These notes will serve as part of a briefing document that I will send off…

Progressive journalists in Britain so easily become willing mouthpieces for mainstream economic lies

Imagine if you are a UK Guardian reader and wanting to assess the options for an almost certain victory by Labour in the upcoming general election. Your understanding of the challenges facing the next government will be conditioned by what you have been reading in that newspaper. Unfortunately, there have been a stream of articles purporting to provide informed analysis of the challenges ahead and the capacities of the new British government to meet them which make it very hard for any progressive reader to assess the situation sensibly. These articles promote the usual macroeconomic fictions about the need for tight fiscal rules that will help the government avoid running out of money as it tries to deal with the decades of degeneration created by the austerity mindset. It is stunning how so-called progressive media commentators have so easily become willing mouthpieces for the mainstream economic lies which have only served to work against everything they purport to stand for. Business as usual though. Sadly.

I read an article at the weekend on the Australian ABC News site – The UK is poorer, sicker and more unsafe. Did the Conservatives break Britain? (June 15, 2024) – which sought to analyse the period since the Tories took power in May 2010.

The title of the article makes its message fairly clear.

The journalists documented how the decline of Britain since the GFC:

… can all be traced back to a policy called “austerity” introduced 14 years ago, when the Conservative Party took power.

It was designed to save the country; instead, it seems to have broken it.

Institutions have eroded, more and more people are relying on charities and food handouts, one in five households with children living in them are struggling to afford food.

I saw that first hand when I returned to London in January this year after a 4-year absence due to Covid restrictions.

I saw street poverty and infrastructure degradation in London that was considerably worse than in 2020, for example.

And, I am reliably told by friends and family who live in the UK that the situation is much worse outside of London in the regional towns.

The ABC article notes that the new Chancellor:

Osborne started working for the Conservative Party straight out of Oxford.

He believed in small government, getting people off benefits and into work. This was the core of his ideology.

We learn that Osborne was not consistent in his application of his austerity ideology (for example, he saved the Army School of Bagpipe Music and Highland Drumming from cuts at the behest of the monarch).

The Treasury analysis of the first two Osborne fiscal statements demonstrate categorically that “the cuts disproportionately hit lower-income groups”.

That is not surprising really, given that these groups are those who most rely on income and service support from the government.

When a politician announces that they need to ‘pull the belt in’ and ‘repair the budget’ they are really announcing a war on the poor.

Austerity cuts rarely damage the top-end-of-town and usually benefit them.

For example, major transfers of property wealth occur in economic downturns as house prices fall, the lower income owners are forced to default, and the wealthy buy up the foreclosed properties at bargain prices.

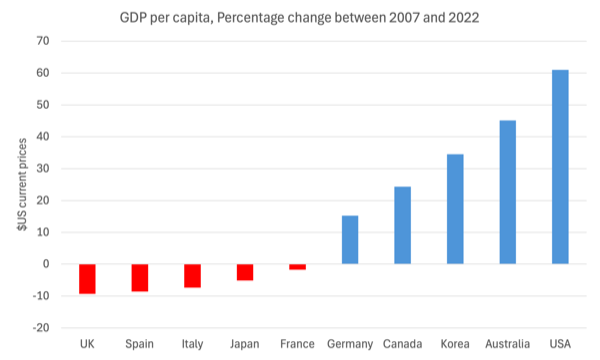

The ABC article presents a graph that purports to show GDP per capita growth (at current $US prices) between 2007 and 2022 using World Bank data.

The graph shows the UK going into negative territory along with Italy, Japan and France among the G20 nations.

Using IMF data, which I consider to be more reliable than the World Bank dataset, and I constructed this graph over the same period using the same data categories.

The outcome is similar.

I also think this finding makes it hard for those to claim that the damage has been due to the Brexit decision.

The major European countries, which embarked on similar austerity policies after the GFC, have also gone backwards over this period or, in the case of Germany, performed in a fairly mediocre fashion.

But it is fairly clear – Britain on average is poorer.

Further, the Gini coefficient, which measures income inequality, has risen somewhat since 2010, indicating that not only the average British person is poorer but the impacts are larger at the lower end of the income distribution.

That result is also reinforced by a rising poverty index.

The UN Special Rapporteur on extreme poverty Report – Statement on Visit to the United Kingdom (published November 16, 2018) – found in relation to the UK that:

14 million people, a fifth of the population, live in poverty. Four million of these are more than 50% below the poverty line, and 1.5 million are destitute, unable to afford basic essentials … a 7% rise in child poverty between 2015 and 2022, and various sources predict child poverty rates of as high as 40%. For almost one in every two children to be poor in twenty-first century Britain is not just a disgrace, but a social calamity and an economic disaster, all rolled into one.

It concluded that the “Government has remained determinedly in a state of denial.”

The research by Arun Advani, George Bangham and Jack Leslie – The UK’s wealth distribution and characteristics of high-wealth households – published in the journal Fiscal Studies (October 25, 2021) – found that “wealth inequality in the UK is high and has increased slightly over the past decade as financial asset prices have increased in the wake of the financial crisis.”

They also found that the usual survey data sources grossly underestimate the extent of wealth inequality in the UK and its rise since the Tories took power.

The Joseph Rowntree Foundation report (published May 2, 2024) – Changing the narrative on wealth inequality – finds that:

In the UK, the bottom 50% of the population owned less than 5% of wealth in 2021, and the top 10% a staggering 57% (up from 52.5% in 1995). The top 1% alone held 23% (World Inequality Lab, 2022). The ratio of wealth to income has risen in the UK from 2.3 to 1 in 1948, to 5.7 to 1 in 2020.

The ABC report also notes the usual outcomes – cut government spending purportedly to reduce the fiscal deficit and outstanding public debt obligations, yet find that the deficit and debt ratio rises.

No-one who understands the dynamics of the monetary system and the impact that fiscal policy has would consider austerity to be the best way to reduce outstanding public debt or the public debt to GDP ratio.

The ABC article also reports other negative effects such as the falling life expectancy in Britain and the “approximately 335,000 additional deaths had occurred between 2012 and 2019 compared with what had been previously been reported.”

The conclusion is that the:

… extreme, ideologically-driven austerity policies … made one of the richest countries in the world undeniably more unsafe, poorer and sicker.

Current election and Labour

I also read a UK Guardian article over the weekend (published June 15, 2024) – Caution, not grand plans, is needed if Labour is to build wealth in Britain – which is full of misinformation and makes it hard for informed voters to really understand what the options facing the next government in Britain will be.

The Labour Party leaders haven’t helped, obviously, with their relentless talk of obeying fiscal rules etc.

I will analyse the latest Labour Manifesto and what the embedded fiscal rules mean.

But the short conclusion is that the Labour government, should that eventuate, will be so hamstrung by these rules that a definitive escape from austerity policies will be difficult.

More importantly, the new government will find it impossible to meet the challenges facing the nation, in the light of the 14 years of Tory degradation (discussed above) and the new problems that have emerged (climate change, pandemic etc).

The Inman UK Guardian article, inasmuch as it is from a progressive media source, so-called, is a disgraceful example of how far that side of the political fence has embraced the sound finance narratives of the conservatives.

It begins with the claim that:

Everyone wants the Labour leadership to be more honest with the electorate about how it will pay for policies designed to drive growth, tackle the climate crisis and improve living standards.

Well if the Labour leadership was to be “honest with the electorate” it would tell the people that they will pay for these strategies in the same way they pay for everything – instructing the Bank of England (or agents) to credit private bank accounts on behalf of the H.M. Treasury.

Simple.

The question really should be whether there will be available productive resources available to shift into these areas of focus and if there are not then what additional policies will be required (such as taxation) to allow the government to deploy the necessary resources without provoking inflationary pressures (arising from a price bidding war for the use of resources already in existing use).

It is obvious that “Without a jolt to the economy from tens of billions of pounds of extra spending … growth will remain sloth-like, only inching ahead.”

But it is also clear that the Labour leadership has decided to remain dishonest (either through ignorance or design) and scale down expectations of how much they will spend.

The emphasis on growth is unfortunate because in order to meet some of the challenges ahead, the economy will have to reduce its growth rates, at least, in terms of the pattern of spending (consumption and investment).

This point differentiates GDP growth per se from the way that growth is achieved.

A lot of the low-carbon activities that contribute to GDP growth have been disproportionately damaged by the austerity – Council services etc – and more of those should replace the more destructive production activities.

Inman’s UK Guardian article moves on to articulate the usual lie – that the British government is financially constrained:

… they also want Starmer and Reeves to explain to the voting public that, in the absence of higher taxes, extra borrowing is the solution to a lack of funds and can be justified by the long-term benefits.

The British government does not need to borrow in order to spend more than the tax revenue that comes back to them (from initial spending).

The term “lack of funds” in the context of the capacity of the British government is inapplicable and erroneous.

There can never be a ‘lack of funds’ in that context.

Progressives who believe that are just falling into the mainstream framing and undermining the progressive cause.

Inman then pulls the depoliticisation dodge:

If they turn half an ear to reports by the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD), they will hear how the UK’s 97% ratio of debt to national income, or gross domestic product (GDP), is already too high …

The influence of ostensibly independent international arbiters of “economic laws” is always underestimated.

There are no ‘economic laws’.

These so-called “independent international arbiters” are nothing of the sort.

They are organisations that have evolved to maintain and reinforce the mainstream economics Groupthink which is built on a body of theory that is essentially a fiction.

They serve the political process and the politicians as vehicles for outsourcing responsibility for destructive economic policy making.

Appealing to these neoliberal ideological attack dogs may allow Starmer and Reeves to defuse the responsibility for their conservative choices while Britain continues to flounder, but progressives should never fall into the lie that these institutions (IMF etc) have credibility or legitimate authority.

Inman then invokes another of the usual stupid comparisons, by comparing Britain (which issues its own currency) with France and Germany (that doesn’t).

The French government, for example, faces financial constraints on its spending and issues debt to the private bond markets that carries default risk.

It can go broke and so high debt ratios are a problem (possibly).

The British government debt is risk free and the debt ratio is largely irrelevant.

And finally, Inman seems to support the privatisation agenda that began decades ago and has been an unmitigated disaster.

He asks “would the state do a better job of running the water companies, the railways and the energy companies?” and then claims that fleeting attempts at public enterprise have been disastrous.

One of his examples relates to the Nottingham City Council that issued a section 114 notice last year – “in effect declaring itself bankrupt” (Source).

The Council had run the so-called not-for-profit – Robin Hood Energy – scheme to provide competition for the privatised energy providers in order to reduce power costs for residents.

Trying to use that example to demonstrate the inability of well-funded public enterprises to operate efficiently is dishonest in the extreme.

It is widely acknowledged that “the council’s financial ‘mistakes’ were small in comparison with the year-on-year reduction of funding from central government”.

This article (August 17, 2020) – Robin Hood dies: the legend lives on – provides some balance to the mainstream conclusions that public ownership will always fail.

The Report – When We Own It A model for public ownership in the 21st century – should be studied by characters such as the UK Guardian journalists, which might make them think twice before touting privatisation over public ownership.

The evidence from Nottingham also shows that restrictive rules relating to competition against the big energy companies are in place, which make it hard to survive.

Further, it is clear that local trade unions did not shift their accounts to the Robin Hood Energy companies and (Source):

… refused writing to their members endorsing Robin Hood Energy.

As a result, the experiment failed and now it is used, just like the ‘We have to borrow from the IMF’ was used in 1975 to reinforce the neoliberal message.

Progressives fall over themselves to promote these ‘examples’ of why Labour governments have to have fiscal rules and promote austerity (even if they try to deny that is what they are doing).

Moreover, Inman thinks the case against renationalisation is strong because:

Britain’s state authorities … many have become rundown after more than a decade of austerity.

It is obvious that the capacity of any state authority will be reduced and damaged if they are starved of funds.

The conclusion then is not that they are incapable of delivering first-class and effective services but that they need more funding.

But the main problem for Inman types is that the experiment was conducted by a local council that was simultaneously being squeezed across all its operations by the austerity imposed by the national government.

No such constraints would exist on properly funding such an enterprise if the renationalisation was at the central government level.

The same sort of messaging was evident in another UK Guardian article (published June 16, 2024) – Thatcherism, austerity, Brexit, Liz Truss… goodbye and good riddance to all that – by Will Hutton.

The only point I would make in relation to this article is that it presents a biased view of British history over the last 50 years.

It suggests that the current malaise facing Britain began in the 1980s:

The first catastrophe was the monetarist experiment of the 1980s – a means to roll back the state so it would print less money – which achieved neither a smaller state nor lower inflation. Other countries may have fallen for the same snake oil, but none so emphatically as Britain.

As we explained in our 2017 book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, September 2017) – the Thatcher regime was not the first British government to embrace the Monetarist “snake oil”.

In fact, it was the Callaghan-Healy Labour government in the mid-1970s that fell prey to the “snake oil” and it engaged in the big lie that the country had run out of money and had to borrow from the IMF.

That lie has bedevilled progressive thinking ever since and is the reason that the likes of Hutton and Inman and other progressive writers push out the junk that they do.

It is also instrumental in the obsessive adherence to neoliberal-type fiscal rules by the Labour party.

And Hutton also claims that the:

… second catastrophe, with the same ideological roots, was the commitment to financial deregulation in general and the big bang in particular – allowing the world’s investment banks both to lend and speculate in financial securities backed by the same capital.

Once again it was the Blair-Brown Labour government that really set the country up for the GFC by their so-called ‘light touch’ (meaning virtually none) regulation of the City.

Conclusion

Labour will probably win because the Tories have been an unmitigated disaster.

But they too will stumble unless they break out of the mainstream austerity narrative.

To do that, the progressive media would have to start pumping out sensible and accurate economic commentary, diametrically at odds with the type of UK Guardian articles that are now coming out.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

Should we use the oppositions phrase ‘sound finance’, or should we describe the view accurately: ‘rigid finance’.

Inflexible in the face of certain and necessary change.

Change for which we need dynamic finance, and people in charge who understand how it works and how to use it.

Try “functional finance” – Abba Lerner.

Might this be the heart of the problem of MMT acceptance, or at least a big piece of it?–that MMT’s obvious truths, especially that the federal government has total control over the creation and distribution of fiat money–point toward socialism, while the fiction of money being largely in private hands, and needing to be clawed back by the government in order to be spent, tends to vindicate capitalism.

Perhaps MMT needs publicising as Fiat Money Practice ?

Last week we had a headline political interviewer, one Laura Kuennsberg, erstwhile BBC Political Editor, who, in comparing government revenue spending with capital expenditure, demonstrated her ignorance of basic economics by using this inarticulate comparison :-

“One of the differences that is very important is the limit on borrowing for different kinds of spending. And just to give people some context, and I know some people object to trying to use metaphors to explain this stuff, I think actually it is quite important so you understand that borrowing for capital spending is a bit like if you took out a mortgage to buy a house or for day-to-day spending you buy loads of new frocks on your credit card: they are not the same kind of spending.”

Unfortunately, senior politicians have been equally stupid, as Reeves, currently Shadow Chancellor, Keir Starmer, Labour leader, and Rishi Sunak who we’ve suffered both as PM and Chancellor, have all used the “maxing out the credit card” analogy.

Modern day orthodox economics, as practised and endorsed in the neoliberal western hemisphere, is death by a thousand cuts for those at the bottom of the financial heap and increasingly so for the heretofore middle class. The least financially secure are driven by those who control money and choices to evermore extreme levels of desperation. The rapid expansion of such as community foodbanks in wealthy societies tells us so much about the choices of governments.

