In the annals of ruses used to provoke fear in the voting public about government…

British government spending cuts will probably increase the fiscal deficit and make the ‘non negotiable’ fiscal rules impossible to achieve

The British press are reporting that the Government there is planning further spending cuts of the order of billions of pounds because the economic environment has changed and the current fiscal trajectory is threatening their self-imposed fiscal rules thresholds. We already heard last week how the Government is significantly cutting Overseas Aid as it ramps up military expenditure. Now, it is reported that billions will be cut from the welfare area and the justification being used is that there is widespread rorting of that system by welfare cheats. There are several points to make. First, getting rid of rorting is desirable. But I have seen no credible research that suggests such skiving is of a scale sufficient to justify cutting billions out of welfare outlays. Second, quite apart from that question, the micro attack on the welfare outlays have macroeconomic consequences. The British Office of Budget Responsibility estimates that the output gap is close to zero which means it is claiming there is full employment. Even if that is true, that state is underpinned by the current level of government spending (whether it is on cheats or not). If the spending cuts that are targetting rorting are not replaced by spending elsewhere then a recession will occur and the Government will surely fail to achieve its ‘non negotiable’ fiscal rule targets. It is a mess of their own making.

I have dealt with issues relating to this in recent blog posts as well as a long list of posts from a few years ago.

The recent posts include:

1. Britain and its fiscal rule death wish (February 17, 2025).

2. These claimed essential fiscal rules in the UK seems to be disposable at the whim of the polity (October 24, 2024).

3. The British government does not have to appease the financial markets (October 14, 2024).

4. More economists are now criticising the British government’s fiscal rules – including those who influenced their design (September 23, 2024).

5. The new British Labour government will have to abandon its fiscal rule or deliver very little (July 24, 2024).

6. British Labour Party once again tripping over their nonsensical fiscal rules (June 20, 2024).

The situation is becoming more absurd as time passes with Rachel Reeves setting the ‘fiscal rules are non-negotiable’ in concrete, which will be her downfall.

Remember back in June 2024 in the lead up to the General Election, which was held on July 4, 2024.

Labour leader Starmer gave many interviews where he asserted to the voters that if he won the election his government would not continue with fiscal austerity.

For example, in this interview (June 28, 2024) – Keir Starmer on being as ‘bold as Attlee’ and why there’ll be no return to austerity under his watch – which was recorded just six days before the election, Starmer said:

I’ll be as bold as Attlee. I ran a public service during austerity, I saw the impact of the Tories’ decisions. There will be no return to austerity with a Labour government. We’ll have a decade of national renewal instead, with ambitious investment and reform.

He waxed lyrical about how the welfare system was not generous enough and that his government would improve access and bolster payments.

His demeanour in the interview would lead a voter with progressive views to feel favourably towards the leader who resonated empathy with the downtrodden and those dependent on government services for their existence.

Well that demeanour was obviously just a veil of deceit and once he had his hands on power he installed former investment banker Rachel Reeves into the Chancellor’s role and together what did they do?

Continue fiscal austerity and then under the cover of changing international events – namely the madcap policies coming out of Washington – they are now saying they will ramp it up even further.

I commented on the recent claims that British Overseas Aid was being cut to ‘pay’ for the planned escalation in military spending on Monday – Britain can easily increase military expenditure while increasing ODA to honour its international obligations (March 3, 2025).

Yesterday, the BBC published a report (March 5, 2025) – Chancellor set to cut welfare spending by billions – which revealed further shifts in the position of the British government.

Apparently:

The chancellor has earmarked several billion pounds in draft spending cuts to welfare and other government departments ahead of the Spring Statement.

The “world has changed” cover is being used as the excuse.

One aspect of that is the imposition by the US of tariffs on various nations.

I haven’t yet written anything about that issue (but I will in due course) but the likelihood is that the US policy shift will increase the UK’s external deficit a bit.

I consider that prospect below.

The ‘billions’ in cuts are designed “to meet the chancellor’s self-imposed rules on borrowing money.”

So the fiscal rules are set in stone and something else has to give – which is spending, given they promised no significant tax changes.

The justification is that the government has to “maintain credibility with financial markets”.

So there are layers of absurdity that build on each other to get to this point.

The train of spurious logic is obvious and goes like this:

Absurd proposition 1: The government which is the only institution in Britain that issues the pound has to get the pound from the non-government sector via taxation or borrowing in order to spend it.

Reality: The British government spends by typing numbers into bank accounts – no taxes or borrowing are required.

Absurd proposition 2: Recurrent spending (whatever that is) must be matched at all times by tax revenue.

Reality: This is a self-imposed constraint with no basis in economic theory.

Absurd proposition 3: Any additional capital spending must be matched by issuing debt.

Reality: This is a self-imposed constraint with no basis in economic theory and constitutes corporate welfare to the gamblers in the financial markets.

Absurd proposition 4: If Absurd proposition 2 and Absurd proposition 3 are endangered then the financial markets will stop buying the debt that the government issues.

Reality: So what? The choice would not alter the spending capacity of the government at all.

Absurd proposition 5: To avoid Absurd proposition 4 occurring, the government has to cut spending dramatically.

Reality: the end of the chain of absurdity.

The government is also adding to its cover by invoking the same sort of examples that a succession of Australian governments deployed to cut spending on welfare – the ‘welfare cheat’ ruse.

The BBC article reports that “there were ‘too many’ young people not in work, education or training” who were skiving away on welfare payments.

I have seen no credible research that suggests there are enough of such cases to justify billions being cut.

Further, sickness benefits are allegedly being rorted as people “game the system”.

Most of the increase in payments for sickness has occurred after the onset of Covid and there is strong evidence that there are now tens of thousands of workers who are disabled as a result of long Covid and related symptoms.

Again, I have seen no credible research that suggests there are enough of such cases to justify billions being cut.

But even if there are millions of welfare cheats who are ‘gaming the system’, the government is misleading the voters as to the consequences of their proposed cuts.

This is the point.

No progressive should support government spending being ‘gamed’ by cheats.

I agree with that proposition.

Which is one reason I advocated a Job Guarantee replacing the income support payments relating to unemployment.

Then the ‘activity test’ becomes straightforward.

If the government offers a job to a person seeking income support that is within their physical capacities and close to their home then a refusal would suggest the person doesn’t want to work.

Pretty simple.

If there are no jobs on offer under the Job Guarantee at some point in time, then the applicant receives the Job Guarantee wage without question until the government does offer them a job.

Pretty simple.

If a person for whatever reason is assessed by the NHS to be unable to work then they should receive income support without question.

But the point is that it is sensible for the Government to improve the veracity of the welfare support system by ridding it of criminals (cheaters).

Okay, let’s accept that proposition without buying into the claim that system rorting is widespread.

Even if it is, the next point is valid and indicates that cutting billions off government spending will cause harm.

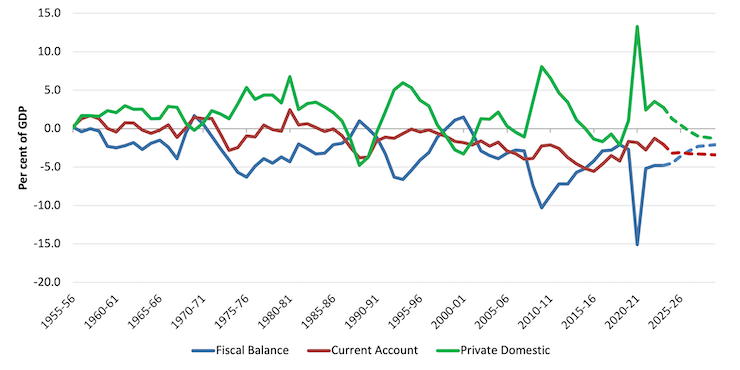

The following graph shows the sectoral balances for the three major macroeconomic sectors: government (G – T), external (X – M), and private domestic (S – I) – as a per cent of GDP.

The dotted lines reflect the latest forward estimates from the Office for Budget Responsibility – Data Here – which go out to 2029-30.

These balances are derived from the national accounts and are thus accounting statements with behavioural drivers (national income shifts) underpinning the dynamics.

Remember that the three balances sum to zero as an accounting fact:

(S – I) – (G – T) – (X – M) = 0

What we deduce from these relationships is that if the external balance is zero, then the net overall saving of the private domestic sector (households and firms) will equal the fiscal balance with an opposite sign.

So if the external balance is 0 per cent of GDP, and the Government is running a deficit of 2 per cent of GDP, then the private domestic sector will be net saving 2 per cent of GDP.

As the external balance goes into deficit (as at present for the UK) – say 2 per cent of GDP, then the fiscal deficit would have to rise to 4 per cent of GDP, if the net overall saving of the private domestic sector was to remain at 2 per cent of GDP.

If the fiscal deficit was recorded at 2 per cent of GDP, while the external sector recorded a deficit of 2 per cent of GDP, then the private domestic sector would record zero net saving.

National income shifts cause the balances to change, because G and T have cyclical elements (for example, in a downturn, tax revenue T falls); the external balance is cyclical via the sensitivity of import spending to movements in GDP; and finally, household saving and business investment tends to rise when GDP increases and vice versa.

A striking feature of this long recorded history for the UK is the fact that whenever there is a fiscal shift towards surplus, the net overall saving of the private domestic sector heads to negative territory.

But think about the current fiscal strategy of the British government.

The forward estimates suggest the fiscal deficit will shrink from 4.8 per cent of GDP in 2023-24 to 2.1 per cent by 2029-30.

Those estimates were based on GDP growth forecasts of 2 per cent in 2025 falling to 1.6 per cent in 2029.

The latest estimates from the Office of National Statistics (ONS) show that real GDP grew by just 0.1 per cent in the December-quarter 2024 following zero growth in the September-quarter 2024.

Annual GDP growth has not got near 2 per cent over the last 15 years.

So to get the fiscal balance down to around 2 per cent of GDP by 2029-30 given that tax revenue is unlikely to be as robust as the fiscal estimates suggest will take significantly higher cuts to government spending, which in turn will cause GDP growth to deviate further from the forecasts.

But if the Government succeeded in achieving a 2 per cent of GDP deficit by 2029-30, then given OBRs external balance forecasts, the private domestic sector would be plunged into deficit of around 1.3 to 1.5 per cent of GDP, which means the already precarious debt position of that sector would become even more so.

The private domestic sector can only fund an increasing deficit (spending more than its income) by running down wealth and increasing liabilities.

That strategy is unsustainable and is likely to lead fairly quickly to recession and a rising fiscal deficit.

It also means that it would be hard for the government to satisfy its fiscal rules, particularly the component relating to reducing the public debt ratio over the course of the current Parliament.

Further, the tariff issue, which is being used by the Government to justify further fiscal austerity, will probably (if there is any significant effect) increase the external deficit.

Under that scenario, if the Government really digs in and keeps cutting spending, then the income effects will push the private domestic sector into a deepening deficit and the real effects of the likely recession (lost jobs, rising unemployment, lost incomes etc) would probably lead to widespread debt defaults and bankruptcies.

Which, in turn, would lead to an increasing fiscal deficit via the automatic stabilisers, which would make it virtually impossible to meet the fiscal rule goals.

But there is another significant point that relates to the spending cuts and the earlier discussion about welfare cheats.

The question of welfare fraud is a micro issue but dealing with it has macroeconomics implications.

Whether there is widespread rorting in an interesting question but the government spending (on the rorting or not) is still flowing each day into the expenditure stream which is underpinning output and employment.

So the question then is whether there is an output gap or not.

According to the OBR, the current output gap is -0.2 per cent of GDP, which means the OBR thinks the British economy is close to full capacity operation.

I could tell you that the estimation method used by these agencies always produces forecasts that are biased towards lower output gaps than are actual,

But that is a separate discussion.

Even if we accept the OBR estimate above, the fact is that if overall spending is cut by billions then that output gap will increase and unemployment will rise.

So while they might want to reduce welfare rorting which I think is an okay goal (but please note I would estimate the rorting to be minor) – the fact remains that the spending on such ‘rorting’ must be replaced by spending elsewhere if the output gap is to remain at its current level.

The government might claim that because the UK economy is at full employment (courtesy of the OBR estimate) then things are okay.

But it is at ‘full employment’, in part, because of the current levels of welfare spending.

Cut it without spending elsewhere and recession loom.

Conclusion

The British Labour government is proving to be a big disappointment.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

Rorting. What a fantastic term. We’re definitely importing that phrase!

What’s frustrating about this entire debate, besides the complete compliance of journalists, is that obtaining Personal Independence Payments is not easy. So if there is an increase in the number of people claiming that support, they’ve managed to get through a whole number of hoops to get there.

Therefore there is a real problem of some sort that has sprung up over the last five or so years, which nobody wants to address. Far easier to tighten the PIP rules and have even more people begging on the streets.

Annoyingly the solution already exists. If an individual commits a crime and is sentenced by a magistrate to community service, not only is a job created for them but a whole raft of support services are made available to deal with substance abuse, mental issues and physical rehabilitation.

Why is that process not more widely available?

That system needs taking out of the ‘punishment and restitution’ pot and changed to be a general rehabilitation service available to all branches of government to help people get back on their feet, made to feel part of society and back to contributing to it.

The punishment and restitution bit can then be dealt with via the usual 50% attachment of earnings we already have within the PAYE mechanism, whereas everybody else could receive a full living wage for the created job.

We’re a gnat’s whisker away from a guaranteed alternative job in the UK. Everything is already there. It just needs the left hand to be introduced to the right.

The trouble with blairites is that things are always worst than they were before. The Starmer type of Blair fan- boy is a sort of manager of economic and societal decay. Every corner of the road has to be dealt with new forms of plunder. The plunder of the working people first, then the plunder of the middle classes. When the middle classes are gone, then the elites will try to “eat” each other.

The once greatest empire of the world is a mock democracy.

“DOGE” “efficiency” ideology is spreading everywhere. Cutting welfare spending under the guise of “fraud” or “bloat”. Straight up class warfare.

I have come to believe that the end state of Neo-liderlsim is for one man to own all the money and ever every one else is dead so there is no competition.

It’s a bit of a stretch to call Reeves an investment banker. She did work for HBOS in their complaints department though, and apparently didn’t fiddle her expenses. That might provide her with suitable training as the complaints flood in as she craters the UK economy as chancellor though.

je m’oppose. The only welfare rort is the gilt issuance to the top end of town. Not only are fraudulent welfare benefits not really much of a rort, it is a phenomenon largely caused by the austerity imposed by government.

If you can diddle the government for a few extra scorepoints which they imposed upon you a need to get, it is not hurting those who are not so smart or “criminal” who do not want to engage in the diddling, it only means those more honest people have a higher moral ground for demanding work for wages from the government, even if it is going around town dispensing hugs.