Well my holiday is over. Not that I had one! This morning we submitted the…

Another Milton Friedman legacy bites the dust

Milton Friedman and his gang at Chicago, including the ‘boys’ that went back and put their ‘free market’ wrecking ball through Chile under the butcher Pinochet, have really left a mess of confusion and lies behind in the hallowed halls of the academy, which in the 1970s seeped out, like slime, into the central banks and the treasury departments of the world. The overall intent of the literature they developed was to force governments to abandon so-called fiscal activism (the discretionary use of government spending and taxation policy to fine-tune total spending so as to achieve full employment), and, instead, empower central banks to disregard mass unemployment and fight inflation first. Several strands of their work – the Monetarist claim that aggregate policy should be reduced to a focus on the central bank controlling the money supply to control inflation (the market would deliver the rest (high employment and economic growth, etc); the promotion of a ‘natural rate of unemployment’ such that governments who tried to reduce the unemployment rate would only accelerate inflation; and the so-called Permanent Income Hypothesis (households ignored short-term movements in income when determining consumption spending), and others – were woven together to form a anti-government phalanx. Later, absurd notions such as rational expectations and real business cycles were added to the litany of Monetarist myths, which indoctrinated graduate students (who became policy makers) even further in the cause. Over time, his damaging legacy has been eroded by researchers and empirical facts but like all tight Groupthink communities the inner sanctum remain faithful and so the research findings haven’t permeated into major shifts in the academy. It will come – but these paradigm shifts take time.

The latest research effort to wipe Friedman’s theoretical legacy off the map was presented to the ASSA Annual Meetings (in Chicago, this year) at a session on January 8, 2017 by two young Harvard economists.

The paper – How Does Unemployment Affect Consumer Spending? – demonstrates that households when forming their consumption decisions do not accord with the view promoted by Friedman, which became part of his barrage against active fiscal policy.

Taking a step back in history for a moment, John Maynard Keynes outlined in his 1936 The General Theory of Employment, Interest and Money a view that household consumption was dependent on disposable income, and, that in times of economic downturn, the government could stimulate employment and income growth using fiscal policy, which would boost consumption.

In Chapter 3 The Principle of Effective Demand, Keynes wrote:

When employment increases, aggregate real income is increased. The psychology of the community is such that when aggregate real income is increased aggregate consumption is increased, but not by so much as income …

The relationship between the community’s income and what it can be expected to spend on consumption, designated by D1, will depend on the psychological characteristic of the community, which we shall call its propensity to consume. That is to say, consumption will depend on the level of aggregate income and, therefore, on the level of employment N, except when there is some change in the propensity to consume.

Keynes later (in Chapter 6 The Definition of Income, Saving and Investment) considered factors that might influence the decision to consume and talked about “how much windfall gain or loss he is making on capital account”.

He elaborated further in Chapter 8 The Propensity to Consume … and wrote:

The amount that the community spends on consumption obviously depends (i) partly on the amount of its income, (ii) partly on the other objective attendant circumstances, and (iii) partly on the subjective needs and the psychological propensities and habits of the individuals composing it and the principles on which the income is divided between them (which may suffer modification as output is increased).

And concluded that:

1. An increase in the real wage (and hence real income at each employment level) will “change in the same proportion”.

2. A rise in the difference between income and net income will influence consumption spending.

3. “Windfall changes in capital-values not allowed for in calculating net income. These are of much more importance in modifying the propensity to consume, since they will bear no stable or regular relationship to the amount of income.” So, wealth changes will impact positively on consumption (up and down).

Later, as he was reflecting in Chapter 24 on the “Social Philosophy towards which the General Theory might lead” he wrote:

… therefore, the enlargement of the functions of government, involved in the task of adjusting to one another the propensity to consume and the inducement to invest, would seem to a nineteenth-century publicist or to a contemporary American financier to be a terrific encroachment on individualism, I defend it, on the contrary, both as the only practicable means of avoiding the destruction of existing economic forms in their entirety and as the condition of the successful functioning of individual initiative.

For if effective demand is deficient, not only is the public scandal of wasted resources intolerable, but the individual enterpriser who seeks to bring these resources into action is operating with the odds loaded against him …

It was thus clear – that active fiscal policy was the “only practicable means of avoiding the destruction” of recession brought about by shifts in consumption and/or investment.

That view dominated macroeconomics for several decades.

In 1957, Milton Friedman, who had been chipping away at the view that fiscal policy interventions were crucial for the maintenance of prosperity, published his book – A Theory of the Consumption Function – in which he outlined (in Chapter III) what became known as the Permanent Income Hypothesis.

It provided him with a basis for refuting any notions that active fiscal policy could stimulate household consumption, a major contention of the then dominant Keynesian policy consensus that had sustained full employment and strong real GDP growth in the peace time after the end of World War 2.

The idea of a propensity to consume, which had been formalised in textbooks as the Marginal propensity to consume (MPC) – which described the extra consumption that would follow a $ of extra disposable income, was thrown out by Friedman.

The MPC concept – that households consume only a proportion of each extra $1 in disposable income received – formed the basis of the expenditure multiplier.

Please read my blog – Spending multipliers – for more discussion on this point.

Accordingly, if government deficit spending of, say $100 million, was introduced into a recessed economy, firms would respond by increasing output and incomes by that same amount $100 million.

But the extra incomes paid out ($100 m) would stimulate ‘induced consumption’ spending equal to the MPC times $100m. If the MPC was, say, 0.80 (meaning 80 cents of each extra dollar received as disposable income would be spent) then the ‘second-round’ effect of the stimulus would be an additional $80 million in consumption spending (assuming that disposable and total income were the same – that is, assuming away the tax effect for simplicity).

In turn, firms would respond and produce an additional $80 million in output and incomes, which would then create further induced consumption effects.

Each additional increment, smaller than the last, because the MPC of 0.80 would mean some of the extra disposable income was being lost to saving.

But it was argued that the higher the MPC, the greater the overall impact of the stimulus would be.

Instead, Friedman claimed that consumption was not driven by current income (or changes in it) but, rather by expected permanent income.

Permanent income becomes an unobservable concept driven by expectations. It also leads to claims that households smooth out their consumption over their lifetimes even though current incomes can fluctuate.

So when individuals are facing major declines in their current income – perhaps due to unemployment – they can borrow short-term to maintain the smooth pattern of spending and pay the credit back later, when their current income is in excess of some average expectation.

The idea led to a torrent of articles mostly mathematical in origin trying to formalise the notion of a permanent income. They were all the same – GIGO – garbage in, garbage out. An exercise in mathematical chess although in search of the wrong solution.

This period of theoretical development was rife when I was in graduate school and so I, along with my colleagues, waded through hours of tedium in our studies.

We learned (or whatever you might call it) that consumption smoothing occurs in perfect capital markets – that is, where anybody can access credit no matter what.

We learned that relative assessment of how consumption patterns in our neighbourhoods or social groups were irrelevant in determining an individual’s lifetime consumption.

The so-called https://en.wikipedia.org/wiki/Relative income hypothesis developed by James Duesenberry, which stated that individuals were not robustly independent (as in Friedman’s story) but linked in social groups and neighbourhoods was rejected.

Duesenberry had argued that “an individual’s attitude to consumption and saving is dictated more by his income in relation to others than by abstract standard of living”.

It was the “keeping up with the Jones” theory.

But Friedman was not one to embrace interdependence. In the ‘free market’ tradition, all decision makers were rational and independent who sought to maximise their lifetime utility.

Accordingly, they would borrow when young (to have more consumption than their current income would permit) and save over their lifetimes to compensate when they were old and without incomes. Consumption was strictly determined by this notion of a lifetime income.

Only some major event that altered that projection would lead to changes in consumption.

The Permanent Income Hypothesis is still a core component of the major DSGE macro models that central banks and other forecasting agencies deploy to make statements about the effectiveness of fiscal and monetary policy.

So it matters whether it is a valid theory or not. It is not just one of those academic contests that stoke or deflate egos but have very little consequence for the well-being of the people in general.

It turns out that the theory is moribund to say the least.

As Noah Smith wrote (July 26, 2016) in his Op Ed – :

So it’s not much of an exaggeration to say that Friedman’s PIH is the cornerstone of modern macroeconomic theory. Unfortunately, there’s just one small problem — it’s almost certainly wrong.

The empirical world hasn’t been kind to Friedman across all his theories. But the Permanent Income Hypothesis, in particular, hasn’t done well in explaining the dynamics of consumption spending.

Noah Smith cites several articles in recent years that have demonstrated Friedman’s great hypothesis to be bunkum.

What we know about the real world consumption patterns is fairly clear.

People do respond quickly to increases in income even if they are windfalls (see Keynes above) and increase consumption spending as a result.

Consistent with the evolution of mainstream macroeconomic theory as a degenerating paradigm (in the Lakatosian sense), the Friedmanites responded to empirical flaws in the theory with with ad hoc defenses.

David M. Gordon (in his great 1972 book – Theories of poverty and underemployment, Lexington, Mass: Heath, Lexington Books) wrote about in relation to neoclassical human capital theory.

Gordon said that mainstream economists continually responded to empirical anomalies with these ad hoc or palliative responses.

So whenever the mainstream paradigm is confronted with empirical evidence that appears to refute its basic predictions it creates an exception by way of response to the anomaly and continues on as if nothing had happened.

When it is observed that a government stimulus leads to increasing consumption – the ad hoc response was to drop the perfect credit market assumption and claim individuals did face credit market constraints (many cannot borrow at all) and as a consequence spent up big if they received a windfall.

It has always been a poor argument.

The paper I cited at the outset – which was presented earlier this month in Chicago – puts a further (the final, hopefully) nail in the Permanent Income Hypothesis.

In won’t go into the methodology in detail – you can pursue that if you like.

But the researchers deploy a very rich dataset to:

… study the spending of unemployed individuals using anonymized data on 210,000 checking accounts that received a direct deposit of unemployment insurance (UI) benefits. The account holders are similar to a representative sample of U.S. UI recipients in terms of income, spending, assets, and age.

This is the classic windfall gain territory.

1. The person becomes unemployed with a sudden loss of income. The changes are large.

2. They then go onto unemployment benefits, which they know provide a temporary income boost (could not be conceived as increasing their ‘permanent income’.

3. They then (in the US) lose their benefits and plunge into income uncertainty (none).

If the permanent income hypothesis was a good framework for understanding what happens to the consumption patterns of this cohort then we would expect a lot of smoothing going on and relatively stable consumption.

Individuals, according to Friedman, are meant to engage in “self-insurance” to insure against calamity like unemployment. The evidence is that they do not.

The researchers reject what they call the “buffer stock model” (which is a version of the permanent income hypothesis).

They find:

1. “Spending drops sharply at the onset of unemployment, and this drop is better explained by liquidity constraints than by a drop in permanent income or a drop in work-related expenses.”

2. “We find that spending on nondurable goods and services drops by $160 (6%) over the course of two months.”

3. “Consistent with liquidity constraints, we show that states with lower UI benefits have a larger drop in spending at onset.” In other words, the fiscal stimulus coming from the unemployment benefits attenuates the loss of earned income somewhat.

4. “As UI benefit exhaustion approaches, families who remain unemployed barely cut spending, but then cut spending by 11% in the month after benefits are exhausted.”

In other words, people operate in very short-term horizons. They know that their benefits will terminate (and when) so the “drop in income is predictable” but they do not plan ahead.

So this has nothing to do with credit constraints.

5. As it turns out the “When benefits are exhausted, the average family loses about $1,000 of monthly income … In the same month, spending drops by $260 (11%).”

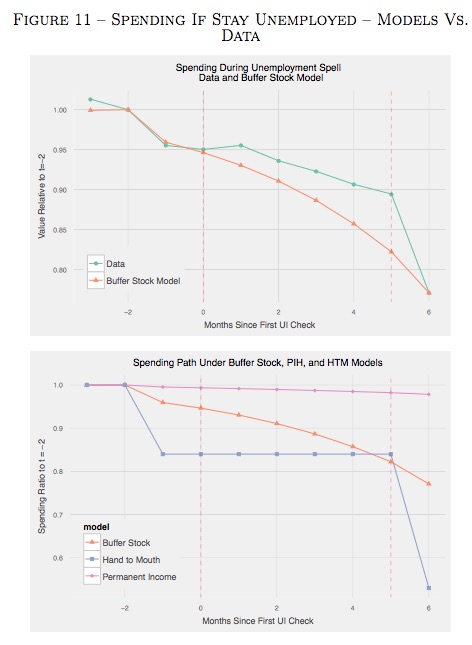

6. They compare the “path of spending during unemployment in the data to three benchmark models and find that the buffer stock model fits better than a permanent income model or a hand-to-mouth model.”

The first models predict consumption smoothing of varying degrees, with the permanent income hypothesis predicting “that spending should evolve smoothly in the face of predictable income changes”.

The buffer stock model assumes that families smooth their consumption after an income shock by liquidating previous assets – “a key prediction of buffer stock models is that agents accumulate precautionary savings to self-insure against income risk.”

The researchers find that the:

the buffer stock model has two major failures – it predicts substantially more asset holdings at onset and it predicts that spending should be much smoother at benefit exhaustion.

The hand-to-mouth consumers lives by the day and spends extra income without regard for later income prospects.

They provide this graph to show the comparison. The top panel compares the actual spending data (green line) over the history of the unemployed person (vertical line from 0 on the horizontal is when individual receives the benefit and then the second is when it expires) with the buffer stock model.

The bottom panel puts the predictions of all three models into perspective.

So the two sharp declines in spending are clear (on losing the job, and the expiration of benefits). The Permanent Income Hypothesis predictinos do not come close to capturing what is happening in the real world.

Equally, there is more smoothing than the hand-to-mouth model predicts, suggesting some asset liquidation is going on to maintain spending.

7. Finally, the researchers found “that families do relatively little self-insurance when unemployed as spending is quite sensitive to current monthly income.”

Families “do not prepare for benefit exhaustion”.

Conclusion

The points that emerge from this type of research is that fiscal interventions can be very beneficial in sustaining household consumption in the face of income loss from unemployment.

The multiplier is alive and well.

The Permanent Income Hypothesis and its accompanying political implications is well and truly dead.

But try telling the mainstream economists about that – they still quote MV = PY whenever something disagreeable crosses their computer screens.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

The spending multiplier may be alive and well, but the socio-economic policies based on mainstream nostrums are not. They are getting worse. Just the other day, one UK health minister said that children have to begin taking care of their elderly parents, that the state didn’t have the resources to do so any longer.

They may like to do this, but if they are working, they are often working all the hours they can, and if they are not, they may be out looking for work. If they are not working, how are they supposed to support their elderly parents’ financial needs; they possibly can’t support their own. And what if they have mental health issues that might well prevent them from properly caring for their parents?

He drew an analogy between parents taking care of their children and the children taking care of their elderly parents. This fails on so many levels re contemporary Western society, it is difficult to know where to begin dissecting it. It was a tad cloudy but it appeared to me that he assumed some kind of self-insurance a la Friedman. How are the children who have lived all their lives in a particular kind of system supposed to become self-insuring late in their lives? These Tories are Worse than Thatcher.

Dear Bill

One problem with the permanent income hypothesis is that the permanent income is an expectation, and such an expectation can change all the time as people’s life circumstances change. If someone is 30 years old and has had a good job for 6 years, he may think that his current income will continue indefinitely or increase slightly over time. Then the company for which he works unexpectedly goes bankrupt. That may completely alter his expectation of his future income path.

A lot of people nowadays don’t have job security. As a result, these people will incline toward a hand-to-mouth lifestyle. It is hard to plan when economic ups and downs are the norm. You may as well spend the money when you have it and cut expenditure when you are forced to do so.

The more the welfare state provides income security, the less need there is for a buffer stock. If the state provides free health care, good old age pensions, and generous insurance in case of unemployment and disability, then the need for a buffer stock is sharply reduced. The poorer people are, the less able they are to provide a buffer stock. In countries which are very poor and have only a skeletal welfare state, we can expect people to have a hand-to-mouth lifestyle.

It is amazing how many people manage to spend significant lottery winnings or a sizable inheritance in a very short time. If the permanent income hypothesis were true, they would behave in such a fashion that this windfall would be spent more or less evenly over the rest of their lifetime.

Regards. James

Larry-do you have a source for that Tory statement? It is utterly horrific, at a time when job insecurity is rife, pay is low, housing virtually demands you sell your soul to a rentier and now social care on top. The Tories are vile cretins who see themselves as rentier Ubermenschen who look down from a mountain on the stressed masses running around like scared ants while it is trebles all ’round for them.

Due to the abysmal failure of the Left (that Bill documents so well) I’m afraid these gut-wrenching shysters on streroids will be with us for some years now. The notion that people can ‘self-insure’ when they are in credit card debt to the average tune of £10,000 is laughable.

This is operation Malthus!

Simon, it is in the UK Guardian. The minister is David Mowat. Here is the link: https://www.theguardian.com/society/2017/jan/31/take-care-of-your-elderly-mothers-and-fathers-says-tory-minister.

Simon Cohen here it is. It was on today’s news stand in the town and I was shocked. Such an outrageous comment from a Tory Minister but I’ve long since given up being surprised at their nastiness. In fact I’m with Aneurin Bevan’s analysis of the Tory heart.

http://www.telegraph.co.uk/news/2017/01/31/parents-responsible-care-elderlymothers-fathers-much-children/

Hi all,

I have started to learn economics a month ago in my free time. Luckily, I started off from MMT. I am reading the MMT primer by Dr. Wray atm and have a book by Steve Keen and another one by Michael Hudson.

I used to think Milton Friedman was a god in economics and his ideas shouldn’t be questioned (I mean he looked smart with the glasses and he talked about business and personal responsibility!). I remember a video of him arguing with a young Michael Moore about seat belts. Looking back, it seems silly now because people, through a functional representative government, can decide seat belts should be implemented by law and that’s that.

For the paper Dr. Mitchell referenced in the blog post, I am surprised by how recent the paper is. Certainly, there must be data testing/refuting Friedman’s theories that have been put out before Dr. Mitchell’s reference in this blog post? Or better yet, where are Friedman’s evidence that his hypothesis exists in the real world in some form? Shouldn’t there be a seminal paper by Friedman? Also, shouldn’t there be other academics who would question/support his result and put out seminal papers of their own? I’m not a very good scientist in the lab I work in, but you can’t just say stuff in here without backing it up-NOBODY would accept it, not even my mother if she were a scientist.

Even now when I go to youtube, type in “Milton Friedman,” and read the description on the first video, I still see his zombie ideas peddled as wisdom:

1) Wealthy people really deserve their income and society shouldn’t adjust inequality, but as Dr. Mitchell referenced in one of his posts, CEO pay has no bearing on company performance. I also love how he conveniently left out the huge government deficit spending by US gov with the new deal and WWII; he also conveniently left out low level of private debt and less severe income inequality back then. They had full employment for god’s sakes!

2) Great depression was not a failure of business. I am not aware of anyone in MMT has said that great depression was a failure of business. I think Dr.Wray has said that every single government budget surplus is followed by a recession though.

3) Free lunch is a myth. I don’t think Friedman was aware that government doesn’t need tax to spend. Free lunch is a myth, but when government spends to pay teachers and firemen, they need to use their time and energy to teach kids and fight fire, that’s a real cost because they could be doing something else.

To be fair, Friedman may be more nuanced and thorough in his discussion in the video, but judging from the right wing in US, I don’t think I am misrepresenting their perspective by a huge margin from a practical point of view.

In the comment section, you can his cultists worship Friedman and his ideas still-even in this age when people simply don’t have income to purchase and are loaded up with private debt.

Maybe Friedman is still getting away with it because not enough people know MMT and so don’t have the tools to push back.

Tom, in the 1980s, two short books were published that attacked Friedman’s ideas and their implementation by Thatcher. They were by Nicholas Kaldor. They were The Economic Consequences of Mrs Thatcher and The Scourge of Monetarism, which as Bill has mentioned segued into neoliberalism. While Kaldor became a post-Keynesian, his primary interest was in social justice, one reason he attacked the monetary policies of the time, especially those of Thatcher, which are being reenacted today if not more so.

Hi Larry,

Thanks for reply! I will write those titles onto my book list as well. I think I may have found the first one you mentioned online. I will make sure that it is the one. It seems I can finish it pretty quickly.

My parents say that back in their days, Margaret Thatcher (“The Iron Lady” if you will) was looked up to by people very much. I was reading Howard Zinn’s People’s History up to the pre-civil war class struggle before I got sidetracked by MMT, and I found that more often than not we can apply critical eye towards the past beyond what some people would have us believe. Margaret Thatcher, for me, is one of those myths of greatness/revisions of history. However, I may be able to learn more about the economic back then and her impact by looking into the books you listed.

Cheers!

Tom

@Tom,

The tragedy at the heart the rise of Thatcher (as with Trump today) is that she could never, ever, have won without working class support.

The tabloids under Murdoch and Rothermere helped her ensure that victory, but depressingly, those who had benefitted most from the post war settlement and the Welfare State were among the first to fall for the greed that was unleashed – short-sightedly snapping up the bribes on offer: council house purchases under Right-to-Buy, along with pathetic little windfalls from buying and selling the small allocations of shares in newly privatised industries – but with no regard as to the damage it would do to the following generations in the resultant housing crisis, or for that matter, themselves, from higher utility charges and transport fares.

And the Right got away with it again, thirty years later, with the ‘strivers vs. scroungers’, divide-and-rule tactics of Cameron and Osborne, and the ‘bankrupt Britain’, we-can’t-afford-it, government-as-household narrative. Except that, by then, there was no more carrot on offer, just more stick.

Socially and economically, the Tories would appear to want to lead the UK back to the C18th – when the poor were lucky to own the shirt on their back, whilst the tiny wealthy minority owned *literally* everything in sight. They believe it’s the natural order of things.

But until received opinion changes, and MMT can get its message across to the general population, and convince them they have been categorically lied to for nearly 50 years, I can’t see much changing for the better.

As such, our host’s blog is a little haven of hope in dark times.

“Margaret Thatcher, for me, is one of those myths of greatness/revisions of history.”

She was looked up to very much, and she was a unique character who stood out. Her influence isn’t exaggerated, nor is her personality.

Her trick was to appeal to people’s short-term selfishness and their (deluded) sense of moral superiority (e.g. wagging your finger at others).

Cameron and Osborne have used a different trick, but they’ve set off a time-bomb just the same, in order to complete Thatcher’s work. 7 years later, we’re still asleep at the wheel and it’s detonating section after section of our society.