Start from a situation where the external surplus is the equivalent of 2 per cent of GDP and the government surplus is 2 per cent. If the government balance stays constant and the external surplus rises to the equivalent of 4 per cent of GDP then

Answer: National income rises and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP.

The answer is Option (d) National income rises and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

We know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

So here is the accounting (again). The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X - M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X - M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X - M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I - S) + (G - T) + (X - M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

These balances are usually expressed as a per cent of GDP but that doesn't alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I - S) + (X - M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

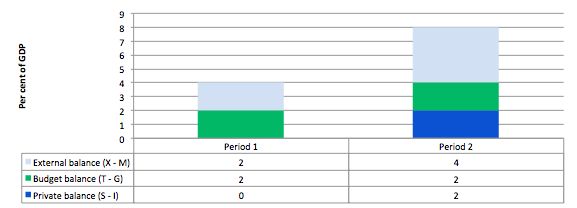

Consider the following graph and accompanying table which depicts two periods outlined in the question.

In Period 1, with an external surplus of 2 per cent of GDP and a government surplus of 2 per cent of GDP the private domestic balance is zero. The demand injection from the external sector is exactly offset by the demand drain (the fiscal drag) coming from the government balance and so the private sector can neither net save or spend more than they earn.

In Period 2, with the external sector adding more to demand now - surplus equal to 4 per cent of GDP and the government balance unchanged (this is stylised - in the real world the government will certainly change), there is a stimulus to spending and national income would rise.

The rising national income also provides the capacity for the private sector to save overall and so they can now save 2 per cent of GDP.

The fiscal drag is overwhelmed by the rising net exports.

This is a highly stylised example and you could tell a myriad of stories that would be different in description but none that could alter the basic point.

If the drain on spending (from the public sector) is more than offset by an external demand injection, then GDP rises and the private sector overall saving increases.

If the drain on spending from the government balance outweighs the external injections into the spending stream then GDP falls (or growth is reduced) and the overall private balance would fall into deficit.

You may wish to read the following blogs for more information: