Well my holiday is over. Not that I had one! This morning we submitted the…

Australian fiscal statement 2015-16 – cynical and venal

Last night, the Australian Federal Treasurer brought down his second ‘fiscal statement’ (aka, the Federal ‘Budget’). I try to avoid the term ‘budget’ when discussing national government fiscal balances because it leads to a confusion between a the finances of a household, which uses the currency and is financially constrained and the finances of a sovereign government, which is never revenue constrained because it is the monopoly issuer of the currency. In last night’s fiscal statement, the Treasurer committed the Government to a policy path that will entrench mass unemployment (over 6 per cent for the next three years and not much below that in 2018-19). In each of the next four years, the fiscal shift is contractionary despite claims that it is a ‘big-spending budget’. It has nothing much to do with economics and all to do with the dramatic failure of last year’s fiscal strategy and the resulting plunge in electoral support. With an election next year, the Federal government has tried to run a fiscal policy with headline appeal but the reality is that the outcomes will continue to undermine the well-being of the disadvantaged. It will also fail to achieve its own fiscal targets because the in-built growth assumptions are too optimistic. Finally, it exposes the lie that the Government peddled in the lead up to the last election that on-going deficits would cripple the economy and send the nation bust. In that sense, the government is looking like the Tories in Britain in 2012 when they cut short the ridiculous austerity push which had sent the economy back into recession and instead allowed for an on-going deficit. The deficit wasn’t nearly large enough and so growth there has been pitiful. But it was large enough to support some growth. The same will be the case in Australia.

The Federal government clearly has realised that its big talk about cutting into public deficits was going to be electoral suicide if they had have continued to actually implement their policies as planned.

The Australian economy has slowed dramatically under their watch and unemployment continues to rise. Their electoral popularity is rock bottom and they faced the rare prospect of being a one-term government.

The answer? Forget about all the talk about impending national bankrupcty and the need for emergency cuts.

Remember the Treasurer’s – Speech to the National Press Club – on May 22, 2013, prior to being elected to government later that year?

As Opposition Shadow Treasurer he said:

If we have the honour of being elected the Coalition will work hard, day and night, to make our country better.

We will build a strong budget to build a strong economy …

… honesty does not come when a government excuses its past profligacy on the promise of a surplus – but then not only fails to deliver one, but delivers a $19bn deficit with more to come …

Firstly, they have broken the most solemn promise already.

On over 500 occasions they boasted that they were delivering a surplus this year and the Prime Minister even boasted that the surplus had already been achieved.

But this budget has just delivered more deficit and debt. In fact it is a $20 billion deterioration in just six months.

Next years forecast surplus of $2.2 billion has now become a deficit of $18 billion. Again a deterioration of $20 billion.

Now the government expects you to believe that they will deliver a modest surplus in four years time, that is after two more elections.

It would be comical if it wasn’t so tragic …

… under Labor, gross debt, that is the money we actually have to repay, has been going up and up.

… the reality is that the cupboard is bare.

Under Labor the Budget will never come back to surplus.

The debt will keep growing.

… we will balance the books, live within our means and return the budget to surplus as quickly as possible.

Because of the fiscal emergency …

And so it went.

Just like George Osborne’s about turn in 2012, the current Australian government has conveniently shelved all that blow-hard rhetoric about fiscal emergencies, realising that the economy is slowing down rather quickly and the labour market has deteriorated under their watch.

They only care about that because it is now showing up in some very negative public opinion polls for them and they face the prospect of being a one-term government, which is a rare feat only the most incompetent federal regimes achieve.

Their electoral plunge is all the more profound given how pathetic the Labor Party is at present.

So there is now no fiscal emergency and on-going deficits and rising public debt are okay. The problem is that their DNA is such that they won’t take the next step and realise that spending equals income and their isn’t enough of it and unemployment is rising as a consequence of employment growth being unable to keep pace with the underlying population growth.

The result is a fiscal strategy that does not impose as much austerity and inequality as their DNA would support but also fails to meet the major challenges facing the nation – the increasing labour underutilisation rates, flat real wages, flat economic growth – and provides no path to addressing these things within the realities that climate change and natural resource frailty impose.

In terms of its macroeconomics qualifications I have listed a few facts (with graphs for those that prefer to learn that way) as context. To understand why context matters, please read the following blog – MMT Fiscal Principles.

There you will see that a responsible fiscal policy requires two conditions be fulfilled:

1. The discretionary fiscal position (deficit or surplus) must aim to fill the gap between the non-government saving minus investment minus the gap between exports minus imports.

2. When filling that gap, the government has to ensure that the non-government saving, import and investment levels are at their full employment levels.

These conditions specify a strict discipline on fiscal policy if the aim is to achieve full employment.

The 2016-16 Fiscal Statement (‘the Budget’) fails badly when judged against these conditions. To make matters worse, it doesn’t even consider them in any explicit way.

Not many other commentators or rival politicians seem to understand them either. The new Greens leader was on national radio this morning claiming that the fiscal strategy “doesn’t balance the budget”. What!

There are also commentators continually raving on about the need to ‘repair the budget’. National broadcast anchors this morning were concentrating on the alleged ‘need to fix the budget’. And so it goes on – there is no meaning in the terminology – repair, deterioration, fix – when applied to the federal government fiscal balance.

Deterioration means a worsening. A government balance cannot become worse or better – it is what it is. Employment growth or unemployment – things that matter – can deteriorate and that would present a problem. But a rising government deficit is of no concern in its own right.

We should understand it in the context of other events in the economy which matter – in that sense, the shifts in the fiscal position are reflective rather than being intrinsically interesting.

Further how can we view a rising deficit as a deterioration when it is clearly providing spending support for some growth?

So what about these other events?

All the relevant fiscal documents for 2015 are – HERE.

Basic Lies

In Statement 3 (‘Budget Paper 1’) we read:

This Budget redirects spending towards investments that boost productivity and workforce participation

Which of course is spin and the Government’s own numbers do not support that claim. It amounts to an outright lie.

First, in the December-quarter 2014 National Accounts, GDP per hour worked was growing at 1.7 per cent per annum. In the Forward Estimates, productivity is assumed to grow at 1.25 per cent for the next three fiscal years. That is a reduction in productivity growth by my reckoning.

Second, the estimates assume that the labour force participation rate, which is currently 64.8 per cent will remain constant at 64.75 per cent through to 2018-19. That is a reduction in workforce participation by my reckoning.

Note that the current participation rate is well down on the recent peak (November 2010) when it was 65.9 per cent.

This means that for the next four years, the workforce participation rate will be below the level that prevailed before the previous government tried to cut its deficit prematurely.

The current fiscal strategy is locking in this diminished labour force participation for the next four years.

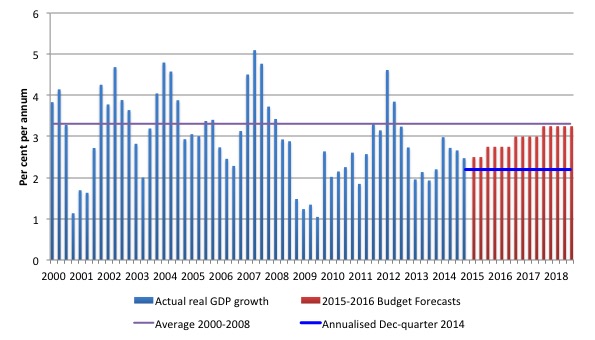

Real GDP growth is well below trend

Real GDP growth is still well below its recent trend.

The following graph shows the recent history of real GDP growth. The trend line (at 3.3 per cent) is calculated as the average annual growth rate between the March-quarter 2000 to the March-quarter 2008. In general a trend growth rate between 3.25 and 3.5 is found for Australia no matter which reasonably long growth sample you select.

The blue horizontal line is the annualised growth rate as per December-quarter 2014 (the most recent estimate). If that quarter’s performance continued then the economy would be growing at 2.2 per cent well below the rate required to keep unemployment from rising.

The red bars are the real GDP forecasts out to 2017-18.

If the Government is correct, then it is accepting that its policies will only generate below trend growth for the next three years at least.

It should be remembered that even when the economy was growing at the (purple) trend there were still high rates of labour underutilisation. Even at the peak of the last cycle (February 2008), the sum of unemployment and underemployment was around 9.9 per cent.

So this is a very mediocre aspiration for the Government to adopt. Moreover, there is nothing in the fiscal statement that would justify the optimistic increase in real GDP over the next few years.

There is every reason to expect, especially with the fiscal contribution to growth declining, that the economy will labour on at well below trend rates of growth, given the developments in China and elsewhere. Certainly the Reserve Bank of Australia is more concerned about the persistence of below-trend growth rates than the Government (the Treasury) seems to be.

The point is that the economic cycle is not overheating or even heading upwards. If anything a further slowdown would be expected.

In that context, running a contractionary fiscal position is irresponsible and the anathema of good policy.

Now that the Government has admitted (by implication) that there is no ‘fiscal emergency’ and that was all a beat up to scare voters into supporting them at the last election, it should take the next necessary step towards responsible government and increase its discretionary fiscal deficit to stimulate employment.

Had they done that they would then have been justified in claiming that their fiscal strategy will boost productivity and workforce participation.

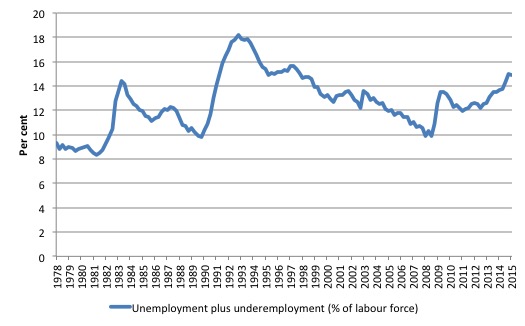

Further context – Labour Underutilisation is high and rising

The Australian economy is far from being close to full employment. The following graph shows the ABS Broad labour underutilisation series, which simply adds the official unemployment rate to the underemployment rate.

It is currently at 14.9 per cent (February-quarter 2015) having risen from 13.5 per cent since the current Government was elected.

This means that at least 15 per cent of the available workforce is not working their desired hours – some none at all (6.2 per cent) and others working, on average, 15 odd hours less per week than they desire (8.7 per cent).

This labour wastage is a reflection of the massive output gap that currently exists and will persist according to the Government’s strategy for at least the next three fiscal years.

How can a government claim to be acting in the best interests of the nation when it predicts its fiscal policy strategy will entrench unemployment rates of between 6.25 and 6.5 per cent (that is, higher than the already elevated rate of 6.2 per cent at present) for the next three years?

Inflation is benign (and falling) and even the Treasury estimates of the non-accelerating inflation rate of unemployment (the NAIRU) are down around 5 per cent.

What is the justification for planning to deliberately lock in such high rates of labour wastage? You won’t find the answer in any of the ‘Budget Documents’.

Again, a sign of an irresponsible and incompetent government.

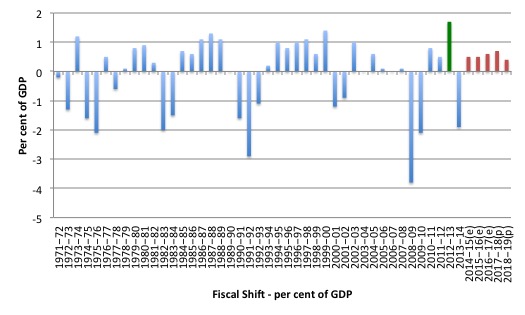

The following graph shows the recent history (from 1970-71) of fiscal shifts calculated as the change in the fiscal balance over the previous fiscal year expressed as a percentage of GDP.

A positive value (bar above zero line) indicates that the fiscal deficit was reduced and vice versa.

The green bar, which is the largest fiscal shift in the last 44 years, was associated with the second-last fiscal statement from the previous Labor government in 2012-13 and was equivalent to 1.7 per cent of GDP.

That government was obsessively trying to achieve a fiscal surplus in the next year and was blind to the reality that the private sector was not going to fill the spending gap left by the retrenchment in net government spending. Private spending was weak at the time and there was a need for higher fiscal deficits.

The result was totally predictable – the economy took a nosedive, tax revenue fell even further and the fiscal balance moved further into deficit with unemployment rising.

The reversal in the fiscal balance was larger than the attempted contraction the year before (1.9 per cent compared to 1.7 per cent), which just tells you that it is folly to try to cut a deficit when private demand is weak.

That was the situation the current government inherited and part of the 2013-14 result is due to the fact that the conservatives initially tried to emulate the Labor government’s folly.

It didn’t work as you can see and the fiscal deficit went from $A18.8 billion (1.2 per cent of GDP) in 2012-13 to $A48.5 billion (3.1 per cent of GDP) in 2013-14 as growth (and tax revenue) fell and unemployment rose.

It was all predictable yet the government was urged on by the commentariat who had bought in fully to the ‘fiscal emergency’ nonsense.

In last night’s fiscal statement, the fiscal shift planned is contractionary despite what today’s commentators are claiming (I have read that this is a “big spending” government).

The fiscal shift is not as radical as the 2012-13 but is still around 0.5 per cent of GDP (or $A7.4 billion net). That is a significant amount to be taking out of the economy in one fiscal year given the weakening external environment (slowdown in exports and collapsing terms of trade) and weak private domestic spending (especially investment).

Unless there is an extraordinary pick up in private spending or net exports then the economy will not achieve the underlying growth assumed and we will be left at the end of the fiscal year with a fiscal deficit higher than they forecast and an even weaker economy than exists now.

The fiscal shifts in the later years get progressively bigger (0.6 per cent, 0.7 per cent of GDP, etc), which further puts in doubt the growth forecasts in this year’s statement.

What this means is this.

With the economy slowing at present and unemployment rising, the current Federal government is invoking a pro-cyclical fiscal policy change, which are the anathema of responsible fiscal management.

Discretionary changes in fiscal policy should typically be counter-cyclical – that is, expand deficits when private spending is weak and vice versa – to manage output gaps.

The only time an expansionary discretionary fiscal change should be pro-cyclical is when growth is positive but not strong enough to achieve full employment. Once capacity is reached, fiscal policy should counteract non-government spending changes.

Here are some further questions the journalists should be asking but are not:

1. What reason does the government give for contracting net spending while the real GDP growth rate is falling (well below trend) and the unemployment rate is rising and well above what the Government, itself, claims is full employment?

2. Why would a government deliberately impose massive daily national income losses on the economy, which are disproportionately endured by the poorest members of our society?

The private sector’s debt position is set to worsen

The economic predictions, which underpin the fiscal statement and are contained in ‘Budget Paper No.1’, show that the Treasury is forecasting the current account deficit to be at 3 per cent of GDP in the coming fiscal year With a fiscal deficit estimated to be 2 per cent of GDP, that means they believe the private domestic sector will be spending more than they are earning by an equivalent of 1 per cent of GDP.

Over the next three fiscal years, the private domestic deficit will increase to 2.25 per cent of GDP up from 1 per cent of GDP, on the projections in the fiscal statement.

That means the Government expect the private domestic sector to maintain the growth in the economy by increasing its indebtedness.

We are heading in the same direction as before the crisis – growth becomes reliant on private debt buildup.

The whole nation is transfixed on fears that the government debt in Australia is too high – courtesy of all the scaremongering that has been going on. But nary a word gets mentioned about the dangerous private debt levels. It is true that most of the debt is owed by higher income people in Australia, which makes an insolvency crisis of the likes of the sub-prime less likely here.

But the reality is that the debt levels and the growth in them (about the same as disposable income) means that consumer spending is likely to remain fairly subdued overall. It is unlikely we will see a return to the pre-crisis period when debt grew much faster than disposable income and the resulting spending maintained stronger economic growth.

Conclusion

I could have analysed specific fiscal changes to programs etc but I don’t think that would have been a very interesting exercise. It is also done to death in any of the other media outlets.

The point that is not being made by anyone much are those that I choose to focus on. The macroeconomic issues – below trend growth, entrenched unemployment etc.

Overall, this year’s fiscal statement from the conservative government reveals them as pragmatic liars. They are prepared to maintain a deficit of some proportion despite claiming three years ago there was a fiscal emergency that required an immediate surplus.

They are doing that for the same reasons the Tories in Britain reversed direction in 2012. They are facing a defeat in the next federal election and know that if they continued their proposed austerity program the economy would move back into recession very quickly.

Instead, they are maintaining a deficit that will provide some support to a tepid growth rate, which will probably stave off further electoral damage.

However, by keeping the deficit well below the level required to reduce unemployment, they are demonstrating that they are willing to sacrifice the well-being of those they are deliberately rendering jobless, for political gain.

Only a venal, nasty government would adopt such a cynical fiscal position.

The contractionary fiscal position will slowly undermine growth rather than kill it completely.

It will increase hardship on those least able to cope with it.

And why? For no substantive economic reason. This is not an economic statement. It is a desperate attempt to maintain office.

The Guardian coverage is a disgrace

One of many low-points in the media coverage of the Fiscal Statement was the Guardian newspaper’s – You balance the budget – page.

It invited readers to play around with various cuts, which they have put $ amounts next and a brief description. Such things as cutting expenditure on public health, privatisting public assets, increasing taxes on various things, and the rest of it.

The UK Guardian says that:

Help the prime minister find savings to fund these measures. However, these savings measures are not without consequences – each time you make a cut, it might have a negative effect on something.

I made $A32.177 billion in net spending reductions (I selected all the options) and ended up with a $A977 million fiscal surplus, which would be about 0.24 per cent of projected GDP for next year.

So, what were the consequences? The obvious consequences were not included in the ‘game’. The UK Guardian apparently doesn’t think it is important that the public understand the basic rule of macroeconomics that spending equal income and drives output and employment.

They apparently just want to have the public fight it out between competing targets for spending cuts and/or tax increases without actually understanding what the impact of those changes would be for real GDP growth and unemployment.

There is no measure of what ‘balancing the budget’ would do for the things that really matter.

It is just assumed that ‘balancing the budget’ is a desirable goal which requires us to ‘sacrifice’ for.

It is a disgrace that a so-called ‘progressive’ newspaper would enter this area of mythology and misinformation.

Fortunately, the smart-ar** who wrote the code for the game didn’t test it in Firefox. It only works in Safari if you use OS X as your operating system.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

This “budget” or whatever is a purely political strategy. My guess is that the clowns will try an early election stunt on the “strength” of it, preferably a double dissollution. Good,go for it bozos. The sight of bloodied clowns would make my day.

The Guardian Australia is a third rate rag – nothing unusual in that. But they carry First Dog On The Moon and the “budget” cartoon is a classic.

Hello,

In light of the critique of the 2015 budget you offered, could you provide any recommendations to current fiscal polices, using economic theory to back up any recommendations? In particular, if the government wanted to place direct emphasis on macroeconomic objectives such as Full Employment, higher standard of living and stronger economic growth, what would you suggest that the government of today does to better achieve these objectives?

thank you.