When there is an external deficit, the private sector can reduce its overall indebtedness as long as the government supports private saving by running a deficit.

Answer: False

The answer is False.

This question relies on your understanding of the sectoral balances that are derived from the national accounts and must hold by definition. The statement of sectoral balances doesn't tell us anything about how the economy might get into the situation depicted. Whatever behavioural forces were at play, the sectoral balances all have to sum to zero. Once you understand that, then deduction leads to the correct answer.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X - M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X - M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X - M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I - S) + (G - T) + (X - M) = 0

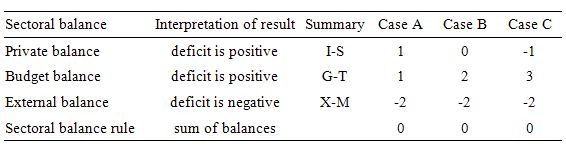

That is the three balances have to sum to zero. The sectoral balances derived are:

These balances are usually expressed as a per cent of GDP but that doesn't alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I - S) + (X - M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

For the private sector reduce it overall indebtedness (that is a net result) it must spend less than it earns - that is, run a surplus. So we understand the question to be examining the conditions under which the private domestic sector can run a surplus when the external sector is in deficit.

The following Table shows three cases expressing the sectoral balances as percentages of GDP in each case there is an external deficit. So the constant external deficit then allows you to understand the relationship between the other two balances - government and private domestic.

In Cases A and B, the private balance is in deficit or balanced which means that no net debt repayments could occur even though the government sector is in deficit.

In Case C, we see that the deficit has risen to 3 per cent of GDP and larger than the external deficit as a percent of GDP (2 per cent). At that point, the private sector balance goes into surplus which facilitates reductions in debt levels overall.

So the coexistence of a fiscal deficit (adding to aggregate demand) and an external deficit (draining aggregate demand) does not necessarily lead to the private domestic sector being in surplus.

It is only when the fiscal deficit is large enough (3 per cent of GDP) and able to offset the demand-draining external deficit (2 per cent of GDP) that the private domestic sector can save overall (Case C).

The economics lying behind the accounting statements (which are true by definition) is that the fiscal deficits underpin spending and allow income growth to be sufficient to generate private saving greater than investment in the private domestic sector.

But they can only do that as long as they can offset the demand-draining impacts of the external deficits and thus provide sufficient income growth for the private domestic sector to save.

The following blogs may be of further interest to you: