I started my undergraduate studies in economics in the late 1970s after starting out as…

A sad place – a $58 billion deficit and soaring unemployment!

I must have just woken from a bad dream. Did I read this week that the Australian Government will record a deficit of $A58 billion or 4.9 per cent of GDP but are forecasting unemployment will rise from its present parlous level of 5.4 per cent to 8.5 per cent by the middle of 2012? It must be a joke. If it is serious then this lot deserve to be a one-term government not that I have any hope that the alternative (conservative or green) would do any better. They are all caught up in this neo-liberal straitjacket which has been increasingly tightened over the last 30 years and now ensures that our national government will not use its economic policy capacity responsibly. Our current Federal Government not only continues to abandon full employment but is also abandoning the unemployed. What a place!

Many readers of my academic work and this blog write to me and ask me whether it is true that I don’t care about deficits. I must be a bad communicator because this is not at all what I write or think. What I think is stupid is to concentrate on a target figure (say $58 billion) and then concluding that it is high or low or a record or some other terminology to assess its scale independent of what really matters. What really matters is how the deficit enhances the capacity of the economy to generate sufficient employment – sufficient being defined in terms of the desire for work by the available labour force. That is what matters.

The budget deficit is then a means to achieve that high level of employment and should be whatever it takes to get it.

But then there is also a notion of the quality of the net spending. Clearly, the Great Depression was finally wiped out when the world armed to prosecute the Second World War. All the madcap neo-classical remedies (that are now the neo-liberal mainstream – by the way!) were tried and failed. It was only the large net spending by government tooling up for war that closed the spending gap and re-established high employment levels. After the war, governments sat around and thought about how they might achieve the same full employment outcomes in the peace time. Easy. They used fiscal policy (continued to generate deficits) to build their nations – public infrastructure, strong public education and health programs and the rest of it.

Some would say that stimulating an economy to produce tanks and guns is not as good an outcome as building schools and hospitals. I would agree. So the composition of the Budget also matters a lot.

So could we do better in the 12 months ahead given that the Government is projecting a spiralling of unemployment even though they are planning to run a deficit of $58 billion? The answer is clearly – we could do much better.

Could we actually have a lower deficit and achieve better outcomes? Probably. That is what this blog is about.

The elephant in this year’s Budget was unemployment! The single most significant cause of poverty and other social pathologies. The biggest waste of potential income (output) – the daily losses from unemployment dwarf any of the so-called “microeconomic” losses that have been the focus of attention over the last 20 years. These sort of costs (the “inefficiencies in resource allocation”) are minor compared to how much we forgo through unemployment. More about soon.

But the Budget all but ignored the unemployment problem and conceded that by the middle of 2012 there would be and unemployment rate of 8.5 per cent. Given usual labour force growth between now and then I estimate that 1,009 thousand will be unemployed if we have 8.5 per cent. That is over a million!

But the GDP growth forecasts built into the Budget are overly optimistic and so I expect the unemployment rate to go higher. Especially, as there is still more bad news to come from the US as the CDOs associated with student loan debt, car loans, and commercial real estate are yet to really start impacting. These will unwind and further damage the banks in the coming year.

So we can conclude that if all the forecasts are correct the Government is choosing as part of its policy targets and aspirations for this country to have more than 1 million Australians without work.

I have written about this before but I just finished a three year study designed to assess unmet community need around Australia and estimate how much the Federal Government would actually have to invest to wipe out unemployment via a Job Guarantee.

In the major report Creating effective local labour markets: a new framework for regional employment that CofFEE released (in partnership with Jobs Australia) in December 2008 as a result of this study, we estimated that to achieve a full employment level (consistent with 2 per cent official unemployment, no hidden unemployment and no time-related underemployment), an extra 559.2 thousand full-time equivalent jobs would have been required in May 2008. The figure will be higher now and increasing by the week.

In addition the research that underpinned the report conducted a national survey of local governments in Australia. We identified hundreds of thousands of jobs that would be suitable for low-skill workers in areas such as community development and environmental care services. There is enormous unmet need for public works across regional Australia.

The report also proposes a role for the state in direct skill formation through a National Skills Development (NSD) framework which we consider could be integrated into the Job Guarantee.

