Well my holiday is over. Not that I had one! This morning we submitted the…

The rich are getting richer in Australia while the rest of us mark time

Only a short blog post today – in terms of actual researched content. Plenty of announcements and news though, a cartoon, and some great music. I have been meaning to write about the household income and wealth data that the ABS released in July, which showed that real income and wealth growth over a significant period for low income families has been close to zero, while the top 20 per cent have enjoyed rather massive gains. These trends are unsustainable. A nation cannot continually be distributing income to the top earners who spend less overall while starving the lower income cohorts of income growth. A nation cannot also continually create wealth accumulation opportunities for the richest while the rest go backwards. These trends generate spending crises, asset bubbles and social instability. That is what is emerging in Australia at present.

The absurdity of trends in income and wealth

On August 2, 2019, the ABS released the latest – Retail Trade, June 2019 – data, which showed that “Australian turnover rose 0.4% in June 2019. This follows a rise of 0.1% in May 2019 and a fall of 0.1% in April 2019.”

The ABS said that:

… overall the retail environment remains subdued …

We also learned that with growth so weak, some retail segments are in free fall.

This was the first release since the RBA cut interest rates, once again, confirming that spending is not very sensitive to interest rate movements.

Some reports argued that “while things are not getting worse, the figures from the past year are close to recessionary levels” (Source).

The same commentator said that:

The most eye-catching figure is the annual growth rate in retail volumes – at just 0.2 per cent, growth over the last 12 months has been weaker than in the GFC and the weakest since the early-90s recession.

The data also shows that Department stores went backwards and the big retailers are confirming they are in trouble.

They have blamed structural shifts – on-line behaviour, the rise of specialty stores that can undercut the ‘departments’ in the big integrated stores – and slower spending overall (macro failure).

There are many observers who are predicting that the big two Department store companies in Australia will soon be one – as the other goes broke.

There seems to be a race to see which one can hold out for the longest.

Undoubtedly, there are structural factors that are undermining the concept of the department store. They tend to be unwieldy and expensive relative to the specialty shops in electronics, clothing, homewares etc.

The costs of running the big stores are also much higher.

There is also the issue of offering what people want.

I read recently that in the UK, Dr Marten’s boot have seen their profits “soar by 70 per cent in the year to the end of March, thanks to the success of its new vegan range of boots” (Source).

So much for Brexit.

In Australia, a specialist electronic company is similarly bucking the trends.

But there is some bigger than the structural shifts going on.

On July 12, 2019, the ABS released its latest – Household Income and Wealth, Australia, 2017-18 – data, which tells a pretty sorry story of what has been happening to spending power as the Federal government pursues its mindless austerity obsession and the economy slows to a near-standstill.

What that data told us was that:

1. “In 2017-18, the average equivalised disposable household income was $1,062 per week. This was not significantly different from the average in 2015-16 ($1,046 per week), but was compared to a decade ago ($1,018 per week in 2007-08).”

In other words, there has been hardly any income growth in the decade to 2017-18.

2. “Close to three in four (73%) households were in debt in 2017-18. Of these households, 28% were servicing a total debt that was three or more times their annualised disposable income.”

Households are now carrying record levels of debt and the situation is becoming unsustainable. The overall household saving ratio cannot keep declining without a bust occurring.

3. “the wealthiest 20% of Australian households owned 63% of total household wealth in 2017-18. By comparison, the lowest 20% of households owned less than 1% of all household wealth.”

4. “distribution of wealth is more unequal than the distribution of income”.

5. the wealthier Australians have been getting richer and the gap between the rest of us has widened quite significantly in the recent years.

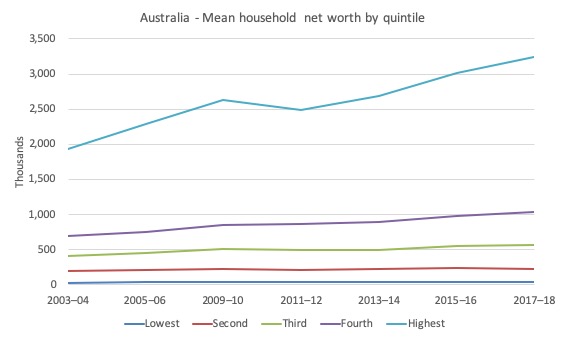

In terms of mean household net worth, the highest quintile has seen significant growth while the lowest three quintiles have barely moved.

The following graph tells the story.

In real terms, the household net worth of the highest quintile rose by 68 per cent since 2003-04.

But for the households in the lower categories, their real net worth increase was around zero.

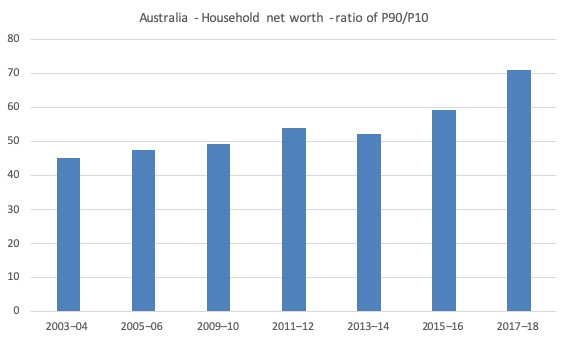

And the share of the highest quintile has risen substantially since 2003-04 as the next graph shows.

In 2003-04, the top quintile accounted for 59 per cent of total household net worth. By 2017-18, they had 63.4 per cent. Each of the bottom three quintiles went backwards in this measure.

Why does this matter?

The neoliberal paradigm is laying the roots for its own destruction.

The GFC was the first major hiccup.

And the stagnation that followed is leading to the next episode in the demise of the current policy orthodoxy.

With growth in income and wealth being increasingly skewed towards the top end of the distributions, where spending propensities are lower, private spending growth will falter – as we are seeing.

The only way that growth can be maintained in that environment is with significant government deficits. But the neoliberal era has locked governments into a mindless surplus obsession.

Taken together, the system cannot survive.

There are hints that the era of fiscal austerity is coming to an end as governments are being forced into action.

But I suspect the dam walls will only break when we go back into a serious downturn.

Sydney Modern Monetary Theory (MMT) Event

The Modern Money Australia NSW Branch is organising their first major event on August 24, 2019 in Sydney.

Details of the event are available – HERE.

I will be speaking as will Rohan Grey.

Tickets to the event are free – which doesn’t tell you anything about the quality of the speakers (-:

It will be held between 14:00 and 16:00 at:

Theatre 203, Pioneer House, Notre Dame University Broadway Campus

128-140 Broadway

Chippendale, NSW 2008

Please support this group as they become part of the national MMT network – joining the excellent work being done by the Melbourne Chapter of Modern Money Australia.

I am donating a copy of Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017) – as a door prize.

For Japanese readers

A group at Kyoto University have just published the latest edition of – The Criterion, September 2019 – which features a symposium on MMT.

They have kindly translated my work for that edition and I thank them for their efforts.

I will be following up in early November with a lecture visit to Kyoto and Tokyo. I will have more specific details available soon, but I hope to meet a lot of my regular readers and also make some new acquaintances.

It is great that MMT is getting such widespread coverage now in Japan.

Future dates for your diary

I will soon be a position to announce a very high profile coalition of groups that I have been assembling to create a Roadmap for an MMT-inspired Green New Deal-Nation Building exercise in Australia which hopefully will also help other nations – given the groups involved have a global presence.

We are launching this initiative in a series of events:

1. Brisbane – November 18, 2019.

2. Newcastle – November 21, 2019.

3. Sydney – November 23, 2019.

4. Melbourne – November 30, 2019.

5. Canberra – possibly early December (not yet certain).

The Roadshow will then shift in early 2020 to regional areas, particularly those that will be most affected by jobs loss as we transition away from carbon-based production.

Full details will be coming very soon including the release of our White Paper which details what the Roadmap might look like.

Billy – Time to Learn about Money

I was waiting for a plane the other day and stumbled on this little bit of fun – Billy, It’s Time You Learn About Money.

The comic artist SrGrafo (who is the Argentinian Andre Rojas) created this ‘exploitable template’ (unfinished comic) to see what people might do with it. There were lots of interesting variations.

Well here is my version of the comic.

There is no TV version of our book but you can get it (now the second printing is available) at Macmillan Publishing.

Call for financial assistance to make the MMT University project a reality

The – Foundation for Monetary Studies Inc. – aka The MMT Foundation serves as a legal vehicle to raise funds and provide financial resources for educational projects as resources permit and the need arises.

The Foundation is a non-profit corporation registered in the State of Delaware as a Section 501(c)(3) company. I am the President of the company.

Its legal structure allows people can make donations without their identity being revealed publicly.

The first project it will support is – MMTed (aka MMT University) – which will provide formal courses to students in all nations to advance their understanding of Modern Monetary Theory.

At present this is the priority and we need some solid financial commitments to make this project possible and sustainable.

Some sponsors have already offered their generous assistance.

We need significantly more funds to get the operations off the ground.

In order for FMS to solicit tax-exempt donations while our application to the IRS is being processed, the Modern Money Network, Ltd. (“MMN”) has agreed to serve as a fiscal sponsor, and to receive funds on FMS’s behalf.

MMN is a non-profit corporation registered in the State of Delaware, and is a federal tax-exempt public charity under Section 501(c)(3) of the Internal Revenue Code.

Donations made to MMN on behalf of FMS are not disclosed to the public.

Furthermore, all donations made to MMN on behalf of FMS will be used exclusively for FMS projects.

Please help if you can.

We cannot make the MMTed project viable without funding support.

Music today …

Today, for some reason that is one of those unknown reasons, I was out running early around the harbour and beach and I started to think about the now deceased Canadian blues player – King Biscuit Boy – (Richard Newell).

The name King Biscuit Boy was apparently coined by the famous R&B singer Ronnie Hawkins.

King Biscuit Boy played harmonica and sang with many of the great bands/artists – Muddy Waters, The Meters, Allen Tousaint.

His life was marred (value-judgement) by alcoholism and he became very unreliable as a performer before dying at a relatively young age in 2003.

He was very popular around his hometown of Hamilton, Ontario.

I bought his album King Biscuit Boy (released 1974) in the mid-1970s and have listened to it ever since.

I loved the album – not the least because The Meters were the backing band and Allen Toussaint produced it and sang backing vocals on some tracks.

It was recorded at the famous Sea-Saint Recording Studio in New Orleans.

So it is no surprise that Dr John also played some guitar on the album.

Lead guitar player Danny McBride apparently used a borrowed guitar on the recording.

Here is one of the great songs from that album – Deaf, Dumb, Crippled and Blind.

Great singing, great guitar playing and a really tight rhythm section.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

The data is damning but the Australian population will never know and if by chance some were to hear or read such evidence they would in most cases reject it.

Our neiliberal opponents control the means of information and their political agents know which buttons to push such as offering lower taxes or lying about being responsible economic managers or fear mongering about ethnic groups or offering a two tier society with generous tax concessions to help them get ahead or being tough on crime or lying about despatchable power or promising lots of jobs in the mining industry or from free trade agreements and so on.

And the Australian people in a rigged electoral system vote for more as was demonstrated recently in the federal and NSW state elections that returned hard right neoliberal climate change denying conservative governments, even as the earth’s biosphere is hurtling towards catastrophe in terms of mass extinctions, massive habitat loss, the eventual melting of the Greenland and Antarctic ice sheets and the eventual death of most humans in an awful hothouse earth.

Even neoliberal team B was not neoliberal or bigoted enough for them?

If a political party offers good policy it is subject to a media blackout or is relentlessly demonised if they become known and more than enough of the general populace believes the lies. Most don’t even bother to take an interest in politics and resent the inconvenience of elections.