he understands what Ryan’s eponymously named plan entails? Obama’s effort isn’t much better, but at the very least it isn’t a major and overt cash grab for the rich. Guess it’s all about a number for Bernanke, which makes it all worse that he’s commenting on this……Anyway, what also stuns me is the way the Democrats are not only showing breathtaking spinelessness in so many areas, but are not being true to their (so-called) ideals. Do they still have those ideals? I honestly don’t know. But from where I sit, they will lose the 2012 election without having stood for anything remotely related to the history of their party. From there, it just gets worse.

jan —

Given the geopolitical situation in MENA, why do you think that oil prices is a monetary policy issue? Do you propose that the Fed take action (raising rates say) to target that? How would that response work? And what would be the costs of that approach?

D

The US central bank can effectively set interest rates. Yes, it would have to be prepared to purchase all the bonds on offer should bond markets decline to participate in the tender

First the Fed should be allowed to do that, is it? The Bank of England is not as someone recently pointed out in this blog.

Now that would be monetizing the debt, so excess reserves will remain in the system bringing interest rates down to the interest rate paid on reserves. So I would say that the Central Bank can effectively set interest rates because it can pay interests on reserves, not because it can purchase Treasury bonds directly.

I go back and re-read the last section of Naomi Klein’s book “The Shock Doctrine”, where she writes about the leftward swing of Latin America. They kicked the IMF right out of their continent.

Don’t believe all you read. Many countries paid all their debt to the IMF but they didn’t kick it out.

Tabare Vezquez, Uruguay’s former president, is even on the IMF payroll now.

Reuters ran a word cloud on Bernanke’s speech. It says it all:

http://blogs.reuters.com/frontrow/2011/04/27/whats-on-bens-mind/

dehbach-

i think it’s a monetary policy issue because with the crisis in 2008 food oil and gold prices went very low

then they start going higher after the fed took action

how do u explain gold and silver prices are so high?

jan–

First, I would say that Silver looks pretty bubbly. See: http://pragcap.com/silver-prices-display-some-bubbly-characteristics and http://www.marketanthropology.com/2011/03/topspotting.html.

Second, silver and gold have been strongly correlated to equity prices for some time now. I do not think that this is consistent with your thesis.

Third, I would point to the 2008 oil spike and suggest that no one has claimed that “money printing” caused that run up.

Finally, what “fed action” are you referring to? The US Fed has not “printed” “money.”

In short: if there is all this inflation out there, why isn’t inflation, you know, higher? It pretty low in the US.

D

dehbach-

well, silver and gold can be bubbly or correlated with equity prices or anything but how do u explain that they are at record highs?

it’s not true no one has claimed that the 2008 oil spike wa caused by a too easy fed, on the contrary some explain that spike saying the fed hold rates too low for too much after 2001.

Fed action i refer to are:

– fed funds rate to 0.25

– qe1 and qe2

i mean that’s my opinion, it’s probably wrong… but in my mind it explains somewhat why gold and silver are so high

what’s yours? and what explanation do mmters give to gold and silver prices at records high, never heard one…

There are lots of money in the investment markets, even pension funds buy commodities these days. So if someone honestly believes QE2 can cause inflation that can drive up commodity prices in itself. There were crop failures in Russia last year and Libya has ceased oil production so there are/were genuine supply-side inflationary pressures also.

@MamMoTh

“Tabare Vezquez, Uruguay’s former president, is even on the IMF payroll now.”

I’m afraid you meant meant this as a compliment.

jan —

Quantitative easing is not “money printing” its a swap of one type of “money” (treasuries) for another (reserves). There is lots on this site on that point.

D

dehbach –

u didnt give me your opinion on gold and silver high prices… mmters never talk about this… why?

“Quantitative easing is not “money printing” its a swap of one type of “money” (treasuries) for another (reserves).”

if this swap has no effects on inflation as you claim, then which are his effects?

Quantitative easing is not “money printing” its a swap of one type of “money” (treasuries) for another (reserves).

Actually it’s a swap that pays interests, so in a way it is printing money in the sense that interests on bonds are printed money or reserves if you prefer.

Jan, the problem with assessing the price of gold and to a lesser degree silver since it is an industrial commodity is that there is no cash flow associated with them so it is not possible to know when they are overvalued. They could be in a bubble and it would be impossible to mount a rational argument, although when a price curve goes exponential (look at silver) that is a tip off that upside momentum is becoming excessive.

The “reason” that PMs and commodities are doing well is currency revulsion, feeding on dollar depreciation. A good argument can be mounted that this is intentional on the part of the US, since the president has declared US intentions of doubling US exports in five years. That can only be done by depreciating the dollar. The effect of this is to export inflation, especially since a great deal of international trade is denominated in the USD, which the US “prints” and others have to obtain.

I look at the falling dollar as integral to the announced US export strategy and the resulting asset appreciation as the market response.

@Tom

I agree with you but i really can’t understand how mmt explain a high price of gold (that sounds like a signal of inflation) and high unemployment. Bill in this blog always write inflation is not an issue at the moment, but gold is at 1540 and silver at 50. So which are the causes of that if not inflation?

The high prices of gold and silver might be somehow related to QE but it has nothing to do with MMT.

Bill also distinguishes between inflation as CPI rise and asset inflation. If people want to speculate on gold and silver they should be free to do it. There will be winners and losers and that’s it.

My main concern is with central banks interventions in those markets. If they are buying gold and silver then it boils down to a fiscal injection that bails out the speculators.

The other will be how much of it is fuelled by cheap credit again, an if it were just a bubble waiting to burst as soon as interest rates rise it will affect the rest of the economy, again…

Jan, inflation is measured in relation to a currency. The issue in the case of PM’s is fx. Curerncy depreciation is different from inflation. The US has historically low core inflation but the USD has depreciated considerably over the recent past. Those who saw this coming moved out of dollars. Similarly, the disruptions and uncertainty in Europe have resulted in people moving out of euros. This has involved portfolio shifts that have created demand for other asset classes. Generally, only a small portion of portfolio distribution would go to PM’s. Since the uncertainty brought on by the global crisis, this has increased significantly. For example, it would have been advisable to heavily increase portfolio holdings of gold after Bear and to continue to hold an above normal position. I don’t think that gold is as much as hedge against inflation or hyperinflation (as may assume) as it is against uncertainty in a turbulent world.

Jan,

I believe the Fed are rebooting the international financial system now. They in my opinion want to stoke even higher inflation in China due to cost-push effect while the US is largely immune to developing an inflationary spiral due to high unemployment. The endgame would be the USD stripped of its global reserve currency status but China may end up much worse, either restoring elements of the command economy or lingering in a kind-of “lost decade” or two like Japan after Plaza Accords.This obviously sounds rather not MMT-ish and I don’t pretend to be an economist (rather a software engineer). I don’t think that principal axioms of MMT for example that the Government creates demand for the currency by levying taxes apply on the forex markets.

Whether the reasoning of Krugman, Bernanke & Co is based on sound economics is rather irrelevant – they believe that a bit of inflation will push the American economy out of the liquidity trap. They also believe that ultra-loose monetary policy will do the trick. As I said they may be wrong in principle but if they push hard enough they will get what they want. I think that eventually when oil costs $500/barrel (and other commodities follow) the Chinese will either have to de-peg, their labour will not cost 10-20% of the costs in the West due to compounded inflation or they will have to implement a Balcerowicz’s plan and fight inflation with high unemployment what will kill their economy and set them back 20 years to the era of Tienanmen Square riots. In the meantime the American economy may sustain a kind of recovery out of necessity because the import gap will gradually close.

The Americans should be able to survive this nasty ride provided that deficit hawks do not implement an austerity plan to fight inflation in the US prematurely.

So either strong dollar has to be sacrificed or the global superpower status is gone in 10 years due to China overtaking the US.

Anyway these are only my views and I can be wrong… half a year ago I thought that the US is toasted already due to the anarchy setting in their political decision making centre but they seem to be fighting back by trying to inflate the private debt and shake off the Chinese sitting on their back. For now gold may shine…

It’s the dogma of rarity. The dogma of a fixed budget. People think about a State, or think about the economy of the State

in a religious view. In their ideas, in their view of the world, there is constantly a fixed budget. Like a voice, a God that decide:

2009: the budget is tot, govern you.

2010: the budget is tot, govern you.

2011: the budget is tot, govern you.

What a fuck? Who is this voice? You haven’t imagination.

Jan – you seem to believe “gold/silver higher, ergo there must be inflation”.

I think the onus is more on you to substantiate this view, in a way that doesn’t presuppose we are about to re-join the gold standard…