Start from a situation where the external surplus is the equivalent of 2 per cent of GDP and the fiscal surplus is 2 per cent of GDP. If the fiscal balance stays constant as a percent of GDP and the external surplus rises to the equivalent of 4 per cent of GDP then

Answer: National income rises and the private domestic surplus moves from 0 per cent of GDP to 2 per cent of GDP.

The answer is Option (d) National income rises and the private domestic surplus moves from 0 per cent of GDP to 2 per cent of GDP.

Please refer to the explanation in Question 3 for the conceptual material required to understand this question and answer.

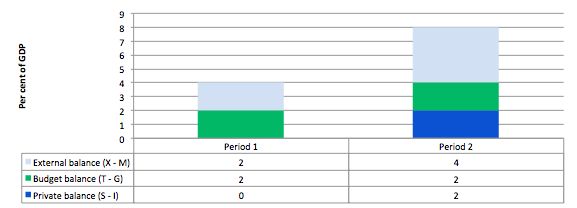

Consider the following graph and accompanying table which depicts two periods outlined in the question.

In Period 1, with an external surplus of 2 per cent of GDP and a fiscal surplus of 2 per cent of GDP the private domestic balance is zero. The demand injection from the external sector is exactly offset by the demand drain (the fiscal drag) coming from the fiscal balance and so the private sector can neither net save or spend more than they earn.

In Period 2, with the external sector adding more to demand now - surplus equal to 4 per cent of GDP and the fiscal balance unchanged (this is stylised - in the real world the fiscal balance will certainly change), there is a stimulus to spending and national income would rise.

The rising national income also provides the capacity for the private sector to save overall and so they can now save 2 per cent of GDP.

The fiscal drag is overwhelmed by the rising net exports.

This is a highly stylised example and you could tell a myriad of stories that would be different in description but none that could alter the basic point.

If the drain on spending (from the public sector) is more than offset by an external demand injection, then GDP rises and the private sector overall saving increases.

If the drain on spending from the fiscal stance outweighs the external injections into the spending stream then GDP falls (or growth is reduced) and the overall private balance would fall into deficit.

You may wish to read the following blogs for more information: