In the annals of ruses used to provoke fear in the voting public about government…

US wealth distribution – fiscal policy increases private net worth but the poor miss out

I read an interesting report this morning, which resonated with some other work I had been looking into earlier in the week. The Australian Council of Social Services (ACOSS) released a report yesterday (September 27, 2023) – Inequality in Australia 2023: Overview – which shows that “The gap between those with the most and those with the least has blown out over the past two decades, with the average wealth of the highest 20% growing at four times the rate of the lowest”. It is one of the manifestations of the neoliberal era and is ultimately unsustainable. Earlier in the week, I spent some time analysing the latest data from the US Federal Reserve on the distribution of wealth among US households. The US data goes a long way to explaining why the recent interest rate hikes have been inflationary in themselves.

As an aside, one of the characteristics of neoliberalism that is not often recognised is the way in which it has created schizoid welfare institutions – where key organisations that deliver or advocate for improved safety nets or poverty relief adopt internally inconsistent positions without, seemingly, knowing it.

A glaring example in Australia of this schizoid behaviour in the last few decades has been the church-based welfare organisations that were roped into tendering for contracts to deliver the government’s privatised job services disaster and became the front line troops in coercing the unemployed and reporting breaches of the income support activity tests back to government, while at the same time offering emergency food relief etc.

They became the instruments of the most pernicious treatment of the most disadvantaged in our society while preaching love and forgiveness.

Earlier this week I commented on the Federal Government’s White Paper on Full Employment release – Australia’s new White Paper on Full Employment is a dud and just reinforces the failed NAIRU cult (September 26, 2023) – and the title summarises my views on it.

I wouldn’t have expected the peak welfare body in Australia to praise the White Paper.

Well ACOSS, in the same week it published shocking wealth inequality data, did exactly that.

In its press statement (September 26, 2023) – White Paper lays good foundations for full employment, clear goals and targets are the missing planks – ACOSS was generally uncritical and didn’t seem to grasp that the ‘missing planks’ that it identified were exactly why the foundations laid by the White Paper are just more-of-the-same NAIRU neoliberalism.

The ‘missing planks’ are the logical outcome of the supply-side approach, which relies on a ever-shifting concept of maximum employment, to justify not actually pursuing true full employment.

I did several radio interviews this week where I was asked why the government didn’t actually ‘nail down’ a full employment unemployment rate.

The reason is that then they would be forced to leave the NAIRU world.

Anyway, that is a digression.

Australian inequality

The ACOSS research (in partnership with UNSW researchers) reveals:

1. “wealth inequality has increased strongly over the past two decades”.

2. “From 2003 to 2022, the average wealth of the highest 20% rose by 82% and that of the highest 5% rose by 86%, leaving behind the middle 20% (with a 61% increase) and the lowest 20% (with a 20% increase).”

3. “The overall increase in wealth inequality over the period was mainly driven by superannuation, which grew by 155% in value due to compulsory savings property investment.”

4. “the wealthiest 20% hold 82% of all investment property by value.”

The fact that it is real estate investments that is driving this wealth inequality reflects on the biased tax structure that rewards multiple property holdings with tax breaks.

One of the first things the government should do is eliminate the so-called ‘negative gearing’ provisions within the tax act which allow rich people to buy up real estate, manipulate the expenses of renting the properties so as to write off ‘losses’ against other income, while at the same time accumulating massive capital gains as the value of the properties rise.

Interestingly, and this is where the resonance with the US data comes in, the researchers found that:

… the government’s timely pandemic response reduced income inequality … In 2020-21, the average income of the lowest 20% income group grew by 5.3% compared with 2% for the middle 20% and 2.4% for the highest 20%, predominantly due to the introduction of COVID income supports.

Which tells us that appropriately targetted fiscal policy is a very effective tool for improving the lot of low-income households.

While the mainstream claim that fiscal policy is an inferior tool because, for example, households are alleged to stop spending when there are deficits because they fear higher future taxes and need to save up to pay them, the evidence exposes the fictions of these core mainstream eocnomic claims.

Further, the researchers found that:

However, during 2021-22, the removal of these income supports largely reversed those trends, restoring income inequality close to its pre-COVID level.

Incomes fell generally, but more so for those with the least. The average income of the lowest 20% fell by 3.5% compared with 0.5% for the middle 20% and 0.1% for the highest 20%.

So there is no doubt at all that the prevalence and persistence of poverty is a policy choice.

The currency-issuing government can always eliminate poverty just as it can always eliminate mass unemployment (and the two are intrinsically linked) if it wants to.

So the conclusion is that if we observe rising poverty and high unemployment the blame is directly apportioned to a policy failure.

Most people don’t see it that way and the reason is because they have been seduced by the fictions propagated by my profession.

The current Federal Reserve Distribution of Wealth release

I found some time earlier this week to study the most recent release (September 22, 2023) of the – Distributional Financial Accounts (DFAs) – which is released by the US Federal Reserve on a quarterly basis.

The DFA data integrates:

1. “quarterly data on aggregate balance sheets of major sectors of the U.S. economy” – The Financial Accounts of the United States.

2. “comprehensive triennial microdata on the assets and liabilities of a representative sample of U.S. households” – the Survey of Consumer Finances (SCF).

The data reveals some stunning developments.

The following Table shows wealth by wealth percentile group by $US trillions, with the proportion of the total in brackets.

The data shows several things including:

1. The rising grip on the total wealth that the richest American households enjoy and the declining share of the bottom 50 per cent of American households.

2. The dramatic effect that the GFC had on the poorest American households while the richest were far less impacted despite the initial cause of the crisis being sourced in the financial markets.

| Date | Top 0.1% | 99-99.9% | 90-99% | 50-90% | Bottom 50% |

| 1989Q3 | $1.76 (8.6%) | $2.84 (13.9%) | $7.64 (37.4%) | $7.41 (36.3%) | $0.78 (3.8%) |

| 2000Q1 | $4.61 (10.9%) | $7.12 (16.9%) | $14.74 (35.0%) | $14.27 (33.9%) | $1.37 (3.3%) |

| 2007Q4 | $7.79 (11.9%) | $11.14 (16.9%) | $24.95 (38.1%) | $20.67 (31.7%) | $1.21 (1.6%) |

| 2010Q4 | $6.93 (11.1%) | $10/77 (17.3%) | $24.67 (39.5%) | $19.63 (31.5%) | $0.37 (0.6%) |

| 2023Q2 | $18.63 (12.8%) | $27.15 (18.6%) | $54.81 (37.6%) | $41.74 (28.6%) | $3.64 (2.5%) |

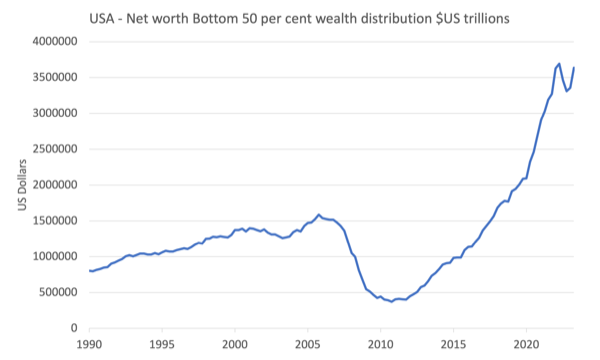

The following graph shows the net worth ($US trillions) of the bottom 50 per cent of American households in the wealth distribution.

The negative impact of the GFC was amazing although the decline in net worth began well before the crisis emerged in the financial market chaos.

The peak net worth before the GFC for the bottom 50 per cent came in the December-quarter 2005.

Between then and the trough in the Decemer-quarter 2010, $US1.21 trillion was wiped off the wealth holdings of the bottom 50 per cent a 76.5 per cent decline.

Over that period, total assets for the bottom 50 per cent fell by $US0.04 trillion while total liabilities rose by $US1.17 trillion

In more detail:

1. Real estate assets declined by $US0.29 trillion while consumer durables rose by $US0.12 trillion.

2. Home mortgages rose by $US0.80 trillion while Consumer credit rose by $US0.26 trillion.

So while indebtedness was rising sharply, the assets that were backing the debt (housing) fell significantly in value.

There is also evidence that credit cards and loans were being used to purchase consumer durables in a period when income growth was relatively flat.

While this data is very complex and it will take be more time to really analyse, the other thing that comes out is the impact of the fiscal intervention during the pandemic.

You can see broadly from the graph above that there was a sharp increase in net worth for the bottom 50 per cent during the pandemic.

In figures:

1. Between the March-quarter 2020 and the March-quarter 2022, the net worth of the bottom 50 per cent of American households rose by $US1.54 trillion or 73.4 per cent.

2. Total assets rose by $US2.3 trillion while total liabilities rose by $US0.77 trillion.

3. Major asset gains in real estate $US1.3 trillion, Consumer Durables $0.49 trillian.

This period coincided with the extensive fiscal support being offered to American households.

We need to be careful though.

Most of the increase in net worth during the pandemic for the bottom 50 per cent American households came from increases in housing values, which are biased towards the upper end of the bottom 50 per cent.

That increase is on paper until they sell and if they sold they would be buying into the inflated market with much higher mortgage servicing burdens (due to the higher house prices and the higher interest rates).

Further, the lower segments of the bottom 50 per cent group are typically renters and they have been hit very hard by combination of inflated real estate values and rising interest rates.

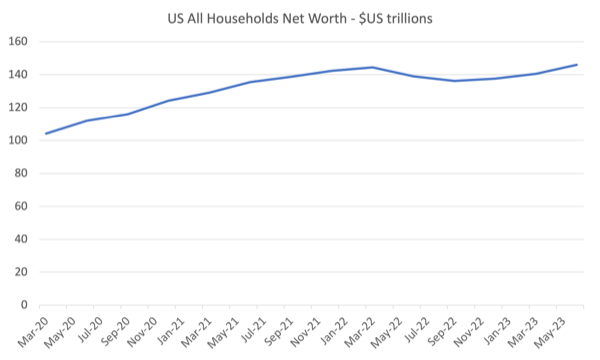

The last point I would make at this stage is to note that there was a massive increase in total net worth across the board during the pandemic.

The following graph shows the situation from the March-quarter 2020 to the June-quarter 2023.

We note that:

1. Net worth rose $US40.3 trillion during this period or 36.7 per cent.

2. Total assets rose by $US42.5 trillion while total liabilities only rose by $US2.3 trillion.

3. The two major contributors to the rise in assets were real estate (up $US11.8 trillion) and Corporate equities and mutual fund shares (up $US18 trillion).

4. Of the $US40.3 trillion increase in net worth:

– $US6.4 trillion went to the top 0.1 per cent of the wealth distribution.

– $US9 trillion went to the 99 to 99.9 percentile group.

– 13.8 trillion went to the 90 to 99 percentile group.

– $US9.6 trillion went to the next 40 group.

– only $US1.5 trillion went to the bottom 50 group.

All during a period of substantial fiscal expansion.

It tells me that the fiscal expansion was poorly targetted and the wealthier American households – who own real estate and financial assets (Shares etc) made hay while the bottom 50 stood still.

Conclusion

This does help to explain why the rise in interest rates has not yet caused a major downturn in spending or economic activity.

The top 50 per cent of the wealth distribution enjoyed a rapid increase in their net worth during the pandemic and have probably increased their spending capacity as interest rates rises have rewarded them with rising incomes.

I need to examine the income distribution data attached to this dataset to make further conclusions.

But overall very interesting.

That is enough for today!

“The currency-issuing government can always eliminate poverty just as it can always eliminate mass unemployment (and the two are intrinsically linked) if it wants to.” – Bill Mitchell.

This requires a provisos although they are understood in the Australian context.

The currency-issuing government can always eliminate poverty just as it can always eliminate mass unemployment (and the two are intrinsically linked) if it wants to *and* provided the nation has adequate resources, the economy is adequately efficient and governance is not dysfunctional.

These provisos are well understood in the Australian case but perhaps ought to be made explicit in any case to head off the illiterates who will say “but what about Burundi, Central African Republic and Haiti?”, for example.

The currency-issuing government can always eliminate poverty just as it can always eliminate mass unemployment (and the two are intrinsically linked) if it wants to.” – Bill Mitchell.

This requires a provisos although they are understood in the Australian context.

The currency-issuing government can always eliminate poverty just as it can always eliminate mass unemployment (and the two are intrinsically linked) if it wants to *and* provided the nation has adequate resources, the economy is adequately efficient and governance is not dysfunctional.

These provisos are well understood in the Australian case but perhaps ought to be made explicit in any case to head off the illiterates who will say “but what about Burundi, Central African Republic and Haiti?”, for example.

I’ve never given much credence to national measures of net worth where financial assets and many over-priced durable assets (e.g., property) are combined with real wealth (i.e., physical stuff possessed for the sole purpose of enjoying their use value) to obtain the total value of a nation’s assets. Besides financial assets being forms of ‘virtual’ wealth with exchange value but no use value (hence, I don’t consider them ‘real’ wealth), national measures of net worth suffer from the fallacy of composition. It’s fine for an individual to consider the exchange value of their financial assets and any durable asset they may be holding for savings purposes (i.e., to at least maintain its real exchange value – property again being an example) as an asset because an individual’s actions have virtually no bearing on market values or the remaining productive capacity of the nation. If an individual decides to convert all their financial assets or savings-based durable assets into real wealth (i.e., spend on the stuff that has use value – the stuff that yields benefits), they can do so knowing that the $10,000 of virtual wealth they currently possess can be converted to $10,000 of real wealth. But what if everyone in a country did the same? Firstly, the exchange value of financial assets (e.g., shares) and savings-based durable assets would crash. $100 billion of virtual wealth might fall to $10 billion. If so, one might consider the latter value to better reflect what should appear in a nation’s asset column. Secondly, what if a nation only had $5 billion of idle productive capacity? The $10 billion of virtual wealth would not be convertible to $10 billion of real wealth. The conversion (spending) would mobilise the idle resources and might even lead to full employment. But it would only generate $5 billion of real wealth (at current prices). The excess spending (spending above productive capacity) would be inflationary. The $5 billion shortfall might be spent on imported goods, but that is likely to be negated by a currency depreciation. In my opinion, the total assets of a country equal the exchange value of the durable stuff already in existence (stocks of existing real wealth), natural capital (forests, fisheries, ore deposits), plus the exchange value of any idle productive capacity that can be quickly mobilised by the conversion of virtual wealth to real wealth (spending). Even then, adding the value of human-made wealth and natural capital is problematic because the former cannot provide the services generated by the latter, and so a decline in natural capital is not offset by an increase in human-made capital (additional trawlers don’t increase the fish harvest if a fish population crashes). Any virtual wealth beyond productive capacity is not virtual wealth at all (worthless) and therefore not a true asset.

