I started my undergraduate studies in economics in the late 1970s after starting out as…

Australian government logic – destroy the future to save it

The Australian government announced its new agenda for public education yesterday. It announced that it would spend an addition $A14.5 billion, overwhelmingly in the public schooling system, over the next six years. A major Report released last year showed that the last few decades of neo-liberal cuts to public education have undermined the quality of outcomes. Australia now trails behind nearly every advanced nation in this respect. The Report called for a massive injection of funds into the public schooling system. So we should applaud the Government announcement. The problem is that it thinks it still has a major fiscal problem (deficit currently around 3.2 per cent of GDP). As a consequence it thinks it has to cut spending elsewhere to fund the public school initiative. This is a wrong logic for two reasons. First, real GDP growth is falling and unemployment is rising fast which indicates that we need more aggregate demand not less (or the same). Second, it has chosen to get the cash to help restore the credibility of the public schooling system from the higher education system. Destroy the future to save it sort of logic. Another mindless demonstration of its fiscal ignorance.

The Australian government announced its new agenda for public education. It announced that it would spend an addition $A14.5 billion, overwhelmingly in the public schooling system, over the next six years.

In fact, the Government will only commit $A9.4 billion over that period, with the states and territories being required to match it on a 2 for 1 basis.

Where does the Government plan to get the cash from? Answer: From the university system – $A2.8 billion in total – across the following:

1. By cutting money out of the higher education sector (university funding) – imposing an efficiency dividend of 2 per cent in 2014, reducing to 1.25 per cent in 2015.

2. Pushing more user-pays onto higher education students – scrapping the deduction for paying the university fees upfront; reducing tax deductions for self-education expenses (textbooks etc), requiring students on Start-up Scholarships to pay the money back,

In addition to the cuts to higher education funding, the Government will scrap existing school funding initiatives – that is, recycling the already committed cash.

The Prime Minister claimed that the cuts to university funding were:

… not a cut …. We are asking universities to accept a lower growth rate.

She also said (Source):

It’s a lot of money, but I believe it is a wise investment in our children’s future and in our nation’s future.

But its a case of destroy the future to save it. This is the same sort of nonsensical logic that is used to justify the so-called fiscal contraction expansion approach (aka fiscal austerity).

Apparently, a government can cut spending and make it grow. Except we know that doesn’t work despite all the theoretical machinations provided by mainstream economists under the guise of ruses such as Ricardian Equivalence.

Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

Now the Australian government wants us to believe that by cutting spending in one part of the education system and putting it elsewhere everyone is better off.

By way of background …

By way of background, in February 2012, the Government released the 300-odd page Review of Funding for Schooling – which was the first serious study of Australian educational funding since 1973.

The so-called Gonski Review (named after the panel chairperson who conducted the Review) reflected on the 39 year period over which a series of ad hoc changes have been made – mostly at the expense of the public schooling system.

Successive governments have ploughed increasing quantities of public funding into the private school system and then towards to elite end of that cohort. The evidence is that the private school system caters for the rich and high-income families, whereas the vast majority of students are “educated” in the public school system.

Australia has a deeply flawed school-funding model.

The Australian Curriculum, Assessment and Reporting Authority (ACARA) publish the – National Report on Schooling in Australia 2010 – (the latest is 2010), which provides a summary of the national education policy in Australia. It says:

Within Australia’s federal system, constitutional responsibility for school education rests predominantly with the six State and two Territory governments.

All States and Territories provide for 13 years of formal school education. Primary education, including a preparatory year, lasts for either seven or eight years and is followed by secondary education of six or five years respectively. Typically, schooling commences at age five, is compulsory from age six until age 17 (with provision for alternative study or work arrangements in the senior secondary years) and is completed at age 17 or 18.

The majority of schools, 71 per cent, are government schools, established and administered by State and Territory governments through their education departments or authorities. The remaining 29 per cent are non-government schools, made up of 18 per cent Catholic schools and 11 per cent independent schools. Non-government schools are established and operated under conditions determined by State and Territory governments through their registration authorities.

For those who are interested in the crazy system of educational funding in Australia this 2007 Report – Australia’s School Funding System – provides a good introduction (although policy changes since have occurred). The current situation remains similar to that outlined in this paper though.

An important point the paper makes is that:

… the process of school funding, including the way in which amounts are calculated, distributed and reported upon, is unavailable not only to the wider public but to some extent even to those working in education

You really have to dig in a number of places to piece together a story.

The Canberra Times article (February 21, 2012) – Gillard’s dissembling response undoes much of Gonski’s backbreaking work – described the funding model as:

… a tangled web of financial intrigue involving ancient deals negotiated between the Commonwealth, states and territories and underpinned by a dizzying array of financial incentives, anomalies, bribes, threats and add-ons that attach themselves during the political cycle.

In fact, governments at the federal and state levels deliberately obscure how much is being spent and where because then they can shift the blame back and forward among themselves when political needs suit.

The reality is that the Australian Constitution created a very poor matching of taxation powers and spending responsibilities, the former being dominated by the Federal Government and the latter mostly the domain of the States.

As a consequences the Commonwealth funds most of the educational budget but as a result of the redistribution of the taxation revenue to the States as general grants, most of the discretionary spending on education is performed by the State and Territory governments.

The essential findings of the Gonski Review were clear:

- “Over the last decade the performance of Australian students has declined at all levels of achievement, notably at the top end. In 2000, only one country outperformed Australia in reading and scientific literacy and only two outperformed Australia in mathematical literacy. By 2009, six countries outperformed Australia in reading and scientific literacy and 12 outperformed Australia in mathematical literacy.”

- “Australia has a significant gap between its highest and lowest performing students. This performance gap is far greater in Australia than in many Organisation for Economic Co-operation and Development countries, particularly those with high-performing schooling systems. A concerning proportion of Australia’s lowest performing students are not meeting minimum standards of achievement. There is also an unacceptable link between low levels of achievement and educational disadvantage, particularly among students from low socioeconomic and Indigenous backgrounds.”

- “Funding for schooling must not be seen simply as a financial matter. Rather, it is about investing to strengthen and secure Australia’s future. Investment and high expectations must go hand in hand. Every school must be appropriately resourced to support every child and every teacher must expect the most from every child.”

- There should be a minimum public spend per enrolled student – the so-called “schooling resource standard” which would then be increased for children from disadvantaged or indigenous backgrounds. Students with a disability should also be given a loading on the mimnimum. Note that Gonski failed to address the issue of whether public funds should fund private schools per se. The ideological bias of public funding towards privileged private schools is a significant part of the problem.

- A $5 billion investment boost is needed to begin redressing these problems (in 2009 dollars).

The Gonski Review also clearly demonstrated that the schooling funding model has been infested with the growing dominance of neo-liberalism over the last three decades which has seen the funding skewed to the richer schools catering for the children of privilege. Further, the poorer schools where the disadvantaged families have to attend have fallen well behind.

There is now a small group of very wealthy, private schools that receive government assistance, while the vast majority of government schools, which cater for the majority of students and all of the children from disadvantaged backgrounds, are squeezed for public funds.

The private school lobby always claims that the private system caters for the disadvantaged and poor through special access arrangements – scholarships, etc. But the Gonski Review dispels that myth.

A small minority of children from families in the lowest quintile of the socio-economic advantage index make it to private schools.

It is clear from the data that the private schools take their students from high income, well-educated families. Our educational system is one that intrinsically uses privilege to reinforce privilege.

The vast majority of Australian children (over 75 per cent) are educated within the public school system yet it has been starved for funds by successive governments seeking to not only cut back on government deficits but also to pander to the neo-liberal sentiments.

An overwhelming majority (around 80 per cent) of students from “relatively poor, ill-educated households” are educated within the public system. The same sort of proportions apply when we consider disabled students, indigenous (with the categories often overlapping).

But the Gonski Review shows that the public schools get less funding per student than the private schools, and this disparity widens dramatically when it comes to the elite private schools.

So the simple conclusion: the majority of our public schools are underfunded and the educational standards are going backwards. We are falling behind nations such as China and India, significant trading partners and it won’t be long before our standards of living fall as a result of the failure to invest in public education.

Today’s international assessments reveal that 25 percent of our Year 4 students have unacceptably low literacy skills.

And now …

In their last 6 months of tenure before they will be decimated in the September federal election, the Federal Labor Government is trying to claim its social democratic credentials are intact by increasing spending on the beleaguered public school system, a system that they themselves have helped to run-down as a result of their insistence on neo-liberal fiscal rectitude.

They could have scrapped the funding model they inherited from the conservatives, which increasingly moved federal money into the coffers of the richest schools. Even under this model, demographic shifts would have seen major cuts to the elite schools but the Labor government chose to override those trends by announcing no school would lose money.

Anyway, at the last minute they now announce some major funding initiatives for the public schooling system, most of which will be undermined by the resistance of the conservative state governments. Labor previously dominated all the state legislatures but has progressively been wiped out at state and territory elections as their incompetence catches up with them – election by election.

It is also hard to see the new conservative Federal government maintaining the announced spending initiatives. They will claim, once elected, that there is “huge black hole” in the budget and will use that to maintain their ideological allegiance to the private schools and allow the public system to fall further behind as if the Gonski Review was a figment of our imagination.

Please note: I applaud extra funding for the the public school system. It is desperately in need of cash and unless there are billions spent in that sector our falling educational standards will worsen and spare the thought for the future.

We will become impoverished as a result of our relative dumbness – it is already happening but will intensify.

The problem I have, in the words of Tim Colebatch (The Melbourne Age’s economic editor) (April 15, 2013) – The price of getting school funding to those who need it most – is:

The Gonski reforms, if they ever take effect, will be paid for by recycled money. They will dilute the Gonski review’s focus on the most disadvantaged.

Tim Colebatch, unfortunately chooses to perpetuate the myth that the Government has been pushing for ages, which has led them to take the money for these initiatives from the higher education system. He says:

But it makes sense. When the budget is in trouble, and you’ve ruled out new sources of funding, you can finance a big new spending plan only by taking money from existing programs. And that is what Labor plans.

Tim, what constitutes a “budget in trouble”?

How can a budget of a currency-issuing nation be in trouble when real GDP growth is well below trend and falling fast, unemployment is rising as employment is too weak to even keep pace with the underlying population growth, inflation is falling, and there are at least 1.8 million people who have either insufficient hours of work or no work at all?

And … the non-government spending growth is too weak to push the economy any faster and is heading in the wrong direction as mining investment starts to fade?

How can the “budget” be in trouble under those circumstances?

To understand this myopia, the trick is in the next statement – when “you’ve ruled out new sources of funding”. The Government has just arbitrarily ruled out expanding its deficit.

There is no economic logic to that. They have decided to take the “budget” out of the context of the real economy and are pursuing a budget surplus at all costs even though in doing so they are destroying growth, killing jobs and undermining their own tax base.

At the weekend (April 13, 2013), the Sydney Morning Herald article – More headaches in Canberra as revenue falls $7b below forecast – reported that:

The government’s budget woes continued to deepen in February as revenue fell $7 billion behind the official forecast for this time of year. The previous figures for January showed revenue tracking $6 billion behind the official forecast. The government forecast $373.7 billion of revenue this financial year. So far it has collected $202.4 billion.

Which was totally predictable given the fiscal position the government (austerity) has taken in relation to non-government spending growth (flat). The Government is choosing to blame “the unusual divergence between the sustained high dollar and the terms of trade” and its impact on company profits. Which just means that the economy is growing well below the inflated forecasts that were bandied around in the Budget and in subsequent public statements from the Government.

Which means that it should be relaxing the fiscal position not seeking to tighten it.

The Australian Bureau of Statistics will release the latest government finance data tomorrow and we will see how much the taxation revenue was down relative to predictions. The gap will be substantial. Be prepared for the Treasurer claiming even tougher spending cuts are needed. Mindless.

The problem also is that the head of Universities Australia (the peak body representing our university sector) claimed yesterday that he acknowledged the Federal government had budget difficulties and had to make cuts somewhere to find new money.

A few weeks ago, the same head (University of Melbourne Vice Chancellor Glyn Davis) demonstrated his macroeconomic acumen (not!) when he called for tax increases to allow the government to spend more on universities (Universities Australia boss Glyn Davis calls for higher taxes to boost teacher standards).

With leaders of our sector falling hook, line and sinker into the neo-liberal miasma it is no wonder the Government can think it can get away with cutting higher education spending and still have the audacity to claim it is looking after the future.

The claims that there is a fiscal problem that requires these sorts of gymnastics by the Federal government should be rejected out of hand.

There is no financial crisis beckoning in Australia. The crisis is a real one – a rapidly failing public education sector (at all levels) squeezed by mindless neo-liberal cost cutting.

Are we really saying that there will not be enough real resources available to provide first-class public education in this country? That is never the statement made. The worry is always that public outlays will rise because more real resources will be required “in the public sector” than previously.

But as long as these real resources are available there will be no problem. In this context, the type of policy strategy that is being driven by these myths will probably undermine the future productivity and provision of real goods and services in the future.

The future material prosperity of the nation depends on our productivity growth. Productivity growth comes from research and development and in Australia the private sector has an abysmal track record in this area. Typically they are parasites on the public research system which is concentrated in the universities and public research centres.

Productivity growth starts with Pre-School education and then requires first-class secondary schooling and an innovative and inclusive public university system.

For all practical purposes one of the most useful real investments that can be made today that will remain useful 50 years from now is in public education.

Unfortunately, tackling the problems of the distant future in terms of current “monetary” considerations which have led to the conclusion that fiscal austerity is needed today to prepare us for the future will actually undermine our future.

The irony is that the pursuit of budget austerity leads governments to target public education almost universally as one of the first expenditures that are reduced.

The latest decision by the Federal government is an exact demonstration of this error of logic and understanding.

Budget should be increased not cut

The normal situation requires that the Federal government runs a continuous deficit of around 2-3 per cent of GDP. That corresponds with our typical external balance (Current Account deficit) and the behaviour of the private domestic sector.

Trying to impose fiscal drag onto an economy when the other sectors are not pursuing consistent outcomes is unsustainable no matter what the ideological preference is.

If an economy is not running a large external surplus then the government will be unable to sustain budget surpluses no matter how hard it tries. The private domestic sector will always bring it back to reality. The latter might run large deficits for a short-period but will eventually seek to reduce the precariousness of its balance sheet (run down debt) and when it does, non-government spending growth slows and the economic downturn increase the budget deficit irrespective of what the government tries to do.

Clearly, in those circumstances the government should be running a discretionary (that is, structural) deficit to ensure that the spending drains coming from the non-government sector are consistent with (true) full employment).

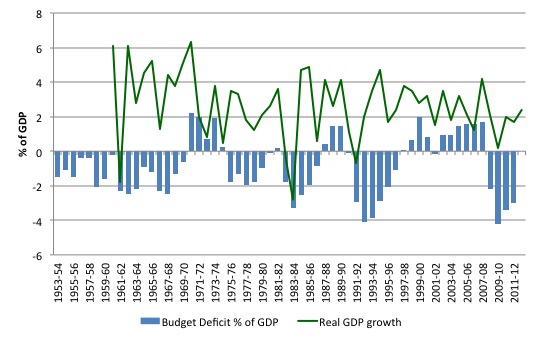

This graph shows the Federal budget balance and real GDP growth by fiscal years since 1959-60 (using RBA and Treasury data). The periods when the government achieved surpluses were followed by economic slowdown or major recession and the normal pattern of deficits was reestablished by dint of the automatic stabilisers.

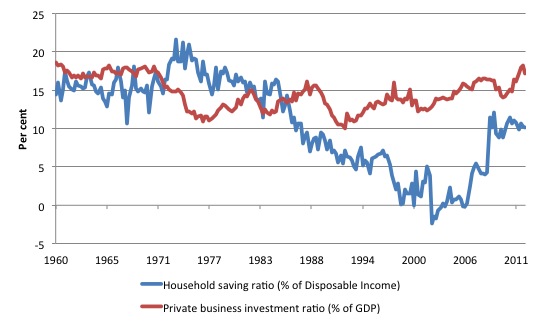

The next graph (taken from National Accounts data) shows the behaviour of the household saving ratio (% of disposable income) and the private business investment ratio (% of GDP) from first-quarter 1960 to the December-quarter 2012.

The data is related to (but not an exact depiction of) the private domestic sector balance. Note the vertical axis is a percentage but the denominator in each case is different – being disposable income in the case of household saving and nominal GDP in the case of the investment ratio.

It is clear that up to the mid-1980s (and during the full employment era), the household savings ratio moved more or less with the private business investment ratio.

The two series become divergent in the mid-1980s, as the then Labor government started pursuing its neo-liberal reforms of the financial system and squeezed the capacity of trade unions to ensure that real wages kept pace with productivity growth.

As a result, consumption spending became increasingly reliant on credit growth as the financial services industry started to grow quickly. Just before the crisis, Australian households have built up record levels of debt and realised their position was becoming precarious and unsustainable

The onset of the crisis accelerated that sentiment and the household saving ratio started to rise and move back towards the investment ratio.

The point is that the neo-liberal period leading up to the crisis were atypical in behavioural terms.

The government was only able to run surpluses during this period because credit-fuelled consumption growth was able to maintain the tax base growth.

It was unsustainable and with the current account behaving more or less as usual (deficit of around 4 per cent), the federal government will have to run more or less continuous deficits of around 2-3 per cent of GDP if the economy is to grow steadily on trend.

The attempt to pursue budget surpluses given the spending behaviour of the non-government sector is reckless and unsustainable as the continuing decline in the tax base is signalling.

What does the data show

The OECD regularly publish their – Education at a Glance – Australia – the latest being for 2012 (published September 11, 2012).

The OECD’s – Education at a Glance Indicators Raw Data – provides comprehensive data on educational inputs and outputs across its membership (and more recently including G20 non-OECD members such as Brazil).

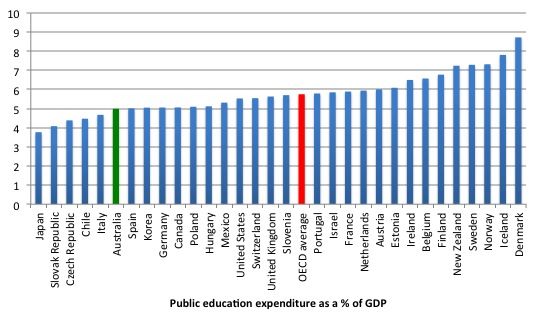

The next graph shows the Total public expenditure on education as a % of GDP in 2009. Australia consistently is at the bottom of the distribution.

The 2009 figures are also distorted for Australia because as the OECD notes:

This relatively high expenditure level is partly the result of a one-off injection of funds forming a part of the government’s stimulus spending package approved in the aftermath of the economic crisis. The AUD 16.2 billion Building the Education Revolution programme was provided to upgrade physical infrastructure, including halls and libraries, in Australian primary and secondary schools.

Even so, the “public share of Australia’s total expenditure on educational institutions was 73% in 2009, which is lower than the OECD average of 84% in the same year”.

The next graph shows the Total public expenditure on higher education as a % of GDP in 2009. Australia consistently is at the bottom of the distribution. We are also trailing well behind those nations that are committed to first-class human capital development.

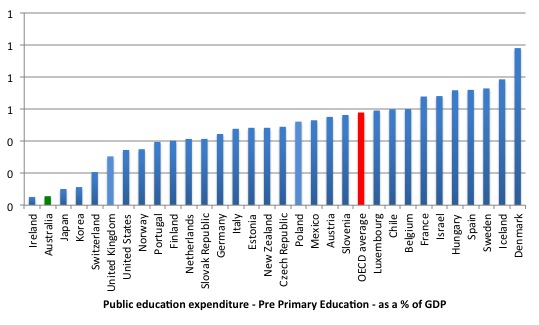

But it is at the pre-school level that we really start undermining our future. This graph shows the Total public expenditure on Pre-Primary School education as a % of GDP in 2009.

This analysis (March 7, 2013), from the Save Our Schools group of the latest OECD report on Education – Australia is Well Behind Other OECD Countries in Pre-School Education – is essentially sound.

The OECD Report – How do early childhood education and care (ECEC) policies, systems and quality vary across OECD countries? – tells us that Australian Pre-school education is heavily privately funded on a fee-for-service basis relative to the free publicly funded services available in most European nations.

This has the impact of reducing participation both by the children and the mothers who are forced to stay at hometo care for their children.

The OECD say that the “bottom line” is that:

In an era of fiscal consolidation, ensuring access to high-quality ECEC should remain a priority for improving children’s outcomes and long-term efficiency gains for society at large, and the most vulnerable should be protected.

Australia fails in this regard and needs significant boosts in public funding.

The OECD also show that in 2009 that government expenditure on pre-school education in Australia is the lowest in the OECD (with Ireland).

People not buying it though …

At least the Fairfax readers were not buying the Government’s logic. Here is the on-line poll results at at lunchtime Monday April 15, 2013:

Conclusion

As I have noted on previous occasions, the government could have shown great fiscal leadership on the challenges posed by the Gonski Report. It could have created a truly virtuous circle of increased funding for the public school system to reverse some of the damage incurred by it as a result of the neo-liberal mania for austerity.

But in doing so, the circle would have been completed by providing the necessary stimulus to aggregate demand and increasing employment generally via multiplier effects and reducing the rising unemployment.

It could have ensured real GDP growth was sufficient to push the economy back towards full employment, yet improved our educational standards at the same time.

This sort of growth would also not further undermine the natural environment which would have been an added plus.

As it standards, the ideologues won out and nothing will be achieved by way of aggregate demand boost and one educational sector will be undermined to help the other. That demonstrates both a failure to understand their fiscal responsibility and also a failure to stand up to the manic neo-liberal lobby groups and media barons.

The policy priorities should be:

1. Maximise incomes in the economy by ensuring there is full employment. This requires a vastly different approach to fiscal and monetary policy than is currently being practised.

2. If we adequately fund our public universities to conduct more research which will reduce the real resource costs of providing for an ageing population in the future (via discovery) and further improve labour productivity then the real burden on the economy will not be anything like the scenarios being outlined in the “doomsday” reports.

But then these reports are really just smokescreens to justify the neo-liberal pursuit of budget surpluses.

I thought about where I would “cut” today where the least damage will be caused. I concluded that the efficiency dividend cuts could start with paring back the exorbitant salaries that the University managers seem fit to pay themselves these days.

This article (May 9. 2011) – University chiefs earning top dollar – documents some of that.

Things have moved on though since 2011.

A recent entry into the VC pay outrage is this article (April 4, 2013) – Vice-Chancellor earns 10 times the average Coast wage.

The spokesperson for this VC claimed that “if you pay peanuts, prepare to get monkeys”. Isn’t that what all the bankers say!

At least you know he believed the nonsense

The Melbourne Age reported today (April 15, 2013) that – Billionaire Paulson the biggest loser after precious metal falls.

The article says that with the recent slump in gold prices to its “its lowest price in almost two years” (dropping 4.1 per cent on Friday alone), the billionaire lost:

… about $US328 million from his net worth on this bet alone.

Apparently, Mr Paulsen has been struggling “with poor returns for the past two years” but:

He told investors last year that his $US700 million gold fund would beat his other strategies over five years because gold was the best hedge against inflation and currency debasement as countries pump money into their economies. The fund slumped 28 per cent this year through to March …

Hmm. I would not have been making these bets given the way the economy operates.

His firm’s strategist was reported as saying that governments have been “pumping money into the economy at a rate not seen before”, which is not a factually correct statement if we consider growth rates in M1 to M3 measures of the money stock.

He then concluded:

We expect the strengthening of the economy and stockmarket to cause money supply to rise more than real growth and eventually lead to inflation

Which is also a highly vague statement. There is continual inflation in monetary economies. Which means that the money supply growth (if velocity is constant) would have to be equal to the real GDP growth rate plus the rate of inflation.

What he is trying to say (I think) is that if the money supply growth rate accelerates and the gap between it and the real GDP growth rate accelerates, the the rate of inflation will accelerate (with velocity constant).