Evidently all is going fine, as we are told by publicly favoured economists, corporate media and their captured politicians, so long as the headlined aggregate metrics continue to grow and there is negligible concern for the distributions within those aggregates. Why is it that all economists aren’t making noise about this obsession with a continuation of sole concern with aggregates and not distributions. Would it be because the purpose of labour is to serve the capitalist economy and not for the economy to be serving the people of our society?

All at the top (those of the power elite actually in charge and not their co-opted politicians) is about power and control and the ability to create debt free money which is what they fear being out of their control. That control is exercised through the propaganda of their corporate media, groupthink of orthodox mainstream economists and co-opted ignorant or complicit politicians as we are seeing in the UK and Australia at present. As Blair Fix explains in this post https://economicsfromthetopdown.com/2020/07/05/why-isnt-modern-monetary-theory-common-knowledge/ “When governments create money, they accumulate power, which implicitly means taking power away from other (powerful) people.” Power realities are something not discussed by corporate media which intentionally holds up politicians as those who wield power over us while their puppet masters remain in the shadows. Those with power continually pushing us toward private debt and away from the benefits of debt free public money which they reserve as they can for their own uses.

Clearly, today’s practice of capitalism’s orthodox economics as sold to the masses is not about the wellbeing of all members of society (if you are poor it’s your fault and you get what you deserve) but only about continuing growth and never mind who (the well off) gets the financial benefits. All metrics of asserted economic importance pushed by corporate media being in accord with quantitative measures, as demonstrated by such as GDP and unemployment, and not qualitative such as quality of paid work jobs (see David Graeber’s Bullshit Jobs) or income and wealth distributions.

Ignore the spiel from both government and opposition when they blithely say that their one task is to “Keep Australians safe”. Safe from what? Certainly not safe from poverty but when it comes to war toys for dealing with a confected enemy propagandised and determined by the US Empire, the sky’s the limit. And, of course, certainly not keeping the people safe from advancing global heating or the rolling pandemic infections and their consequences.

All is distraction. Look over there at this new shiny thing or some culture war issue while politics continues to be synonymous with economics. How is it to be paid for?

The ABC website has this news story: “Birmingham, Britain’s second-largest city, is being forced to dim lights and cut sanitation services due to bankruptcy”.

Some gems in the article include;

“The second-largest city in the United Kingdom is in heavy debt, with childhood poverty near 50 per cent.”

“The city is turning out street lights at night and only collecting garbage fortnightly to save money.”

“In September Birmingham City Council (had) issued a 114 notice, effectively declaring it was bankrupt.”

In my opinion this is beginning of the end for Britain. At this rate and without changing (neoliberal austerity) policies Britain faces near total economic and social collapse. It faces an endless and rapid downward spiral to rock bottom failed state status. What is there in current policies that would arrest its collapse? Well, frankly, there isnothing.

Have a look at the “Children of Men” movie to see where Britain is headed. I don’t mean zero births (the SciFi part) but I do mean collapse into total poverty for the 90% and severe social unrest to the point of igniting civil war. That’s what they face without a complete policy turnaround. If I was even a 90th percentile Brit in Britain I would be racing to get out now, if I could.

Hi Bill,

I’ve followed your blog for a long time and I’m always particularly interested in your analysis of the UK (where I live).

I’m interested on your ideas around what the actual limits to financing government spending in the UK are before you need to use extra taxation. Or to put it another way what the monetary gap between spending and taxation is before you start to witness an acceleration in inflation? Have you or any of your MMT colleagues ever attempted to model what this gap might be at a particular point in any country? (I am presuming it would be different for each country and dependent on where that country is in the business cycle in relation to unemployment and growth etc).

What hope do we have with hawkish lies and myths from msm underscored by politicians against a dovish look at reality by MMT.

Surely the truth must prevail, but sadly, the hawkish smearing from the standard economics school silencing MMT with more lies.

The disingenuous comments from the majority in economics who have a voice (media) is mind-boggling to me.

I wonder if guardian would publish column written by Bill giving differing opinion on these matters. Would be quite eye-opening to many.