Well my holiday is over. Not that I had one! This morning we submitted the…

The German government celebrates its record surplus while infrastructure collapses

Wednesday blog post – so only a few snippets including some discussion about Germany’s latest extreme outcome – a record fiscal surplus, which the Ministry of Finance is claiming is responsible. Judged by the fact that the economy has ground to a halt and there is a massive infrastructure deficit in the country as a result of a systematic starving of capital expenditure by the government, one has to ask: are they joking! The surplus was, in part, the result of the German government not spending allocated public investment funds because there are insufficient skilled public servants on tap to manage the projects. So the government has hacked into skilled employment first, then it finds that there are not enough qualified officials left to oversee essential projects. So capital formation contracts and the allocated funds go unspent. So, the Government records a surplus and cheers while bridges, roads, hospitals, IT infrastructure, transport infrastructure decays further. Modern day Germany – ridiculous.

Germany being irresponsible – as usual

On Monday (January 13, 2020), the German Finance Ministry announced that Germany has recorded a record fiscal surplus of some €13.5 billion.

Its – Press Release (in German) – claimed that such a result was “Klug und verantwortungsvoll handeln – Vorfahrt für Investitionen” (Acting wisely and responsibly …) and will help it increase public investment while maintaining fiscal balance over the period to 2023.

Further, there was an amount equal to €5.5 billion that was allocated to helping refugees which went unspent – so the total fiscal surplus was, in fact, around €19 billion.

Tax revenue was up and spending down as a result of negative interest rates.

While the Finance Minister Olaf Scholz claimed the ‘surplus’ would be spent on investment projects, the reality is that past allocations for infrastructure development were not spent apparently because, in part, there has been a shortage of skilled employment in the public sector such that there are not enough “skilled civil servants to process applications” (Source).

The German government is clearly ignoring the calls from European economists and the central bank officials (not the least Mario Draghi as he left the ECB job) to provide some fiscal stimulus to Europe to break the stagnation and high unemployment that the fiscal austerity has created.

And even in the context of the German economy, quite apart from its central place in the Eurozone, the pursuit of fiscal austerity is plain irresponsible.

On November 14, 2019, the German statistical agency DeStatis released the latest – National Accounts – data for the third quarter.

It found that:

1. Real GDP grew by just 0.1 per cent in the third-quarter 2019 after falling by 0.2 per cent in the second-quarter.

2. Gross value added in the goods producing sector was down by 3.1 per cent over the 12 months with manufacturing down 2.6 per cent.

3. Gross capital formation was down by 3.8 per cent in the third-quarter 2019.

4. Labour productivity growth has stagnated.

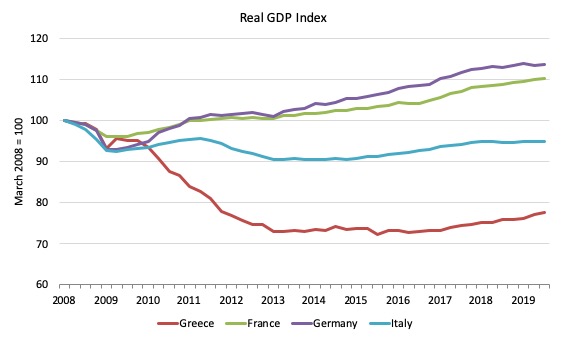

The following graph shows the evolution of real GDP since the beginning of the GFC (March-quarter 2008) to the September-quarter 2019.

Both Italy and Germany are now stagnating with Greece still in nowhere land.

The interesting point, apart from the sheer idiocy of the German position, is that the way we think about these flows for Germany or any nation that uses a foreign currency is different to the way we would construct the situation for a currency-issuing government such as Australia or the UK.

In both cases, a fiscal surplus means a net withdrawal of spending power by the government which squeezes the non-government sector for liquidity, and, once the transactions are completed causes non-government financial wealth to decline overall.

But in the case of Germany, which uses the euro as a foreign currency, the surplus allows it to put the excess flow into bank accounts somewhere and increase its spending power in periods ahead.

But talking about a currency-issuing government ‘spending’ its surplus is misleading.

A surplus results after the public spending flows into the non-government sector are below the spending withdrawals (drains) via tax flows into government.

The stock adjustments that accompany this result forces a reduction in net financial assets in the non-government sector and a reduction in debt-issuance, if the government is, unnecessarily, matching the deficits with debt sales.

But to say this provides the government with more resources to spend in the future than it did before it ran the surplus makes no sense for such a government.

It can always spend X, if desired, irrespective of whether it has run a deficit or a surplus in the previous period.

The surplus flow is accounted for and disappears from the monetary system.

Film to see if you can – Racism in Australia

I don’t often watch movies on flights, preferring to read and listen to music. But the other day I was able to watch – The Australian Dream – which I had missed when it was in the cinemas because I was away at the time.

It is about racism in Australia and traces the life of one of our greatest Australian football players Adam Goodes who was driven out of the game because fans took exception to him having a voice.

They don’t mind ‘black fellas’ being absolute stars in our local football code but when they get a voice and talk about racism then the pack turns on them.

This is what happened to Adam Goodes.

The film documents how we are unable in this country to come to terms with our history – a brutal invasion by white colonialists intent on destroying the population that had lived here for some 60,000 years.

It was a very disturbing movie.

Adam Goodes and his mother are legends.

A number of people come out well from it (Sam Grant, Michael O’Loughlin, Brett Goodes, Natalie Goodes, Tracey Holmes, Nova Peris, Nicky Winmar, Gilbert McAdam, Linda Burney, Paul Roos, John Longmire, Nathan Buckley), while others (Eddie McGuire and Andrew Bolt and all the social media heroes who hide behind their screens and vilify and pump out toxic stuff about people they do not know or have any understanding off) do not.

See it if you can.

This ABC article (September 3, 2019), written by the script writer for the movie (Stan Grant) tells you some more about it – The Australian Dream tells Adam Goodes’ story but its message is universal.

He talks about introducing the film to an American audience at the Telluride film festival in Colorado last year.

We need to change some things in this country and all nations.

February 2020 – European and UK Speaking and Lecture Tour

Here is my current schedule for February in Europe and the UK.

The ‘tba’ listings mean either I haven’t agreed yet to current proposals to speak or that the day is free of events so far.

If anyone wants to organise and event or set up a meeting, then please contact me and we will see what is possible.

- Monday, February 03, 2020 – Speaking on ‘What is the meaning of political economy today?’ at Think Corner, Helsinki – 17:00 to 19:00

- Tuesday, February 04, 2020 – Teaching, University of Helsinki – 16.15-17.45, Porthania P674 – all lectures are public.

- Wednesday, February 05, 2020 – Teaching, University of Helsinki – 10.15-11.45, Language Centre in Fabianinkatu room 207

- Thursday, February 06, 2020 – Teaching, University of Helsinki – 10.15-11.45, Main building, Hall 16

- Friday, February 07, 2020 – Rome, Presentation to Parliament – details to follow.

- Saturday, February 08, 2020 – Rome, Events with activists – details to follow.

- Sunday, February 09, 2020 – Travel

- Monday, February 10, 2020 – Breakfast presentation – ‘The future of monetary policies’ – Nordic West Group, Helsinki.

- Tuesday, February 11, 2020 – Teaching, University of Helsinki – 16.15-17.45, Porthania room 723

- Wednesday, February 12, 2020 – Teaching, University of Helsinki – 10.15-11.45, Language Centre in Fabianinkatu room 207

- Thursday, February 13, 2020 – Teaching, University of Helsinki – 10.15-11.45, Main building, Hall 16

- Friday, February 14, 2020 – Presentation, Dublin.

- Saturday, February 15, 2020 – Presentation, Dublin.

- Sunday, February 16, 2020 – tba

- Monday, February 17, 2020 – tba

- Tuesday, February 18, 2020 – Paris, Reception, French Senate, Palace of Luxembourg – 18:00

- Wednesday, February 19, 2020 – Paris, events and interviews – details to follow

- Thursday, February 20, 2020 – Paris, Presentation to French Senate Commission, Palace of Luxembourg – 8:30-10:30

- Thursday, February 20, 2020 – London, GIMMS presentation, MMT education – afternoon – Details.

- Friday, February 21, 2020 – Manchester, GIMMS presentation, The Harwood Room in the Barnes Wallis Building, University of Manchester, Details.

- Saturday, February 22, 2020 – MMTed Masterclass Workshop, London, for Details and Tickets. Limited spaces available.

- Sunday, February 23, 2020 – Amsterdam – Private meetings.

Music for the day

I was listening to this album this morning as I worked. It is from US jazz pianist – Bill Evans – who is best known for paying with Miles Davis but recorded a lot on his own.

This track from 1- Like Someone in Love (written by Jimmy Van Heusen, Johnny Burke in 1944) – is from the album – Time Remembered – and was recorded in 1962 but not released until the 1980s, when I acquired it.

I could write a lot about his playing style, but for now, I will leave it to the ears.

That is enough for today!

(c) Copyright 2020 BIll Mitchell. All Rights Reserved.

Prof Bill, Singapore’s also running fiscal surplus of 2.5% of nominal gdp https://www.ceicdata.com/en/indicator/singapore/consolidated-fiscal-balance–of-nominal-gdp with a much bigger trade surplus. But it manages to have first class infrastructure. How is that?

“Modern day Germany – ridiculous.”

That depends on when exactly “modern” begins for you, Bill. As a young(ish) man I would more accurately go with: “Germany – ridiculous as ever.”

The indignation of German media and the biased coverage of the scenes of resistance in France are particularly soul-sapping to me. They literally complain they have it too good and shouldn’t be whining whithout even considering that maybe the “whining” part is the reason the french have it “so good”. Here’s your German word for the day: Obrigkeitshörigkeit.

A little off-topic but could Bill or someone else provide some comment on the recent “repo agreements” business the FED has engaged in?

It kinda sounds like a repo trade are means to inject liquidity over night to fullfill tax and other obligations when there is a deficit of reserves in the banking system. But then I struggle to understand how this deficit would come to be and feel there is a bigger story hidden here. Then again, this whole business is probably nothing, but after reading me some Michael Hudson’s “Superimperialism” I’m beginning to read “financial meltdown” in every piece of information. Might as well be a case of Jon Ronson’s:

“Ever since I learned about confirmation bias, I’ve been seeing it everywhere.”

Cheers!

@HermanTheGerman,

The recent article from Ellen Brown is ominous, entitled “The Fed protects gamblers at the expense of the economy”.

“Although the repo market is little known to most people, it is a $1-trillion-a-day credit machine, in which not just banks but hedge funds and other “shadow banks” borrow to finance their trades. Under the Federal Reserve Act, the central bank’s lending window is open only to licensed depository banks; but the Fed is now pouring billions of dollars into the repo (repurchase agreements) market, in effect making risk-free loans to speculators at less than 2%.”

further on in the article:

” Central bank quantitative easing won’t create hyperinflation, says Gammon, but “it will create a huge discrepancy between the haves and have nots that will totally wipe out the middle class, and that will bring on MMT or helicopter money”.

and concluding with:

“Solutions are available, but Congress itself has been captured by the financial markets, and it may take another economic collapse to motivate Congress to act. The current repo crisis could be the fuse that triggers that collapse”

Bill does not see any sign of recession in the latest US economic data re the real economy, but this Brown article is something else….

@Neil Halliday

Thanks a lot, Neil. That just happens to be the article that put me in my current state of heightened anxiety 🙂

I think I picked it up on truthdig or counterpunch.

” Central bank quantitative easing won’t create hyperinflation, says Gammon, but “it will create a huge discrepancy between the haves and have nots that will totally wipe out the middle class, and that will bring on MMT or helicopter money”.

Only that it might come with a scoop of fascism. It would be disheartening to see the wrong people take advantage of the right tools, after having fought against them for so long.

“Bill does not see any sign of recession in the latest US economic data re the real economy, but this Brown article is something else….”

I feel “no recession” is a rather moot point if it is based on whether there were two (or was it three?) quarters with zero or negative growth, if there is positive growth but only in the FIRE sector. Of course,

I might as well be wrong and “the real economy” is doing fine. Indeed, I did look up the delinquency rates at the FED and nothing in particular seems to be out of control, despite my gut telling me the car and student loan bubbles are ripe to pop any day now. Problem is, the same charts show how it got really bad really fast once the first dominoes fell back in 2008/09.

The fact Bill hasn’t even blinked is the one thing that makes me think it might still take a while before a crash.

Cheers!

Thanks for updating the lecture details. See you in Manchester.

@ jerry

My amateur response is that Singapore’s trade surplus may be what makes running a fiscal surplus possible. I infer this from my understanding that monetarily sovereign nations which float their currency and run trade deficits must run fiscal deficits sufficient to offset the demand destruction of the private sector’s propensity to save AND those trade deficits in order to operate as close as possible to full employment.

Jerry,

I think the degree of things matter.

perhaps Singapore has enough trade surplus to pursue first class infrastructure and economic shrinkage.

I don’t see any problem there.

The repo market provides liquidity for Over-the-Counter (OTC) derivative market.

Just look under the counter.

Anyway I would like to share a piece of news which is in my view extremely important, also in the context of Germany not spending enough. In the US a bipartisan Senate bill has been proposed to create a fund (more than 1 billion USD) to finance an American competitor to Huawei. They want to catch up with the R&D.

Finally, the Sputnik moment has arrived as they discovered that market forces alone would not guarantee the adequate level of expenditure. I would say they are 10 years late (Andy Grove, one of the last modern geniuses, wrote his article “How America Can Create Jobs” on 2010/07/01 – search Bloomberg, disable Javascript in the browser to read it without garbage popping out).

However if the US goes full steam ahead with these plans instead of wasting political energy on fruitless sanctions and trade wars, we (the Western Civilisation or whatever I am supposed to worship), have just bought another 50 years. It is precisely this type of competition from the 1960s which brought to all of us, regardless where we live (and for all the wrong reasons), the modern technology. Why this was possible was not a macroeconomic question. It was a question of overcoming political resistance and mobilising real resources.

The competition with China has one unique feature – an hour of labour in the US buys a few hours of similar labour in China but the currency exchange market is pretty much in equilibrium, also thanks to the special role of the US dollar and the presence of illegal capital outflows from China. The Chinese Central Bank is not manipulating the exchange rate, the CCP is just harnessing the “hacked” market forces. Obviously serious research is required in this space as nothing is obvious. Another Plaza Accord simply won’t do and I believe that the anti-Chinese hawks in the administration of president Trump have just realised this. There is only one “straight and narrow path” for America to avoid being overtaken by China in terms of the level of sophistication of civilisation and implicitly the power of the military force. Direct government expenditure into the R&D.

The Chinese are spending massive amounts of money on catching up with microprocessor technology, robotics and jet engines. (And not only this), Even the Iranians have developed high precision missiles. The only way the US can remain as a serious international player in the next few decades is by matching and surpassing the Chinese R&D expenditures.

What about financing the R&D on energy storage and renewable jet fuel? What about not relying on Chinese-made solar-panels? Do we have to wait another 10 years to discover that fracking is not enough, it is actually moving us backwards?

This is not a matter of being “green” this has to be framed as the National Security for the US. We need to create “MMT framed for d..heads”. Dear American bloggers, just go an infiltrate the right wing blogs and discussion forums. We need to “lock her up”, oops, sorry, spend 1 Trillion on defending ourselves against the new “red peril”. The Soviets were trying to send us missiles, the Chinese are sending smartphones with their evil technology. Now the moment has arrived to build the 6G and land the American space ship on Mars (not on Marx, what the Chinese want to do). Everyone will benefit, this will actually “trickle down” unlike the hoarding of the wealth by the richest.

Does that mean if a country has a trade surplus it has to have a fiscal surplus? And conversely if a country has a trade deficit it has to have a fiscal surplus?

I meant if a country has a trade deficit does it have a fiscal deficit

Hi Patricia,

There are three terms in the sectoral balance equation: Private, government, and external (trade).

So a trade deficit doesn’t guarantee fiscal deficit because you government can hypothetically run a surplus along a trade deficit.

However, It would be extremely unwise to not have a fiscal deficit in almost all cases of trade deficit. It just generally doesn’t happen unless a country has crazy politicians/culture that want to commit national suicide.

Patricia,

From my understanding, and in very simple terms, if a country can run a healthy trade surplus, then it may then be able to afford to also run a fiscal surplus without damaging the non-government sector of the economy.

Germany tends to run large trade surpluses, and so, in principle, it can also probably afford to run a fiscal surplus. But the problem is that its infrastructure is (apparently) rotting away, and it should really be spending more on that. That would in principle eat into its fiscal surplus, and might even turn it into a deficit, or at least make it tend towards balance. But there are of course other factors, like having the skilled workers and other real resources to rebuild the infrastructure.

As Bill often points out, the actual outcome of the fiscal balance, whether deficit, surplus or zero balance, is not what matters. What matters is the public good, which in Germany’s case, would mean rebuilding its infrastructure (which would probably help reduce unemployment and underemployment as well). But for the reasons stated, she is not doing this, but is trumpeting the budget surplus as a good thing in itself, which it isn’t, at least when seen through the MMT lens.

Dear Bill, Big big thanks for the insights into the German economy among many other great knowledge you provide. I really feel grateful for everything.

I wish one day i have a chance to sit as in your lecture room, or invite you here as our honor guest. Let us know in advance, when you are visiting Bangkok, hope it will be soon. She is experiencing very strong Thai bahts for months now. And it seems no one has the foggiest what to do, especially all the economists here.

(Any help?)

Mike Ellwood, your explanation is very clear and easy to understand, thank you very much also.

Have a very nice day to all!

vorapot

@AdamK

Thanks for the hint on repos and interesting comment as usual.

I understand your point but consider the risk behind “harnessing the hate and the stupidity” too great. As Chris Hedges often says, magical thinking has already set in, as it usually does in decaying states/empires, and the stage for a “glorious last battle” and subsequent ascent to cristo-fascist Valhalla is already set for a considerable but not decisive part of the population. No need to stoke the flames even more. It won’t matter much if Armageddon is fueled by green energy or conventional sources.

I would instead try to exploit the war fatigue in the non-brainwormed part of the public and insist that the ressources spent abroad to maintain a futile military siege of the world be better spent at home for living instead of killing.

Cheers!

Thank you Tom and Mike for your explantations. I must remember not to think in absolutes!! You are so right Mike. It all depends and the overriding thing is the needs of the people.

Dear HermannTheGerman,

The technological race between the superpowers is not the same as war-mongering. We will all benefit. I may be biased but I see no chance of escaping the Malthusian curse of rising material footprint of the human civilisation as a whole without a dramatic increase in the R&D. This includes developing the technologies enabling rapid decarbonisation of the global economy because of the urgent need to slow down and halt the climate change processes.

At least the problem of acquiring jet engine technology by China (not the most modern but still quite reliable) appears to have been partially resolved. The Americans need to take a note.

Search “Наука и Техника” for “Почему украинские ученые хотят приехать в Китай?” (“Why Ukrainian scientists want to move to China”)

The Russian internet news site “Science and Technology” is presenting an article originally published on “Sina” (which I can’t read because it is in Mandarin). Apparently the Chinese are no longer worried that the Americans are able to keep blocking the purchase of Moto-Sich, the main Ukrainian manufacturer of jet and rocket engines by Beijing Skyrizon Aviation . (The Ukrainians still have the old Soviet technology, especially the knowledge of material science).

“Nowadays the jet engine industry in China still needs highly qualified personnel. Even mid-level specialists will be greeted with open arms. In the US they can’t count on any opportunities as the Americans are not interested in their services, especially if they are of a pensioner age. But in China specialists with significant professional professional experience will find demand for their knowledge and will be able to make good money.”

Do you remember one Wernher Magnus Maximilian Freiherr von Braun? Yes he might have had obnoxious past but he contributed so much to advancing the space technology that we may forgive him his sins from WW2. He built the rocket which allowed humans to land on the Moon. This was to me the pinnacle of the technological progress of the whole humanity.

In the end, everyone is using a GPS and other modern satellite-based telecommunication technology. Not to mention the computers, mobile phones etc. Whatever I do for living, is based on the military technologies developed mostly in the 1960s.

Apparently it was the transfer of technology from Ukraine what enabled North Korea to build their own reliable rocket engines so that technology is still viable. This seems to be scary but re-igniting the technological arms race, this time between China and the US, may be the price all of us have to pay for breaking the political barriers preventing the governments of Western countries from spending enough money on the R&D.

Otherwise, how will you convince Mrs Merkel to make the proper use of her surplus? She needs to feel threatened. I don’t believe in wishful thinking that progressive people can win the elections and just change everything. So far the progressives can only self-ignite like Warren going after Sanders. They should have taken horse tranquilliser before the debate. It is so childish, naive and sad what they are doing here and there.

I am not worried about the “Christo-fascist Valhalla”, the Commander in Chief has bone spurs, apparently doesn’t know that India borders China and can only play golf.

Hi Patricia,

As I ruminate a bit more, Bill often makes the point that it doesn’t really matter if you try to move to surplus anyway because a recession and job losses will inevitably push the nation back into deficit.

So fiscal deficit will happen even if you try to move it gov sector to surplus because of automatic stabilizer and I thank sigmar for automatic stabilizers.

@AdamK

Sorry for the late reply.

I do not deny the creative power of the threat of annihilation. It is the consecuences I dread. As you say, “cadet bone spurs” is a senile clown, but there are more than enough fascist hardliners in his natsec apparatus willing to go “bay of pigs” all over again without an insurance it will not blow in their faces this time around. (Remember Dr. Strangelove? Once you provide a hair trigger for the “doomsday machine” all bets are off.”

Furthermore, the technology you cite was largely created as a byproduct of the research in more “destruction oriented” topics. I would rather not engage in a rehash of the arms race and hope some new green technology is developed by accident in the search for the 55th way to erase life on earth. Honestly, even the maligned hydrogen technology needs merely funding for the necessary infrastructure in order to provide a safe and feasible way to store and thus regulate the supply of renewable energy. It’s not a matter of lack of research, but a matter of keeping rivals down and impede energy (and food) self-sufficiency, thus a matter of geopolitics.

Mrs. Merkel is but a lap dog of the Atlantic Council, German Marshall Fund and all those “think tanks” and councils. She lacks the courage to pursue any political goals that would put her at odds with Uncle Sam or the local captains of finance and industry. Anyway, she’s done. If you’re looking for a fiscal revolution, as is the case for any other kind of revolution, don’t look for it to start in Germany. The current tensions in the franco-german relationship are palpable and I believe Macron will ultimately only have delayed Mrs. LePen’s rise to power. Here lies the potential for a reorientation of powers in Europe.

Warren just went “all in” (probably at the behest of the DNC) and lost what litlle credibility she had among the working class. She’s done. The choreography of the after-debate “hand-shakegate” didn’t do CNN’s already battered image any good either. Sanders has the receipts to brush this off but it remains to be seen how it plays out with the more centrist (and sadly non-negligible) Hillary-Nostalgia wing of the party. Barring a “lone wolf” taking him out, Sanders will win the presidency if he gets the nomination and has shown enough glimpses of anti-imperialism that a retreat from the middle east is plausible. Once that chip falls it becomes increasingly hard to justify the rest of ressource-draining outposts around the globe.

If that fails, I’m willing to give your more “gung-ho” approach a go.

Anyway, I appreciate your insight into Asian matters and particularly around China. Can you share some of your sources? Unfortunately, I speak neither Russian, Mandarin nor Cantonese.

Cheers!