At the moment, the UK Chancellor is getting headlines with her tough talk on government…

Options for Europe – Part 77

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Part III – Options for Europe

Chapter 23 Abandon the Euro Costs, threats and opportunities

[PREVIOUS MATERIAL HERE]

[BY WAY OF EXPLANATION – I AM WRITING SECTIONS OF THIS CHAPTER AS I GET INFORMATION SORTED IN A COHERENT WAY – IN THE FINAL DRAFT – THE SECTIONS MIGHT BE ARRANGED IN A DIFFERENT ORDER TO WHAT WILL APPEAR HERE OVER THE NEXT FEW DAYS. I WROTE MUCH MORE TODAY THAN APPEARS BELOW – BUT THE TEXT BELONGS IN SEVERAL SUB-SECTIONS AND SO I THOUGHT IT WOULD BE LESS DISJOINTED FOR THOSE THAT ENJOY FOLLOWING THE UNFOLDING STORY IF I JUST KEPT WHOLE SUB-SECTIONS TOGETHER.]

[NEW MATERIAL TODAY]

1. Issuing the new currency

By exercising the sovereignty embodied in its own constitution, the exiting nation would reintroduce its own currency and immediately make it the unit in which all tax and other contractual obligations within the nation would be recognised. The strategic operations that would accompany this reissuance do not really concern us. Clearly, a covert operation involving a weekend and the announcement of a bank holiday and the imposition of captial controls for a period would be involved. The announcement would then come into effect on the first business day of the new week.

The newly stated tax obligation would pass down to all levels levels of government. The imposition of taxes obligations in the new currency immediately creates a demand for it from all local residents and firms. Whether they use a foreign currency (such as the euro) for other transactions, they know they have to acquire the new currency to remain within the law in the exiting country.

The actual practicalities of creating the new currency (minting coins and printing bank notes) would involve minimal changes because under the current system, the national central banks are already responsible for this function. All the euro Member States already produce large quantities of euro currency. With sufficient forward planning, the new currency tokens could be issued on the first day of the new system. Scott (2012: 19) suggests that because the existing euro notes and coins have “the unique national identifying marks” or other identifiable symbolism, the urgency to introduce new distinctive tokens would be reduced. However, the logistics of introducing the new tokens are relatively trivial and that would be the preferable way forward to avoid confusion and the need to physically stamp the existing currency “with an identifying mark” (Scott, 2012: 19).

The more significant issue is to decide at what parity the new currency will be introduced at relative to the euro and other currencies. The benefit-cost ratio of exiting the eurozone would be increased if the losses embodied in the process of redemonination and subsequent (expected) depreciation were also minimised. The preferred option is to fully float but some analysts suggest that the nation should immediately arrange a peg to the euro, which would involve participating in the Mark II version of the Exchange Rate Mechanism (ERM II). Proponents of this option argue that the decision to peg would reduce the capital outflow and provide a way of “coordinating its economic policy with other E.U. Member States” (Scott, 2012: 35). Accordingly, the national central bank would be expected to intervene in the foreign exchange market if the new currency was in danger of breaching the agreed upper or lower bands within which the currency was allowed to fluctuate. We have traversed the problems of this type of arrangement in the earlier chapters. Effectively, the central bank would lose control of its monetary policy discretion and the interest rate would be dictated by the ECB policy rate. Further, history tells us that the currency would become hostage to financial market speculators and this volatility would be beyond the scope of the central bank to control given it would soon run out of foreign reserves. Sure enough, in theory, the ECB could provide an “unlimited swap line” (Scott, 2012: 38) to allow the national central bank to maintain the fixed exchange rate, but that would be resisted by the Bundesbank among others because it would mean an expansion of euro currency stocks and increase the fear of inflation. This likelihood was exactly the reason the Bundesbank refused to operate in a symmetric manner during the Snake and the first iteration of the ERM in the 1980s to help weaker currencies avoid devaluation.

While the depreciation that followed the launch of the new currency would, initially be significant, the scaremongering that it would be bottomless, leading to hyperinflation is unfounded. We can be guided, in part, by what happened to the Argentinean peso in the years after the Argentinean government floated the peso after its crisis in 2001. In April 1991, Argentina adopted a rigid peg of the peso to the dollar and guaranteed convertibility under this arrangement. That is, the central bank stood by to convert pesos into dollars at the pegged parity. This decision was totally unsuited to the reality of Argentina’s trade and production structure relative to the US. In the same way that most of the EMU countries do not share anything like the characteristics that would suggest an optimal currency area, Argentina never looked like it could be a member of an optimal US-dollar area. Argentina regularly faced quite different external pressures compared to those that the US economy had to deal with. The US predominantly traded with countries whose own currencies fluctuated in line with the US dollar. Given the relative closed nature and large size of its non-traded goods sector, the US economy could thus benefit from nominal exchange rate swings and use them to balance the relative price of tradables and non-tradables.

Argentina was a very open economy with a small non-tradables domestic sector. So the Argentine economy had to take the brunt of swings in the terms of trade (export prices relative to import prices), which made domestic policy management very difficult.

Convertibility was also the idea of the major international organisations such as the IMF as a way of disciplining domestic policy. While Argentina had suffered from high inflation in the 1970s and 1980s, the correct solution was not to impose a peg with the US dollar because the arrangement unnecessarily constrained both monetary and fiscal policy. The Argentine central bank could only issue pesos if they were backed by their holdings of US dollars (with a tiny, meaningless tolerance range allowed). So US dollars had to be earned through net exports which would then allow the domestic policy to expand.

After the peg was introduced, the neo-liberals made matters worse with wide-scale privatisation programs, harsh cuts to social security, and deregulation of the financial sector, the latter which burdened the economy with massive amounts of foreign-currency denominated debt.

Things started to come unstuck in the late 1990s as export markets started to decline and the peso became seriously over-valued (as the US dollar strengthened) with subsequent loss of Argentinean competitiveness in the export markets. Lumbered with so much foreign-currency sovereign debt the decline in the real exchange rate (competitiveness) was lethal and the domestic economy in the late 1990s was mired in recession and high unemployment. The unemployment rate was around 16 per cent in 1999. The bond markets then introduced the ‘Greek scenario’. The bond traders realised the nation would become insolvent as exports collapsed and the capacity to generate US dollars fell, and as a result require ever increasing interest returns (yields) on any sovereign debt that was issued. In 2000, under direct orders from the IMF (with the threat of refusal to maintain financial assistance), the Argentinean government tried to appease the bond markets by implementing a harsh program of fiscal austerity (mainly through tax increases), which impacted negatively an already decimated domestic economy. The government believed the rhetoric from the IMF and others that this would reinvigorate capital inflow and ease the external imbalance. But at the time it was obvious that it was only a matter of time before the convertibility system would collapse. The Banco Central de la Republica Argentina (BCRA) couldn’t hold back the flood waters indefinitely.

In December 2000, an IMF bailout package was negotiated but further austerity was imposed but there was no observed increase in net capital inflow. Why would anyone want to invest in a place mired in recession and unlikely to be able to pay back loans in US dollars anyway? The resonance with the Greek tragedy and that of other crisis-ridden EMU nations in the current period is powerful. That was also an obvious prediction but one which was ignored by the IMF forecasting modelling. Just as in the current crisis the IMF’s modelling has proven to be destructively ignorant of reality, the same situation was applicable in the case of Argentina. The IMF also pushed the Argentinean government into announcing that it would maintain the peg against the US dollar, but also extend it to the euro once the two achieved parity. This meant that it was guaranteeing convertibility in both major world currencies – an impossibility given its export volatility. Pure neo-liberal dogma was thus exacerbating the crisis that it created in the first place.

Economic growth continued to decline and the foreign debts piled up. In April 2001, the Argentinean government forced local banks to buy government bonds (they changed prudential regulation rules to allow them to use the bonds to satisfy liquidity rules), which further exposed the local banks to the foreign-debt problem. The bank run started in late 2001 – with the oil bank deposits being the first. This led to the freeze on cash withdrawals in December 2001 and the collapse of the payments system. The riots in December 2001 brought hometo the Government the folly of their strategy. In early 2002, they defaulted on all government debt and abandoned the peg and associated institutional arrangements (known as the ‘currency board’). All US dollar-denominated financial contracts were compulsorily converted into peso-denominated contracts and terms renegotiated with respect to maturities of the liabilities (short-term were pushing into longer-term commitments).

This default was been largely successful. Initially, Foreign Direct Investment (FDI) dried up completely when the default was announced. However, the Argentinean government could not service the debt as its foreign currency reserves were gone, and, additionally realised, to their credit, that borrowing from the International Monetary Fund (IMF) would have required an austerity package that would have precipitated revolution. As it was riots broke out as citizens struggled to feed their children. Despite stringent criticism from the World’s financial power brokers (including the IMF), the Argentine government refused to back down and in 2005 completed a deal whereby around 75 per cent of the defaulted bonds were swapped for others of much lower value with longer maturities.

The crisis was engendered by faulty (neo-liberal policy) in the 1990s – the peg and convertibility. What happened after the nation abandoned the peg and restored full currency sovereignty? Once Argentina abandoned the fixed exchange rate and convertibility arrangements, its exchange rate was no longer tied to the dollar’s performance; its fiscal policy was no longer held hostage to the quantity of dollars the government could accumulate; and its domestic interest rate came under control of its central bank. At the time of the 2001 crisis, the government realised it had to adopt a domestically-oriented growth strategy. One of the first policy initiatives taken by newly elected President Kirchner was a massive job creation program that guaranteed employment for poor heads of households. Within four months, the Plan Jefes y Jefas de Hogar (Head of Households Plan) had created jobs for 2 million participants which was around 13 per cent of the labour force. This not only helped to quell social unrest by providing income to Argentina’s poorest families, but it also put the economy on the road to recovery. Conservative estimates of the multiplier effect of the increased spending by Jefes workers are that it added a boost of more than 2.5 per cent of GDP. In addition, the program provided needed services and new public infrastructure that encouraged additional private sector spending. Without the flexibility provided by a sovereign, floating, currency, the government would not have been able to promise such a job guarantee.

Argentina demonstrated something that the World’s financial masters didn’t want anyone to know about. That a country with huge foreign debt obligations can default successfully and enjoy renewed fortune based on domestic employment growth strategies and more inclusive welfare policies without an IMF austerity program being needed. The clear lesson is that sovereign governments are not necessarily at the hostage of global financial markets. They can steer a strong recovery path based on domestically-orientated policies – such as the introduction of a Job Guarantee, which directly benefit the population by insulating the most disadvantaged workers from the devastation that recession brings.

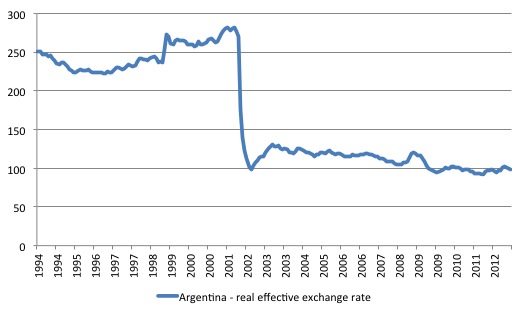

The following graph shows the so-called real effective exchange rate (REER) for Argentina from January 1994 to October 2012. The REER is a measure of international competitiveness and takes into account both movements in the nominal exchange rate on world markets and relative inflation rates. A falling REER indicates a substantial increase in competitiveness relative to the nation’s trading partners. The REER for Argentina peaked in October 2001, just before the crisis really began and by January 2002 it had fallen to 62.1 (indexed at 100 as at October 2001). The low point came in June 2002 (index number was 34.8), after which it rose and stabilised around 45. Almost all of the change in the REER was due to the depreciation of the peso once the government floated it and abandoned the peg. The peso certainly depreciated significantly in a short time span, but there was a massive boost to international competitiveness as the bonus.

Figure 23.2 Real effective exchange rate, Argentina, January 1994 to October 2012

Source: Bank of International Settlements.

The nominal depreciation created a major change in the fortunes of the traded-goods sector of the economy. Argentine exports became much cheaper and demand for them in world markets grew rapidly at the same time as spending on imports fell because of the rise in prices in the newly restored local currency. It also turned out that the rise in China helped Argentina via soya bean exports which helped stabilise the currency. In general agriculture started booming. The Government also sought to take advantage of the massive shift in the terms of trade by providing incentives for import substitution. The tourism industry also grew rapidly as a result of the currency depreciation.

Before too long, the peso started appreciating again but by then the economy was on a solid growth footing with strong social welfare spending to maintain domestically-sourced growth and a booming export sector. In the mid-2000s the Government actually had to take measures to stop the peso appreciating further given the size of its trade surplus. The central bank acquired huge stockpiles of foreign reserves (USDs mainly) by selling pesos in the foreign exchange market. The exchange rate is now relative stable at the higher value.

Is any of that experience applicable to Greece? Of-course it is. Greece would suffer the same short-term collapse in its currency value once it was traded on foreign exchange markets. The claims that nobody would want the peso once it depreciated were proven to be false. It is clear that people still wanted to buy the Argentinean currency on foreign exchange markets even with the massive default and the plunging value (Banco Central de la Republica Argentina, 2007). By 2007, international buyers of the depreciating currency were many. After the peg was abandoned and exchange rate liberated, the data shows that current account deficit of the nation moved quickly into surplus as a result of the dramatic improvements in international competitiveness (Banco Central de la Republica Argentina (2007: 6). Further, after nearly running out of US dollar reserves in 2002, the BCRA was had quadrupled their holdings by early 2007. (p.7). Where did they get these dollars from? Between 2003 and 2007, the foreign exchange market transactions (measured in US dollars) rose from 22.3 billion to around 64.5 billion. The total traded volume was very healthy and mostly involved transactions between local private banks and foreign banks (pp.4-5). The evidence that emerged as the nation started to grow again and reorganise itself as a fully sovereign nation was not remotely like that predicted by the scaremongers as Argentina defaulted and abandoned the peg.

It is true that the nations such as Greece do not have large quantities of natural resources like Argentina did when it defaulted and floated in 2001-02 but it is equally untrue to say they have no desirable assets that are exchange rate sensitive. Of importance is that Argentina created new export capacity given the shift in its competitiveness. Nations such as Greece could also do the same. And just like Argentina, the positive change in the current account would put a floor into the downward spiral of the new currency. Further, in the same way that Argentina had to bear a major inflation impulse as its currency depreciated, which eroded real living standards, the reversal in standards was just as swift as the currency appreciated again on the back of renewed growth. Greece would experience the same dynamic as the Germans flooded into the sunny Greek islands to escape the Berlin winter and enjoy the dramatically cheaper vacations.

[CONTINUE TOMORROW – OUTLINING ALL THE STEPS AND ISSUES INVOLVED IN A UNILATERAL EXIT]

Additional references

This list will be progressively compiled.

Athanassiou, P. (2009) ‘Withdrawal and Expulsion from the EU and EMU: Some Reflections’, Legal Working Paper Series, European Central Bank, No 10, December. www.ecb.int/pub/pdf/scplps/ecblwp10.pdf

Banco Central de la Republica Argentina (2007) ‘Single Free Exchange Market (MULC) Transactions and the Foreign Exchange Balance in the First Quarter of 2007’. www.bcra.gov.ar/pdfs/estadistica/MULC1trim07i.pdf

Bundesverfassungsgericht (2009) ‘Entscheidungen: Lissabon-Urteil’, 2 BvE 2/08 vom 30.6.2009. http://www.bverfg.de/entscheidungen/es20090630_2bve000208.html

ECB (2014) ‘Capital Subscription’, https://www.ecb.europa.eu/ecb/orga/capital/html/index.en.html, Accessed May 1, 2014.

European Commission (2010) ‘Consolidated versions of the Treaty on European Union and the Treaty on the Functioning of

the European Union ‘, Official Journal of the European Union, C83, 30.3.10.

MacCormick, N. (1999) Questioning Sovereignty, Oxford, Oxford University Press.

Policy Exchange (2012) ‘Wolfson Economics Prize 2012’. http://www.policyexchange.org.uk/component/zoo/item/wolfson-economics-prize-2012

Reuters (2005) ‘Italy minister says should study leaving euro-paper’, June 3, 2005.

Scheller, H.K. (2004) ‘The European Central Bank – History, Role and Functions’, European Central Bank, Franfurt. https://www.ecb.europa.eu/pub/pdf/other/ecbhistoryrolefunctions2004en.pdf

Thieffry, G. (2005) ‘The not so unthinkable – the break-up of the European Monetary Union’, International Financial Law Review, July. http://www.iflr.com/Article/1978253/Not-so-unthinkablethe-break-up-of-European-monetary-union.html

Voßkuhle, A. (2012) ‘Über die Demokratie in Europa’, Speech to Rhur Political Forum, Dortmund Concerthall, February 6, 2012 published in Aus Politik und Zeitgeschichte (APuZ), 13/2012, Bundeszentrale für politische Bildung, 3-9.

Wetzel, D. (2001) A Duel of Giants: Bismarck, Napoleon III, and the Origins of the Franco-Prussian War, Madison, The University of Wisconsin Press.

Wolf, M. (2013) ‘Why the euro crisis is not yet over’, Financial Times, February 19, 2013. http://www.ft.com/intl/cms/s/0/74acaf5c-79f2-11e2-9dad-00144feabdc0.html#axzz30L8DwwS0

Wolf, M. (2014) ‘Managing a Bad Monetary Marriage’, paper presented to iNET Conference, Toronto, Canada, April 2014.

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Hurry up and finish this book , Bill. 🙂

There is such a lot of nonsense being talked and written about the Aussie economy right now in the pre-budget period. We need you back!

Tony Shepherds record while he was in charge at Transfield is all the evidence we need. Through his genius Transfield went from a $96.4m net profit to a $254.4m loss within only a year.

Wonderful Australian and clearly in a league of his own with respect to matters of finance.

Dear petermartin2001 (at 2014/05/02 at 23:03)

I am sorry to disappoint. I am actually relieved I have this book to finish as cover given the obscene playacting that is going on under the guise of the Commission of Audit and related followup. The class war is on in earnest. I guess I will get back to it in a few weeks when the book is finished.

best wishes

bill

Now that we are talking about new currencies, there is historical opportunity to establish one without goverment bonds, so that it would be clear to everybody that goverment that issues its own currency does not face spending constraints.

I think that would be truly a game-changing event. Otherwise, austerity mania could continue even with new currencies.