I grew up in a society where collective will was at the forefront and it…

Fiscal insanity – cutting the deficit only to get a larger one

Being a researcher is interesting and frustrating. But it almost always takes one on a ride that is unpredictable, which is part of the fun. Sometimes, you hit a dead-end (often = frustrating). Other times, you end up somewhere that you never planned but which is instructive in itself (= interesting). Yesterday, my blog was about financial market criminals that seem to escape prosecution. The insulation from prosecution of white collar criminals is not confined to the financial markets. Today, the basic message is that if a nation engenders growth the budget deficit will likely fall and the benefits of the growth will be higher employment, higher national income and improved material living standards. The opposite is the case when a nation contracts. The irony is that the nation will still probably have a budget deficit, but in this case it will be accompanied by stagnation. The first deficit is good and virtuous the second bad and irresponsible (from the perspective of the government fiscal policy stance). So even if you are obsessed with reducing deficits, the best way is to engender growth. The dumbest thing a government can do if it wants a lower deficit is to impose fiscal austerity. There are a lot of dumb governments out there. The problem is they are aided and abetted by criminal types who know full well it is dumb to cut net public spending but pressure governments to do so as long as the space for spending on them expands.

First, as a starting point for all that is wrong. The epitome of evil, Americans for Prosperity (their own) – released a press release last week (December 18, 2010) – Senate Key Vote: Oppose Superstorm Sandy Unemployment Relief Act of 2012 – which urged US Senators to:

… to oppose the so-called Superstorm Sandy Unemployment Relief Act of 2012 … The package, which totals $60.4 billion, does not include an offset. In order to bring fiscal sanity to Washington, lawmakers need to stop the practice of borrowing money to spend in the present.

This Bill is designed to provide federal aid to those who endured the worst of the recent storms. It is in any one’s language – basic aid to those without very much if anything.

Some more information on this petition comes from the article – David Koch Now Taking Aim at Hurricane Sandy Victims

The terminology “Key Vote” indicates that “senators who support sending money for reconstruction could face an avalanche of attack ads in their next election” from the rich folks at AFP. The major financer of AFP is David Koch, who also, reportedly spend $US125 million to undermine President Obama’s election campaign. A failed ploy nonetheless.

A Koch spokesperson – one Steve Lonegan – who is the New Jersey state director for David Koch’s Americans for Prosperity group – told the press that the idea that the federal government would be a:

… disgrace … This is not a federal government responsibility … We need to suck it up and be responsible for taking care of ourselves.

I guess the primary federal responsibility is to ensure the corporate welfare junket that the likes of the Koch Brothers have enjoyed continues unabated.

The Koch Brothers appear to do a considerable (billions) worth of sucking on the public teat.

This article – 7 Ways the Koch Bros. Benefit from Corporate Welfare – helps us understand the extent to which the oil brothers have benefited from the public purse.

A more detailed analysis (by the same author) is available in this article (September 4, 2010) – 7 Ways the Koch Bros. Benefit from Corporate Welfare.

I liked the question and answer: “How libertarian are they? The short answer … not very”. And the assessment: “Simply put: the Kochs have no problem with socialism – as long as they’re in on the action”.

The “Takeaway Message” of the article is as follows:

The next time you hear Michele Bachmann (who’s a welfare queen in her own right) screaming at the top of her lungs that socialized healthcare is “reaching down the throat and ripping the guts out of freedom” or watch a Cato Institute shill on Meet the Press layout a case for why you should support the privatization of social security, remember: they aren’t hypocrites, they’re cons looking to rip you off.

Of-course, all is not well with Koch and the Cato Institute – Koch Brothers sue Cato Institute, president. Apparently, the Brothers want to “transform Cato from an independent, nonpartisan research organization into a political entity that might better support his partisan agenda”.

This was settled in June 2012 – Cato, Koch Brothers Settle Suits Over Control of Think Tank.

Lonegan, himself has a questionable history. This investigative report – Koch Operative Steve Lonegan Offers Rude Gesture When We Ask About Lawsuit Over His Questionable Public Financing – details how Mr Lonegan accepted $US2.7 million in public funds to finance his unsuccessful bid as the Republican candidate for New Jersey governor in 2009.

The problem is that the matter is now in the courts with a litigant claiming that Lonegan obtained the funds through deception.

But the case study that said the most was when the Koch Brothers oil company was found to have stolen oil from some very un-well off native Americans.

The case is documented in the – A Report of the Special Committee on Investigations of the Select Committe on Indian Affairs – to the 101st US Congress (Senate) on November 20, 1989.

The Report found that:

… Koch Oil, the largest purchaser of Indian oil in the country, was engaged in a widespread and sophisticated scheme to steal crude oil from Indians and others through fraudulent mismeasuring and reporting. The Committee sent its investigators into the field to conduct covert surveillance and caught Koch stealing from Indians on six separate occasions. By further investigation, the Committee determined that Koch was engaged in systematic theft, stealing millions in Oklahoma alone.

The Interior Department’s Bureau of Land Management (BLM), which is “charged with detecting and preventing the theft of oil and gas on Indian lands” told the Committee that they had not tried to detect the theft, didn’t report it when it came to their notice because (as one supervisor) claimed “didn’t have the proper telephone number for the FBI”.

Here is some help for that miserable bastard – FBI Contact. Here are the Oklahoma details.

The Senate Report concluded after a forensic examination that:

The records further indicate that about one-quarter of Koch’s 1988 profits in crude oil can be attributed to obtaining oil it did not pay for.

The evidence given to the Committee from Koch employees indicates they were taught to cheat which internally was called “volume enhancement” under “constant pressure from their superiors”.

With the evidence stacked against them, Charles Koch “and other top Koch executives denied under oath before Committee investigators that the company was stealing by fraudulently reporting the amount of oil measured and purchased”. They claimed it was the result of uncertainty. However, no other companies that provided evidence to the hearings showed evidence of such behaviour.

When offered the chance to respond to that point, Koch officials “declined to do so”.

Instead, they issued a press release claiming that:

Koch was a minor player on Indian land, when in fact it is the largest purchaser of Indian oil in the United States … After the hearings, Koch also attempted to look into the personal backgrounds of Committee staff. One Koch employee in Oklahoma even went so far as to interview the ex-wife of a Committee investigator about the circumstances of their divorce.

So, all round nice guys. For more on the “Koch Method” of cheating read – Koch Brothers Flout Law Getting Richer With Secret Iran Sales.

The Committee submitted to the US Department of Justice that that company should be prosecuted. Apparently, Republican presidential hopeful Bob Dole “to influence the Senate committee to soft-pedal the probe” (Source).

This article – Bob Dole’s Oil-Patch Pals – reported that the Senate Report:

… triggered a grand jury probe. The inquiry was dropped in March, 1992, which provoked outrage by congressional investigators.

There is also evidence to show there was political pressure brought to bear and rewards handed out after the matter was dropped.

Bloomberg reported (October 2, 2011) –

Koch Brothers Flout Law Getting Richer With Secret Iran Sales – that in “December 1999, a civil jury found that Koch Industries had taken oil it didn’t pay for from federal land by mismeasuring the amount of crude it was extracting. Koch paid a $25 million settlement to the U.S.”

The case was brought by William Koch, an estranged brother of the two right-wingers. He won the civil suit, settled for a pitiful $US25 million and the indians who had been stolen from got about nothing. For details see – Koch loses oil fraud case

That was a longish detour into the agenda for today. I have to say that I am ambivalent at times about governments of any persuasion bailing out rich private citizens who choose to live in disaster prone areas because they are usually peaceful and beautiful places to reside and under-insure. This is a common debate in Australia after a major bush-fire. At some point, private citizens have to pay the risk for the benefits they enjoy most of the time as a result of living in these exotic but risky locations.

However, I don’t put the locations of the recent storm path in that category (exclusively). It is also clear that low-income families were devastated. In that case I have no trouble with government spending being used to help these families/people get back on their feet.

The detour into the dirty world of Koch was the result of their statement that such aid would represent fiscal insanity. The likes of the Koch family want the government to cut spending that doesn’t benefit them. I didn’t note above the defence industry contracts their companies enjoy. All public spending.

I also thought about what is going on in Portugal at present. The UK Guardian article (December 25, 2012) – Portugal to hold fire-sale of state assets – was a lovely xmas story of generosity and caring by the State for the lawyers, brokerage firms, management consultants and others who have plenty but need more.

Xmas is such a caring time.

The article began with a photo of a small girl receiving “a Christmas present during a charity toy distribution in one of the poorest neighbourhoods in Lisbon”.

Families in that neighbourhood will become poorer yet courtesy of their irresponsible and intellectually corrupt government.

The story was about the intention of that government, under pressure from the irrepressible Troika (EC, ECB and the IMF), to:

… embark on a sweeping fire-sale of state companies over the coming months, possibly even privatising state broadcaster RTP, as it bends to the will of the troika of lenders that bailed it out 20 months ago.

This “fire-sale” is a sop to the Troika to get them to put some slack into the death grip it has imposed on the nation. So die a little more slowly.

The vultures are circling. These are the companies that run lobby campaigns preaching the efficiency of private sector delivery and the opposite of public delivery and then just happen to turn up to the tenders when the government is finally bashed into submission and privatises the valuable assets.

There is also a long trail of privatisations at distress prices to ensure the the sales are “successful”. It should be noted that the lawyers, brokers and management consultants that manage the sales never take a discount. But governments are risk-averse and the last thing they want is for the sale to fail.

The private vultures know that and get the assets at bargain prices thus stealing wealth from the people.

The other tactic is to force the government to structure the accounts of the state company so that the debts are moved to the “treasury” and the company is then sold with higher net assets.

But while the Portuguese government is busy undermining the public wealth and the services that such wealth can provide to the citizens because it thinks the Troika will go easy on it, the Germans, true to form, are already expressing disdain that any easing might occur.

Back in the real world, “Portugal’s economy shrank by 3% this year and the country has lost almost 6% of GDP since the credit crunch of 2007”. It has youth unemployment was at 39.1 per cent and rising in October 2012 and the general unemployment was at 16.3 per cent and rising.

It will not easily bring down its deficits to the thresholds that will satisfy the ridiculous rules embedded in the Stability and Growth Pact.

That is no surprise. The same problem is being experienced by France, which the UK Guardian article (December 26, 2012) – France needs more leeway to meet deficit targets, suggests IMF – reports “would miss its 2013 target for a deficit of 3% of gross domestic product, estimating that it was on course for 3.5% as a result of weaker than expected growth”.

There is nothing sensible about trying to achieve a given budget deficit to GDP ratio by shrinking GDP, which is effectively the strategy pursued by those governments that are imposing fiscal austerity.

The IMF have admitted that France should not try to cut discretionary net spending any further because it “could further hold back economic growth”.

But still the IMF want the French government to maintain its attack on “public sector flab”. If I was the French government the two discretionary spending cuts I would make would be to eliminate all corporate welfare and also to withdraw national funding to the IMF. Then the government should increase discretionary spending to provide more work to the unemployed. That would be a good redirection of the spending side of the budget.

Remember that the government budget balance is the difference between total revenue and total outlays. Both sides of the books are influenced by two determinants: (a) discretionary government spending and tax policies; and (b) the state of non-government spending.

If total revenue is greater than outlays, the budget is in surplus and vice versa.

We might wrongly conclude that if the budget is in surplus then the fiscal impact of government is contractionary (withdrawing net spending) and if the budget is in deficit the fiscal impact expansionary (adding net spending).

However, we cannot then conclude that changes in the fiscal impact reflect discretionary policy changes. The reason for this uncertainty is that there are automatic stabilisers operating. To see this, the most simple model of the budget balance we might think of can be written as:

Budget Balance = Revenue – Spending.

Budget Balance = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth. These components of the Budget Balance are the so-called automatic stabilisers

In other words, without any discretionary policy changes, the Budget Balance will vary over the course of the business cycle. When the economy is weak – tax revenue falls and welfare payments rise and so the Budget Balance moves towards deficit (or an increasing deficit). When the economy is stronger – tax revenue rises and welfare payments fall and the Budget Balance becomes increasingly positive. Automatic stabilisers attenuate the amplitude in the business cycle by expanding the budget in a recession and contracting it in a boom.

So just because the budget goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

This knowledge also confirms that the final budget balance is the result, once the government has made its budget decisions each year, of what the non-government spending and saving decisions will be over the course of the year.

If the non-government sector decides to cut its spending growth (or level) then the budget outcome will move towards deficit or to a higher deficit, without the government changing any policy parameters. The automatic stabilisers guarantee that.

An economy which is weakening is predisposed to higher deficits (or lower surpluses) at current (unchanged) policy settings. The opposite is that case in a growing economy.

The automatic stabilisers mean that in a growing economy, tax revenue rises (because it is tied to economic activity via income taxes) and spending is lower (less income support is required).

Which means that governments should only focus on maintaining high rates of economic growth (within general constraints imposed by the need to be environmentally sustainable) and ignore the actual budget balance.

If Portugal did that (and restored its own currency) it could avoid handing selling-off public wealth (and service delivery scope and quality) to the greedy private sector interests. It could tell the IMF to go take a walk – a long one off a short pier!

Which brings me back to the US (where our little excursion into the dirty world of the Koch Brothers began).

Recent data shows that the moderate growth that the US economy is enjoying at present is seeing a substantial increase in tax revenue which is reducing the budget balance rather quickly.

That obversation puts all the debates about “fiscal insanity” into context. As a result of the political impasse in the US, the economy keeps growing. That is because they haven’t yet been able to decimate public spending. The deficit remains while it should be much larger.

The US Treasury Department provides updates on the latest economic data which is useful – US Economic Data – Quarterly and US Economic Data – Monthly.

The monthly data tells us that the capacity utilisation rate (percent) in the US has been improving steadily since the trough year 2009. It has averaged 78.3 per cent since June 2012. In 2008, it averaged 77.3 per cent, then dived to 68.6 per cent in 2009, rising to 73.7 per cent in 2010, then 76.8 per cent in 2011.

The labour market analogue is the employment rate and that has been mirroring the improvement in the capacity utilisation rate.

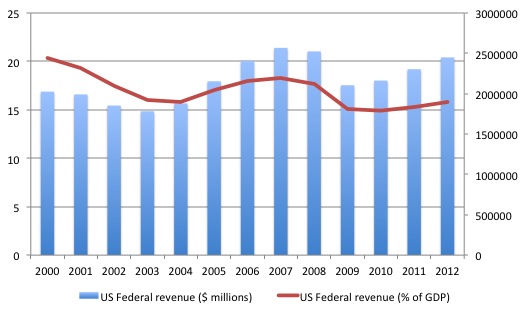

The following graph shows what has happened to total revenue in the US, both in absolute terms and relative to GDP.

Spending has also been falling (slightly) and the result is that the deficit is also falling.

If growth had have been maintained at higher rates (as were evident earlier in the recovery) and more people brought back into the employed work force then these changes would have been greater.

Conclusion

But the real message of today’s blog is along the lines of “honey, I shrunk GDP and reached the 3 per cent threshold”. What a stupid character! Why not growth GDP and let the budget balance adjust on its own accord.

Then the nation will have higher employment, higher national income and lower unemployment. Any deficit that remains is a good deficit and required to match the non-government desire to save. Required in the sense, that aggregate demand growth is maintained at rates sufficient to absorb available productive capacity and increase employment.

The latest data in the US tells me that things have improved by there is still plenty of excess productive capacity to allow more fiscal stimulus to work a treat.

Worrying about the budget balance on a daily basis and listening to the lies from the likes of the Koch Brothers is not a wise strategy for the US government to adopt.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

I am currently reading a biography of the the photographer Dorathea Lange.She was a successful portrait photographer in San Francisco in the 1920s.When the Great Depression ruined her business she turned her hand to portraying the faces of the unemployed and the workers(those who were left). The results are stunning in their simple beauty and unspoken message,to say the least.

When I read the political background to her story as told in this book I get a strong feeling of deja vu – So what has changed? Has anything been learned in the 80 years since that disaster?

Hi Bill,

I have a bit of a problem with this section of the argument:

“An economy which is weakening is predisposed to higher deficits (or lower surpluses) at current (unchanged) policy settings. The opposite is that case in a growing economy.

The automatic stabilisers mean that in a growing economy, tax revenue rises (because it is tied to economic activity via income taxes) and spending is lower (less income support is required).”

As you’re well aware, your colleague Prof. Wray, has been arguing for a new ‘meme’ or fashioning of the political discourse, required if ‘progressives’, a loaded term if ever there was, are to ‘win the argument’. Yet in the statements above you refer ‘tax revenue rises’, ‘lower spending’, and ‘government deficits’, phrases couched in terms which have little connection with the ideas you and your fellow MMT-based theorists base your argument.

First, if I have been reading MMT correctly over the past year or so, and that’s no by no means a given as I am no economist, there is no such thing as ‘tax revenue’, the money doesn’t go anywhere and so will have no impact on any budget in the same way dead people are no longer counted as part of the population. It is dead money.

Second, government does can not and does not spend money. Instead, in the fashion of the god in Genesis, the state via the agency of government says ‘let there be money’ and ‘go forth and multiply’, metaphorically breathing life into the economy. The state allows for the creation of living currency continually.

Third, the ‘deficit’ is not a deficit at all but an accumulation of all extent ‘living money’, the population of all living money in the economy. It is all the active members of the ‘currency/monetary community’.

Therefore, if we are to accept this highly flawed analogy, so-called ‘Conservatives’ would argue for less government spending (birth) and less taxation (death), thus calling for an ‘ageing population’ and longer ‘life’ for the currency, while so-called ‘Progressives’ argue for the opposite, more ‘birth’ and more ‘death’, a kind of ‘Logan’s Run’ economy kept ‘young and vital’, and more equal due to less ‘time’ for ‘accumulation’.

Again, this analogy can only go so far but we might be also think of money as red blood cells (RBC) or haemoglobin. With too little RBCs we become anaemic, and are effectively malnourished. With too many RBCs blood viscosity becomes too thick and can cause clots: both these phenomena affect the overall health of the body and can cause death. Would it not be right to think of the RBC as equivalent to think of the monetary count? If the economy is anaemic, it requires an injection, creation, birth of new cells (money)? If the ‘blood’ is too ‘thick’, then higher taxation is required too ‘kill’ or ‘remove’ excess ‘money cells’ from the economy? As we certainly wouldn’t begin to think of our count of RBCs as a deficit, why should we think of the state supply of ‘money cells’ as a deficit?

In terms of UK Government economic policy at the moment, it could be argued that the economic body is anaemic but the ‘doctor’ is killing cells (increased taxation for certain parts of the population) and refusing to create new cells (cuts in ‘spending’) making the conditions worse. In order for the political argument to made, heterodox economists are going to have create new terms, maybe even a new language, not hitched to the old economic paradigms that have the potential to create misunderstanding particularly with the general public.

So, why don’t we talk about the ‘cell count’, or a better term, rather than a deficit? Let’s not put ‘tax’ and ‘revenue’ together – since when has the accumulation of dead cells been of any value? Death and taxes have been acknowledged to be inextricably linked for some time now, we can certainly utilise that argument. Government ‘cell renewal’ or ‘cell count maintenance’ isn’t the perfect term to describe the process, but it has a far less negative connotation than ‘spend’ which has been poisoned by certain ideological actors as being ‘irresponsible’.

Anyway Bill, many thanks for this blog which has provided me with a very good education into the true nature of macroeconomics and will, I hope, continue to do for many years to come. All I want to do here is illustrate the power of linguistic genealogy to shape the architecture of our thoughts and how, if not detected, they can undermine/trap alternative or contradictory ideas within the orthodoxy of the structures of the status quo. I hope this helps to break the cycle.