It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Case Study – British IMF loan 1976 – Part 2

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013 (to be ready in draft form for second semester teaching). Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

Previous parts:

Case Study – The British IMF loan in 1976

[CONTINUING]

The definitive historical chronicle of the IMF between 1945 and 1965 is provided by the three-volume hardback publication – The International Monetary Fund, 1945-1965: Twenty Years of International Monetary Cooperation.

The Purposes of the IMF are outlined in Article 1 of the – Articles of Agreement of the International Monetary Fund – which were adopted at the United Nations Monetary and Financial Conference, Bretton Woods, New Hampshire, July 22, 1944 and became enforced from December 27, 1945.

Article I outlines a number of purposes including “To promote exchange stability, to maintain orderly exchange arrangements among members, and to avoid competitive exchange depreciation” and (Section (v)):

… to give confidence to members by making the general resources of the Fund temporarily available to them under adequate safeguards, thus providing them with opportunity to correct maladjustments in their balance of payments without resorting to measures destructive of national or international prosperity.

Before the growth of the financial services sector and the massive mobilisation of international capital in the 1970s and beyond, the IMF was a major source of finance for governments seeking funds to support their exchange rates under the Bretton Woods agreement.

During this period, the IMF primarily made advances to industrial countries to provide them with the means to address “short-term trade fluctuations” which threatened their capacity to maintain a stable currency value as per the Bretton Woods agreement (see Lending by the IMF).

With the collapse of the Bretton Woods system in 1971, advanced nations have been able to access capital on international capital markets and the target of IMF lending has shifted to “lower- and lower-middle-income countries” including transition nations as the Soviet system collapsed.

Article V (Section 2a) of the IMF Articles of Agreement define the limitations on the IMFs capacity to provide funding assistance:

Except as otherwise provided in this Agreement, transactions on the account of the Fund shall be limited to transactions for the purpose of supplying a member, on the initiative of such member, with special drawing rights or the currencies of other members from the general resources of the Fund, which shall be held in the General Resources Account, in exchange for the currency of the member desiring to make the purchase.

First, assistance is not properly conceived of as being a “loan”. Nation seeking assistance agreed to buy “special drawing rights or the currencies of other members” from the IMF using their own currency.

A – Special Drawing Right (SDR) is:

… an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves … The SDR is neither a currency, nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. Holders of SDRs can obtain these currencies in exchange for their SDRs in two ways: first, through the arrangement of voluntary exchanges between members; and second, by the IMF designating members with strong external positions to purchase SDRs from members with weak external positions.

Initially, the SDRs were valued in terms of the amount of gold that would exchange under the convertible currency system for one US dollar. When the Bretton Woods system collapsed, the SDRs lost relevance but were valued in terms of a basket of currencies (euro, US dollar, yen and pound sterling).

During the last years of the Bretton Woods system, the SDRs were introduced to help member nations maintain a stable exchange rate. Each nation needed stocks of official reserves (either foreign currencies or gold) which they could use to buy its own currency in foreign exchange markets at times when there was downward pressure on their exchange rate.

By the late 1960s, the IMF determined that there wasn’t enough gold or US dollars in circulation to allow governments to maintain exchange rate stability as international trade and financial capital flows expanded dramatically.

As a result, the IMF introduced SDRs as a new international reserve currency. The funding arrangements between the IMF and the member-states were thus exchanges of currencies rather than loans in the normal meaning of the term.

Second, the nation has to agree to repurchase its own currency back under the terms of funding agreement.

Third, the IMF is deemed a passive player. The member-nation seeking assistance had to approach the IMF and make a case for the funding.

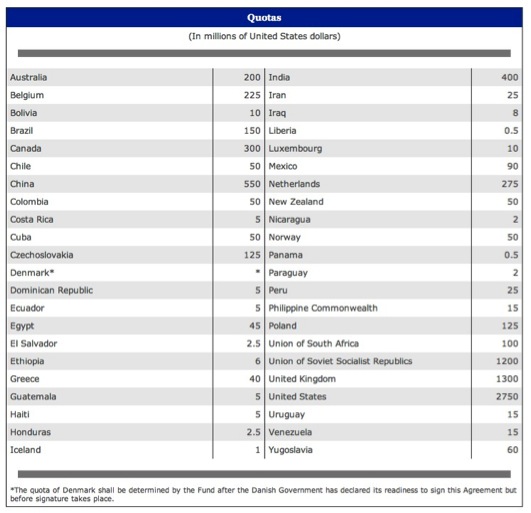

Article III Quotas and Subscriptions of the IMF Articles of Agreement define the funding responsibilities of the member states to the IMF and the extent to which they can draw on the IMF for financial assistance.

A system of Quotas was established and defined how much each nation would have to contribute. These quotas were adjusted from time to time.

The agreed quotas were specified in Schedule A of the Articles of Agreement and are reproduced in the following Table.

Within a given year, each nation could draw up to 25 per cent of its quota and there was a cumulative limit of 100 per cent of the quota. This limit has changed over time.

The IMF thus agreed to fund current account deficits for a time but only within limits that were designed to reflect a nation’s capacity to repay the reserves advanced.

The IMF also progressively imposed so-called “conditionality” on the use of drawings by member-states. Prior to the 1970s, the conditionality was designed to correct chronic balance of payments disequilibria. Since that time, the conditionality has reflected a much more explicit ideological perspective, which eschews government regulations, public enterprise and broad-based public social welfare provision.

The conditionality was scaled by four so-called credit tranches each defined in terms of the quota. The first credit tranche, which was equivalent to 25 per cent of the member-nation’s quota were relatively unconditional. The next three “upper” credit tranches were subjected to increasingly stringent assessments and conditionality.

While there are many different funding programs that the IMF has offered by way of assistance, and these have evolved over time, the so-called – Stand-By Arrangements (SBA) – which were established in June 1952, have been the IMFs main funding instrument for nations that call upon it for assistance.

The SBA advance funds at rates that are typically “lower than what countries would pay to raise financing from private markets” and usually are in operation for periods of 12-24 months. They are intended to address short-term balance of payments issues.

The IMF would require these governments to demonstrate that their economic policy stances were consistent with a stable currency. This typically translated into a policy of domestic deflation for a country with an external deficit.

The 1976 request by the British government for an IMF Standby-Arrangement has been constructed as a recognition by a desperate government that it had to tailor domestic policies to meet the constraints imposed on it by international capital markets.

However, the reality is that the British government had drawn on such arrangements several times in the preceding two decades. Prior to the increased focus on conditionality, Britain borrowed in both 1948 and 1949.

The British government had previously sought access to the arrangements in 1956, 1961, 1962, 1967 (associated with the subsequent devaluation) and 1974-75.

[MORE DISCUSSION HERE NEXT WEEK]

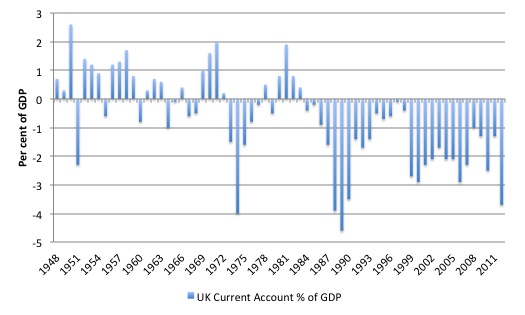

Figure 1 shows the Current Account balance as a per cent of GDP for Britain from 1948 to 2012.

[MORE HERE NEXT WEEK ON THESE DATA]

Figure 1 UK Current Account % of GDP

Source: UK Office of National Statistics – Balance of Payments Dataset

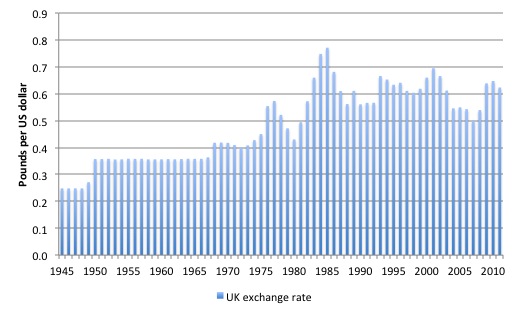

Figure 2 shows the evolution of the Sterling exchange rate against the US dollar from 1945 to 2011.

[MORE HERE NEXT WEEK ON THESE DATA]

Figure 2 UK Exchange Rate, 1945-2011

Source: Lawrence H. Officer, “Exchange Rates Between the United States Dollar and Forty-one Currencies,”, MeasuringWorth, 2013, http://www.measuringworth.com/exchangeglobal/

[TO BE CONTINUED]

Conclusion

NEXT WEEK WE WILL CONSIDER THE LEAD UP TO 1976.

THIS WILL PLACE THE BRITISH REQUEST TO THE IMF IN ITS CORRECT CONTEXT.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill,

Are the axes on that last chart labelled correctly? Shouldn’t it be US dollars per £ rather than £ per $?

Thanks for doing a case study on this topic. I hope there will be a discussion about how the British government could have handled the situtation if they had understood the monetary system from an MMT perspective.

Minor point, the link for Case Study – British IMF loan 1976 – Part 1 – takes you back to the same page. I think it should be https://billmitchell.org/blog/?p=24221

“The graph shows how many pounds each US dollar could purchase.”

Is this correct? This would mean that in 2010 each US dollar could purchase 1.5 pounds. More likely the other way around.

Oh, and the link in Part I is wrong. It links to Part II.

Dear Ben and Philip

The graph now shows the price of a US dollar in Pounds Sterling. Previously it showed the reciprocal of that. So at present you need around 0.65 pence to purchase one US dollar.

best wishes

bill