I am late today because I am writing this in London after travelling the last…

We need trade unions to grow again

It is clear that the Reserve Bank of Australia (RBA) management is at odds with the elected Federal Government over the current state of the economy and what needs to be done to get through the COVID-19 pandemic. The Federal government is about to significantly wind back its fiscal stimulus, which although was insufficient at the outset, did help reduce the damage that the health responses to the pandemic caused (lockdowns, etc). The Government has the view that the private sector will now rebound quickly especially as the vaccination process has begun. The RBA though is clearly not convinced and its senior officials are wont to point out (regularly) that growth will struggle for years unless the stimulus is maintained and the government promotes an environment where wages can grow more quickly. The RBA clearly blames the Government for the record low growth in wages given the penchant of the latter to impose wage freezes and wage caps on public sector workers, which spill over into poor private sector outcomes. And that is quite apart from the damage that Government industrial relations legislation has done to the capacity of unions to gain wages growth for workers. The chances that we will break out of this malaise are close to zero. The Government is anti-union and anti-wages growth. It thinks that suppressing wages growth to historically record lows and further attacking the unions, will drive the wage share down even further (as the profit share rises). And, of course, the funding of the conservative political forces largely comes from the beneficiaries of these trends. For the vast majority of Australians the situation gets worse. Our real incomes stagnate and to maintain consumption levels we have to borrow more, even though household debt is at record levels in relation to disposable income. It is not a sustainable future but the damage will get worse until there is a pushback from the population. And one of the things holding that back is the deplorable state of the Australian Labor Party in electoral terms. We can generalise all this to most nations. The neoliberal score card: Biggest F you can find.

In a Speech delivered to a Business Summit in Sydney last week (March 10, 2021) – The Recovery, Investment and Monetary Policy – the RBA Governor noted that while the rest of the economy was still struggling, the housing market had boomed.

While he acknowledged that the near zero interest rate environment was “one of the factors contributing to higher housing prices”, he also noted that:

There are various tools, other than higher interest rates, to address these concerns, leaving monetary policy to maintain its strong focus on the recovery in the economy, jobs and wages.

The tools he was hinting at are all related to government policy – including the massive tax gains that investors get from speculating in the housing market (negative gearing).

The tax structure biases savings allocations towards investment in multi-property portfolios (totally unproductive) rather than channelling loans and investment into productive infrastructure.

It also fuels the housing boom, which has made housing effectively unaffordable for low income families. That is, on top of the failure by governments in Australia to invest in social housing, which was always the way in which lower income families could get a foothold into the property market.

So in that sense, he considered the problem of housing market price bubbles to be more a problem of treasury policy rather than monetary policy.

He told the Summit that the RBA would maintain low interest rates until inflation was “sustainably within the 2 to 3 per cent target range.”

And:

For inflation to be sustainably within the 2 to 3 per cent range, it is likely that wages growth will need to be sustainably above 3 per cent … and that the profit share of national income does not continue to trend higher.

He noted that “wages growth is running at just 1.4 per cent, the lowest rate on record” and this was not a condition that the pandemic had created – “Even before the pandemic, wages were increasing at a rate that was not consistent with the inflation target being achieved”.

The solution?

The evidence strongly suggests that this will not occur quickly and that it will require a tight labour market to be sustained for some time … There is, inevitably, some uncertainty about exactly what constitutes full employment in our modern economy. Over the past decade, the estimates of the unemployment rate associated with full employment have been repeatedly lowered both here and overseas … But based on this experience, it is certainly possible that Australia can achieve and sustain an unemployment rate in the low 4s, although only time will tell.

So all of that was central bank speak for saying that the Government willingness to tolerate, as per its latest – Mid-Year Economic and Fiscal Outlook – an unemployment rate of 6.25 per cent for the next two years at least, is the problem.

The most recent RBA statement is also significant because for years they have claimed that full employment was reached at 5 per cent unemployment.

Now they have “experience” that the unemployment rate can go much lower without triggering any inflationary pressures.

That is progress.

And the Government’s plan to withdraw a substantial portion of the fiscal stimulus at the end of this month will make it much harder to get the unemployment rate down.

There is a tsunami of job losses just waiting to happen in the Australian economy as the stimulus is withdrawn. The Government claims that maintaining the wage subsidy is too expensive and distorts business choice – they have a view that a lot of zombie businesses are being propped up by the subsidy and those resources need to flow into more productive areas.

Well, if you think about that, if there was a torrent of new high productivity activity just waiting to burst forth, then they would easily be able to attract labour resources away from the zombie businesses that were ‘hanging on’ as a result of the wage subsidy.

They would just have to offer wages above the subsidy (in most cases) and if they were really highly productive then they would be able to pay large premiums on the subsidy and the zombie firms would collapse because they would not be able to retain their labour forces.

But the problem goes deeper than this.

I read an interesting article in the Financial Times the other day (March 9, 2021) – Trade unions are back after a long absence – which referred to the trend in the UK economy for renewed growth in trade union membership after 30 years of decline.

The article notes that if there is such a trend then:

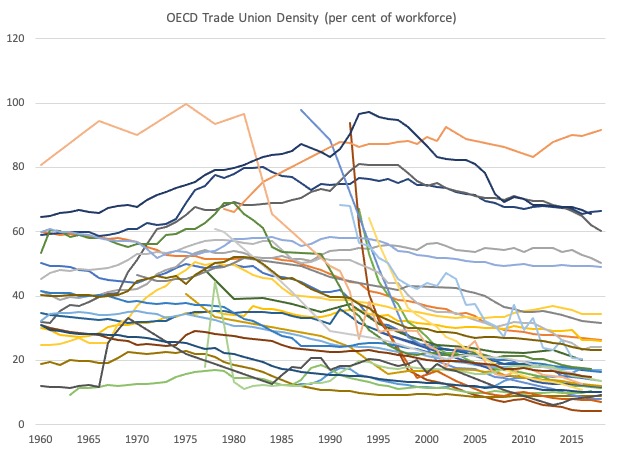

… it would mean the reversal of a trend that has lasted more than 30 years and spanned most of the developed world. Since 1985, trade union membership has halved on average across OECD countries, while coverage of collective agreements signed at the national, sector or company level has declined by a third.

Trade unions originally formed to provide a counterveiling force against industrial capital, and also, in the pre-welfare state period, to provide welfare services to their members and their families during period of unemployment, illness, and death.

In Australian colonial history, “As early as 1791 there is evidence of convicts taking strike action to demand that their rations be distributed weekly” (Source).

One of the major reasons that wages growth has plummetted and the wage share in national income in Australia has fallen from high 58-59 per cent to below 50 per cent in the most recent quarter is because trade union density has fallen to record levels.

On December 11, 2020, the ABS released the latest Australian data – Trade union membership – which shows that:

– 14% of employees (1.4 million) were trade union members.

– Since 1992, the proportion of employees who were trade union members has fallen from 40% to 14%.

We have to distinguish between the effectiveness of trade unions in gaining wages growth for their membership and the impact on overall wages growth of a declining density.

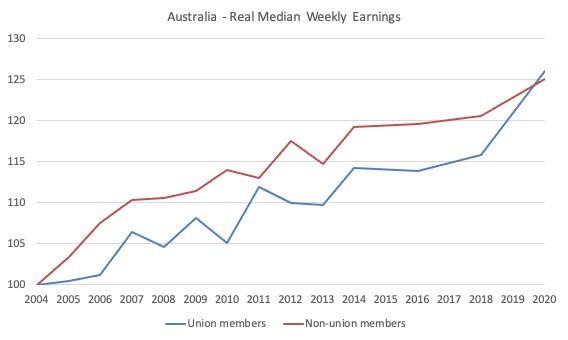

Examining the first question, there is a clear wage premium for unionised workers in Australia as is shown in the first graph. Note this data series became bi-annual in 2014.

But it is also clear that union members in Australia have not been able to extract higher real Median Weekly Wages growth than non union workers (see second graph).

The growth of both segments in the workforce (unionised and non-unionised) have been very poor since 2004 (when this dataset started).

And both segments of the workforce have endured very little real growth in the last 6 years (don’t be fooled by the vertical axis). Productivity growth has been much stronger over this period, which is why the wage share has collapsed below 50 per cent.

So even though union members enjoy higher median weekly earnings than non-union members, the unions have also had a hard time gaining wages growth for their members.

The decline in trade union density (proportion of workers in unions) is a global phenomenon as the FT article noted.

The following rather messy graph uses the OECD trade union density data from 1960 to 2018 for some 35 nations (only Israel is missing) and just demonstrates the historical decline.

That is Iceland at the top resisting the trend (especially since the GFC collapse of the banking sector). That example, is perhaps what the FT article is suggesting.

That the COVID-19 crisis is now encouraging workers to once again join unions.

Here is a less messy graph showing some of the big declines since the 1960s.

One of the problems facing the union movement is the increase in precarious, casualised employment, which is difficult to organise.

Further, government regulations have encouraged the growth of ‘independent contractors’, which is a major way that firms get around legal minimum wage and conditions requirements.

Everyone is an entrepreneur in this regard – and the capitalist who is really the only entrepreneur shifts the risk of the enterprise onto the workers, who are convinced that they are the entrepreneurs.

The current Australian government is planning even more dire industrial relations legislation that will further impact on the ability of unions to penetrate workplaces.

The problem is clear:

1. As union density declines, more workers are paid less – they lose the premium.

2. As the legislative framework becomes even more coercive against unions, they struggle to use their counterveiling power to extract wages growth for their members, even though they can preserve the premium.

3. All workers are enduring the structural shifts promoted by legislation that has broken down protections and minimum standards.

4. Poorly conceived and executed macroeconomic policy, which maintains elevated levels of unemployment and unemployment make it very hard for any worker – union member or not – to extract wages gains from firms.

Conclusion

If the RBA governor is to get his wish – which is for wages growth to start pushing the inflation rate in Australia up into the 2 to 3 per cent range – then there has to be major changes in federal government policy.

They will have to maintain and extend the stimulus for many months yet and start revising some of the industrial relations framework that has undermined the operations of unions as legitimate representatives of labour.

The chances of them doing either is – well – zero.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“Further, government regulations have encouraged the growth of ‘independent contractors’, which is a major way that firms get around legal minimum wage and conditions requirements.

Everyone is an entrepreneur in this regard – and the capitalist who is really the only entrepreneur shifts the risk of the enterprise onto the workers, who are convinced that they are the entrepreneurs.”

So true.

Has worker immigration been reduced due to covid? What effect do you expect that will have on wages?

Could someone explain how, here in Australia, wages growth is affected by the industry awards? What proportion of workers are on awards, and how the fact that awards are reviewed only every 4 years (I believe) must surely artificially depress wages growth?

Or is it such a small proportion of workers that they are not significant? And if that’s the case, then why is the Fair Work Commission and so politically and legally important?

Capital has harnessed the power of the state and engendered a form of slavery. Anti union laws, privatisations, outsourcing and off shoring have rendered unions mere bit players in much of the economy. Many younger people have never experienced the relative prosperity that older people enjoyed.

How does this turnaround? Maybe matters have to get worse by overreach of the greed of capital before younger people will not stand for further attacks on their wages and conditions… if there are union organisers out there willing to take on capital and it’s enablers, the neoliberals dominating the political sphere.

T

“The tools he (RBA governor Lowe) was hinting at are all related to government policy – including the massive tax gains that investors get from speculating in the housing market (negative gearing).

The tax structure biases savings allocations towards investment in multi-property portfolios (totally unproductive) rather than channelling loans and investment into productive infrastructure”.

Yes, but Lowe is either deliberately or inadvertently ignoring the fact that Labor tried to deal with that problem in the last Federal election. Fact is no-one wants to pay higher taxes, and as we saw in the election, the Libs had a field-day misrepresenting the negative gearing issue…so much so that the ALP has dropped it altogether.

Hence Lowe remains a prime suspect in the entire economic dysfunction scenario, in my estimation. His reply to Adam Bandt, in a Senate committee hearing, that “the reserve bank doesn’t create and spend its own money into the economy” says it all.

“The Federal government is about to significantly wind back its fiscal stimulus, which although was insufficient at the outset, did help reduce the damage that the health responses to the pandemic caused (lockdowns, etc.). The Government has the view that the private sector will now rebound quickly especially as the vaccination process has begun.” Are we nearing the end of this pandemic, or just beginning our dance with Covid? As I understand the unfolding science, new and more virulent variants of this virus are emerging as we speak, some of which may be able to evade current vaccines and treatments. And these variants are spreading from country to country, with one of them (Covid B117) being responsible for the re-lockdown of the UK. The likelihood may well be that we’re looking at a chronic relationship with Covid, one involving intermittent surges and lockdowns for the foreseeable future, as opposed to confronting an acute crisis about to end so that neoliberal business can return to normal. Bill’s readers might want to check out the weekly YouTube reports of Dr. Michael Osterholm, an eminent American epidemiologist who has made one right call after another concerning the immanent course of this pandemic–how it can be expected to play…not play out. If he’s again on the money about the impending global surge of B117 and perhaps other, even more dangerous and resistant variants, then the Australian government (among others) is in for a very rude awakening in the next several weeks. As are most of us.

I don’t understand the Australian housing market- it seems to be neverending in its growth- with no bust (like ’08 atlantic economies)

Will austerity kill off the Australian housing market, if you take the sectoral balances approach (Wynne Godley)-

A fiscal surplus+over indebted private sector and a reducing foreign sector surplus(China has decided to shut downs its Australian imports )

Will this cause a Housing bust?

Or will it keep going on as it always has.

“Over the past decade, the estimates of the unemployment rate associated with full employment have been repeatedly lowered both here and overseas”

But its so damn high still. NAIRU is stupid. Even looking at narrow U2 unemployment rate itself is problematic because people simply give up looking for work.

“One of the problems facing the union movement is the increase in precarious, casualised employment, which is difficult to organise.”

Yes. Problem is also the propaganda is so much that proletarian themselves think its wrong to organize unions. It seems to me the problem that the ideologies of post-WWII windfall generation still has not died, which is the social contract. I simply don’t think, as a group, they are comprehending what is happening to the young generation.

“…who are convinced that they are the entrepreneurs.”

Haha, yes.

Although I wish trade unions were much stronger, one should not underestimate the role that their incompetence played in the rise of Thatcher in the 1970s.

I don’t see much evidence that they are much wiser today. Which trade unions are looking at the world through an MMT lens?

@MartinD,

There are people in my union leadership who know MMT but we are much too small too be super relevant.

IMO, Leninism + MMT lens are must haves.

The working class should not just aim to become as strong as they were. It is time to surpass primitiveness in the past.

A lot of practical work and education still need to be done. I can say that for myself in no uncertain terms.

In regard to the Australian housing/real estate bubble the powerful property industry and the compliant political class has always been able to find more investors to sustain the real estate bubble and this giant ponzi scheme is still waiting to burst.

The stupid and destructive Australian tax system incentives for speculation in rental properties and the relatively low and stable interest rates inflated the bubble and economists like Steve Keen predicted market collapse a few years ago due to the increasing inability to service the record household and business debt levels but Chinese ethnicity investors in the main continued to be big investors into Australia’s bigger city real estate often using local bank finance based on fraudulant foreign asset and income documentation. A scam that was well known by the major banks. Property investors probably worked out the quantity of new investment needed to further sustain the bubble.

The Labor party now are too timid to remove the negative gearing and 50% CGT concessions following their unexpected loss last federal election.

More recently extremely low interest rate policy by the RBA has again driven strong real estate price increases. Maintaining support for speculators appears to be a primary aim of the current conservative federal government and the RBA.

Two troubled areas however are multistorey apartments that were mostly popular with migrants and students from China that now has gross oversupply, and empty office space due to the pandemic.

I can’t see any more ways left for inflating the bubble apart from allowing vaccinated international students and migrants back into Australia in large numbers.

As Bill writes Australian wages are stagnant and job insecurity and unemployment are expected to further worsen but inflation and interest rates are expected to remain low.

Immigration has stopped and the first home buyers grant is leading to a high level of construction which will lead to less upward pressure on property prices.

It looks to me once the current low interest financed mini boom runs its course there are more downward pressures than up and a descent of real estate prices becomes inevitable within a year or two or three?

Thanks Bill, I greatly admire your work and as a former Union official and life member of my union I strongly agree that “We need trade unions to grow again”. However, what sort of Unions? The modern service organisations which provide a pathway to academia or parliament? Or, as I would support the type modelled by the sadly missed Jack Mundey and Joe Owens who saw the need to build alliances with the community on broad issues. In the seventies, the likes of Laurie Carmichael and Ted Wilshire who took up national broad programmes for an Australia ReConstructed. With the levels of unemployment, inequality and environmental destruction that we face today I’m not sure that “reconstructed” gives us the true depth of the problem.

It seems to me that just as Chifley recognised the need for Government to fund change, MMT offers the justification for our monopoly currency issuer to take centre stage –though there needs to be a massive clearance of neoliberal obstacles. Communication is one such obstacle. This is one place that unions can and have been successful in the past. But it needs to be communication with a clear focus and wide appeal .

One such area is the potential of Concentrated Solar Thermal power generation ( we export some of this growing technology to China) it is growing rapidly . This would provide good jobs for coal miners, families and regions plus the potential to desalinate water, electrify a national railway system ( diesel locos are approx 30% efficient where electric locos are more powerful and approx 95 % efficient). New industries and cleaner revivals of iron and other metals from their ores…

There is a lot of literature on this field but it it is well concealed. Instead we are encouraged to buy

giant batteries, photo voltaics and all those “solutions” promoted by neoliberal ideology.

Of course Bill the Jobs Guarantee has a major role but as you clearly warn it is NOT the same as a Green New Deal (GND) for example. The GND needs closer scrutiny, I support such an idea, I also have various current generation energy solutions on my farm but we should be looking beyond the present and considering a systematic (as opposed to reductionist) approach to what are the greatest crises facing the species.

Yup! Can the Libs now see how the COVID-19 response has shown we’re able to spend money on social problems – maybe including housing unaffordability? MMT rules!

And Australian trade unions & the ALP might revisit their roots to see that taxing land values away instead of wages would bring cheaper housing and see workers retain more of their earnings. It’s becoming clearer that high land prices has led to lower wages, so keeping a lid on land prices (‘asset price inflation’) will deliver higher wages.