A nation can export less than the sum of imports, net factor income (such as interest and dividends) and net transfer payments (such as foreign aid) and run a government surplus

Answer: Of equal proportion to GDP, while the private domestic sector is spending more than they are earning.

The correct answer is the second option - "A nation can run a current account deficit accompanied by a government sector surplus of equal proportion to GDP, while the private domestic sector is spending more than they are earning".

Note that the the current account is equal to the trade balance plus invisibles. The trade balance is exports minus imports and the invisibles are equal to the sum of net factor income (such as interest and dividends) and net transfer payments (such as foreign aid). So the question is asking about a current account deficit.

Draw on the explanation in Question 2 for background.

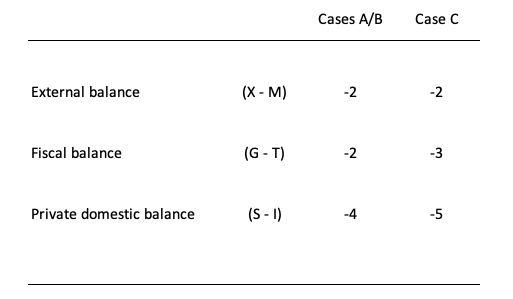

The following Table represents the three options in percent of GDP terms.

To aid interpretation remember that:

1. (S-I ) < 0 means that the private domestic sector is spending more than they are earning.

2. (G-T) < 0 means that the government is running a surplus because T > G.

3. (X-M) < 0 means the external position is in deficit because imports are greater than exports (taking net factor income into account).

The first two possibilities we might call Case A and Case B:

A: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending less than they are earning.

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

So Case A says the private domestic sector is saving overall, whereas Case B say the private domestic sector is dis-saving (and going into increasing indebtedness).

These options are captured in the first column of the Table.

The arithmetic example depicts an external sector deficit of 2 per cent of GDP and an offsetting fiscal surplus of 2 per cent of GDP.

You can see that the private sector balance is negative (that is, the sector is spending more than they are earning - Investment is greater than Saving - and has to be equal to 4 per cent of GDP.

Given that, the only proposition that can be true is:

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

Column 2 in the Table captures Case C:

C: A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

So the current account deficit is equal to 2 per cent of GDP while the fiscal surplus is now larger at 3 per cent of GDP. You can see that the private domestic deficit rises to 5 per cent of GDP to satisfy the accounting rule that the balances sum to zero.

The final option available is:

D: None of the above are possible as they all defy the sectoral balances accounting identity.

It cannot be true because as the Table data shows the rule that the sectoral balances add to zero because they are an accounting identity is satisfied in both cases.

So if the government is spending less than it is 'earning' and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income.

The following blogs may be of further interest to you:

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.