If the external sector is accumulating financial claims on the local economy and the GDP growth rate is lower than the real interest rate, then the private domestic sector and the government sector can run surpluses without damaging employment growth.

Answer: False

The answer is False.

When the external sector is accumulating financial claims on the local economy it must mean the current account is in deficit - so the external balance is in deficit. Under these conditions it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the national accounting rules and income adjustments will always ensure that is the case.

The relationship between the rate of GDP growth and the real interest rate doesn't alter this result and was included as superflous information to test the clarity of your understanding.

To understand this we need to begin with the national accounts which underpin the basic income-expenditure model that is at the heart of introductory macroeconomics. See the answer to Question 1 for the background conceptual development.

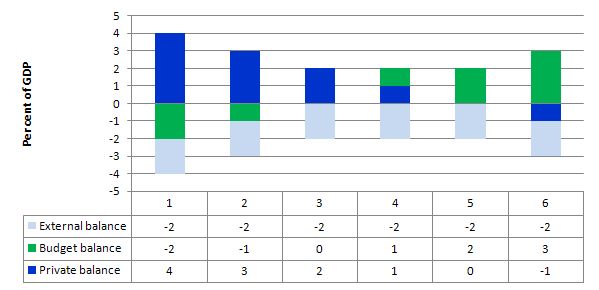

Consider the following graph and associated table of data which shows six states. All states have a constant external deficit equal to 2 per cent of GDP (light-blue columns).

State 1 show a government running a surplus equal to 2 per cent of GDP (green columns). As a consequence, the private domestic balance is in deficit of 4 per cent of GDP (royal-blue columns). This cannot be a sustainable growth strategy because eventually the private sector will collapse under the weight of its indebtedness and start to save. At that point the fiscal drag from the budget surpluses will reinforce the spending decline and the economy would go into recession.

State 2 shows that when the budget surplus moderates to 1 per cent of GDP the private domestic deficit is reduced.

State 3 is a budget balance and then the private domestic deficit is exactly equal to the external deficit. So the private sector spending more than they earn exactly funds the desire of the external sector to accumulate financial assets in the currency of issue in this country.

States 4 to 6 shows what happens when the budget goes into deficit - the private domestic sector (given the external deficit) can then start reducing its deficit and by State 5 it is in balance. Then by State 6 the private domestic sector is able to net save overall (that is, spend less than its income).

Note also that the government balance equals exactly $-for-$ (as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances). This is also a basic rule derived from the national accounts.

Most countries currently run external deficits. The crisis was marked by households reducing consumption spending growth to try to manage their debt exposure and private investment retreating. The consequence was a major spending gap which pushed budgets into deficits via the automatic stabilisers.

The only way to get income growth going in this context and to allow the private sector surpluses to build was to increase the deficits beyond the impact of the automatic stabilisers. The reality is that this policy change hasn't delivered large enough budget deficits (even with external deficits narrowing). The result has been large negative income adjustments which brought the sectoral balances into equality at significantly lower levels of economic activity.

The following blogs may be of further interest to you: