Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Real resource constraints and fiscal policy design

There is an interesting dilemma currently emerging in Australia, which provides an excellent case study on how governments can use fiscal policy effectively and the problems that are likely to arise in that application. At present, the Australian states are engaging in an infrastructure building boom with several large (mostly public sector) projects underway involving improvements to road, ports, water supply, railways, airports and more. I travel a lot and in each of the major cities you see major areas sectioned off as tunnels are being dug and buildings erected. Not all of the projects are desirable (for example, the West Connex freeway project in Sydney has trampled on peoples’ rights) and several prioritise the motor car over public transport. But many of the projects will deliver much better public transport options in the future. On a national accounts level, these projects have helped GDP growth continue as household consumption has moderated and private investment has been consistently weak to negative. But, and this is the point, there have been sporadic reports recounting how Australia is running out of cement, hard rock and concrete and other building materials, which is pushing up costs. This is the real resource constraint that Modern Monetary Theory (MMT) emphasises as the limits to government spending, rather than any concocted financial constraints. If there are indeed shortages of real resources that are essential to infrastructure development then that places a limit on how fast governments can build these public goods. The other point is that as these shortages are emerging, there is still over 15 per cent of our available labour resources that are being unused in one way or another – 714,600 are unemployed, 1,123.9 thousand are underemployed, and participation rates are down so hidden unemployment has risen. So that indicates there is a need for higher deficits while the infrastructure bottlenecks suggest spending constraints are emerging. That is the challenge. Come in policies like the Job Guarantee.

Infrastructure boom yet idle labour

Australia is currently enjoying a major infrastructure spending boom via several large-scale projects in the States and Territories, but also at the Federal level (for example, the National Broadband Network construction).

There is no doubt that one of the major reasons Australia’s GDP growth has been relatively robust in recent years is due to this large public spending commitment.

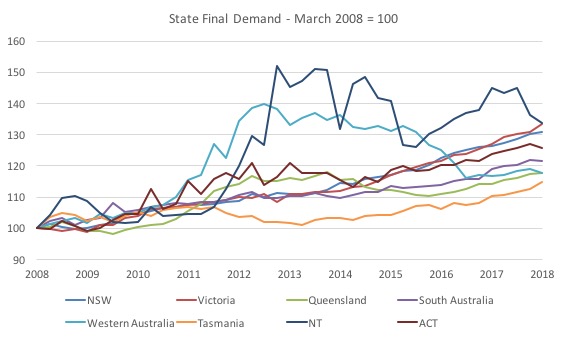

The first graph shows movements in State Final Demand indexes from the March-quarter 2008 to the March-quarter 2018 (most recent data). The March-quarter 2008 was the peak of the last cycle before the GFC slowdown.

The humps in WA and Northern Territory between 2012 and 2015 relate to the Mining boom (mostly private investment) which is now well and truly over.

But you can also see that in the last few years, there has been an acceleration of State Final Demand nearly across the board, which is mostly down to public spending.

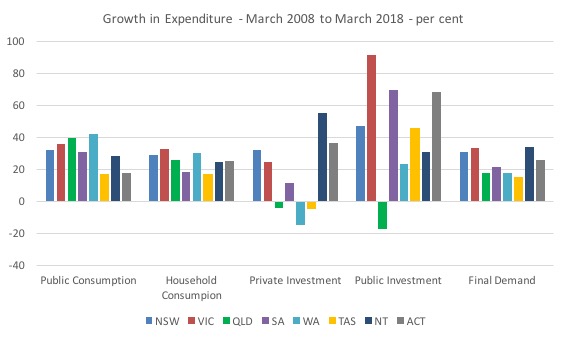

The next graph breaks down the aggregate Final Demand measure into its components and show the overall growth in each expenditure component over the decade from the March-quarter 2008.

You can see the strong growth in public investment over that time (biased to recent years), which has been an important driver of growth in the Australian economy.

Over the same period, household consumption expenditure growth has been moderate and private investment expenditure weak to negative in many states.

But as I have indicated in my labour force briefings – see latest (June 14, 2018) – Australian labour market – weaker in May with tepid employment growth – Australia is still a long way from being ‘fully employed’.

The May 2018 data confirms that:

1. There are 714,600 persons unemployed with an official unemployment rate of 5.4 per cent (1.4 percentage points higher than the pre-GFC low).

2. There are 1,123.9 thousand persons underemployed (working less hours than they desire) which is 8.5 per cent of the labour force.

3. The total labour underutilisation rate (unemployment plus underemployment) is thus 13.9 per cent or 1,838.6 thousand workers.

4. At 65.5 per cent, the labour force participation rate is still below its previous peak (December 2010) of 65.8 per cent. This means that hidden unemployment has risen over that period and if we adjusted the official unemployment rate to include that effect it would be 5.9 per cent rather than 5.4 per cent. Unemployment would be 780.4 thousand rather than 714.6 thousand.

5. Many of those who are unemployed or underemployed are typically low-paid workers, many classified as low-skill.

What this means is that the fiscal deficit is to low relative to the non-government spending and saving behaviour.

There is a need to stimulate labour demand (generate jobs). That is unambiguous. The question is where that increased labour demand should be stimulated.

Resource constraints increasing in Australia’s construction sector

There have been sporadic reports over the last year or so, in response to this infrastructure construction boom, recounting how Australia is running out of cement, hard rock and concrete and other building materials, which is pushing up costs.

Other reports generalise this and suggest that there is a growing shortage of many other productive resources.

For example, on March 19, 2018, there was a report – Growing demand pushing up construction costs – which suggested that:

… the growing demand from the infrastructure sector is creating pressures within the construction industry with personnel, plant and equipment as well as base materials such as cement, steel and aggregates showing a significant increase in cost.

Most of these media flurries were based on the interesting report released in January 2018 by the international construction cost analysis firm, WT Partnership – Construction Market Conditions 2018.

There are large-scale projects, mostly public spread across Australian states at present.

New South Wales and Victoria are leading the charge.

In New South Wales there is “record levels of investment in infrastructure and strong demand for residential, commercial and retail”.

There is on-going “Government investment in projects such as CityLink and Tullamarine freeways, Melbourne Metro Rail, West Gate Tunnel and North East Link in Melbourne” (Victoria), which is transforming the state’s urban transport systems.

In Queensland, the Government is embarking on several major projects (“Cross River Rail, social and affordable housing, and schools”).

Similarly in Western Australia (“significant road, rail, and port projects”), South Australia (“numerous cranes in the city skyline and forecasts growth in various sectors including aged care, student accommodation, defence and education”), Australian Capital Territory (“construction of commercial, retail, housing and aged care”), “Major LNG development and defence projects continue to underpin activity in the Northern Territory” and so on.

This significant level of (mostly public) infrastructure development is:

… pushing up costs of personnel, plant and equipment, and base materials such as aggregates, cement and steel. As resources become more stretched, these pressures create an industry wide challenge.

These trends raise significant issues for the conduct of fiscal policy – its design and implementation.

In this blog post – I wonder what the hell I have been writing all these years (February 12, 2013) – I discussed, in part, the Modern Monetary Theory (MMT) approach to inflation theory.

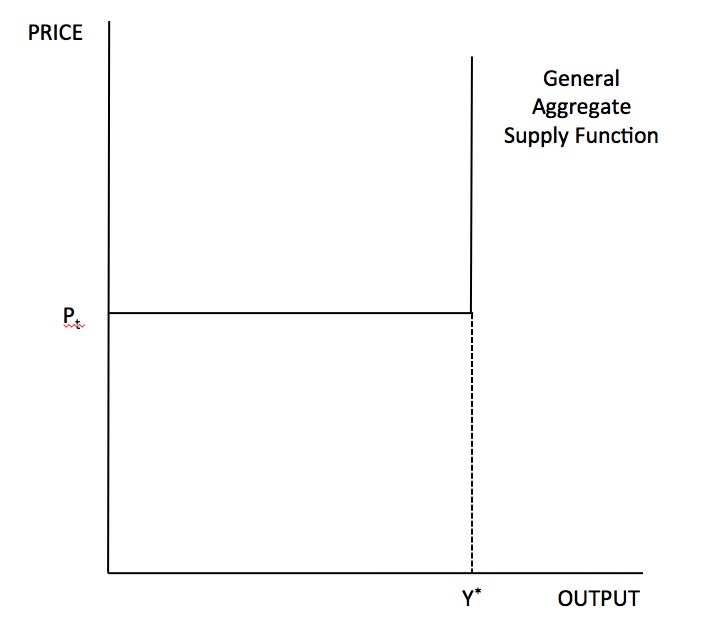

In our introductory textbook – Modern Monetary Theory and Practice: An Introductory Text – we introduced a simple first blush model of the aggregate supply function (which tells us at what prices firms will supply output).

It looks like this:

If we assume that the price mark-up that firms use to price their goods and services and money wage rates and labour productivity (and all other unit resource costs) then it reasonable to assume that firms would supply output at a constant price – quoted in their catalogues and honour those prices for some time.

There is a cost to a firm of changing prices regularly and also a possible loss of customer loyalty.

On the horizontal portion of the supply curve, firms in aggregate will supply as much real output (goods and services) as is demanded at the current price level set according to the mark-up rule described above.

The vertical portion of the curve after full employment (Y*) is explained by the fact that the economy exhausts its capacity to expand short-run output due to shortages of labour and capital equipment.

At that point, firms will be trying to outbid each other for the already fully employed labour resources and in doing so would drive money wages up.

Under normal circumstances, economy rarely approach the output level (Y*, which means that for normally encountered utilisation rates the economy typically faces constant costs.

The description of the model in the textbook acknowledged that:

- If the money wage rate rises, other things equal, the unit cost level rises and the firms would translate this into a price rise via the constant mark-up.

- If there is growth in labour productivity (LP) as a result of say, increased labour force morale, increased skill levels, more technologically-based production techniques, better management, and the like, then unit costs (W/LP) will fall. This means that the firms can generate the same profit margin at lower prices. The AS function would thus shift downwards by the extent of the decline in unit costs.

- Variations in the mark-up (m) will cause the price level to change. Increases in industrial concentration, more advertising etc may lead to firms being able to increase the overall profit margin that can be sustained. Tight conditions in the goods and services market, where sales are constrained, may lead firms to reduce the mark-up desired as they all struggle for market share. This could occur as a result of flagging sales and strong trade unions pushing (successfully) for wage increases. Thus to avoid losing market share, the firms may choose to absorb some of the cost rises into the margin.

- If employment is below full employment and thus Yactual < Y*, which means there is an output gap present, then increases in aggregate demand (spending) which are seen by firms to be permanent will result in an expansion of output without any price increases occurring. If the firms are unsure of the durability of the demand expansion they may resist hiring new workers and utilise increased overtime instead. That is, they initially respond to the increased aggregate spending by increasing hours of work rather than persons employed. The higher costs (as labour productivity falls) are likely to be absorbed in the profit margin because firms desire to maintain their market share overall.

There are thus a lot of behavioural factors to be considered and analysed in each specific situation. MMT incorporates these complications in its approach to inflation.

It acknowledges that bargaining is central to the wage-price bargains but also allows for industrial concentration, regulation etc to influence outcomes. We have incorporated a lot of institutional literature into our approach.

After considering all that, the text explicitly states, that:

There is some debate about when the rising costs might be encountered given that all firms are unlikely to hit full capacity simultaneously. The reverse-L shape simplifies the analysis somewhat by assuming that the capacity constraint is reached by all firms at the same time. In reality, bottlenecks in production are likely to occur in some sectors before others and so cost pressures will begin to mount before the overall full capacity output is reached.

This could be captured in Figure 9.5 by some curvature near Y*, thus eliminating the right-angle. We consider this issue in more detail in Chapter 11 Inflation and Unemployment.

The point is that the reverse-L is only a first simple step into a macroeconomics that is not based on perfectly competitive pricing and the supply curves that arise logically from those assumptions.

We recognise that firms set prices on mark-ups and do not vary prices with variations in demand in the short-run. In this real world context, the reverse-L depiction is a de-conditioning heuristic to steer students away from the continuously upward sloping supply models they get in neo-classical (mainstream) text books.

But MMT clearly acknowledges that in the real world, bottlenecks in certain sectors can arise before full employment is reached, which then conditions the way that fiscal expansion has to be designed and managed.

That is the case that the infrastructure boom in Australia has presented us.

Generalised very spatially-targetted expansion

There is a tendency to think of MMT has a return to Keynesian economics.

For a discussion on the meaning of the term ‘Keynesian’ please read the blog post – Those bad Keynesians are to blame (November 5, 2009).

To complicate matters further the term Post Keynesian is used – largely to distinguish modern progressive (non-Marxist – although that is even contentious) thinking from the earlier classifications of Keynesians.

Some Post Keynesians are fundamentalist Keynesians (see cited blog post for more detail) while others are not.

But almost all Post Keynesians agree that the orthodox unemployment buffer stock approach (NAIRU) to inflation control is costly and unacceptable.

The neo-liberal solution to the resulting unemployment is to pursue supply-side policies (labour market deregulation, welfare state retrenchment, privatisation, and public-private partnerships) to give the economy “room” to expand without cost pressures emerging.

Post Keynesians, in general reject this strategy because the sacrifice ratios (lost output per inflation point lowered) are high and the distributional implications (creation of under class and working poor and loss of essential services) are unsavoury.

However there is no alternative consensus.

Some Post Keynesians, following closely the policy recommendations of Keynes himself advocate what I have termed “generalised expansion” in my academic writing – this is where the government ensures that spending is sufficient to purchase all available output.

In essence, this policy purchases at market prices or provides incentives to profit-seekers to create private employment expansion.

Typically, public and private capital formation is targeted.

This is the situation in Australia with all these large public sector infrastructure projects underway. They are injecting billions of public spending into the economy and purchasing goods and services from the non-government sector at market prices.

As the specific real resource constraints start to emerge, competition for those finite real resources starts to drive their price up.

The government becomes just another bidder for the resources.

This strategy also ignores the role for a buffer employment stock policy, which allows the government to guarantee full employment using automatic stabilisers by purchasing at fixed rather than market prices.

Typically, Post Keynesians advocate generalised fiscal and monetary expansion mediated by incomes policy and controlled investment as a solution to unemployment.

But when the real resource constraints are manifesting in the form of a lack of cement, sand, rocks etc – the essential building materials for large public infrastructure projects – an incomes policy that controls wage demands in the face of labour shortages will not provide a price anchor.

Further (indiscriminate) expansion (competing at market prices) in isolation is unlikely to lead to employment opportunities for the most disadvantaged members of society and does not incorporate an explicit counter-inflation mechanism.

It also fails to address the spatial labour market disparities.

The large-scale public infrastructure projects are mostly in the large urban centres (capital cities) and the central business districts of the same.

As regional spaces are hollowed out, how can we be sure that the investment will provide jobs in failing regions?

Upon what basis are the most disadvantaged workers with skills that are unlikely to match those required by new technologies or the large building projects going to be included in the ‘generalised expansion’?

Where is the inflation anchor in this approach – if spending is manifest in purchases at market prices?

An understanding of MMT, allows you to conclude that the State can resolve demand gaps which cause unemployment in two ways:

1. By increasing net spending via purchasing goods and services and/or labour at market prices as explained in the previous paragraphs; and/or

2. By using its currency issuance power to provide a fixed-wage job to all those who are unable to find a job elsewhere.

The employment buffer stock approach is what I termed the Job Guarantee, which is an effective strategy for a fiat-currency issuing government to pursue to ensure that work is available at a liveable wage to all who wish to work but who cannot find market sector employment (including regular public sector).

The government would provide a buffer stock of jobs that are available upon demand.

Crucially, the Job Guarantee differs from a ‘Keynesian generalised expansion’ because it represents the minimum stimulus (the cost of hiring unemployed workers) required to achieve full employment rather than relying on market spending and expenditure multipliers to generate aggregate demand.

The Job Guarantee also provides an inherent inflation anchor missing in the generalised Keynesian approach.

Clearly, and emphatically, a mixture of both options is likely to be optimal although the first option alone is not preferred because it is likely to run up against real resource constraints well before full employment is reached.

The current situation in Australia with the infrastructure boom and cranes everywhere being coincident with more than 15 per cent of our available labour reources unused is the demonstration of that point.

The Job Guarantee approach is juxtaposed with the NAIRU approach which accompanied a regime shift in macroeconomic policy in the 1970s. The NAIRU approach is exemplified by tight monetary policy that targets low inflation, a bias to fiscal austerity and the resulting use of unemployment as a policy tool rather than a target.

The countries that avoided high unemployment in the 1970s maintained an employer of last resort capacity which allowed them to absorbs the fluctuations in demand without significant unemployment consequences.

There is some reason why countries like Japan which has been through hell over the last 20 years or so still has relatively low unemployment.

Further, environmental constraints militate against generalised Keynesian expansion. Higher output levels are required to increase employment, but the composition of output remains a pivotal policy issue.

Job Guarantee jobs would be designed to support local community development and advance environmental sustainability.

Job Guarantee workers could participate in many community-based, socially beneficial activities that have intergenerational payoffs, including urban renewal projects, community and personal care, and environmental schemes such as reforestation, sand dune stabilisation, and river valley and erosion control.

Most of this labour intensive work requires very little capital equipment and training.

While there may be a need for more generalised expansion – to boost public infrastructure investment which enhances the profitability of private sector investment and contributes to aggregate demand and employment – this approach is clearly limited by real resource availability.

Whether there is a capacity to pursue the more general approach is moot. Clearly, the Australian State Governments are reaching the limits of that approach within a price stability framework.

For MMT though, such limits are independent of the need for a Job Guarantee.

Conclusion

While the upgrades to our public transport systems and the re-engineering of our cities is highly desirable and decades overdue, as a policy preference I would prioritise the introduction of a Job Guarantee and ensure it was ccompanied by social wage spending to increase employment in education, health care and the like.

That would absorb idle labour without placing further strains on the construction resources.

A sole reliance on public sector investment in public infrastructure to achieve full employment, also creates considerable economic inflexibility. The ebb and flow of the private sector would not be readily accommodated and an increasing likelihood of inflation would result.

Further and crucially, public investment is unlikely to benefit the most disadvantaged workers in the economy. The Job Guarantee is designed to explicitly provide opportunities for them.

By way of example, during the golden age in Australia (1945-1975) when public capital formation and social wage expenditure was strong, full employment was only achieved because the public sector (implicitly) provided a Job Guarantee for low skilled workers.

This experience is shared across all advanced economies.

The Job Guarantee is thus designed to ensure that the lowest skilled and experienced workers are able to find employment. It does not presume that Job Guarantee jobs will suit all skills. For some skilled workers who become unemployed in a downturn the income loss implied would be significant.

The contention is that a fully employed economy with the Job Guarantee workers paid liveable minimum wages is a significant improvement, when compared to the current unemployment and underemployment bias.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

I’ve never lived in Australia, so I can never really have the same understanding of what life is / has been like there. But if I can try to compare with the UK in, say, the 1970s, when (for all its faults), the Labour government(s), were not so finance-constrained as nowadays – I mean, they didn’t – at least – make a virtue of austerity. And even the Tory government of the early seventies (Ted Heath as PM, and Anthony Barber as his Chancellor) had its “dash for growth”, which may have been ill-conceived in some respects, at least wasn’t mean-minded and penny-pinching like the Thatcher government.

One thing I do remember, with not 100% pleasure, from the 1970s, was the spending on large hospitals. On the face of it, this “had to be a good thing, didn’t it?” – well, yes, up to a point. But it often meant the closing of, or severe cutting back of funding for, small local hospitals, which actually served some patients better than massive hospitals many miles away.

The other thing I remember about the 1970s in the UK was the massive spending on roads & motorways, with the utter neglect of the railway network. People were not so environmentally aware in those days, and “everyone” wanted a car, and we also eventually became a nation of multiple-cars-per-family.

I thought of this when the article above talked about people’s rights being trampled over.

That’s one thing I’ve never been happy about with the UK Labour Party. Whichever wing (left or right or centre) is in power, they tend to have a centralising “we know best” approach.

Conceivably, Corbyn’s version of Labour might be different, but he has yet to convince us, and now I’m talking about those of us who are basically sympathetic to what he is trying to achieve.

“The Job Guarantee is thus designed to ensure that the lowest skilled and experienced workers are able to find employment. It does not presume that Job Guarantee jobs will suit all skills. For some skilled workers who become unemployed in a downturn the income loss implied would be significant.

The contention is that a fully employed economy with the Job Guarantee workers paid liveable minimum wages is a significant improvement, when compared to the current unemployment and underemployment bias.”

It always makes me wonder when ‘significant improvement’ stopped being a good reason to do something. So many critics of the Jobs Guarantee point out things like ‘Hey- it won’t solve the world’s environmental problems’ like that is some problem with the idea. It isn’t supposed to cure cancer either. Doesn’t mean it won’t do what it is designed to do.

If an economy is reaching the point where real resources are constrained, the constraint on the supply of real goods and services is being approached.

If there is residual unemployment and this unemployment is to be managed with a JG scheme this will require the creation of fiat money.

The creation of fiat money effectively puts income into the pockets of the JG scheme participants.

However, no increase in the production of real goods and services to satisfy the higher consumption demand generated will be forthcoming.

Will this not increase inflationary pressure?

I recently wrote a 3 part piece on Modern Monetary Theory from a New Zealand perspective including this part on a Job Guarantee and how it might look. It is such a simple way of addressing unemployment & absolute poverty. It also provides the many social & self esteem benefits that a UBI misses. Not to say in a couple of decades that perhaps a reduced hour Job Guarantee & UBI couldn’t work in tandem if automation/robotics/AI really took off. But at moment There is so much human work that could be done, a JG is much better option

https://unframednz.wordpress.com/2018/06/13/modern-monetary-theory-part-two-government-job-guarantee/

Australia has enough concrete and steel making and other building and construction raw materials in the ground to probably cover much of the country’s surface in buildings.

If demand is outstripping supply then it’s because we don’t have enough capacity to transform the mountains of raw natural materials eg iron ore, limestone etc into basic building materials fast enough.

Bill says that construction projects are unlikely to have many vacancies for JG type labour, but then says that “education and health care” are more likely to have vacancies. So schools, hospitals and doctors surgeries (or those type of activities) can find loads of vacancies for relatively unskilled JG type labour? I doubt it.

The fact is that it is the private sector, and private sector type activities, that are better at employing relatively unskilled labour. That’s why I have advocated for the last twenty years letting private employers take on JG type labour (as is done in the nearest thing the UK has to JG at the moment, i.e. the so called “Work Programme”).

Moreover, the empirical evidence from studies in Switzerland is that temporary subsidised work of the JG type in the private sector results in a better subsequent work record for employees concerned than JG work in the public sector and charities. Perhaps that’s not surprising: the private sector arguably has to meet harsh commercial realities, whereas the public sector and charities do not face the latter problems.

@Ralph Musgrave….

Would private sector employers utilising JG workers face harsh commercial realities with regards to employing workers whose wages are paid by someone else (government) rather than needing to come out of business turnover?

Might it not be tempting for private business to reduce the hours/headcount of their non-subsidised employees when they are essentially being given free or at least subsidised workers, therefore undermining the whole purpose?

My understanding of the JG was that it is meant to absorb those who needed work but whom the private sector has no current use for. Keep it public.

Dear Henry Rech (at 2018/06/21 at 11:54 am)

The blog post was about specific sectors reaching bottlenecks rather than there being full capacity utilisation generally.

If it gets to the point that the productive capacity of the economy is full exhausted and the government wants to provide more work, then taxes have to rise.

best wishes

bill

Dear Ralph Musgrave (at 2018/06/21 at 2:51 pm)

Once again you choose to misconstrue by conflating my two preferences – for a Job Guarantee and more government employment in education and health care.

While there are many unskilled jobs in the latter sectors, which would be ideally suited to Job Guarantee workers, I was indicating that:

1. I would prefer a Job Guarantee to absorb low-skill workers who cannot find a bid for their services elsewhere.

2. I would also like more government spending to be allocated to education and health which might increase regular employment in those sectors but which would place very little strain on the sort of resources that are currently in short supply in construction as a result of the infrastructure boom.

You either chose to or could not see the difference in the two conjoint preferences.

Finally, the Job Guarantee should NEVER be used to provide private sector employment for obvious reasons. If the latter has scope to increase employment then they should. But wage subsidies to the private sector never work and only increase profits at the expense of workers.

best wishes

bill

Bill,

“If it gets to the point that the productive capacity of the economy is full exhausted and the government wants to provide more work, then taxes have to rise.”

So the private sector is taxed more with the aim of slowing it down.

This means the output of private sector goods is reduced.

The unemployed are soaked up with a JG scheme funded by new fiat money, putting money income in the pockets of the JG schemers.

Same question. Doesn’t this lead to more money income chasing fewer real goods, hence more inflationary pressure?

Am I missing something?

Ralph says- “The fact is that it is the private sector, and private sector type activities, that are better at employing relatively unskilled labour.”

Is that a fact? I don’t think that is any kind of fact. Does ‘better at employing’ consider that the private sector will only hire when they think they can make a profit? Why would it be better to ensure private businesses make a profit on labor than employ directly? You might make a case that the government is always a worse manager of labor, but at least you should try to present that case. Otherwise it is a pure belief statement.

In the US, there are many who believe that privately owned companies will always be more efficient than government employees even to the point where many states have ‘privatized’ functions they are bound by their own laws to carry out. This has not gone very well that I can see. A lot of times the functions do not get performed at the standards required by law and when they do, they often cost as much or more than what it cost when the state employed people directly to do the job. I don’t see that changing much if the state took on the responsibility of employing the unemployed.

Bill,

I agree that where what constrains a general increase in demand is a shortage of materials for construction projects, it will be feasible to increase employment in the health and education sectors. But that’s an unusual situation. The more usual situation when an economy is at or near capacity is that there is a shortage of skilled labor affecting most or all sectors. In that situation, the scope for JG jobs in the health and education sectors is not good.

Re your claim that JG should not extend to the private sector because that increases profits, I suggest that employing temporary, subsidised and relatively unskilled labour is not vastly profitable for employers. In fact there was a JG type scheme in the UK about 20 years ago where the relevant publicity appealed to employers’ sense of civic responsibility (to employ the relatively unskilled) rather than their profit motive.

Second, in as far as private sector JG does boost profits, competition ought to return employers’ profits back to the normal level after a time – I’m using the word “normal” in the technical sense, i.e. as per economics text books. (But for those who don’t know, that sense is quite similar to the every-day meaning of the word.)

Third, objecting to private sector JG is a purely political point. Everyone is entitled to their political views of course, but we’re talking economics, aren’t we? Take two schools which are identical in all respects except that one is publically owned and the other private. The strictly economic effect of a JG job in each of them ought to be exactly the same.

‘”generalised expansion” in my academic writing’ — references? I know some of your technical work, but I am not sure about this.

Expository point:

‘Crucially, the Job Guarantee differs from a ‘Keynesian generalised expansion’ because it represents the minimum stimulus (the cost of hiring unemployed workers) required to achieve full employment rather than relying on market spending and expenditure multipliers to generate aggregate demand.

The Job Guarantee also provides an inherent inflation anchor missing in the generalised Keynesian approach.’

The functionality of the minimum stimulus seems clear. But how does the inherent inflation anchor work? Is more exposition appropriate here?

Addendum:

Apologies. This got left out.

It is clear from the related discussion that competition re market prices is not counter-inflationary. Rather, it tends to be inflationary. Can we expect one to infer that fixed JG pricing constitutes a counter-inflationary mechanism? If so, re the above Q, how would it work? It may be that I am seeing reader difficulties where none exist.

Ralph always fails to recognise the bottom up approach of the JG.

Ralph can’t leave his private sector good, public sector bad bias at the door and always shoehorns himself into an ideological cul de sac.

Joan Robinson famous quotes always turns Ralph’s cul de sac into his own private jail.

” It is a popular error that bureaucracy is less flexible than private enterprise. It may be so in detail, but when large scale adaptations have to be made, central control is far more flexible. It may take two months to get an answer to a letter from a government department, but it takes twenty years for an industry under private enterprise to readjust itself to a fall in demand.”

And

” I do not regard the Keynesian revolution as a great intellectual triumph. On the contrary, it was a tragedy because it came so late. Hitler had already found out how to cure unemployment before Keynes had finished explaining why it occured.”

As Ralph knows fine well money is no object but resource constraints are. So you don’t get on a bike to find work or have to move away from friends or family. You set up JG centres locally and ask the local communities what they need and what they would like. Analyse what resources you have nationally and then ask the locally unemployed to provide them for their communities.

Ideologically thinking, that making cheap plastic goods then funding those goods with £ billions of worth of marketing techniques trying to convince consumers that they are must have products. Is somehow more productive than the government providing jobs locally to help communites leaves Ralph in a jail of his won making.

In Those Bad Keynesians, Bill mentions Edmund Phelps. In January of this year, Phelps penned a critique of Trump’s economic policymaking in Project Syndicate. Spiegel termed Phelps’ critique a critique of Fascist economics, entitled “Economic Policy as Fascism”. The quote they use in the sub-header comes apparently from Spiegel and is not in the Project Syndicate article that is critical of Trump. Phelps, however, does compare Trump to Mussolini of the 1920s at the very beginning.

As Bill noted at the time, Phelps could not be said to be an MMTer. In PS, Phelps contends implicitly, as part of a solution to current economic ills, that account needs to be taken of factors that influence the ‘natural’ unemployment rate (his quote marks, but I agree, there is nothing natural about it). While noting that the US has been in the economic doldrums for the past four decades or so and notes that both politicians and economic models have been less than helpful, he restricts himself to critiquing Trump’s corporate tax breaks which he notes have not done what Trump claimed for them. I do not wish to give the impression that there is nothing worthwhile in the article, but I do not think this is the place for me to provide a summary of it either. Just to note that the article has some relevance to Bill’s current topic, as I hope I have indicated.

Ralph,

” I suggest that employing temporary, subsidised and relatively unskilled labour is not vastly profitable for employers. ”

It clearly is, that’s what they been propagandizing, buying, and paying for the last 40 years. The euroland reforms have mostly been about it. Southern countries’ neverending troika programs have all been entirely about it, and every single attempt to do otherwise is firmly stamped down by the german boot.

Derek,

Re what you call my “private sector good public sector bad bias”, I actually supported my points by reference to two FACTS. First, that the private sector employs more relatively unskilled people than the public sector, and second that the empirical evidence is that private sector JG type work results in a better subsequent employment record for those concerned. It’s a bit odd to accuse someone of “bias” when their evidence is based on real world evidence. Plus are you interested in imparting skills to JG employees that are relevant for real world jobs? If so, the evidence is that the private sector is better than the public and charity sector.

Second, your Joan Robinson quote and your claim that the public sector is just as good overall as, if not better than the private sector is irrelevant. You may well be right there. I’m simply dealing with the world as it is. E.g. if the reality is that the private sector is better at employing the relatively unskilled, that is an indisputable FACT which JG needs to recognise. Obviously if you manage to change your country into some sort of socialist utopia where every employer is government run and owned, then that’s a different scenario.

Re the “cheap plastic products” that consumers allegedly don’t really want, looking around me right now I can see numerous plastic products: a PC and associated equipment (e.g. a keyboard), pens, a printer, a TV, a clock, plastic boxes to keep things in, a sellotape dispenser, a plastic container for yogurt, etc etc. I bet you’ve got much the same. If you’ve been fooled into getting those things when you don’t really need them, then more fool you. Personally I find them very useful.

Paulo,

It’s news to me that millions of temporary subsidised jobs have been created in south European countries. Had they been created, those countries would be in a better state than they actually are.

The way the EZ deals with lack of competitiveness in relevant countries is simply to impose an inadequate level of demand in those countries, which results in widespread unemployment, and which is aimed at reducing those counties’ costs in terms of Euros. As we all know that has not been brilliantly successful.

Ralph. “I agree that where what constrains…” It’s confusing. It feels like being handed something that, if accepted, leads the reader onto thin ice. Taking out of context. Granting that in this unusual, unrealistic situation you are right, but hey let’s get back to reality, where you are at. Right? Hey, he was talking about bottlenecks. Right? An unfair comparison cause you changed the ground where everyone was standing. Guess what? When the Whole Economy is maxed out, all sectors, shortage of skilled labor – like you said, well you don’t need JG. Just like WWII, the economy will take anyone they can find.

Ralph. I think JG is OK. You see people are flawed. Greed and selfishness rides high. The “masters of the earth.” The people who lust for wealth and power, most of the time they’r the ones who end up with wealth and power. Along with that goes the subordination and subjugation of others, to their purposes and goals. It’s an aggressive posture based on taking as much as you can from everyone. Exhaust the resources of everyone. Have them accrue to you. It’s why they hate the idea of fiat money. Nothing is quite so frustrating for the wealthy and powerful as trying to acquire all the wealth in the world, and then hear that the government is just printing up more. Makes a christian hate the poor doesn’t it? There is no end-game if someone just turns around and redistributes. Right?

Again, I think that subsidising private business to employ low-skilled workers in place of a publicly-run JG would merely lead to business substituting the free labour for hours worked for which they must pay.

Why would you pay for something if someone is prepared to give it to you for free and allow you to put the money you would otherwise have spent as a cost in your own pocket and additionally, allow you to be more competitive against those who do not?

Subsidising employment seems to me to run counter to the aim of a JG which is to employ those who need work but whom the labour market does not currently want.

Dear Henry Rech (at 2018/06/21 at 6:17 pm)

I accept that your reference to “JG schemers” was referring to participants in a scheme rather than ‘scheming’ participants.

I thus reinstated the comment you offered.

You are assuming that the introduction of a Job Guarantee adds to overall aggregate demand at a time when all available capacity is producing output.

1. Job Guarantee workers are typically already in the ‘public sector’ by virtue of receipt of income support. So we are talking relatively small incremental increases in spending capacity.

2. Some of that incremental increase will go into saving and some into import spending.

3. If there is a further strain on resources overall, the government can increase taxes to stifle aggregate spending.

Please read the blog posts under the Job Guarantee category – I have addressed these type of questions for more than 25 years now in my work.

best wishes

bill

Ralph,

All you need to do is follow your ideology to its own conclusion, but you don’t you stop half way through and have done for years now.

You’ve been putting these arguements built on sand for over a decade now. It’s not proven at all in the JG context it is pure ideological on your part without foundation.

We wouldn’t even be discussing the JG at all. If the private sector was as you claim, so good at producing jobs. The private sector is also excellent at destroying jobs as they develop it is built into their ethos. That’s the real world I’ve witnessed all around me growing up. I don’t need your ideology to try and convince me anything different. Welome to my world and millions of others not some Narnia far off land that you seem to live in.

It is also impossible for the private sector to develop the unskilled if there are no jobs in the local community. That is a simple fact wether they are good at it or not.

It’s like saying most business owners vote conservative because they want to pay less tax. Vote for reduced budget deficits and all of the other fiscal conservative nonsense. Then pay no tax at all because they have no profits and then wonder why they went bankrupt. As the private sector drown in debt.

The JG is there to support the private sector Ralph and make it compete not to replace it.Improve life chances when human beings don’t have to worry about getting paid off, losing your house, your marriage and spiralling into a world of drink, drugs and depression and finally jail.

Competition, now there’s a right wing word you would embrace Ralph which is so much better than low wage, unsecure slavery . That would finally help out Humans in the age old battle of Capital v’s Labour. The human element that is not built on sand but embedded in every fabric that runs right through the foundation of the JG.

You may find plastic goods useful Ralph. However, a quick scan of the headlines puts a human element to it.

Hundreds of Irish jobs to go at computer giant Intel.

Yogurt firm Rachel’s Organic to axe staff after Tesco blow.

Over 100 job loses at Parker Pen Plant in Sussex.

Lego to axe 1,400 jobs in UK

ICL plastic manufacturer set to cut 140 Boulby Mine jobs on Teeside

Need I go on ?

How many of these humans would be facing huge problems because they have lost their jobs

Ralph?

Answer – None if a JG was in place.

Bill,

“I accept that your reference to “JG schemers” was referring to participants in a scheme rather than ‘scheming’ participants.”

Thank you.

When I wrote it, it did not occur to me at all there was an ambiguity in meaning.

Leftwinghillybillyprospector,

Re your claim that private sector employers would use JG people to displace regular employees, that is a very obvious potential problem which advocates of private JG have actually tumbled to. Moreover, public sector employers are under very much the same cost cutting and output increasing pressures as private employers, and are thus similarly tempted. That was actually a problem with the Comprehensive Education and Training Act introduced in the US in 1973. CETA was not “pure JG”, but it involved subsidised jobs in the public sector aimed at the less employable. Numerous public sector employers simply used CETA to cut costs.

As to how to cut down on “substitution” (in both private and public sectors), I suggest strictly limiting the time JG people stay with a given employer: that does not greatly change the nature of JG, since JG jobs are supposed to be temporary anyway. Employers do not give temporary staff jobs which are crucial to an organisation: they give them relatively unproductive peripheral jobs.

Derek Henry,

You cite several examples of private employers sacking people. Presumably you’re aware that public sector employers are also forced to contract and make people redundant.

Re your claim that there’d be no job losses if JG was in place, I’m not arguing against JG: I’m just arguing over exactly how it should be organised and on how big a scale it should be.

I also reject the idea that having a job is the be all and end all. For example if someone becomes unemployed and wants to spend a large portion of the week job searching rather than doing a JG job, then why not? Also one of the lessons of the WPA in the 1930s is that while some JG type jobs are reasonably productive, others are farcical. As it happens there was a JG type scheme 100 meters from where I live six months ago, which was a shambles.

If someone wants to live on basic income guarantee or do job searching rather than do what seems to them to be a pointless JG job, I have no objections.

Perhaps we should start to talk about the Non-Accelerating Inflation Rate of Profit (NAIRP) as a way of illustrating how disputes for incomes and business margins are in fact the cause of inflation.

Dear Ralph Musgrave (at 2017/06/22 at 2:53 pm)

You once again disclose your ignorance of what the Job Guarantee (in Modern Monetary Theory) is.

You say:

That is not the case. The Job Guarantee is a buffer stock capacity. For some people, the jobs might be temporary. For others, they could well be permanent. The buffer stock is unlikely to be zero given that the private sector and the regular public sector has rarely provided sufficient work to satisfy the preferences of all workers for hours of work.

best wishes

bill

Ralph:- “I’m simply dealing with the world as it is. E.g. if the reality is that the private sector is better at employing the relatively unskilled, that is an indisputable FACT which JG needs to recognise”.

First 1) the claim to be “dealing with the world as it is” is (unconditionally) made. Then 2) a supposition “if the reality….relatively unskilled” is advanced, and then 3) that supposition is transformed at a stroke into “an indisputable fact” which is held to support the supposition (ie itself). It’s like Baron Munchausen lifting himself and his horse out of a swamp by his own hair.

It’s a mystery how anyone (Ralph included) could imagine such a transparently circular argument to be convincing. But then Ralph of course starts from a predetermined conclusion. I sometimes wonder who he thinks he’s fooling – apart from himself.

Dear Ralph, re 14:53 22nd June

Do you mean that if ten JG workers have been sent by their local command structure to work for ebay for the last 30 days (or 60 day or 90 days for example) to load trucks that on the 31st day ebay is going to have offer 10 JG workers contracts (full or part time) as ebay employees to be allowed to have the JG command structure send them 10 more temp. workers for the next 30, 60 or 90 days?

If that were a fact there would be no unemployment among unskilled workers because the private sector would be employing all of them already.

So it is obviously not a fact.

Henry Rech,

Remember that when people produce work in their JG position there are adding to GDP in terms of goods and services and so income matches to production and is therefore not inflationary.

Unemployment benefit recipients not working, not producing goods and services to match income is potentially inflationary.

That is the key point you are missing.

There is an accounting identity that sums the relationship that you might wish to make a note of.

Gross domestic product = gross domestic income.

GDP = GDI.

By prioritising infrastructure investment you are increasing the productive capacity of the country ….which expands the real resource limitations of the country.

This type of investment is necessary.

JG may be less inflationary then capital projects purchases at market prices but they both rely on a multiplier effect to boost national income during a recession.

Ralph

“It’s news to me that millions of temporary subsidised jobs have been created in south European countries. Had they been created, those countries would be in a better state than they actually are.”

I didn’t claim that, I said such schemes were implemented within the flexisecurity theoretical nonsense, with the obvious consequence that they replaced regular “temporary” jobs. At firms that don’t need the money to invest at all, since they have little competition at best and avoid taxes anyway. Which is what everyone is pointing out.

Alan Longbon

“Remember that when people produce work in their JG position there are adding to GDP in terms of goods and services and so income matches to production and is therefore not inflationary. ”

The goods and services produced by JG participants are unlikely to be consumer goods of the kind that are in question. Cleaning up a creek or digging up a road generally aren’t the sort of goods counted as consumer goods.

But I do take Bill’s points and am thinking about them.

Before I relate my concerns about the approach highlighted let me make clear

my belief in full voluntary employment.The right to work has been a central demand

of left progressives historically long before MMT literature emerged from FDR to Leon Trotsky.

I have no problem with a job guarentee.It is the assertions made on its behalf which

I know are central to MMT policy proscriptions.

I say assertions because being a natural sceptic for me this is where MMT swaps its lens

to view the world for a crystal ball to see the future (complete with harmonious positive

feedback loops ,inflation control and the like).Also assertions that the post war settlement had

widespread implicit job guarentees for which no evidence seems forthcoming.

There are more lessons than the desireablity of job guarentees to Australia’s bottleneck

in infra structure projects or the UK’s chronic lack of trained health and education workers.

Or the chronic lack of reasonable standard housing or the failure to switch to sustainable

energy sources.

Real resource constraint is the primary problem.Progressive government’s role to

direct sustainable real resources for public needs is the primary policy problem.

I quite except Jerry’s point that the job guarentee is a good on its own terms

and does not need to be a magic bullet but it does seem to be presented that way.

Kevin,

If I am not mistaken taxation policies are the answer that mmt proposes to ensure that real resources, especially non renewable and polluting ones are used sparingly by the private sector so that these types of resources are available for critical public infrastructure programs.

I myself have had concerns about poorer countries not getting their share of real resources if the Governments of the advanced industrial nations are meeting the desires of their populations to save and to import. I think that the mmt answer to that is not to unconditionally support free trade.

The full spectrum of mmt proposals might be the magic 7.77mm cartridge. MMT seems to me to be the best short to medium term plan on the market.

It is worth noting that both the JG and the NAIRU systems are buffer stock systems to put downward pressure on private sector wages.

A lot of the talk here seems to pretend that JG is high bidding rather than low bidding for labour.

For JG the lower bound is non zero.

For JG the stock remains relatively job ready and healthy.

JG relies for financing on parliamentary support.

Regarding the use of JG labour to directly generate private profits, this is clearly a violation of the worker’s right to the fruit of their labour.