Start from a situation where the external surplus is the equivalent of 2 per cent of GDP and the fiscal surplus is 2 per cent of GDP. If the fiscal balance remains unchanged and the external surplus rises to 4 per cent of GDP then

Answer: National income rises and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP.

The answer is Option (d) National income rises and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP.

First, you need to understand the basic relationship between the sectoral flows and the balances that are derived from them. The flows are derived from the National Accounting relationship between aggregate spending and income. So:

(1) Y = C + I + G + (X - M)

where Y is GDP (income), C is consumption spending, I is investment spending, G is government spending, X is exports and M is imports (so X - M = net exports).

Another perspective on the national income accounting is to note that households can use total income (Y) for the following uses:

(2) Y = C + S + T

where S is total saving and T is total taxation (the other variables are as previously defined).

You than then bring the two perspectives together (because they are both just "views" of Y) to write:

(3) C + S + T = Y = C + I + G + (X - M)

You can then drop the C (common on both sides) and you get:

(4) S + T = I + G + (X - M)

Then you can convert this into the familiar sectoral balances accounting relations which allow us to understand the influence of fiscal policy over private sector indebtedness.

So we can re-arrange Equation (4) to get the accounting identity for the three sectoral balances - private domestic, government fiscal balance and external:

(S - I) = (G - T) + (X - M)

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents.

Another way of saying this is that total private savings (S) is equal to private investment (I) plus the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

Thus, when an external deficit (X - M < 0) and public surplus (G - T < 0) coincide, there must be a private deficit. While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process.

Second, you then have to appreciate the relative sizes of these balances to answer the question correctly.

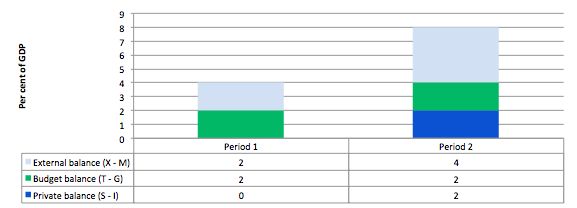

Consider the following graph and accompanying table which depicts two periods outlined in the question.

In Period 1, with an external surplus of 2 per cent of GDP and a fiscal surplus of 2 per cent of GDP the private domestic balance is zero. The demand injection from the external sector is exactly offset by the demand drain (the fiscal drag) coming from the fiscal balance and so the private sector can neither net save or spend more than they earn.

In Period 2, with the external sector adding more to demand now - surplus equal to 4 per cent of GDP and the fiscal balance unchanged (this is stylised - in the real world the fiscal balance will certainly change), there is a stimulus to spending and national income would rise.

The rising national income also provides the capacity for the private sector to save overall and so they can now save 2 per cent of GDP.

The fiscal drag is overwhelmed by the rising net exports.

This is a highly stylised example and you could tell a myriad of stories that would be different in description but none that could alter the basic point.

If the drain on spending (from the public sector) is more than offset by an external demand injection, then GDP rises and the private sector overall saving increases.

If the drain on spending from the fiscal balance outweighs the external injections into the spending stream then GDP falls (or growth is reduced) and the overall private balance would fall into deficit.

You may wish to read the following blogs for more information: