Only one of the following propositions is possible (with all balances expressed as a per cent of GDP)

Answer: A nation can run an external deficit and equal government surplus while the private domestic sector is dis-saving overall.

The best answer is the second option - "A nation can run an external deficit and equal government surplus while the private domestic sector is dis-saving overall".

This is a question about the sectoral balances - the government fiscal balance, the external balance and the private domestic balance - that have to always add to zero because they are derived as an accounting identity from the national accounts.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

(1) GDP = C + I + G + (X - M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X - M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all tax revenue minus total transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X - M) + FNI

To render this approach into the sectoral balances form, we subtract total net taxes (T) from both sides of Expression (3) to get:

(3) GNP - T = C + I + G + (X - M) + FNI - T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP - C - T) - I = (G - T) + (X - M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP - C - T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP - C - T) - I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP - C - T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G - T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X - M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S - I) = (G - T) + CAD

which is interpreted as meaning that government sector deficits (G - T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G - T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S - I) - CAD] = (G - T)

where the term on the left-hand side [(S - I) - CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

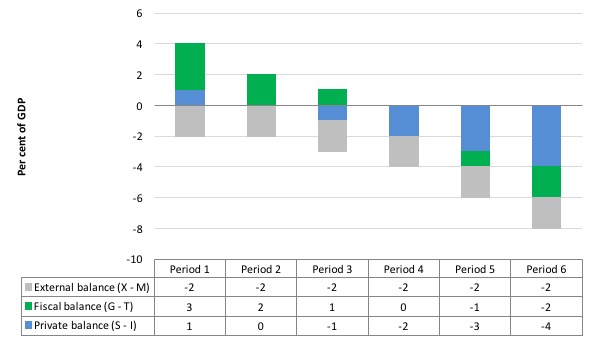

The following graph (with table) represents the three options in percent of GDP terms. To aid interpretation remember that (S-I) < 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

The first two possibilities we might call A and B:

A: A nation can run an external deficit and equal government surplus while the private domestic sector is saving overall.

B: A nation can run an external deficit and equal government surplus while the private domestic sector is dissaving overall.

So Option A says the private domestic sector is saving overall, whereas Option B say the private domestic sector is dissaving (and increasing indebtedness).

The private domestic sector only saves overall in Period 1 (S - I) = 1, when the external sector deficit of 2 per cent of GDP is accompanied by a larger fiscal deficit - (G - T) = 3.

The private domestic dissaves in Periods 3 to 6.

In each of those periods, the fiscal deficit is less than the the external deficit or in balance or surplus.

Given that the only proposition that can be true is:

B: A nation can run an external deficit and equal government surplus while the private domestic sector is dissaving overall.

The final option available is:

D: None of the above are possible as they all defy the sectoral balances accounting identity.

It cannot be true because as the Table data shows the rule that the sectoral balances add to zero because they are an accounting identity is satisfied in both cases.

So if the G is spending less than it is taxation receipts T and the external sector is adding less income (X) than it is absorbing spending (M), then the private domestic sector must be spending more than it is earning.

The following blogs may be of further interest to you: