I have closely followed the progress of India's - Mahatma Gandhi National Rural Employment Guarantee…

Large-scale employment guarantee scheme in India improving over time

Today I am reflecting on employment guarantees. I ran into a mate in a computer shop in Melbourne yesterday, totally by accident. He happens to be one of the big players in the job services sector – the unemployment industry. We exchanged our usual pleasantries and then we got angry together about the government policies – the usual interaction. Then I said well what we need is all you guys and the related charities (such as the Brotherhood of St Laurence, the Smith Family) and other groups (such as Greenpeace, Amnesty International etc) all getting out of their comfort zones and agreeing that being angry is stupid and that action is required. These are the people who lobby government. Academics only create ideas and write them out. I suggested that these groups use their significant public profiles to organise a coalition of support for the Job Guarantee and really push it hard – if only to expose the denials and failures of the orthodoxy that besets us all. Anyway, that conversation just happened to dove-tail with an article I read last week about employment guarantees in practice that I found interesting and which was exposing the deniers for what they are – ideological sycophants. That is what this blog is about.

As regular readers know I promote the idea of employment guarantees as part of a macroeconomic stability framework where full employment and price stability can be simultaneously achieved.

The use of buffer stocks are inherent in maintaining stable inflation and the current neo-liberal system uses a pools of unemployed in this way. I have argued since I first developed the idea of a Job Guarantee based on the buffer stock principle that maintaining a buffer stock of jobs is a superior way of achieving stable inflation.

For a complete range of blogs on this topic go to the – Job Guarantee – category of my blog.

While politicians in the advanced economies think it is a clever strategy to deliberately create poverty via unemployment, there are now several countries which have implemented direct job creation schemes to counter the major problems associated with persistent unemployment.

For example, the Argentinean government introduced the Jefes de Hogar (Head of Households) program in 2001 to combat the social malaise that followed the financial crisis in that year. Another example, is the Expanded Public Works Program (EPWP) in South Africa, which was introduced to overcome the extremely high unemployment and accompanying poverty in that country.

These programs run against the full employability tide that dominates the policy agenda in advanced nations and is pushed onto poorer nations by organisations such as the World Bank and the IMF and starts with the accusation that an individual is unemployed because they don’t want to work hard enough. The victim of the problem becomes the problem.

Nations that have instituted direct public job creation programs recognise that the solution to joblessness and the accompanying poverty lies in the provision of employment opportunities rather than a focus on the victims. They also recognise that the Government (Federal down to local) have a major role to play in providing for employment guarantees.

The largest employment guarantee scheme is maintained in India in the form of the – Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) – which was instituted in 2005 and is administered and managed by the Ministry of Rural Development in the Indian government. It is sometimes called the NREGA program.

The – Mahatma Gandhi National Rural Employment Guarantee Act 2005 (Note: 9 mb file) – was proclaimed on September 7, 2005 and aims to:

… provide for the enhancement of livelihood security of the households in rural area of the country by providing at least one hundred days of guaranteed wage employment in every financial year to every household whose adult members volunteer to do unskilled manual work …

The MGNREGS was introduced to bridge the vast rural-urban income disparities inequality that have emerged as India’s information technology service sector has boomed. Essentially, the growing jobs boom in the urban areas created massive incentives for poor rural workers to move into the cities in search of a living.

There were two negative consequences of this. First, the urban centres could not cope with the increased populations – housing, transport, public services, etc – were in adequate to meet the demands of the rising populations.

Second, the exit of tens of thousands disrupted the continuity of the rural areas.

The answer was to create job opportunities in the rural areas, where they had been extremely scarce to provide a minimum standard of living for those who stayed and were prepared to perform manual work for a certain guaranteed number of hours per year. That was the main motivation for the introduction of the scheme.

The MGNREGS guarantees 100 days of minimum-wage employment on public works to every rural household that asks for it. The adults must be willing to undertake unskilled manual labour at the legal minimum wage. Once an adult applies for work, the scheme must employ them within 15 days or pay unemployment benefits.

Local communities have input into the selection and design of the jobs and local government plans and implements the work activities.

The Indian Government maintains a wonderful NREGA homePage with a wealth of information available.

The Economist article (November 5, 2009)- Faring well – noted that “India’s grand experiment with public works enjoys a moment in the sun” had some administrative issues but concluded that:

Despite such flaws, the NREGA is winning praise from unexpected quarters. One reason India weathered the financial crisis of the past year was the strength of rural demand, many economists argue, and one reason for that strength was the expansion of the act to every rural district in April 2008. Once dismissed as a reckless fiscal sop, the scheme is now lauded as a timely fiscal stimulus. Because it must accommodate anyone who demands work, it can expand naturally as the need arises.

I am often asked when giving presentations how we should assess public policy. I reply by noting a simple rule of thumb!

Successful policy is not about how rich it makes society in general but how rich it makes the poor! I see richness in broad terms which embrace both economic and social valuations. So it is not just about how much stuff one can command ownership of. Various versions of this rule have been expounded by people over the years.

It is anti-trickle down and all the neo-liberal hype that justified transferring real income and wealth to the top-end-of-town, via deregulation etc and then claiming it would eventually enrich the lower income groups and poor as a result of the increased endeavour at the top that was claimed to engender. A total lie.

The rule of thumb underpins the MGNREGS program. None other than the great Mahatma Gandi wrote in 1948 (one of the last things he wrote) that:

I will give you a talisman. Whenever you are in doubt, or when the self becomes too much with you, apply the following test. Recall the face of the poorest and the weakest man whom you may have seen, and ask yourself, if the step you contemplate is going to be of any use to him. Will he gain anything by it? Will it restore him to a control over his own life and destiny? In other words, will it lead to swaraj (i.e. self-rule/freedom) for the hungry and spiritually starving millions?

Then you will find your doubts and your self melt away.

(Pyarelal Nayyar (1958) Mahatma Gandhi, Last Phase, Vol. II, page 65, published by Navajivan Publishing House, Ahmedabad]

Obviously, these ideas would be expressed in gender neutral language these days. But the principle remains the same. Sophists can come up with a massive number of issues about anything. But they rarely start with the basic principle espoused by Ghandi above.

In answer to those who claim such schemes are unproductive, the MGNREGS:

… provides opportunities for generating productive assets, protecting the environment, empowering rural women, reducing rural-urban migration, fostering social equity and strengthening rural governance through decentralisation and process of transparency and accountability etc.

(see Overview of MGNREGS)

The initial design of the MGNREGS was far from the Job Guarantee ideal. Remember the features of the Job Guarantee are designed to ensure the simultaneous achievement of full employment and price stability and exploit the currency monopoly held by the national government.

The following Table provides a brief comparison of the desirable properties of a buffer stock employment scheme and the MGNREGS.

The MGNREGS is a cut-down version of the Job Guarantee, in the sense, that the latter is unconditional and demand-driven (that is, the government employs at a fixed price up to the last person who seeks work) whereas the MGNREGS is conditional and supply-driven (that is, the government rations the scheme according to some rules – number of jobs, hours of work or some other rationing device).

You can readily appreciate that the underlying MMT which drives the JG conception is missing from the MGNREGS.The scheme does not provide a permanent job offer which means there is no ‘buffer stock’ capacity available in India.

The lack of universality of the programs means that unemployed workers are unable to freely enter and exit the program. As we will see the promise of 100 days work per year was an illusion in the early years of the MGNREGS.

Unlike a true JG policy, the MGNREGS does not operate as a buffer stock of jobs which allows the wage to serve as a price anchor.

A lack of universality is not the only way that the MGNREGS fails to serve the buffer stock role.

In the MGNREGS, sub-national governments, which are revenue-constrained, contribute to the investment outlays of the scheme, which limits its scope to respond to the demand side.

Also, given the wage arrangements (some of the wage can be paid in food) the MGNREGS does not provide a comprehensive nominal price anchor. By paying a minimum wage to all workers, the Job Guarantee creates ‘loose full employment’ – in the sense it places no pressures on the price level in its own right.

It can also be used to discipline the inflation process by redistributing workers to the fixed price sector. There is no such capacity in the MGNREGS.

Finally, MGNREGS provides no training capacity. The ideal Job Guarantee would integrate skills development into the unconditional job offer and thus build dynamic efficiencies into the economy and provide the least-advantaged workers income security but a ladder to move to higher productivity jobs in the future.

Each of the job creation programs in India, South Africa, Argentina provide employment opportunities in labour intensive infrastructure development, social development, and environmental protection. In India, an emphasis is placed on creating assets for say water conservation and then implementing maintenance programs to protect the wealth created.

However, the jobs are typically available in ‘project blocks’, which means that there is little continuity in the employment experience of the participants and means that the scheme is not very effective in offering training and skill development.

A Job Guarantee buffer stock approach would ensure that there was work available on demand, which clearly requires an infrastructure be developed by government to support the policy. Governments must create an inventory of employment opportunities which can be quickly made operational when required.

In many of the job creation schemes under the MGNREGS, the jobs on offer were mostly designed to accommodate women and/or those with disabilities. An effective JG policy would ensure an inclusive range of jobs was to accommodate all workers in need of employment.

On the positive side, the Indian experience suggests that a large-scale direct job creation program can be introduced within a matter of months to provide productive work opportunities and improved the circumstances for its participants.

There was an interesting paper published by the World Bank (March 1, 2012) – Does India’s employment guarantee scheme guarantee employment? – which offers some insights into how the Indian employment guarantee works.

The World Bank research confirms the outcomes of my own work on the Indian scheme that it’s conditionality reduces its effectiveness. Those who gain jobs benefit but there is a shortage of jobs on offer relative to the demand for them. Modern Monetary Theory (MMT) shows that an unconditional, demand-driven employment guarantee, run as an automatic stabiliser, is the most superior buffer stock approach to price stability.

Conditional (supply-driven) approaches not only undermine the job creating potential but also reduce the capacity of the scheme to act as a nominal anchor.

The reality is the Job Guarantee approach is the only guaranteed way that the national government can ensure there are enough jobs available at all times without activating an inflationary spiral. It is a very modest approach given those aims – choosing to work via the automatic stabilisers.

The World Bank article says that in introducing this MGNREGS “India embarked on an ambitious attempt to fight rural poverty.” They consider the ways in which the scheme fights poverty:

1. Direct employment and income guarantee to poor rural areas.

2. Poor people will leave the scheme only when something better arises and non-poor will not seek to access it.

3. The minimum wage becomes binding for all casual work whether in the scheme or not. It thus “can radically alter the bargaining power of poor men and women in the labor market”.

4. It “can help underpin otherwise risky investments” because “(e)ven those who do not normally need such work can benefit from knowing it is available”.

The scheme, despite its shortcomings (see below) has been very successful and millions of jobs have been created and a noticeable dent in poverty has occurred.

Wages paid sometimes exceed the going private sector wage and this has led to complaints from employers who want to pay below what effectively becomes the minimum wage.

Far from being an undesirable characteristic of such schemes, a developing nation gains by using the currency monopoly embedded in the state to force out low productivity, private sector firms and encourage others to invest in more capital to allow them to pay the higher wages.

Maintaining sectors in the private labour market that pay poverty wages is not consistent with a robust development strategy, despite what the IMF and its ilk might claim. It in the interests of any developing economy that higher productivity employment is fostered rather than relying on low-wage, working poor jobs to absorb the unskilled labour force.

In this way, employment guarantee schemes can serve as an industry policy to promote a quickening of this move to a high-wage, high productivity economy by placing pressure on market economy employers through the wage floor it establishes

The labour market dynamics that emerge in this situation are interesting. As the employment guarantee wage becomes the new national minimum, both demand and supply effects would be present. Employers currently paying below the wage would be confronted with the decision of operating that new legal minimum or closing down.

What would happen to the workers who lost their jobs depends on how many employment guarantee jobs were created and the impact of the higher wages on spending and overall job creation. There would also be a dynamic present to restructure existing employment.

If the employment guarantee is universal, that is, scales up into an unconditional wage offer to anyone who wants a jobs (which we recommend) then the supply effects are likely to be significant.

In this latter context, employers paying below the proposed minimum would start to find it difficult to attract labour as the Job Guarantee jobs (being always available, local and better paid) would become far better alternatives to the available labour.

The employers would then be forced to invest in productive capital to increase the productivity of labour and pay at least proposed minimum per month to retain labour.

There may be some cases where a worker would agree to working below that if the job provided them with other non-pecuniary rewards that compensated.

Some private employers would close their operations because they would not be able to operate at the higher costs. Economic development always involves a movement from lower productivity-higher cost production to higher productivity-lower cost production.

The ability of the Job Guarantee to absorb this displaced labour would depend, in turn, on its scale. If there was a universal safety net operating then these closures would shift workers into higher income areas and represent an improvement. That is the rationale of using the Job Guarantee as a quasi-industry policy which can stimulate the local economy towards the desirable high-wage, high productivity growth path.

In the case of the MGNREGS, the World Bank article concluded that the concerns expressed by opponents of the Scheme that the “the wage rate on MGNREGS is being set too high, relative to actual casual labor market wages” were unfounded. In fact, “for India as a whole the two wages are quite close”.

The World Bank article considers this issue in some detail. The authors say:

The idea of an employment guarantee is clearly important to realizing the full benefits of such a scheme. The gains depend heavily on the scheme’s ability to accommodate the supply of work to the demand. That is not going to be easy, given that it requires an open-ended public spending commitment; similarly to an insurance company, the government must pay up when shocks hit. This kind of uncertainty about disbursements in risky environments would be a challenge for any government at any level of economic development.

If the maximum level of spending on the scheme by the center is exogenously fixed for budget planning purposes then rationing may well be unavoidable at any socially acceptable wage rate. Or, to put the point slightly differently, the implied wage rate-given the supply of labor to the scheme and the budget-may be too low to be socially acceptable, with rationing deemed (implicitly) to be the preferred outcome.

They consider a simple model aimed at assessing the performance of MGNREGS “in meeting the demand for work across states”. They note that the administrative data available from the Scheme (available from the link I provided above) shows that “52.865 million households in India demanded work in 2009/10, and 99.4% (52.53 million) were provided work”.

They say the such a claim “demand”” is unlikely to reflect true demand for work because there were administrative disincentives for states to provide a full reckoning of “excess demand” and other processes were likely to reduce the demand for work (ignorance, officials discouraging certain cohorts).

These are well-known problems with the Scheme. For example, the publicly-available data shows that the scheme has failed to reach the 100 days per year per household target consistently.

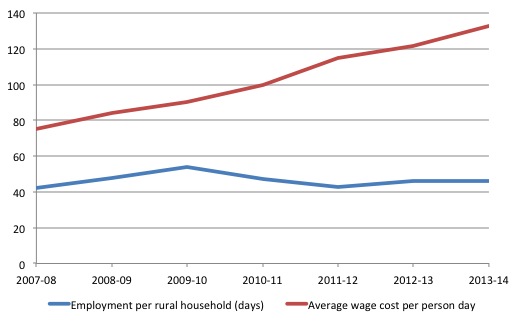

The following graph shows the history of the Scheme in terms of the Employment Per Rural Household (days per year) and the Average wage cost per person-day.

It is clear that even though the average wage was rising (as an anti-poverty measure) the overall benefits to rural households being offset by the declining employment available. One – crore equals 10 million.

The following map gives a glimpse of the performance for the so-called ‘scheduled tribes’ (ST) in terms of the employment days per year. Remember, 100 days is the aim.

Jobs versus cash handouts

The Economist article then makes an interesting point:

Policy wonks argue that cash handouts to the poor would be easier to administer, and would leave the recipients free to work the fields or roll beedis for private employers. But the poor themselves seem surprisingly sceptical of such an idea. “If money comes for free, it will never stay with us,” one elderly farmer says. “The men will drink it.” To wring anything out of India’s calcified bureaucracy takes a fight. If people feel they have earned their money from the government, they become more determined to claim it, even if that means waiting all day outside the village bank.

Mainstream economists always think cash handouts are better way of solving income insecurity because it allows the recipient to choose and it is always assumed that the individual knows best. The problems with this conception are manifest. The most obvious one noted in the quotation above is that individuals do not hunt alone. They tend to have families and have to assume wider responsibilities.

So often more enlightened policy advocates will argue that “in-kind” transfers are better – because at least the children will be fed! The NREGA is a twist on that theme and raises another very important point.

The “in-kind” component is the job. And it works to get “food on the table” instead of “grog down the throat” because people intrinsically value their involvement in productive work. There is a sense of achievement in earning one’s living.

Mainstream economics textbooks have labour-leisure choice models to determine labour supply. Labour is a bad and hence undesirable, leisure is a good. The only way you will engage in a bad is if you are paid. But this extremely blinkered view of the world that mainstream economists have reflects their ignorance of work in other social sciences. Economists have one of the worst records as a discipline in cross-citations of other disciplines. They just think they know everything – and end up knowing nothing much at all.

Other disciplines (sociology and psychology, for example) reveal that work is seen as desirable (rather than a bad) and the value of it extends far beyond the wage earned. That is one the reasons I always advocate creating jobs rather than paying basic income guarantees or other forms of income support

Corruption

Significantly, the lack of universality also exposed the MGNREGS to corruption and helps to explain why it hasn’t created as much work as it was hoped. This was an early criticism of the scheme and the evaluation reports conducted by the Indian Comptroller verified the incidence of significant corruption.

The manifestation of the corruption takes several forms but the major problems have been:

1. Embezzlement of the money allocated to labour-intensive employment projects.

2. Inflating the so-called ‘muster rolls’ (total employees) and the difference is then siphoned off to ‘middlemen’.

3. Giving jobs to preferred people in various relationships with the decision maker, often for favour.

However, a recent report suggests that things are improving as the systems become more sophisticated.

An article in The Hindu (August 23, 2014) – Learning from NREGA – by Jean Drèze, a Belgian who helped design the MGNREGS. His own life story is very interesting, having come from the well known (and well-to-do) academic family (father founded CORE at the Univeristy of Louvain) and having spent a large proportion of his working life helping the poor in India.

Jean Drèze examines the latest audit reports and concludes that:

Corruption in NREGA works has steadily declined in recent years. There are important lessons here that need to be extended to other domains.

He notes that the scheme has learned from the poor practices and significant improvements are now in place.

For example, the “muster rolls were beyond public scrutiny and the crooks had a field day” but now they are displayed on the internet and audited, which has broken down this source of corruption.

He also says that:

A major breakthrough was the transition to bank (or post office) payments of NREGA wages … the new system makes it much harder to embezzle NREGA funds since the money now goes directly to workers’ accounts.

It is true that the banking infrastructure is not yet fully developed and the “village post offices are still vulnerable to capture by powerful middlemen” but there is now “strict norms of identity verification” in place, which cuts down the capacity for embezzlement.

Scammers still operate but then rich, educated citizens are victim the world over of fraudsters, so that is not unique to this Scheme.

Jean Drèze summarises the results of the second India Human Development Survey (IHDS) conducted in 2011-12, which provides evidence about the extent of corruption in the MGNREGS. His calculations (you can follow them in his article if you are interested) suggest that “the bulk of official NREGA wage expenditure is fully reflected in this independent household survey” – that is, they are going into employing people rather than being embezzled.

Other recent surveys (for example, the Public Evaluation of Entitlement Programmes (PEEP) survey) confirmed the IHDS results.

Survey findings

The overall conclusion from these surveys (and another he cites) is that there has been:

… a sharp reduction in the extent of embezzlement of NREGA funds in recent years, at least in the wage component of the programme. However, it is not clear whether this also applies to the material component. Preventing an entrepreneur from submitting an inflated bill for materials is much harder than preventing fake muster roll entries. This problem, of course, is not specific to NREGA – it is endemic in the entire construction sector. This is one reason why the corporate sector loves government-sponsored “infrastructure” projects: there is plenty of scope for padding the costs.

These problems are of-course not restricted to these sorts of schemes or to the public sector. Due diligence is required everywhere to guard against shonky operators.

Jean Drèze confirms that the data shows that “labour-intensive works can be very productive”. He cites the example of “land levelling and contour bunding” and says that:

Even a good earth road is often much better than a pucca road built with sub-standard material by a corrupt contractor.

He considers it an imperative to maintain “the current 60:40 norm for the labour-material ratio in NREGA works” as it reduces the capacity to embezzle and maximises the employment per unit of outlay.

The secret to increasing the productivity of the workforce is “to provide more technical assistance to Gram Panchayats”, which organise the projects.

Conclusion

The critics will always try to get rid of an idea by pointing to practical flaws. If they were really worried about inefficiency and design flaws then they would close the financial sector and the Eurozone down immediately, the costs of their dysfunction being multiples of the inefficiencies in the MGNREGS.

The fact is that a complex scheme that employs millions of people across the vast Indian continent is bound to have administrative issues and these can only be ironed out by improving audit and management systems. The evidence is that these improvements are ongoing.

Jean Drèze says that “Much remains to be done to ensure that NREGA is corruption-proof – not just the wage component but also the material component … In this and other respects, the programme is a great learning tool. This process aspect of NREGA deserves more recognition than it has received so far”.

That is, the lessons learned will improve the governance overall of the Indian nation, which will be of great benefit.

These programs are a work in progress but the gains to the individuals involved are obvious and in terms of doing nothing – well there is an expression n’est ce pas – its a no-brainer.

The short answer is that these experimental and huge schemes expose how foolish nations like Australia are in dealing with poverty and unemployment. They show that the government can be creative and improve peoples lives through public sector job creation.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

My one problem with the JG has always been its ease of access to those who would corrupt it. As someone who has lived in the US south for some time, it’s been pretty obvious to me that a JG program here in particular would almost immediately be converted into some form of slavery, especially one that targeted our Black and Hispanic populations. Interesting to get a look at how this sort of problem is being addressed elsewhere.

Bill,

Great info! thanks you for the update and the links.

Justin

As someone who has lived in the US south for some time, it’s been pretty obvious to me that a JG program here in particular would almost immediately be converted into some form of slavery, especially one that targeted our Black and Hispanic populations.

Very dubious. Is that what happened in earlier programs like the WPA, like pretty full employment even for members of minorities in WWII? A JG will pay money, when a person wants and needs the money. A flood of money into poorer communities, that will create a great deal of secondary, “multiplier” employment. Any JG worth the name will particularly help poor, Black or Hispanic populations in particular, making living standards much more equal, making employment much less like slavery than it is now.

I am in favour of the job guarantee. In the “old” days (late 1960s and early 1970’s actually), the Federal Public Service and the State ones partly functioned as a job guarantee. Most people who could not get a job elsewhere could get a job in the public service. Before that statement is mis-interpreted, let me say that there were many hard working, competent people in the public service. Those who could not get a job elsewhere were often compent too and it was market failures which meant private employment was scarce at times. In addition, some people who would have struggled in private employ (we now might call them “challenged” or “disabled”) but were not very seriously impaired could get a safe, useful niche in the public service which matched their abilities. This is vastly preferrable to throwing many hundreds of thousands of people onto unemployment benefits and disability benefits.

A full, formal job guarantee would work well in Australia. We would certainly have less administration problems than India has with its challenges.

I think we have to ask what are the fears of the rich and the oligarchs? Inflation is one fear but I think the greater fear is of the social and political emancipation of the poorest classes. Demands for fair wages and a more equal society is what the rich fear and they have and will always work very actively against such progress.

Beyond the job guarantee question, we have to look at the ownership of the means of production and indeed the corporate law and ownership systems and customs of our society. Why is it that ownership of money capital is so concentrated and confers such power? Why has the excess reification of money been permitted to the point that the money of the rich becomes more important than the lives of the poor?

I am not Catholic nor even religious but I applaud the Evangelii Gaudium of Pope Francis. Chapter 2 (I) has sub-section headings like;

– No to an economy of exclusion [53-54]

– No to the new idolatry of money [55-56]

– No to a financial system which rules rather than serves [57-58]

– No to the inequality which spawns violence [59-60]

These are statements that should be in our Consitution.

@SomeGuy ~ And yet that is exactly my point. The South has been historically poorer simply because they do not have an inclusive labor market (which lowers aggregate demand). Why would we believe that the people who created the South’s discriminatory labor environment would, upon being presented with a JG, do anything different. How would the JG suddenly make these people more beneficent, when they had never over the previous 400 years shown any tendency to be so?

Benedict – Erm… because the US now has a Federal Government and could run Federal programs.

Doesn’t the Army already offer a job guarantee?