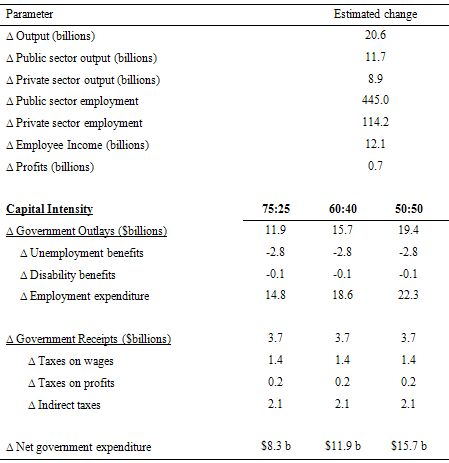

The following table is taken from our Report (Table 14.5).

First, the little triangle symbol before the entries is shorthand for change. To further understand the numbers, the $8.3 billion is a net figure. The employment of Job Guarantee workers gives rise to increased disposable income and increased consumption demand which leads to additional private sector output, employment and income, which in turn leads to further increases in consumption demand, as is depicted by the multiplier process. Thus the increase of employment of 559.2 thousand is made up of both Job Guarantee (~80 per cent) and private sector employment (~20 per cent).

We compared this to a generalised expansion where the Government pump-primed the economy to get the private market to generate the extra work. That would require higher outlays and much higher growth rates which we consider to be less inviting than the Job Guarantee route which allows the Government to target public goods-type output. There are also savings on government outlays, because nearly 80 per cent of the additional jobs are paid at the minimum wage under the Job Guarantee.

The change in employment outlays represents the wage and non-wage costs of employing the Job Guarantee workers. In the low capital intensity scenario, the net additional expenditures by government total $8.3b (per annum). The shift to medium or high capital intensity Job Guarantee jobs merely increases Job Guarantee employment expenditure by government to $18.6b and $22.3b, respectively which leaves net additional expenditures of $11.9b and $15.7b, respectively. We estimated that all of the jobs could easily be offered at the low capital intensity option and there would still be unmet community and environmental needs across regional Australia.

Can we afford this? Well we are net spending $58 billion in the year ahead. So all those old arguments have been made redundant by the scale of this crisis.

But we should note that what we are really asking is whether there are sufficient real resources to underpin the programme. The nominal outlay shown in the budget statement is an accounting entry and does not necessarily reflect the real resource investment.

In terms of fiscal policy, there are only real resource restrictions on its capacity to increase spending and hence output and employment. If there are slack resources available to purchase then a fiscal stimulus has the capacity to ensure they are fully employed. Further, in a Job Guarantee scheme, the government spending to fund the Job Guarantee wage would not be at market prices because by definition there is no market bid for the workers in question. The real resource costs would be the extra food, clothing and transport resources that the Job Guarantee workers might consume, given that they now earn the minimum hourly wage, rather than receiving unemployment benefit, the disability support pension or no income at all.

Given that the minimum wage should be aligned with community expectations of what constitutes a reasonable standard of living, the extra resources that the Job Guarantee workers would consume could not be considered excessive. If there are overall real resource constraints imposed by the consumption of extra resources by Job Guarantee workers, then we advocate making these resources available by redistributing from other workers. However, it is unlikely that this latter situation would be the norm.

So the question is why does the Government ignore evidence-based solutions to the worst social problem there is? Why are they net spending $58 billion in the year ahead and allowing unemployment to rise when they could reduce that net spending considerably and wipe out unemployment at the same time?

Others are questioning the lack of focus on unemployment now. In today’s Melbourne Age, Josh Gordon writes that Labor makes it worse for the unemployed. This is one of the few articles that is perceptive enough to pick up on the wastage that our Government’s discretionary policies are causing. Gordon says:

These are darker days. The financial carnage inflicted by the global economic crisis is more worthy of a bad 1980s horror flick. There has been a $210 billion downward revision in tax revenues. The budget is in deficit by a record amount and net public debt is expected to leap to $188 billion by 2012 … Worse, the unemployment rate is expected to hit 8.5 per cent towards the middle of 2012. That implies the ranks of the unemployed will swell to 1 million – more than the recession of the early 1990s. Put another way, in the coming months close to 370,000 people are expected to be thrown out of work. Beneath the big numbers will lie thousands of miseries: families destroyed, savings lost, homes taken away, dignity gone.

He quotes the Treasurer Wayne Swan who responded to questions about the rising unemployment …

[it goes] … to the very core of why I’m in politics … Nothing entrenches disadvantage more than prolonged, high unemployment.

We can agree on that. But it makes it all the more puzzling why they are ignoring the direct job creation option.

But it gets worse. While the Government refuses to encounter direct public sector job creation it is forcing the rising number of unemployed to live on below poverty line incomes.

Why is it okay for the aged pensioner to require a $32 per week increase (single) which takes them to $335 per week but not the unemployed? The answer is it is politics! Swan prefers to play politics than to address what he calls his core calling! A single unemployed person gets $227 per week or $32.50 per day. As Josh Gordon says:

The standard answer to such charges is that the comparison is not valid, because Newstart is intended as a short-term payment, while the pension is designed to provide permanent income support.

This used to be the case when we had true full employment but this is the age of long-term unemployment (spells of unemployment longer than one year). In the full employment, long-term unemployment was defined as spells of unemployment greater than 12 weeks. They change the data definitions to suit the political reality.

So what can you get for $32.50 a day? My cup of tea cost $4 this morning at a little cafe I went to after a long bike ride. The newspaper was delivered for around $1.30. The bits and pieces at the hardware added up to $12 odd. Some petrol in the car – probably $3 worth. And I haven’t started to eat or pay electricity or this broadband connection or my housing costs or the rest of it.

The unemployment benefit is now below the poverty line in Australia. The Australia Fair: International Comparisons 2007 report reported that research estimated the poverty line for a single person to be $249 in 2004. If we adjust that for inflation (crudely just scaling it up) we would get around $285 per week.

So the Government not only fails to act responsibly by creating enough jobs to satisfy the available workforce but then it forces them to live below the poverty line even though it is not revenue-constrained and could easily pay them the same income support as the aged pensioners.

Employment Minister Julia Gillard appeared on ABC2 TV on Thursday, May 13 and responded to a question that the Government was not doing enough for the unemployed (read: abandoning them!) She was interviewed by Joe O’Brien. Here is the relevant segment of the Interview

JOE O’BRIEN: But even the Government concedes that the number of jobless is going to grow significantly over the next couple of years. The unemployed didn’t deserve more as far as you’re concerned from this Budget?

JULIA GILLARD: Well there is more support for the unemployed in this Budget. We are supporting jobs, and for people that find themselves unemployed, we are making sure that they get the services and access to training that they need … When people find themselves unemployed, what they want of course is the best possible chance of getting the next job. That means that they need employment services, which is why for retrenched Australians we are giving immediate access to intensive personalised employment services, and why we are making huge investments in skills and training, so people can get the skills that they need to get into those parts of the economy that are still crying out for skilled labour, and get the skills they need to be ready to go when the economy recovers … We have of course a big suite of measures here, $1.5 billion in our Jobs and Training Compact, around $5 billion in apprenticeships and other related programs, and more $2 billion in our Productivity Places – interlinked programs to provide support to unemployed Australians.

The same old neo-liberal mantra. We had it under Hawke, then Howard and now Rudd. How about addressing the question? Why is Government policy not taking responsibility for creating enough jobs? And given that the current Government is choosing to abrogate that responsibility why are they then forcing the unemployed to live below the poverty line?

Josh Gordon finished his article like this:

But once again the jobless – long demonised by politicians and talkback radio shock jocks – have missed out. For whatever reason, the Federal Government seems content to let this growing army fall further into the mire of disadvantage.

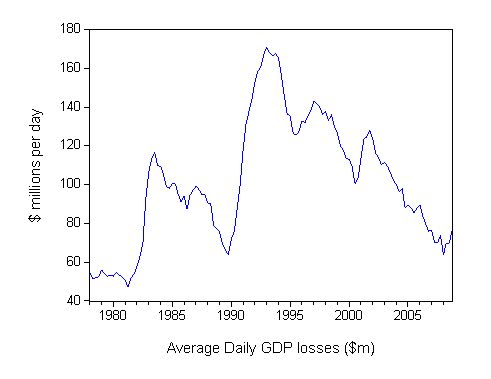

The points made above are not that hard to come to terms with. But what is not often understood is that the persistent unemployment is very costly. I mentioned these daily income (GDP) losses that we incur from unemployment above.

I did some calculations today to put some numbers on it. I computed the potential GDP which would be produced if we had 2 per cent unemployment. I ignore underemployment here so understate the losses. To some extent this understatement gives me room on labour productivity and so even if the unemployed were only half as productive as the rest of us (on average) the numbers would still hold up. But they would be easily more than half the average labour productivity if they were employed in the Job Guarantee on the federal minimum wage.

I computed the average daily GDP gap for each quarter which results from the actual GDP being below the potential GDP level. Remember that GDP = national income.

The following graph (from February 1978 to December 2008) shows the computed daily GDP (income) losses that Australia endures as a result of maintaining persistent unemployment above full employment. When you are confronted with this sort of evidence – that every day the country is foregoing this sort of income – when a policy choice is available that could quickly get the

For the December quarter, the average daily income loss was $77 million. Say that over again: Every single day we sacrifice $77 million in output and income because we have abandoned full employment.

Accumulate that day by day and year by year for the last 35 years! Huge losses.

For the year 2008, these losses amounted to $25,586.4 million. That is more than 3 times what we estimated the full implementation of the Job Guarantee would cost. Even if we adopted the most capital intensive assumption for the Job Guarantee (capital costs = 75 per cent) then the annual GDP loss is still around twice as much as the most expensive Job Guarantee would cost.

It is just lunacy not to attempt the plan. All the arguments used against it ultimately come down to an ideological distaste. But why would Wayne “Unemployment is the very core of why I’m in politics” Swan want to fall into the neo-liberal anti-government, hate the unemployed ideology? It just doesn’t make sense.

There are clear operational and implementation issues but as my friend Warren Mosler keeps saying “We sent men to the moon 40 years ago, cram mind boggling technology into cell phones, do robotic surgery, and don’t understand how a simple spreadsheet called the monetary system works.” And to this we might add “and we aren’t even smart enough to put a million people into productive work when the unmet community and environmental need is just staring us in the face on a daily basis”.

The Report we did (see link above) outlines in fine detail how these operational problems can be managed.

Imagine if we produced all this extra daily output and then the Government took it off us and dumped it. We would all be hostile and demand to know why the Government was stealing income and future wealth of us. I cannot imagine us letting the Government getting away with that.

But in fact, what we allow the Government to actually do in reality is worse than this. We not only go along with policies that force the economy to forego that income but we also allow the Government to force the labour that could have produced it to live a penurious, isolated existence. We also allow the Government to vilify the victims of this waste to justify our tacit consent and ultimately, our ignorance.

What a sad lot we all are!

Some sanity returns

In case you haven’t already read the news … the Government has given back the $A15 million it took off the ABS, which led to cutting of the sample size for the Labour Force survey. The funds will allow the ABS to restore credibility to the labour force estimates including the regional labour data which has become all but useless in recent months. It will also reinstate the job vacancies survey which was deleted. This survey provides much more accurate representations of the state of labour demand than the commercial job advertisement series. We will also get better Retail Sales data again as a result of the funding reinstatement.

This makes my life easier again as a researcher who relies on this sort of data.

Digression: the stimulus is not all being saved

Well there was more news that the stimulus has gone into consumption spending. Apparently, flat-screen TV sets are now walking out the door quicker than the factories can deliver them to the retailers and so the waiting list is growing. One producer has even created a new model – the Kevin37, which is a 37″ LCD TV priced at $900, the size of the personal handout in February’s second stimulus. That pours some water on the claims that households are not pushing any of the cash back into the economy and therefore underwriting employment growth. But the employment growth is clearly going to be less than required. See all the discussion above again!

Bill, if the government pursues a surplus while the private sector is attempting to net save, what sorts of symptoms might we expect to see before we end up dragged back into deficit? Credit squeezes as the supply of money contracts?

Dear Lefty

Rising inventories first. Firms will then cut back on output and start making labour adjustments – hours first then people. Unemployment rises towards the end of this process. There is no reason for there to be a shortage of credit although banks may take the line that loans would be more risky as aggregate demand is falling.

Then as tax revenue declines and welfare spending rises, the budget heads towards deficit – that is, the automatic stabilisers start to dampen the decline in demand.

Only a Norway-like net export boom would attenuate this process. Unlikely in our case.

best wishes

bill