From a distributional perspective, it’s the shuffling of virtual wealth (financial claims on real wealth) that is more of a problem than the unequal distribution of national income. Most economic models, if they do include virtual wealth at all, assume it exists as money in a non-interest-bearing bank account or as a benign interest-bearing government bond. The aim of the modern chrematistic game is to convert your non-interest-bearing virtual wealth into another form of virtual wealth or durable asset for pure speculative purposes to increase one’s financial claims on real wealth without producing one bit of real wealth. That’s the way most great fortunes are made these days, assisted by financial deregulation and tax advantages. Wall Street is a prime example. People with massive financial claims on real wealth, yet not a single bit of real wealth ever makes its way north of Lower Manhattan (New York’s financial district). These people don’t make hay (real wealth), but acquire lots of hay to everyone else’s detriment, especially people on low wages, Third World sweat-shop workers, and future generations (impending ecological catastrophe). Plus, they are making the purchase of a house and some staple foods unaffordable for many people, and they destabilise financial systems.

Apologies for the excessive length of my comment.

Philip Lawn,

You might be interested in the way “Capital as Power” theorists look at the capitalization of wealth. They see financial capital as the only kind of capital (purely speaking) and they see this capital (its quantity in the numeraire or currency) as a measure of power in this system and not as a measure of value or “wealth”.

https://bnarchives.yorku.ca/259/2/20090522_nb_casp_full_indexed.pdf

Bill,

Two things.

1] On a site I often post on, a poster claimed that there are 2 ways that economists calculate net wealth.

. . a] Get the value of all their holding of things and money, etc., and deduct the amount they owe.

. . b] Take their current income and discount it by some number less than 1, then calculate their income for an infinite number of years. This will be a finite number because the discounting is cumulative.

2] So, Bill which of these 2 methods was used to derive your data and graphs?

And, what do you think of the 2nd method?

. . . Anyone can answer what they think of the 2nd one.

Despite the predisposition for many people to dismiss “religions”, it is imperative to acknowledge that the modern world’s ideals are heavily influenced by the radiating light with-in them; atheists are generally one existential threat away from conversion, and agnostics towards the end tend to seek the heavens. The process of returning to the creator is forever in motion – we are all a manifestation of one wave, responding to different existential frequencies. It is only through learning to vibrate to the esoteric frequency that underlies all existential frequencies that we can avoid creating dissonance. MMT’s revelations are a springboard for positioning faith based people towards a light of the world beyond the false seduction of nihlistic reasoning.

Faith leaders are equivalent to mainstream economists, where the consequences of their persistence to ignore truth forces the people they are outwardly serving to become surrounded by the abyss, reinforcing their authority – chaos is needed for them to be seen as the light afterall. Preaching a sovereign nation has limited currency is like preaching that God has limited love, preaching that we should focus on the unemployment rate instead of guaranteeing jobs is like preaching that we should focus on prayer frequency instead of communal service etc. etc. These false preachers, like mainstream economists, are too invested i.e., indebted, to satan and a third of the angels (who are the only ones longing to go to heaven – God’s kingdom incorporates the Earth), that they have become comfortable, power hungry, masters in inducing fear throughout the generations of community, there authority reinforced through the silos of selective information.

It is only through the intersection of multiple disciplines that the transformation of energy speeds up creation, of course it also speeds up destruction when poorly managed, either way there is no escaping a shock wave; the difference being the intention of force.

Schizoid behavior by welfare institutions is symptomatic of regulatory capture of the welfare institutions.

Neolibs counter the wealth gap data with the “bigger pie” argument (that what matters are absolute levels of wealth, which are rising, not comparative levels among groups).

The bigger pie argument also suggests that ever expanding wealth gaps are sustainable, as long as the total size of the pie grows. (I’m not advocating these arguments, just suggesting that the arguments haven’t been countered effectively.)

The other problem is environmental: Growth is no longer the goal! Economics has to figure out how to manage the deindustrialisation of rich countries. Economics has no theoretical framework in which to create discourse on deindustrialisation.

Continued industrial growth dooms the natural world, regardless of the energy source used to facilitate the industrial growth.

In what could be a side illustration to bill’s article, Blair Fix at _Economics From The Top Down_ uses the Forbes 400 list of billionaires to show that even billionaires are becoming more inequal to each other — drastically.