Quiz #83

- 1. A budget deficit equivalent to 3 per cent of GDP signals that the government is adopting a less expansionary policy than if the budget deficit outcome was equivalent to 5 per cent of GDP.

- 2. When the government borrows from the private sector to match an increase in net public spending, the resulting increase in aggregate demand is less than would be the case if there was no bond sale.

- 3. If the external balance remains in surplus, then the national government will not impede economic growth by running a budget surplus.

- 4. Fiscal rules such as are embodied in the Stability and Growth Pact of the EMU will continually create conditions of slower growth because they deprive the government of fiscal flexibility to support aggregate demand when necessary.

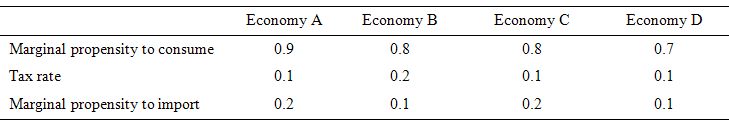

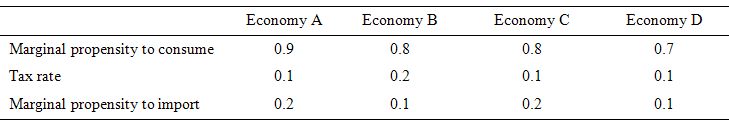

- 5. Premium Question: Consider the following table which describes four different economies in terms of the behavioural parameters relating to the leakages to aggregate demand. Assume that in all four economies, there is idle capacity, the central bank holds all interest rates constant, inflation is constant and there is no changes in international competitiveness.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending. - Economy D

- Economy C

- Economy B

- Economy A

Quiz #83 answers

- 1. A budget deficit equivalent to 3 per cent of GDP signals that the government is adopting a less expansionary policy than if the budget deficit outcome was equivalent to 5 per cent of GDP.

Answer: Maybe

- 2. When the government borrows from the private sector to match an increase in net public spending, the resulting increase in aggregate demand is less than would be the case if there was no bond sale.

Answer: False

- 3. If the external balance remains in surplus, then the national government will not impede economic growth by running a budget surplus.

Answer: False

- 4. Fiscal rules such as are embodied in the Stability and Growth Pact of the EMU will continually create conditions of slower growth because they deprive the government of fiscal flexibility to support aggregate demand when necessary.

Answer: False

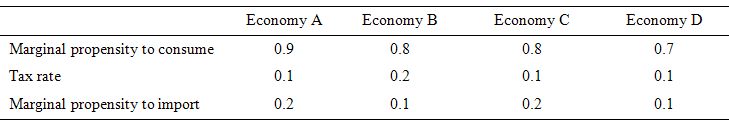

- 5. Premium Question: Consider the following table which describes four different economies in terms of the behavioural parameters relating to the leakages to aggregate demand. Assume that in all four economies, there is idle capacity, the central bank holds all interest rates constant, inflation is constant and there is no changes in international competitiveness.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending. Answer: Economy A

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending. Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending. Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending.