Public spending can "crowd out" private spending.

Answer: False

The answer is True.

The question relates to the meaning of the term "crowding out".

The normal presentation of the crowding out hypothesis which is a central plank in the mainstream economics attack on government fiscal intervention is more accurately called "financial crowding out".

If I had have used the term "financial crowding" out then the answer would have been false.

At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

In Mankiw, which is representative, we are taken back in time, to the theories that were prevalent before being destroyed by the intellectual advances provided in Keynes' General Theory. Mankiw assumes that it is reasonable to represent the financial system as the "market for loanable funds" where "all savers go to this market to deposit their savings, and all borrowers go to this market to get their loans. In this market, there is one interest rate, which is both the return to saving and the cost of borrowing."

This is back in the pre-Keynesian world of the loanable funds doctrine (first developed by Wicksell).

This doctrine was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

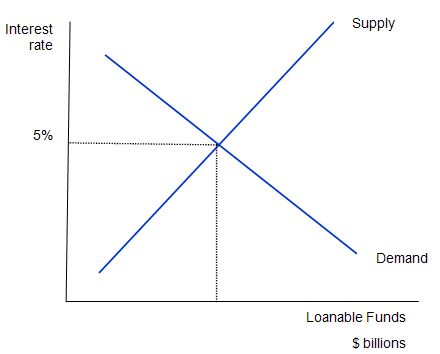

The following diagram shows the market for loanable funds. The current real interest rate that balances supply (saving) and demand (investment) is 5 per cent (the equilibrium rate). The supply of funds comes from those people who have some extra income they want to save and lend out. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc). The interest rate is the price of the loan and the return on savings and thus the supply and demand curves (lines) take the shape they do.

Note that the entire analysis is in real terms with the real interest rate equal to the nominal rate minus the inflation rate. This is because inflation "erodes the value of money" which has different consequences for savers and investors.

Mankiw claims that this "market works much like other markets in the economy" and thus argues that (p. 551):

The adjustment of the interest rate to the equilibrium occurs for the usual reasons. If the interest rate were lower than the equilibrium level, the quantity of loanable funds supplied would be less than the quantity of loanable funds demanded. The resulting shortage ... would encourage lenders to raise the interest rate they charge.

The converse then follows if the interest rate is above the equilibrium.

Mankiw also says that the "supply of loanable funds comes from national saving including both private saving and public saving." Think about that for a moment. Clearly private saving is stockpiled in financial assets somewhere in the system - maybe it remains in bank deposits maybe not. But it can be drawn down at some future point for consumption purposes.

Mankiw thinks that fiscal surpluses are akin to this. They are not even remotely like private saving. They actually destroy liquidity in the non-government sector (by destroying net financial assets held by that sector). They squeeze the capacity of the non-government sector to spend and save. If there are no other behavioural changes in the economy to accompany the pursuit of fiscal surpluses, then as we will explain soon, income adjustments (as aggregate demand falls) wipe out non-government saving.

So this conception of a loanable funds market bears no relation to "any other market in the economy" despite the myths that Mankiw uses to brainwash the students who use the book and sit in the lectures.

Also reflect on the way the banking system operates - read Money multiplier and other myths if you are unsure. The idea that banks sit there waiting for savers and then once they have their savings as deposits they then lend to investors is not even remotely like the way the banking system works.

This framework is then used to analyse fiscal policy impacts and the alleged negative consquences of fiscal deficits - the so-called financial crowding out - is derived.

Mankiw says:

One of the most pressing policy issues ... has been the government budget deficit ... In recent years, the U.S. federal government has run large budget deficits, resulting in a rapidly growing government debt. As a result, much public debate has centred on the effect of these deficits both on the allocation of the economy's scarce resources and on long-term economic growth.

So what would happen if there is a fiscal deficit. Mankiw asks: "which curve shifts when the budget deficit rises?"

Consider the next diagram, which is used to answer this question. The mainstream paradigm argue that the supply curve shifts to S2. Why does that happen? The twisted logic is as follows: national saving is the source of loanable funds and is composed (allegedly) of the sum of private and public saving. A rising fiscal deficit reduces public saving and available national saving. The fiscal deficit doesn't influence the demand for funds (allegedly) so that line remains unchanged.

The claimed impacts are: (a) "A budget deficit decreases the supply of loanable funds"; (b) "... which raises the interest rate"; (c) "... and reduces the equilibrium quantity of loanable funds".

Mankiw says that:

The fall in investment because of the government borrowing is called crowding out ...That is, when the government borrows to finance its budget deficit, it crowds out private borrowers who are trying to finance investment. Thus, the most basic lesson about budget deficits ... When the government reduces national saving by running a budget deficit, the interest rate rises, and investment falls. Because investment is important for long-run economic growth, government budget deficits reduce the economy's growth rate.

The analysis relies on layers of myths which have permeated the public space to become almost "self-evident truths". Sometimes, this makes is hard to know where to start in debunking it. Obviously, national governments are not revenue-constrained so their borrowing is for other reasons - we have discussed this at length. This trilogy of blogs will help you understand this if you are new to my blog - Deficit spending 101 - Part 1 | Deficit spending 101 - Part 2 | Deficit spending 101 - Part 3.

But governments do borrow - for stupid ideological reasons and to facilitate central bank operations - so doesn't this increase the claim on saving and reduce the "loanable funds" available for investors? Does the competition for saving push up the interest rates?

The answer to both questions is no! Modern Monetary Theory (MMT) does not claim that central bank interest rate hikes are not possible. There is also the possibility that rising interest rates reduce aggregate demand via the balance between expectations of future returns on investments and the cost of implementing the projects being changed by the rising interest rates.

MMT proposes that the demand impact of interest rate rises are unclear and may not even be negative depending on rather complex distributional factors. Remember that rising interest rates represent both a cost and a benefit depending on which side of the equation you are on. Interest rate changes also influence aggregate demand - if at all - in an indirect fashion whereas government spending injects spending immediately into the economy.

But having said that, the Classical claims about crowding out are not based on these mechanisms. In fact, they assume that savings are finite and the government spending is financially constrained which means it has to seek "funding" in order to progress their fiscal plans. The result competition for the "finite" saving pool drives interest rates up and damages private spending. This is what is taught under the heading "financial crowding out".

A related theory which is taught under the banner of IS-LM theory (in macroeconomic textbooks) assumes that the central bank can exogenously set the money supply. Then the rising income from the deficit spending pushes up money demand and this squeezes interest rates up to clear the money market. This is the Bastard Keynesian approach to financial crowding out.

Neither theory is remotely correct and is not related to the fact that central banks push up interest rates up because they believe they should be fighting inflation and interest rate rises stifle aggregate demand.

However, other forms of crowding out are possible. In particular, MMT recognises the need to avoid or manage real crowding out which arises from there being insufficient real resources being available to satisfy all the nominal demands for such resources at any point in time.

In these situation, the competing demands will drive inflation pressures and ultimately demand contraction is required to resolve the conflict and to bring the nominal demand growth into line with the growth in real output capacity.

So, it is this context that the proposal in the question is True.

Further, while there is mounting hysteria about the problems the changing demographics will introduce to government fiscal positions all the arguments presented are based upon spurious financial reasoning - that the government will not be able to afford to fund health programs (for example) and that taxes will have to rise to punitive levels to make provision possible but in doing so growth will be damaged.

However, MMT dismisses these "financial" arguments and instead emphasises the possibility of real problems - a lack of productivity growth; a lack of goods and services; environment impingements; etc.

Then the argument can be seen quite differently. The responses the mainstream are proposing (and introducing in some nations) which emphasise fiscal surpluses (as demonstrations of fiscal discipline) are shown by MMT to actually undermine the real capacity of the economy to address the actual future issues surrounding rising dependency ratios. So by cutting funding to education now or leaving people unemployed or underemployed now, governments reduce the future income generating potential and the likely provision of required goods and services in the future.

The idea of real crowding out also invokes and emphasis on political issues. If there is full capacity utilisation and the government wants to increase its share of full employment output then it has to crowd the private sector out in real terms to accomplish that. It can achieve this aim via tax policy (as an example). But ultimately this trade-off would be a political choice - rather than financial.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.