Why would that happen in the foreseeable future? No particular reason.

I imagine he thinks the growth in the monetary base held by central banks is the same thing as the authorities “pumping money into the economy”. That is also not a reasonable depiction of what has been going on. And if the banks start lending more it won’t be because the monetary base is considerably higher than before the downturn. It will reflect renewed confidence by firms in the outlook.

In that context the real GDP growth rate will increase given the massive excess productive capacity that lingers following the recession. There isn’t any sign of accelerating inflation in any of that.

As an aside I love the terminology – “strategist”. It sounds important and authoritative But given the sort of comments these characters regularly make in public I think it just amounts to inflation (of meaning). That is, a diminution in value.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Thanks Bill. I had always wondered about that in Australia as I know recessions quickly followed surpluses in the US but we can’t really make that argument in Australia without significant nuance given the surpluses in 2000s did slow real GDP but not at a significant rate. I know the answer is the private sector leveraged up. As you say that next. I’m just saying its a more difficult proposition to sell than surpluses cause recessions.

Your graph however is the first step.

Bill, I really enjoy your blog. It has improved my knowledge of economics, and while I don’t always agree with your philosophical views and prescriptions, I feel your analysis is thorough and built on a solid base. As I see it you (and other high profile MMTers) need to find a way to push this into the mainstream.

Ultimately, you kind of need to do what Friedman did with his Free To Choose series (and no, you don’t have travel to Hong Kong). That changed the thinking of a lot of people (though arguably not for the best!). Having seen you present in Melbourne last year you have a good voice and are surely more suited to the camera than Milton ever was.

Perhaps a first step would be to try for a regular column in a national paper (sort of like Krugman). At least this would encourage a broader discussion.

One way or another, if you don’t lift your profile outside of the Blogosphere and academia then I’m afraid you might be forever confined to the fringes. In the US, Cullen Roach (with nowhere near your training) has made inroads by making it onto Business Insider dot com. While MR is an offshoot of MMT, at least it gets some airtime in that country.

Otherwise, run for the Senate (I know I have harped on this before). If not for Ron Paul, virtually no-one in the general public would know about Austrian economics. Also, you will give me two people to vote for in September (Assange is the other – I like transparent governments).

Once you become a household name there is at least a chance that a lot of the damage being done in this country can be reversed…there is no time like the present!

Cheers,

Esp.

Hi Bill,

“…but as a result of the redistribution of the taxation revenue to the States…”

I was under the impression that government spending is not taxpayer money, just numbers changing on a spreadsheet with the press of a couple of keys. Am I wrong?

Dear Mojo Rhythm (at 2013/04/15 at 22:43)

You are correct. But overlaying the conceptual plane are accounting arrangements whereby the Grants Commission redistributes sums that are collected to the State governments. It just happens the Federal government levies the tax so numbers show up in its accounts.

These are just purely accounting and distributional arrangements, which is not to say that individuals and firms who pay the tax do not have reduced purchasing power as a consequence.

best wishes

bill

Another great post Prof,

While it is true “The Gonski reforms, if they ever take effect, will be paid for by recycled money.” and of course will not provide the “necessary stimulus to aggregate demand and increasing employment generally “, there are some distributional issues of the funding that already exists to consider.

(i) “A small minority of children from families in the lowest quintile of the socio-economic advantage index make it to private schools.” Where these children enter the “elite” schools via a sporting /academic scholarship the school is effectively paying to increase their overall average “performance” by “mining” the talent of the working class. In this way the private schools are able to dilute the downward pressure on their results exerted by rich “plodders”. While it is true that the scholarships holders may benefit individually from the facilities offered by the private schools, the process tends to favourably distort the statistics that promoters of private schools use to support their arguments.

(ii) The plan to “scrap (sic) the deduction for paying the university fees upfront” although proving no stimulus is I think a distributional winner. While I fundamentally disagree with the whole HECS/HELP system in the first place (I resigned, way back when, from the Labor party over the issue),it seem unfair to give the wealthy a way of giving their children a “leg up” by paying the fees upfront. I think its fairly obvious that when fees (actually HELP contribution, fees are much larger) are paid upfront its the rich parents who are doing the paying. At least with the HELP repayment system it is based on the income the student eventually achieves.

Bill,

I believe your gov will be hearing from our gov lawyers, as to IP and CopyRight claims.

We did it first! Australia should be paying royalties to our NeoCons/Liberals/Keynesians … oh, our frauds.

i.e., “usufruct” defines ownership by usage;

what do you call ownership by destruction?

I’m a recent Uni graduate and when I heard these reforms I was pretty disheartened. Many University Students are already struggling to make ends meet. And I don’t mean struggling in an ‘ I can’t afford my $2m mortgage and my Bi-annual Bali Holiday’ that many seem to identify as financial difficulty.

It seems to me that a great many problems in the economy would be mitigated by increased government participation (if they stay out of credit markets). Interest rates are at record lows, indicating that competition for wholesale funds is not as bad as banks would have us believe. Exchange rates are at record highs, which is adversely effecting balance of trade. Unemployment is bad and worsening, I’m one of very few graduates lucky enough to have a job in my industry and it doesn’t get any easier without a qualification. In this Employment Market you are lucky to stack shelves.

If there was ever a time where fiscal stimulus was required, this is it. Pursuit of surplus for surplus’ sake demonstrates gratuitous economic ignorance – this ground has been covered before. So-called believers in ‘free markets’, who advocate government abstinence while centralizing decision making into even more desensitized clusters – are rubbing their hands together and thanking Thatcher for the absurd public interpretation of Hayek’s work.

End Rant!

I declare a jihad against corrupt morons who use the term “taxpayers’ money”. It’s the most ideologically biased, elite-serving piece of newspeak cooked up in many a moon. Re: the education abomination, it’s reminiscent of the Yes Minister episode in which the leads discuss the fact that there are two motorways to Oxford, but one to Cambridge, and that there hasn’t been a PM who went to Cambridge for decades. The reason for the redundant roads, of course, was to ensure that politicians could get to dinners at their old colleges without getting stuck in traffic. The Australian elites (especially top public servants and politicians) send their offspring to private schools – they don’t give two hoots for those outside their socioeconomic circle. So private schools continue to benefit from high fee revenue from parents, big government handouts and, as bob said, the mining of talent from lower socioeconomic strata to provide propaganda opportunities.

@Jonathan – I don’t feel the term “taxpayer’s money” is inappropriate. The current government has put a post hoc limit on expenditure which is proportionate to tax revenue and so in effect any government spending is tied (by choice) to taxpayer dollars.

The major issue is allocation.

But Mike, the term is inappropriate at the federal (sovereign) level because it implies that ownership of government spending power is vested only in those who pay taxes, when in truth said power belongs to all citizens. Furthermore, the term is used to promote the deceit that the federal government can only spend what it collects in tax revenue and/or borrows from private debt markets. The term, in my view, has been deliberately retained to promote the neoliberal agenda of sabotage of any policy that promotes democratic public purpose via net government spending. Global banking interests do not want competition in their money-creating powers from pesky democratically elected governments. Also, as another commenter said the other day, there is a massively powerful constituency that wants real returns from government bonds to be as high as possible, regardless of whether this involves depression conditions.

Re: allocation, the whole point of MMT is that arbitrary, damaging neoliberal rules are ignored. Why should it be accepted that university Peter must be robbed to pay school Paul?

@Jonathan

I agree that the suggestion that government is constrained by taxation is wrong – though there are other constraints beyond real capacity.

However, I would bet that the vast majority of Australians (even or perhaps especially low SES) believe the myth. I would go far as to say that a lot of Politicians, with limited formal economic education, would also believe it to be true. If you look at my comment earlier, I absolutely agree that there is a ‘Bourgeoisie’ that is very happy to perpetuate the budget constraint myth, but where my real issue is that Government – in their belief that they are constrained – is unwilling to reallocate the available funds towards public benefit (for example, more per capita funding to private schools than public) and to legislate to protect society against corporate exploitation (e.g. minimum wage & collective bargaining issues).

They operate under the idea that a free market is an efficient market – true in the traditional sense, but a corporate economy is no more free than a totalitarian economy. It’s just more subtle.